Find the best stock of the era

|

Description

Book Introduction

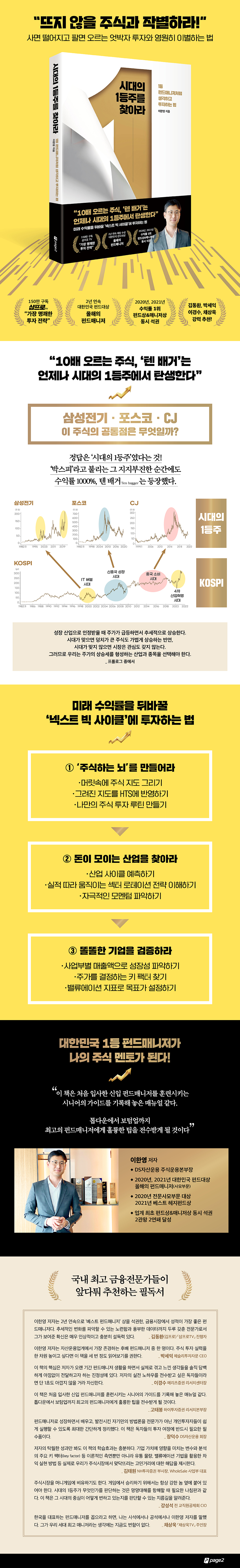

10x the return, 'Ten Bagger' Always born from the best of the times How to Invest in the "Next Big Cycle" That Will Transform Future Returns Titles that sound impressive just by hearing them, such as ‘No. 1 in profitability for two consecutive years,’ ‘Fund Manager of the Year,’ and ‘First in the industry to win both the Fund Award and Manager Award at the same time,’ are the modifiers used to introduce author Lee Han-young. "No. 1 Fund Manager" is the word that best describes author Lee Han-young, a combination of these adjectives. Just as you study like the top student in your school, how great would it be if you could invest like the top fund manager in Korea? "Find the Best Stock of the Era" is a book that summarizes the study and investment methods that the author has consistently adhered to for 17 years, from when he was a new employee to when he rose to his current position. It very kindly teaches how to study the flow of money and invest in the "best stocks" in industries where money is concentrated. Looking back, Samsung Electronics rose significantly during the IT bubble era in the late 1990s, POSCO during the emerging market growth era in the 2000s, and CJ during the Chinese consumption era in the mid-2010s. All three stocks were leading stocks representing their respective eras. The author clearly shows how to find the 'best stocks of the era' by covering both top-down and bottom-up approaches. American fund manager Peter Lynch called stocks that yield returns ten times the investment amount a "ten bagger." Ten Bagger was born from the "leading stocks of the times," which always lead the times. Since industries that lead the times always exist, it is possible to make large profits regardless of the fluctuations in market indices like KOSPI. |

- You can preview some of the book's contents.

Preview

index

Recommendation

Introduction | The goal of stock investing is not unrequited love, but return.

Part 1

If you're unsure whether to buy something, don't buy it.

Mentally prepared to invest

01 The Royal Road to Stock Investment: Study! Study! Study!

02 Establish your own unwavering investment principles

03 Flexible thinking increases your chances of success.

04 Let's make a comfortable investment

05 Let's create a 'stock-trading brain'

06 Stock prices are not expressed as 'cheap' or 'expensive'.

07 Let's think about it for one more minute

08 Information Flood: Let's Cover It Again

09 Stocks are a lonely fight.

10 Investment Routines That Drive Your Investment

Part 2

"Find the best of the era"

Judging the Stock Market: A Top-Down Approach

11 Stock Investing: Keep It Simple

12 Stand at the inflection point where the flow of money changes.

13. Let's figure out Korea's location.

14 Verification with the Buffett Index

The secret to a 10x return is the "#1 stock of the era."

16 Reasons to Buy First-Class Stocks

17 Find industries that will grow now with past data.

18 Growth Rate 0% → 'New Industry' Growing Infinitely

19 Overcoming stagnation in leading stocks with alternative stocks

Knowing the 20 cycle reveals the timing for profit taking.

21 A map of the industry's value chain that you can use for a lifetime with just one study.

Let's check the performance in January, April, July, and November.

23. A 'Sector Rotation Strategy' Based on Performance

24 Find the stimulating momentum

25. Developing an Eye for the Market: The Rapidly Changing Stock Market

26 All stocks move within the market.

27 Current market conditions in Korea as seen through KOSPI

28 How high can KOSPI go?

29 Set realistic expected returns.

Part 3

Find the key factors that determine stock prices.

How to Study Business: A Bottom-Up Approach

30 Write a business analysis report

31 Knowing the company's history and history reveals its future.

There are 32 key factors that determine stock prices.

33. Buying and selling is easy when circulation is good.

34 Is capital fluctuation good or bad news?

Let's understand growth potential through performance by business unit.

Prepare for various situations with 36 future scenarios.

37 Valuation is only a means to set a target price.

Systematic profit realization is possible simply by understanding PER and PBR.

39 There are two choices: buy or sell.

40 If you're still afraid, 'Infinite Repetition' is the answer.

Outgoing Post | My Study Method, Consistent for 17 Years

Appendix | Corporate Report at a Glance

Introduction | The goal of stock investing is not unrequited love, but return.

Part 1

If you're unsure whether to buy something, don't buy it.

Mentally prepared to invest

01 The Royal Road to Stock Investment: Study! Study! Study!

02 Establish your own unwavering investment principles

03 Flexible thinking increases your chances of success.

04 Let's make a comfortable investment

05 Let's create a 'stock-trading brain'

06 Stock prices are not expressed as 'cheap' or 'expensive'.

07 Let's think about it for one more minute

08 Information Flood: Let's Cover It Again

09 Stocks are a lonely fight.

10 Investment Routines That Drive Your Investment

Part 2

"Find the best of the era"

Judging the Stock Market: A Top-Down Approach

11 Stock Investing: Keep It Simple

12 Stand at the inflection point where the flow of money changes.

13. Let's figure out Korea's location.

14 Verification with the Buffett Index

The secret to a 10x return is the "#1 stock of the era."

16 Reasons to Buy First-Class Stocks

17 Find industries that will grow now with past data.

18 Growth Rate 0% → 'New Industry' Growing Infinitely

19 Overcoming stagnation in leading stocks with alternative stocks

Knowing the 20 cycle reveals the timing for profit taking.

21 A map of the industry's value chain that you can use for a lifetime with just one study.

Let's check the performance in January, April, July, and November.

23. A 'Sector Rotation Strategy' Based on Performance

24 Find the stimulating momentum

25. Developing an Eye for the Market: The Rapidly Changing Stock Market

26 All stocks move within the market.

27 Current market conditions in Korea as seen through KOSPI

28 How high can KOSPI go?

29 Set realistic expected returns.

Part 3

Find the key factors that determine stock prices.

How to Study Business: A Bottom-Up Approach

30 Write a business analysis report

31 Knowing the company's history and history reveals its future.

There are 32 key factors that determine stock prices.

33. Buying and selling is easy when circulation is good.

34 Is capital fluctuation good or bad news?

Let's understand growth potential through performance by business unit.

Prepare for various situations with 36 future scenarios.

37 Valuation is only a means to set a target price.

Systematic profit realization is possible simply by understanding PER and PBR.

39 There are two choices: buy or sell.

40 If you're still afraid, 'Infinite Repetition' is the answer.

Outgoing Post | My Study Method, Consistent for 17 Years

Appendix | Corporate Report at a Glance

Detailed image

Into the book

If you study stocks properly just once, you can use it for the rest of your life.

Because businesses don't change as 'quickly' or 'as much' as you might think.

Therefore, if you properly analyze and understand the company from the beginning, you only need to continuously update the changes from then on.

If you have just 10 companies that you understand well, you will have no problem generating stable profits for a lifetime.

I can say this confidently from experience, and I am actually studying it right now.

--- p.19

Once we've completed our studies, we can make quick and accurate decisions about buying and selling, and even time our purchases and sales accordingly.

In other words, your own judgment increases the probability of a successful investment.

--- p.22

The first thing we need to figure out is where our money is going.

But as I talk, I see investors who have no interest in or intention to figure out where their money is going.

Often, people are simply interested in the question, “So what should I buy?”

As mentioned earlier, investors cannot establish criteria for judgment just by hearing this.

I said that we should first find out where the money is going because only by understanding the trend can we know whether a stock will be a good one or a bad one no matter what stock we hear about.

--- p.85

If we grasp this flow earlier, we will be able to play in the so-called 'field of possibility'.

It goes without saying, but in an industry where it's possible, if you get it right, you'll hit the jackpot, and even if you don't, you'll likely break even.

When an industry is booming and recognized as a growth industry, prices rise sharply and trend upward, but when the boom period ends, prices fall sharply or trend downward.

--- pp.111~112

These cases shown in the graph are meaningful because they are all representative stocks from different industries.

This data clearly shows that when the times are right, even large stocks like this can rise easily like individual stocks, and when the times are wrong, the market pays no attention.

It shows what kind of results can be achieved by riding the wave of the times and buying leading stocks in promising industries.

--- p.113

When buying stocks, it is right to buy them if you know what the leading stock is.

Nonetheless, many investors feel burdened by the growth rate and price per share (absolute price) of major stocks, and make the mistake of buying second-tier stocks or stocks with lower price per share in the same industry.

Just as it is right to buy the right product at once, let's invest in stocks in the same way.

--- p.119

By understanding the company's history and stock price trends since listing, you can identify key factors in the stock price, as well as the number of tradable and dilutable shares, as well as the shareholder status, and you can get a rough idea of the stock's DNA.

In fact, this is enough to observe the stock price trend and update the business contents.

--- p.233

By understanding a company's history and business structure, assessing its performance and growth potential, and determining an appropriate valuation based on these factors, and even setting a clear target price, you can increase the accuracy of your investments.

So, I hope you stop investing in things you don't even know the source of, and instead, try making your own analysis and judgment the basis for your investments.

If you diligently practice the process of making the final decision to buy or sell every day, you will gradually gain confidence.

If you repeat the above process endlessly, you will naturally be investing in the best stocks of the era without even realizing it, and you will be securing stable returns despite the sharp fluctuations in the index.

Because businesses don't change as 'quickly' or 'as much' as you might think.

Therefore, if you properly analyze and understand the company from the beginning, you only need to continuously update the changes from then on.

If you have just 10 companies that you understand well, you will have no problem generating stable profits for a lifetime.

I can say this confidently from experience, and I am actually studying it right now.

--- p.19

Once we've completed our studies, we can make quick and accurate decisions about buying and selling, and even time our purchases and sales accordingly.

In other words, your own judgment increases the probability of a successful investment.

--- p.22

The first thing we need to figure out is where our money is going.

But as I talk, I see investors who have no interest in or intention to figure out where their money is going.

Often, people are simply interested in the question, “So what should I buy?”

As mentioned earlier, investors cannot establish criteria for judgment just by hearing this.

I said that we should first find out where the money is going because only by understanding the trend can we know whether a stock will be a good one or a bad one no matter what stock we hear about.

--- p.85

If we grasp this flow earlier, we will be able to play in the so-called 'field of possibility'.

It goes without saying, but in an industry where it's possible, if you get it right, you'll hit the jackpot, and even if you don't, you'll likely break even.

When an industry is booming and recognized as a growth industry, prices rise sharply and trend upward, but when the boom period ends, prices fall sharply or trend downward.

--- pp.111~112

These cases shown in the graph are meaningful because they are all representative stocks from different industries.

This data clearly shows that when the times are right, even large stocks like this can rise easily like individual stocks, and when the times are wrong, the market pays no attention.

It shows what kind of results can be achieved by riding the wave of the times and buying leading stocks in promising industries.

--- p.113

When buying stocks, it is right to buy them if you know what the leading stock is.

Nonetheless, many investors feel burdened by the growth rate and price per share (absolute price) of major stocks, and make the mistake of buying second-tier stocks or stocks with lower price per share in the same industry.

Just as it is right to buy the right product at once, let's invest in stocks in the same way.

--- p.119

By understanding the company's history and stock price trends since listing, you can identify key factors in the stock price, as well as the number of tradable and dilutable shares, as well as the shareholder status, and you can get a rough idea of the stock's DNA.

In fact, this is enough to observe the stock price trend and update the business contents.

--- p.233

By understanding a company's history and business structure, assessing its performance and growth potential, and determining an appropriate valuation based on these factors, and even setting a clear target price, you can increase the accuracy of your investments.

So, I hope you stop investing in things you don't even know the source of, and instead, try making your own analysis and judgment the basis for your investments.

If you diligently practice the process of making the final decision to buy or sell every day, you will gradually gain confidence.

If you repeat the above process endlessly, you will naturally be investing in the best stocks of the era without even realizing it, and you will be securing stable returns despite the sharp fluctuations in the index.

--- pp.269~270

Publisher's Review

“Say goodbye to stocks that won’t rise!”

A personalized investment guide for beginner investors who see prices fall when buying and rise when selling.

The second half of 2020 was Samsung Electronics' era.

The stock price, which was in the 60,000 won range, soared to 90,000 won in two months, and investors painted a rosy picture of a future where they shouted, "100,000 won."

However, from then on, stock prices did not rise significantly and instead only bottomed out. The situation was the same even when materials and industrial materials companies such as POSCO, S-Oil, and Lotte Chemical renewed their historic highs in the first half of 2021.

This was an example that showed that no matter how well a large-cap stock is doing, it cannot attract the market's attention if it does not follow the main trend.

The high returns achieved by SK Innovation, Kakao, and Samsung Electronics in 2020 were all the result of properly aligning with this trend.

Industries such as secondary batteries, platforms, and semiconductors took turns leading the market, and the top stocks representing each industry generated significant profits.

If you press the buy button too late without knowing this background, you will end up being caught at the end of the bull market.

Therefore, to achieve dramatic profit margins, you must first understand what a 'rising industry' is.

The news is full of stories about historic highs, but my account balance remains the same because I don't know where my money is going.

If you focus only on the rising and falling stock prices without seeing the bigger picture, you will experience a disjointed investment experience where the price falls when you buy and rises when you sell.

“Stand at the inflection point where the flow of money changes!”

The Power of "No. 1 Stocks" That Beginner Investors Often Overlook

His ability to maintain his position as the top fund manager in the highly volatile domestic stock market was as much due to his accurate and clear investment insights as his outstanding performance.

Since the market atmosphere changes every year, achieving the highest return for two consecutive years means that you can accurately identify the flow of money and trends and employ various strategies accordingly.

To illustrate market movements, the author used a top-down, bottom-up approach.

This method involves using a top-down approach to understand how the market environment will change and which industries are attracting money. Then, using a bottom-up approach, we thoroughly examine the company's history, performance, and growth potential to identify promising companies worthy of investment.

At the intersection of these two approaches, the 'No. 1 stock of the era' is born.

You don't need to study the entire macroeconomy to understand the flow of money.

For busy individual investors, we've selected only the essential data, and included the indicators and formats the author uses in practice.

Just knowing this much will allow you to determine whether money will flow to developed countries or emerging countries, or whether it will flow to growth industries or value stocks.

If you look at the flow from the past to the present, you will naturally get a sense of which industries you should keep an eye on next.

It's not difficult to pick the best stock.

This is because the top companies are large companies that we already know or where our acquaintances work.

Just as history repeats itself, the company's history is likely to repeat itself, and news and analysis data are readily available.

In fact, if you have studied just 10 companies in depth, you will have no trouble investing in them for the rest of your life.

This book provides detailed information on practical trading techniques that beginner investors often overlook, such as identifying key factors that influence stock prices, assessing a company's direction based on performance by division, and other basic business analysis methods. It also covers avoiding risk through the number of shares available for trading, setting target prices using valuation, and developing responsiveness through future scenarios.

"Even VIP funds worth hundreds of billions of won invest this way."

A method to study properly once and use it for life

Author Lee Han-young is a private equity fund manager who manages the investment funds of 49 or fewer minority investors.

As the number of participants is limited, only investors who meet a certain standard can participate, making it a popular investment destination for VIPs, with investment amounts reaching hundreds of billions of won.

This book contains the author's extensive know-how acquired as a 'manager' who manages funds and a 'technician' who conducts actual trading with clients' money.

This book also includes valuable tips that active investors should definitely try, such as how to switch sectors when the flow of money changes, how to profit from alternative stocks when leading stocks are at a standstill, how to systematically realize profits, and how to capture extra profits through the value chain.

The 'Corporate Report at a Glance' provided as an appendix is a copy of what author Lee Han-young wrote himself in the past.

Let's study properly just once by organizing what we learned from the book into this format.

Because companies don't change much over the years, systematic analysis like this will serve as valuable investment data that you can refer to throughout your life.

A personalized investment guide for beginner investors who see prices fall when buying and rise when selling.

The second half of 2020 was Samsung Electronics' era.

The stock price, which was in the 60,000 won range, soared to 90,000 won in two months, and investors painted a rosy picture of a future where they shouted, "100,000 won."

However, from then on, stock prices did not rise significantly and instead only bottomed out. The situation was the same even when materials and industrial materials companies such as POSCO, S-Oil, and Lotte Chemical renewed their historic highs in the first half of 2021.

This was an example that showed that no matter how well a large-cap stock is doing, it cannot attract the market's attention if it does not follow the main trend.

The high returns achieved by SK Innovation, Kakao, and Samsung Electronics in 2020 were all the result of properly aligning with this trend.

Industries such as secondary batteries, platforms, and semiconductors took turns leading the market, and the top stocks representing each industry generated significant profits.

If you press the buy button too late without knowing this background, you will end up being caught at the end of the bull market.

Therefore, to achieve dramatic profit margins, you must first understand what a 'rising industry' is.

The news is full of stories about historic highs, but my account balance remains the same because I don't know where my money is going.

If you focus only on the rising and falling stock prices without seeing the bigger picture, you will experience a disjointed investment experience where the price falls when you buy and rises when you sell.

“Stand at the inflection point where the flow of money changes!”

The Power of "No. 1 Stocks" That Beginner Investors Often Overlook

His ability to maintain his position as the top fund manager in the highly volatile domestic stock market was as much due to his accurate and clear investment insights as his outstanding performance.

Since the market atmosphere changes every year, achieving the highest return for two consecutive years means that you can accurately identify the flow of money and trends and employ various strategies accordingly.

To illustrate market movements, the author used a top-down, bottom-up approach.

This method involves using a top-down approach to understand how the market environment will change and which industries are attracting money. Then, using a bottom-up approach, we thoroughly examine the company's history, performance, and growth potential to identify promising companies worthy of investment.

At the intersection of these two approaches, the 'No. 1 stock of the era' is born.

You don't need to study the entire macroeconomy to understand the flow of money.

For busy individual investors, we've selected only the essential data, and included the indicators and formats the author uses in practice.

Just knowing this much will allow you to determine whether money will flow to developed countries or emerging countries, or whether it will flow to growth industries or value stocks.

If you look at the flow from the past to the present, you will naturally get a sense of which industries you should keep an eye on next.

It's not difficult to pick the best stock.

This is because the top companies are large companies that we already know or where our acquaintances work.

Just as history repeats itself, the company's history is likely to repeat itself, and news and analysis data are readily available.

In fact, if you have studied just 10 companies in depth, you will have no trouble investing in them for the rest of your life.

This book provides detailed information on practical trading techniques that beginner investors often overlook, such as identifying key factors that influence stock prices, assessing a company's direction based on performance by division, and other basic business analysis methods. It also covers avoiding risk through the number of shares available for trading, setting target prices using valuation, and developing responsiveness through future scenarios.

"Even VIP funds worth hundreds of billions of won invest this way."

A method to study properly once and use it for life

Author Lee Han-young is a private equity fund manager who manages the investment funds of 49 or fewer minority investors.

As the number of participants is limited, only investors who meet a certain standard can participate, making it a popular investment destination for VIPs, with investment amounts reaching hundreds of billions of won.

This book contains the author's extensive know-how acquired as a 'manager' who manages funds and a 'technician' who conducts actual trading with clients' money.

This book also includes valuable tips that active investors should definitely try, such as how to switch sectors when the flow of money changes, how to profit from alternative stocks when leading stocks are at a standstill, how to systematically realize profits, and how to capture extra profits through the value chain.

The 'Corporate Report at a Glance' provided as an appendix is a copy of what author Lee Han-young wrote himself in the past.

Let's study properly just once by organizing what we learned from the book into this format.

Because companies don't change much over the years, systematic analysis like this will serve as valuable investment data that you can refer to throughout your life.

GOODS SPECIFICS

- Date of issue: September 3, 2021

- Page count, weight, size: 296 pages | 502g | 152*210*20mm

- ISBN13: 9791190977371

- ISBN10: 1190977370

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)