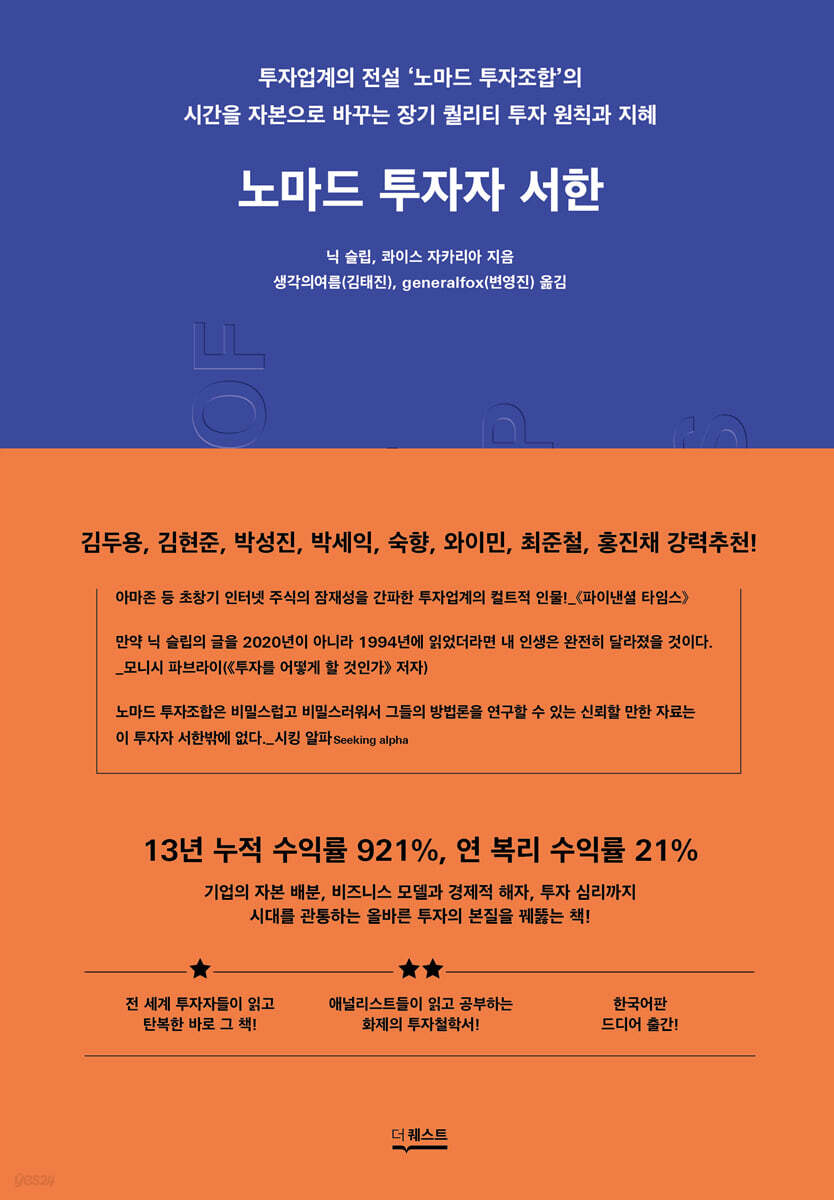

Nomad Investor Letter

|

Description

Book Introduction

Kim Du-yong, Kim Hyeon-jun, Park Seong-jin, Park Se-ik, Sook Hyang, Wai Min, Choi Jun-cheol, Hong Jin-chae, etc. A book highly recommended by Korea's top investors! Finally, we have the 'Nomad Investor Letter' that rivals Warren Buffett's shareholder letters! In the investment world, where there are many experts in the market and outside the industry, there is one person who has been recognized by many for a long time. Nick Sleep and Quaith Zakaria, former British fund managers, want to hear their stories and meet them, but never want to be exposed to the media. The letters they sent to investors while operating a fund under the name of 'Nomad Investment Association' for approximately 13 years from 2001 to 2013 have been compiled into a book. "The Nomad Investor's Letter," which addresses the essence of investment that transcends the times, from corporate capital allocation and business models to economic moats and even investor psychology, has sold over 3,000 copies in an unusually short period for an independent publication, and thanks to numerous reader requests for its publication, it has been republished after refining its translation, editing, and design. |

- You can preview some of the book's contents.

Preview

index

The praise poured in for this book

To begin with

Nick Sleep's letter

Warren Buffett's letter

2001 Annual Letter

2002 Semi-Annual Letter

2002 Annual Letter

2003 Semiannual Letter

2003 Annual Letter

2004 Semiannual Letter

Attached Document_Article from 『Outstanding Investor's Digest』

2004 Annual Letter

Attachment 1_Excerpt from the Global Investment Review

Attachment 2_Perpetual Growth Institution

2005 Semi-Annual Letter

Attachment 1_Measurement of the moat

Attachment 2_Zimbabwe

2005 Annual Letter

Attached Document_Lecture for the Board of Directors of the Foundation Investment Fund

2006 Semiannual Letter

Attached Document_Nomad Investment Company Shareholder Letter

2006 Annual Letter

Attached Document_Performance Compensation and Management Compensation Methodology

2007 Semi-Annual Letter

Attachment_X Dear Investor

2007 Annual Letter

2008 First Half Letter

2008 Annual Letter

2009 First Half Letter

2009 Annual Letter

2010 First Half Letter

2010 Annual Letter

2011 First Half Letter

2011 Annual Letter

2012 First Half Letter

2012 Annual Letter

2013 First Half Letter

2013 Annual Letter

In conclusion

Translation review

Americas

Search

To begin with

Nick Sleep's letter

Warren Buffett's letter

2001 Annual Letter

2002 Semi-Annual Letter

2002 Annual Letter

2003 Semiannual Letter

2003 Annual Letter

2004 Semiannual Letter

Attached Document_Article from 『Outstanding Investor's Digest』

2004 Annual Letter

Attachment 1_Excerpt from the Global Investment Review

Attachment 2_Perpetual Growth Institution

2005 Semi-Annual Letter

Attachment 1_Measurement of the moat

Attachment 2_Zimbabwe

2005 Annual Letter

Attached Document_Lecture for the Board of Directors of the Foundation Investment Fund

2006 Semiannual Letter

Attached Document_Nomad Investment Company Shareholder Letter

2006 Annual Letter

Attached Document_Performance Compensation and Management Compensation Methodology

2007 Semi-Annual Letter

Attachment_X Dear Investor

2007 Annual Letter

2008 First Half Letter

2008 Annual Letter

2009 First Half Letter

2009 Annual Letter

2010 First Half Letter

2010 Annual Letter

2011 First Half Letter

2011 Annual Letter

2012 First Half Letter

2012 Annual Letter

2013 First Half Letter

2013 Annual Letter

In conclusion

Translation review

Americas

Search

Detailed image

Into the book

Costco, along with Sam's Club, dominates the warehouse club industry, with annual sales of $35 billion in 2001.

Costco has a retail concept where customers who pay a standard annual fee of $45 can enter the store for a year.

Instead, the company offers very low product prices through a constant low-price strategy that only adds a 14% markup to branded products and a 15% markup to private label products.

It's a very simple and honest customer proposition.

Membership fees help build customer loyalty, and most of these sales are recorded as profit.

In return, Costco sells its products to cover its operating expenses.

Moreover, by adhering to a standard markup rate, savings from product acquisition or scale are passed on to consumers in the form of lower prices, which in turn fuels growth and further extends the advantage of scale.

It's a retail version of the perpetual motion machine, and it's the model that Walmart has used extensively.

(Omitted) Let’s find out the growth potential.

The company operates 21 stores in Washington state, which has only 2% of the U.S. population.

Applying this density nationwide, there is room to expand to about 1,000 stores in the US (currently 284) and about 200 stores in the UK (currently 14).

At a 10% annual growth rate, the company can grow for the next 13 years.

At a $30 stock price, the company is a cash cow.

As operating rates rise, we expect the company to show high profitability and a reasonable growth rate, which suggests that the company has a valuation of over $50 per share.

Our analysis suggests that Costco is a perfect growth stock, available for purchase at half its true market value.

---From the "2002 Annual Letter"

Bill Miller said there are roughly three competitive advantages in investing.

Informational competitive advantage: knowing meaningful information that no one else knows; analytical competitive advantage: harvesting public information to reach superior conclusions; and psychological competitive advantage: relating to investor behavior.

Typically, a sustainable competitive advantage is achieved when analytical and psychological competitive advantages are combined.

The combination of our investors' patience and our fund managers' analytical and psychological inclinations gives Nomad an overwhelming competitive advantage.

(Omitted) We spend a significant amount of time thinking about what corporate actions will make the future more predictable and reduce investment risk.

Costco's obsession with sharing the efficiencies of scale with its customers gives it a more predictable and less risky future outlook than typical companies.

That's why Costco is our largest investment in our portfolio.

---From the "2005 First Half Letter"

Proper investing is like an unpopular sport.

This means that to achieve better investment performance than others, you have to act differently from the crowd.

What the crowd lacks is patience.

(Omitted) It is easier to predict business performance several years from now than in the near future.

For example, we have no idea how the stock market will end this year.

However, given the company's strategy, capital allocation, and valuation at the time of acquisition, we believe we have some idea of how the companies we invest in will develop over the next few years.

A longer investment period can increase your stock investment returns while also reducing your risk.

(Omitted) Our goal is to ‘hand over (the investment) management authority to a good person at a good price.’

That's what investing is.

Zakaria and I focus on deep reality, the inputs that drive change in future corporate value.

While our industry peers trade the short-term, most competitive part of the yield curve, we invest in the long-term, least competitive part.

We react to completely different stimuli.

---From the "2006 Annual Letter"

Nomad Investments has seen revenue growth of nearly 30% annually during recessions.

This figure is a weighted average that includes weak companies like weeds.

Two-thirds of the companies we invest in are companies with a "shared economies of scale" business model.

This is a model where increased sales lead to scale advantages, scale advantages lead to cost reductions, cost reductions lead to lower selling prices, and lower selling prices lead to increased sales.

In the process, the moat surrounding the company would have widened significantly.

Therefore, for 'sharing economies of scale' companies, a recession is synonymous with a significant improvement in their competitive positioning.

This company has a lot to achieve in the future, but we intend to leave it as is.

It might be tempting for Zakaria and I to declare victory, high-five, sell the winning stock, and move on to a new investment.

But I think that such behavior is fraught with reinvestment risks.

(Omitted) However, the decision not to change the portfolio is an active decision, and we will continue to research as always.

We're discovering a lot of great companies that you can buy at prices that actually seem reasonable.

But it's not any better than the companies we already own.

We move forward by constantly comparing what we have with alternatives, but when it comes to our portfolios, we usually do nothing.

Costco has a retail concept where customers who pay a standard annual fee of $45 can enter the store for a year.

Instead, the company offers very low product prices through a constant low-price strategy that only adds a 14% markup to branded products and a 15% markup to private label products.

It's a very simple and honest customer proposition.

Membership fees help build customer loyalty, and most of these sales are recorded as profit.

In return, Costco sells its products to cover its operating expenses.

Moreover, by adhering to a standard markup rate, savings from product acquisition or scale are passed on to consumers in the form of lower prices, which in turn fuels growth and further extends the advantage of scale.

It's a retail version of the perpetual motion machine, and it's the model that Walmart has used extensively.

(Omitted) Let’s find out the growth potential.

The company operates 21 stores in Washington state, which has only 2% of the U.S. population.

Applying this density nationwide, there is room to expand to about 1,000 stores in the US (currently 284) and about 200 stores in the UK (currently 14).

At a 10% annual growth rate, the company can grow for the next 13 years.

At a $30 stock price, the company is a cash cow.

As operating rates rise, we expect the company to show high profitability and a reasonable growth rate, which suggests that the company has a valuation of over $50 per share.

Our analysis suggests that Costco is a perfect growth stock, available for purchase at half its true market value.

---From the "2002 Annual Letter"

Bill Miller said there are roughly three competitive advantages in investing.

Informational competitive advantage: knowing meaningful information that no one else knows; analytical competitive advantage: harvesting public information to reach superior conclusions; and psychological competitive advantage: relating to investor behavior.

Typically, a sustainable competitive advantage is achieved when analytical and psychological competitive advantages are combined.

The combination of our investors' patience and our fund managers' analytical and psychological inclinations gives Nomad an overwhelming competitive advantage.

(Omitted) We spend a significant amount of time thinking about what corporate actions will make the future more predictable and reduce investment risk.

Costco's obsession with sharing the efficiencies of scale with its customers gives it a more predictable and less risky future outlook than typical companies.

That's why Costco is our largest investment in our portfolio.

---From the "2005 First Half Letter"

Proper investing is like an unpopular sport.

This means that to achieve better investment performance than others, you have to act differently from the crowd.

What the crowd lacks is patience.

(Omitted) It is easier to predict business performance several years from now than in the near future.

For example, we have no idea how the stock market will end this year.

However, given the company's strategy, capital allocation, and valuation at the time of acquisition, we believe we have some idea of how the companies we invest in will develop over the next few years.

A longer investment period can increase your stock investment returns while also reducing your risk.

(Omitted) Our goal is to ‘hand over (the investment) management authority to a good person at a good price.’

That's what investing is.

Zakaria and I focus on deep reality, the inputs that drive change in future corporate value.

While our industry peers trade the short-term, most competitive part of the yield curve, we invest in the long-term, least competitive part.

We react to completely different stimuli.

---From the "2006 Annual Letter"

Nomad Investments has seen revenue growth of nearly 30% annually during recessions.

This figure is a weighted average that includes weak companies like weeds.

Two-thirds of the companies we invest in are companies with a "shared economies of scale" business model.

This is a model where increased sales lead to scale advantages, scale advantages lead to cost reductions, cost reductions lead to lower selling prices, and lower selling prices lead to increased sales.

In the process, the moat surrounding the company would have widened significantly.

Therefore, for 'sharing economies of scale' companies, a recession is synonymous with a significant improvement in their competitive positioning.

This company has a lot to achieve in the future, but we intend to leave it as is.

It might be tempting for Zakaria and I to declare victory, high-five, sell the winning stock, and move on to a new investment.

But I think that such behavior is fraught with reinvestment risks.

(Omitted) However, the decision not to change the portfolio is an active decision, and we will continue to research as always.

We're discovering a lot of great companies that you can buy at prices that actually seem reasonable.

But it's not any better than the companies we already own.

We move forward by constantly comparing what we have with alternatives, but when it comes to our portfolios, we usually do nothing.

---From the "2010 Annual Letter"

Publisher's Review

Strongly recommended by Kim Du-yong, Kim Hyun-jun, Park Sung-jin, Park Se-ik, Sook-hyang, Wai-min, Choi Jun-cheol, Hong Jin-chae, etc.!

The principles and wisdom of long-term, quality investing from the investment industry legend, Nomad Investment Association.

★ A hot topic book that sold 3,000 copies in a short period of time as an independent publication, and has finally been officially published ★

In early 2022, a book spread by word of mouth among investors.

It was a book with an unfamiliar title, 'Nomad Investment Association Investor Letter'.

This independent publication, which was not sold in bookstores but was run as a non-profit project through a personal homepage, sold over 3,000 copies in a short period of time and became a must-read among many investment experts, eventually being published as "Letters from the Nomad Investor."

'Nomad Investment Partnership' is not a widely known fund, but it is a British investment partnership that is already a legend among investment experts, having achieved an incredible record of 921% cumulative return and 21% annual compound return over approximately 13 years from 2001 to 2013.

Nick Sleep and Quais Zakaria, who ran the fund, are cult figures in the investment community who recognized the potential of companies like Costco and Amazon 20 years ago, and are famous for holding onto their stakes even after the investment partnership was dissolved in 2014.

During the 13 years they ran the investment fund, the authors sent letters to investors twice a year, which clearly outlined their investment principles and philosophy.

Nomad has provided investors with enormous returns, but the authors' reclusive nature has made this letter the only source of their insights.

For that reason, this letter, which was originally a confidential document, was only circulated in pirated copies among investment experts.

However, the global stock market frenzy triggered by the COVID-19 pandemic brought the letter to the surface, and an unofficial version with strange additions to the letter began circulating online. In early 2021, the authors shared the official version of the letter on the website of their charity foundation.

Upon learning of the existence of this letter, two fans (co-editors) wanted to share Nomad's investment principles and wisdom with many Koreans. With the authors' permission, they translated the entire 200-page English PDF manuscript into a 600-page independent publication. As orders poured in, they ended up publishing it through a publisher.

13-year cumulative return of 921%, annual compound return of 21%!

Don't get caught up in short-term numbers; think long-term about your company's ultimate destination!

"Nomad Investor Letters" contains a detailed record of the investment process of the Nomad Investment Association from 2001 to 2013, including which companies they invested in, why they made those decisions, and how their thoughts and judgments changed over time.

Rather than basing their investment decisions on stock price, Sleep and Zakaria thoroughly explored the company's fundamental values, such as its ultimate destination and what makes it successful.

We examine business models with a high probability of long-term success ('shared economies of scale'), pay close attention to the quality of management, and constantly emphasize the existence and sustainability of corporate moats, investor sentiment, and the 'patience' to invest for the long term.

Furthermore, he has been called the "heretic of the investment world" for his sound and intellectually honest investment philosophy and methodology, including operating expenses that are significantly lower than those in the industry and performance-based compensation that is not paid unless performance is good.

Although this book contains investment records from approximately 21 years ago, its contents remain relevant and offer many insights.

Nomads knew how to see the potential in companies that no one had properly examined, and they knew how to persevere in their decisions even during major crises like the subprime crisis.

Despite achieving phenomenal returns for over a decade, they never became complacent. Instead, they constantly considered what to do and what not to do, continually evolving their investment philosophy and methods.

This book will resonate deeply with readers who are drawn to short-term success and ride the roller coaster of investing, those disheartened by the current investment turmoil, those who want to block out the deluge of information and focus on what truly matters, and above all, those who simply want to read a good article on sound investment philosophy.

The principles and wisdom of long-term, quality investing from the investment industry legend, Nomad Investment Association.

★ A hot topic book that sold 3,000 copies in a short period of time as an independent publication, and has finally been officially published ★

In early 2022, a book spread by word of mouth among investors.

It was a book with an unfamiliar title, 'Nomad Investment Association Investor Letter'.

This independent publication, which was not sold in bookstores but was run as a non-profit project through a personal homepage, sold over 3,000 copies in a short period of time and became a must-read among many investment experts, eventually being published as "Letters from the Nomad Investor."

'Nomad Investment Partnership' is not a widely known fund, but it is a British investment partnership that is already a legend among investment experts, having achieved an incredible record of 921% cumulative return and 21% annual compound return over approximately 13 years from 2001 to 2013.

Nick Sleep and Quais Zakaria, who ran the fund, are cult figures in the investment community who recognized the potential of companies like Costco and Amazon 20 years ago, and are famous for holding onto their stakes even after the investment partnership was dissolved in 2014.

During the 13 years they ran the investment fund, the authors sent letters to investors twice a year, which clearly outlined their investment principles and philosophy.

Nomad has provided investors with enormous returns, but the authors' reclusive nature has made this letter the only source of their insights.

For that reason, this letter, which was originally a confidential document, was only circulated in pirated copies among investment experts.

However, the global stock market frenzy triggered by the COVID-19 pandemic brought the letter to the surface, and an unofficial version with strange additions to the letter began circulating online. In early 2021, the authors shared the official version of the letter on the website of their charity foundation.

Upon learning of the existence of this letter, two fans (co-editors) wanted to share Nomad's investment principles and wisdom with many Koreans. With the authors' permission, they translated the entire 200-page English PDF manuscript into a 600-page independent publication. As orders poured in, they ended up publishing it through a publisher.

13-year cumulative return of 921%, annual compound return of 21%!

Don't get caught up in short-term numbers; think long-term about your company's ultimate destination!

"Nomad Investor Letters" contains a detailed record of the investment process of the Nomad Investment Association from 2001 to 2013, including which companies they invested in, why they made those decisions, and how their thoughts and judgments changed over time.

Rather than basing their investment decisions on stock price, Sleep and Zakaria thoroughly explored the company's fundamental values, such as its ultimate destination and what makes it successful.

We examine business models with a high probability of long-term success ('shared economies of scale'), pay close attention to the quality of management, and constantly emphasize the existence and sustainability of corporate moats, investor sentiment, and the 'patience' to invest for the long term.

Furthermore, he has been called the "heretic of the investment world" for his sound and intellectually honest investment philosophy and methodology, including operating expenses that are significantly lower than those in the industry and performance-based compensation that is not paid unless performance is good.

Although this book contains investment records from approximately 21 years ago, its contents remain relevant and offer many insights.

Nomads knew how to see the potential in companies that no one had properly examined, and they knew how to persevere in their decisions even during major crises like the subprime crisis.

Despite achieving phenomenal returns for over a decade, they never became complacent. Instead, they constantly considered what to do and what not to do, continually evolving their investment philosophy and methods.

This book will resonate deeply with readers who are drawn to short-term success and ride the roller coaster of investing, those disheartened by the current investment turmoil, those who want to block out the deluge of information and focus on what truly matters, and above all, those who simply want to read a good article on sound investment philosophy.

GOODS SPECIFICS

- Publication date: November 30, 2022

- Format: Hardcover book binding method guide

- Page count, weight, size: 528 pages | 1,078g | 152*225*35mm

- ISBN13: 9791140702084

- ISBN10: 1140702084

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)