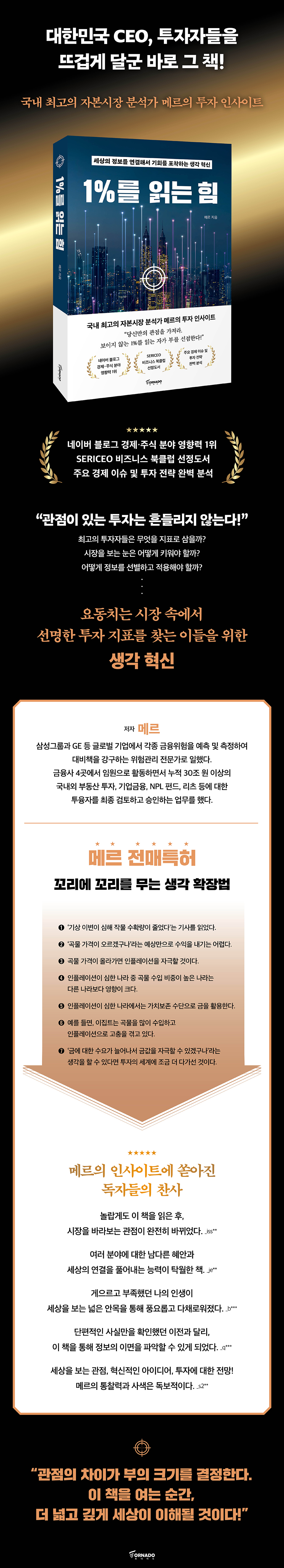

The power of reading 1%

|

Description

Book Introduction

- A word from MD

-

Discovering new perspectives and opportunitiesThis is Mer's first book, which has captivated many by providing unique insight into the market through articles posted daily under a pseudonym.

Let's discover a new perspective that connects information and uncovers hidden opportunities through a thought-provoking, holistic approach rather than a fragmented view of events.

August 29, 2023. Economics and Management PD Kim Sang-geun

Ranked first on Kyobo, Yes24, and Aladdin immediately after publication

Naver Blog ranks first in the economy and stocks category

SERICEO Business Book Club Selections

Mer, the country's top capital market analyst

Innovation in thinking that connects the world and discovers opportunities

There is a blog that has been praised as “a world seen from the shoulders of giants,” “Mer’s insight is not 1%, but 0.01%,” and “a blog that even those who were indifferent to the economy will find themselves reading.”

By posting a new article every day at 00:10, the number of subscribers has exceeded 100,000 in just over a year, and the number of views has been breaking records with each article posted, receiving explosive attention.

Author Mer, who has accumulated expertise while working as a risk management expert at global companies such as Samsung Group and GE, and his practical experience as an executive at four financial institutions, where he reviewed and approved over 30 trillion won worth of domestic and international real estate investments, NPL funds, and REITs, introduces the easiest and most interesting way to understand economic trends and discover opportunities within them.

When investing, there are times when it feels like you are walking through a long tunnel.

These questions arise when you have no idea where to go, whether to go further or stop.

"What indicators do the best investors use?", "How can I develop a keen eye for the market?", "How can I filter and apply the daily news?" This book will provide useful hints for finding answers to these questions.

Author Mer says that while the quality of information is important, what is more important is the ability to view and organize information from different perspectives.

Because you need to have your own perspective, your investments won't be easily shaken or made unstable.

Investing isn't everything.

If you can read the flow of the world and apply the insights to your daily life, you will be able to create many more opportunities and achieve success sooner.

If you want to find clear investment indicators in a volatile market, learn how to develop your own perspective, or discover the secrets of wealth and investment hidden in economic principles, this book is a must-read.

Before you know it, you'll gain insight into the essence of investing and gain a broader and deeper understanding of the world.

Naver Blog ranks first in the economy and stocks category

SERICEO Business Book Club Selections

Mer, the country's top capital market analyst

Innovation in thinking that connects the world and discovers opportunities

There is a blog that has been praised as “a world seen from the shoulders of giants,” “Mer’s insight is not 1%, but 0.01%,” and “a blog that even those who were indifferent to the economy will find themselves reading.”

By posting a new article every day at 00:10, the number of subscribers has exceeded 100,000 in just over a year, and the number of views has been breaking records with each article posted, receiving explosive attention.

Author Mer, who has accumulated expertise while working as a risk management expert at global companies such as Samsung Group and GE, and his practical experience as an executive at four financial institutions, where he reviewed and approved over 30 trillion won worth of domestic and international real estate investments, NPL funds, and REITs, introduces the easiest and most interesting way to understand economic trends and discover opportunities within them.

When investing, there are times when it feels like you are walking through a long tunnel.

These questions arise when you have no idea where to go, whether to go further or stop.

"What indicators do the best investors use?", "How can I develop a keen eye for the market?", "How can I filter and apply the daily news?" This book will provide useful hints for finding answers to these questions.

Author Mer says that while the quality of information is important, what is more important is the ability to view and organize information from different perspectives.

Because you need to have your own perspective, your investments won't be easily shaken or made unstable.

Investing isn't everything.

If you can read the flow of the world and apply the insights to your daily life, you will be able to create many more opportunities and achieve success sooner.

If you want to find clear investment indicators in a volatile market, learn how to develop your own perspective, or discover the secrets of wealth and investment hidden in economic principles, this book is a must-read.

Before you know it, you'll gain insight into the essence of investing and gain a broader and deeper understanding of the world.

- You can preview some of the book's contents.

Preview

index

prolog

Chapter 1: Old Perspectives and New Interpretations

01 Semiconductors are a key to the competition among hegemonic nations.

02 The Future of the Electric Vehicle and Battery War

03 Why OPEC Plus and the US are Fighting

04 Korea's Shipbuilding Industry Preparing for a Super Cycle

05 New meat is coming

06 The World of Rare Earth Elements 1 (Space Wars)

07 The World Moved by Rare Earth 2 (Motors, Robots, Greenland)

08 The Butterfly Effect of the Ukrainian War

09 The Opportunity of the Sinking of Indonesia's Capital

Chapter 2: Changing Your Perspective Reveals Opportunities

01 Why America Became Selfish

02 Reshoring and Nearshoring in the United States

03 The Inside Story of the Bank of Japan in a Dilemma

04 Keywords for Understanding the Korean Economy

05 Opportunities brought about by drug repositioning

06 The Korean foreign exchange crisis started elsewhere.

07 Why Commercial Real Estate Is the Fuel for the Global Economy

The world where the 08 petrodollar moved is changing.

09 The Secret of Household Loans and DSR

Chapter 3: The Secrets of Wealth and Investment Hidden in Economic Principles: Basics

01 How to Measure Real Estate Value

02 The Economic Argument Hidden in the Japanese Yen and Government Bonds

03 Exchange Rates and Dollar Smile

04 Why we take the inversion of short-term and long-term interest rates seriously

05 The Inside Story of Warren Buffett's Investment in a Japanese General Trading Company

06 What is the investment appeal of silver?

07 Understanding the Real Estate PF Structure Provides Insight into the Real Estate Market

08 The myth that bond investments are safer than stocks

Chapter 4: The Secrets of Wealth and Investment Hidden in Economic Principles: Advanced Edition

01 Investment Opportunities Brought About by Climate Change

02 Limitations and Future of Renewable Energy

03 The Importance of Information Seen Through the Imjin War

04 Why are savings interest rates higher than deposit interest rates?

05 The World Economy Through Egg Prices

06 The Power of Resources Demonstrated in the Trade Dispute Between China and Australia

07 Understanding the market situation by looking at hedge funds

08 Population structure drives major economic trends.

09 Why is the world buying gold now?

Chapter 5: Create and Develop Your Own Perspective

01 Commonalities of Investments That Produce Good Results

02 Build your own competitive edge with key information

03 Where can I find useful information?

04 How to find the best time to buy

05 Thinking in connection increases batting average

06 What should you look for when evaluating a company's value?

07 The world is connected like a net.

Chapter 1: Old Perspectives and New Interpretations

01 Semiconductors are a key to the competition among hegemonic nations.

02 The Future of the Electric Vehicle and Battery War

03 Why OPEC Plus and the US are Fighting

04 Korea's Shipbuilding Industry Preparing for a Super Cycle

05 New meat is coming

06 The World of Rare Earth Elements 1 (Space Wars)

07 The World Moved by Rare Earth 2 (Motors, Robots, Greenland)

08 The Butterfly Effect of the Ukrainian War

09 The Opportunity of the Sinking of Indonesia's Capital

Chapter 2: Changing Your Perspective Reveals Opportunities

01 Why America Became Selfish

02 Reshoring and Nearshoring in the United States

03 The Inside Story of the Bank of Japan in a Dilemma

04 Keywords for Understanding the Korean Economy

05 Opportunities brought about by drug repositioning

06 The Korean foreign exchange crisis started elsewhere.

07 Why Commercial Real Estate Is the Fuel for the Global Economy

The world where the 08 petrodollar moved is changing.

09 The Secret of Household Loans and DSR

Chapter 3: The Secrets of Wealth and Investment Hidden in Economic Principles: Basics

01 How to Measure Real Estate Value

02 The Economic Argument Hidden in the Japanese Yen and Government Bonds

03 Exchange Rates and Dollar Smile

04 Why we take the inversion of short-term and long-term interest rates seriously

05 The Inside Story of Warren Buffett's Investment in a Japanese General Trading Company

06 What is the investment appeal of silver?

07 Understanding the Real Estate PF Structure Provides Insight into the Real Estate Market

08 The myth that bond investments are safer than stocks

Chapter 4: The Secrets of Wealth and Investment Hidden in Economic Principles: Advanced Edition

01 Investment Opportunities Brought About by Climate Change

02 Limitations and Future of Renewable Energy

03 The Importance of Information Seen Through the Imjin War

04 Why are savings interest rates higher than deposit interest rates?

05 The World Economy Through Egg Prices

06 The Power of Resources Demonstrated in the Trade Dispute Between China and Australia

07 Understanding the market situation by looking at hedge funds

08 Population structure drives major economic trends.

09 Why is the world buying gold now?

Chapter 5: Create and Develop Your Own Perspective

01 Commonalities of Investments That Produce Good Results

02 Build your own competitive edge with key information

03 Where can I find useful information?

04 How to find the best time to buy

05 Thinking in connection increases batting average

06 What should you look for when evaluating a company's value?

07 The world is connected like a net.

Detailed image

Publisher's Review

“Throw away the ordinary 99%,

“Find the 1% that no one has seen!”

The Secret of Those Who Constantly Unearth Amazing Opportunities in an Unpredictable Market

To make good investments, we access a lot of information through news and YouTube, and listen to the opinions of renowned experts.

However, fake news that cleverly obscures the truth is rampant, and with different interpretations of the same issue, it is difficult to distinguish between what is real and what is fake and to make judgments about what to believe and what not to believe.

Ironically, the more information you are exposed to, the more blurred your investment direction becomes, rather than the clearer it should be.

Everyone knows that investing requires a unique perspective.

But few people know how to create and develop a perspective, and even if they are lucky enough to learn how, making it their own is not easy.

The author says that the most important thing is not the 'arithmetic balance' of choosing the middle ground between different arguments, but the 'balance of thought' of finding the center of my thoughts.

The key is to have your own perspective.

Ultimately, those who survive in the market are not those who blindly believe or are swept away by the advice of experts or the success stories of those who became rich through investment, but rather those who choose the methods that suit them and sometimes learn from them.

With these standards in place, you can read the market signals, avoid missing the right timing, and anticipate impending crises to prepare for them in advance.

“The ability to read the invisible flow of the world

“People take everything!”

A "thinking expansion method" to create your own unique perspective and viewpoint is revealed.

How can we break free from conventional wisdom and conventional wisdom and view the market from a completely new perspective? This book emphasizes "seeing the world through connections" as a way to create and develop your own unique perspective.

The moment you realize that the world is interconnected like a net, the narrow perspectives and boundaries of your thoughts that you previously held will inevitably crumble.

It is structured to help readers understand the underlying issues by interpreting and organizing them differently from conventional perspectives, and vividly conveys how to connect economic trends with investment.

It also provides a macroeconomic outlook on the global economy, while analyzing key economic issues to uncover investment opportunities and develop strategies, providing practical know-how.

In particular, the author Mer's patented tail-chasing method of expanding thinking is very practical and unique.

As you follow the fascinating interpretation that connects seemingly unrelated events, the 1% hidden between the lines of information begins to become clear.

The practice of expanding your horizons over several stages enhances your investment capabilities and opens up a whole new world, revealing the surprisingly diverse range of investment options.

In addition, it's packed with practical and effective strategies for investors, including commonalities among successful investments, how to create your own unique investment weapon, how to build your own competitive edge with key information, how to find useful information, and how to determine the best buying timing. It's also filled with ways to increase your investment success rate.

Let's take a look at Mer's thinking and insights, which are highly recommended by Korean CEOs and investors.

Each line will thrill you with realization and wonder.

“Find the 1% that no one has seen!”

The Secret of Those Who Constantly Unearth Amazing Opportunities in an Unpredictable Market

To make good investments, we access a lot of information through news and YouTube, and listen to the opinions of renowned experts.

However, fake news that cleverly obscures the truth is rampant, and with different interpretations of the same issue, it is difficult to distinguish between what is real and what is fake and to make judgments about what to believe and what not to believe.

Ironically, the more information you are exposed to, the more blurred your investment direction becomes, rather than the clearer it should be.

Everyone knows that investing requires a unique perspective.

But few people know how to create and develop a perspective, and even if they are lucky enough to learn how, making it their own is not easy.

The author says that the most important thing is not the 'arithmetic balance' of choosing the middle ground between different arguments, but the 'balance of thought' of finding the center of my thoughts.

The key is to have your own perspective.

Ultimately, those who survive in the market are not those who blindly believe or are swept away by the advice of experts or the success stories of those who became rich through investment, but rather those who choose the methods that suit them and sometimes learn from them.

With these standards in place, you can read the market signals, avoid missing the right timing, and anticipate impending crises to prepare for them in advance.

“The ability to read the invisible flow of the world

“People take everything!”

A "thinking expansion method" to create your own unique perspective and viewpoint is revealed.

How can we break free from conventional wisdom and conventional wisdom and view the market from a completely new perspective? This book emphasizes "seeing the world through connections" as a way to create and develop your own unique perspective.

The moment you realize that the world is interconnected like a net, the narrow perspectives and boundaries of your thoughts that you previously held will inevitably crumble.

It is structured to help readers understand the underlying issues by interpreting and organizing them differently from conventional perspectives, and vividly conveys how to connect economic trends with investment.

It also provides a macroeconomic outlook on the global economy, while analyzing key economic issues to uncover investment opportunities and develop strategies, providing practical know-how.

In particular, the author Mer's patented tail-chasing method of expanding thinking is very practical and unique.

As you follow the fascinating interpretation that connects seemingly unrelated events, the 1% hidden between the lines of information begins to become clear.

The practice of expanding your horizons over several stages enhances your investment capabilities and opens up a whole new world, revealing the surprisingly diverse range of investment options.

In addition, it's packed with practical and effective strategies for investors, including commonalities among successful investments, how to create your own unique investment weapon, how to build your own competitive edge with key information, how to find useful information, and how to determine the best buying timing. It's also filled with ways to increase your investment success rate.

Let's take a look at Mer's thinking and insights, which are highly recommended by Korean CEOs and investors.

Each line will thrill you with realization and wonder.

GOODS SPECIFICS

- Date of issue: August 30, 2023

- Page count, weight, size: 316 pages | 512g | 145*215*18mm

- ISBN13: 9791158512767

- ISBN10: 1158512767

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)