A Time of Crisis and Opportunity in South Korea

|

Description

Book Introduction

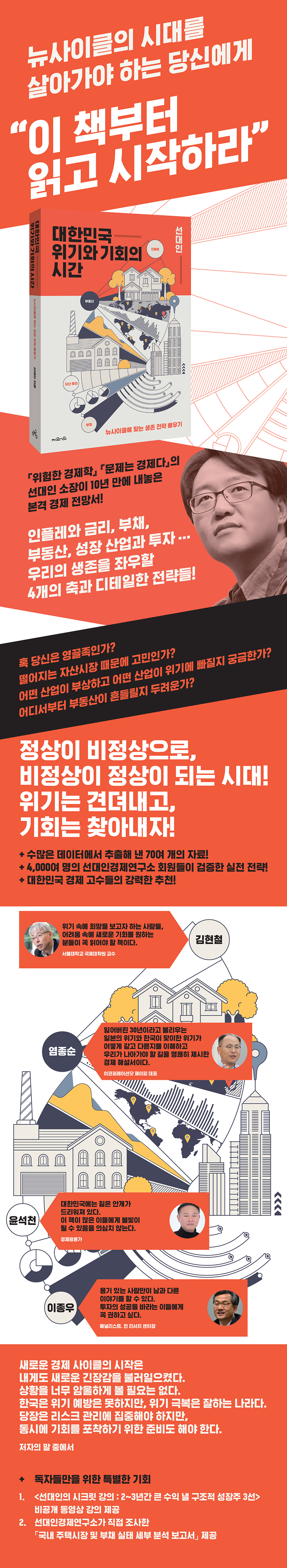

A major change that began after 13 years! Where is the golden opportunity in the midst of a recession? The predecessor of 『Dangerous Economics』 and 『The Problem is Economics』, Korea's economic outlook released for the first time in 10 years If you're living in the New Cycle era, start by reading this book. The long period of ultra-low interest rates and abundant liquidity has finally come to an end. A new economic cycle has begun, and countries around the world are busy formulating countermeasures to the economic downturn. So what will the future hold for the Korean economy? This book is the first full-fledged economic outlook by Seon Dae-in, a leading South Korean economic expert, in ten years, following "Dangerous Economics" in 2009 and "The Problem is the Economy" in 2012. Which assets will survive inflation? How will the real estate slumps in Japan and Korea differ? When will the impact of demographic changes begin? These are essential questions for understanding the new cycle. Drawing on a broad perspective on the Korean economy and over 70 data points extracted from a vast database, this book comprehensively covers four areas: inflation, interest rates, debt, real estate, industry, and investment. A book proven by over 4,000 members of the Seondae In Economic Research Institute and recommended by leading Korean economic experts. If you are someone who must live in the New Cycle era, start by reading this book. Let's weather the crisis and not miss the golden opportunity that comes during the recession. Let's take a look at the detailed strategies that will determine your survival. |

- You can preview some of the book's contents.

Preview

index

Part 1.

Scenario for an Inflationary Era

Chapter 1.

The End of the Era of Ultra-Low Interest Rates and Massive Liquidity

The 13-year period ends

Understanding Inflation in Four Areas

From abnormal to normal

Inflation Past and Present

Chapter 2.

Adding insult to injury: Inflation triggers

Adding insult to injury 1.

Corona liquidity bomb

Understanding Inflation with the Bullwhip Effect and the Piggy Cycle

Adding insult to injury 2.

Supply chain disruption and restructuring

Adding insult to injury 3.

The decline of globalization and the growing US-China economic bloc

Adding insult to injury 4.

The Russo-Ukrainian War: A Reshaping of Energy Geopolitics

How Long Will the Global Supply Chain Crisis Last?

Chapter 3.

US inflation, future scenarios

Could inflation slow down?

Four-Stage Inflation Outlook and Four Interest Rate Hike Scenarios

Is a global recession coming?

Chapter 4.

How will Korea move forward?

Will the 2008 financial crisis repeat itself?

The dangers of the 'gray rhino' that Korea cannot see

Part 2.

Surviving in a debt-ridden nation

Chapter 1.

The landscape of a debt-ridden nation

Scenery 1.

How a Seoul-based office worker came to own over 30 homes.

Scenery 2.

The Reality of Gap Speculation and Young-Geul Tribe

Scenery 3.

Generations that entered the subscription process in fear

Scenery 4.

The "revenge of debt" will return to all households, from parents to children.

Chapter 2.

Dissecting South Korea's Household Debt

Two surges

How do US and South Korean debt differ?

Household Debt: Look Beyond the Surface

Beware of Gap Speculation Landlords

Chapter 3.

Will the economy thrive with massive debt?

The economic fallout from Korea's household debt

The History of Debt Growth in South Korea

Income-led growth vs. debt-led growth

Cause of debt surge 1.

Liquidity overload during the COVID-19 period

Cause of debt surge 2.

failed fiscal policy

Cause of debt surge 3.

Loan structure and post-sale system

If you have ability, is it okay to have debt?

What should individuals do going forward?

Part 3.

Where is the real estate republic?

Chapter 1.

Will Korea follow Japan's path?

Scenery 1.

The Plaza Accord and the Bankruptcy of the Japanese Economy

Scenery 2.

Korea during the COVID-19 surge

How far along is the housing market cycle?

Chapter 2.

What is the real estate level?

Why did house prices rise?

How the Young-Geul Tribe Was Born

The next five years will be a period of real estate decline.

Chapter 3.

Five Stages of the Real Estate Market

Step 1.

real estate stagflation

Step 2.

Beware of gap speculation and concentrated areas of young people.

Step 3.

How much will Seoul's Gangnam fall?

Step 4.

The reemergence of the house poor

Step 5.

The combination of delayed housing supply and population shock

Chapter 4.

What are the future housing price outlook and hidden risks?

What Factors Determine Home Prices: Interest Rates and Population Shocks

Is a real estate-driven financial crisis coming?

Are the government's real estate policies safe?

The Attitude You Should Take in the New Housing Market Cycle

Part 4.

Growth industries and investment opportunities amidst the crisis

Chapter 1.

Can the Korean economy grow?

Opportunity after crisis

Seeing opportunities in the battery industry

Pay attention to wind power stocks

What will happen to the semiconductor supply problem?

Changes after the COVID-19 reopening

Chapter 2.

Investing in a recession is different.

Don't become a pig

The profit principle of the box market and bear market

Survival Strategy 1.

Structural growth stocks that can withstand interest rate hikes

Survival Strategy 2.

Small and mid-cap stocks that can be analyzed directly

Survival Strategy 3.

A certain level of concentrated investment

Survival Strategy 4.

Don't be swayed by macroeconomic trends

Survival Strategy 5.

Breaking Bad Habits That Lead to Failure

The 3+2 Rule for High Profitability

For quality shareholder capitalism

References

Scenario for an Inflationary Era

Chapter 1.

The End of the Era of Ultra-Low Interest Rates and Massive Liquidity

The 13-year period ends

Understanding Inflation in Four Areas

From abnormal to normal

Inflation Past and Present

Chapter 2.

Adding insult to injury: Inflation triggers

Adding insult to injury 1.

Corona liquidity bomb

Understanding Inflation with the Bullwhip Effect and the Piggy Cycle

Adding insult to injury 2.

Supply chain disruption and restructuring

Adding insult to injury 3.

The decline of globalization and the growing US-China economic bloc

Adding insult to injury 4.

The Russo-Ukrainian War: A Reshaping of Energy Geopolitics

How Long Will the Global Supply Chain Crisis Last?

Chapter 3.

US inflation, future scenarios

Could inflation slow down?

Four-Stage Inflation Outlook and Four Interest Rate Hike Scenarios

Is a global recession coming?

Chapter 4.

How will Korea move forward?

Will the 2008 financial crisis repeat itself?

The dangers of the 'gray rhino' that Korea cannot see

Part 2.

Surviving in a debt-ridden nation

Chapter 1.

The landscape of a debt-ridden nation

Scenery 1.

How a Seoul-based office worker came to own over 30 homes.

Scenery 2.

The Reality of Gap Speculation and Young-Geul Tribe

Scenery 3.

Generations that entered the subscription process in fear

Scenery 4.

The "revenge of debt" will return to all households, from parents to children.

Chapter 2.

Dissecting South Korea's Household Debt

Two surges

How do US and South Korean debt differ?

Household Debt: Look Beyond the Surface

Beware of Gap Speculation Landlords

Chapter 3.

Will the economy thrive with massive debt?

The economic fallout from Korea's household debt

The History of Debt Growth in South Korea

Income-led growth vs. debt-led growth

Cause of debt surge 1.

Liquidity overload during the COVID-19 period

Cause of debt surge 2.

failed fiscal policy

Cause of debt surge 3.

Loan structure and post-sale system

If you have ability, is it okay to have debt?

What should individuals do going forward?

Part 3.

Where is the real estate republic?

Chapter 1.

Will Korea follow Japan's path?

Scenery 1.

The Plaza Accord and the Bankruptcy of the Japanese Economy

Scenery 2.

Korea during the COVID-19 surge

How far along is the housing market cycle?

Chapter 2.

What is the real estate level?

Why did house prices rise?

How the Young-Geul Tribe Was Born

The next five years will be a period of real estate decline.

Chapter 3.

Five Stages of the Real Estate Market

Step 1.

real estate stagflation

Step 2.

Beware of gap speculation and concentrated areas of young people.

Step 3.

How much will Seoul's Gangnam fall?

Step 4.

The reemergence of the house poor

Step 5.

The combination of delayed housing supply and population shock

Chapter 4.

What are the future housing price outlook and hidden risks?

What Factors Determine Home Prices: Interest Rates and Population Shocks

Is a real estate-driven financial crisis coming?

Are the government's real estate policies safe?

The Attitude You Should Take in the New Housing Market Cycle

Part 4.

Growth industries and investment opportunities amidst the crisis

Chapter 1.

Can the Korean economy grow?

Opportunity after crisis

Seeing opportunities in the battery industry

Pay attention to wind power stocks

What will happen to the semiconductor supply problem?

Changes after the COVID-19 reopening

Chapter 2.

Investing in a recession is different.

Don't become a pig

The profit principle of the box market and bear market

Survival Strategy 1.

Structural growth stocks that can withstand interest rate hikes

Survival Strategy 2.

Small and mid-cap stocks that can be analyzed directly

Survival Strategy 3.

A certain level of concentrated investment

Survival Strategy 4.

Don't be swayed by macroeconomic trends

Survival Strategy 5.

Breaking Bad Habits That Lead to Failure

The 3+2 Rule for High Profitability

For quality shareholder capitalism

References

Detailed image

Into the book

Over the past decade, the global economy has gone through very pulsating cycles.

But because the cycle has become so long, many people have forgotten that the economy has cycles.

Inflation and interest rates remained low, and asset prices continued to rise amidst abundant liquidity.

The real economy was not particularly active, but it did not shrink significantly either.

Many people have become so accustomed to this cycle, which is supported by the power of enormous amounts of money, that they have even shown signs of addiction.

---From the author's note

When have we ever experienced inflation?

Since the financial crisis of 2008, and even further back, after the dot-com bubble burst in the early 2000s, the era of low interest rates and excessive liquidity has begun in earnest, leading to sustained, high-inflation in almost all asset-based sectors of the economy and the lending markets that support them.

It's just that inflation didn't occur in the so-called real economy.

---From "From Abnormal to Normal"

It is worth looking at how different asset classes behaved depending on the level of economic growth at the time when inflation occurred globally.

In 2005, Barclays Bank in the UK published a study examining how different assets performed in the UK market under four inflation/growth rate combinations from World War II to 2004.

---From "Four Stages of Price Outlook and Four Interest Rate Hike Scenarios"

Household debt in Korea has grown at the fastest rate in the world since the COVID-19 pandemic and the Moon Jae-in administration.

Housing prices also increased faster in the metropolitan area than in most countries.

The Seondae Economic Research Institute examined transactions that occurred during the COVID-19 pandemic in about 10 apartment complexes in Seoul and Gyeonggi Province.

We investigated the actual state of debt by checking each copy of the register.

---From "Landscape 4: The Revenge of Debt" that Returns to the Parents' Generation, the Children's Generation, and the Entire Household

There is a tendency to think that Korea's household debt problem will be easily resolved, comparing it to the United States, which faced the 2008 financial crisis due to excessive mortgage lending.

Let's compare Korea's household debt problem with that of the United States.

Unlike Korea, the United States has implemented strong measures to curb bad household debt.

Since the 2008 financial crisis, the United States has pursued reforms aimed at eliminating various threats to the stability of the financial system.

---From "How Household Debt in the U.S. and Korea Differs"

The responses of the Japanese government after the Plaza Accord and the South Korean government after the COVID-19 outbreak are strangely similar.

The fiscal ministries of both countries, obsessed with fiscal soundness and responding with indiscriminate monetary easing, seem to have triggered a real estate speculation frenzy, leading to a massive inflated real estate bubble.

---From "Landscape 2: Korea during the Corona Surge"

The logic is that there is a shortage of housing that meets people's rising expectations. This is to fill the shortage of supply from the last housing downturn cycle. There is a shortage of supply in certain areas, such as Gangnam in Seoul, where people really want to live.

This argument was also made during the housing price increase cycle in the early to mid-2000s.

However, in the last cycle, after passing the inflection point, housing prices continued to decline even after a certain point, despite a decrease in the housing supply in the metropolitan area.

---From "Low Interest Rates and Excess Liquidity vs. Housing Supply Shortage Theory"

When a real estate frenzy hits, the population decreases by a few tens of thousands, but it doesn't have much of an impact.

But the effects of demographic change continue to accumulate.

Even if it's not a year or two, what will happen in the future if the population in the age group that needs housing decreases and the elderly population that plays a role in supplying housing increases accumulates for 10 or 20 years?

---From "Population Structure Change and Real Estate"

Typically, after an economic downturn or crisis, industries are reorganized around companies with financial resources and competitiveness, or the market share of leading companies increases.

Ahead of this restructuring process, many domestic companies are already moving quickly to secure future growth engines while absorbing the shock of economic downturns or economic cycle shifts.

---From "Opportunities After Crisis"

It seems theoretically correct, given the background of macroeconomic trends.

But individuals must fight in a David-like manner, suited to individual investors, rather than as Goliaths like institutional investors.

Except for some super ants, individual investors do not handle large sums of money like institutions.

---From "Survival Strategy 2: Small and Mid-Cap Stocks Over Large-Cap Stocks"

Among these, it can be seen that staying in the market was the most profitable.

A key reason to stay in the market as much as possible, even during corrections or bear markets, is that the top 1% of trading days with the highest returns determine most of the returns over the entire period.

But because the cycle has become so long, many people have forgotten that the economy has cycles.

Inflation and interest rates remained low, and asset prices continued to rise amidst abundant liquidity.

The real economy was not particularly active, but it did not shrink significantly either.

Many people have become so accustomed to this cycle, which is supported by the power of enormous amounts of money, that they have even shown signs of addiction.

---From the author's note

When have we ever experienced inflation?

Since the financial crisis of 2008, and even further back, after the dot-com bubble burst in the early 2000s, the era of low interest rates and excessive liquidity has begun in earnest, leading to sustained, high-inflation in almost all asset-based sectors of the economy and the lending markets that support them.

It's just that inflation didn't occur in the so-called real economy.

---From "From Abnormal to Normal"

It is worth looking at how different asset classes behaved depending on the level of economic growth at the time when inflation occurred globally.

In 2005, Barclays Bank in the UK published a study examining how different assets performed in the UK market under four inflation/growth rate combinations from World War II to 2004.

---From "Four Stages of Price Outlook and Four Interest Rate Hike Scenarios"

Household debt in Korea has grown at the fastest rate in the world since the COVID-19 pandemic and the Moon Jae-in administration.

Housing prices also increased faster in the metropolitan area than in most countries.

The Seondae Economic Research Institute examined transactions that occurred during the COVID-19 pandemic in about 10 apartment complexes in Seoul and Gyeonggi Province.

We investigated the actual state of debt by checking each copy of the register.

---From "Landscape 4: The Revenge of Debt" that Returns to the Parents' Generation, the Children's Generation, and the Entire Household

There is a tendency to think that Korea's household debt problem will be easily resolved, comparing it to the United States, which faced the 2008 financial crisis due to excessive mortgage lending.

Let's compare Korea's household debt problem with that of the United States.

Unlike Korea, the United States has implemented strong measures to curb bad household debt.

Since the 2008 financial crisis, the United States has pursued reforms aimed at eliminating various threats to the stability of the financial system.

---From "How Household Debt in the U.S. and Korea Differs"

The responses of the Japanese government after the Plaza Accord and the South Korean government after the COVID-19 outbreak are strangely similar.

The fiscal ministries of both countries, obsessed with fiscal soundness and responding with indiscriminate monetary easing, seem to have triggered a real estate speculation frenzy, leading to a massive inflated real estate bubble.

---From "Landscape 2: Korea during the Corona Surge"

The logic is that there is a shortage of housing that meets people's rising expectations. This is to fill the shortage of supply from the last housing downturn cycle. There is a shortage of supply in certain areas, such as Gangnam in Seoul, where people really want to live.

This argument was also made during the housing price increase cycle in the early to mid-2000s.

However, in the last cycle, after passing the inflection point, housing prices continued to decline even after a certain point, despite a decrease in the housing supply in the metropolitan area.

---From "Low Interest Rates and Excess Liquidity vs. Housing Supply Shortage Theory"

When a real estate frenzy hits, the population decreases by a few tens of thousands, but it doesn't have much of an impact.

But the effects of demographic change continue to accumulate.

Even if it's not a year or two, what will happen in the future if the population in the age group that needs housing decreases and the elderly population that plays a role in supplying housing increases accumulates for 10 or 20 years?

---From "Population Structure Change and Real Estate"

Typically, after an economic downturn or crisis, industries are reorganized around companies with financial resources and competitiveness, or the market share of leading companies increases.

Ahead of this restructuring process, many domestic companies are already moving quickly to secure future growth engines while absorbing the shock of economic downturns or economic cycle shifts.

---From "Opportunities After Crisis"

It seems theoretically correct, given the background of macroeconomic trends.

But individuals must fight in a David-like manner, suited to individual investors, rather than as Goliaths like institutional investors.

Except for some super ants, individual investors do not handle large sums of money like institutions.

---From "Survival Strategy 2: Small and Mid-Cap Stocks Over Large-Cap Stocks"

Among these, it can be seen that staying in the market was the most profitable.

A key reason to stay in the market as much as possible, even during corrections or bear markets, is that the top 1% of trading days with the highest returns determine most of the returns over the entire period.

---From "The Profit Principles of Box Markets and Bear Markets"

Publisher's Review

To you who must live in the era of the new cycle

Are you a young person? Are you worried about the falling asset market? Are you confused about which industries will thrive and which will fall into crisis? Are you curious about which regions will face real estate crisis? The start of a new cycle, marked by inflation and rising interest rates.

A period of turbulent change where things we previously considered normal become abnormal, and things we previously considered abnormal become normal.

Are your future and wealth truly safe?

Four axes and detailed strategies that will determine our survival!

This book, "A Time of Crisis and Opportunity in the Republic of Korea," forecasts the Korean economy at the start of a new economic cycle and suggests different survival strategies to suit it.

It presents four axes that will determine the New Cycle era: inflation, interest rates, debt, real estate, industry, and investment, and thoroughly explains how these axes organically influence each other.

Part 1 explains why and how the current inflation is occurring, and what impact it will have on the domestic and international economies.

Part 2 addresses household debt, a key issue in the Korean economy.

This book closely examines the differences between household debt in the United States and Korea, the potential for household debt to become a problem at any given point, and provides precise guidance on where households and businesses should prepare.

Part 3, titled "Where is the Real Estate Republic Headed," examines the current state of Korean real estate in the housing market cycle, and diagnoses the direction and impact of the new government's real estate policies, along with the expected changes in the real estate market in five stages.

The final part, Part 4, details which industries are growing in the Korean economy despite the crisis of debt and the real estate bubble correction, which companies will benefit from this growth, and how individuals should invest to share in the benefits.

Highly recommended by South Korea's economic experts! A book for your future and wealth security.

The economy is shrinking due to high prices and rising interest rates, and huge detonators such as debt and real estate are lurking, but there is no need to view the situation so gloomy.

Korea is a country that is not good at preventing crises, but is good at overcoming them.

While we need to focus more on risk management now, we also need to prepare in advance to seize opportunities.

This book is a continuation of the lineage of 『Dangerous Economics』 and 『The Problem is Economics』, among the 14 books written by the previous director.

In particular, this is the first book to cover the overall reality of the Korean economy in depth in nearly 10 years since 『The Problem is the Economy』 published in 2012.

This book is praised by Korea's leading economic experts, including Kim Hyun-chul, Yeom Jong-sun, Yoon Seok-cheon, and Lee Jong-woo, as a "book filled with courageous insight," and contains practical strategies verified by 4,000 members of the Seondae In Economic Research Institute.

Now let's look at the detailed strategies that will determine your survival.

Are you a young person? Are you worried about the falling asset market? Are you confused about which industries will thrive and which will fall into crisis? Are you curious about which regions will face real estate crisis? The start of a new cycle, marked by inflation and rising interest rates.

A period of turbulent change where things we previously considered normal become abnormal, and things we previously considered abnormal become normal.

Are your future and wealth truly safe?

Four axes and detailed strategies that will determine our survival!

This book, "A Time of Crisis and Opportunity in the Republic of Korea," forecasts the Korean economy at the start of a new economic cycle and suggests different survival strategies to suit it.

It presents four axes that will determine the New Cycle era: inflation, interest rates, debt, real estate, industry, and investment, and thoroughly explains how these axes organically influence each other.

Part 1 explains why and how the current inflation is occurring, and what impact it will have on the domestic and international economies.

Part 2 addresses household debt, a key issue in the Korean economy.

This book closely examines the differences between household debt in the United States and Korea, the potential for household debt to become a problem at any given point, and provides precise guidance on where households and businesses should prepare.

Part 3, titled "Where is the Real Estate Republic Headed," examines the current state of Korean real estate in the housing market cycle, and diagnoses the direction and impact of the new government's real estate policies, along with the expected changes in the real estate market in five stages.

The final part, Part 4, details which industries are growing in the Korean economy despite the crisis of debt and the real estate bubble correction, which companies will benefit from this growth, and how individuals should invest to share in the benefits.

Highly recommended by South Korea's economic experts! A book for your future and wealth security.

The economy is shrinking due to high prices and rising interest rates, and huge detonators such as debt and real estate are lurking, but there is no need to view the situation so gloomy.

Korea is a country that is not good at preventing crises, but is good at overcoming them.

While we need to focus more on risk management now, we also need to prepare in advance to seize opportunities.

This book is a continuation of the lineage of 『Dangerous Economics』 and 『The Problem is Economics』, among the 14 books written by the previous director.

In particular, this is the first book to cover the overall reality of the Korean economy in depth in nearly 10 years since 『The Problem is the Economy』 published in 2012.

This book is praised by Korea's leading economic experts, including Kim Hyun-chul, Yeom Jong-sun, Yoon Seok-cheon, and Lee Jong-woo, as a "book filled with courageous insight," and contains practical strategies verified by 4,000 members of the Seondae In Economic Research Institute.

Now let's look at the detailed strategies that will determine your survival.

GOODS SPECIFICS

- Date of issue: August 1, 2022

- Page count, weight, size: 404 pages | 750g | 153*224*25mm

- ISBN13: 9791191521153

- ISBN10: 119152115X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)