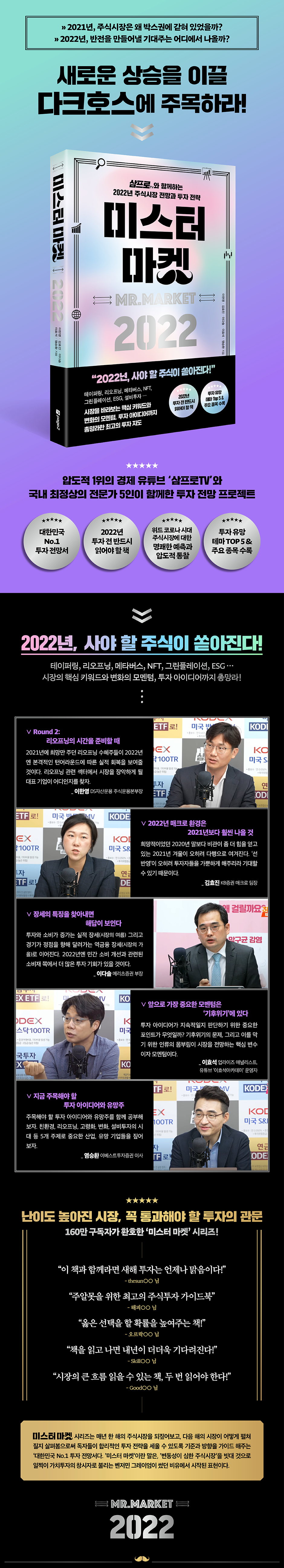

Mr. Market 2022

|

Description

Book Introduction

- A word from MD

-

Opportunities come even in difficult times.Unlike 2020, when stock investments brought profits to many, 2021 was a harsh year for investors.

It hurts, but you have to admit failure and prepare to seize the opportunity.

"Mr. Market 2022" looks back on 2021 and reflects on past investments.

It also provides new opportunities through future outlook and response strategies from an investment perspective.

December 10, 2021. Economics and Management PD Kim Sang-geun

"2022, a flood of stocks to buy!"

Reopening, metaverse, NFTs, space industry, entertainment/content, ESG, facility investment…

Key words for looking at the market and momentum of change,

The ultimate investment guide, covering everything from investment ideas to

In the stock market in 2021, many investors complained that it was particularly difficult.

This is because, although it recorded an unprecedented rise at the end of 2020 and beginning of 2021, it has been in a sluggish market since then, unable to break out of the box.

Unlike 2020, when everyone made profits, investors who entered the market late in 2021 suffered greatly.

In particular, unprepared novice investors suffered significant losses in 2021, a year marked by extreme differentiation across industries and stocks.

It was a year in which lamentations like, “Why isn’t the stock I bought going up?” and “What on earth is going on with the market?” could be heard everywhere.

So, how will the stock market unfold in 2022? The market's difficulty has certainly increased significantly, and investors may face even more challenging challenges in the future.

Mr. Market is a formidable figure.

It never brings easy profits.

But there is no need to be afraid or disappointed in advance.

By examining the lessons learned from the 2021 market and analyzing what perspectives and responses we should take in 2022, we can identify the dark horses that will lead to new growth.

For those who are looking, the stocks to buy are clearly visible.

Reopening, metaverse, NFTs, space industry, entertainment/content, ESG, facility investment…

Key words for looking at the market and momentum of change,

The ultimate investment guide, covering everything from investment ideas to

In the stock market in 2021, many investors complained that it was particularly difficult.

This is because, although it recorded an unprecedented rise at the end of 2020 and beginning of 2021, it has been in a sluggish market since then, unable to break out of the box.

Unlike 2020, when everyone made profits, investors who entered the market late in 2021 suffered greatly.

In particular, unprepared novice investors suffered significant losses in 2021, a year marked by extreme differentiation across industries and stocks.

It was a year in which lamentations like, “Why isn’t the stock I bought going up?” and “What on earth is going on with the market?” could be heard everywhere.

So, how will the stock market unfold in 2022? The market's difficulty has certainly increased significantly, and investors may face even more challenging challenges in the future.

Mr. Market is a formidable figure.

It never brings easy profits.

But there is no need to be afraid or disappointed in advance.

By examining the lessons learned from the 2021 market and analyzing what perspectives and responses we should take in 2022, we can identify the dark horses that will lead to new growth.

For those who are looking, the stocks to buy are clearly visible.

- You can preview some of the book's contents.

Preview

index

introduction

Chapter 1 Round 2: Preparing for the Reopening _ Lee Han-young

Stock investing is a mix of risk and opportunity.

Lessons the 2021 market taught us

- Did the market feed me the profits, or did I do well?

- Please think about it for just one minute, and please study the business.

- Let's think flexibly

- Let's adjust the weight using the concept of 'yield contribution'.

- Let's create a simple and intuitive investment strategy.

Why was the market stuck in a box?

2021 index movements reminiscent of the monsoon front

Four factors hindering the rise of the index

Key Points to Watch in the 2022 Market

Chapter 2: Growing Pains Toward a Real Post-Corona Era _ Kim Hyo-jin

Review: 2021, a year of struggles with the reflection of the sun and the lower half of the sky.

A sneak peek into 2022 with three keywords

- From abnormal to normal

- From decoupling to coupling

- In the fight against debt: low interest rates and restructuring

Risks to consider in the future

Real Estate Prices: Soaring Real Estate Prices in Major Global Countries

US-China Rematch: It Will Play Out in a Different Way

2022 Keywords: Reopening, Coupling, Tapering, Korean Exports

Chapter 3: Identifying the characteristics of the market reveals a response strategy _ Dasol Lee

The four seasons of the stock market

Financial Market: Spring in the Stock Market

- Performance Market: Summer in the Stock Market

- Reverse Financial Market: The Fall of the Stock Market

- Reverse performance trend: Winter in the stock market

- Where is the market now?

Memories of 2011: How the Box Office Was Born

- The beginning of the box recommendation ①: The end of the second quantitative easing

- The Beginning of the Box Recommendation ②: The Greek Crisis

- The beginning of the box-recommended tax ③: The spread of the Southern European crisis

- The Beginning of the Box Recommendation Tax ④: The U.S. Credit Rating Downgrade

- Is the 2021 Evergrande crisis in China a déjà vu of Greece?

Flowers in the Box: Brilliant Individual Stock Performance

- Expansion of domestic consumption in China: Consumer goods companies

- New growth industry: Bio

- New platform: mobile games

Notable Industries and Issues in 2022

- Consumer goods: Consumer goods purchased in the United States in particular

- New growth industry: space industry

- New Platforms: Metaverse and NFTs

Let's focus on areas where consumption is expected to recover rapidly.

Chapter 4: The most important momentum going forward lies in the 'climate crisis' _ Lee Hyo-seok

What exactly is the climate crisis?

- Four numbers highlighted by the UN

- Where are the four numbers now?

- Conclusions of the IPCC 6th Assessment Report

- Then isn't it over anyway?

How Climate Issues Affect Financial Markets

Inflation entering a new phase

Rising asset prices are a disease: A sad outlook.

The root cause of disease is 'deflation'

- The fundamental reason for the continued rise in asset prices: the magnitude of deflation.

Zombie companies created by low interest rates, unicorns created by liquidity.

- Why the object of fear isn't debt itself

- Real risks: Zombiecon, destructive deflation

- Inflation: Supply Chain Issues

All investments should be reviewed from an ESG perspective.

- A fundamental question about ESG: Can price change value?

- Why Professor Damodaran is negative about ESG

- A more important question than 'Will ESG make money?': Will ESG become more important?

What the ECB's Climate Stress Test Reveals

Are you an ESG-motivated investor?

Chapter 5: Investment Ideas and Promising Stocks to Watch in 2022_Seunghwan Yeom

A year of hope for recovery from COVID-19 and normalization.

Eco-Friendly: All roads now lead to eco-friendliness.

Hydrogen: The Industry That Will Lead the Next Decade

- CCUS: An Opportunity to Preempt Future Technologies

- Eco-friendly technology: Leading the change to an eco-friendly environment.

Reopening: Anticipation for a Return to Daily Life

- Overseas travel: The sector with the fastest demand recovery.

- Concert: The signal flare for revival has already been fired.

- Aircraft Manufacturing: The harsh winter is over and a warm spring is coming.

Aging: New Opportunities for Growth Are Here

Aesthetic Medical Devices: Invest in Companies That Will Make You Open Your Wallet

Dental medical devices and blood glucose meters: A market with only increasing growth potential.

Change: Find companies that turn change into opportunity.

- OLED: Be on the winning side in the war of the stars.

Mobility: Cars are now software.

- Personalized advertising: Ads read me.

Foldable Phone: A Surprising Turnaround Made Possible Through Technological Development

- Waste (Waste): An era where waste becomes money

The keyword for the 2022 market is "resolving the supply shortage."

Detailed image

Into the book

There were many people around me who invested in stocks for the first time or for the first time in a long time in 2020 and made huge profits.

But now, most of them ask me every day, worried and perplexed, “What’s going on with the market?”

Then I ask, “How come you did so well in 2020?”

The answers that come back at this time are mostly similar.

“The market was good!”

I think this is the biggest lesson we need to learn in the 2021 market.

'The market is not easy!', 'There is a reason why Mr. Market exists.'

That is why we must continue to study the market, study companies, and study stocks.

--- p.26

Let's think about the word 'seonbanyeong', which we use so easily.

No matter how good the economy and corporate performance are, if the market has already fully recognized and reflected them, prices will no longer rise.

Conversely, even if a company's performance is really bad, if the market is already well aware of it, the stock price may actually rebound.

So how can we know whether it has been reflected in advance or not?

Among economic indicators, it is worth utilizing the Economic Surprise Index.

When a company's performance exceeds expectations, it is called an 'earnings surprise', and it is the same surprise as that time.

The Economic Surprise Index is an indicator that compares economists' expectations for various economic indicators, such as unemployment rate, inflation, growth rate, and consumption, with the actual results of the economic indicators.

A positive economic surprise index means that actual economic indicators were better than financial market expectations, while a negative index means that actual economic indicators were worse than expected.

--- p.78

When we think of consumer goods, industries such as distribution, fashion, cosmetics, food and beverage, and pharmaceuticals come to mind first.

When domestic consumption improves, sales are the first to increase.

It is a growing industry.

However, looking at the stock market in 2012, industries limited to domestic consumption did not play a leading role.

At that time, the center of global consumption was China.

As China's economy grew rapidly, the middle class grew rapidly, and their consumption preferences quickly led to increased sales for global consumer goods companies.

In the domestic stock market, cosmetics and casinos have also become leading stocks, benefiting from increased domestic consumption as well as Chinese consumption.

Therefore, I believe that the consumer goods sectors to watch in 2022 should be those that can achieve export growth in addition to domestic demand.

--- p.172

'Can price change value?' Investing is often defined as 'buying stocks that are trading at a price lower than their fair value (value) and selling them when the price reaches the fair value (value).'

However, based on this definition, it means that value can influence the price of something that is being traded incorrectly, but price cannot influence value.

But surprisingly, stocks like GameStop and AMC had price-to-value effects.

These two companies paid off their debt by selling their stocks or using cash from capital increases after their stock prices soared.

Naturally, the financial structure improved and the credit rating also improved.

A rising stock price can be understood as a change in price, while an improvement in financial structure and credit rating can be understood as a change in the company's value.

Can price really change a company's value? Here's another example.

It's Tesla.

--- p.251

Large-cap stocks like Samsung Electronics and Hyundai Motor, which led the market with expectations of a big cycle at the beginning of the year, as well as Kakao, which was plagued by regulatory issues, LG Chem, which saw its stock price plummet 20% in a month due to a battery fire accident, and NCSoft, which saw its stock price halved due to disappointment with its gaming business, all lost face and left individual investors heartbroken.

The stock market in 2021 was so difficult that, with the exception of secondary battery materials, vaccines, and some eco-friendly stocks, it was practically impossible to see any leading stocks.

If 2020 was the 'water test', 2021 was the 'impossible test' with the highest level of difficulty.

(Omitted) Stock prices reflect the future.

Investing in stocks is investing in companies that will do well in the future, not the present.

There is no great technique.

I believe that the technique of stock investment is to gather information from various channels, such as newspapers, news, securities reports, and YouTube, activate your own thought circuit to summarize and organize the content, select industries with future growth potential, and invest in companies with competitiveness within those industries.

But now, most of them ask me every day, worried and perplexed, “What’s going on with the market?”

Then I ask, “How come you did so well in 2020?”

The answers that come back at this time are mostly similar.

“The market was good!”

I think this is the biggest lesson we need to learn in the 2021 market.

'The market is not easy!', 'There is a reason why Mr. Market exists.'

That is why we must continue to study the market, study companies, and study stocks.

--- p.26

Let's think about the word 'seonbanyeong', which we use so easily.

No matter how good the economy and corporate performance are, if the market has already fully recognized and reflected them, prices will no longer rise.

Conversely, even if a company's performance is really bad, if the market is already well aware of it, the stock price may actually rebound.

So how can we know whether it has been reflected in advance or not?

Among economic indicators, it is worth utilizing the Economic Surprise Index.

When a company's performance exceeds expectations, it is called an 'earnings surprise', and it is the same surprise as that time.

The Economic Surprise Index is an indicator that compares economists' expectations for various economic indicators, such as unemployment rate, inflation, growth rate, and consumption, with the actual results of the economic indicators.

A positive economic surprise index means that actual economic indicators were better than financial market expectations, while a negative index means that actual economic indicators were worse than expected.

--- p.78

When we think of consumer goods, industries such as distribution, fashion, cosmetics, food and beverage, and pharmaceuticals come to mind first.

When domestic consumption improves, sales are the first to increase.

It is a growing industry.

However, looking at the stock market in 2012, industries limited to domestic consumption did not play a leading role.

At that time, the center of global consumption was China.

As China's economy grew rapidly, the middle class grew rapidly, and their consumption preferences quickly led to increased sales for global consumer goods companies.

In the domestic stock market, cosmetics and casinos have also become leading stocks, benefiting from increased domestic consumption as well as Chinese consumption.

Therefore, I believe that the consumer goods sectors to watch in 2022 should be those that can achieve export growth in addition to domestic demand.

--- p.172

'Can price change value?' Investing is often defined as 'buying stocks that are trading at a price lower than their fair value (value) and selling them when the price reaches the fair value (value).'

However, based on this definition, it means that value can influence the price of something that is being traded incorrectly, but price cannot influence value.

But surprisingly, stocks like GameStop and AMC had price-to-value effects.

These two companies paid off their debt by selling their stocks or using cash from capital increases after their stock prices soared.

Naturally, the financial structure improved and the credit rating also improved.

A rising stock price can be understood as a change in price, while an improvement in financial structure and credit rating can be understood as a change in the company's value.

Can price really change a company's value? Here's another example.

It's Tesla.

--- p.251

Large-cap stocks like Samsung Electronics and Hyundai Motor, which led the market with expectations of a big cycle at the beginning of the year, as well as Kakao, which was plagued by regulatory issues, LG Chem, which saw its stock price plummet 20% in a month due to a battery fire accident, and NCSoft, which saw its stock price halved due to disappointment with its gaming business, all lost face and left individual investors heartbroken.

The stock market in 2021 was so difficult that, with the exception of secondary battery materials, vaccines, and some eco-friendly stocks, it was practically impossible to see any leading stocks.

If 2020 was the 'water test', 2021 was the 'impossible test' with the highest level of difficulty.

(Omitted) Stock prices reflect the future.

Investing in stocks is investing in companies that will do well in the future, not the present.

There is no great technique.

I believe that the technique of stock investment is to gather information from various channels, such as newspapers, news, securities reports, and YouTube, activate your own thought circuit to summarize and organize the content, select industries with future growth potential, and invest in companies with competitiveness within those industries.

--- p.271

Publisher's Review

An annual project with [Sampro TV], an economic YouTube channel with 1.6 million subscribers.

Korea's No. 1 Investment Outlook

The term 'Mr. Market' is a metaphor for the 'volatile stock market' and originated from a metaphor used by Benjamin Graham, the founder of value investing.

This book series, "Mr. Market," is a project planned in collaboration with the economic YouTube channel "Sampro TV" and Korea's top experts. It is the true "Korea's No. 1 investment outlook book" that guides readers in establishing rational investment strategies by looking back on the stock market each year and examining how the market will unfold in the following year.

"Mr. Market 2022," now back for its second installment, is filled with even more advanced perspectives and insights.

“The market can be said to be the sum total of the relationships that countless investors have with each other, with corporations, and with governments.

As Kim Dong-hwan of [Sampro TV] said, “Let’s look back at what kind of relationship we have as investors,” investing is ultimately about understanding the changes in the world and actively responding to and communicating with those changes.

In that respect, "Mr. Market 2022" provides readers with a meaningful opportunity to reflect on how to better communicate with the world, grow into better investors, and achieve success.

“There are many ways to develop a positive relationship with the stock market, but I try to expose myself to new perspectives whenever possible.

The world is changing much faster than before, so if you try to understand the market from a traditional perspective, your expectations are likely to turn into disappointment.

The five authors of this book are executives and managers at their respective companies, so it might be awkward to call them young. However, their way of thinking and engaging with the market are very young.

“I hope they will share how they view the current market and what they are focusing on in the market next year.”

_ From the introduction (Kim Dong-hwan [Sampro TV] host)

Why was the market stuck in a box in 2021?

The market has become more difficult, and it's time for a real showdown!

As this is their second collaboration, the combination and harmony of the diverse perspectives presented by the five authors shines even brighter.

Each book reviews the 2021 market and forecasts the 2022 market with different points, messages, and formats, yet each is meaningful enough to be omitted. This single book is sufficient to master investment studies and preparation for the coming year.

It encompasses key market keywords, momentum for change, and investment ideas, providing readers with a solid investment guide that allows them to view the market from a deeper and broader perspective.

In 2021, the market continued to show a sluggish box-like trend.

Unlike 2020, when everyone profited easily from the extremely liquid market, 2022 saw significant volatility within a range, leaving many investors with sleepless nights.

Certainly, the market's difficulty has leveled up, and there are concerns that the 2022 market will be no easy task.

But looking back, in the end, when the majority is worried, the minority that takes advantage of it becomes the winner.

2022 could be the year when the real battle unfolds.

Now, let’s embark on the path to becoming a winner in the stock market in 2022 with five experts: Director Lee Han-young, ‘the fund manager with the highest return for two consecutive years’, Team Leader Kim Hyo-jin, ‘who understands the pulse of the global economy’, Manager Lee Da-sol, ‘who has the skills of winning first place in real investment competitions’, Team Leader Lee Hyo-seok, ‘Korea’s Young Power Leader selected by Forbes’, and Director Yeom Seung-hwan, ‘the expert most loved and trusted by individual investors’.

Where will the promising players who will create a turnaround in 2022 come from?

Identify the dark horse that will lead the new rise!

Round 2: Preparing for the Reopening

When performance is supported, companies that survive adverse conditions continue to rise in earnest.

Stocks that benefited from the reopening in 2021 will see a full-fledged turnaround and a recovery in performance in 2022.

Let's identify the companies that will emerge as leaders in the reopening sector and the representative companies that will dominate the market after surviving.

_ Lee Han-young

The final pains toward a real post-corona era

With the US tapering, the prolonged COVID-19 pandemic, and Chinese regulations, it's difficult to say the outlook for 2022 is entirely bright.

However, the winter of 2021, with pessimism gaining ground compared to the hopeful end of 2020, is considered a blessing.

This is because it can be expected that ‘seonbongyeong’ will rather make investors feel lighter.

_ Kim Hyo-jin

Identifying the characteristics of the market reveals a response strategy.

During the financial boom, which is called the spring of the stock market, the government actively spends money to encourage investment and consumption.

However, in the summer of the stock market, when earnings are high, the lead in investment and consumption shifts to the private sector.

And this phenomenon continues into the fall of the stock market, when the economy is heading towards its peak, the reverse financial market.

In 2022, there are bound to be more investment opportunities in consumer goods related to improving private consumption.

_ Dasol Lee

The most important and sustainable momentum going forward lies in the climate crisis.

The most important and sustainable momentum for future investment is likely to be humanity's struggle to prevent the climate crisis.

And the biggest threat to this momentum is inflation.

Recently, various new factors that could lead to inflation have emerged, to the point that the term 'greenflation' has been coined.

_ Lee Hyo-seok

Investment ideas and promising stocks to watch now

In 2021, a year marked by extreme differentiation across industries and stocks, unprepared novice investors suffered significant losses.

The high-difficulty market is likely to continue in 2022.

That doesn't mean you need to be scared in advance.

Let's study investment ideas and promising stocks that deserve attention.

Let's take a look at key industries and promising companies under five themes: eco-friendliness, reopening, aging, change, and the era of facility investment.

_ Yeom Seung-hwan

Korea's No. 1 Investment Outlook

The term 'Mr. Market' is a metaphor for the 'volatile stock market' and originated from a metaphor used by Benjamin Graham, the founder of value investing.

This book series, "Mr. Market," is a project planned in collaboration with the economic YouTube channel "Sampro TV" and Korea's top experts. It is the true "Korea's No. 1 investment outlook book" that guides readers in establishing rational investment strategies by looking back on the stock market each year and examining how the market will unfold in the following year.

"Mr. Market 2022," now back for its second installment, is filled with even more advanced perspectives and insights.

“The market can be said to be the sum total of the relationships that countless investors have with each other, with corporations, and with governments.

As Kim Dong-hwan of [Sampro TV] said, “Let’s look back at what kind of relationship we have as investors,” investing is ultimately about understanding the changes in the world and actively responding to and communicating with those changes.

In that respect, "Mr. Market 2022" provides readers with a meaningful opportunity to reflect on how to better communicate with the world, grow into better investors, and achieve success.

“There are many ways to develop a positive relationship with the stock market, but I try to expose myself to new perspectives whenever possible.

The world is changing much faster than before, so if you try to understand the market from a traditional perspective, your expectations are likely to turn into disappointment.

The five authors of this book are executives and managers at their respective companies, so it might be awkward to call them young. However, their way of thinking and engaging with the market are very young.

“I hope they will share how they view the current market and what they are focusing on in the market next year.”

_ From the introduction (Kim Dong-hwan [Sampro TV] host)

Why was the market stuck in a box in 2021?

The market has become more difficult, and it's time for a real showdown!

As this is their second collaboration, the combination and harmony of the diverse perspectives presented by the five authors shines even brighter.

Each book reviews the 2021 market and forecasts the 2022 market with different points, messages, and formats, yet each is meaningful enough to be omitted. This single book is sufficient to master investment studies and preparation for the coming year.

It encompasses key market keywords, momentum for change, and investment ideas, providing readers with a solid investment guide that allows them to view the market from a deeper and broader perspective.

In 2021, the market continued to show a sluggish box-like trend.

Unlike 2020, when everyone profited easily from the extremely liquid market, 2022 saw significant volatility within a range, leaving many investors with sleepless nights.

Certainly, the market's difficulty has leveled up, and there are concerns that the 2022 market will be no easy task.

But looking back, in the end, when the majority is worried, the minority that takes advantage of it becomes the winner.

2022 could be the year when the real battle unfolds.

Now, let’s embark on the path to becoming a winner in the stock market in 2022 with five experts: Director Lee Han-young, ‘the fund manager with the highest return for two consecutive years’, Team Leader Kim Hyo-jin, ‘who understands the pulse of the global economy’, Manager Lee Da-sol, ‘who has the skills of winning first place in real investment competitions’, Team Leader Lee Hyo-seok, ‘Korea’s Young Power Leader selected by Forbes’, and Director Yeom Seung-hwan, ‘the expert most loved and trusted by individual investors’.

Where will the promising players who will create a turnaround in 2022 come from?

Identify the dark horse that will lead the new rise!

Round 2: Preparing for the Reopening

When performance is supported, companies that survive adverse conditions continue to rise in earnest.

Stocks that benefited from the reopening in 2021 will see a full-fledged turnaround and a recovery in performance in 2022.

Let's identify the companies that will emerge as leaders in the reopening sector and the representative companies that will dominate the market after surviving.

_ Lee Han-young

The final pains toward a real post-corona era

With the US tapering, the prolonged COVID-19 pandemic, and Chinese regulations, it's difficult to say the outlook for 2022 is entirely bright.

However, the winter of 2021, with pessimism gaining ground compared to the hopeful end of 2020, is considered a blessing.

This is because it can be expected that ‘seonbongyeong’ will rather make investors feel lighter.

_ Kim Hyo-jin

Identifying the characteristics of the market reveals a response strategy.

During the financial boom, which is called the spring of the stock market, the government actively spends money to encourage investment and consumption.

However, in the summer of the stock market, when earnings are high, the lead in investment and consumption shifts to the private sector.

And this phenomenon continues into the fall of the stock market, when the economy is heading towards its peak, the reverse financial market.

In 2022, there are bound to be more investment opportunities in consumer goods related to improving private consumption.

_ Dasol Lee

The most important and sustainable momentum going forward lies in the climate crisis.

The most important and sustainable momentum for future investment is likely to be humanity's struggle to prevent the climate crisis.

And the biggest threat to this momentum is inflation.

Recently, various new factors that could lead to inflation have emerged, to the point that the term 'greenflation' has been coined.

_ Lee Hyo-seok

Investment ideas and promising stocks to watch now

In 2021, a year marked by extreme differentiation across industries and stocks, unprepared novice investors suffered significant losses.

The high-difficulty market is likely to continue in 2022.

That doesn't mean you need to be scared in advance.

Let's study investment ideas and promising stocks that deserve attention.

Let's take a look at key industries and promising companies under five themes: eco-friendliness, reopening, aging, change, and the era of facility investment.

_ Yeom Seung-hwan

GOODS SPECIFICS

- Publication date: November 29, 2021

- Page count, weight, size: 356 pages | 626g | 152*225*30mm

- ISBN13: 9791190977449

- ISBN10: 1190977443

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)