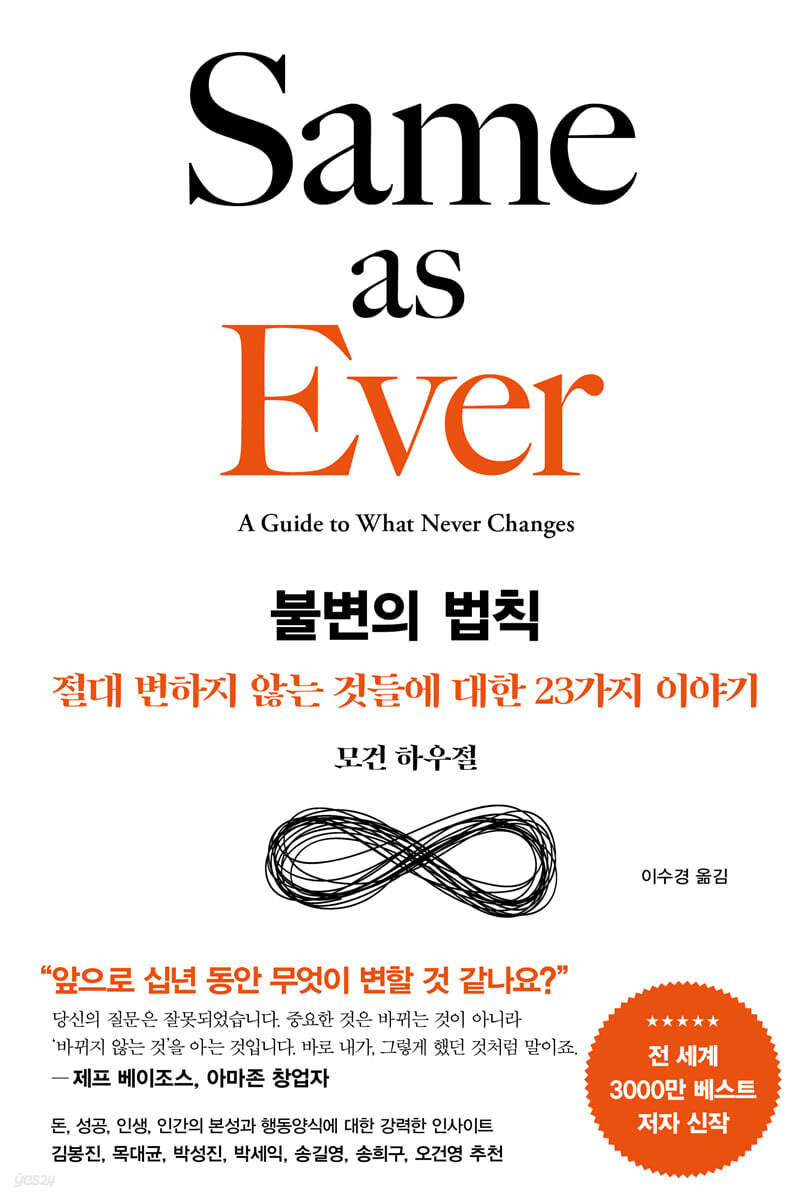

immutable law

|

Description

Book Introduction

Morgan Housel, author of the international bestseller "The Psychology of Money," has released a new book, three years after his first. It tells "23 stories about things that never change." As soon as it was published, it rose to the top of the Amazon and New York Times bestseller lists, receiving rave reviews from Amazon readers and opinion leaders. This book is praised for its multi-layered and complex message, covering not only the areas of money and investment, but also human nature and the ways of the world. Morgan Housel emphasizes that while people are always interested in what will change, in order to prepare for the future, we should rather know about the 'immutable laws' that have not changed in the past, present, or future. It tells interesting historical stories and anecdotes about human behavior patterns and repetitive patterns that will remain valid even 1,000 years later. Each story unfolds like a documentary novel, including Warren Buffett's sneakers, Bill Gates' hidden anxiety, the unexpected criticism Yuval Harari received, the unseen variables of the GameStop incident, the end of the Battle of the Bulge, and the death of magician Houdini. He received praise for his insightful anecdotes that penetrate human history and life lessons, which he weaves like beads, saying, “This is Morgan Housel, after all.” Scott Galloway, Lion Holliday, and other leading domestic leaders read the book first and praised it as “a great book.” |

- You can preview some of the book's contents.

Preview

index

Introduction: The Little Rules of Life

1.

Such a precarious world

- When we look back on the past, we realize that the future is unpredictable.

2.

The invisible, the risk

- Actually, we are quite good at predicting the future.

It's just that we can't predict surprising and unexpected events.

And that's what makes all the difference.

3.

Expectations and Reality

- The first rule for happiness is to lower your expectations.

4.

Humans, the unknown beings

- People who have unique but great qualities also have unique but not great qualities.

5.

Probability and Certainty

- What people want is not accurate information.

What people want is certainty.

6.

A great story wins

- Stories are always stronger than statistics.

7.

What Statistics Miss

- Immeasurable forces move the world.

8.

Peace sows the seeds of chaos

- A market that is overheating like crazy doesn't mean it's broken.

Crazy overheating is normal.

It's also normal for it to get more crazy and overheat.

9.

More, faster

- Even a good idea becomes a bad idea if you push it too hard.

10.

The moment when magic happens

- Pain, unlike peace, stimulates concentration.

11.

Tragedy is fleeting, miracles take a long time.

- Good things happen through small, incremental changes, so it takes time.

Bad things happen because of a sudden loss of trust or a fatal mistake made in the blink of an eye.

12.

Little things and huge consequences

- Little things accumulate to create something great.

13.

Hope and despair

- Optimism and pessimism must coexist for development.

14.

The Trap of Perfection

- A little imperfection is actually useful.

15.

Every journey is inherently difficult.

- Anything worth pursuing comes with pain.

What matters is the mind that does not care about pain.

16.

Keep running

- Competitive advantage eventually disappears.

17.

About the wonders of the future

- Progress always seems to be sluggish.

So it's easy to underestimate the potential of new technologies.

18.

It's harder than it looks, and not as fun as it looks.

- “The grass is always greener on soil fertilized with lies.”

19.

Incentives: The Most Powerful Force in the World

- Incentives sometimes lead to crazy behavior.

People can justify or defend almost anything.

20.

You have to experience it to know

- Nothing is as persuasive as direct experience.

21.

About seeing far ahead

- Saying “I’m going for a long-term strategy” is like pointing to the summit from the bottom of Mount Everest.

It's like saying, "I'm going up there."

Well, that's a great idea.

And now the countless trials and tribulations begin.

22.

Complexity and simplicity

- Nothing is more complicated than it needs to be.

23.

Wounds heal, but scars remain.

- What experience has that person had that I haven't that leads to that view?

If I had that experience, would I think the same way?

Questions to consider

Acknowledgements

annotation

Regarding translation

1.

Such a precarious world

- When we look back on the past, we realize that the future is unpredictable.

2.

The invisible, the risk

- Actually, we are quite good at predicting the future.

It's just that we can't predict surprising and unexpected events.

And that's what makes all the difference.

3.

Expectations and Reality

- The first rule for happiness is to lower your expectations.

4.

Humans, the unknown beings

- People who have unique but great qualities also have unique but not great qualities.

5.

Probability and Certainty

- What people want is not accurate information.

What people want is certainty.

6.

A great story wins

- Stories are always stronger than statistics.

7.

What Statistics Miss

- Immeasurable forces move the world.

8.

Peace sows the seeds of chaos

- A market that is overheating like crazy doesn't mean it's broken.

Crazy overheating is normal.

It's also normal for it to get more crazy and overheat.

9.

More, faster

- Even a good idea becomes a bad idea if you push it too hard.

10.

The moment when magic happens

- Pain, unlike peace, stimulates concentration.

11.

Tragedy is fleeting, miracles take a long time.

- Good things happen through small, incremental changes, so it takes time.

Bad things happen because of a sudden loss of trust or a fatal mistake made in the blink of an eye.

12.

Little things and huge consequences

- Little things accumulate to create something great.

13.

Hope and despair

- Optimism and pessimism must coexist for development.

14.

The Trap of Perfection

- A little imperfection is actually useful.

15.

Every journey is inherently difficult.

- Anything worth pursuing comes with pain.

What matters is the mind that does not care about pain.

16.

Keep running

- Competitive advantage eventually disappears.

17.

About the wonders of the future

- Progress always seems to be sluggish.

So it's easy to underestimate the potential of new technologies.

18.

It's harder than it looks, and not as fun as it looks.

- “The grass is always greener on soil fertilized with lies.”

19.

Incentives: The Most Powerful Force in the World

- Incentives sometimes lead to crazy behavior.

People can justify or defend almost anything.

20.

You have to experience it to know

- Nothing is as persuasive as direct experience.

21.

About seeing far ahead

- Saying “I’m going for a long-term strategy” is like pointing to the summit from the bottom of Mount Everest.

It's like saying, "I'm going up there."

Well, that's a great idea.

And now the countless trials and tribulations begin.

22.

Complexity and simplicity

- Nothing is more complicated than it needs to be.

23.

Wounds heal, but scars remain.

- What experience has that person had that I haven't that leads to that view?

If I had that experience, would I think the same way?

Questions to consider

Acknowledgements

annotation

Regarding translation

Detailed image

Into the book

Looking at history makes you realize how precarious the world is.

Sometimes the major events that changed the course of history were caused by completely unexpected encounters or careless decisions made without much thought.

It can lead to wonderful results or it can lead to tragedy.

Writer Tim Urban said:

“If you were to travel back in time to a world before you were born, you wouldn’t be able to do anything rash.

Because we know that even the smallest action can have a huge impact on the future.”

--- p.27, from “This Precarious World”

There is an irony that is felt when looking into history.

The thing is, we usually know how a story ends, but we don't know where it begins.

Let me give you an example.

What caused the 2008 financial crisis? To answer that question, we must first understand the structure of the mortgage market.

So what has affected the mortgage market? To understand, we need to understand how interest rates have fallen over the past 30 years.

What factors led to the decline in interest rates? To understand, we must first understand inflation in the 1970s.

Why did inflation occur in the 1970s? To understand, we need to examine the monetary system of the 1970s and the impact of the Vietnam War.

Why did the Vietnam War happen? To understand, we need to understand how Americans developed a fear of communism during the Cold War following World War II.

If we keep going on like this, it will go on and on forever.

--- p.40, from “This Precarious World”

It is no exaggeration to say that NASA is the most planned and thorough organization on Earth.

Moreover, sending humans to the moon isn't something you can simply do with folded hands and a prayer of good luck, so they must have prepared even more thoroughly. NASA had Plan A, Plan B, and even Plan C for every imaginable risk.

But even then, one tiny mistake that no one thought of brought about disaster.

Financial planner Carl Richards said:

“Risk is what remains after you think you've considered every scenario.”

--- p.49, from “The Invisible, Risk”

I guarantee you that it will continue to be so in the future.

The biggest risk and most important news story of the next decade will be something no one is talking about right now.

It doesn't matter what year it is when you read this book.

The reason I can say this with confidence is because it has always been this way.

The very nature of unpredictability is what makes risk dangerous.

--- p.53, from “The Invisible, Risk”

If someone says something will happen and it actually happens, then their prediction is correct.

If someone says something will happen and it doesn't, then their prediction was wrong.

People only think this way.

Because thinking that way takes less mental energy and is more comfortable.

It's difficult to convince people (or yourself) that the outcome could have been different when the actual outcome is right in front of you.

The point is this.

People believe they want an accurate view of the future, but what they really want is certainty.

--- p.102, from “Probability and Certainty”

Let's think about an event that is described as 'once in a century'.

A hundred-year flood, a hurricane, an earthquake, a financial crisis, fraud, a pandemic, a political collapse, a recession, and so on.

Many horrific events can be called "once-in-a-century" events. "Once-in-a-century" doesn't mean they happen once every 100 years.

This means that there is about a 1 percent chance of that event occurring in any given year.

This feels like a low probability.

But if there are hundreds of individual, once-in-a-century events, what are the odds that one of them will occur in a given year? It's quite high.

--- p.106, from “Probability and Certainty”

In a perfect world, the importance of information would not depend on the storytelling skills of its conveyer.

But the world we live in is one where people get bored easily, lack patience, are easily swayed by emotions, and want complex information to be easily digestible, like a scene from a story.

Let's take a closer look around.

In any context where information flows—whether it's products, businesses, politics, knowledge, education, or culture—great stories win.

Stephen Hawking once said of his physics books:

“Someone told me that.

“For every equation added to a book, sales would drop by half.” What readers want is a memorable story, not a boring lecture.

-pp.

129-130, from “A Great Story Wins”

Historian Stephen Ambrose argues that in late 1944, U.S. commanders Dwight Eisenhower and Omar Bradley had the best rational judgment needed to formulate wartime strategy, but they missed one detail.

That was how crazy Hitler was.

A source close to Bradley said at the time:

“If we had fought against rational men, they would have surrendered long ago.” But they were not rational men.

And that fact, that fact that is difficult to measure with logic and reason, determined everything.

--- p.146, from “What Statistics Miss”

On September 10, 2008, Lehman Brothers' financial health appeared sound.

The bank's capital adequacy ratio (an indicator that evaluates a financial institution's ability to absorb losses) was 11.7 percent.

This was a higher figure than the previous quarter.

It was higher than Goldman Sachs or Bank of America.

That was a higher capital adequacy ratio than Lehman Brothers had in 2007, when the financial industry was booming.

And 72 hours later, Lehman Brothers went bankrupt. The only thing that changed in those three days was investor confidence in the bank.

--- p.152, from “What Statistics Miss”

One result led to another.

The desire to achieve growth targets ultimately pushed out rational analysis and judgment.

The saturation of Starbucks stores has reached an extreme.

Even during a boom, same-store sales growth fell by 50 percent.

Howard Schultz wrote in a 2007 email to executives:

“As we grew from less than 1,000 stores to 13,000, we made a series of decisions that, in retrospect, diluted the ‘Starbucks experience.’”

--- p.186, from “More, Faster”

Investor Patrick O'Shaughnessy said:

“I’ve met a lot of people who have achieved amazing things, and they usually don’t seem happy.

Rather, it would be more accurate to say that it looked ‘distressed.’ Fear, pain, and adversity are powerful motivators that positive emotions can never match.

This is a great lesson from history.

And this lesson ultimately leads us to this realization:

'Think carefully and decide what kind of life you want.' A life without any worries, pain, or stress seems like a happy one.

But there is no motivation or progress in that kind of life.

No one welcomes adversity with open arms.

But we must recognize that it is the most powerful fuel for creative problem solving and innovation.

--- p.212-213, from “The Moment When Magic Happens”

If I were to ask, “What are the chances that the average American will be twice as wealthy in 50 years?” it would sound far-fetched.

It seems highly unlikely that will happen.

Becoming twice as rich as you are now? Doubling your wealth? That seems like an ambitious goal.

But if you ask me, “What are the chances that we will achieve an average annual growth rate of 1.4 percent over the next 50 years?” I would be called a pessimist.

People will say.

“One percent? Just that?” But the two above are the same thing.

We always have, and we always will.

--- p.225, from “Tragedy is fleeting, miracles take a long time”

It is important to be able to judge how much of a bothersome problem or inconvenience is best to tolerate.

Most people don't realize this fact.

President Franklin Roosevelt was the strongest man in the world, but he was paralyzed from the waist down and had to rely on an aide to help him even to the bathroom.

He once said:

“If you can’t use your legs, you want orange juice, but when people bring you milk, you have to know how to say, ‘No thanks,’ and drink the milk.” President Roosevelt knew how much inefficiency and inconvenience he had to endure.

--- p.280, from “All journeys are inherently difficult”

Jason Zweig, a columnist for the Wall Street Journal, identifies three paths for professional writers:

1.

You can make a lot of money by lying to people who want to hear it.

2.

You can make a living by telling the truth to those who want to hear it.

3.

If you tell the truth to those who want to hear lies, you'll get kicked in the butt.

Could the power of incentives be more clearly encapsulated? And it reminds us why people sometimes behave in ways that are irrational or even unconventional.

--- p.325, from “Incentives: The Most Powerful Force in the World”

It's easy to follow the advice of the investment world and say, "I'll be greedy when others are fearful," but it's not so easy to put it into practice.

Making such assurances underestimates how much your thinking and goals can change when the market actually turns sour.

The reason why market conditions can lead to the adoption of previously unexpected goals and perspectives is that it's not just asset prices that change during a downturn.

If I asked you to imagine what you would do if a stock fell 30 percent, you would imagine everything else remaining the same and only the stock fell 30 percent.

But things don't work that way in the world.

--- p.345, from “You have to experience it to know”

'After suffering, we long for stability.' It's easy to say this when looking at history.

“Look at that.

“If you just look far ahead and endure a little, you will eventually recover and somehow survive.” However, this is a statement that forgets the fact that the human mind is more difficult to recover than buildings or the economy.

We can observe and measure almost everything in the world, but we cannot measure people's moods, fears, hopes, resentments, goals, motivations, and expectations.

Partly for that very reason, incomprehensible things have happened and will continue to happen throughout history.

Sometimes the major events that changed the course of history were caused by completely unexpected encounters or careless decisions made without much thought.

It can lead to wonderful results or it can lead to tragedy.

Writer Tim Urban said:

“If you were to travel back in time to a world before you were born, you wouldn’t be able to do anything rash.

Because we know that even the smallest action can have a huge impact on the future.”

--- p.27, from “This Precarious World”

There is an irony that is felt when looking into history.

The thing is, we usually know how a story ends, but we don't know where it begins.

Let me give you an example.

What caused the 2008 financial crisis? To answer that question, we must first understand the structure of the mortgage market.

So what has affected the mortgage market? To understand, we need to understand how interest rates have fallen over the past 30 years.

What factors led to the decline in interest rates? To understand, we must first understand inflation in the 1970s.

Why did inflation occur in the 1970s? To understand, we need to examine the monetary system of the 1970s and the impact of the Vietnam War.

Why did the Vietnam War happen? To understand, we need to understand how Americans developed a fear of communism during the Cold War following World War II.

If we keep going on like this, it will go on and on forever.

--- p.40, from “This Precarious World”

It is no exaggeration to say that NASA is the most planned and thorough organization on Earth.

Moreover, sending humans to the moon isn't something you can simply do with folded hands and a prayer of good luck, so they must have prepared even more thoroughly. NASA had Plan A, Plan B, and even Plan C for every imaginable risk.

But even then, one tiny mistake that no one thought of brought about disaster.

Financial planner Carl Richards said:

“Risk is what remains after you think you've considered every scenario.”

--- p.49, from “The Invisible, Risk”

I guarantee you that it will continue to be so in the future.

The biggest risk and most important news story of the next decade will be something no one is talking about right now.

It doesn't matter what year it is when you read this book.

The reason I can say this with confidence is because it has always been this way.

The very nature of unpredictability is what makes risk dangerous.

--- p.53, from “The Invisible, Risk”

If someone says something will happen and it actually happens, then their prediction is correct.

If someone says something will happen and it doesn't, then their prediction was wrong.

People only think this way.

Because thinking that way takes less mental energy and is more comfortable.

It's difficult to convince people (or yourself) that the outcome could have been different when the actual outcome is right in front of you.

The point is this.

People believe they want an accurate view of the future, but what they really want is certainty.

--- p.102, from “Probability and Certainty”

Let's think about an event that is described as 'once in a century'.

A hundred-year flood, a hurricane, an earthquake, a financial crisis, fraud, a pandemic, a political collapse, a recession, and so on.

Many horrific events can be called "once-in-a-century" events. "Once-in-a-century" doesn't mean they happen once every 100 years.

This means that there is about a 1 percent chance of that event occurring in any given year.

This feels like a low probability.

But if there are hundreds of individual, once-in-a-century events, what are the odds that one of them will occur in a given year? It's quite high.

--- p.106, from “Probability and Certainty”

In a perfect world, the importance of information would not depend on the storytelling skills of its conveyer.

But the world we live in is one where people get bored easily, lack patience, are easily swayed by emotions, and want complex information to be easily digestible, like a scene from a story.

Let's take a closer look around.

In any context where information flows—whether it's products, businesses, politics, knowledge, education, or culture—great stories win.

Stephen Hawking once said of his physics books:

“Someone told me that.

“For every equation added to a book, sales would drop by half.” What readers want is a memorable story, not a boring lecture.

-pp.

129-130, from “A Great Story Wins”

Historian Stephen Ambrose argues that in late 1944, U.S. commanders Dwight Eisenhower and Omar Bradley had the best rational judgment needed to formulate wartime strategy, but they missed one detail.

That was how crazy Hitler was.

A source close to Bradley said at the time:

“If we had fought against rational men, they would have surrendered long ago.” But they were not rational men.

And that fact, that fact that is difficult to measure with logic and reason, determined everything.

--- p.146, from “What Statistics Miss”

On September 10, 2008, Lehman Brothers' financial health appeared sound.

The bank's capital adequacy ratio (an indicator that evaluates a financial institution's ability to absorb losses) was 11.7 percent.

This was a higher figure than the previous quarter.

It was higher than Goldman Sachs or Bank of America.

That was a higher capital adequacy ratio than Lehman Brothers had in 2007, when the financial industry was booming.

And 72 hours later, Lehman Brothers went bankrupt. The only thing that changed in those three days was investor confidence in the bank.

--- p.152, from “What Statistics Miss”

One result led to another.

The desire to achieve growth targets ultimately pushed out rational analysis and judgment.

The saturation of Starbucks stores has reached an extreme.

Even during a boom, same-store sales growth fell by 50 percent.

Howard Schultz wrote in a 2007 email to executives:

“As we grew from less than 1,000 stores to 13,000, we made a series of decisions that, in retrospect, diluted the ‘Starbucks experience.’”

--- p.186, from “More, Faster”

Investor Patrick O'Shaughnessy said:

“I’ve met a lot of people who have achieved amazing things, and they usually don’t seem happy.

Rather, it would be more accurate to say that it looked ‘distressed.’ Fear, pain, and adversity are powerful motivators that positive emotions can never match.

This is a great lesson from history.

And this lesson ultimately leads us to this realization:

'Think carefully and decide what kind of life you want.' A life without any worries, pain, or stress seems like a happy one.

But there is no motivation or progress in that kind of life.

No one welcomes adversity with open arms.

But we must recognize that it is the most powerful fuel for creative problem solving and innovation.

--- p.212-213, from “The Moment When Magic Happens”

If I were to ask, “What are the chances that the average American will be twice as wealthy in 50 years?” it would sound far-fetched.

It seems highly unlikely that will happen.

Becoming twice as rich as you are now? Doubling your wealth? That seems like an ambitious goal.

But if you ask me, “What are the chances that we will achieve an average annual growth rate of 1.4 percent over the next 50 years?” I would be called a pessimist.

People will say.

“One percent? Just that?” But the two above are the same thing.

We always have, and we always will.

--- p.225, from “Tragedy is fleeting, miracles take a long time”

It is important to be able to judge how much of a bothersome problem or inconvenience is best to tolerate.

Most people don't realize this fact.

President Franklin Roosevelt was the strongest man in the world, but he was paralyzed from the waist down and had to rely on an aide to help him even to the bathroom.

He once said:

“If you can’t use your legs, you want orange juice, but when people bring you milk, you have to know how to say, ‘No thanks,’ and drink the milk.” President Roosevelt knew how much inefficiency and inconvenience he had to endure.

--- p.280, from “All journeys are inherently difficult”

Jason Zweig, a columnist for the Wall Street Journal, identifies three paths for professional writers:

1.

You can make a lot of money by lying to people who want to hear it.

2.

You can make a living by telling the truth to those who want to hear it.

3.

If you tell the truth to those who want to hear lies, you'll get kicked in the butt.

Could the power of incentives be more clearly encapsulated? And it reminds us why people sometimes behave in ways that are irrational or even unconventional.

--- p.325, from “Incentives: The Most Powerful Force in the World”

It's easy to follow the advice of the investment world and say, "I'll be greedy when others are fearful," but it's not so easy to put it into practice.

Making such assurances underestimates how much your thinking and goals can change when the market actually turns sour.

The reason why market conditions can lead to the adoption of previously unexpected goals and perspectives is that it's not just asset prices that change during a downturn.

If I asked you to imagine what you would do if a stock fell 30 percent, you would imagine everything else remaining the same and only the stock fell 30 percent.

But things don't work that way in the world.

--- p.345, from “You have to experience it to know”

'After suffering, we long for stability.' It's easy to say this when looking at history.

“Look at that.

“If you just look far ahead and endure a little, you will eventually recover and somehow survive.” However, this is a statement that forgets the fact that the human mind is more difficult to recover than buildings or the economy.

We can observe and measure almost everything in the world, but we cannot measure people's moods, fears, hopes, resentments, goals, motivations, and expectations.

Partly for that very reason, incomprehensible things have happened and will continue to happen throughout history.

--- p.384, from “Wounds heal, but scars remain”

Publisher's Review

30 million rave reviews worldwide

The Psychology of Money: Morgan Housel's new masterpiece!

★ Amazon Bestseller ★ New York Times Bestseller ★ Exported to 36 Countries Worldwide ★

The Immutable Laws transcend the realms of money and psychology.

This book covers everything from human 'birth' to 'death'!

- Amazon Reader -

A word from Amazon founder Jeff Bezos

"What do you think will change in the future? You're asking the wrong question."

Amazon founder Jeff Bezos says he often gets asked, “What do you think will change in the next 10 years?”

He added:

“But I rarely get asked, ‘What won’t change in the next 10 years?’

“I actually think this second question is more important.”

In 1994, Bezos founded his first online bookstore business and named it Amazon.

And then, the following year, they put up this advertisement.

“We sell a large selection of books at low prices.”

Look at the ad he ran in 1995.

Amazon's management philosophy today, in 2024, is not much different.

Bezos said he couldn't imagine a future where Amazon customers' desire for low prices and fast delivery disappeared.

He focused on what doesn't change, not what does, and he's maintained that in his business for decades.

Thanks to this, Amazon was able to grow into the world's leading online shopping platform with a market capitalization of over 1.4 trillion won.

■ What Morgan Housel Learned After 10 Years of Studying History

“The human head is the same in 1920, 2000, and 2020.”

Jeff Bezos' story clearly sends the following message:

'Things that don't change are important.

Knowing this allows you to predict the future with confidence.'

Morgan Housel also noted the same point as Jeff Bezos.

He explains why he wrote a book on the subject of 'immutable laws' as follows:

“A little over a decade ago, I set a goal to study more history and read less predictive material.

That decision brought about a remarkable change in my life.

Ironically, the more I learned about history, the less anxious I became about the future.

When we stop trying to predict the uncertain future and instead focus on what never changes, the invisible begins to become visible.

This is an immutable law that still holds true over time.”

He emphasizes again that only when we realize what is ‘unchanging’ in a changing world can we begin to gauge what the better direction for the future will be, because “the human mind is the same in 1920, 2000, and 2020.”

■“I thought it was an investment book, but I learned something about life.”

23 Immutable Laws That Were True 1,000 Years Ago and Will Be True 1,000 Years Ago

In his new book, "The Immutable Laws," published after three years, Morgan Housel has summarized 23 "immutable laws" that were true 1,000 years ago and will remain true 1,000 years from now.

He tells interesting historical stories and anecdotes about human behavior and repetitive patterns in a unique and entertaining way.

Warren Buffett's sneakers, Bill Gates' hidden anxiety, why Yuval Harari received unexpected criticism, Howard Schultz's regrets, the invisible variable of the GameStop incident, the end of the Battle of the Bulge, the death of magician Houdini, and more.

Each chapter unfolds as if it were a documentary novel, with each story unfolding one by one.

These interesting anecdotes are like beads threaded through human history with insights and life lessons.

The enormous impact of a 1% risk, the lever between expectations and reality, the secret of probability and certainty, the usefulness of imperfection, the power of stories that is stronger than statistics, how a 1-second mistake can destroy 100 years of achievement, etc., the 23 'immutable laws' exquisitely woven into the beginning and end of the episodes all evoke sighs and admiration.

“I thought it would be as fun as the previous one, but I was wrong.

Readers' reviews such as "This is more than that," and "I thought it was an investment book, but I learned something about life." are not empty boasts.

By following Morgan Housel's masterful narrative, anyone can experience the same sense of fulfillment and relief that leaders at home and abroad have described: "A three-hour encounter with a young, enlightened guru."

The Psychology of Money: Morgan Housel's new masterpiece!

★ Amazon Bestseller ★ New York Times Bestseller ★ Exported to 36 Countries Worldwide ★

The Immutable Laws transcend the realms of money and psychology.

This book covers everything from human 'birth' to 'death'!

- Amazon Reader -

A word from Amazon founder Jeff Bezos

"What do you think will change in the future? You're asking the wrong question."

Amazon founder Jeff Bezos says he often gets asked, “What do you think will change in the next 10 years?”

He added:

“But I rarely get asked, ‘What won’t change in the next 10 years?’

“I actually think this second question is more important.”

In 1994, Bezos founded his first online bookstore business and named it Amazon.

And then, the following year, they put up this advertisement.

“We sell a large selection of books at low prices.”

Look at the ad he ran in 1995.

Amazon's management philosophy today, in 2024, is not much different.

Bezos said he couldn't imagine a future where Amazon customers' desire for low prices and fast delivery disappeared.

He focused on what doesn't change, not what does, and he's maintained that in his business for decades.

Thanks to this, Amazon was able to grow into the world's leading online shopping platform with a market capitalization of over 1.4 trillion won.

■ What Morgan Housel Learned After 10 Years of Studying History

“The human head is the same in 1920, 2000, and 2020.”

Jeff Bezos' story clearly sends the following message:

'Things that don't change are important.

Knowing this allows you to predict the future with confidence.'

Morgan Housel also noted the same point as Jeff Bezos.

He explains why he wrote a book on the subject of 'immutable laws' as follows:

“A little over a decade ago, I set a goal to study more history and read less predictive material.

That decision brought about a remarkable change in my life.

Ironically, the more I learned about history, the less anxious I became about the future.

When we stop trying to predict the uncertain future and instead focus on what never changes, the invisible begins to become visible.

This is an immutable law that still holds true over time.”

He emphasizes again that only when we realize what is ‘unchanging’ in a changing world can we begin to gauge what the better direction for the future will be, because “the human mind is the same in 1920, 2000, and 2020.”

■“I thought it was an investment book, but I learned something about life.”

23 Immutable Laws That Were True 1,000 Years Ago and Will Be True 1,000 Years Ago

In his new book, "The Immutable Laws," published after three years, Morgan Housel has summarized 23 "immutable laws" that were true 1,000 years ago and will remain true 1,000 years from now.

He tells interesting historical stories and anecdotes about human behavior and repetitive patterns in a unique and entertaining way.

Warren Buffett's sneakers, Bill Gates' hidden anxiety, why Yuval Harari received unexpected criticism, Howard Schultz's regrets, the invisible variable of the GameStop incident, the end of the Battle of the Bulge, the death of magician Houdini, and more.

Each chapter unfolds as if it were a documentary novel, with each story unfolding one by one.

These interesting anecdotes are like beads threaded through human history with insights and life lessons.

The enormous impact of a 1% risk, the lever between expectations and reality, the secret of probability and certainty, the usefulness of imperfection, the power of stories that is stronger than statistics, how a 1-second mistake can destroy 100 years of achievement, etc., the 23 'immutable laws' exquisitely woven into the beginning and end of the episodes all evoke sighs and admiration.

“I thought it would be as fun as the previous one, but I was wrong.

Readers' reviews such as "This is more than that," and "I thought it was an investment book, but I learned something about life." are not empty boasts.

By following Morgan Housel's masterful narrative, anyone can experience the same sense of fulfillment and relief that leaders at home and abroad have described: "A three-hour encounter with a young, enlightened guru."

GOODS SPECIFICS

- Date of issue: February 28, 2024

- Format: Hardcover book binding method guide

- Page count, weight, size: 420 pages | 588g | 145*217*25mm

- ISBN13: 9791198517425

- ISBN10: 1198517425

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)