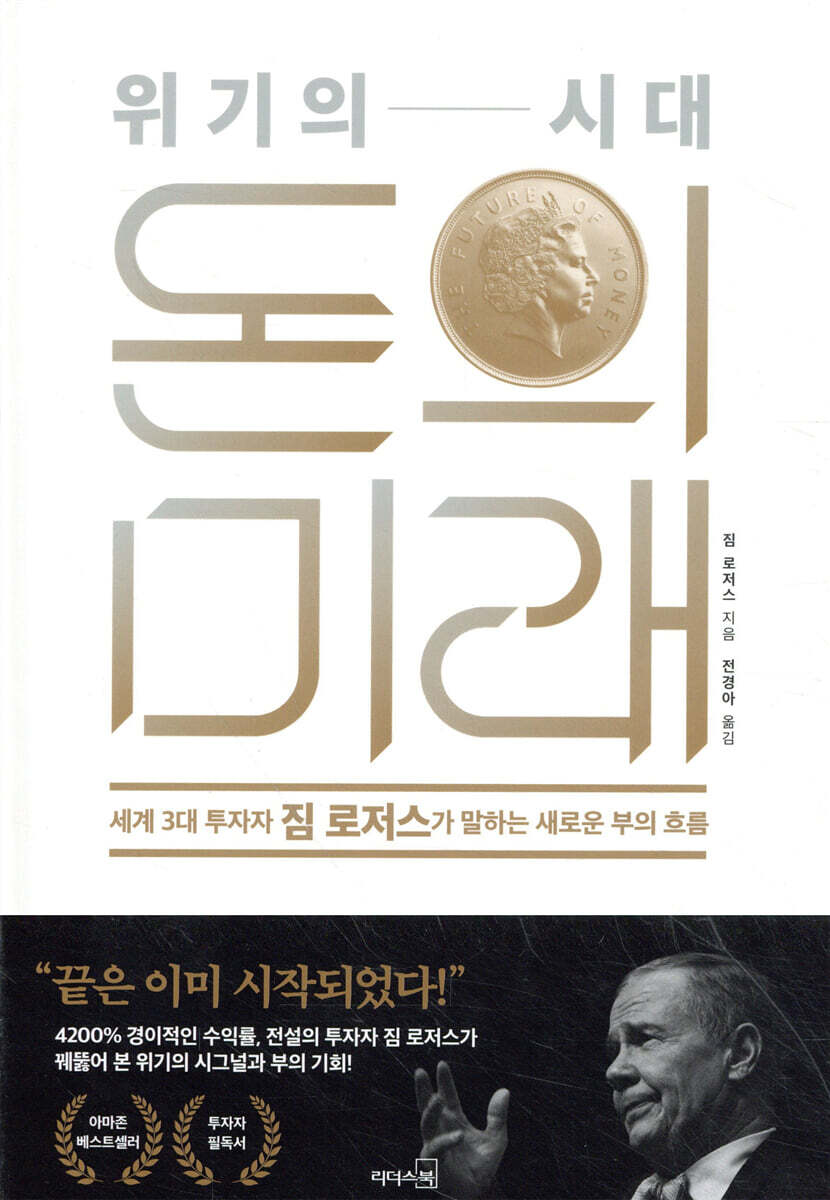

The Future of Money in Times of Crisis

|

Description

Book Introduction

- A word from MD

-

His solution: 4200% returns over 10 yearsJim Rogers is a legendary investor who predicted major economic crises, including the dot-com bubble and the subprime mortgage crisis.

He has warned of a massive economic downturn that would surpass the last global financial crisis.

His perspective on the signs of an economic downturn goes beyond survival, but instead focuses on offering investment solutions that create new opportunities.

December 1, 2020. Economics and Management PD Kang Min-ji

“The end has already begun!

What should we focus on and how will we survive?

A phenomenal 4200% return,

Legendary investor Jim Rogers saw through it

Signals of Crisis and Opportunities for Wealth

Amazon Bestseller

A must-read for Donghak ants

Jim Rogers, who has been called one of the world's top three investors, achieved an astonishing 4200% return over 10 years.

He has garnered market attention for accurately predicting economic crises that have swept the world, including Black Monday in 1987, the dot-com bubble in the early 2000s, and the subprime mortgage crisis in 2007.

While everyone was intoxicated by the apparent boom, he used his unique analytical skills to detect the crisis ahead of time, and thanks to this, he was able to record astonishing returns even when the market hit bottom.

Now Jim Rogers warns in a firm voice, “This is going to be the worst crisis of my lifetime.”

The global boom that has lasted more than a decade is coming to an end, and the recession caused by the coronavirus outbreak is just the beginning.

Indeed, as governments around the world struggle to stimulate their economies, spending trillions of dollars, the massive liquidity released into the market is flocking to stocks and real estate like moths to a flame.

In a global economic environment expected to experience extreme turmoil, what will the future of money hold? What strategies can we use to anticipate impending dangers and survive even the worst-case scenario? The cool-headed insights of an investment guru who has weathered 50 years of ups and downs, establishing himself as a legend, will serve as the ultimate guide to deciphering the flow of wealth at a turning point.

What should we focus on and how will we survive?

A phenomenal 4200% return,

Legendary investor Jim Rogers saw through it

Signals of Crisis and Opportunities for Wealth

Amazon Bestseller

A must-read for Donghak ants

Jim Rogers, who has been called one of the world's top three investors, achieved an astonishing 4200% return over 10 years.

He has garnered market attention for accurately predicting economic crises that have swept the world, including Black Monday in 1987, the dot-com bubble in the early 2000s, and the subprime mortgage crisis in 2007.

While everyone was intoxicated by the apparent boom, he used his unique analytical skills to detect the crisis ahead of time, and thanks to this, he was able to record astonishing returns even when the market hit bottom.

Now Jim Rogers warns in a firm voice, “This is going to be the worst crisis of my lifetime.”

The global boom that has lasted more than a decade is coming to an end, and the recession caused by the coronavirus outbreak is just the beginning.

Indeed, as governments around the world struggle to stimulate their economies, spending trillions of dollars, the massive liquidity released into the market is flocking to stocks and real estate like moths to a flame.

In a global economic environment expected to experience extreme turmoil, what will the future of money hold? What strategies can we use to anticipate impending dangers and survive even the worst-case scenario? The cool-headed insights of an investment guru who has weathered 50 years of ups and downs, establishing himself as a legend, will serve as the ultimate guide to deciphering the flow of wealth at a turning point.

- You can preview some of the book's contents.

Preview

index

PART 1.

Signs of a burgeoning crisis

Optimism that has dominated the world for a decade

Bubbles eventually burst | Signs of crisis appear everywhere

The reality of the faltering economies of major economies

India, the world's second most populous nation, is experiencing a recession. China, once the world's savior, has become a debtor.

The United States, the world's largest 'deficit country'

Read the signs of crisis that appear around you.

Accelerating quantitative easing policy

Central banks around the world are buying bonds and ETFs | Snowballing fiscal deficits

There are no winners in a trade war.

Economic crisis: The trigger for war | There has never been a problem-free era.

PART 2.

What Past Crises Teach Us

What 1929 tells us

No wise man can stop a crisis | The Great Depression spreads across the globe in an instant

People who made a lot of money during the crisis

The biggest victims of the crisis are the middle class.

People Seeking an Outlet for Their Anger | Crisis Creates a New System

What I learned from losing everything

How I Could Predict Black Monday

The Nixon Shock | All bubbles follow the same trajectory.

The shockwaves of the recession could be even bigger this time.

How did Japan, once successful, fall into decline?

Chapter 3.

How to survive

Investing begins by challenging common sense.

15 years, a turning point for change

A wise investor doesn't make hasty moves.

The best timing is when everyone else fails.

An asset you must have in a crisis

What Should Businesses Do When the Waves Rise?

Don't assume that what the majority believes is right.

Opportunities arise in the face of disaster.

The Secret to a 100x Return on Lockheed Stock

Investing during a recession should be completely different from investing during a boom.

Figure out what's happening 'now'

Chapter 4.

The Absolute Rules for Successful Investing

Pay attention to the 'cycle' of financial statements.

If you invest without knowing, you will definitely fail.

You have to know what you're doing

Investing Wisdom from the Greats

Distinguish between what you know and what you don't know: Confucius | You can't beat a person who studies: Plato

If you fail forty times, you can succeed three times.

How to Spot a Crucial Opportunity

There is no right answer, but you need your own style.

A few lessons about money

One, don't interfere with other people's decisions. Two, don't rely on other people's money. Three, know how to spend it wisely.

Don't rely on one source

If you want your children to be rich

Only the prepared catch the lucky ones.

Chapter 5.

The Time of the Investment Master

A six-year-old boy selling peanuts

A childhood where I wanted to be free

A country bumpkin who went to Yale

The farther you go, the more you learn

Towards a wider world, to Oxford

Taking your first steps on Wall Street

Founding the Quantum Fund with George Soros

The foundation that created the best investors

Not giving up

Chapter 6.

Where is the world going?

The American Crisis and the 2020 Presidential Election

Britain shakes in the face of Brexit

Brexit threatens the UK's disintegration | Will EU withdrawal lead to a domino effect?

The endangered status of financial hubs

The Swiss franc, controlled by Google and Amazon

The global economic hegemony is shifting eastward.

The Paradox of One-Party Dictatorship and Prosperity

The Transformation of China and Russia, the Communist Bloc's Leading Players | The Key to Growth: 'Openness'

Why Russian Farmers Are Thanking Trump

China's Belt and Road Initiative Overlooks Africa

China's Influence Expands in Africa | The Secret Behind Its Strange Borders |

How Africa's Transportation Infrastructure Will Change the World's Geography

Hong Kong's Future: Political Instability

Why India's Future Is So Bleak

Turn your eyes to where new opportunities lie.

The Korean Peninsula: A Region with Huge Growth Potential | Rising Russia, Developing Vladivostok

Declining vs. Prosperous Countries

Social Reasons Why America Is Inevitably Declining

The world may change, but human nature remains the same.

Where will the next battlefield be?

Chapter 7.

A smart investor questions common sense.

The Traps of National Events and Economic Stimulus

Beware of baseless enthusiasm

Education needed in an era of great transformation

America's Colleges in Crisis | The Education System Is Rapidly Moving Online | Don't Waste Your Life on an MBA

Their own feast, divorced from reality

There is no such thing as a free lunch.

Pay attention to the hype surrounding the "second Silicon Valley."

Gather news from around the world through various channels.

China is breaking the laws of history

Anyway, the cat just has to catch mice.

The Rising Status of Women in Asia

The cannabis market that no one paid attention to

Marijuana Legalization and the Emergence of New Investment Ventures

What We're Missing from Blockchain

Words of advice

Beware of blind investing

Editor's Note

Signs of a burgeoning crisis

Optimism that has dominated the world for a decade

Bubbles eventually burst | Signs of crisis appear everywhere

The reality of the faltering economies of major economies

India, the world's second most populous nation, is experiencing a recession. China, once the world's savior, has become a debtor.

The United States, the world's largest 'deficit country'

Read the signs of crisis that appear around you.

Accelerating quantitative easing policy

Central banks around the world are buying bonds and ETFs | Snowballing fiscal deficits

There are no winners in a trade war.

Economic crisis: The trigger for war | There has never been a problem-free era.

PART 2.

What Past Crises Teach Us

What 1929 tells us

No wise man can stop a crisis | The Great Depression spreads across the globe in an instant

People who made a lot of money during the crisis

The biggest victims of the crisis are the middle class.

People Seeking an Outlet for Their Anger | Crisis Creates a New System

What I learned from losing everything

How I Could Predict Black Monday

The Nixon Shock | All bubbles follow the same trajectory.

The shockwaves of the recession could be even bigger this time.

How did Japan, once successful, fall into decline?

Chapter 3.

How to survive

Investing begins by challenging common sense.

15 years, a turning point for change

A wise investor doesn't make hasty moves.

The best timing is when everyone else fails.

An asset you must have in a crisis

What Should Businesses Do When the Waves Rise?

Don't assume that what the majority believes is right.

Opportunities arise in the face of disaster.

The Secret to a 100x Return on Lockheed Stock

Investing during a recession should be completely different from investing during a boom.

Figure out what's happening 'now'

Chapter 4.

The Absolute Rules for Successful Investing

Pay attention to the 'cycle' of financial statements.

If you invest without knowing, you will definitely fail.

You have to know what you're doing

Investing Wisdom from the Greats

Distinguish between what you know and what you don't know: Confucius | You can't beat a person who studies: Plato

If you fail forty times, you can succeed three times.

How to Spot a Crucial Opportunity

There is no right answer, but you need your own style.

A few lessons about money

One, don't interfere with other people's decisions. Two, don't rely on other people's money. Three, know how to spend it wisely.

Don't rely on one source

If you want your children to be rich

Only the prepared catch the lucky ones.

Chapter 5.

The Time of the Investment Master

A six-year-old boy selling peanuts

A childhood where I wanted to be free

A country bumpkin who went to Yale

The farther you go, the more you learn

Towards a wider world, to Oxford

Taking your first steps on Wall Street

Founding the Quantum Fund with George Soros

The foundation that created the best investors

Not giving up

Chapter 6.

Where is the world going?

The American Crisis and the 2020 Presidential Election

Britain shakes in the face of Brexit

Brexit threatens the UK's disintegration | Will EU withdrawal lead to a domino effect?

The endangered status of financial hubs

The Swiss franc, controlled by Google and Amazon

The global economic hegemony is shifting eastward.

The Paradox of One-Party Dictatorship and Prosperity

The Transformation of China and Russia, the Communist Bloc's Leading Players | The Key to Growth: 'Openness'

Why Russian Farmers Are Thanking Trump

China's Belt and Road Initiative Overlooks Africa

China's Influence Expands in Africa | The Secret Behind Its Strange Borders |

How Africa's Transportation Infrastructure Will Change the World's Geography

Hong Kong's Future: Political Instability

Why India's Future Is So Bleak

Turn your eyes to where new opportunities lie.

The Korean Peninsula: A Region with Huge Growth Potential | Rising Russia, Developing Vladivostok

Declining vs. Prosperous Countries

Social Reasons Why America Is Inevitably Declining

The world may change, but human nature remains the same.

Where will the next battlefield be?

Chapter 7.

A smart investor questions common sense.

The Traps of National Events and Economic Stimulus

Beware of baseless enthusiasm

Education needed in an era of great transformation

America's Colleges in Crisis | The Education System Is Rapidly Moving Online | Don't Waste Your Life on an MBA

Their own feast, divorced from reality

There is no such thing as a free lunch.

Pay attention to the hype surrounding the "second Silicon Valley."

Gather news from around the world through various channels.

China is breaking the laws of history

Anyway, the cat just has to catch mice.

The Rising Status of Women in Asia

The cannabis market that no one paid attention to

Marijuana Legalization and the Emergence of New Investment Ventures

What We're Missing from Blockchain

Words of advice

Beware of blind investing

Editor's Note

Detailed image

Into the book

Since 2019, I have been warning that a crisis of a magnitude far surpassing the global financial crisis of 2008 is imminent.

That crisis is about to begin.

What I want to emphasize is that the coronavirus is just the beginning.

In fact, the economic crisis has been showing signs of occurring for some time.

--- p.4

In the 12 years since the Lehman Brothers collapse in 2008, stock prices have risen around the world.

Historically, it is extremely unusual for stock prices to rise steadily for over 10 years.

But at the same time that the stock market was booming, the national debt also increased.

As always, too much debt causes serious problems.

There are several countries that stand out with serious fiscal problems due to excessive debt.

--- p.6

If you only had twenty investments to make in your life, you would be very cautious about investing.

Just because you hear something that sounds appealing about making money doesn't mean you'll jump in blindly or rely on other people's information.

If you haven't discovered anything with your own eyes, it's better to stay in the world you know and not invest anywhere.

--- p.76

I too have had experiences where I made great profits when I thought it was a crisis.

It was 1973, when I co-founded the Quantum Fund with George Soros.

At the time, the market was dominated by the expectation that the US defense budget would decrease significantly with the end of the Vietnam War, which put the US defense industry in a state of existential crisis.

Defense industry stocks plummeted, with Lockheed, the industry's biggest player, trading at just $2.

At the time, Lockheed was virtually bankrupt, carrying a huge amount of debt and requiring loan guarantees from the U.S. government.

It was a situation where everyone thought investing in Lockheed was crazy.

--- p.90

It is no exaggeration to say that the current Swiss franc is being protected by Google and Amazon.

The Swiss central bank has been buying large amounts of stock in U.S. companies, particularly those of tech giants like Google, Amazon, and Microsoft.

As of 2019, the Swiss National Bank reportedly held 2,507 holdings of U.S. stocks worth approximately $91.2 billion, with IT companies among its top holdings.

Because it is extremely rare for a central bank to buy individual stocks, the Swiss National Bank's moves have drawn considerable attention.

--- p.162

In the future, I believe that Shenzhen in Guangdong Province, China, will become a new center of innovation and become increasingly prominent.

Bangalore, India and Tel Aviv, Israel are also emerging innovative cities.

But Tel Aviv faces geopolitical risks.

The weakness is that it is located in the middle of an area that could become a battlefield.

Moreover, the political tensions in geographically close Hong Kong are something Shenzhen can applaud.

Moreover, I believe that Shenzhen possesses both the strengths of hardware production and the software that other regions boast, making it a two-wheeled innovation hub.

For this reason, if I had to pick just one candidate for future innovation, I would choose Shenzhen.

That crisis is about to begin.

What I want to emphasize is that the coronavirus is just the beginning.

In fact, the economic crisis has been showing signs of occurring for some time.

--- p.4

In the 12 years since the Lehman Brothers collapse in 2008, stock prices have risen around the world.

Historically, it is extremely unusual for stock prices to rise steadily for over 10 years.

But at the same time that the stock market was booming, the national debt also increased.

As always, too much debt causes serious problems.

There are several countries that stand out with serious fiscal problems due to excessive debt.

--- p.6

If you only had twenty investments to make in your life, you would be very cautious about investing.

Just because you hear something that sounds appealing about making money doesn't mean you'll jump in blindly or rely on other people's information.

If you haven't discovered anything with your own eyes, it's better to stay in the world you know and not invest anywhere.

--- p.76

I too have had experiences where I made great profits when I thought it was a crisis.

It was 1973, when I co-founded the Quantum Fund with George Soros.

At the time, the market was dominated by the expectation that the US defense budget would decrease significantly with the end of the Vietnam War, which put the US defense industry in a state of existential crisis.

Defense industry stocks plummeted, with Lockheed, the industry's biggest player, trading at just $2.

At the time, Lockheed was virtually bankrupt, carrying a huge amount of debt and requiring loan guarantees from the U.S. government.

It was a situation where everyone thought investing in Lockheed was crazy.

--- p.90

It is no exaggeration to say that the current Swiss franc is being protected by Google and Amazon.

The Swiss central bank has been buying large amounts of stock in U.S. companies, particularly those of tech giants like Google, Amazon, and Microsoft.

As of 2019, the Swiss National Bank reportedly held 2,507 holdings of U.S. stocks worth approximately $91.2 billion, with IT companies among its top holdings.

Because it is extremely rare for a central bank to buy individual stocks, the Swiss National Bank's moves have drawn considerable attention.

--- p.162

In the future, I believe that Shenzhen in Guangdong Province, China, will become a new center of innovation and become increasingly prominent.

Bangalore, India and Tel Aviv, Israel are also emerging innovative cities.

But Tel Aviv faces geopolitical risks.

The weakness is that it is located in the middle of an area that could become a battlefield.

Moreover, the political tensions in geographically close Hong Kong are something Shenzhen can applaud.

Moreover, I believe that Shenzhen possesses both the strengths of hardware production and the software that other regions boast, making it a two-wheeled innovation hub.

For this reason, if I had to pick just one candidate for future innovation, I would choose Shenzhen.

--- p.227

Publisher's Review

“The worst crisis that will surpass all previous recessions is coming!”

Jim Rogers, one of the world's top three investors, is paying attention.

Signs of a Global Economic Crisis

“The global economic boom that has lasted for 11 years since 2008 is about to come to an end.”

In 2020, the global economy suddenly went into a state of crisis, and people were gripped by fear.

The spread of the coronavirus has halted international travel and trade, and the real economy has begun to freeze.

Governments around the world are attempting the largest stimulus packages in history, but the future of the global economy remains bleak.

While many believe this global recession was caused by an unexpected pandemic, legendary Wall Street investor Jim Rogers sees things differently.

He has been warning since early 2019 that a recession worse than the last global financial crisis is coming.

The coronavirus has merely brought that point forward; the "bubble trajectory" was already evident across the global economy before the pandemic.

He cites two signals as evidence for this.

The first is the ‘signs of crisis’ that have appeared historically.

There were common phenomena during past global economic crises, such as the Great Depression of 1929, Black Monday of 1987, and the global financial crisis of 2008.

Stock and real estate prices were rising sharply even before the stock market crash, corporate bankruptcies, and mass unemployment began to appear in earnest.

Seeing the resulting 'fake boom' and the 'all-time highs' being renewed every day, people, without exception, rushed into the market.

And this is strikingly similar to the current situation.

The second sign of a crisis is the 'fiscal deficit'.

Since 2008, governments around the world have been printing, borrowing, and spending trillions of dollars.

The United States has incurred the most debt in its history over the past six months, and even China, which served as the world economy's white knight during the 2008 global financial crisis, is seeing its national debt skyrocket.

Looking behind the scenes, even banks in Europe, including Deutsche Bank, Germany's largest private bank known for its strong finances, have been in bad shape since 2017.

If we look at the situations that are occurring in succession in various countries around the world, including India, Brazil, Argentina, Indonesia, and Turkey, we can clearly see the reality of the crisis that Rogers speaks of.

Achieved 4200% returns over 10 years!

What is the survival strategy of an investment guru who shines even brighter in times of crisis?

So, what should ordinary individuals keep in mind and how should they prepare to survive in this volatile economic environment? Rogers, an active investor for over 50 years on Wall Street, a gathering place for prominent investors, shares in detail the secrets of his remarkable returns.

The private equity fund he founded with George Soros, Quantum Fund, recorded an astonishing return of 4200%, while the S&P recorded a return of 47%.

This is why he is nicknamed the "Legendary Investor" on Wall Street.

Having experienced several major economic crises and changes in the world, Rogers emphasizes that investing during a recession should be completely different from investing during a boom.

In fact, he is an investor who shines even more in times of crisis.

At a time when the military industry was considered to be a thing of the past, he boldly purchased Lockheed Martin stock despite being ridiculed by others, and as a result, he made a profit of over 100 times the price.

Black Monday in 1987 is also not to be missed.

At the time, Rogers said that a major crash would soon occur as a reaction to the overheated market, but no one listened to him.

However, on Black Monday, the New York stock market fell 22.6% in a single day, which was the largest decline in the history of the U.S. stock market and remains a record that has not been broken to this day.

While most investors suffered huge losses, Rogers, who had anticipated the crash in advance, was able to short all of his stocks and make a large profit.

He suggests 'questioning common sense' and 'a counter-intuitive mindset' as the secrets to surviving the recession.

A wise investor is not swept away by the blind mood, but assesses the situation with a cool-headed eye, and moves more nimbly than anyone else when he feels the optimal timing has arrived.

Based on this, the book is richly packed with information on promising investment opportunities in the coming low-interest-rate era, tips for wisely gathering and judging information, and asset management strategies necessary in times of crisis.

Meanwhile, the lessons he learned from his painful mistakes in his youth and the investment principles he has maintained to this day offer readers in desperate need of strategies to survive in times of crisis a deep and broad perspective.

Black Monday, the dot-com bubble, the Lehman Brothers crisis…

A master who accurately predicted the world economic trends for 50 years

A bold and unconventional outlook,

And the future of money and new opportunities

Rogers is famous not only for his remarkable returns but also for his accurate predictions of macroeconomic trends for over 50 years.

He already predicted the rise of China in the 1980s and accurately predicted major events that hit the global economy, including Black Monday, the dot-com bubble in the 2000s, and the global financial crisis in 2008.

In this book, he forecasts the changes that will occur in each economic zone in the future, drawing on his extensive knowledge of history, accumulated experience over many years, and keen analysis of the current situation.

It covers a wide range of issues that could alter the global economic landscape, including the impact of the US presidential election and the trade war, the long-term changes in Europe due to Brexit, the economic future of Hong Kong amid heightened political tensions, and China's ambitious Belt and Road Initiative in Africa.

In addition, it presents insights that investors should definitely pay attention to, such as the second Silicon Valley, the relationship between global big tech companies and the Swiss franc, and the core of blockchain.

Finally, Rogers emphasizes the new opportunities that the worst crisis can bring.

According to him, a crisis is a wonderful opportunity for investors.

Because while it creates painful situations, it also creates a completely new system and protagonist.

The unprecedentedly long global economic boom is now coming to an end.

Who knows what might happen when the bubble bursts.

But there is no need to be afraid.

This book will be your most powerful weapon to help you escape the rough waves and seize your own opportunities.

Jim Rogers, one of the world's top three investors, is paying attention.

Signs of a Global Economic Crisis

“The global economic boom that has lasted for 11 years since 2008 is about to come to an end.”

In 2020, the global economy suddenly went into a state of crisis, and people were gripped by fear.

The spread of the coronavirus has halted international travel and trade, and the real economy has begun to freeze.

Governments around the world are attempting the largest stimulus packages in history, but the future of the global economy remains bleak.

While many believe this global recession was caused by an unexpected pandemic, legendary Wall Street investor Jim Rogers sees things differently.

He has been warning since early 2019 that a recession worse than the last global financial crisis is coming.

The coronavirus has merely brought that point forward; the "bubble trajectory" was already evident across the global economy before the pandemic.

He cites two signals as evidence for this.

The first is the ‘signs of crisis’ that have appeared historically.

There were common phenomena during past global economic crises, such as the Great Depression of 1929, Black Monday of 1987, and the global financial crisis of 2008.

Stock and real estate prices were rising sharply even before the stock market crash, corporate bankruptcies, and mass unemployment began to appear in earnest.

Seeing the resulting 'fake boom' and the 'all-time highs' being renewed every day, people, without exception, rushed into the market.

And this is strikingly similar to the current situation.

The second sign of a crisis is the 'fiscal deficit'.

Since 2008, governments around the world have been printing, borrowing, and spending trillions of dollars.

The United States has incurred the most debt in its history over the past six months, and even China, which served as the world economy's white knight during the 2008 global financial crisis, is seeing its national debt skyrocket.

Looking behind the scenes, even banks in Europe, including Deutsche Bank, Germany's largest private bank known for its strong finances, have been in bad shape since 2017.

If we look at the situations that are occurring in succession in various countries around the world, including India, Brazil, Argentina, Indonesia, and Turkey, we can clearly see the reality of the crisis that Rogers speaks of.

Achieved 4200% returns over 10 years!

What is the survival strategy of an investment guru who shines even brighter in times of crisis?

So, what should ordinary individuals keep in mind and how should they prepare to survive in this volatile economic environment? Rogers, an active investor for over 50 years on Wall Street, a gathering place for prominent investors, shares in detail the secrets of his remarkable returns.

The private equity fund he founded with George Soros, Quantum Fund, recorded an astonishing return of 4200%, while the S&P recorded a return of 47%.

This is why he is nicknamed the "Legendary Investor" on Wall Street.

Having experienced several major economic crises and changes in the world, Rogers emphasizes that investing during a recession should be completely different from investing during a boom.

In fact, he is an investor who shines even more in times of crisis.

At a time when the military industry was considered to be a thing of the past, he boldly purchased Lockheed Martin stock despite being ridiculed by others, and as a result, he made a profit of over 100 times the price.

Black Monday in 1987 is also not to be missed.

At the time, Rogers said that a major crash would soon occur as a reaction to the overheated market, but no one listened to him.

However, on Black Monday, the New York stock market fell 22.6% in a single day, which was the largest decline in the history of the U.S. stock market and remains a record that has not been broken to this day.

While most investors suffered huge losses, Rogers, who had anticipated the crash in advance, was able to short all of his stocks and make a large profit.

He suggests 'questioning common sense' and 'a counter-intuitive mindset' as the secrets to surviving the recession.

A wise investor is not swept away by the blind mood, but assesses the situation with a cool-headed eye, and moves more nimbly than anyone else when he feels the optimal timing has arrived.

Based on this, the book is richly packed with information on promising investment opportunities in the coming low-interest-rate era, tips for wisely gathering and judging information, and asset management strategies necessary in times of crisis.

Meanwhile, the lessons he learned from his painful mistakes in his youth and the investment principles he has maintained to this day offer readers in desperate need of strategies to survive in times of crisis a deep and broad perspective.

Black Monday, the dot-com bubble, the Lehman Brothers crisis…

A master who accurately predicted the world economic trends for 50 years

A bold and unconventional outlook,

And the future of money and new opportunities

Rogers is famous not only for his remarkable returns but also for his accurate predictions of macroeconomic trends for over 50 years.

He already predicted the rise of China in the 1980s and accurately predicted major events that hit the global economy, including Black Monday, the dot-com bubble in the 2000s, and the global financial crisis in 2008.

In this book, he forecasts the changes that will occur in each economic zone in the future, drawing on his extensive knowledge of history, accumulated experience over many years, and keen analysis of the current situation.

It covers a wide range of issues that could alter the global economic landscape, including the impact of the US presidential election and the trade war, the long-term changes in Europe due to Brexit, the economic future of Hong Kong amid heightened political tensions, and China's ambitious Belt and Road Initiative in Africa.

In addition, it presents insights that investors should definitely pay attention to, such as the second Silicon Valley, the relationship between global big tech companies and the Swiss franc, and the core of blockchain.

Finally, Rogers emphasizes the new opportunities that the worst crisis can bring.

According to him, a crisis is a wonderful opportunity for investors.

Because while it creates painful situations, it also creates a completely new system and protagonist.

The unprecedentedly long global economic boom is now coming to an end.

Who knows what might happen when the bubble bursts.

But there is no need to be afraid.

This book will be your most powerful weapon to help you escape the rough waves and seize your own opportunities.

GOODS SPECIFICS

- Publication date: November 20, 2020

- Format: Hardcover book binding method guide

- Page count, weight, size: 264 pages | 522g | 145*210*20mm

- ISBN13: 9788901245713

- ISBN10: 890124571X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)