The mind to invest

|

Description

Book Introduction

- A word from MD

-

Today, I dedicate this day to investors who are feeling distressed."What should I buy? Should I sell now? Where's the bottom?" Replace these meaningless questions with "Invest in long-term value. Do the opposite of what everyone else is saying." Rethink those tired old adages.

If I reflect on my own mindset as a stock trader and understand myself as an investor, I will find a way to not give up in this difficult market.

I recommend this book to individual investors (including myself) who have more difficult days than comfortable days.

November 3, 2020. Park Jeong-yoon, Economics and Management PD

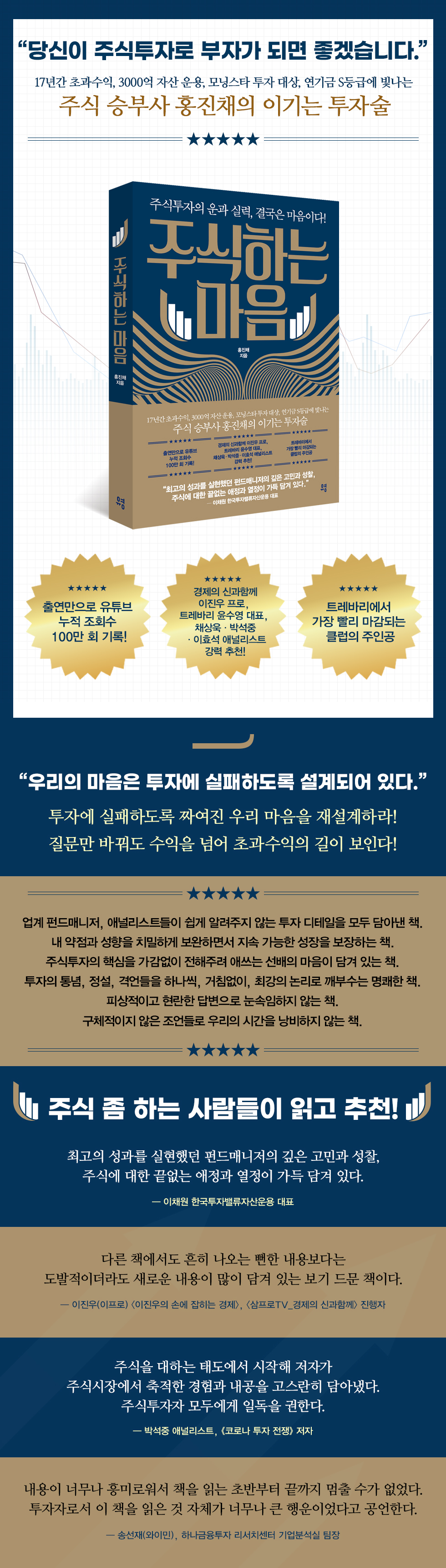

“I hope you become rich through stock investment.”

Achieved 1 million cumulative YouTube views just by appearing! Become the star of the fastest-selling club in Trevari!

Investment expert Hong Jin-chae shares his take on "Successful Stock Investing."

Hong Jin-chae, CEO of Raccoon Asset Management, a fund manager with exceptional performance, has redesigned our minds, which are wired to fail at investing, to create a survival guide to stock investment that will help anyone move beyond mere profits and onto the path to "excess returns."

This book, "The Mind of Stock Investing," diagnoses the obvious mistakes many people make when investing, reconstructs meaningless questions and investment maxims from stock market experts, and integrates the principles of investment with the principles of life. Ultimately, it contains a solid mental training process that will help you become a "winning investor" and a "smart investor."

Moreover, it kindly informs you about the fundamental attitudes and mindset of investors that even industry experts easily overlook, rather than fragmented investment knowledge that loses its meaning after a while.

This book will change your investment mindset 180 degrees and help you understand not only stocks but also yourself. Through this book, you will be able to quickly welcome the day when you feel at ease with stocks and become rich through stocks.

Achieved 1 million cumulative YouTube views just by appearing! Become the star of the fastest-selling club in Trevari!

Investment expert Hong Jin-chae shares his take on "Successful Stock Investing."

Hong Jin-chae, CEO of Raccoon Asset Management, a fund manager with exceptional performance, has redesigned our minds, which are wired to fail at investing, to create a survival guide to stock investment that will help anyone move beyond mere profits and onto the path to "excess returns."

This book, "The Mind of Stock Investing," diagnoses the obvious mistakes many people make when investing, reconstructs meaningless questions and investment maxims from stock market experts, and integrates the principles of investment with the principles of life. Ultimately, it contains a solid mental training process that will help you become a "winning investor" and a "smart investor."

Moreover, it kindly informs you about the fundamental attitudes and mindset of investors that even industry experts easily overlook, rather than fragmented investment knowledge that loses its meaning after a while.

This book will change your investment mindset 180 degrees and help you understand not only stocks but also yourself. Through this book, you will be able to quickly welcome the day when you feel at ease with stocks and become rich through stocks.

- You can preview some of the book's contents.

Preview

index

Recommendation

prolog

[PART 1] Our minds are wired to fail at investing.

Chapter 1 Why am I like this every day?

Today's painful stock investor

A surefire recipe for failure

One Shin Woo Il Shin, always like the first time

Chapter 2: Blame Evolution, It's Not Your Fault

Storytelling obsession

Cycles and False Learning

The unconscious self, the zombie within me

Chapter 3 How to avoid being swept away by emotions?

Record

Make decisions the day before

Starting over again

Be humble

Harnessing emotions

[PART 2] Just changing the question reveals the path.

Chapter 4 Reframing the Question

Smart questions and smart answers

What is a good question?

Chapter 5: Always Asking Pointless Questions

Where is the floor?

Can I still invest in stocks when the economy is not doing well?

When can I buy it?

What do you think the market will do?

What should I buy?

When should I sell it?

Isn't it risky if there are a lot of individual purchases?

Chapter 6: Proverbs That Seem True But Are Dangerous

Invest for the long term

Move against others

Discover in life

Analyze thoroughly

Focus on intrinsic value

History repeats itself

Have an investment philosophy

[PART 3] Winning Questions, Unwavering Investments

Chapter 7 What is Price?

reflexivity

Agreed fantasy

Price-Value Gap Model

bounded rationality model

Chapter 8 How to Generate Excess Returns

What is the difference between my thoughts and other people's thoughts?

When and how will that gap be filled?

How and when will I know I'm wrong?

What can I learn when I'm wrong?

Chapter 9: What Kind of Investor Am I?

Defensive and aggressive investors

Asset allocation

More exposure than expected

[PART 4] For Sustainable Growth

Chapter 10 Who to Learn from

The illusion of being an expert

The illusion of collective intelligence

Signal and noise

Chapter 11 Probabilistic Thinking

Luck and skill

dice game

Probability distribution × multiple trials

Chapter 12: Barbell Strategy

Probability distribution inference in the real world

Jensen's inequality and asymmetry

The Babel Strategy of Life

Epilogue

annotation

prolog

[PART 1] Our minds are wired to fail at investing.

Chapter 1 Why am I like this every day?

Today's painful stock investor

A surefire recipe for failure

One Shin Woo Il Shin, always like the first time

Chapter 2: Blame Evolution, It's Not Your Fault

Storytelling obsession

Cycles and False Learning

The unconscious self, the zombie within me

Chapter 3 How to avoid being swept away by emotions?

Record

Make decisions the day before

Starting over again

Be humble

Harnessing emotions

[PART 2] Just changing the question reveals the path.

Chapter 4 Reframing the Question

Smart questions and smart answers

What is a good question?

Chapter 5: Always Asking Pointless Questions

Where is the floor?

Can I still invest in stocks when the economy is not doing well?

When can I buy it?

What do you think the market will do?

What should I buy?

When should I sell it?

Isn't it risky if there are a lot of individual purchases?

Chapter 6: Proverbs That Seem True But Are Dangerous

Invest for the long term

Move against others

Discover in life

Analyze thoroughly

Focus on intrinsic value

History repeats itself

Have an investment philosophy

[PART 3] Winning Questions, Unwavering Investments

Chapter 7 What is Price?

reflexivity

Agreed fantasy

Price-Value Gap Model

bounded rationality model

Chapter 8 How to Generate Excess Returns

What is the difference between my thoughts and other people's thoughts?

When and how will that gap be filled?

How and when will I know I'm wrong?

What can I learn when I'm wrong?

Chapter 9: What Kind of Investor Am I?

Defensive and aggressive investors

Asset allocation

More exposure than expected

[PART 4] For Sustainable Growth

Chapter 10 Who to Learn from

The illusion of being an expert

The illusion of collective intelligence

Signal and noise

Chapter 11 Probabilistic Thinking

Luck and skill

dice game

Probability distribution × multiple trials

Chapter 12: Barbell Strategy

Probability distribution inference in the real world

Jensen's inequality and asymmetry

The Babel Strategy of Life

Epilogue

annotation

Detailed image

Into the book

If you don't keep records, you will distort past decisions, and if you evaluate the present based on distorted memories, you will inevitably reach wrong conclusions.

No matter how much you apply the principles derived from such evaluations to the market, it will only result in incorrect learning.

It doesn't grow.

In non-complex adaptive systems, the importance of records may not be so great.

In places where explicit principles exist, you can grow by practicing following them a lot so that good principles are 'memorized'.

However, in complex adaptive systems where it is difficult to establish clear principles for success, we have no choice but to think probabilistically, and the decision-making process in probabilistic thinking is a continuous process of accumulating uncertain hypotheses and then pulling the trigger at some point.

You should always assume that you might be wrong and keep in mind what you will learn from being wrong.

--- pp.66~67

If you own stocks, you're always faced with two questions: "Should I buy more here?" or "Should I sell now?"

Asking questions this way exposes us to path dependency.

Because it's based on the fact that 'I already own this stock.'

Future stock price fluctuations have nothing to do with whether or not I own the stock.

When factors unrelated to stock price fluctuations become a factor in your thinking, the likelihood of making wrong decisions increases.

You could rephrase the question like this:

If you ask yourself, "If I currently held this amount 100% in cash, how much of this stock would I buy today?" and the answer differs significantly from your actual position (the percentage or amount held), it's time to shift your position.

--- p.76

A good question should be 'answerable', and the answer should 'be wrong'.

'Being able to answer' and 'being able to find the answer' are two different things.

Changing bad questions into good questions isn't about finding the right answer.

To find answers that you can take responsibility for yourself.

Constructing questions is also a process of self-verification.

If I can't transform a bad question into a good one, it means I don't know enough about the problem I'm trying to solve.

--- p.102

When you start investing, you should first ask yourself, "How do I define this game?"

That is, you must first answer the question, 'How long do you aim to achieve meaningful returns?'

It can refer to the entire period of time you invest in life, or it can refer to the validity period of an individual investment.

If my investment period is one year, the stock price gauge I care about should be able to ignore most daily fluctuations.

Conversely, if you're looking to make a profit through short-term trading today, every minute, or even second, of stock price fluctuation will be important.

--- p.109

What is the relationship between the overall market and individual stocks? Market sentiment generally refers to the direction of the stock index representing the market.

By definition and calculation formula, a stock index is 'the sum of the movements of individual stocks.'

It's not that individual stocks are rising because the market is good, but rather that individual stocks are rising a lot and the market is good.

As long as my chosen stocks perform well, what does the overall market trend matter? Of course, when investor sentiment is generally depressed, it's not uncommon for the prices of my healthy stocks to fall as well.

However, over time, the overall market's influence fades away, leaving only the individual stock's unique movements.

--- p.120

This doesn't mean that you shouldn't ask each other for stock recommendations or even make recommendations.

We must actively exchange and refine each other's ideas.

You can't survive in this market with just your own ideas. After all, prices are ultimately determined by others.

This is also where cooking and boxing differ.

No matter how delicious a dish I make, if others say it's "tasteless," the capital market is a place where the dish becomes tasteless.

Even if I knock out my opponent in the first round, the capital market is a place where others judge that 'you lost' and it becomes a decision loss.

Only when you have your own thoughts can you listen to others' thoughts and incorporate them into your own.

Without my own thoughts, the thoughts of others are just the sound of the wind passing by.

--- p.126

Capturing differences in thinking is just the first step toward finding investment opportunities.

Most investors fall into this trap.

'I think the market is wrong.

So you have to buy it now.' There should be a very important question between these two sentences.

The key is how one side realizes that they are wrong.

Please focus on the object of the sentence.

It's not about how you realize that 'the market is wrong'.

The question is how to realize that 'one side is wrong'.

It could be the market that's wrong, or it could be me.

When I admit I was wrong or the market admits it was wrong and changes its position, the gap will be filled.

--- p.222

In complex systems, skill ultimately means the quality of decision-making.

To make good decisions, you need to formulate various possible scenarios for a given investment target, break down the logical chain of each scenario, and examine its likelihood, feasibility, and probability.

In the final stage, probability, it is difficult to express the probability in exact numbers, but in the possibility and plausibility stages, it is relatively easy to filter out wrong decisions.

The quality of decisions can be significantly improved simply by filtering out those that lack feasibility and validity.

No matter how much you apply the principles derived from such evaluations to the market, it will only result in incorrect learning.

It doesn't grow.

In non-complex adaptive systems, the importance of records may not be so great.

In places where explicit principles exist, you can grow by practicing following them a lot so that good principles are 'memorized'.

However, in complex adaptive systems where it is difficult to establish clear principles for success, we have no choice but to think probabilistically, and the decision-making process in probabilistic thinking is a continuous process of accumulating uncertain hypotheses and then pulling the trigger at some point.

You should always assume that you might be wrong and keep in mind what you will learn from being wrong.

--- pp.66~67

If you own stocks, you're always faced with two questions: "Should I buy more here?" or "Should I sell now?"

Asking questions this way exposes us to path dependency.

Because it's based on the fact that 'I already own this stock.'

Future stock price fluctuations have nothing to do with whether or not I own the stock.

When factors unrelated to stock price fluctuations become a factor in your thinking, the likelihood of making wrong decisions increases.

You could rephrase the question like this:

If you ask yourself, "If I currently held this amount 100% in cash, how much of this stock would I buy today?" and the answer differs significantly from your actual position (the percentage or amount held), it's time to shift your position.

--- p.76

A good question should be 'answerable', and the answer should 'be wrong'.

'Being able to answer' and 'being able to find the answer' are two different things.

Changing bad questions into good questions isn't about finding the right answer.

To find answers that you can take responsibility for yourself.

Constructing questions is also a process of self-verification.

If I can't transform a bad question into a good one, it means I don't know enough about the problem I'm trying to solve.

--- p.102

When you start investing, you should first ask yourself, "How do I define this game?"

That is, you must first answer the question, 'How long do you aim to achieve meaningful returns?'

It can refer to the entire period of time you invest in life, or it can refer to the validity period of an individual investment.

If my investment period is one year, the stock price gauge I care about should be able to ignore most daily fluctuations.

Conversely, if you're looking to make a profit through short-term trading today, every minute, or even second, of stock price fluctuation will be important.

--- p.109

What is the relationship between the overall market and individual stocks? Market sentiment generally refers to the direction of the stock index representing the market.

By definition and calculation formula, a stock index is 'the sum of the movements of individual stocks.'

It's not that individual stocks are rising because the market is good, but rather that individual stocks are rising a lot and the market is good.

As long as my chosen stocks perform well, what does the overall market trend matter? Of course, when investor sentiment is generally depressed, it's not uncommon for the prices of my healthy stocks to fall as well.

However, over time, the overall market's influence fades away, leaving only the individual stock's unique movements.

--- p.120

This doesn't mean that you shouldn't ask each other for stock recommendations or even make recommendations.

We must actively exchange and refine each other's ideas.

You can't survive in this market with just your own ideas. After all, prices are ultimately determined by others.

This is also where cooking and boxing differ.

No matter how delicious a dish I make, if others say it's "tasteless," the capital market is a place where the dish becomes tasteless.

Even if I knock out my opponent in the first round, the capital market is a place where others judge that 'you lost' and it becomes a decision loss.

Only when you have your own thoughts can you listen to others' thoughts and incorporate them into your own.

Without my own thoughts, the thoughts of others are just the sound of the wind passing by.

--- p.126

Capturing differences in thinking is just the first step toward finding investment opportunities.

Most investors fall into this trap.

'I think the market is wrong.

So you have to buy it now.' There should be a very important question between these two sentences.

The key is how one side realizes that they are wrong.

Please focus on the object of the sentence.

It's not about how you realize that 'the market is wrong'.

The question is how to realize that 'one side is wrong'.

It could be the market that's wrong, or it could be me.

When I admit I was wrong or the market admits it was wrong and changes its position, the gap will be filled.

--- p.222

In complex systems, skill ultimately means the quality of decision-making.

To make good decisions, you need to formulate various possible scenarios for a given investment target, break down the logical chain of each scenario, and examine its likelihood, feasibility, and probability.

In the final stage, probability, it is difficult to express the probability in exact numbers, but in the possibility and plausibility stages, it is relatively easy to filter out wrong decisions.

The quality of decisions can be significantly improved simply by filtering out those that lack feasibility and validity.

--- p.294

Publisher's Review

Sampro TV_Pro Jinwoo Lee with the God of Economy, value investing expert Chaewon Lee,

Trevari CEO Yoon Soo-young strongly recommends analysts Chae Sang-wook, Park Seok-joong, and Lee Hyo-seok!

An investment expert with 17 years of excess returns, KRW 300 billion in assets under management, Morningstar Investment Award, and an S-rated pension fund.

The first solo book by Hong Jin-chae, CEO of Raccoon Asset Management!

How long has it been since individual investors have been so interested in the stock market, following the cryptocurrency boom of 2017 and the real estate boom around that time? After 2007, when large funds like Mirae Asset Global Investments dominated the market, a handful of investment advisory firms dominated the market in 2010.

The stocks they had chosen, the so-called "7 Princesses," had their prices rise endlessly, and starting in late 2011, a product called the "Korean hedge fund" was introduced, and in 2015, regulations were further relaxed, leading to a proliferation of hedge funds.

However, most of these products underperformed or caused unpleasant incidents, losing customer trust. With nowhere else to go, individual investors' money turned to cryptocurrencies and real estate.

As a result of these markets also being in jeopardy as a market, investors have finally decided to invest in stocks themselves.

In the face of the global disaster known as COVID-19, 2020 has been a year of unprecedented stock market frenzy.

From books that tell you to blindly follow stock investment, to books that promise to complete your stock studies in a few days, to books that demand you know everything from financial statements, the flood of stock books is a direct reflection of the current reality that people of all ages and genders are interested in stock investment.

But even if you pore over books on the subject, diligently watch YouTube economics broadcasts, and surround yourself with experts offering advice that's practically confidential, investors, both beginners and intermediate, end up asking the same questions.

"Where is the bottom? The economy is sluggish, so is it still okay to invest in stocks? When should I buy? What stocks should I buy?" People who no longer trust brokerage reports and instead seek out good stocks through independent research, and those who believe their monthly salary alone can never guarantee financial freedom.

What is the one thing that is missing from them?

Are our minds wired to fail at investing?

A book that provides answers to investors who are troubled by stock price rises and falls!

“Our minds are designed to fail at investing!” Hong Jin-chae, a fund manager who has achieved the best results such as achieving excess returns for 17 years, managing 300 billion won in assets responsibly, winning the Morningstar Investment Award, and receiving an S-grade rating from the National Pension Service, uses his deep insight and inner strength to closely examine not only our minds but also our brains that are designed to fail at investing, and guides us on the path to investment that will not fail.

In 『Stock Mind』, which is also his first solo book, he not only provides practical investment details that guarantee excess returns by simply changing the questions, but also contains strategies that lead to sustainable growth while meticulously complementing one's weaknesses and tendencies, and mental training that allows one to invest calmly in stocks whether the market rises or falls sharply by boldly and logically breaking down investment common sense, orthodoxy, and proverbs one by one.

This book thoroughly analyzes the theoretical causes of investment failure and teaches you the most useful and crucial questions and thinking methods for practical use. This book will equip you with an investment mindset that can withstand any external shock.

If you want to become rich, redesign your 'stock investing mindset'!

Overturning common sense and investment conventions in the stock market through thorough verification!

"The Heart of Stock Investment" is a masterpiece that brings together the author's deep reflections and introspection, his unwavering love and passion for stocks, and his achievements as a fund manager. Its greatest strength lies in its detailed unraveling of investment topics that even industry fund managers and analysts constantly grapple with.

This book also contains the heart of a senior who strives to convey the essence of stock investment without any exaggeration.

Instead of superficial and flashy answers, we break down the real-life moments of investing into one-on-one discussions, creating anticipation and tension, as if we were giving a private lesson.

It's full of stories about the attitudes and investment habits essential for those who want to increase their chances of long-term profits in the stock market.

Part 1, "Our Minds Are Wired to Fail at Investing," takes a comprehensive approach to the pitfalls of thinking that humans inevitably fall into, drawing on behavioral economics, brain science, and artificial intelligence as a preliminary step toward acquiring an "unwavering investment psychology."

In Part 2, "Change Your Questions and You'll Find the Way," the author uses his exceptional insight to delicately reinterpret the seemingly pointless questions we often ask, along with the seemingly pointless proverbs that often serve as answers to those questions, helping us eliminate unnecessary investment ideas.

Part 3, "Winning Questions, Unwavering Investments," is a process of incorporating essential investment ideas.

It addresses the most important questions in stock investing, such as what price is and how to outperform others.

Part 4, "For Sustainable Growth," is the solid foundation for your investment journey.

It explains step-by-step the entire process of acquiring knowledge in various fields, including what kind of mindset to adopt in the life you will face in the future, how to view the world, and what to learn from whom.

The author concludes the book with the sentence, “In a capitalist society, stocks are an asset that is necessary not only to gain something but also to avoid losing something.”

I've tried to verify all the maxims of investment gurus, and through the process, I've experienced many successes and failures, establishing my own solid investment principles.

"The Heart of Stock Investing," which contains the author's investment strategies that have generated excess returns for 17 years, will help you achieve financial freedom and independence as soon as possible, and enjoy a more affluent life than you have now.

Trevari CEO Yoon Soo-young strongly recommends analysts Chae Sang-wook, Park Seok-joong, and Lee Hyo-seok!

An investment expert with 17 years of excess returns, KRW 300 billion in assets under management, Morningstar Investment Award, and an S-rated pension fund.

The first solo book by Hong Jin-chae, CEO of Raccoon Asset Management!

How long has it been since individual investors have been so interested in the stock market, following the cryptocurrency boom of 2017 and the real estate boom around that time? After 2007, when large funds like Mirae Asset Global Investments dominated the market, a handful of investment advisory firms dominated the market in 2010.

The stocks they had chosen, the so-called "7 Princesses," had their prices rise endlessly, and starting in late 2011, a product called the "Korean hedge fund" was introduced, and in 2015, regulations were further relaxed, leading to a proliferation of hedge funds.

However, most of these products underperformed or caused unpleasant incidents, losing customer trust. With nowhere else to go, individual investors' money turned to cryptocurrencies and real estate.

As a result of these markets also being in jeopardy as a market, investors have finally decided to invest in stocks themselves.

In the face of the global disaster known as COVID-19, 2020 has been a year of unprecedented stock market frenzy.

From books that tell you to blindly follow stock investment, to books that promise to complete your stock studies in a few days, to books that demand you know everything from financial statements, the flood of stock books is a direct reflection of the current reality that people of all ages and genders are interested in stock investment.

But even if you pore over books on the subject, diligently watch YouTube economics broadcasts, and surround yourself with experts offering advice that's practically confidential, investors, both beginners and intermediate, end up asking the same questions.

"Where is the bottom? The economy is sluggish, so is it still okay to invest in stocks? When should I buy? What stocks should I buy?" People who no longer trust brokerage reports and instead seek out good stocks through independent research, and those who believe their monthly salary alone can never guarantee financial freedom.

What is the one thing that is missing from them?

Are our minds wired to fail at investing?

A book that provides answers to investors who are troubled by stock price rises and falls!

“Our minds are designed to fail at investing!” Hong Jin-chae, a fund manager who has achieved the best results such as achieving excess returns for 17 years, managing 300 billion won in assets responsibly, winning the Morningstar Investment Award, and receiving an S-grade rating from the National Pension Service, uses his deep insight and inner strength to closely examine not only our minds but also our brains that are designed to fail at investing, and guides us on the path to investment that will not fail.

In 『Stock Mind』, which is also his first solo book, he not only provides practical investment details that guarantee excess returns by simply changing the questions, but also contains strategies that lead to sustainable growth while meticulously complementing one's weaknesses and tendencies, and mental training that allows one to invest calmly in stocks whether the market rises or falls sharply by boldly and logically breaking down investment common sense, orthodoxy, and proverbs one by one.

This book thoroughly analyzes the theoretical causes of investment failure and teaches you the most useful and crucial questions and thinking methods for practical use. This book will equip you with an investment mindset that can withstand any external shock.

If you want to become rich, redesign your 'stock investing mindset'!

Overturning common sense and investment conventions in the stock market through thorough verification!

"The Heart of Stock Investment" is a masterpiece that brings together the author's deep reflections and introspection, his unwavering love and passion for stocks, and his achievements as a fund manager. Its greatest strength lies in its detailed unraveling of investment topics that even industry fund managers and analysts constantly grapple with.

This book also contains the heart of a senior who strives to convey the essence of stock investment without any exaggeration.

Instead of superficial and flashy answers, we break down the real-life moments of investing into one-on-one discussions, creating anticipation and tension, as if we were giving a private lesson.

It's full of stories about the attitudes and investment habits essential for those who want to increase their chances of long-term profits in the stock market.

Part 1, "Our Minds Are Wired to Fail at Investing," takes a comprehensive approach to the pitfalls of thinking that humans inevitably fall into, drawing on behavioral economics, brain science, and artificial intelligence as a preliminary step toward acquiring an "unwavering investment psychology."

In Part 2, "Change Your Questions and You'll Find the Way," the author uses his exceptional insight to delicately reinterpret the seemingly pointless questions we often ask, along with the seemingly pointless proverbs that often serve as answers to those questions, helping us eliminate unnecessary investment ideas.

Part 3, "Winning Questions, Unwavering Investments," is a process of incorporating essential investment ideas.

It addresses the most important questions in stock investing, such as what price is and how to outperform others.

Part 4, "For Sustainable Growth," is the solid foundation for your investment journey.

It explains step-by-step the entire process of acquiring knowledge in various fields, including what kind of mindset to adopt in the life you will face in the future, how to view the world, and what to learn from whom.

The author concludes the book with the sentence, “In a capitalist society, stocks are an asset that is necessary not only to gain something but also to avoid losing something.”

I've tried to verify all the maxims of investment gurus, and through the process, I've experienced many successes and failures, establishing my own solid investment principles.

"The Heart of Stock Investing," which contains the author's investment strategies that have generated excess returns for 17 years, will help you achieve financial freedom and independence as soon as possible, and enjoy a more affluent life than you have now.

GOODS SPECIFICS

- Publication date: October 28, 2020

- Page count, weight, size: 324 pages | 540g | 153*215*30mm

- ISBN13: 9791130632032

- ISBN10: 1130632032

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)