A country without shareholder rights

|

Description

Book Introduction

“Korea is a country that legally takes away shareholder rights.” A new book has been published by Park Young-ok, a leading investor and stock farmer in South Korea, and Kim Kyu-sik, chairman of the Korea Corporate Governance Forum. It is a country without shareholder rights. In this book, the author states that Korea is a country that legally violates shareholders' interests. This is because there are constant instances of depriving good shareholders of their rights, such as simultaneous listings after physical divisions that hit ordinary shareholders in the back of the head, tunneling that siphons off corporate profits, unreasonable merger ratios, and voluntary delisting. Because of this, Donghak ants are leaving the Korean stock market, and stock prices are said to be stuck in a box range. Why does this keep happening in the Korean stock market? Is there no solution? The author says that the problems in the Korean stock market are a result of the 'lack of protection mechanisms for ordinary shareholders.' They say that if this is resolved, we can become a country with an advanced stock market in one fell swoop, like the United States, where everyone becomes a millionaire upon retirement. However, the current Korean stock market has no realistic means of redress when rights are violated. Rather, it is structurally, legally and institutionally made easy for controlling shareholders to rob ordinary shareholders of their interests. There are as many as eight shareholder interest exploitation systems that exist only in Korea. The current state of the Korean stock market is a lawless state where there is no system to punish those who are assaulted. The United States has a set of five systems that protect the interests of common shareholders. Decisions cannot be made solely for the benefit of the board of directors or controlling shareholders. There is no such legal system in Korea. In this situation, it is simply surprising that the country has risen to become the world's 10th largest economy. In this book, the author explains the chronic problems of the Korean stock market, the eight shareholder rights violations unique to Korea, and how they have infringed on the interests of good shareholders, using real-life corporate cases. And we present seven ways to improve this reality and realize shareholder democracy. As you read this book, you will be shocked by how your rights are being taken away. Anger may well up. However, the author confidently states that all problems can be solved once and for all when the shareholder rights of the 14 million lost investors can be recovered. I hope that by heeding the advice in this book, the Korean stock market will soar and its benefits will be shared by all citizens. |

- You can preview some of the book's contents.

Preview

index

prolog

Prologue 1.

The South Korean stock market has a history of shareholder betrayal.

Prologue 2.

Dreaming of a happy 'accompanying investment' for 14 million investors

Chapter 1.

Why Are Korean Stock Investors Suffering?

· Business owners who are being treated coldly

· Innocent investors who keep their eyes open and their noses cut off

· If there are parasites living in my house

· A suspicious indulgence that makes shareholders cry

· Korean companies that only learn bad things

· Donghak ants leaving the Korean market

Chapter 2.

Korea's stock market suffers from chronic illness

· Why we need to escape the swamp of undervaluation

· The board of directors has become a broken voting machine.

· Shareholders who received an invitation that was not invited

· Cotton bats are funny scammers

· Strange investors who don't care about returns

· To prevent governance risks from returning as shareholder risks

Chapter 3.

Eight Critical Problems That Destroy Shareholder Value

· No investor can survive without trust.

Minimum systems for protecting shareholder rights

· 01.

The merger ratio that benefits controlling shareholders is now under scrutiny.

· 02.

A mandatory public offering system is in place to protect ordinary shareholders who are being pushed out at a low price.

· 03.

Simultaneous listing after physical division that destroys the tower of hard work in one fell swoop

· 04.

Voluntary delisting of promising companies at a low price: who benefits from it?

· 05.

The Ghost That's Raking Shareholders' Coffers: The "Magic of Treasury Stocks"

· 06.

From 'A League of Their Own' to 'A League of Us': Directors' Fiduciary Duties to Shareholders

· 07.

Let's break the shackles of securities class action lawsuits by allowing immediate appeals to hold back shareholders.

· 08.

Let's resolve the burden of proof shifting to shareholders through the evidence discovery system.

Chapter 4.

Seven Suggestions for Realizing Shareholder Democracy

· Corporate Governance_To become a company that investors want to work with

· Dividend Policy: Creating an investment environment and culture that shares performance through dividends.

· Financial Investment Income Tax_Market maturity comes before implementation of the financial investment tax

· Inheritance and Gift Tax_Fair and sensible inheritance and gift methods

· Short Selling: How to Fix the Tilt in the Short Selling Market

Punishing Financial Crimes: What We Need to Do to Protect the Foundations of the Capital Market

· Investment and Economic Education _ Stock Investment: The More You Know, the More You See

Prologue 1.

The South Korean stock market has a history of shareholder betrayal.

Prologue 2.

Dreaming of a happy 'accompanying investment' for 14 million investors

Chapter 1.

Why Are Korean Stock Investors Suffering?

· Business owners who are being treated coldly

· Innocent investors who keep their eyes open and their noses cut off

· If there are parasites living in my house

· A suspicious indulgence that makes shareholders cry

· Korean companies that only learn bad things

· Donghak ants leaving the Korean market

Chapter 2.

Korea's stock market suffers from chronic illness

· Why we need to escape the swamp of undervaluation

· The board of directors has become a broken voting machine.

· Shareholders who received an invitation that was not invited

· Cotton bats are funny scammers

· Strange investors who don't care about returns

· To prevent governance risks from returning as shareholder risks

Chapter 3.

Eight Critical Problems That Destroy Shareholder Value

· No investor can survive without trust.

Minimum systems for protecting shareholder rights

· 01.

The merger ratio that benefits controlling shareholders is now under scrutiny.

· 02.

A mandatory public offering system is in place to protect ordinary shareholders who are being pushed out at a low price.

· 03.

Simultaneous listing after physical division that destroys the tower of hard work in one fell swoop

· 04.

Voluntary delisting of promising companies at a low price: who benefits from it?

· 05.

The Ghost That's Raking Shareholders' Coffers: The "Magic of Treasury Stocks"

· 06.

From 'A League of Their Own' to 'A League of Us': Directors' Fiduciary Duties to Shareholders

· 07.

Let's break the shackles of securities class action lawsuits by allowing immediate appeals to hold back shareholders.

· 08.

Let's resolve the burden of proof shifting to shareholders through the evidence discovery system.

Chapter 4.

Seven Suggestions for Realizing Shareholder Democracy

· Corporate Governance_To become a company that investors want to work with

· Dividend Policy: Creating an investment environment and culture that shares performance through dividends.

· Financial Investment Income Tax_Market maturity comes before implementation of the financial investment tax

· Inheritance and Gift Tax_Fair and sensible inheritance and gift methods

· Short Selling: How to Fix the Tilt in the Short Selling Market

Punishing Financial Crimes: What We Need to Do to Protect the Foundations of the Capital Market

· Investment and Economic Education _ Stock Investment: The More You Know, the More You See

Detailed image

Into the book

Reality is harsh.

Korean companies still lack the effort to enhance shareholder value, and shareholders do not receive a proper share of the profits.

There is a widespread negative perception among investors that they cannot work with Korean companies, and the capital market and companies have become objects of distrust.

In addition, stock investment has been transformed into a dynamic gambling den due to the misconception that one can make money by buying and selling in the short term.

As a result, the Korean capital market is unable to escape a state of perpetual undervaluation and is being ignored by the public.

There are numerous cases where companies with net asset values of 1 trillion won are traded at market capitalizations of 400-500 billion won, and companies that should be valued at 500 billion won are traded at 200-300 billion won.

It's not like there's half water and half fish, but there's a lot of fish, but strangely enough, investors don't want to take it.

This is a strange phenomenon that can only be seen in Korea's capital market.

--- p.27

Let's assume, to the extreme, that all of our citizens do not invest in our own companies, but only in foreign companies.

So what will ultimately become of our companies? And what will become of our citizens who work for them? (Omitted) The competitive edge of today's cutting-edge industries lies in speed.

Securing investment funds is paramount to responding quickly to rapidly changing technological trends and international situations.

And the easiest way to do this is to attract domestic investors to the stock market.

This is why we must catch the Donghak ants.

(Omitted) It is necessary to keep in mind that the saying, ‘If you sell all your Korean stocks, you will go to the US’ did not come out of nowhere.

--- p.68

The Western ants have one belief.

It is the belief that the performance of the company in which I invested will definitely come back to me.

Whether it is capital gains or dividends.

American companies actively pursue shareholder-friendly policies to repay investors' trust.

They do their best to increase their stock price through stock buybacks and are not stingy with dividends.

It is a structure in which corporate value cannot but be properly reflected in stock prices.

On the other hand, domestic companies not only have low shareholder return rates, but also frequently make news with incidents such as spin-offs and tunneling, where controlling shareholders seize wealth from common shareholders.

There is no way for the corporate value to increase and the stock price cannot escape the box.

Korean companies have a significantly low dividend payout ratio, let alone buybacks of their own stock.

--- p.75

The Korean economy has been pursuing catch-up economic growth, taking unfair practices for granted in order to achieve results in a short period of time.

We also neglected to establish institutional mechanisms for a healthy investment environment.

Perhaps for this reason, shareholder protection mechanisms that are taken for granted in OECD countries do not exist in Korea.

As a result, Korea's capital market has become a lawless place where assaulting others goes unpunished.

To overcome these problems, a plan to effectively compensate for the collective damage suffered by ordinary shareholders must first be established.

--- p.183

What if something like a simultaneous listing after a spin-off had happened in the United States, not in Korea? Shareholders would have immediately filed a class action lawsuit demanding discovery.

Because the company made a decision that clearly harmed the interests of shareholders.

Of course, such an incident could never happen in the United States.

In the United States, the discovery system allows both sides to simultaneously disclose evidence before a formal trial begins.

Accordingly, the company's board of directors or controlling shareholder can be requested to disclose specific evidence that can be used to determine 'why such a decision was made' and 'whether such a decision is truly in the interests of shareholders.'

This is why shareholders do not hesitate to file lawsuits. (Omitted) An example of a class action lawsuit filed in the United States is the lawsuit filed by Twitter shareholders in 2016.

Shareholders filed the lawsuit in federal court in the Northern District of California, alleging that management misled shareholders in November 2014 by inflating the company's growth prospects.

At the time, management predicted that Twitter's monthly active users would increase by approximately 20% in the short term, reaching 550 million, but it was claimed that this misled investors. (Omitted)

Ultimately, in September 2021, Twitter agreed to pay a total of $895 million (approximately 950 billion won) to shareholders who had filed a class action lawsuit regarding its earnings forecast.

This is possible in the United States because of the five-part set of shareholder rights protections.

These include the securities class action system, the discovery system, the punitive damages system, the obstruction of justice (false statement crime), and the permission for law firms to advertise for shareholder recruitment.

There is no such legal system in Korea.

So, it is said that investors have no place to vent their grievances and are only able to hang around the shareholder bulletin boards of portal sites.

--- p.186~188

In other countries, such as the United States, market capitalization is calculated based on the number of outstanding shares, excluding treasury shares, from the total number of issued shares.

When a company buys back its own stock, the number of outstanding shares immediately decreases, the market capitalization decreases, and the stock price rises.

This creates a shareholder return effect.

However, in Korea, strangely, market capitalization is calculated based on the total number of issued shares.

So, even if you buy back your own stock, the market capitalization calculation does not change, and there is no change in the stock price.

Our exchange discloses in its financial statements that treasury stock repurchases constitute shareholder returns, but does not recognize treasury stock repurchases as shareholder returns based on market capitalization.

It is the only contradictory calculation method in the world.

These market capitalization calculation criteria are merely internal guidelines of the exchange.

In other words, the Korea discount can be partially resolved simply by changing the market capitalization calculation guidelines internally.

We can change the bad practices and order in our capital markets and improve governance in a healthy way through simple methods.

What remains is a matter of will and practice.

--- p.171~172

A class action system related to securities has also been introduced in Korea.

However, the cases in which a class action lawsuit can be filed are very limited, as it is limited to reasons such as false disclosure and fraudulent accounting.

The barriers to class action lawsuits related to securities are so high that it can be seen as virtually blocking attempts at class action lawsuits.

There are many obstacles, such as high litigation costs, difficulty proving corporate wrongdoing, and limitations on litigation attorneys, making it difficult to even begin. (Omitted) A bigger problem is that, unlike general litigation, securities class action lawsuits can only be initiated after filing a class action application with the court and receiving permission to file.

Moreover, if the company raises an objection, i.e., an ‘immediate appeal’ during this process, the procedure is suspended.

After that, it takes three trials, including the first trial, the second trial, and the Supreme Court, to decide whether or not to file a class action lawsuit.

Only the application process, not this lawsuit, goes up to three trials, and if you include this lawsuit, it can be said to be a six-trial system.

--- p.183~185

Some people say that the separate taxation of dividend income or the policy of lowering dividend income tax are 'tax cuts for the rich.'

But increasing dividends isn't just good for controlling shareholders.

In the case of domestic companies, the controlling shareholder typically owns 20-30% of the shares, and general shareholders own 70-80%. Therefore, if dividends increase, more citizens can enjoy the fruits of our company. (Omitted) Rather than allowing controlling shareholders to avoid receiving dividends and receive high salaries or create multiple subsidiaries to take salaries here and there, sharing the fruits of our company through dividends is a better choice, even at the national level.

Moreover, if an investment environment is created in which our citizens invest in our companies and share in the results, not only our companies but also the lives of our citizens will greatly improve.

As a result, it becomes a way to move forward on the path to living well together. (Omitted)

--- p.211~213

Korea's capital market has been far from the spirit of 'noblesse oblige'.

Controlling shareholders have viewed the capital market as merely a means of raising capital and inheriting and gifting assets, and have even used it as a channel for personal gain.

Social responsibility and sharing of achievements were put on the back burner, and only personal interests were pursued.

Even though the law and system supported the controlling shareholder, the various atrocities committed by the controlling shareholder, such as embezzlement, breach of trust, work hoarding, and tunneling, showed no end.

Things must change now.

The capital market must be reborn as a source of hope for all citizens.

We need to remember once again that a company cannot exist alone, and that its value comes from the nation and its people.

A nation can become prosperous only when households and businesses grow together.

This is why the government, businesses, controlling shareholders, general shareholders, and all citizens must join forces to create a society where the promises of corporations are kept.

Korean companies still lack the effort to enhance shareholder value, and shareholders do not receive a proper share of the profits.

There is a widespread negative perception among investors that they cannot work with Korean companies, and the capital market and companies have become objects of distrust.

In addition, stock investment has been transformed into a dynamic gambling den due to the misconception that one can make money by buying and selling in the short term.

As a result, the Korean capital market is unable to escape a state of perpetual undervaluation and is being ignored by the public.

There are numerous cases where companies with net asset values of 1 trillion won are traded at market capitalizations of 400-500 billion won, and companies that should be valued at 500 billion won are traded at 200-300 billion won.

It's not like there's half water and half fish, but there's a lot of fish, but strangely enough, investors don't want to take it.

This is a strange phenomenon that can only be seen in Korea's capital market.

--- p.27

Let's assume, to the extreme, that all of our citizens do not invest in our own companies, but only in foreign companies.

So what will ultimately become of our companies? And what will become of our citizens who work for them? (Omitted) The competitive edge of today's cutting-edge industries lies in speed.

Securing investment funds is paramount to responding quickly to rapidly changing technological trends and international situations.

And the easiest way to do this is to attract domestic investors to the stock market.

This is why we must catch the Donghak ants.

(Omitted) It is necessary to keep in mind that the saying, ‘If you sell all your Korean stocks, you will go to the US’ did not come out of nowhere.

--- p.68

The Western ants have one belief.

It is the belief that the performance of the company in which I invested will definitely come back to me.

Whether it is capital gains or dividends.

American companies actively pursue shareholder-friendly policies to repay investors' trust.

They do their best to increase their stock price through stock buybacks and are not stingy with dividends.

It is a structure in which corporate value cannot but be properly reflected in stock prices.

On the other hand, domestic companies not only have low shareholder return rates, but also frequently make news with incidents such as spin-offs and tunneling, where controlling shareholders seize wealth from common shareholders.

There is no way for the corporate value to increase and the stock price cannot escape the box.

Korean companies have a significantly low dividend payout ratio, let alone buybacks of their own stock.

--- p.75

The Korean economy has been pursuing catch-up economic growth, taking unfair practices for granted in order to achieve results in a short period of time.

We also neglected to establish institutional mechanisms for a healthy investment environment.

Perhaps for this reason, shareholder protection mechanisms that are taken for granted in OECD countries do not exist in Korea.

As a result, Korea's capital market has become a lawless place where assaulting others goes unpunished.

To overcome these problems, a plan to effectively compensate for the collective damage suffered by ordinary shareholders must first be established.

--- p.183

What if something like a simultaneous listing after a spin-off had happened in the United States, not in Korea? Shareholders would have immediately filed a class action lawsuit demanding discovery.

Because the company made a decision that clearly harmed the interests of shareholders.

Of course, such an incident could never happen in the United States.

In the United States, the discovery system allows both sides to simultaneously disclose evidence before a formal trial begins.

Accordingly, the company's board of directors or controlling shareholder can be requested to disclose specific evidence that can be used to determine 'why such a decision was made' and 'whether such a decision is truly in the interests of shareholders.'

This is why shareholders do not hesitate to file lawsuits. (Omitted) An example of a class action lawsuit filed in the United States is the lawsuit filed by Twitter shareholders in 2016.

Shareholders filed the lawsuit in federal court in the Northern District of California, alleging that management misled shareholders in November 2014 by inflating the company's growth prospects.

At the time, management predicted that Twitter's monthly active users would increase by approximately 20% in the short term, reaching 550 million, but it was claimed that this misled investors. (Omitted)

Ultimately, in September 2021, Twitter agreed to pay a total of $895 million (approximately 950 billion won) to shareholders who had filed a class action lawsuit regarding its earnings forecast.

This is possible in the United States because of the five-part set of shareholder rights protections.

These include the securities class action system, the discovery system, the punitive damages system, the obstruction of justice (false statement crime), and the permission for law firms to advertise for shareholder recruitment.

There is no such legal system in Korea.

So, it is said that investors have no place to vent their grievances and are only able to hang around the shareholder bulletin boards of portal sites.

--- p.186~188

In other countries, such as the United States, market capitalization is calculated based on the number of outstanding shares, excluding treasury shares, from the total number of issued shares.

When a company buys back its own stock, the number of outstanding shares immediately decreases, the market capitalization decreases, and the stock price rises.

This creates a shareholder return effect.

However, in Korea, strangely, market capitalization is calculated based on the total number of issued shares.

So, even if you buy back your own stock, the market capitalization calculation does not change, and there is no change in the stock price.

Our exchange discloses in its financial statements that treasury stock repurchases constitute shareholder returns, but does not recognize treasury stock repurchases as shareholder returns based on market capitalization.

It is the only contradictory calculation method in the world.

These market capitalization calculation criteria are merely internal guidelines of the exchange.

In other words, the Korea discount can be partially resolved simply by changing the market capitalization calculation guidelines internally.

We can change the bad practices and order in our capital markets and improve governance in a healthy way through simple methods.

What remains is a matter of will and practice.

--- p.171~172

A class action system related to securities has also been introduced in Korea.

However, the cases in which a class action lawsuit can be filed are very limited, as it is limited to reasons such as false disclosure and fraudulent accounting.

The barriers to class action lawsuits related to securities are so high that it can be seen as virtually blocking attempts at class action lawsuits.

There are many obstacles, such as high litigation costs, difficulty proving corporate wrongdoing, and limitations on litigation attorneys, making it difficult to even begin. (Omitted) A bigger problem is that, unlike general litigation, securities class action lawsuits can only be initiated after filing a class action application with the court and receiving permission to file.

Moreover, if the company raises an objection, i.e., an ‘immediate appeal’ during this process, the procedure is suspended.

After that, it takes three trials, including the first trial, the second trial, and the Supreme Court, to decide whether or not to file a class action lawsuit.

Only the application process, not this lawsuit, goes up to three trials, and if you include this lawsuit, it can be said to be a six-trial system.

--- p.183~185

Some people say that the separate taxation of dividend income or the policy of lowering dividend income tax are 'tax cuts for the rich.'

But increasing dividends isn't just good for controlling shareholders.

In the case of domestic companies, the controlling shareholder typically owns 20-30% of the shares, and general shareholders own 70-80%. Therefore, if dividends increase, more citizens can enjoy the fruits of our company. (Omitted) Rather than allowing controlling shareholders to avoid receiving dividends and receive high salaries or create multiple subsidiaries to take salaries here and there, sharing the fruits of our company through dividends is a better choice, even at the national level.

Moreover, if an investment environment is created in which our citizens invest in our companies and share in the results, not only our companies but also the lives of our citizens will greatly improve.

As a result, it becomes a way to move forward on the path to living well together. (Omitted)

--- p.211~213

Korea's capital market has been far from the spirit of 'noblesse oblige'.

Controlling shareholders have viewed the capital market as merely a means of raising capital and inheriting and gifting assets, and have even used it as a channel for personal gain.

Social responsibility and sharing of achievements were put on the back burner, and only personal interests were pursued.

Even though the law and system supported the controlling shareholder, the various atrocities committed by the controlling shareholder, such as embezzlement, breach of trust, work hoarding, and tunneling, showed no end.

Things must change now.

The capital market must be reborn as a source of hope for all citizens.

We need to remember once again that a company cannot exist alone, and that its value comes from the nation and its people.

A nation can become prosperous only when households and businesses grow together.

This is why the government, businesses, controlling shareholders, general shareholders, and all citizens must join forces to create a society where the promises of corporations are kept.

--- p.244

Publisher's Review

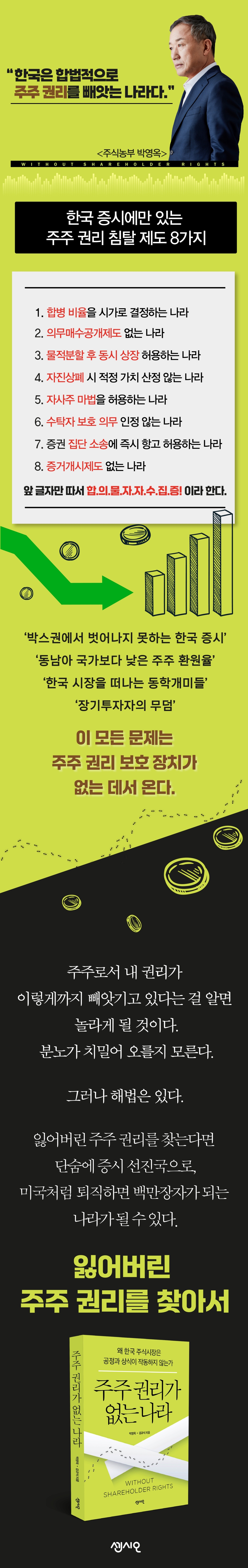

“Korea is a country that legally takes away shareholder rights.”

Korea's leading investor, 'stock farmer' Park Young-ok and Korea Corporate Governance Forum Chairman Kim Kyu-sik

Sharp advice for the Korean capital market

The author of "A Country Without Shareholder Rights" describes the Korean stock market as a history of shareholder betrayal.

Simultaneous listing after physical division, tunneling to embezzle profits, illegal succession, unreasonable merger ratio, voluntary delisting by exploiting the system, white knight disposal of treasury stock, etc.

This is because the phenomenon of rights violations that strike common shareholders in the face for the interests of controlling shareholders is constantly occurring.

This has led to the Korean stock market being the most undervalued in the world, stock prices being stuck in a box, and retail investors leaving the Korean stock market.

Why is the Korean stock market only being abused by ants?

You need to know the essence of the problem to find the right solution.

The author states that the various problems of the Korean stock market mentioned above 'started from the lack of protection mechanisms for common shareholders.'

The undervalued Korean stock market is often referred to as a "governance risk," but the core of this governance risk lies in the presence of a realistic system that can protect ordinary shareholders when their interests are harmed.

They argue that these problems can be solved once and for all when the shareholder rights of the 14 million lost investors can be restored.

In fact, the author says, Korea is a country that legally steals shareholder profits.

Because there is no realistic means of redress when the rights of common shareholders are violated.

Rather, it emphasizes that the controlling shareholder is structurally, legally, and institutionally supported in a sophisticated and meticulous manner to easily rob the interests of general shareholders.

This is the fundamental reason why cases of damage to common shareholders continue to occur.

Since there is no system to prevent this exploitation of shareholder rights or it is practically impossible to use, some controlling shareholders abuse this system and fall into moral hazard, and the entire market uncritically learns from this, falling into a vicious cycle.

The United States has a set of five systems that protect the interests of common shareholders.

Therefore, decisions cannot be made solely for the benefit of the board of directors or controlling shareholders.

If a problem arises, the company must shoulder the burden of proof.

On the other hand, Korea does not have a single legal system like this.

What's even more surprising is that there are eight shareholder profit exploitation systems that exist only in Korea.

8 Shareholder Rights Violations Existing Only in the Korean Stock Market

A country that determines the merger ratio based on market price

Countries without a mandatory purchase disclosure system

Countries that allow simultaneous listing after physical division

A country that does not calculate fair value in case of voluntary delisting

A country that allows treasury stock magic

Countries that do not recognize the duty of care of trustees

Countries that allow immediate appeals in securities class action lawsuits

Countries without a discovery system

The author calls these eight bad habits 'Agreement, Object, Self, Self, Collection, and Proof' by taking the first letters of the names.

The Korean market is a place where things that would be unimaginable in other countries happen every day.

Simply put, the current state of the Korean stock market is a lawless state where there is no realistic system to punish the person who assaulted the person, even if the person was a large person.

In this situation, it is simply surprising that the country has risen to become the world's 10th largest economy.

Korean companies that only learn bad things

Newly listed companies quickly learn the bad habits of their predecessors.

"Tunneling," where controlling shareholders embezzle profits; unfair merger price calculations that maximize only the interests of controlling shareholders and leave general shareholders in the lurch; and "simultaneous listing after physical division," which strikes general shareholders in the back of the head.

The damage is passed on entirely to general investors.

Ordinary shareholders who have long invested in the company's value are shedding tears of blood.

This is not all. Chronic ills of the Korean capital market, such as controlling shareholder-centered decision-making that excludes common shareholders, management practices that undermine corporate value and infringe upon shareholder interests, and remarkably low shareholder return rates, are ongoing.

There is a reason why the authors used the extreme expression, “The Korean stock market has a history of shareholder betrayal.”

Suggestions for shareholder democratization to advance to advanced countries

This book consists of four chapters.

The first chapter examines why Korean stock investors are suffering, and the second analyzes the chronically ill Korean stock market.

The third chapter highlights eight critical problems that undermine shareholder value, and the fourth chapter presents seven suggestions for realizing shareholder democracy, where investors are the masters.

Through this, we will criticize and reveal uncomfortable truths by exposing various cases in which good shareholders have been neglected and mocked, as well as the chronic problems of the Korean stock market hidden within them.

Readers will be shocked to learn that their rights are being taken away to this extent.

Anger may well up.

Nevertheless, the author speaks of hope.

If our companies embrace a spirit of partnership and strive to properly share performance with investors, and if this is preceded by improvements to the system that protects investors, I am confident that South Korea's 14 million shareholders will confidently regain their rights, and our investment environment and corporate governance will quickly rise to the ranks of advanced nations.

Korea's leading investor, 'stock farmer' Park Young-ok and Korea Corporate Governance Forum Chairman Kim Kyu-sik

Sharp advice for the Korean capital market

The author of "A Country Without Shareholder Rights" describes the Korean stock market as a history of shareholder betrayal.

Simultaneous listing after physical division, tunneling to embezzle profits, illegal succession, unreasonable merger ratio, voluntary delisting by exploiting the system, white knight disposal of treasury stock, etc.

This is because the phenomenon of rights violations that strike common shareholders in the face for the interests of controlling shareholders is constantly occurring.

This has led to the Korean stock market being the most undervalued in the world, stock prices being stuck in a box, and retail investors leaving the Korean stock market.

Why is the Korean stock market only being abused by ants?

You need to know the essence of the problem to find the right solution.

The author states that the various problems of the Korean stock market mentioned above 'started from the lack of protection mechanisms for common shareholders.'

The undervalued Korean stock market is often referred to as a "governance risk," but the core of this governance risk lies in the presence of a realistic system that can protect ordinary shareholders when their interests are harmed.

They argue that these problems can be solved once and for all when the shareholder rights of the 14 million lost investors can be restored.

In fact, the author says, Korea is a country that legally steals shareholder profits.

Because there is no realistic means of redress when the rights of common shareholders are violated.

Rather, it emphasizes that the controlling shareholder is structurally, legally, and institutionally supported in a sophisticated and meticulous manner to easily rob the interests of general shareholders.

This is the fundamental reason why cases of damage to common shareholders continue to occur.

Since there is no system to prevent this exploitation of shareholder rights or it is practically impossible to use, some controlling shareholders abuse this system and fall into moral hazard, and the entire market uncritically learns from this, falling into a vicious cycle.

The United States has a set of five systems that protect the interests of common shareholders.

Therefore, decisions cannot be made solely for the benefit of the board of directors or controlling shareholders.

If a problem arises, the company must shoulder the burden of proof.

On the other hand, Korea does not have a single legal system like this.

What's even more surprising is that there are eight shareholder profit exploitation systems that exist only in Korea.

8 Shareholder Rights Violations Existing Only in the Korean Stock Market

A country that determines the merger ratio based on market price

Countries without a mandatory purchase disclosure system

Countries that allow simultaneous listing after physical division

A country that does not calculate fair value in case of voluntary delisting

A country that allows treasury stock magic

Countries that do not recognize the duty of care of trustees

Countries that allow immediate appeals in securities class action lawsuits

Countries without a discovery system

The author calls these eight bad habits 'Agreement, Object, Self, Self, Collection, and Proof' by taking the first letters of the names.

The Korean market is a place where things that would be unimaginable in other countries happen every day.

Simply put, the current state of the Korean stock market is a lawless state where there is no realistic system to punish the person who assaulted the person, even if the person was a large person.

In this situation, it is simply surprising that the country has risen to become the world's 10th largest economy.

Korean companies that only learn bad things

Newly listed companies quickly learn the bad habits of their predecessors.

"Tunneling," where controlling shareholders embezzle profits; unfair merger price calculations that maximize only the interests of controlling shareholders and leave general shareholders in the lurch; and "simultaneous listing after physical division," which strikes general shareholders in the back of the head.

The damage is passed on entirely to general investors.

Ordinary shareholders who have long invested in the company's value are shedding tears of blood.

This is not all. Chronic ills of the Korean capital market, such as controlling shareholder-centered decision-making that excludes common shareholders, management practices that undermine corporate value and infringe upon shareholder interests, and remarkably low shareholder return rates, are ongoing.

There is a reason why the authors used the extreme expression, “The Korean stock market has a history of shareholder betrayal.”

Suggestions for shareholder democratization to advance to advanced countries

This book consists of four chapters.

The first chapter examines why Korean stock investors are suffering, and the second analyzes the chronically ill Korean stock market.

The third chapter highlights eight critical problems that undermine shareholder value, and the fourth chapter presents seven suggestions for realizing shareholder democracy, where investors are the masters.

Through this, we will criticize and reveal uncomfortable truths by exposing various cases in which good shareholders have been neglected and mocked, as well as the chronic problems of the Korean stock market hidden within them.

Readers will be shocked to learn that their rights are being taken away to this extent.

Anger may well up.

Nevertheless, the author speaks of hope.

If our companies embrace a spirit of partnership and strive to properly share performance with investors, and if this is preceded by improvements to the system that protects investors, I am confident that South Korea's 14 million shareholders will confidently regain their rights, and our investment environment and corporate governance will quickly rise to the ranks of advanced nations.

GOODS SPECIFICS

- Date of issue: January 19, 2024

- Page count, weight, size: 246 pages | 416g | 148*210*15mm

- ISBN13: 9791166571336

- ISBN10: 1166571335

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)