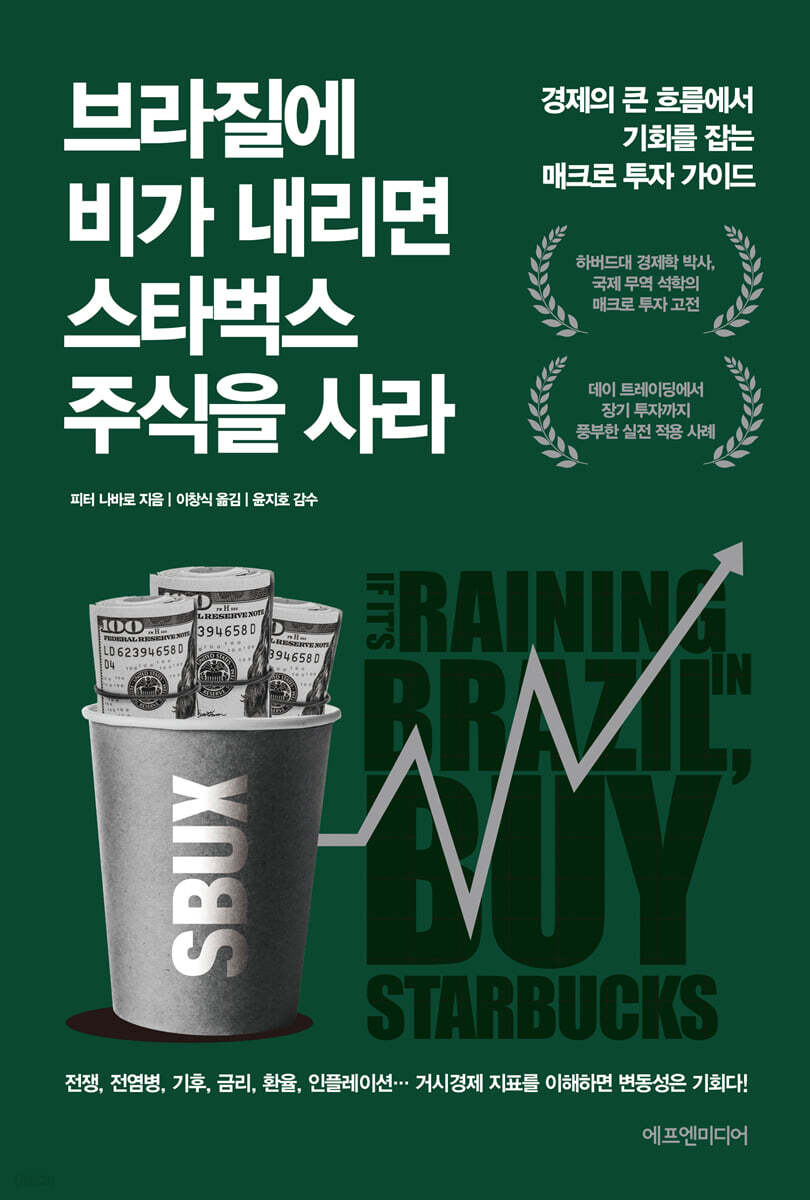

If it rains in Brazil, buy Starbucks stock.

|

Description

Book Introduction

Look at the 'forest (economic trends) and trees (stocks)' together! War, epidemics, climate, interest rates, exchange rates, inflation… Understanding macroeconomic indicators reveals that volatility is an opportunity! Why would a sudden interest rate hike by the US central bank shock European and Asian stock markets? What impact would a large-scale production cut by the Organization of Petroleum Exporting Countries have on inflation and energy sector stocks in China and Korea? This book explains how these macroeconomic variables are linked to the stock market and offers specific methods for leveraging them to improve investment performance and manage risk. This book is widely known as a 'classic of macro investing' that clearly organizes key economic indicators and how to use them. Part 1 lays the foundation for macro investing, including macroeconomic waves that move the economy and fiscal and monetary policies. Part 2 explains the key principles of macro investing, the importance of sectors, how to protect your capital and manage risk, and provides a checklist for successful macro investing. Part 3 is a 'practical manual' for macro investing. We analyze in detail the impact of each specific wave, such as inflation, recession, and productivity, on various sectors of the stock market. It also presents an industry-specific rotational trading strategy based on the stock market cycle, helping you build a successful portfolio in both bull and bear markets. Author Peter Navarro is a scholar with a background in both theory and practice, having received a Ph.D. in economics from Harvard University, taught economics and public welfare at the University of California, Irvine, and later served as the Director of the U.S. Bureau of Trade and Manufacturing Policy. He is renowned for his thorough approach to applying a macroeconomic perspective to investment, combining in-depth analysis with concrete examples. From day traders to long-term investors, from value investors to growth investors, no matter your investment style, apply macro investing to capitalize on stock market volatility. |

- You can preview some of the book's contents.

Preview

index

Recommendation: Congratulations on the Reissue of a Masterpiece | Hong Chun-wook

Prologue: We Must Read the Big Economic Trends

Introduction: Let's Make Macroeconomics Work for Us

Part 1.

Who moves the big wheels of the economy?

Chapter 1.

Macroeconomic waves that pressure the market

What is a macro wave? | Inflation, the stock market's most feared enemy | The next most dangerous recession | Economic growth, the most revered by Wall Street | Stocks that move in business cycles | Productivity that soothes investors' souls | Fiscal deficits that destroy the economy and the stock market | Trade deficits that destroy the value of currency | Social upheaval is a golden opportunity | Government and your portfolio | Technological change, a decisive factor in stock price fluctuations

Chapter 2.

The power behind the scenes: the economists

Classicism Lost in the Face of the Great Depression | Keynes the Savior | Napalm and Monetarism | Friedman's Monetarism, the Order of Hardship | The Sweet Temptation of Growth: Supply-Side Economics | Neoclassicism Sacrificed in the Economic War | Something Worth 10,000 Dow Points

Chapter 3.

Government Toolbox

Why GDP Matters | The Waves of Fiscal Policy | The Paradox of the Fiscal Deficit | Fiscal Policy Makes Financial Markets Dance

Chapter 4.

Don't fight the Fed

The Mystery of Monetary Policy | Macroeconomic Chain Reactions | You Can Pull the String, But You Can't Push It | When the Fed Sneezes, Europe Catches a Cold

Part 2.

You need to read the big picture to see the market properly.

Chapter 5.

8 Principles of Macro Investing

Invest, don't gamble | Diversify and minimize risk | Hop on the train that's right for you | Don't go against the trend | Each sector in the stock market reacts and moves independently | Look at the stock, bond, and currency markets together | Don't trade on impulse.

Chapter 6.

What matters is the industry

The Importance of Industry Rotation | What Makes an Industry? | Who Are the Customers? | How Products Are Made? | Cyclical or Defensive? | Trade Deficits and Stock Prices | The Stock Market Fears Regulation | When It Rains in Brazil, Buy Starbucks Stock

Chapter 7.

Finding Strong Sectors

Wall Street experts' secrets for spotting trends | More than half of stocks move in tandem with their sectors | The virtues of basket trading | The wonderful game played by macro investors

Chapter 8.

10 Rules for Protecting Your Money

Block losses | Set stop-losses | Increase profits | Don't let a jackpot turn into a bust | Don't ride the wave | Reduce portfolio turnover | Place market orders to capture price momentum in a trending market | Place limit orders within the trading range | Avoid placing market orders before the market opens or during an IPO | Read the fine print when entering into a brokerage contract

Chapter 9.

12 Rules for Managing Risk

Pay close attention to the macroeconomic calendar | When in doubt, take the wait-and-see approach | Beware of earnings announcement traps | Trade only highly liquid stocks | Bet only as much as you can comfortably afford | Avoid closely related stocks | Adjust trade size to price volatility | Increase trade size gradually | Beware of margin trading | Always keep a trading journal | Do your homework before trading | Ignore advice and the latest information from others

Chapter 10.

Applying a macro perspective to all investment types

The Day Trader's Nightmare | The Swing Investor's Mistake | The Inflexible Buy-Hold Investor | The Technical Trader Trapped in the Chart Trap | Should You Buy at the Bottom or the Top? | The Fundamentalist's Regrettable Losses | Value Investors vs. Growth Investors | Even Transformational Investors Are No Exception

Chapter 11.

Checklist for Successful Macro Investing

If you're fooled twice, blame yourself | Bloomberg and CNBC | How to write an investment journal | Is it a bull market or a bear market? | Which sectors are strong | Picking investment targets | Stock reviews

Part 3.

Macro Investment Practical Manual

Chapter 12.

Economic indicators are the compass for macro exploration.

When Good News Turns Bad News | Not All Indicators Are Created Equally | Wall Street Moves in Predictions

Chapter 13.

Responding to the Bear Market of a Recession

Car and Truck Sales | Housing Report | Housing Starts and Building Permits | New and Existing Home Sales | Construction Spending | Unemployment Claims | Employment Report | Unemployment Rate | The Unemployment Rate's Flaws | Average Hours Worked | Why Bonds Love Bear Markets and Market Declines During Recessions

Chapter 14.

Investing with the business cycle

Where Smart Money Trades | GDP Report | Consumption | Retail Sales Report | Personal Income and Spending | Consumer Confidence | Consumer Credit | Investment and Production | Purchasing Managers' Report | Durable Goods Orders | Factory Orders | Business Inventory and Sales Report | Industrial Production and Capacity Utilization | Industry Cycles are the Most Important Investment Decisions

Chapter 15.

When inflation comes

The Law of Inflation Inertia | Clear the Table While the Party is in Full Swing | What Makes the Fed Ineffective | The Scary Inflation Caused by Wage Increases | The Consumer Price Index | The Producer Price Index | The GDP Deflator | The Trap of Wage Inflation | Other Inflation Indicators | How the Market Reacts to Inflation News

Chapter 16.

Why Increasing Productivity Is Important

Critical Growth Hormone, Technological Change | Productivity Report

Chapter 17.

How to View the Fiscal Deficit

How to view the national debt | The difference between structural and cyclical deficits | Eisenhower's dogmatism shaped Nixon's fate | The economic advisors who ruined George W. Bush | How to finance the deficit | Currency printing | Worries even with a surplus budget | The Treasury budget report

Chapter 18.

The trade deficit trap

The World's Largest Debtor | Unstable Balance of Payments | Current Account | Capital Account | Exchange Rate Mystery | International Trade Report | Four Scenarios

Chapter 19.

Social upheaval is a golden opportunity

If there's an earthquake in Taiwan, buy Samsung stock | A gift from Hussein | Hurricanes and insurance companies | The vulnerabilities of multinational corporations | Mexico and Citibank | Dear Computer Virus | OPEC's devil meets the rising sun

Chapter 20.

Go into politics and come out into economics

Trust dismantlers and merger blockers | Patent protectors | The Bush and Gore stock market tremors | The power of local government

Epilogue _ Enjoy stock investing!

Appendix _ Useful Information for Macro Investing

Commentary: A Complete Guide to Macro Investing, From Basics to Practice | Jiho Yoon

Into the book

The Fed raises interest rates, consumer confidence plummets, war breaks out in the Balkans, a drought in Brazil reduces the coffee harvest, oil prices soar in Rotterdam, Congress passes a new health care bill regulating the prices of prescription drugs, and the U.S. trade deficit hits a record high.

Each of these macroeconomic waves, some thousands of kilometers apart, will move the stock market in a systematic and predictable manner, albeit in a different way.

A thorough understanding of these macroeconomic fluctuations will enable you to make better investments and trades, regardless of your investment or trading style.

This is the power of macro investing, and this is what I will explain in this book.

--- p.17

Whenever a new macroeconomic shock hits the economy, its repercussions affect financial markets in the United States and around the world in a systematic and predictable way.

These repercussions could turn into a tsunami due to unforeseen, massive macroeconomic events.

An example of a small aftermath is Starbucks.

Rain in Brazil lowers wholesale coffee prices, leading to higher profits and higher stock prices for coffee retailers like Starbucks.

An example of a macroeconomic tsunami on the other hand is the Asian financial crisis of the late 1990s, triggered by the collapse of Thailand's currency.

The crisis not only rocked the Dow and Nasdaq, but also brought down stock exchanges around the world, from Japan's Nikkei and Hong Kong's Hang Seng to London's FTSE 100, Frankfurt's Jetra DAX and Mumbai's Sensex.

--- p.28

As Jeremy Siegel, a prominent financial authority, puts it:

“The word ‘crisis’ in Chinese has two symbols.

“First is risk… second is opportunity.” That’s right.

He is right.

As dire as it may sound, macro-savvy investors should view every natural disaster or war as an opportunity to play macroeconomics.

This would not be wrong if only we could accurately interpret and predict the impact of disasters on financial markets.

Therefore, it is important to understand how different shocks can impact industries and markets.

--- p.44~45

When looking at the stock market, macro investors tend to look first at sectors like energy, computers, and retail, rather than companies like Chevron, Dell, and Walmart.

Because we know that most big moves in the stock market are driven by industries rather than companies.

In reality, the movements of individual stocks are usually driven by industry-specific events rather than the company's own sales performance.

This means that even if you invest in a world-class company, you could end up in trouble if you choose the wrong industry at the wrong time.

--- p.109

We are human after all.

So, instead of immediately blocking the loss, there are many cases where small losses are rolled around and allowed to grow like a snowball.

The human psychology that makes things happen is based on two sharply conflicting emotions: hope and fear.

Every time you trade, you have a hope for profit and a fear of loss.

Unfortunately, in situations where losses must be blocked, the hope for profit always overwhelms the fear of loss.

And the result is always the opposite.

(Omitted) We must learn to reduce losses like a cold, ruthless, efficient, and calculating Terminator.

--- p.142

A macro perspective on the stock market can help inform your final decisions, regardless of your trading style or strategy.

This is true for at least three reasons:

First, it helps us better predict the overall trends of the stock market.

As I said, the stock market trend is your friend, so you don't want to trade or invest against that trend.

Second, it helps us discern the different impacts that different macroeconomic news can have on different sectors of the market.

(Omitted) The third reason, which is in some ways the most important, is that it helps us see the entire market more clearly.

--- p.183~184

You might be wondering how you can tell when a recession is looming.

(Omitted) Macro investors will first look at two economic indicators.

One is car and truck sales, and the other is housing starts and building permits.

These two are the most representative leading indicators that first suggest whether the economy is in a recession or recovery.

In addition, two important signals suggesting the onset of a recession can be found in indicators released by the Labor Department.

Unemployment claims are the number of people who applied for unemployment benefits in the previous week.

The five-star employment report, a key indicator, calculates unemployment rates by industry, region, and demographic, and also provides important information on factors such as weekly work hours and hourly earnings.

--- p.229~230

The most important thing in this diagram is to clearly understand which sectors are strongest and which are weakest at different points in the stock market cycle.

Understanding the dynamics of the stock market is key to sector-specific rotation and effective macro investing.

(Omitted) This figure clearly shows the progression of nine different industries, from the initial bullish phase starting with the transportation and technology industries to the later bearish phase ending with the financial and consumer cyclical industries.

--- p.246

A massive earthquake measuring 7.6 on the Richter scale struck Taiwan, killing more than 2,000 people and forcing many factories to halt production.

As soon as he heard the news of the earthquake, scenarios began to swirl in Ron's mind.

Taiwan accounts for 15% of the world's DRAM chip supply, so it was clear as day that this earthquake would affect the world's DRAM supply.

Under such assumptions, Ron speculated that leading DRAM chip manufacturers like Samsung and Hyundai would benefit.

Because now both companies will be able to raise prices sufficiently.

At the same time, it was thought that several computer manufacturing plants in Taiwan would cease production, which would deal a huge blow to computer manufacturers such as Apple and Dell.

(Omitted) Based on this assumption, Ron immediately purchased 5,000 shares of Samsung and Hyundai stocks, and sold them the next day at a 10% profit.

Moreover, he shorted 5,000 shares of Apple and Dell each and was pleased to see their stock prices fall by nearly 20% in a month.

--- p.335~336

You have to see the forest and the trees together.

This is especially true if you have little experience investing in stocks.

We often see cases where people focus too much on specific stocks or issues and miss the overall trend of the stock market.

While it's important to select good eggs that won't break easily (stock selection) and divide them into several baskets (diversification), it's equally important to understand whether now is the time to put eggs in, or whether it's time to empty the basket as much as possible and carry it lightly.

Professional investors with long-term experience investing in a variety of stocks across various industries will already know that assessing not only corporate performance and industry outlook, but also macroeconomic and economic trends is crucial for achieving investment results and successfully managing risk.

Each of these macroeconomic waves, some thousands of kilometers apart, will move the stock market in a systematic and predictable manner, albeit in a different way.

A thorough understanding of these macroeconomic fluctuations will enable you to make better investments and trades, regardless of your investment or trading style.

This is the power of macro investing, and this is what I will explain in this book.

--- p.17

Whenever a new macroeconomic shock hits the economy, its repercussions affect financial markets in the United States and around the world in a systematic and predictable way.

These repercussions could turn into a tsunami due to unforeseen, massive macroeconomic events.

An example of a small aftermath is Starbucks.

Rain in Brazil lowers wholesale coffee prices, leading to higher profits and higher stock prices for coffee retailers like Starbucks.

An example of a macroeconomic tsunami on the other hand is the Asian financial crisis of the late 1990s, triggered by the collapse of Thailand's currency.

The crisis not only rocked the Dow and Nasdaq, but also brought down stock exchanges around the world, from Japan's Nikkei and Hong Kong's Hang Seng to London's FTSE 100, Frankfurt's Jetra DAX and Mumbai's Sensex.

--- p.28

As Jeremy Siegel, a prominent financial authority, puts it:

“The word ‘crisis’ in Chinese has two symbols.

“First is risk… second is opportunity.” That’s right.

He is right.

As dire as it may sound, macro-savvy investors should view every natural disaster or war as an opportunity to play macroeconomics.

This would not be wrong if only we could accurately interpret and predict the impact of disasters on financial markets.

Therefore, it is important to understand how different shocks can impact industries and markets.

--- p.44~45

When looking at the stock market, macro investors tend to look first at sectors like energy, computers, and retail, rather than companies like Chevron, Dell, and Walmart.

Because we know that most big moves in the stock market are driven by industries rather than companies.

In reality, the movements of individual stocks are usually driven by industry-specific events rather than the company's own sales performance.

This means that even if you invest in a world-class company, you could end up in trouble if you choose the wrong industry at the wrong time.

--- p.109

We are human after all.

So, instead of immediately blocking the loss, there are many cases where small losses are rolled around and allowed to grow like a snowball.

The human psychology that makes things happen is based on two sharply conflicting emotions: hope and fear.

Every time you trade, you have a hope for profit and a fear of loss.

Unfortunately, in situations where losses must be blocked, the hope for profit always overwhelms the fear of loss.

And the result is always the opposite.

(Omitted) We must learn to reduce losses like a cold, ruthless, efficient, and calculating Terminator.

--- p.142

A macro perspective on the stock market can help inform your final decisions, regardless of your trading style or strategy.

This is true for at least three reasons:

First, it helps us better predict the overall trends of the stock market.

As I said, the stock market trend is your friend, so you don't want to trade or invest against that trend.

Second, it helps us discern the different impacts that different macroeconomic news can have on different sectors of the market.

(Omitted) The third reason, which is in some ways the most important, is that it helps us see the entire market more clearly.

--- p.183~184

You might be wondering how you can tell when a recession is looming.

(Omitted) Macro investors will first look at two economic indicators.

One is car and truck sales, and the other is housing starts and building permits.

These two are the most representative leading indicators that first suggest whether the economy is in a recession or recovery.

In addition, two important signals suggesting the onset of a recession can be found in indicators released by the Labor Department.

Unemployment claims are the number of people who applied for unemployment benefits in the previous week.

The five-star employment report, a key indicator, calculates unemployment rates by industry, region, and demographic, and also provides important information on factors such as weekly work hours and hourly earnings.

--- p.229~230

The most important thing in this diagram is to clearly understand which sectors are strongest and which are weakest at different points in the stock market cycle.

Understanding the dynamics of the stock market is key to sector-specific rotation and effective macro investing.

(Omitted) This figure clearly shows the progression of nine different industries, from the initial bullish phase starting with the transportation and technology industries to the later bearish phase ending with the financial and consumer cyclical industries.

--- p.246

A massive earthquake measuring 7.6 on the Richter scale struck Taiwan, killing more than 2,000 people and forcing many factories to halt production.

As soon as he heard the news of the earthquake, scenarios began to swirl in Ron's mind.

Taiwan accounts for 15% of the world's DRAM chip supply, so it was clear as day that this earthquake would affect the world's DRAM supply.

Under such assumptions, Ron speculated that leading DRAM chip manufacturers like Samsung and Hyundai would benefit.

Because now both companies will be able to raise prices sufficiently.

At the same time, it was thought that several computer manufacturing plants in Taiwan would cease production, which would deal a huge blow to computer manufacturers such as Apple and Dell.

(Omitted) Based on this assumption, Ron immediately purchased 5,000 shares of Samsung and Hyundai stocks, and sold them the next day at a 10% profit.

Moreover, he shorted 5,000 shares of Apple and Dell each and was pleased to see their stock prices fall by nearly 20% in a month.

--- p.335~336

You have to see the forest and the trees together.

This is especially true if you have little experience investing in stocks.

We often see cases where people focus too much on specific stocks or issues and miss the overall trend of the stock market.

While it's important to select good eggs that won't break easily (stock selection) and divide them into several baskets (diversification), it's equally important to understand whether now is the time to put eggs in, or whether it's time to empty the basket as much as possible and carry it lightly.

Professional investors with long-term experience investing in a variety of stocks across various industries will already know that assessing not only corporate performance and industry outlook, but also macroeconomic and economic trends is crucial for achieving investment results and successfully managing risk.

--- p.368

Publisher's Review

Macroeconomic indicators move the market.

Seize opportunities in macro fluctuations with macro investing.

“A macro-savvy investor noticed a Wall Street Journal article about rains easing a severe drought in Brazil, the world’s largest coffee bean producer.

Based on this news, the investor bought thousands of shares of Starbucks stock.

They figured that if the rain came and Brazil's coffee bean production increased, the price of coffee beans would drop sharply, which would increase Starbucks' profit margin and, in turn, its stock price would rise.

The following week, Starbucks stock fell another 2 points, but the macro investor waited patiently.

Finally, the stock price began to soar at a very fast rate, rising 10 points in just three days.

The investor sold the stock and walked away with $8,000 in profit.”

As in this case, when rain falls in Brazil and the drought is alleviated, coffee retailers like Starbucks enjoy higher profits and higher stock prices.

Conversely, when the Thai currency collapsed in the late 1990s, triggering the Asian financial crisis, not only the Dow and Nasdaq markets collapsed, but also many of the world's stock exchanges, including the Nikkei, Hang Seng, FTSE 100, and Jetra DAX.

Macrowaves that are significant enough to stress any economy include war, epidemics, climate, trade, interest rates, exchange rates, and inflation.

For example, when inflation increases, the Fed raises interest rates.

When interest rates rise, foreign investment is attracted, which increases the value of the dollar.

A stronger dollar increases the trade deficit because it raises the prices of exports and lowers the prices of imports.

Industries that rely on exports are likely to see their profits decline due to declining exports, so stocks like steel and pharmaceuticals are either avoided or targeted for short selling.

On the other hand, foreign companies that import a lot from the US are enjoying increased sales, so it is a good idea to buy stocks of these companies.

Although macro waves take different forms around the world, they move stock markets in a systematic and predictable manner.

A systematic understanding of the impact of these waves on financial markets can help inform investment decisions.

First, it allows us to better predict overall market trends.

Second, it's useful for identifying key sectors to trade (or avoid) when you hear specific macroeconomic news.

Macrowave investing is the practice of predicting and investing in market trends, industry trends, and stock price movements by visualizing long chains that begin with macroeconomic events and end with individual stock price fluctuations.

From the Basics of Macro Investing to Practice

A Complete Guide to Key Economic Indicators and How to Use Them

This book, which explains macro investing, is divided into three parts.

Part 1 explains macroeconomic waves, economic schools of thought, and fiscal and monetary policies that move the economy as a whole, serving as the foundation for macro investing.

Part 2 is the foundation of macro investing, explaining key investment principles, the importance of sectors, and methods for protecting funds and adjusting risks, and providing a checklist for successful macro investing.

The final three parts are a practical guide to macro investing, focusing on specific waves such as inflation, recession, and productivity, examining the most important data points and release dates to watch, as well as the impact of these waves on various sectors of the stock market.

For example, important data that indicate the phase of the business cycle include the retail sales report, personal income and spending, and purchasing managers' reports, while key inflation indicators include the consumer price index, producer price index, and employment cost index.

At this time, the same news can be interpreted differently depending on the economic situation.

For example, let's say there's news that the unemployment rate has increased.

If the economy is booming and inflation is rising, the stock market will immediately rise, embracing news of rising unemployment like a long-lost brother.

However, if a recession begins and there is no sign of inflation, rising unemployment could send the stock market lower.

So there is no absolutely good news or absolutely bad news in the market.

If there is a sector that suffers losses from news, there is bound to be a sector that benefits, and in the sector that suffers losses, there are ways for investors to turn that loss into profit.

With industry-specific circular sales strategies

Earn stable profits in both bull and bear markets.

The economy and the stock market move in parallel and cyclically, which is why they are called "twin cycles," and the stock market cycle acts as a leading indicator of the business cycle.

When the stock market is in a bull market, industries like computers and electronics may rise faster than industries like chemicals and automobiles.

Also, during a recession, sectors like housing and technology can fall faster and more sharply than so-called "defensive" sectors like food and pharmaceuticals.

Therefore, the author recommends buying strong stocks in strong industries during an upward trend and shorting weak stocks in weak industries during a downward trend.

We also suggest a "sector-by-sector rotation" strategy that moves in line with the stock market cycle, shifting to the railway and shipping sectors during early strength, the chemical and metal sectors during late strength, the food and medical sectors during early weakness, and the banking and retail sectors during late weakness.

This allows you to build a portfolio that can successfully capitalize on both rising and falling markets.

The author received his Ph.D. in economics from Harvard University, taught economics and public welfare at the University of California, Irvine, Graduate School of Business, and later served as Director of the U.S. Bureau of Trade and Manufacturing Policy.

Rather than theorizing through complex mathematical formulas and programs, this book clearly explains quantitative methods for applying a macroeconomic perspective to investing, focusing on real-world technologies and strategies through in-depth analysis and concrete case studies.

From day traders to long-term investors, from value investors to growth investors, whatever your investment style, apply macro investing to turn volatility—war, pandemic, inflation, and rising interest rates—into opportunities.

Seize opportunities in macro fluctuations with macro investing.

“A macro-savvy investor noticed a Wall Street Journal article about rains easing a severe drought in Brazil, the world’s largest coffee bean producer.

Based on this news, the investor bought thousands of shares of Starbucks stock.

They figured that if the rain came and Brazil's coffee bean production increased, the price of coffee beans would drop sharply, which would increase Starbucks' profit margin and, in turn, its stock price would rise.

The following week, Starbucks stock fell another 2 points, but the macro investor waited patiently.

Finally, the stock price began to soar at a very fast rate, rising 10 points in just three days.

The investor sold the stock and walked away with $8,000 in profit.”

As in this case, when rain falls in Brazil and the drought is alleviated, coffee retailers like Starbucks enjoy higher profits and higher stock prices.

Conversely, when the Thai currency collapsed in the late 1990s, triggering the Asian financial crisis, not only the Dow and Nasdaq markets collapsed, but also many of the world's stock exchanges, including the Nikkei, Hang Seng, FTSE 100, and Jetra DAX.

Macrowaves that are significant enough to stress any economy include war, epidemics, climate, trade, interest rates, exchange rates, and inflation.

For example, when inflation increases, the Fed raises interest rates.

When interest rates rise, foreign investment is attracted, which increases the value of the dollar.

A stronger dollar increases the trade deficit because it raises the prices of exports and lowers the prices of imports.

Industries that rely on exports are likely to see their profits decline due to declining exports, so stocks like steel and pharmaceuticals are either avoided or targeted for short selling.

On the other hand, foreign companies that import a lot from the US are enjoying increased sales, so it is a good idea to buy stocks of these companies.

Although macro waves take different forms around the world, they move stock markets in a systematic and predictable manner.

A systematic understanding of the impact of these waves on financial markets can help inform investment decisions.

First, it allows us to better predict overall market trends.

Second, it's useful for identifying key sectors to trade (or avoid) when you hear specific macroeconomic news.

Macrowave investing is the practice of predicting and investing in market trends, industry trends, and stock price movements by visualizing long chains that begin with macroeconomic events and end with individual stock price fluctuations.

From the Basics of Macro Investing to Practice

A Complete Guide to Key Economic Indicators and How to Use Them

This book, which explains macro investing, is divided into three parts.

Part 1 explains macroeconomic waves, economic schools of thought, and fiscal and monetary policies that move the economy as a whole, serving as the foundation for macro investing.

Part 2 is the foundation of macro investing, explaining key investment principles, the importance of sectors, and methods for protecting funds and adjusting risks, and providing a checklist for successful macro investing.

The final three parts are a practical guide to macro investing, focusing on specific waves such as inflation, recession, and productivity, examining the most important data points and release dates to watch, as well as the impact of these waves on various sectors of the stock market.

For example, important data that indicate the phase of the business cycle include the retail sales report, personal income and spending, and purchasing managers' reports, while key inflation indicators include the consumer price index, producer price index, and employment cost index.

At this time, the same news can be interpreted differently depending on the economic situation.

For example, let's say there's news that the unemployment rate has increased.

If the economy is booming and inflation is rising, the stock market will immediately rise, embracing news of rising unemployment like a long-lost brother.

However, if a recession begins and there is no sign of inflation, rising unemployment could send the stock market lower.

So there is no absolutely good news or absolutely bad news in the market.

If there is a sector that suffers losses from news, there is bound to be a sector that benefits, and in the sector that suffers losses, there are ways for investors to turn that loss into profit.

With industry-specific circular sales strategies

Earn stable profits in both bull and bear markets.

The economy and the stock market move in parallel and cyclically, which is why they are called "twin cycles," and the stock market cycle acts as a leading indicator of the business cycle.

When the stock market is in a bull market, industries like computers and electronics may rise faster than industries like chemicals and automobiles.

Also, during a recession, sectors like housing and technology can fall faster and more sharply than so-called "defensive" sectors like food and pharmaceuticals.

Therefore, the author recommends buying strong stocks in strong industries during an upward trend and shorting weak stocks in weak industries during a downward trend.

We also suggest a "sector-by-sector rotation" strategy that moves in line with the stock market cycle, shifting to the railway and shipping sectors during early strength, the chemical and metal sectors during late strength, the food and medical sectors during early weakness, and the banking and retail sectors during late weakness.

This allows you to build a portfolio that can successfully capitalize on both rising and falling markets.

The author received his Ph.D. in economics from Harvard University, taught economics and public welfare at the University of California, Irvine, Graduate School of Business, and later served as Director of the U.S. Bureau of Trade and Manufacturing Policy.

Rather than theorizing through complex mathematical formulas and programs, this book clearly explains quantitative methods for applying a macroeconomic perspective to investing, focusing on real-world technologies and strategies through in-depth analysis and concrete case studies.

From day traders to long-term investors, from value investors to growth investors, whatever your investment style, apply macro investing to turn volatility—war, pandemic, inflation, and rising interest rates—into opportunities.

GOODS SPECIFICS

- Publication date: April 25, 2022

- Page count, weight, size: 392 pages | 696g | 152*225*30mm

- ISBN13: 9791188754588

- ISBN10: 1188754580

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)