Korean-style value investing

|

Description

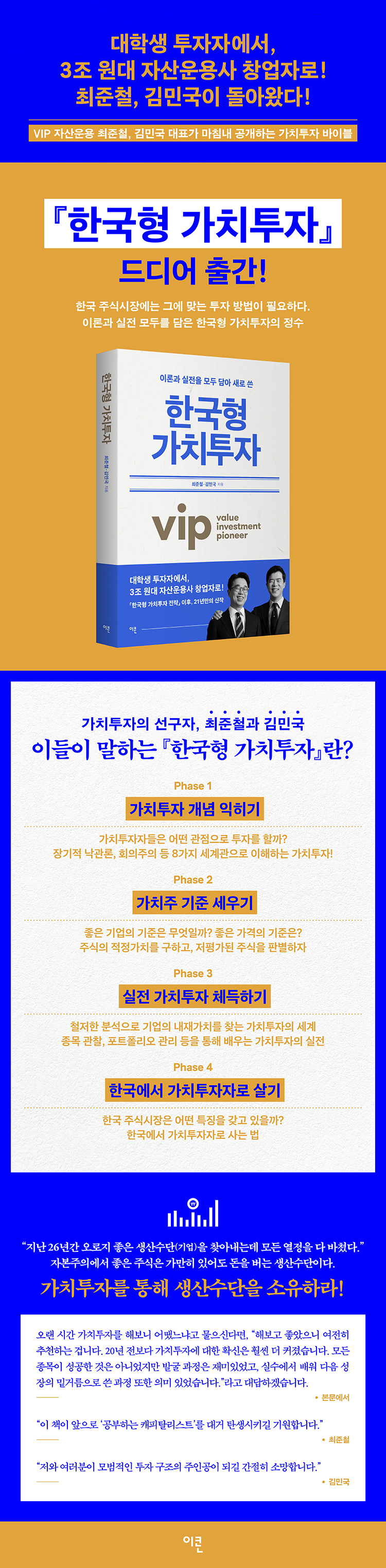

Book Introduction

Choi Jun-cheol and Kim Min-guk, VIP asset managers who manage over 3 trillion won

The Value Investing Bible Finally Revealed

『Korean Value Investing』 is the third installment of the value investing series, following 『Korean Value Investing Strategy』 and 『V Chart: Making Value Investing Easy』.

While 『Korean Value Investing Strategy』 focused on the concept of value investing and proper stock selection, and 『V Chart: Easy Value Investing』 focused on financial statement interpretation techniques, 『Korean Value Investing』 rewrites the basics of value investing from scratch, while minimizing content overlap with previous works as much as possible.

Also, because the difficulty of investing has increased compared to the past, we took care to provide as detailed instructions as possible, as if digging a tunnel to find gold nuggets.

To enhance the validity of the theory, to make the explanation easier, and to double the fun of reading, I tried to incorporate as much insight and know-how as possible from my own experience.

This is a must-read for investors who wish to value invest in the Korean stock market.

The Value Investing Bible Finally Revealed

『Korean Value Investing』 is the third installment of the value investing series, following 『Korean Value Investing Strategy』 and 『V Chart: Making Value Investing Easy』.

While 『Korean Value Investing Strategy』 focused on the concept of value investing and proper stock selection, and 『V Chart: Easy Value Investing』 focused on financial statement interpretation techniques, 『Korean Value Investing』 rewrites the basics of value investing from scratch, while minimizing content overlap with previous works as much as possible.

Also, because the difficulty of investing has increased compared to the past, we took care to provide as detailed instructions as possible, as if digging a tunnel to find gold nuggets.

To enhance the validity of the theory, to make the explanation easier, and to double the fun of reading, I tried to incorporate as much insight and know-how as possible from my own experience.

This is a must-read for investors who wish to value invest in the Korean stock market.

- You can preview some of the book's contents.

Preview

index

Entering

introduction

Choi Jun-cheol and capitalism

Kim Min-guk and the IMF foreign exchange crisis

Part 1: Understanding Value Investing Concepts

Chapter 1.

The worldview of value investing

Long-term optimism

skepticism

The stock market is a master of humiliation

Stocks over the market

long-term investment

circular thinking

probabilistic thinking

intersectional thinking

Chapter 2.

What is value investing?

Definition of value investing

risk

Return

The process of value investing

Misconceptions about value investing

Part 2: Establishing Value Stock Standards

Chapter 3.

Good company and manager

Business model

growth potential

operator

Chapter 4.

Good price

Finding fair value (1)

Finding fair value (2)

Identifying Undervaluation (1)

Identifying Undervaluation (2)

Part 3: Mastering Practical Value Investing

Chapter 5.

Stock discovery

Stock type

Get investment ideas

catalyst

Scope of ability

Chapter 6.

Stock Analysis

Preparation for analysis

Common Checklist

Individual inspection items

Company visit

Quarterly Performance Analysis

Shareholder Policy

Chapter 7.

Portfolio construction and management

buy

Sell

Building a portfolio

Portfolio Management

Determining the cash ratio

Chapter 8.

Psychological management

How to Deal with a Bear Market

How to Deal with a Bull Market

How to deal with alienation

How to deal with bitten stocks

Part 4.

Living as a Value Investor in Korea

Chapter 9.

Thoughts on the Korean stock market

Samsung Electronics

Newly listed stocks

holding company

Donghak Ants and Seohak Ants

The need for activism

The Role of Value Investors

Chapter 10.

Investor growth

Choi Jun-cheol's growth story

Kim Min-guk's growth story

Investor growth stage

Going out

First impressions

Second impression

Value investors who participated in the production

introduction

Choi Jun-cheol and capitalism

Kim Min-guk and the IMF foreign exchange crisis

Part 1: Understanding Value Investing Concepts

Chapter 1.

The worldview of value investing

Long-term optimism

skepticism

The stock market is a master of humiliation

Stocks over the market

long-term investment

circular thinking

probabilistic thinking

intersectional thinking

Chapter 2.

What is value investing?

Definition of value investing

risk

Return

The process of value investing

Misconceptions about value investing

Part 2: Establishing Value Stock Standards

Chapter 3.

Good company and manager

Business model

growth potential

operator

Chapter 4.

Good price

Finding fair value (1)

Finding fair value (2)

Identifying Undervaluation (1)

Identifying Undervaluation (2)

Part 3: Mastering Practical Value Investing

Chapter 5.

Stock discovery

Stock type

Get investment ideas

catalyst

Scope of ability

Chapter 6.

Stock Analysis

Preparation for analysis

Common Checklist

Individual inspection items

Company visit

Quarterly Performance Analysis

Shareholder Policy

Chapter 7.

Portfolio construction and management

buy

Sell

Building a portfolio

Portfolio Management

Determining the cash ratio

Chapter 8.

Psychological management

How to Deal with a Bear Market

How to Deal with a Bull Market

How to deal with alienation

How to deal with bitten stocks

Part 4.

Living as a Value Investor in Korea

Chapter 9.

Thoughts on the Korean stock market

Samsung Electronics

Newly listed stocks

holding company

Donghak Ants and Seohak Ants

The need for activism

The Role of Value Investors

Chapter 10.

Investor growth

Choi Jun-cheol's growth story

Kim Min-guk's growth story

Investor growth stage

Going out

First impressions

Second impression

Value investors who participated in the production

Detailed image

Into the book

The global spread of infectious diseases was a first for modern humans.

So, no one could guarantee how far the impact of the coronavirus would extend.

Crude oil futures prices even fell into negative territory amid fears that global economic activity would grind to a halt.

Faced with the coronavirus that threatens our lives and our very foundations, humanity trembles in collective fear.

But in the end, the world did not end.

---p.25

Value investors view crises based on reason, rooted in modern and contemporary history, rather than on instincts ingrained in their genes.

It is an empirical fact that capitalism has the ability to heal itself.

In other words, this means trusting in the human will and ability to overcome crises.

---p.27

Value investors are a group that persistently pursues cost-effectiveness in the stock market.

We constantly strive to find the intersection between above-average good companies and below-average low prices.

---p.44

Graham added a word to his definition of value investing: if any of the following criteria are not met: thorough analysis, stability of principal, or reasonable returns, it is considered speculation.

---p.50

A good business model has the characteristic of high output relative to input, like a horse that gains muscle even when eating little.

In other words, if more profits are generated with the same amount of capital, shareholders can expect a rapid increase in corporate value.

If the same thing happens every year, the difference will only grow bigger over time.

---p.68

We argue that the role of management is crucial when considering long-term investments.

I've seen videos like this on YouTube.

Hospital ambulance drivers drive sleek supercars, while top-class racer Vettel drives heavy ambulances.

What happened to the win or loss?

---p.82

Just as an album becomes a huge hit if both the tracks and the title track are good, if you are lucky enough to see both the profit and PER increase after purchasing, you will generate significant profits.

Value investors start buying at low PER ranges, so they initially enjoy stock price appreciation only as earnings grow.

---p.100

When you look at a lot of stocks, there are often times when the hidden asset value is so great that it becomes an investment idea ahead of the profit value.

This applies to companies with a lot of real estate, such as paper and textile companies, or when their subsidiaries are more profitable than the parent company.

Another method is to closely examine the asset value and compare it to the market capitalization to determine whether it is undervalued.

---p.113

We further categorize good stocks into four baskets based on the sustainability and slope of their growth, the degree of undervaluation, and factors that could trigger a price reversal.

This is because it makes it easier to decide which direction to take when you come across an investment idea.

---p.121

For value investors, it is extremely painful to fall into a value trap state where it is difficult to expect value to be realized.

I remember feeling frustrated, like eating a sweet potato, at Nexen (Nexen Tire's parent company), which was extremely undervalued to the point that it was considered the cheapest in the market, but had no catalyst whatsoever.

---p.141

A value investor's investment ideas largely stem from clearing up misunderstandings and the potential for change.

In the former case, determining whether the message the market is sending is valid or false becomes the core of stock analysis.

---p.155

When I first heard the name that reminded me of stocks, I thought that maybe I was born with the destiny to become a stock trader.

Since then, I have become a long-time stock manager in charge of IR for the largest company in our country for nearly 10 years, so I thought we weren't joking around for nothing.

---p.168

Contrary to market concerns, the monopoly remained intact, and although new simulator sales were declining, this was offset by replacement demand from existing owners.

Moreover, in the meantime, network services were introduced, showing signs of moving away from the one-time sales model, which we had seen as our greatest weakness.

---p.181

'Ttasang.' This is the magic spell that has captivated investors for the past two years.

How could anyone resist the easy allure of a 2.6x increase when the stocks for which public offerings were subscribed started at a flat opening price and closed at the daily limit as soon as they were listed?

---p.238

In 2001, while I was preparing to return to school after completing my military service, I stumbled upon a striking analysis article on a value investing community called 'New Eye'.

I was interested in the subject, so I had a general idea of the content, but I was truly amazed that a company was completely dissected and its core concepts were explained in such easy language.

---p.260

I am a very curious person.

My hobby is food, and the reason I prefer buffets over a la carte is because I am curious about the taste of various foods.

This curiosity led to investment.

For me, investing is the best hobby and job that endlessly satisfies my curiosity.

---p.276

Becoming an expert is not the end.

You have to invest a lot of time to maintain your skills.

If you let your guard down even a little and become lazy, you will quickly lose your touch.

That's why I emphasize setting high standards for myself and sticking to my own routine.

So, no one could guarantee how far the impact of the coronavirus would extend.

Crude oil futures prices even fell into negative territory amid fears that global economic activity would grind to a halt.

Faced with the coronavirus that threatens our lives and our very foundations, humanity trembles in collective fear.

But in the end, the world did not end.

---p.25

Value investors view crises based on reason, rooted in modern and contemporary history, rather than on instincts ingrained in their genes.

It is an empirical fact that capitalism has the ability to heal itself.

In other words, this means trusting in the human will and ability to overcome crises.

---p.27

Value investors are a group that persistently pursues cost-effectiveness in the stock market.

We constantly strive to find the intersection between above-average good companies and below-average low prices.

---p.44

Graham added a word to his definition of value investing: if any of the following criteria are not met: thorough analysis, stability of principal, or reasonable returns, it is considered speculation.

---p.50

A good business model has the characteristic of high output relative to input, like a horse that gains muscle even when eating little.

In other words, if more profits are generated with the same amount of capital, shareholders can expect a rapid increase in corporate value.

If the same thing happens every year, the difference will only grow bigger over time.

---p.68

We argue that the role of management is crucial when considering long-term investments.

I've seen videos like this on YouTube.

Hospital ambulance drivers drive sleek supercars, while top-class racer Vettel drives heavy ambulances.

What happened to the win or loss?

---p.82

Just as an album becomes a huge hit if both the tracks and the title track are good, if you are lucky enough to see both the profit and PER increase after purchasing, you will generate significant profits.

Value investors start buying at low PER ranges, so they initially enjoy stock price appreciation only as earnings grow.

---p.100

When you look at a lot of stocks, there are often times when the hidden asset value is so great that it becomes an investment idea ahead of the profit value.

This applies to companies with a lot of real estate, such as paper and textile companies, or when their subsidiaries are more profitable than the parent company.

Another method is to closely examine the asset value and compare it to the market capitalization to determine whether it is undervalued.

---p.113

We further categorize good stocks into four baskets based on the sustainability and slope of their growth, the degree of undervaluation, and factors that could trigger a price reversal.

This is because it makes it easier to decide which direction to take when you come across an investment idea.

---p.121

For value investors, it is extremely painful to fall into a value trap state where it is difficult to expect value to be realized.

I remember feeling frustrated, like eating a sweet potato, at Nexen (Nexen Tire's parent company), which was extremely undervalued to the point that it was considered the cheapest in the market, but had no catalyst whatsoever.

---p.141

A value investor's investment ideas largely stem from clearing up misunderstandings and the potential for change.

In the former case, determining whether the message the market is sending is valid or false becomes the core of stock analysis.

---p.155

When I first heard the name that reminded me of stocks, I thought that maybe I was born with the destiny to become a stock trader.

Since then, I have become a long-time stock manager in charge of IR for the largest company in our country for nearly 10 years, so I thought we weren't joking around for nothing.

---p.168

Contrary to market concerns, the monopoly remained intact, and although new simulator sales were declining, this was offset by replacement demand from existing owners.

Moreover, in the meantime, network services were introduced, showing signs of moving away from the one-time sales model, which we had seen as our greatest weakness.

---p.181

'Ttasang.' This is the magic spell that has captivated investors for the past two years.

How could anyone resist the easy allure of a 2.6x increase when the stocks for which public offerings were subscribed started at a flat opening price and closed at the daily limit as soon as they were listed?

---p.238

In 2001, while I was preparing to return to school after completing my military service, I stumbled upon a striking analysis article on a value investing community called 'New Eye'.

I was interested in the subject, so I had a general idea of the content, but I was truly amazed that a company was completely dissected and its core concepts were explained in such easy language.

---p.260

I am a very curious person.

My hobby is food, and the reason I prefer buffets over a la carte is because I am curious about the taste of various foods.

This curiosity led to investment.

For me, investing is the best hobby and job that endlessly satisfies my curiosity.

---p.276

Becoming an expert is not the end.

You have to invest a lot of time to maintain your skills.

If you let your guard down even a little and become lazy, you will quickly lose your touch.

That's why I emphasize setting high standards for myself and sticking to my own routine.

---p.282

Publisher's Review

Discovering Successful Investment Strategies in Value Investing

VIP Asset Management's Choi Jun-cheol and Kim Min-guk reveal 27 years of practical know-how!

"Korean Value Investing" provides practical know-how for successful value investing in the Korean stock market, drawing on the authors' knowledge and experience.

In the first part of the book, you will learn the basic concepts of value investing.

You will learn about the worldview of value investing and what value investing is, and gain an understanding of long-term optimism, skepticism, cyclical thinking, probabilistic thinking, and intersectional thinking.

Part 2 covers the basic concepts for actual stock investment.

Learn how to identify good companies, managers, and good prices, and practice finding fair values and determining undervaluation.

In Part 3, you will learn how to acquire value investing through practice.

You will learn about stock discovery and analysis, portfolio construction and management, and even psychological aspects, and what to consider when making actual investments.

In the final part of the book, you will learn how to value invest in the Korean stock market and how to grow as a value investor.

We cover topics such as Samsung Electronics, newly listed stocks, holding companies, and Donghak and Seohak ants, and learn about the role of investors and the need for activism.

Value investing has many different attributes.

It's not just about investing for the long term, nor is it about being unconditionally optimistic.

That's why the author wanted to cover everything about value investing, from basic concepts to trading and portfolio management, so that readers can have a comprehensive perspective.

Emphasizing this, "Korean Value Investing" can be said to be a book that contains both theory and practice tailored to the Korean stock market.

What investors need is neither luck nor skill.

Stocks represent ownership of a company.

It is a perspective that sees the market as a place to buy and sell.

This is where 'value investing' begins.

The most important thing in stock investment is not luck or skill, but understanding investment.

This is especially true in the area of value investing.

Value investing means investing in the intrinsic value of a company.

So, what is the difference between this and general investing, and what is the difference between a value investor and a general investor?

Fundamentally, value investors have a different concept of how they perceive the stock market.

Value investors view the market as a place to buy and sell ownership of companies.

"The moment you own a stock, you become a part of its business." This is a quote from a book by Warren Buffett that the author read during his college years, and it was at this time that he discovered the answer to value investing.

Starting a business is generally difficult.

But when you buy stock in a company, you're essentially owning that business.

This is the perspective of value investing, which regards stocks as a means of producing capital.

Another thing value investors have is their belief in the self-healing power of capitalism.

During the 2008 financial crisis, Buffett urged people to buy American stocks because he had confidence in America's capabilities.

The author, too, believed in business and devoted all his passion to finding only good companies.

Investing in stocks is not gambling.

If you want to rely on luck, it would be better to buy a lottery ticket.

What value investors need more than anything is the ability to identify good companies and a steady belief in investing.

Understand value investing and believe in yourself.

Start investing for success

Comfort and advice from the authors

This book contains the experiences and know-how of Korea's leading value investors, making it an essential resource for those seeking to succeed as a value investor in the Korean stock market.

This book will help you learn the basic concepts of value investing and practical investment methods, helping you grow as an investor.

Recommended for all investors struggling in the confusing Korean stock market.

"Korean Value Investing" was an unfinished task in the authors' minds.

As time passes, the previous works are still loved, but the authors also have more to add as they gain experience.

I decided to publish a completely new book rather than a revised edition of an existing one.

If you ask the authors what it was like to invest in value over a long period of time, they will answer like this.

“I tried it and liked it, so I still recommend it.

Confidence in value investing is much greater now than it was 20 years ago.

“Not all of the stocks were successful, but the process of discovering them was fun, and the process of learning from mistakes and using them as a foundation for future growth was also meaningful.” I hope that through this book, many investors will gain confidence and enjoyment, as well as courage and the weapons to beat the market.

Who Should Read This Book

1.

People who want to study value investing

2.

People who are already investing or have invested

3.

People who are curious about the means of production of capital

4.

People currently working in the fields of economics and management

5.

People who want to improve their investment insight

VIP Asset Management's Choi Jun-cheol and Kim Min-guk reveal 27 years of practical know-how!

"Korean Value Investing" provides practical know-how for successful value investing in the Korean stock market, drawing on the authors' knowledge and experience.

In the first part of the book, you will learn the basic concepts of value investing.

You will learn about the worldview of value investing and what value investing is, and gain an understanding of long-term optimism, skepticism, cyclical thinking, probabilistic thinking, and intersectional thinking.

Part 2 covers the basic concepts for actual stock investment.

Learn how to identify good companies, managers, and good prices, and practice finding fair values and determining undervaluation.

In Part 3, you will learn how to acquire value investing through practice.

You will learn about stock discovery and analysis, portfolio construction and management, and even psychological aspects, and what to consider when making actual investments.

In the final part of the book, you will learn how to value invest in the Korean stock market and how to grow as a value investor.

We cover topics such as Samsung Electronics, newly listed stocks, holding companies, and Donghak and Seohak ants, and learn about the role of investors and the need for activism.

Value investing has many different attributes.

It's not just about investing for the long term, nor is it about being unconditionally optimistic.

That's why the author wanted to cover everything about value investing, from basic concepts to trading and portfolio management, so that readers can have a comprehensive perspective.

Emphasizing this, "Korean Value Investing" can be said to be a book that contains both theory and practice tailored to the Korean stock market.

What investors need is neither luck nor skill.

Stocks represent ownership of a company.

It is a perspective that sees the market as a place to buy and sell.

This is where 'value investing' begins.

The most important thing in stock investment is not luck or skill, but understanding investment.

This is especially true in the area of value investing.

Value investing means investing in the intrinsic value of a company.

So, what is the difference between this and general investing, and what is the difference between a value investor and a general investor?

Fundamentally, value investors have a different concept of how they perceive the stock market.

Value investors view the market as a place to buy and sell ownership of companies.

"The moment you own a stock, you become a part of its business." This is a quote from a book by Warren Buffett that the author read during his college years, and it was at this time that he discovered the answer to value investing.

Starting a business is generally difficult.

But when you buy stock in a company, you're essentially owning that business.

This is the perspective of value investing, which regards stocks as a means of producing capital.

Another thing value investors have is their belief in the self-healing power of capitalism.

During the 2008 financial crisis, Buffett urged people to buy American stocks because he had confidence in America's capabilities.

The author, too, believed in business and devoted all his passion to finding only good companies.

Investing in stocks is not gambling.

If you want to rely on luck, it would be better to buy a lottery ticket.

What value investors need more than anything is the ability to identify good companies and a steady belief in investing.

Understand value investing and believe in yourself.

Start investing for success

Comfort and advice from the authors

This book contains the experiences and know-how of Korea's leading value investors, making it an essential resource for those seeking to succeed as a value investor in the Korean stock market.

This book will help you learn the basic concepts of value investing and practical investment methods, helping you grow as an investor.

Recommended for all investors struggling in the confusing Korean stock market.

"Korean Value Investing" was an unfinished task in the authors' minds.

As time passes, the previous works are still loved, but the authors also have more to add as they gain experience.

I decided to publish a completely new book rather than a revised edition of an existing one.

If you ask the authors what it was like to invest in value over a long period of time, they will answer like this.

“I tried it and liked it, so I still recommend it.

Confidence in value investing is much greater now than it was 20 years ago.

“Not all of the stocks were successful, but the process of discovering them was fun, and the process of learning from mistakes and using them as a foundation for future growth was also meaningful.” I hope that through this book, many investors will gain confidence and enjoyment, as well as courage and the weapons to beat the market.

Who Should Read This Book

1.

People who want to study value investing

2.

People who are already investing or have invested

3.

People who are curious about the means of production of capital

4.

People currently working in the fields of economics and management

5.

People who want to improve their investment insight

GOODS SPECIFICS

- Date of issue: March 15, 2023

- Page count, weight, size: 296 pages | 528g | 153*224*18mm

- ISBN13: 9791189318413

- ISBN10: 1189318415

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)