Absolute principles of stock investment

|

Description

Book Introduction

- A word from MD

-

“Invest within your knowledge.”It contains the essence of 30 years of investment by author Park Young-ok, who adheres to the principle of 'investing only within the scope of your knowledge.'

He approaches stock investing with a farming mindset, advocating for companies to focus on analyzing their businesses rather than trying to predict the economy or the market.

So, what are the criteria for him, a stock farmer, to select and invest in valuable companies?

October 29, 2021. Economics and Management PD Kang Min-ji

Highly recommended by John Lee, Kim Dong-hwan, and Lee Chae-won!

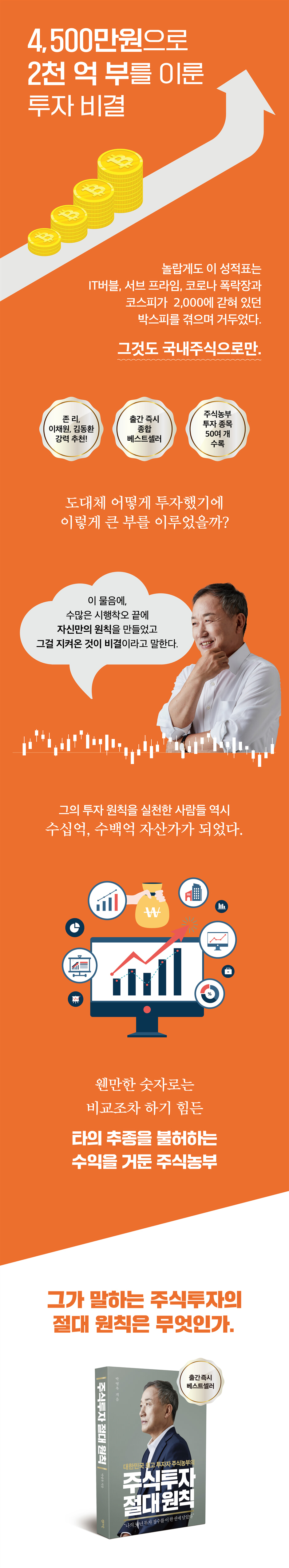

"The Investment Secret to Building 200 Billion Won with 45 Million Won"

A book has been published containing the investment secrets of Korea's richest stock investor, who earned 200 billion won, or approximately 4,500 times the return, with a capital of 45 million won.

What's surprising is that these returns were achieved despite the IT bubble, subprime mortgage crisis, the coronavirus crash, and the KOSPI being stuck at 2,000.

And only with domestic stocks.

There are many people around us who have made hundreds of millions or even billions through stock investment, but there are only a few who have made hundreds of billions.

But you made hundreds of billions of won?

This is probably the first record and one that will not be easily achieved for some time to come.

This is the story of CEO Park Young-ok, widely known as a stock farmer.

How on earth did the stock farmer invest to amass such a huge fortune?

Perhaps there's a special secret to his success? The author responds by saying that his secret lies in the principles he developed through countless trials and errors, and the fact that he has consistently adhered to them.

Those who practiced his investment principles through his connections became wealthy individuals worth tens or hundreds of millions of dollars.

The person most respected by stock investors.

The person that stock market experts most want to meet.

A stock farmer who has achieved unparalleled profits that are difficult to compare with any other number.

What is the absolute principle of stock investment that he speaks of?

"The Investment Secret to Building 200 Billion Won with 45 Million Won"

A book has been published containing the investment secrets of Korea's richest stock investor, who earned 200 billion won, or approximately 4,500 times the return, with a capital of 45 million won.

What's surprising is that these returns were achieved despite the IT bubble, subprime mortgage crisis, the coronavirus crash, and the KOSPI being stuck at 2,000.

And only with domestic stocks.

There are many people around us who have made hundreds of millions or even billions through stock investment, but there are only a few who have made hundreds of billions.

But you made hundreds of billions of won?

This is probably the first record and one that will not be easily achieved for some time to come.

This is the story of CEO Park Young-ok, widely known as a stock farmer.

How on earth did the stock farmer invest to amass such a huge fortune?

Perhaps there's a special secret to his success? The author responds by saying that his secret lies in the principles he developed through countless trials and errors, and the fact that he has consistently adhered to them.

Those who practiced his investment principles through his connections became wealthy individuals worth tens or hundreds of millions of dollars.

The person most respected by stock investors.

The person that stock market experts most want to meet.

A stock farmer who has achieved unparalleled profits that are difficult to compare with any other number.

What is the absolute principle of stock investment that he speaks of?

- You can preview some of the book's contents.

Preview

index

Recommendations_ John Lee (CEO of Meritz Asset Management), Lee Chae-won (Chairman of Life Asset Management), Kim Dong-hwan (CEO of Sampro TV), and Yoo Il-han (Head of MTN Live Broadcast Production Department)

Prologue: You, too, can become a millionaire.

The first commandment of investing.

Get the investor's perspective

The best way for the middle class and working class to become wealthy is through stock investment.

See the world through an investor's eyes

The best sharing system created by humans: the joint-stock company system and the stock market.

Knowing the nature of stocks will show you where to invest.

My criteria for selecting companies to invest in

Stock investing is a business where you get what you pay for.

The second commandment of investing.

Don't act rashly

I set my own standards for value.

Don't be greedy for what isn't yours, and be grateful for what you have.

It's not the stock price that moves, it's the human heart.

Become a Lion Investor with the Heart of a Lion

The end of a crisis is an opportunity

The three commandments of investing.

Invest within your knowledge

Don't try to predict the economy or the market; focus only on the business.

Questions to Ask Before Investing

Why I'm reluctant to recommend stocks

Investing without knowledge will inevitably lead to retribution.

Don't try to take everything, three is enough.

Finding a company that will be your lifelong companion will lead to wealth and comfort.

The Four Commandments of Investing.

The target of investment is a company.

The world's richest people, who are the main creators of wealth?

The only sure investment is a company.

Stock investing is the best business lesson.

Living as a 'host', not a 'guest'

Why there are no thousand-seok hunters, but ten thousand-seok farmers

The Korea Discount Era Ends, and the Korea Premium Era Begins

The 5 Commandments of Investing.

Shareholders are the owners of the company.

Is there a general shareholders meeting you really want to attend?

When times are tough, when you're feeling overwhelmed, stock investing is all about supporting your company.

You need to have faith in a company to invest in difficult times.

Never invest in companies like this.

5 Steps to Stock Investing: There's a Different Way to Invest for Long-Term Profits

Get on board a company that's like an aircraft carrier crossing the Pacific.

The 6 Commandments of Investing.

Communicate and accompany the companies you invest in.

Discernment in choosing a company to work with

Beware of overly flashy companies.

The Law of Wealth: Its Step-by-Step Growth in Every Crisis

Even Warren Buffett lives with his phone on his phone.

Investment habits of observing and studying the companies in which you invest

The 7 Commandments of Investing.

Invest in the company's growth cycle

Timing a trade is nearly impossible.

Investing in stocks is about riding the corporate growth cycle.

It is more important not to lose than to earn.

Even the best companies are successful only when bought at a low price.

If you invest in a business with conviction, you will definitely win.

The 8 Commandments of Investing.

Stock investing is farming.

A farmer never skips a season

Buy with the intention of helping in times of need, and sell with the intention of sharing the profits.

Don't ruin your field because of someone else's field.

To make stock investments that won't fail

The 9 Commandments of Investing.

There are always investment opportunities.

Investors are always the best. 2,400 companies await your choice.

Top 10 Companies in 2008 and Top 10 Companies in 2021

The more you study, the wider the door of opportunity opens.

Invest in a desirable company that you want to acquire.

Imagine the future 3, 5, 10 years from now.

The 10 Commandments of Investing.

Think big with the right mindset

Your heart must be bigger than your money.

Stock investing is not a buying and selling game.

Stock investing is the best economics textbook.

The sooner you start learning about economics through stock investing, the better.

Ultimately, it is you who protects your own wealth.

Let's start the "One Family, One Company" movement.

Epilogue_ Dreaming of a society where investors are respected

Acknowledgements

Prologue: You, too, can become a millionaire.

The first commandment of investing.

Get the investor's perspective

The best way for the middle class and working class to become wealthy is through stock investment.

See the world through an investor's eyes

The best sharing system created by humans: the joint-stock company system and the stock market.

Knowing the nature of stocks will show you where to invest.

My criteria for selecting companies to invest in

Stock investing is a business where you get what you pay for.

The second commandment of investing.

Don't act rashly

I set my own standards for value.

Don't be greedy for what isn't yours, and be grateful for what you have.

It's not the stock price that moves, it's the human heart.

Become a Lion Investor with the Heart of a Lion

The end of a crisis is an opportunity

The three commandments of investing.

Invest within your knowledge

Don't try to predict the economy or the market; focus only on the business.

Questions to Ask Before Investing

Why I'm reluctant to recommend stocks

Investing without knowledge will inevitably lead to retribution.

Don't try to take everything, three is enough.

Finding a company that will be your lifelong companion will lead to wealth and comfort.

The Four Commandments of Investing.

The target of investment is a company.

The world's richest people, who are the main creators of wealth?

The only sure investment is a company.

Stock investing is the best business lesson.

Living as a 'host', not a 'guest'

Why there are no thousand-seok hunters, but ten thousand-seok farmers

The Korea Discount Era Ends, and the Korea Premium Era Begins

The 5 Commandments of Investing.

Shareholders are the owners of the company.

Is there a general shareholders meeting you really want to attend?

When times are tough, when you're feeling overwhelmed, stock investing is all about supporting your company.

You need to have faith in a company to invest in difficult times.

Never invest in companies like this.

5 Steps to Stock Investing: There's a Different Way to Invest for Long-Term Profits

Get on board a company that's like an aircraft carrier crossing the Pacific.

The 6 Commandments of Investing.

Communicate and accompany the companies you invest in.

Discernment in choosing a company to work with

Beware of overly flashy companies.

The Law of Wealth: Its Step-by-Step Growth in Every Crisis

Even Warren Buffett lives with his phone on his phone.

Investment habits of observing and studying the companies in which you invest

The 7 Commandments of Investing.

Invest in the company's growth cycle

Timing a trade is nearly impossible.

Investing in stocks is about riding the corporate growth cycle.

It is more important not to lose than to earn.

Even the best companies are successful only when bought at a low price.

If you invest in a business with conviction, you will definitely win.

The 8 Commandments of Investing.

Stock investing is farming.

A farmer never skips a season

Buy with the intention of helping in times of need, and sell with the intention of sharing the profits.

Don't ruin your field because of someone else's field.

To make stock investments that won't fail

The 9 Commandments of Investing.

There are always investment opportunities.

Investors are always the best. 2,400 companies await your choice.

Top 10 Companies in 2008 and Top 10 Companies in 2021

The more you study, the wider the door of opportunity opens.

Invest in a desirable company that you want to acquire.

Imagine the future 3, 5, 10 years from now.

The 10 Commandments of Investing.

Think big with the right mindset

Your heart must be bigger than your money.

Stock investing is not a buying and selling game.

Stock investing is the best economics textbook.

The sooner you start learning about economics through stock investing, the better.

Ultimately, it is you who protects your own wealth.

Let's start the "One Family, One Company" movement.

Epilogue_ Dreaming of a society where investors are respected

Acknowledgements

Detailed image

Into the book

Although it is tragic, this book is my last record related to stock investment.

Here I have generously shared the principles of investment that I have learned.

This book is my legacy to you, a message of hope I wish to send to many.

There is only one reason why I wrote this book.

This is because I want to record my investment life and investment philosophy and share it with the public, and I hope that everyone who comes across it will join me in investing.

--- p.12

If you follow what others seem to be doing to earn more in a shorter period of time, you will soon lose your way.

They are tempted by the material, tempted by good recommendations, and try to make profits by following stocks that hit the upper limit in a short period of time.

It can be thrilling to succeed a few times temporarily.

I have also tried short-term trading and have experienced many risky trading techniques.

After working in the securities industry for over ten years, why didn't I understand this method? Why, then, did I ultimately return to this method, which others consider foolish and frustrating? And how did this method generate such enormous profits? I urge you to ponder this question carefully.

--- p.14

I gave a lecture in Jeju 10 years ago.

One of the audience members is now worth 7 billion won.

He said that he gave small amounts of money to his children to help them start investing in stocks, and now he owns quite a bit of stock assets.

At the time, I wrote down my portfolio diligently, and among them, I chose only those whose stock prices had not risen, studied them, and invested with them for a long time.

Another person who attended the lecture with me also invested diligently in stocks, but he said that he was so focused on buying and selling that he didn't make much money.

If it's short, ... and if it's long, it's long. It's 10 years.

Even during this period, such mixed results were obtained.

--- p.209

A company is like a living organism; if it fails to evolve with the changing environment, it will degenerate.

Therefore, I do not recommend 'long-term investment' where you buy and leave it alone.

If the stock price rises to the value I set while I'm with you, that's enough.

Any profits that deviate from the standards and principles I have set are not mine.

It's not my fault if the stock price of a company I haven't studied yet goes up.

If you think like this, you will not waste your emotions unnecessarily.

This will definitely have a positive impact on your next investment.

--- p.72

Among the companies I have invested in is Koentech, a waste disposal company.

I started investing around 2015, when the stock price was around 2,000-3,000 won (@500).

The Ulsan-based company was created by several companies within the Ulsan Industrial Complex to process their waste.

I have visited several times with the perspective of an investor and entrepreneur.

The company's site covers 100,000 pyeong, and about 50 employees handle all the work.

Productivity was very high.

The core business model is to collect waste generated by companies and dispose of it through incineration or landfill, and even the heat (steam) generated when processing the waste is sold back to the companies.

It was a company that literally killed two birds with one stone.

Naturally, I studied basic data (quantitative analysis) related to the company and asked around for opinions (information) from analysts around me.

But everyone shook their heads and expressed negative opinions.

(Omitted) Everyone else looked at it negatively, but I looked at this company with a business mindset.

Raw materials (waste) are supplied stably, and the places where products are sold (sales channels) are diverse and stable.

Despite being a manufacturing industry, it does not require a lot of manpower.

In particular, there are many restrictions on obtaining new permits for landfills and incinerators.

Therefore, if you dominate this industry, you can maintain your dominance unless there are major variables.

And above all, the waste management business is absolutely necessary for our society.

It looks dirty and useless and is shunned, but in fact it is not.

I thought that the very fact that our society needs it had tremendous intangible value.

Analyzing and investing in companies this way may seem difficult, but it's not.

As you live, you will inevitably come across valuable businesses around you that are related to you and invisible to others.

It may be a company that seems insignificant and that everyone says is boring and uninteresting.

However, if it is a company that generates stable profits and pays dividends, the stock price will inevitably rise two to three times at some point.

Pay attention and consider the criteria, such as, "If I were an entrepreneur, is this a business I would want to try?" or "If I were an entrepreneur, is this a company I would want to acquire?"

By doing so, you can easily seize opportunities that others do not see.

_pp.164~166

If you're interested in investing in an IPO, I'd advise you to wait three to four years after listing to properly assess its competitiveness before investing.

Moreover, the returns from subscription to public offerings are too small compared to the amount of money invested by individual investors.

It is much more efficient to invest time and energy in studying already listed companies.

Stock investing definitely follows trends and trends.

There are several companies that have grown several times over thanks to the BBIG (bio, battery, internet, and game) stock craze that began in 2020.

But I don't invest much in those companies.

Most of the companies I've invested in have a track record in traditional industries.

Because I value dividends, I have a hard time investing in so-called growth stocks, even if their stock prices rise significantly.

Instead, we have focused on companies that are 'inconvenient to be without in their respective fields.'

Although their appearance may not be flashy, these companies will continue to make profits in their fields as long as our lives last.

--- p.187

I'm not a big believer in the saying, "Hold cash when the market is overheated."

"Observe the stock market, and when the index rises, sell your stocks and realize your profits! Then, wait and see if the index falls again, and look for opportunities to buy at a low price!" This advice is often heard.

But where exactly is the high point and where is the low point? Timing is nice to say, but in reality, it's impossible to get it right.

I don't go in and out of the market like that.

Because I only care about the cycles of the companies I studied, regardless of the ups and downs of the market.

Even if the index rises, the stock price of the company you want to invest in will fall, making it an appropriate time to buy.

On the other hand, even if the index falls, the company I invested in will have grown enough to close the cycle and the time will come to sell.

In this way, the timing of my buying and selling is solely linked to the growth cycle of the companies I invest in.

I don't really care about the rest of the market or the economy.

So sometimes, I don't even know what the KOSPI or KOSDAQ index is.

People say the market is bad, but there are many times when the stock prices of the companies in my portfolio go up.

This is because investments are made only by looking at the company, regardless of the stock index trend.

_pp.201~202

There are times when you suddenly need money and have to sell.

So, which portfolio should you sell? Should you sell the profitable ones? Or the ones with losses?

Many novice investors sell their profitable stocks first.

I think it's better than selling stocks that are losing money.

But usually, these choices are like displaying a variety of items in a store, quickly removing the best-selling items from the shelves and leaving only the unsold items.

Profitability should not be the only criterion for deciding whether to sell.

If you do that, you will only have a vague expectation that it will go up someday as time passes.

The company should always be the standard, and decisions should be made based on which company gives me the confidence to wait.

--- p.213

In 2008, I gave 25 million won to my first daughter, 20 million won to my second daughter, and 16 million won to my third son, and then had them open stock accounts.

At that time, gift tax was exempted up to 15 million won, so they paid taxes equivalent to 10 million won, 5 million won, and 1 million won, respectively, and gave seed money for investment.

Since then, we have been investing together consistently.

I gave them advice, but they studied and chose companies to invest in together with their children.

We also discussed the companies we invested in at the dinner table.

The children first took an interest in the companies they invested in, researched information, spent diligently, and promoted the companies to those around them, practicing investing like entrepreneurs.

Meanwhile, the investment amount also increased significantly.

(syncopation)

Investing in stocks is the best study that helps you develop an eye for reading the world.

When you become the owner of your own business and look at the world, you gain a completely different perspective than when you look at it as an employee, consumer, or customer.

By understanding the framework of society and economy, you will naturally learn how to live well.

The days when one parent would invest in stocks without telling the family are over.

I would like everyone to put the companies they invest in on the table and discuss their thoughts.

It would be even better if families could find a company they would like to work with through discussion and study, and start owning a company (一家一社) for each family.

Here I have generously shared the principles of investment that I have learned.

This book is my legacy to you, a message of hope I wish to send to many.

There is only one reason why I wrote this book.

This is because I want to record my investment life and investment philosophy and share it with the public, and I hope that everyone who comes across it will join me in investing.

--- p.12

If you follow what others seem to be doing to earn more in a shorter period of time, you will soon lose your way.

They are tempted by the material, tempted by good recommendations, and try to make profits by following stocks that hit the upper limit in a short period of time.

It can be thrilling to succeed a few times temporarily.

I have also tried short-term trading and have experienced many risky trading techniques.

After working in the securities industry for over ten years, why didn't I understand this method? Why, then, did I ultimately return to this method, which others consider foolish and frustrating? And how did this method generate such enormous profits? I urge you to ponder this question carefully.

--- p.14

I gave a lecture in Jeju 10 years ago.

One of the audience members is now worth 7 billion won.

He said that he gave small amounts of money to his children to help them start investing in stocks, and now he owns quite a bit of stock assets.

At the time, I wrote down my portfolio diligently, and among them, I chose only those whose stock prices had not risen, studied them, and invested with them for a long time.

Another person who attended the lecture with me also invested diligently in stocks, but he said that he was so focused on buying and selling that he didn't make much money.

If it's short, ... and if it's long, it's long. It's 10 years.

Even during this period, such mixed results were obtained.

--- p.209

A company is like a living organism; if it fails to evolve with the changing environment, it will degenerate.

Therefore, I do not recommend 'long-term investment' where you buy and leave it alone.

If the stock price rises to the value I set while I'm with you, that's enough.

Any profits that deviate from the standards and principles I have set are not mine.

It's not my fault if the stock price of a company I haven't studied yet goes up.

If you think like this, you will not waste your emotions unnecessarily.

This will definitely have a positive impact on your next investment.

--- p.72

Among the companies I have invested in is Koentech, a waste disposal company.

I started investing around 2015, when the stock price was around 2,000-3,000 won (@500).

The Ulsan-based company was created by several companies within the Ulsan Industrial Complex to process their waste.

I have visited several times with the perspective of an investor and entrepreneur.

The company's site covers 100,000 pyeong, and about 50 employees handle all the work.

Productivity was very high.

The core business model is to collect waste generated by companies and dispose of it through incineration or landfill, and even the heat (steam) generated when processing the waste is sold back to the companies.

It was a company that literally killed two birds with one stone.

Naturally, I studied basic data (quantitative analysis) related to the company and asked around for opinions (information) from analysts around me.

But everyone shook their heads and expressed negative opinions.

(Omitted) Everyone else looked at it negatively, but I looked at this company with a business mindset.

Raw materials (waste) are supplied stably, and the places where products are sold (sales channels) are diverse and stable.

Despite being a manufacturing industry, it does not require a lot of manpower.

In particular, there are many restrictions on obtaining new permits for landfills and incinerators.

Therefore, if you dominate this industry, you can maintain your dominance unless there are major variables.

And above all, the waste management business is absolutely necessary for our society.

It looks dirty and useless and is shunned, but in fact it is not.

I thought that the very fact that our society needs it had tremendous intangible value.

Analyzing and investing in companies this way may seem difficult, but it's not.

As you live, you will inevitably come across valuable businesses around you that are related to you and invisible to others.

It may be a company that seems insignificant and that everyone says is boring and uninteresting.

However, if it is a company that generates stable profits and pays dividends, the stock price will inevitably rise two to three times at some point.

Pay attention and consider the criteria, such as, "If I were an entrepreneur, is this a business I would want to try?" or "If I were an entrepreneur, is this a company I would want to acquire?"

By doing so, you can easily seize opportunities that others do not see.

_pp.164~166

If you're interested in investing in an IPO, I'd advise you to wait three to four years after listing to properly assess its competitiveness before investing.

Moreover, the returns from subscription to public offerings are too small compared to the amount of money invested by individual investors.

It is much more efficient to invest time and energy in studying already listed companies.

Stock investing definitely follows trends and trends.

There are several companies that have grown several times over thanks to the BBIG (bio, battery, internet, and game) stock craze that began in 2020.

But I don't invest much in those companies.

Most of the companies I've invested in have a track record in traditional industries.

Because I value dividends, I have a hard time investing in so-called growth stocks, even if their stock prices rise significantly.

Instead, we have focused on companies that are 'inconvenient to be without in their respective fields.'

Although their appearance may not be flashy, these companies will continue to make profits in their fields as long as our lives last.

--- p.187

I'm not a big believer in the saying, "Hold cash when the market is overheated."

"Observe the stock market, and when the index rises, sell your stocks and realize your profits! Then, wait and see if the index falls again, and look for opportunities to buy at a low price!" This advice is often heard.

But where exactly is the high point and where is the low point? Timing is nice to say, but in reality, it's impossible to get it right.

I don't go in and out of the market like that.

Because I only care about the cycles of the companies I studied, regardless of the ups and downs of the market.

Even if the index rises, the stock price of the company you want to invest in will fall, making it an appropriate time to buy.

On the other hand, even if the index falls, the company I invested in will have grown enough to close the cycle and the time will come to sell.

In this way, the timing of my buying and selling is solely linked to the growth cycle of the companies I invest in.

I don't really care about the rest of the market or the economy.

So sometimes, I don't even know what the KOSPI or KOSDAQ index is.

People say the market is bad, but there are many times when the stock prices of the companies in my portfolio go up.

This is because investments are made only by looking at the company, regardless of the stock index trend.

_pp.201~202

There are times when you suddenly need money and have to sell.

So, which portfolio should you sell? Should you sell the profitable ones? Or the ones with losses?

Many novice investors sell their profitable stocks first.

I think it's better than selling stocks that are losing money.

But usually, these choices are like displaying a variety of items in a store, quickly removing the best-selling items from the shelves and leaving only the unsold items.

Profitability should not be the only criterion for deciding whether to sell.

If you do that, you will only have a vague expectation that it will go up someday as time passes.

The company should always be the standard, and decisions should be made based on which company gives me the confidence to wait.

--- p.213

In 2008, I gave 25 million won to my first daughter, 20 million won to my second daughter, and 16 million won to my third son, and then had them open stock accounts.

At that time, gift tax was exempted up to 15 million won, so they paid taxes equivalent to 10 million won, 5 million won, and 1 million won, respectively, and gave seed money for investment.

Since then, we have been investing together consistently.

I gave them advice, but they studied and chose companies to invest in together with their children.

We also discussed the companies we invested in at the dinner table.

The children first took an interest in the companies they invested in, researched information, spent diligently, and promoted the companies to those around them, practicing investing like entrepreneurs.

Meanwhile, the investment amount also increased significantly.

(syncopation)

Investing in stocks is the best study that helps you develop an eye for reading the world.

When you become the owner of your own business and look at the world, you gain a completely different perspective than when you look at it as an employee, consumer, or customer.

By understanding the framework of society and economy, you will naturally learn how to live well.

The days when one parent would invest in stocks without telling the family are over.

I would like everyone to put the companies they invest in on the table and discuss their thoughts.

It would be even better if families could find a company they would like to work with through discussion and study, and start owning a company (一家一社) for each family.

--- p.288~289

Publisher's Review

Includes over 50 companies that are investment targets for stock farmers.

“Anyone can become rich through stock investment if they just follow the right principles!”

The surprising fact is that the return on investment of 200 billion won, achieved by CEO Park Young-ok of Stock Farmer with a capital of 45 million won, was achieved solely through domestic stocks.

Even Boxpi, which everyone was leaving, saying there was no hope for the Korean stock market, achieved an average annual return of more than 50%.

What this tells us is clear.

Just as some companies fail even in boom times and others thrive even in recessions, the ups and downs of the stock market have nothing to do with my investment returns.

In "The Absolute Principles of Stock Investment," the author argues that the problem is not the market, but rather that "anyone can become rich through stock investment like me if they just follow the principles properly!"

In fact, many of those who learned and practiced his investment methods have become wealthy individuals with assets worth tens or hundreds of billions of won.

The author says that while you may be able to make a living by simply trading stocks to realize profits, you will never become very rich.

For example, there aren't many rich people among securities firm employees.

They are always recommending stocks and are at the forefront of market analysis. They know a lot of good companies to invest in, but their actual performance isn't very good.

Because they try to seize too many opportunities and buy and sell repeatedly according to market conditions.

“I have also tried short-term trading and have experienced many risky trading techniques.

"I've worked in the securities industry for over ten years, so why don't I know how to do this? Why, then, did I ultimately return to this method, which others consider foolish and frustrating? And how did I achieve such enormous profits? Because I tried many paths, but this one proved to be the most reliable, least risky, and most profitable." (Omitted...) _From the text of "The Absolute Principles of Stock Investment"

As John Lee, CEO of Marys Asset Management, who wrote the book's recommendation, said, from a long-term perspective, stock investment is almost the only way for ordinary people to become wealthy.

However, if you are caught up in wrong prejudices, stock investment can actually be detrimental.

This means that correct principles are important.

“Along with the stock investment craze, countless books are competing to dominate the bestseller lists.

But I often wonder if it will really help.

I'm afraid that books about short-term trading might have a negative influence on those just starting out in stock investing.

This book will help you establish the right perspective on stock investment and serve as a guide to achieving true wealth and fulfillment.

“I gladly recommend this book in the hope that at least one more person will take the path to wealth.” (Omitted···) ─ John Lee, CEO of Mary’s Asset Management.

From the recommendation of 『Absolute Principles of Stock Investment』

There is only one reason why stock farmer Yongok Park wrote a book.

This is because he wants to record his investment life and investment philosophy and share it with the public, and hopes that everyone who comes across it will join in investing.

This is because I wanted to show that in Korea, if you have the right investment mindset and invest like a farmer, you can be successful.

In this way, the author summarized his 30 years of investment experience into '10 absolute principles' and included them in the book.

Just as the Ten Commandments of Christianity are concise and contain very obvious truths, the Ten Absolute Principles of Stock Investment are also simple and unassuming.

However, anyone who has ever invested will know the meaning contained in these 10 commandments.

The core of the author's investment philosophy is 'investing in companies.'

He believes that stock investment is the act of becoming the owner of a profitable company and sharing in its success.

He points out that between 2008 and 2021, all of the top 10 companies in Korea by market capitalization, with the exception of Samsung Electronics, changed, and says that the rapid change in companies that are performing well means that investment opportunities have opened up significantly.

In other words, depending on how I invest over the next 10 years, the size of my assets can change significantly.

Rather than viewing stocks as a trading game, the author says that we should invest in companies that have the potential to grow and accompany them until they grow. This book specifically and meticulously identifies the areas and stocks that should be paid attention to.

As I read about the process and investment methods the author used to discover the companies he has invested in and is currently investing in, I find myself naturally thinking of companies around me that deserve my attention.

Includes over 50 companies for stock farmers to invest in.

This book is full of wisdom that individual investors should treasure and read over and over again, such as, "You may be able to make a living by thinking of stocks as a simple way to make a profit through trading, but you will never become very rich," "Find a company with an independent business model that makes a lot of money and pays dividends regularly," "Invest in that growth cycle by accompanying it for 3-4 years," and "Encourage middle and high school children to start investing in stocks and select companies that will become big when they become adults."

Whether you're a novice, a professional investor, or aspiring stock investor, if you're hoping to become wealthy and financially independent through stock investing, listen to the Stock Farmer, a sage of this generation who has proven himself for 30 years.

“Anyone can become rich through stock investment if they just follow the right principles!”

The surprising fact is that the return on investment of 200 billion won, achieved by CEO Park Young-ok of Stock Farmer with a capital of 45 million won, was achieved solely through domestic stocks.

Even Boxpi, which everyone was leaving, saying there was no hope for the Korean stock market, achieved an average annual return of more than 50%.

What this tells us is clear.

Just as some companies fail even in boom times and others thrive even in recessions, the ups and downs of the stock market have nothing to do with my investment returns.

In "The Absolute Principles of Stock Investment," the author argues that the problem is not the market, but rather that "anyone can become rich through stock investment like me if they just follow the principles properly!"

In fact, many of those who learned and practiced his investment methods have become wealthy individuals with assets worth tens or hundreds of billions of won.

The author says that while you may be able to make a living by simply trading stocks to realize profits, you will never become very rich.

For example, there aren't many rich people among securities firm employees.

They are always recommending stocks and are at the forefront of market analysis. They know a lot of good companies to invest in, but their actual performance isn't very good.

Because they try to seize too many opportunities and buy and sell repeatedly according to market conditions.

“I have also tried short-term trading and have experienced many risky trading techniques.

"I've worked in the securities industry for over ten years, so why don't I know how to do this? Why, then, did I ultimately return to this method, which others consider foolish and frustrating? And how did I achieve such enormous profits? Because I tried many paths, but this one proved to be the most reliable, least risky, and most profitable." (Omitted...) _From the text of "The Absolute Principles of Stock Investment"

As John Lee, CEO of Marys Asset Management, who wrote the book's recommendation, said, from a long-term perspective, stock investment is almost the only way for ordinary people to become wealthy.

However, if you are caught up in wrong prejudices, stock investment can actually be detrimental.

This means that correct principles are important.

“Along with the stock investment craze, countless books are competing to dominate the bestseller lists.

But I often wonder if it will really help.

I'm afraid that books about short-term trading might have a negative influence on those just starting out in stock investing.

This book will help you establish the right perspective on stock investment and serve as a guide to achieving true wealth and fulfillment.

“I gladly recommend this book in the hope that at least one more person will take the path to wealth.” (Omitted···) ─ John Lee, CEO of Mary’s Asset Management.

From the recommendation of 『Absolute Principles of Stock Investment』

There is only one reason why stock farmer Yongok Park wrote a book.

This is because he wants to record his investment life and investment philosophy and share it with the public, and hopes that everyone who comes across it will join in investing.

This is because I wanted to show that in Korea, if you have the right investment mindset and invest like a farmer, you can be successful.

In this way, the author summarized his 30 years of investment experience into '10 absolute principles' and included them in the book.

Just as the Ten Commandments of Christianity are concise and contain very obvious truths, the Ten Absolute Principles of Stock Investment are also simple and unassuming.

However, anyone who has ever invested will know the meaning contained in these 10 commandments.

The core of the author's investment philosophy is 'investing in companies.'

He believes that stock investment is the act of becoming the owner of a profitable company and sharing in its success.

He points out that between 2008 and 2021, all of the top 10 companies in Korea by market capitalization, with the exception of Samsung Electronics, changed, and says that the rapid change in companies that are performing well means that investment opportunities have opened up significantly.

In other words, depending on how I invest over the next 10 years, the size of my assets can change significantly.

Rather than viewing stocks as a trading game, the author says that we should invest in companies that have the potential to grow and accompany them until they grow. This book specifically and meticulously identifies the areas and stocks that should be paid attention to.

As I read about the process and investment methods the author used to discover the companies he has invested in and is currently investing in, I find myself naturally thinking of companies around me that deserve my attention.

Includes over 50 companies for stock farmers to invest in.

This book is full of wisdom that individual investors should treasure and read over and over again, such as, "You may be able to make a living by thinking of stocks as a simple way to make a profit through trading, but you will never become very rich," "Find a company with an independent business model that makes a lot of money and pays dividends regularly," "Invest in that growth cycle by accompanying it for 3-4 years," and "Encourage middle and high school children to start investing in stocks and select companies that will become big when they become adults."

Whether you're a novice, a professional investor, or aspiring stock investor, if you're hoping to become wealthy and financially independent through stock investing, listen to the Stock Farmer, a sage of this generation who has proven himself for 30 years.

GOODS SPECIFICS

- Publication date: November 1, 2021

- Page count, weight, size: 310 pages | 510g | 148*210*30mm

- ISBN13: 9791166570421

- ISBN10: 1166570428

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)