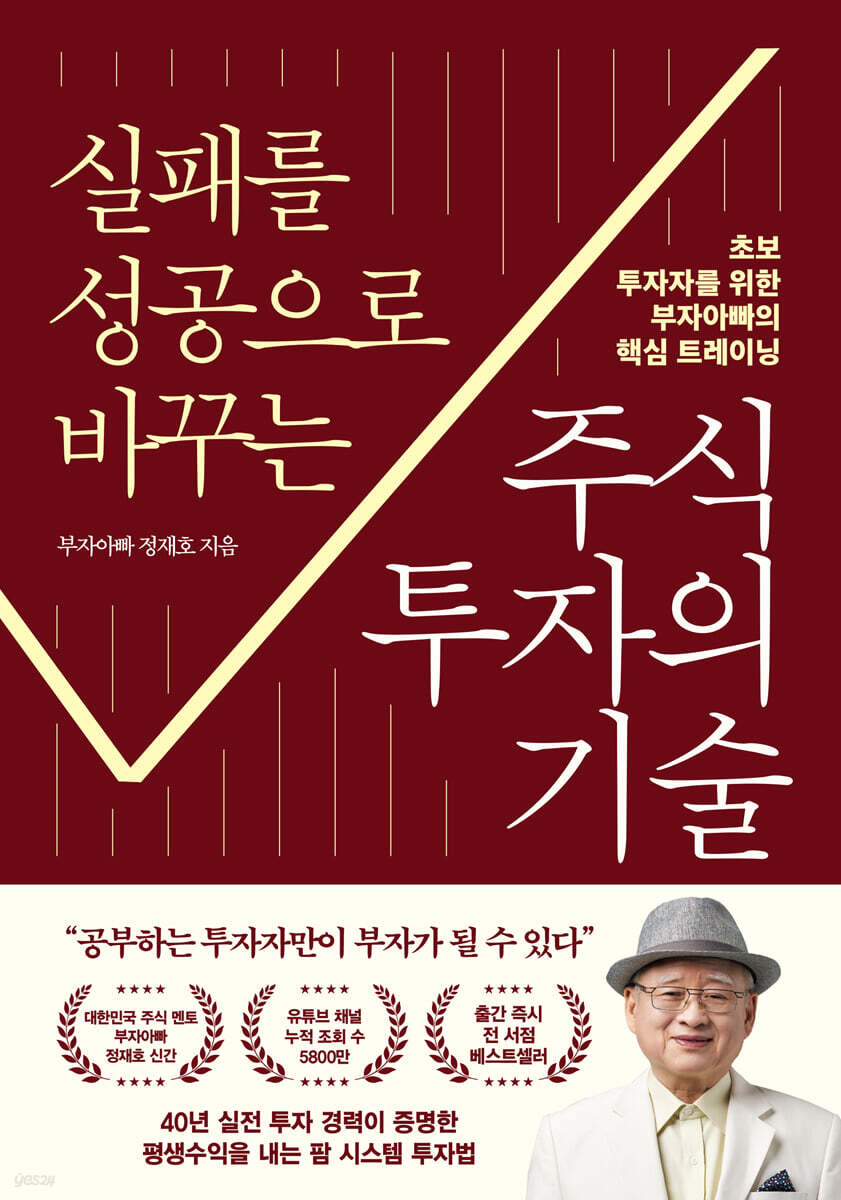

The Art of Turning Failure into Success: Stock Investment (Buljang Edition)

|

Description

Book Introduction

- A word from MD

-

How to Build Long-Term Market SurvivalA new book by Korea's leading stock mentor, author Jaeho Jeong of "Rich Dad," after three years.

It contains the investment philosophy that generates long-term profits based on market principles and public psychology, as well as the know-how of a mindset that is unshaken by market changes.

40 years of real-world investing experience provides practical insights for both beginners and intermediate investors.

May 16, 2025. Economics and Management PD Oh Da-eun

Rich Dad's Bull Market Response Scenario: A Master of Stock Discovery

'Buljang Edition' released!

★ New recommended stocks continue the legacy of the "All Stocks Rising" first edition supplement! Included in the limited edition "Buljang Edition" supplement.

★ Urgent update on the chart of the top 5 leading stocks in the first half of the year

The book "Stock Investment Techniques that Turn Failure into Success," which contains 40 years of practical investment know-how from Jae-ho Jeong, a living legend of the Korean stock market and "Rich Dad," is being newly published in a bull market edition targeting the bull market phase.

All five recommended stocks provided in the limited edition at the time of publication in May 2025 showed high volatility and rose to become leading stocks in the midst of a turbulent market.

Rich dad's words, "There are always individual stocks that quietly rise," have proven true once again.

After four years of adjustment, the domestic stock market turned red.

The KOSPI index has surpassed 3,000, which appears to be a starting point rather than an end point.

As the market is doing well, people who had left the stock market are returning, and there is an overflow of people who want to learn new things.

Rich Dad is back again to help new and novice investors.

The Buljang Edition updates the chart of the top five leading stocks in the first half of the year and provides newly recommended stocks as a limited appendix.

As before, the recommended stocks were selected by applying the principles of the ‘farm system’.

The Palm System recommends investing from a long-term perspective by analyzing the fundamental principles of market prices, the company's actual value, and stock price trends, rather than short-term trends or themes.

I hope you will carefully study the information presented while asking yourself, "Why is this stock worth paying attention to now?"

What investors should not forget is, above all, the determination to study consistently.

Don't be impatient, ride the wave of proven insights from experts and move forward steadily, striving for stable, long-term profits.

If you do this, the path to achieving lifelong wealth will naturally open up.

'Buljang Edition' released!

★ New recommended stocks continue the legacy of the "All Stocks Rising" first edition supplement! Included in the limited edition "Buljang Edition" supplement.

★ Urgent update on the chart of the top 5 leading stocks in the first half of the year

The book "Stock Investment Techniques that Turn Failure into Success," which contains 40 years of practical investment know-how from Jae-ho Jeong, a living legend of the Korean stock market and "Rich Dad," is being newly published in a bull market edition targeting the bull market phase.

All five recommended stocks provided in the limited edition at the time of publication in May 2025 showed high volatility and rose to become leading stocks in the midst of a turbulent market.

Rich dad's words, "There are always individual stocks that quietly rise," have proven true once again.

After four years of adjustment, the domestic stock market turned red.

The KOSPI index has surpassed 3,000, which appears to be a starting point rather than an end point.

As the market is doing well, people who had left the stock market are returning, and there is an overflow of people who want to learn new things.

Rich Dad is back again to help new and novice investors.

The Buljang Edition updates the chart of the top five leading stocks in the first half of the year and provides newly recommended stocks as a limited appendix.

As before, the recommended stocks were selected by applying the principles of the ‘farm system’.

The Palm System recommends investing from a long-term perspective by analyzing the fundamental principles of market prices, the company's actual value, and stock price trends, rather than short-term trends or themes.

I hope you will carefully study the information presented while asking yourself, "Why is this stock worth paying attention to now?"

What investors should not forget is, above all, the determination to study consistently.

Don't be impatient, ride the wave of proven insights from experts and move forward steadily, striving for stable, long-term profits.

If you do this, the path to achieving lifelong wealth will naturally open up.

- You can preview some of the book's contents.

Preview

index

Recommendation

[Prologue] Investing requires the attitude of a farmer sowing seeds.

[Chapter 1] Farm System Investment Method for Lifelong Profits

What Makes a Successful Investor Different?

Market risk factors that lead to losses

The Palm System Investment Method that Understands the Essence of Investment

5 Steps to Prepare for Investing in a Real-World Farm System

[Chapter 2] Creating a Farm Systems Investment Portfolio

Choose a sport where the sun shines

Practical Value Stock Investing Methods: Finding Hidden Value

High-Risk, High-Return Growth Stock Investment Guide

Mix value and growth stocks

Practical investment method for leading stocks in the market

At the crossroads of short-term trading and long-term investment

A Complete Guide to Portfolio Construction Strategies

[Chapter 3] Practical Trading Techniques for the Palm System

Best timing to buy

Buying at the Bottom Strategy to Maximize Profits

Practical Application of Box Breakout Strategy

Additional acquisition strategy according to the company's growth stage

Trading Timing with Technical Analysis

Investment strategies that turn crises into opportunities

[Chapter 4] Completing the Farm System: A Successful Investment Mindset

Avoid emotional investments

Go against the crowd

Keep a long-term perspective

Use your failures as a stepping stone to success.

Stock investment, an attractive business of your own

[Epilogue] Begin Your Journey to Lifelong Income

[Appendix] Q&A with Rich Dad

[Prologue] Investing requires the attitude of a farmer sowing seeds.

[Chapter 1] Farm System Investment Method for Lifelong Profits

What Makes a Successful Investor Different?

Market risk factors that lead to losses

The Palm System Investment Method that Understands the Essence of Investment

5 Steps to Prepare for Investing in a Real-World Farm System

[Chapter 2] Creating a Farm Systems Investment Portfolio

Choose a sport where the sun shines

Practical Value Stock Investing Methods: Finding Hidden Value

High-Risk, High-Return Growth Stock Investment Guide

Mix value and growth stocks

Practical investment method for leading stocks in the market

At the crossroads of short-term trading and long-term investment

A Complete Guide to Portfolio Construction Strategies

[Chapter 3] Practical Trading Techniques for the Palm System

Best timing to buy

Buying at the Bottom Strategy to Maximize Profits

Practical Application of Box Breakout Strategy

Additional acquisition strategy according to the company's growth stage

Trading Timing with Technical Analysis

Investment strategies that turn crises into opportunities

[Chapter 4] Completing the Farm System: A Successful Investment Mindset

Avoid emotional investments

Go against the crowd

Keep a long-term perspective

Use your failures as a stepping stone to success.

Stock investment, an attractive business of your own

[Epilogue] Begin Your Journey to Lifelong Income

[Appendix] Q&A with Rich Dad

Detailed image

.jpg)

Into the book

Now it's your turn.

This book contains the essence of the stock market and the strategies I have learned from my experience over the years.

I wanted to convey how to achieve success through long-term growth and perseverance, without being swayed by short-term trends or themes.

While many people experience losses through fear and greed, the Farm System teaches us to go against these instincts and sow the seeds for growth.

I realized this through countless panics and crashes.

This means that a crisis can ultimately turn into an opportunity.

The important thing is to remain calm even in the face of fear, understand the nature of the market, and wait.

---From "Investment also requires the attitude of a farmer who sows seeds"

In the stock market, "unused stocks" are stocks that big investors have not yet purchased, and these stocks are likely to rise over time.

Therefore, it is important to find stocks that have not yet been fully purchased by big players, have room to rise, and are ready to rise.

Finding these stocks and buying them little by little is an important strategy in stock investment.

To succeed in the stock market, individual investors must understand the strategies of big players and understand the principles of market price.

Many individual investors believe that if they do well, they will easily make money.

However, if you don't know the movements of the big players, you will inevitably suffer losses.

Because we need to see what's behind the numbers, something that can't be seen by simply analyzing the numbers.

So, stock investing may seem easy, but it is actually a difficult task that requires a lot of experience and study.

---From "Market Risk Factors That Lead to Losses"

One of the biggest ways to make money in stock investing is to hold stocks with strong upward trends for the long term.

Leading stocks usually exhibit this upward trend, and that trend does not simply mean a one- or two-day rise, but a sustained rise over several months or years.

(Omitted) Ultimately, investing in leading stocks also requires a long-term perspective to expect high returns.

We must overcome the confusion that comes with short-term volatility and remember that over time, the market will eventually move upward.

Only experts who can recognize the early upward trend and the "young market" can accurately identify the leading stocks and buy and sell according to that trend.

---From "Practical Investment Methods for Leading Stocks"

The saying, “Young people live with their eyes closed” means buying stocks that are still strong and have plenty of growth potential.

Distinguishing between old and young stocks is a key quality of a master, meaning that the ability to distinguish between stocks that have already finished growing and those that still have great growth potential is important.

Choosing low PER stocks is also a strategy.

Normally, if the PER value is less than 10 times, it is considered a low PER.

A low PER provides an opportunity to buy a company when its future value is currently undervalued.

'Ginseng stocks' (stocks that are not well known but have the potential to grow significantly in the future) purchased at the bottom are stocks that require patience and the ability to wait for a long time.

Ginseng wine can be purchased cheaply now, but it takes a long time to grow before you can make a decent profit.

---From "Buying at the Bottom to Maximize Profits"

As can be seen from the five depressed sections marked with boxes on the following HD Hyundai Electric daily chart, the stock price is maintaining an upward trend in the relevant sections, intermittently correcting the box range, and then breaking through the high point again.

We can also confirm that the upward trend is solid as it is moving above the long-term moving average.

If the box breakout is successful, the stock is likely to continue its upward trend.

However, if the breakout fails, it is likely that the market forces did not intervene, which could result in a lack of additional upward momentum.

In such cases, the stock may move sideways or decline again within the box range.

Accurately understanding and utilizing box formation and breakout signals is a crucial key to success in real-world investing.

As the saying goes, “The market asks the market,” investors who thoroughly analyze the market flow and follow it can generate profits in the long term.

---From "Practical Application of Box Breakout Strategy"

The stock market runs around like a dog, but the economy walks slowly towards its destination like its owner.

Therefore, it is a famous metaphor that tells investors that they should not be swayed by the chaotic movements of the stock market like a dog, but should proceed calmly, trusting in the long-term trend of the economy.

When people get excited and buy or sell stocks, it is important to look at the trend from a long-term perspective and interpret it.

You should invest with a good understanding of the fact that the rise and fall of stock prices are determined by supply and demand.

From your previous studies, you probably already know the strategy of selling when the public is excited and buying when the public is fearful.

Now, let's muster up the courage to apply this strategy to real investments.

---From "Walk the Path Against the Public"

Even small failures can become traps that lead to bigger mistakes if left unattended, but if you manage your emotions well, you can use failure as a stepping stone to a new beginning.

So how do you get back on your feet after an investment failure?

First, we need to establish a new investment strategy and philosophy.

You can analyze the reasons for failure and develop an investment strategy that will help you make better decisions.

If you have suffered significant losses due to focusing on one or two stocks, you need to improve your portfolio by diversifying it further to reduce risk.

Only by learning from past mistakes can we succeed in new challenges.

Let's get into the habit of recording the lessons learned from failures and reflecting on them periodically.

These efforts will pay off when making future investment decisions.

This book contains the essence of the stock market and the strategies I have learned from my experience over the years.

I wanted to convey how to achieve success through long-term growth and perseverance, without being swayed by short-term trends or themes.

While many people experience losses through fear and greed, the Farm System teaches us to go against these instincts and sow the seeds for growth.

I realized this through countless panics and crashes.

This means that a crisis can ultimately turn into an opportunity.

The important thing is to remain calm even in the face of fear, understand the nature of the market, and wait.

---From "Investment also requires the attitude of a farmer who sows seeds"

In the stock market, "unused stocks" are stocks that big investors have not yet purchased, and these stocks are likely to rise over time.

Therefore, it is important to find stocks that have not yet been fully purchased by big players, have room to rise, and are ready to rise.

Finding these stocks and buying them little by little is an important strategy in stock investment.

To succeed in the stock market, individual investors must understand the strategies of big players and understand the principles of market price.

Many individual investors believe that if they do well, they will easily make money.

However, if you don't know the movements of the big players, you will inevitably suffer losses.

Because we need to see what's behind the numbers, something that can't be seen by simply analyzing the numbers.

So, stock investing may seem easy, but it is actually a difficult task that requires a lot of experience and study.

---From "Market Risk Factors That Lead to Losses"

One of the biggest ways to make money in stock investing is to hold stocks with strong upward trends for the long term.

Leading stocks usually exhibit this upward trend, and that trend does not simply mean a one- or two-day rise, but a sustained rise over several months or years.

(Omitted) Ultimately, investing in leading stocks also requires a long-term perspective to expect high returns.

We must overcome the confusion that comes with short-term volatility and remember that over time, the market will eventually move upward.

Only experts who can recognize the early upward trend and the "young market" can accurately identify the leading stocks and buy and sell according to that trend.

---From "Practical Investment Methods for Leading Stocks"

The saying, “Young people live with their eyes closed” means buying stocks that are still strong and have plenty of growth potential.

Distinguishing between old and young stocks is a key quality of a master, meaning that the ability to distinguish between stocks that have already finished growing and those that still have great growth potential is important.

Choosing low PER stocks is also a strategy.

Normally, if the PER value is less than 10 times, it is considered a low PER.

A low PER provides an opportunity to buy a company when its future value is currently undervalued.

'Ginseng stocks' (stocks that are not well known but have the potential to grow significantly in the future) purchased at the bottom are stocks that require patience and the ability to wait for a long time.

Ginseng wine can be purchased cheaply now, but it takes a long time to grow before you can make a decent profit.

---From "Buying at the Bottom to Maximize Profits"

As can be seen from the five depressed sections marked with boxes on the following HD Hyundai Electric daily chart, the stock price is maintaining an upward trend in the relevant sections, intermittently correcting the box range, and then breaking through the high point again.

We can also confirm that the upward trend is solid as it is moving above the long-term moving average.

If the box breakout is successful, the stock is likely to continue its upward trend.

However, if the breakout fails, it is likely that the market forces did not intervene, which could result in a lack of additional upward momentum.

In such cases, the stock may move sideways or decline again within the box range.

Accurately understanding and utilizing box formation and breakout signals is a crucial key to success in real-world investing.

As the saying goes, “The market asks the market,” investors who thoroughly analyze the market flow and follow it can generate profits in the long term.

---From "Practical Application of Box Breakout Strategy"

The stock market runs around like a dog, but the economy walks slowly towards its destination like its owner.

Therefore, it is a famous metaphor that tells investors that they should not be swayed by the chaotic movements of the stock market like a dog, but should proceed calmly, trusting in the long-term trend of the economy.

When people get excited and buy or sell stocks, it is important to look at the trend from a long-term perspective and interpret it.

You should invest with a good understanding of the fact that the rise and fall of stock prices are determined by supply and demand.

From your previous studies, you probably already know the strategy of selling when the public is excited and buying when the public is fearful.

Now, let's muster up the courage to apply this strategy to real investments.

---From "Walk the Path Against the Public"

Even small failures can become traps that lead to bigger mistakes if left unattended, but if you manage your emotions well, you can use failure as a stepping stone to a new beginning.

So how do you get back on your feet after an investment failure?

First, we need to establish a new investment strategy and philosophy.

You can analyze the reasons for failure and develop an investment strategy that will help you make better decisions.

If you have suffered significant losses due to focusing on one or two stocks, you need to improve your portfolio by diversifying it further to reduce risk.

Only by learning from past mistakes can we succeed in new challenges.

Let's get into the habit of recording the lessons learned from failures and reflecting on them periodically.

These efforts will pay off when making future investment decisions.

---From “Use your failure experience as a stepping stone to success”

Publisher's Review

“Stock investment: Don't rely on a moment of luck. Create a system that will last a lifetime!”

Everything You Need to Know About the Farm System Investment Method, Which Produces Steady, Stable Profits

Rich Dad's secret to his enormous success in the stock market is not to focus on popular stocks, but to find value stocks that have yet to gain traction and generate long-term profits.

He laments the fact that many people are swayed by greed and rumors to buy and sell stocks easily and suffer huge losses, saying:

“Stock investment is not simply a gamble aiming for price fluctuations, but rather like farming, where you have to wait for the harvest to come.” He said that he has been able to maintain his composure and invest in the turbulent stock market thanks to his pursuit of stable and consistent success, much like a farmer who sows seeds and waits for them to bear fruit.

In fact, he has achieved success to this day by building a system of purchasing and holding stocks with great potential, discovered through thorough analysis, for a long period of time.

Rich Dad named his investment technique of sowing seeds at the right time, being patient, and waiting to achieve and maintain target returns the "Farm System Investment Method." He summarized the specific strategies he implemented with a farmer's mindset as follows:

First, 'identify the true value of a company through the principles of market price and charts to select stocks that will rise'; second, 'construct a portfolio that diversifies risk by establishing leading stocks as pillars and planting the seeds of value stocks'; third, 'use public sentiment to buy low and sell high'; and fourth, 'develop a successful investment mindset that completes the farm system'.

To help readers understand the investment system in an easy and fun way, we've included a wealth of visualized concepts and charts analyzing key stocks.

You can learn rich dad's investment secrets and apply them to real-world investing.

If you're suffering losses due to short-term trends or themes, it's time to leverage a proven, systematic investment strategy.

Instead of relying on uncertain luck, let's become investors who generate lifetime profits by establishing clear standards and strategies through the methods taught by investment experts.

Rich Dad's 7 Key Investment Secrets

* Even if the situation changes, the principles of the market price do not change.

Buy when the public is pessimistic and sell when the public is optimistic.

* Protect against market volatility by investing in a mix of value and growth stocks.

* Don't chase rising stocks, but buy at the point of pressure just before the rise.

* Pay attention when a stock that has been moving sideways breaks out of the box.

* Wait for the market to shake up significantly, not when the leading stock is on the rise.

* Find stocks that have broken through the selling pressure and recorded historic highs.

* Learn the expert's eye for recognizing the early upward trend and 'young market'.

"Only educated investors can become rich."

Timeless Investment Principles That Turn Failure into Success

If you blindly jump into investing, lured by rumors that stocks will rise further and you should buy now, you are bound to experience failure.

Rich Dad also suffered huge losses and went bankrupt five times during his early days as a novice investor, struggling in the rough waters of the stock market.

In that desperate moment when he decided to throw his family into the line of survival and take his own life, it was none other than studying that brought him back to life.

Despite the excruciating pain, he did not leave the market, but studied by reading books and focused on understanding the principles of market prices.

As a result, he successfully recovered and became what people call a super ant, establishing himself as an investment guru followed by numerous investors.

This is precisely why he always emphasizes that studying should take priority over trading.

The fear of falling stock prices, bad news, and a crash comes to everyone.

If you stop studying or neglect the attitude and demeanor necessary to continue wise stock investment just because you've mastered the skills of stock investment, you will inevitably experience failure in times of crisis.

Rich Dad emphasizes that calmness is essential to turning a crisis into an opportunity, and that calmness comes from constant study.

Do you think of stock investing as a battle of wits with others? It's a battle with yourself.

This book argues that having the right investment mindset is a crucial element in completing a farm system.

While strategy and technique are crucial in stock investing, establishing the right investment direction and staying steadfast will help you generate stable income throughout your life, allowing you to secure a second salary and a worry-free retirement.

Investing in stocks is like a marathon, not a sprint.

Even if it's a little slow at first, the secret to success that rich dad has proven is to keep running and finish the race persistently.

He knows from experience that while greedy short-term trading, which involves making quick and easy decisions, may bring about brief but ultimately large losses in the long run.

Stock investing is a field that requires a long-term perspective, clear planning, and self-control.

Rich Dad wrote this book in the hopes that more individual investors would realize this sooner and avoid the path that ultimately leads to failure.

As he emphasizes, let's not forget that only when we cultivate realistic dreams through thorough analysis and mind control, without neglecting our studies, can we maintain balance and reach our destination amidst the turbulent waves of the market.

Everything You Need to Know About the Farm System Investment Method, Which Produces Steady, Stable Profits

Rich Dad's secret to his enormous success in the stock market is not to focus on popular stocks, but to find value stocks that have yet to gain traction and generate long-term profits.

He laments the fact that many people are swayed by greed and rumors to buy and sell stocks easily and suffer huge losses, saying:

“Stock investment is not simply a gamble aiming for price fluctuations, but rather like farming, where you have to wait for the harvest to come.” He said that he has been able to maintain his composure and invest in the turbulent stock market thanks to his pursuit of stable and consistent success, much like a farmer who sows seeds and waits for them to bear fruit.

In fact, he has achieved success to this day by building a system of purchasing and holding stocks with great potential, discovered through thorough analysis, for a long period of time.

Rich Dad named his investment technique of sowing seeds at the right time, being patient, and waiting to achieve and maintain target returns the "Farm System Investment Method." He summarized the specific strategies he implemented with a farmer's mindset as follows:

First, 'identify the true value of a company through the principles of market price and charts to select stocks that will rise'; second, 'construct a portfolio that diversifies risk by establishing leading stocks as pillars and planting the seeds of value stocks'; third, 'use public sentiment to buy low and sell high'; and fourth, 'develop a successful investment mindset that completes the farm system'.

To help readers understand the investment system in an easy and fun way, we've included a wealth of visualized concepts and charts analyzing key stocks.

You can learn rich dad's investment secrets and apply them to real-world investing.

If you're suffering losses due to short-term trends or themes, it's time to leverage a proven, systematic investment strategy.

Instead of relying on uncertain luck, let's become investors who generate lifetime profits by establishing clear standards and strategies through the methods taught by investment experts.

Rich Dad's 7 Key Investment Secrets

* Even if the situation changes, the principles of the market price do not change.

Buy when the public is pessimistic and sell when the public is optimistic.

* Protect against market volatility by investing in a mix of value and growth stocks.

* Don't chase rising stocks, but buy at the point of pressure just before the rise.

* Pay attention when a stock that has been moving sideways breaks out of the box.

* Wait for the market to shake up significantly, not when the leading stock is on the rise.

* Find stocks that have broken through the selling pressure and recorded historic highs.

* Learn the expert's eye for recognizing the early upward trend and 'young market'.

"Only educated investors can become rich."

Timeless Investment Principles That Turn Failure into Success

If you blindly jump into investing, lured by rumors that stocks will rise further and you should buy now, you are bound to experience failure.

Rich Dad also suffered huge losses and went bankrupt five times during his early days as a novice investor, struggling in the rough waters of the stock market.

In that desperate moment when he decided to throw his family into the line of survival and take his own life, it was none other than studying that brought him back to life.

Despite the excruciating pain, he did not leave the market, but studied by reading books and focused on understanding the principles of market prices.

As a result, he successfully recovered and became what people call a super ant, establishing himself as an investment guru followed by numerous investors.

This is precisely why he always emphasizes that studying should take priority over trading.

The fear of falling stock prices, bad news, and a crash comes to everyone.

If you stop studying or neglect the attitude and demeanor necessary to continue wise stock investment just because you've mastered the skills of stock investment, you will inevitably experience failure in times of crisis.

Rich Dad emphasizes that calmness is essential to turning a crisis into an opportunity, and that calmness comes from constant study.

Do you think of stock investing as a battle of wits with others? It's a battle with yourself.

This book argues that having the right investment mindset is a crucial element in completing a farm system.

While strategy and technique are crucial in stock investing, establishing the right investment direction and staying steadfast will help you generate stable income throughout your life, allowing you to secure a second salary and a worry-free retirement.

Investing in stocks is like a marathon, not a sprint.

Even if it's a little slow at first, the secret to success that rich dad has proven is to keep running and finish the race persistently.

He knows from experience that while greedy short-term trading, which involves making quick and easy decisions, may bring about brief but ultimately large losses in the long run.

Stock investing is a field that requires a long-term perspective, clear planning, and self-control.

Rich Dad wrote this book in the hopes that more individual investors would realize this sooner and avoid the path that ultimately leads to failure.

As he emphasizes, let's not forget that only when we cultivate realistic dreams through thorough analysis and mind control, without neglecting our studies, can we maintain balance and reach our destination amidst the turbulent waves of the market.

GOODS SPECIFICS

- Date of issue: May 13, 2025

- Page count, weight, size: 232 pages | 424g | 153*217*19mm

- ISBN13: 9791193401453

- ISBN10: 1193401453

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)