Benjamin Graham's Security Analysis

|

Description

Book Introduction

◆ Published 90 years ago, "Securities Analysis" is a must-read for stock investors, the bible of value investing!

◆ Recommended by Warren Buffett and Hong Jin-chae (CEO of Raccoon Asset Management)!

◆ Strongly recommended by domestic value investors Kim Cheol-gwang, Byun Young-jin, Jeong Chae-jin, and Hong Young-pyo!

◆ Revised 7th edition with new commentary from 15 value investing experts, including Senior Editor Seth Klarman and Howard Marks!

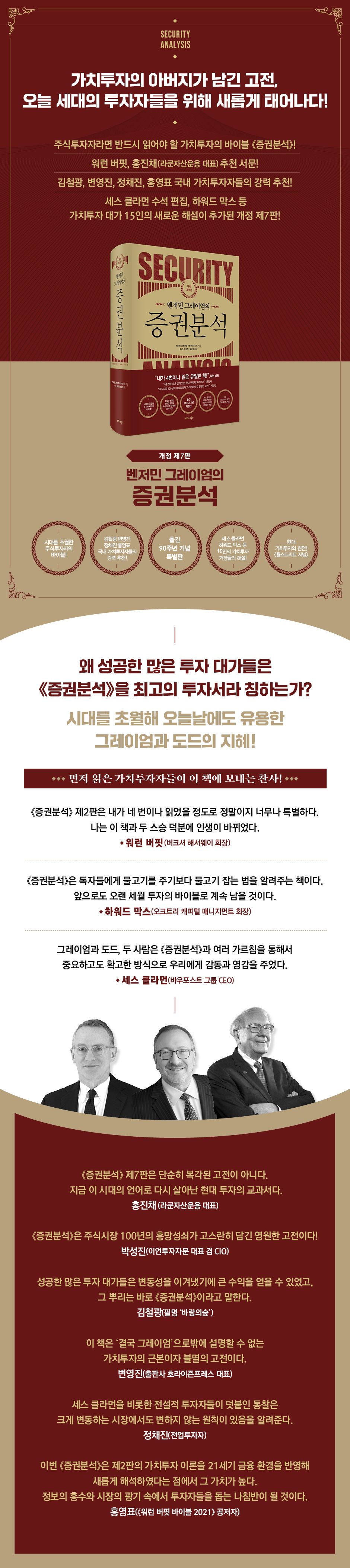

A classic from the father of value investing, reborn for today's investors!

"Securities Analysis," a book that stock investors have heard of at least once, has returned with its 7th revised edition after 14 years.

《Security Analysis》 is a classic among classics that has been considered a bible by investors around the world for 90 years since the first edition was published in 1934 by Benjamin Graham, author of 《The Intelligent Investor》 and known as the 'father of value investing.'

This book, which has sold over a million copies and has been revised several times up to its seventh edition, has established itself as a 'textbook on value investing' by passing on the philosophy and techniques of value investing established by Benjamin Graham and David Dodd to future generations.

This book systematizes for the first time several investment and economic terms and concepts currently in use, such as "margin of safety," "intrinsic value," "the distinction between investment and speculation," and "the gap between market price and value."

This revised seventh edition, a special edition commemorating the 90th anniversary of the original publication, reflects new events since the publication of the sixth edition (such as the pandemic, inflation, and Russia's invasion of Ukraine), recent changes in the economic and business environment, and developments in the investment industry and securities analysis.

The second edition of "Security Analysis," a highly acclaimed book among value investors including Warren Buffett, has been revised and supplemented with commentary from leading investors and experts, providing a contemporary perspective.

Value investors seeking significant returns must constantly train themselves to navigate changing times, new securities, emerging companies and industries, and shifting market environments.

This revised edition expands the depth and breadth of value investing thought by incorporating insights from commentators with diverse experience.

The 7th edition of "Security Analysis" continues to build on its reputation and will remain a valuable classic for years to come.

◆ Recommended by Warren Buffett and Hong Jin-chae (CEO of Raccoon Asset Management)!

◆ Strongly recommended by domestic value investors Kim Cheol-gwang, Byun Young-jin, Jeong Chae-jin, and Hong Young-pyo!

◆ Revised 7th edition with new commentary from 15 value investing experts, including Senior Editor Seth Klarman and Howard Marks!

A classic from the father of value investing, reborn for today's investors!

"Securities Analysis," a book that stock investors have heard of at least once, has returned with its 7th revised edition after 14 years.

《Security Analysis》 is a classic among classics that has been considered a bible by investors around the world for 90 years since the first edition was published in 1934 by Benjamin Graham, author of 《The Intelligent Investor》 and known as the 'father of value investing.'

This book, which has sold over a million copies and has been revised several times up to its seventh edition, has established itself as a 'textbook on value investing' by passing on the philosophy and techniques of value investing established by Benjamin Graham and David Dodd to future generations.

This book systematizes for the first time several investment and economic terms and concepts currently in use, such as "margin of safety," "intrinsic value," "the distinction between investment and speculation," and "the gap between market price and value."

This revised seventh edition, a special edition commemorating the 90th anniversary of the original publication, reflects new events since the publication of the sixth edition (such as the pandemic, inflation, and Russia's invasion of Ukraine), recent changes in the economic and business environment, and developments in the investment industry and securities analysis.

The second edition of "Security Analysis," a highly acclaimed book among value investors including Warren Buffett, has been revised and supplemented with commentary from leading investors and experts, providing a contemporary perspective.

Value investors seeking significant returns must constantly train themselves to navigate changing times, new securities, emerging companies and industries, and shifting market environments.

This revised edition expands the depth and breadth of value investing thought by incorporating insights from commentators with diverse experience.

The 7th edition of "Security Analysis" continues to build on its reputation and will remain a valuable classic for years to come.

- You can preview some of the book's contents.

Preview

index

· Recommendation: Warren Buffett

· Recommendation: A Living Textbook of Modern Investment_Hong Jin-chae

· Praise for the 7th Edition of Security Analysis

· Introduction to this book

· 《Securities Analysis》 edition

Translator's Note: A timeless classic that captures the rise and fall of the stock market over the past 100 years_Park Seong-jin

· Preface to the Seventh Edition: The Timeless Wisdom of Graham and Dodd_Seth Klarman

· Preface to the Second Edition

· Preface to the First Edition

Introduction to the 7th Edition: The Historical Background of Graham and Security Analysis_James Grant

· Introduction to Investment Policy, Second Edition

Part 1: Research and Analysis Techniques

Part 1: Introduction: Benjamin Graham: The Birth of Value Investing and Modern Finance_Roger Lowenstein

Chapter 1 Scope and Limitations of Securities Analysis.

The concept of intrinsic value

Chapter 2: Key Elements of the Analysis Problem.

Quantitative and qualitative factors

Chapter 3 Sources of Information

Chapter 4: Distinction between Investment and Speculation

Chapter 5 Classification of Securities

Part 2 Fixed Income Investments

Part II Introduction: Unleashing the Bond Shackles_Howard Marks

Chapter 6: Fixed-Income Securities Selection Principles 1

Chapter 7 Fixed-Income Securities Selection Principles 2 and 3

Chapter 8: Specific Criteria for Bond Investment 1

Chapter 9: Specific Criteria for Bond Investment 2 (Refer to online materials)

Chapter 10: Specific Criteria for Bond Investments 3

Chapter 11: Specific Criteria for Bond Investment 4 (Refer to online materials)

Chapter 12: Special Elements of Railroad and Utility Bond Analysis (See Online Resources)

Chapter 13: Other Special Elements of Bond Analysis (See Online Resources)

Chapter 14 Preferred Stock Theory (see online resources)

Chapter 15 Preferred Stock Selection Techniques

Chapter 16 Profitable Bonds and Guaranteed Bonds

Chapter 17 Guaranteed Bonds 2

Chapter 18: Protection Provisions and Relief for Holders of Senior Securities

Chapter 19 Protection Clause 2

Chapter 20 Preferred Stock Protection Provisions.

Maintaining subordinated capital (see online resources)

Chapter 21: Checking Stock Holdings

Part 3 Speculative Senior Securities

Part 3: Introduction: Investing in Distressed Debt - Dominique Miel

Chapter 22 Privileged Securities

Chapter 23 Technical Characteristics of Privileged Securities

Chapter 24 Technical Characteristics of Convertible Securities

Chapter 25. Securities with warrants.

Profit-participating securities.

Conversion and Hedging (see online resources)

Chapter 26: Senior Securities with Low Safety

Part 4: Common Stock Investment Theory.

Dividend factor

Part 4: Introduction: Research and Analysis for Value Investing_Todd Combs

Chapter 27: Common Stock Investment Theory

Chapter 28: New Principles of Common Stock Investment

Chapter 29: Dividend Elements in Common Stock Analysis

Chapter 30: Stock Dividends (see online resources)

Part 5: Analysis of the Income Statement.

Profit factors in common stock valuation

Part 5 Introduction 1: The Evolution of Value Investing_Stephen Romick

Part 5 Introduction 2: Partner with Owner-Managers_Benjamin Stein and Zachary Sternberg

Chapter 31: Income Statement Analysis

Chapter 32 Extraordinary Losses and Other Extraordinary Items in the Income Statement

Chapter 33: The Cunning Trick of Falsifying the Income Statement.

Subsidiary profits

Chapter 34: The Relationship Between Depreciation, etc. and Profitability

Chapter 35 Depreciation Policy for Public Interest Corporations (see online resources)

Chapter 36: Amortization Expenses from an Investor's Perspective (See Online Resources)

Chapter 37: The Importance of Profit Performance

Chapter 38: Why You Should Be Questioning Past Performance

Chapter 39: Price-earnings ratio of common stock.

Capital change adjustment

Chapter 40 Capital Structure

Chapter 41 Low-Price Common Stock.

Revenue Source Analysis

Part 6: Analysis of the financial statements.

The meaning of asset value

Part 6: Introduction: The Usefulness of Balance Sheet Analysis_Seth Klarman

Chapter 42: Analysis of the Financial Statements.

The importance of book value

Chapter 43: The Importance of Current Asset Value

Chapter 44. The Meaning of Liquidation Value.

Shareholder-Management Relationship

Chapter 45: Financial Statement Analysis (Conclusion)

Part 7 Other Aspects of Securities Analysis.

The gap between price and value

Part 7: Introduction: Markets Are Still Inefficient_Nancy Zimmerman

Chapter 46 Stock-Option Warrants (see online resources)

Chapter 47 Financial and Operating Costs

Chapter 48: Pyramid-style Corporate Finance

Chapter 49 Comparative Analysis of Similar Companies

Chapter 50: The Price-Value Gap 1

Chapter 51: The Price-Value Gap 2

Chapter 52 Market Analysis and Securities Analysis

Part 8: Modern Concepts of Value Investing

Global Investments_William Dummell, Ashish Pant, Jason Moment

Investing in Private Companies: A Case Study by David Abrams

Fund Management Principles and Case Studies_Seth Alexander

· Appendix (see online materials)

· Introduction to the 7th Edition: About the 7th Edition of Security Analysis_Seth Klarman

· Acknowledgements

· Introduction of the commentator

· About the Translator

· Recommendation: A Living Textbook of Modern Investment_Hong Jin-chae

· Praise for the 7th Edition of Security Analysis

· Introduction to this book

· 《Securities Analysis》 edition

Translator's Note: A timeless classic that captures the rise and fall of the stock market over the past 100 years_Park Seong-jin

· Preface to the Seventh Edition: The Timeless Wisdom of Graham and Dodd_Seth Klarman

· Preface to the Second Edition

· Preface to the First Edition

Introduction to the 7th Edition: The Historical Background of Graham and Security Analysis_James Grant

· Introduction to Investment Policy, Second Edition

Part 1: Research and Analysis Techniques

Part 1: Introduction: Benjamin Graham: The Birth of Value Investing and Modern Finance_Roger Lowenstein

Chapter 1 Scope and Limitations of Securities Analysis.

The concept of intrinsic value

Chapter 2: Key Elements of the Analysis Problem.

Quantitative and qualitative factors

Chapter 3 Sources of Information

Chapter 4: Distinction between Investment and Speculation

Chapter 5 Classification of Securities

Part 2 Fixed Income Investments

Part II Introduction: Unleashing the Bond Shackles_Howard Marks

Chapter 6: Fixed-Income Securities Selection Principles 1

Chapter 7 Fixed-Income Securities Selection Principles 2 and 3

Chapter 8: Specific Criteria for Bond Investment 1

Chapter 9: Specific Criteria for Bond Investment 2 (Refer to online materials)

Chapter 10: Specific Criteria for Bond Investments 3

Chapter 11: Specific Criteria for Bond Investment 4 (Refer to online materials)

Chapter 12: Special Elements of Railroad and Utility Bond Analysis (See Online Resources)

Chapter 13: Other Special Elements of Bond Analysis (See Online Resources)

Chapter 14 Preferred Stock Theory (see online resources)

Chapter 15 Preferred Stock Selection Techniques

Chapter 16 Profitable Bonds and Guaranteed Bonds

Chapter 17 Guaranteed Bonds 2

Chapter 18: Protection Provisions and Relief for Holders of Senior Securities

Chapter 19 Protection Clause 2

Chapter 20 Preferred Stock Protection Provisions.

Maintaining subordinated capital (see online resources)

Chapter 21: Checking Stock Holdings

Part 3 Speculative Senior Securities

Part 3: Introduction: Investing in Distressed Debt - Dominique Miel

Chapter 22 Privileged Securities

Chapter 23 Technical Characteristics of Privileged Securities

Chapter 24 Technical Characteristics of Convertible Securities

Chapter 25. Securities with warrants.

Profit-participating securities.

Conversion and Hedging (see online resources)

Chapter 26: Senior Securities with Low Safety

Part 4: Common Stock Investment Theory.

Dividend factor

Part 4: Introduction: Research and Analysis for Value Investing_Todd Combs

Chapter 27: Common Stock Investment Theory

Chapter 28: New Principles of Common Stock Investment

Chapter 29: Dividend Elements in Common Stock Analysis

Chapter 30: Stock Dividends (see online resources)

Part 5: Analysis of the Income Statement.

Profit factors in common stock valuation

Part 5 Introduction 1: The Evolution of Value Investing_Stephen Romick

Part 5 Introduction 2: Partner with Owner-Managers_Benjamin Stein and Zachary Sternberg

Chapter 31: Income Statement Analysis

Chapter 32 Extraordinary Losses and Other Extraordinary Items in the Income Statement

Chapter 33: The Cunning Trick of Falsifying the Income Statement.

Subsidiary profits

Chapter 34: The Relationship Between Depreciation, etc. and Profitability

Chapter 35 Depreciation Policy for Public Interest Corporations (see online resources)

Chapter 36: Amortization Expenses from an Investor's Perspective (See Online Resources)

Chapter 37: The Importance of Profit Performance

Chapter 38: Why You Should Be Questioning Past Performance

Chapter 39: Price-earnings ratio of common stock.

Capital change adjustment

Chapter 40 Capital Structure

Chapter 41 Low-Price Common Stock.

Revenue Source Analysis

Part 6: Analysis of the financial statements.

The meaning of asset value

Part 6: Introduction: The Usefulness of Balance Sheet Analysis_Seth Klarman

Chapter 42: Analysis of the Financial Statements.

The importance of book value

Chapter 43: The Importance of Current Asset Value

Chapter 44. The Meaning of Liquidation Value.

Shareholder-Management Relationship

Chapter 45: Financial Statement Analysis (Conclusion)

Part 7 Other Aspects of Securities Analysis.

The gap between price and value

Part 7: Introduction: Markets Are Still Inefficient_Nancy Zimmerman

Chapter 46 Stock-Option Warrants (see online resources)

Chapter 47 Financial and Operating Costs

Chapter 48: Pyramid-style Corporate Finance

Chapter 49 Comparative Analysis of Similar Companies

Chapter 50: The Price-Value Gap 1

Chapter 51: The Price-Value Gap 2

Chapter 52 Market Analysis and Securities Analysis

Part 8: Modern Concepts of Value Investing

Global Investments_William Dummell, Ashish Pant, Jason Moment

Investing in Private Companies: A Case Study by David Abrams

Fund Management Principles and Case Studies_Seth Alexander

· Appendix (see online materials)

· Introduction to the 7th Edition: About the 7th Edition of Security Analysis_Seth Klarman

· Acknowledgements

· Introduction of the commentator

· About the Translator

Detailed image

Into the book

In my library, which is overflowing with books, there are four books that I particularly cherish.

Adam Smith's The Wealth of Nations, Benjamin Graham's The Intelligent Investor, Graham and Dodd's second edition of Security Analysis, and the 1934 edition of Security Analysis given to me by Dodd's only daughter, Barbara Dodd Anderson.

These books were all published over 50 years ago.

These four books are still incredibly valuable even if I am reading them for the first time.

Even though the words have faded, the wisdom contained in the book remains the same.

Meeting Graham and Dodd, first through books and then in person, freed me from my intellectual wanderings.

They drew me a road map to investing, and I've been following it for 57 years.

There was absolutely no reason to look for other maps.

---From "Warren Buffett (Recommendation)"

Change is the only constant in the investing world.

Any investment book that is to stand the test of time must be universal.

A successful investment philosophy must be based on simple, solid principles, yet flexible in its application and strategy, and able to navigate change.

Value investing is exactly that kind of investment philosophy.

On the other hand, if you follow market trends, you will end up trading recklessly and constantly being swayed by volatility.

---From "Preface to the 7th Edition: The Timeless Wisdom of Graham and Dodd_Seth Klarman"

Graham teaches a bottom-up approach to stock selection, starting with research and analysis of specific securities.

Ultimately, what matters is the expected earnings and free cash flow that can secure a solid margin of safety.

Any securities that do not do so are not investments but speculation, Graham advised.

Meme stocks, overly inflated private equity valuations, SPACs, cryptocurrencies, and highly leveraged loans from pseudo-crypto banks are all forms of speculation.

---From "Part 1 Introduction: Benjamin Graham - The Birth of Value Investing and Modern Finance_Roger Lowenstein"

Graham and Dodd emphasize content over form, logic over rules.

Credit rating standards should not be fixed but adjusted to meet changing world conditions.

What matters is not the appearance of the bond, but its ability to pay.

Secured debt is not always better than unsecured debt.

Senior bonds are not necessarily more advantageous than subordinated bonds.

If the yield is high enough, a riskier bond may be better than a seemingly safer bond.

Although the formal language of 80 years ago makes it hard to see, a careful reading of this book makes it clear that Graham and Dodd were true pragmatists.

They have more in common with Keynes than in dissimilarity, and advise taking risks wisely (rather than avoiding them blindly) after thorough analysis.

---From "Part 2 Introduction: Unleashing the Bond Shackles_Howard Marks"

The most important thing for distressed debt investors to keep in mind is to focus on the risk of loss.

This is Graham and Dodd's concept of 'margin of safety'.

One has to consider how much further bond prices could fall if things go wrong.

Insolvent companies are more likely to go wrong.

In Chapter 6 of Security Analysis, Graham stated, “The fundamental goal of bond investors should not be to protect themselves when problems arise, but to avoid problems themselves.”

---From "Part 3: Introduction to Bad Debt Investment_Dominique Miel"

Investors must navigate uncertainty and randomness.

The daily decisions companies make, sometimes even decisions made decades ago, impact their businesses and industries today.

The complex web of complex, path-dependent situations makes it difficult for even the most astute executives to grasp the whole picture.

There is no such thing as perfect information.

There are only probabilistic confidence intervals.

That's why a margin of safety is so important in investing.

If we acknowledge that our knowledge is limited, we must leave room for error.

The less you know, the greater your margin of safety.

---From "Part 4: Introduction to Value Investing: Research and Analysis_Todd Combs"

As Graham and Dodd said, the stock market is a polling place in the short term, but it works like a scale in the long term.

Just as you can tell the current temperature by looking at a thermometer, but not the temperature tomorrow, short-term stock price movements tell you nothing about a company's future value.

Thanks to the irrational behavior of other investors, we can buy stocks at a discount and sell them at a premium.

(…) Although much has changed since the publication of Security Analysis, it is still possible to achieve satisfactory results by investing at prices that provide a margin of safety.

I believe that value investing is the best way to secure your principal while achieving attractive long-term returns.

Although important financial variables and indicators may change, the principles remain valid.

---From "Part 5 Introduction 1: The Evolution of Value Investing_Steven Romick"

Graham and Dodd said that good investing is focusing on individual investments and analyzing them thoroughly.

It is necessary to thoroughly understand the contractual terms contained in the securities and the practical elements related to the execution of contractual obligations.

Accurately modeling cash flows, determining an appropriate discount rate, and properly assessing feasibility are crucial to the success of an investment.

Because markets are inefficient and will likely remain so, we must focus our time and capital where the gap between price and value is greatest.

---From "Part 7 Introduction: The Market Is Still Inefficient_Nancy Zimmerman"

Although Security Analysis focuses on the U.S. market, Graham and Dodd's advice is equally useful in global markets.

However, there are some additional considerations to keep in mind when investing globally.

First, assessing the intrinsic value of foreign companies is much more difficult than for U.S. companies due to issues such as foreign exchange risk, uncertain regulatory regimes, and unstable political and economic power.

Additionally, poor corporate governance structures may expose common shareholders to additional risks.

The influence of shareholder activism is also limited.

These risks significantly alter the company's future value, and it is unclear how long a significant discount to intrinsic value will last.

As a result, global investors must discount intrinsic value more deeply and demand a greater margin of safety.

Adam Smith's The Wealth of Nations, Benjamin Graham's The Intelligent Investor, Graham and Dodd's second edition of Security Analysis, and the 1934 edition of Security Analysis given to me by Dodd's only daughter, Barbara Dodd Anderson.

These books were all published over 50 years ago.

These four books are still incredibly valuable even if I am reading them for the first time.

Even though the words have faded, the wisdom contained in the book remains the same.

Meeting Graham and Dodd, first through books and then in person, freed me from my intellectual wanderings.

They drew me a road map to investing, and I've been following it for 57 years.

There was absolutely no reason to look for other maps.

---From "Warren Buffett (Recommendation)"

Change is the only constant in the investing world.

Any investment book that is to stand the test of time must be universal.

A successful investment philosophy must be based on simple, solid principles, yet flexible in its application and strategy, and able to navigate change.

Value investing is exactly that kind of investment philosophy.

On the other hand, if you follow market trends, you will end up trading recklessly and constantly being swayed by volatility.

---From "Preface to the 7th Edition: The Timeless Wisdom of Graham and Dodd_Seth Klarman"

Graham teaches a bottom-up approach to stock selection, starting with research and analysis of specific securities.

Ultimately, what matters is the expected earnings and free cash flow that can secure a solid margin of safety.

Any securities that do not do so are not investments but speculation, Graham advised.

Meme stocks, overly inflated private equity valuations, SPACs, cryptocurrencies, and highly leveraged loans from pseudo-crypto banks are all forms of speculation.

---From "Part 1 Introduction: Benjamin Graham - The Birth of Value Investing and Modern Finance_Roger Lowenstein"

Graham and Dodd emphasize content over form, logic over rules.

Credit rating standards should not be fixed but adjusted to meet changing world conditions.

What matters is not the appearance of the bond, but its ability to pay.

Secured debt is not always better than unsecured debt.

Senior bonds are not necessarily more advantageous than subordinated bonds.

If the yield is high enough, a riskier bond may be better than a seemingly safer bond.

Although the formal language of 80 years ago makes it hard to see, a careful reading of this book makes it clear that Graham and Dodd were true pragmatists.

They have more in common with Keynes than in dissimilarity, and advise taking risks wisely (rather than avoiding them blindly) after thorough analysis.

---From "Part 2 Introduction: Unleashing the Bond Shackles_Howard Marks"

The most important thing for distressed debt investors to keep in mind is to focus on the risk of loss.

This is Graham and Dodd's concept of 'margin of safety'.

One has to consider how much further bond prices could fall if things go wrong.

Insolvent companies are more likely to go wrong.

In Chapter 6 of Security Analysis, Graham stated, “The fundamental goal of bond investors should not be to protect themselves when problems arise, but to avoid problems themselves.”

---From "Part 3: Introduction to Bad Debt Investment_Dominique Miel"

Investors must navigate uncertainty and randomness.

The daily decisions companies make, sometimes even decisions made decades ago, impact their businesses and industries today.

The complex web of complex, path-dependent situations makes it difficult for even the most astute executives to grasp the whole picture.

There is no such thing as perfect information.

There are only probabilistic confidence intervals.

That's why a margin of safety is so important in investing.

If we acknowledge that our knowledge is limited, we must leave room for error.

The less you know, the greater your margin of safety.

---From "Part 4: Introduction to Value Investing: Research and Analysis_Todd Combs"

As Graham and Dodd said, the stock market is a polling place in the short term, but it works like a scale in the long term.

Just as you can tell the current temperature by looking at a thermometer, but not the temperature tomorrow, short-term stock price movements tell you nothing about a company's future value.

Thanks to the irrational behavior of other investors, we can buy stocks at a discount and sell them at a premium.

(…) Although much has changed since the publication of Security Analysis, it is still possible to achieve satisfactory results by investing at prices that provide a margin of safety.

I believe that value investing is the best way to secure your principal while achieving attractive long-term returns.

Although important financial variables and indicators may change, the principles remain valid.

---From "Part 5 Introduction 1: The Evolution of Value Investing_Steven Romick"

Graham and Dodd said that good investing is focusing on individual investments and analyzing them thoroughly.

It is necessary to thoroughly understand the contractual terms contained in the securities and the practical elements related to the execution of contractual obligations.

Accurately modeling cash flows, determining an appropriate discount rate, and properly assessing feasibility are crucial to the success of an investment.

Because markets are inefficient and will likely remain so, we must focus our time and capital where the gap between price and value is greatest.

---From "Part 7 Introduction: The Market Is Still Inefficient_Nancy Zimmerman"

Although Security Analysis focuses on the U.S. market, Graham and Dodd's advice is equally useful in global markets.

However, there are some additional considerations to keep in mind when investing globally.

First, assessing the intrinsic value of foreign companies is much more difficult than for U.S. companies due to issues such as foreign exchange risk, uncertain regulatory regimes, and unstable political and economic power.

Additionally, poor corporate governance structures may expose common shareholders to additional risks.

The influence of shareholder activism is also limited.

These risks significantly alter the company's future value, and it is unclear how long a significant discount to intrinsic value will last.

As a result, global investors must discount intrinsic value more deeply and demand a greater margin of safety.

---From "Part 8 Global Investment_William Dermal, Ashish Pant, Jason Moment"

Publisher's Review

Why do so many successful investors call "Security Analysis" the best investment book ever?

Graham and Dodd's timeless wisdom remains relevant today!

“Investment management is about ensuring the safety of principal and satisfactory returns based on thorough analysis.

Any operation that does not meet these requirements is speculation.”

“People who habitually buy stocks with a price-to-earnings ratio of 20 or more are likely to lose a lot of money in the long run.”

“We’ve come to the long-held principle that you have to wait until the economy is down and the stock market is down to buy blue-chip stocks.

“If not now, you will buy at a high price and regret it later.”

“Attractive investment conditions for novice investors: No matter how good the conditions are, we don't invest in companies with low ratings.”

“Since safety depends entirely on the debtor’s ability to repay, its ability to repay must be measured.”

These tips are part of the principles of value investing that Benjamin Graham and David Dodd passed on to future generations of investors through their book, Security Analysis.

Although Security Analysis was published 90 years ago, the teachings Graham and Dodd left behind are still surprisingly relevant today.

The margin of safety, intrinsic value, and the distinction between investing and speculating that they spoke of are compasses that still work for today's investors.

Of course, the world has changed a lot.

In the past, corporate value came from tangible assets like factories and railroads, but now intangible assets like people, intellectual property, brands, and network effects are key.

Digital-era companies are creating new revenue models with rapid scalability and low cost structures.

But that doesn't mean the principles change.

The lesson of coldly evaluating a company's profitability and investing only when it's priced well below its intrinsic value remains the starting point for successful investing.

The answer is clear in this regard, given the recent investment boom.

Meme stocks are nothing more than speculative investments driven by social media crazes, and SPAC stocks are impossible to analyze until the merger.

Private equity funds generate profits thanks to high leverage, but rising interest rates can actually be detrimental.

So, this is what Graham would say to investors today:

“Look at the intrinsic value.

Beware of leverage.

“Avoid what you can’t analyze.” This is precisely why Security Analysis is still read across generations.

Warren Buffett said of "Security Analysis" that it was "the book that changed my life," and he made the distinction between investment and speculation, which requires thorough analysis to secure safety of principal and satisfactory returns, his lifelong philosophy.

Seth Klarman placed the principle of "Margin of Safety," which is the core of this book, at the center of his investment philosophy, and even titled his book "Margin of Safety."

Howard Marks believes that opportunities arise from the gap between intrinsic value and market price, which is in line with the insight into market inefficiency that was early emphasized in Security Analysis.

Todd Combs of Berkshire Hathaway, known as the "Young Buffett," also read it several times and used it as a textbook for his investment attitude and analytical training.

The advantage that these experts commonly point out is that "Security Analysis" is not just a book on simple techniques, but a book that fundamentally changes investors' mindset and attitude.

Published 90 years ago, it goes beyond the turmoil of the 20th-century American stock market.

The history of "Securities Analysis," which has evolved into a textbook on value investing!

《Security Analysis》 was first published in 1934 and has since been revised and published several times, reflecting the development of value investing theory and changes in the financial environment.

· The first edition (1934) can be called 'an investment book born in the chaos of great prosperity and great crash.'

It was a time of unprecedented upheaval, with the United States and the world falling into the Great Depression.

From its peak in 1929 to its low in 1932, the Dow Jones Industrial Average plummeted nearly 90 percent over a three-year period, and Graham himself suffered a massive loss of -70 percent of his assets.

However, he was not pessimistic. Rather, he analyzed the intrinsic value of stocks and bonds in uncertain market conditions and first proposed the concept of a 'margin of safety.'

In this way, the first edition is a historical version that systematizes the principles of value investing.

· 1940, when the second edition was published, was the height of World War II.

Graham and Dodd were concerned about the growing uncertainty in the aftermath of the war, but they did not change the fundamentals of their analysis.

Rather, it strengthens the theoretical framework of value investing by addressing some of the weaknesses of the first edition, such as expanding the analysis of bonds and preferred stocks and refining corporate analysis techniques.

That's why many investors, including Warren Buffett, consider this version to be the 'original version.'

· From mid-1949 to early 1966, the U.S. stock market experienced its greatest golden age since the Great Depression, with the Dow Jones Industrial Average rising nearly sixfold.

The third edition, published in 1951 at the beginning of this bull market, recommended that the authors focus more on sound, income-generating common stocks than on currency, given the inevitable post-war inflation.

This third edition is the last edition written directly by Graham and Dodd.

· The fourth edition (revised in 1962) was co-authored by Graham, Dodd, and Sidney Cottle, former director of finance at the Stanford Research Institute.

This is an expanded version that covers trends and growth stocks.

The 1960s were an era of growth.

Mutual funds were flooding in, and investors aggressively invested in growth stocks in pursuit of short-term, high returns.

Even experts considered fundamental analysis of a company meaningless and assessed its value solely based on earnings trends.

Only Graham and a young Warren Buffett were pessimistic about the situation.

· The 5th edition (revised in 1988) was published after Graham's death.

Sidney Cottle is the chief editor, and economist Roger Murray and investment researcher Frank E.

Block) supplemented the content.

Includes a foreword by Warren Buffett.

After Black Monday in 1987, investors fled the market, and cheap stocks began to flood in again.

The market, which had been in a sideways trend for a long time, entered another long bull market from mid-1982 until the dot-com bubble burst in early 2000.

· The 6th edition (revised in 2009) was edited by Seth Klarman, and 11 later value investors, including Howard Marks, used the 2nd edition as the basic text, adding commentary to suit the financial environment of the early 21st century.

Immediately after publication.

The financial crisis caused by the 'subprime mortgage crisis' caused a serious recession in the market.

· This 7th edition (revised in 2023) is a revised edition published 14 years after the 6th edition, and is based on the 2nd edition from 1940, with commentary on the original text and a modern perspective.

After the financial crisis, the market enjoyed a boom for 11 years thanks to various government interventions.

But major events like the pandemic, inflation, and Russia's invasion of Ukraine have increased uncertainty.

The 7th edition presents a method for applying Graham and Dodd's principles to the modern investment environment amidst these recent economic and social changes.

To this end, renowned value investors such as James Grant, Roger Lowenstein, and Howard Marks participated as commentators and added their own insights.

Part 8, in particular, sheds new light on the principles of strategy and opportunities in the global market, investment in unlisted companies, and fund management, focusing on the topic of "Modern Concepts of Value Investing."

7th Edition Commentator

Seth A. Klarman

Klarman): Senior Editor of the 7th Edition.

CEO and Portfolio Manager of The Baupost Group, LLC.

Since 1983, we have been successfully operating several investment funds using value investing principles.

He is also the author of the value investing classic, Margin of Safety.

James Grant: [Grant's Interest Rate Observer]

Founder and editor, he has been writing about markets and finance for half a century.

He was co-editor of the 6th edition of Security Analysis.

Roger Lowenstein: A leading American financial writer, he has written books on economic history and finance.

He is the author of the bestsellers Warren Buffett and The Greatest Money Maker.

Howard S. Marks

Marks): Founder and Chairman of Oaktree Capital Management, LP.

He invested in high-yield bonds early on and is an avid follower of Graham and Dodd.

Dominique Mielle: He served as a partner and portfolio manager at a large hedge fund focused on investing in distressed debt. He played a key role in complex bankruptcies, including those of PG&E, Puerto Rico, and a major U.S. airline.

In 2017, she was included in the "50 Leading Women in Hedge Funds" list by The Hedge Fund Journal and Ernst & Young.

Todd A. Combs

Combs) : Chairman and CEO of Geico and chief investment officer of Berkshire Hathaway.

He has also been a director at JP Morgan Chase since 2016.

Steven Romick: Partner at First Pacific Advisors, a value investing investment partnership.

Morningstar awarded him the 2013 "U.S. Asset Allocation Fund Manager of the Year" award for his FPA Crescent Fund, which he managed, for having the highest risk-adjusted return among mutual funds.

Zachary S. Sternberg

Sternberg), Benjamin F. Stein

Stein): The two founded Spruce House Partnership together in New York in 2005, when they were sophomores at the University of Pennsylvania.

Did.

This investment fund makes long-term investments in listed and unlisted companies managed by their owners.

Nancy Zimmerman: Co-founder and partner at Bracebridge Capital, a Boston-based hedge fund that pursues absolute returns.

William Duhamel, Jason E.

Moment), Ashish Pant: Route One Investment Company, LP, founded in 2010

They are representatives.

Root One invests globally using a value investing approach.

David Abrams: He is the CEO of Abrams Capital Management, a hedge fund founded in Boston in 1999.

Seth Alexander: President of MIT Investment Management Company (MITIMCo), a division of MIT. He manages MIT's financial assets, including its endowment, retirement pension, and retiree benefit funds.

Graham and Dodd's timeless wisdom remains relevant today!

“Investment management is about ensuring the safety of principal and satisfactory returns based on thorough analysis.

Any operation that does not meet these requirements is speculation.”

“People who habitually buy stocks with a price-to-earnings ratio of 20 or more are likely to lose a lot of money in the long run.”

“We’ve come to the long-held principle that you have to wait until the economy is down and the stock market is down to buy blue-chip stocks.

“If not now, you will buy at a high price and regret it later.”

“Attractive investment conditions for novice investors: No matter how good the conditions are, we don't invest in companies with low ratings.”

“Since safety depends entirely on the debtor’s ability to repay, its ability to repay must be measured.”

These tips are part of the principles of value investing that Benjamin Graham and David Dodd passed on to future generations of investors through their book, Security Analysis.

Although Security Analysis was published 90 years ago, the teachings Graham and Dodd left behind are still surprisingly relevant today.

The margin of safety, intrinsic value, and the distinction between investing and speculating that they spoke of are compasses that still work for today's investors.

Of course, the world has changed a lot.

In the past, corporate value came from tangible assets like factories and railroads, but now intangible assets like people, intellectual property, brands, and network effects are key.

Digital-era companies are creating new revenue models with rapid scalability and low cost structures.

But that doesn't mean the principles change.

The lesson of coldly evaluating a company's profitability and investing only when it's priced well below its intrinsic value remains the starting point for successful investing.

The answer is clear in this regard, given the recent investment boom.

Meme stocks are nothing more than speculative investments driven by social media crazes, and SPAC stocks are impossible to analyze until the merger.

Private equity funds generate profits thanks to high leverage, but rising interest rates can actually be detrimental.

So, this is what Graham would say to investors today:

“Look at the intrinsic value.

Beware of leverage.

“Avoid what you can’t analyze.” This is precisely why Security Analysis is still read across generations.

Warren Buffett said of "Security Analysis" that it was "the book that changed my life," and he made the distinction between investment and speculation, which requires thorough analysis to secure safety of principal and satisfactory returns, his lifelong philosophy.

Seth Klarman placed the principle of "Margin of Safety," which is the core of this book, at the center of his investment philosophy, and even titled his book "Margin of Safety."

Howard Marks believes that opportunities arise from the gap between intrinsic value and market price, which is in line with the insight into market inefficiency that was early emphasized in Security Analysis.

Todd Combs of Berkshire Hathaway, known as the "Young Buffett," also read it several times and used it as a textbook for his investment attitude and analytical training.

The advantage that these experts commonly point out is that "Security Analysis" is not just a book on simple techniques, but a book that fundamentally changes investors' mindset and attitude.

Published 90 years ago, it goes beyond the turmoil of the 20th-century American stock market.

The history of "Securities Analysis," which has evolved into a textbook on value investing!

《Security Analysis》 was first published in 1934 and has since been revised and published several times, reflecting the development of value investing theory and changes in the financial environment.

· The first edition (1934) can be called 'an investment book born in the chaos of great prosperity and great crash.'

It was a time of unprecedented upheaval, with the United States and the world falling into the Great Depression.

From its peak in 1929 to its low in 1932, the Dow Jones Industrial Average plummeted nearly 90 percent over a three-year period, and Graham himself suffered a massive loss of -70 percent of his assets.

However, he was not pessimistic. Rather, he analyzed the intrinsic value of stocks and bonds in uncertain market conditions and first proposed the concept of a 'margin of safety.'

In this way, the first edition is a historical version that systematizes the principles of value investing.

· 1940, when the second edition was published, was the height of World War II.

Graham and Dodd were concerned about the growing uncertainty in the aftermath of the war, but they did not change the fundamentals of their analysis.

Rather, it strengthens the theoretical framework of value investing by addressing some of the weaknesses of the first edition, such as expanding the analysis of bonds and preferred stocks and refining corporate analysis techniques.

That's why many investors, including Warren Buffett, consider this version to be the 'original version.'

· From mid-1949 to early 1966, the U.S. stock market experienced its greatest golden age since the Great Depression, with the Dow Jones Industrial Average rising nearly sixfold.

The third edition, published in 1951 at the beginning of this bull market, recommended that the authors focus more on sound, income-generating common stocks than on currency, given the inevitable post-war inflation.

This third edition is the last edition written directly by Graham and Dodd.

· The fourth edition (revised in 1962) was co-authored by Graham, Dodd, and Sidney Cottle, former director of finance at the Stanford Research Institute.

This is an expanded version that covers trends and growth stocks.

The 1960s were an era of growth.

Mutual funds were flooding in, and investors aggressively invested in growth stocks in pursuit of short-term, high returns.

Even experts considered fundamental analysis of a company meaningless and assessed its value solely based on earnings trends.

Only Graham and a young Warren Buffett were pessimistic about the situation.

· The 5th edition (revised in 1988) was published after Graham's death.

Sidney Cottle is the chief editor, and economist Roger Murray and investment researcher Frank E.

Block) supplemented the content.

Includes a foreword by Warren Buffett.

After Black Monday in 1987, investors fled the market, and cheap stocks began to flood in again.

The market, which had been in a sideways trend for a long time, entered another long bull market from mid-1982 until the dot-com bubble burst in early 2000.

· The 6th edition (revised in 2009) was edited by Seth Klarman, and 11 later value investors, including Howard Marks, used the 2nd edition as the basic text, adding commentary to suit the financial environment of the early 21st century.

Immediately after publication.

The financial crisis caused by the 'subprime mortgage crisis' caused a serious recession in the market.

· This 7th edition (revised in 2023) is a revised edition published 14 years after the 6th edition, and is based on the 2nd edition from 1940, with commentary on the original text and a modern perspective.

After the financial crisis, the market enjoyed a boom for 11 years thanks to various government interventions.

But major events like the pandemic, inflation, and Russia's invasion of Ukraine have increased uncertainty.

The 7th edition presents a method for applying Graham and Dodd's principles to the modern investment environment amidst these recent economic and social changes.

To this end, renowned value investors such as James Grant, Roger Lowenstein, and Howard Marks participated as commentators and added their own insights.

Part 8, in particular, sheds new light on the principles of strategy and opportunities in the global market, investment in unlisted companies, and fund management, focusing on the topic of "Modern Concepts of Value Investing."

7th Edition Commentator

Seth A. Klarman

Klarman): Senior Editor of the 7th Edition.

CEO and Portfolio Manager of The Baupost Group, LLC.

Since 1983, we have been successfully operating several investment funds using value investing principles.

He is also the author of the value investing classic, Margin of Safety.

James Grant: [Grant's Interest Rate Observer]

Founder and editor, he has been writing about markets and finance for half a century.

He was co-editor of the 6th edition of Security Analysis.

Roger Lowenstein: A leading American financial writer, he has written books on economic history and finance.

He is the author of the bestsellers Warren Buffett and The Greatest Money Maker.

Howard S. Marks

Marks): Founder and Chairman of Oaktree Capital Management, LP.

He invested in high-yield bonds early on and is an avid follower of Graham and Dodd.

Dominique Mielle: He served as a partner and portfolio manager at a large hedge fund focused on investing in distressed debt. He played a key role in complex bankruptcies, including those of PG&E, Puerto Rico, and a major U.S. airline.

In 2017, she was included in the "50 Leading Women in Hedge Funds" list by The Hedge Fund Journal and Ernst & Young.

Todd A. Combs

Combs) : Chairman and CEO of Geico and chief investment officer of Berkshire Hathaway.

He has also been a director at JP Morgan Chase since 2016.

Steven Romick: Partner at First Pacific Advisors, a value investing investment partnership.

Morningstar awarded him the 2013 "U.S. Asset Allocation Fund Manager of the Year" award for his FPA Crescent Fund, which he managed, for having the highest risk-adjusted return among mutual funds.

Zachary S. Sternberg

Sternberg), Benjamin F. Stein

Stein): The two founded Spruce House Partnership together in New York in 2005, when they were sophomores at the University of Pennsylvania.

Did.

This investment fund makes long-term investments in listed and unlisted companies managed by their owners.

Nancy Zimmerman: Co-founder and partner at Bracebridge Capital, a Boston-based hedge fund that pursues absolute returns.

William Duhamel, Jason E.

Moment), Ashish Pant: Route One Investment Company, LP, founded in 2010

They are representatives.

Root One invests globally using a value investing approach.

David Abrams: He is the CEO of Abrams Capital Management, a hedge fund founded in Boston in 1999.

Seth Alexander: President of MIT Investment Management Company (MITIMCo), a division of MIT. He manages MIT's financial assets, including its endowment, retirement pension, and retiree benefit funds.

GOODS SPECIFICS

- Date of issue: September 22, 2025

- Format: Hardcover book binding method guide

- Page count, weight, size: 868 pages | 1,554g | 170*230*46mm

- ISBN13: 9791162544389

- ISBN10: 1162544384

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)