Gift-Giving Santa's Stock Investment Secrets

|

Description

Book Introduction

- A word from MD

-

Now, if you want to invest in stocks, you need to start right.The first book by 'Gift-Giving Santa', a master in the field who started investing in stocks at the age of 20 and amassed 10 billion won in assets, has finally been published.

Stocks are a hot topic these days, but you can't just jump in without any preparation.

Let's learn the absolute principles of investing, unwavering in the face of market and charts! May this be a true gift from Santa to many investors.

April 10, 2020. Park Jeong-yoon, Economics and Management PD

Investors who sighed while looking at charts all day long

How did I become successful in stock investing after meeting him?

“I just followed my investment principles and my assets grew to 10 billion won!”

The stock market suffered its worst-ever plunge in January 2020 due to the COVID-19 pandemic that began in Asia.

For the first time in 10 years, the KOSPI index has collapsed below 1,500, and the exchange rate has hit a new high.

An unprecedented situation occurred in which circuit breakers were activated simultaneously on both KOSPI and KOSDAQ.

Investors panicked.

But in this unpredictable stock market, there are stock investment experts who are sought after by tens of thousands of investors.

It is 'Santa who gives gifts'.

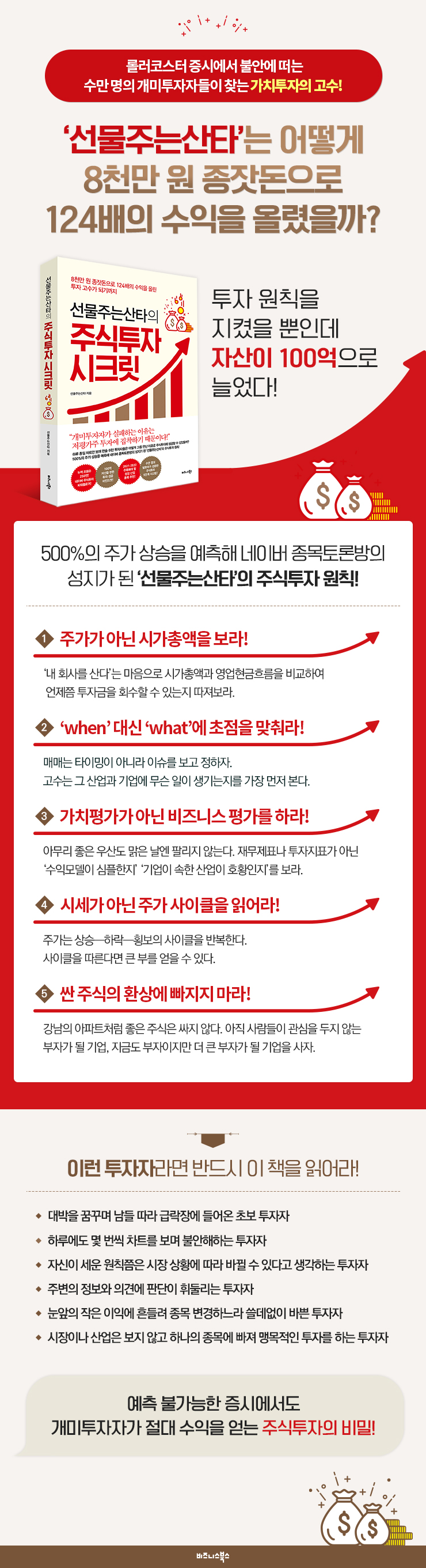

'Gift-Giving Santa' achieved financial freedom by growing his initial investment of 80 million won into assets worth 10 billion won in just 8 years by adhering to his own investment principles.

Through his blog, he shared the stocks he invested in as well as the information he obtained through his own experience, and he recorded it as if he was broadcasting live on how to invest.

In particular, the stocks he invested in rose by more than 500% in just six months, earning him the full trust of investors.

In his book, "Gift-Giving Santa's Stock Investment Secrets," he reveals the absolute principles of stock investment that are easy for individual investors to follow.

In times like today, when it's difficult to even predict tomorrow's market, if you're too focused on following the market by just looking at the charts, you could miss the bigger picture.

The author emphasizes that investments should be made with focus and principles in mind.

These investment principles adhere to the fundamental logic of value investing while also incorporating the author's own philosophy: "Invest with the mindset of acquiring a company," "Don't get hung up on charts and financial statements," "Evaluate the business, not the value," and "Stock selection must have a story."

If you properly understand the author's foolproof investment principles contained in this book, you will be able to successfully invest money without being swayed by small, immediate gains.

How did I become successful in stock investing after meeting him?

“I just followed my investment principles and my assets grew to 10 billion won!”

The stock market suffered its worst-ever plunge in January 2020 due to the COVID-19 pandemic that began in Asia.

For the first time in 10 years, the KOSPI index has collapsed below 1,500, and the exchange rate has hit a new high.

An unprecedented situation occurred in which circuit breakers were activated simultaneously on both KOSPI and KOSDAQ.

Investors panicked.

But in this unpredictable stock market, there are stock investment experts who are sought after by tens of thousands of investors.

It is 'Santa who gives gifts'.

'Gift-Giving Santa' achieved financial freedom by growing his initial investment of 80 million won into assets worth 10 billion won in just 8 years by adhering to his own investment principles.

Through his blog, he shared the stocks he invested in as well as the information he obtained through his own experience, and he recorded it as if he was broadcasting live on how to invest.

In particular, the stocks he invested in rose by more than 500% in just six months, earning him the full trust of investors.

In his book, "Gift-Giving Santa's Stock Investment Secrets," he reveals the absolute principles of stock investment that are easy for individual investors to follow.

In times like today, when it's difficult to even predict tomorrow's market, if you're too focused on following the market by just looking at the charts, you could miss the bigger picture.

The author emphasizes that investments should be made with focus and principles in mind.

These investment principles adhere to the fundamental logic of value investing while also incorporating the author's own philosophy: "Invest with the mindset of acquiring a company," "Don't get hung up on charts and financial statements," "Evaluate the business, not the value," and "Stock selection must have a story."

If you properly understand the author's foolproof investment principles contained in this book, you will be able to successfully invest money without being swayed by small, immediate gains.

- You can preview some of the book's contents.

Preview

index

Preface | If you follow sound investment principles, you can make money even in a bear market.

Chapter 1: Eight Years After Quitting My Job, I Gained Financial Freedom Through Stocks: The Rich Mindset of Santa, the Gift-Giving Man

1.

I didn't want to be a poor father.

Why I Never Put Down My Books Even When I Was Poor | The Path to Wealth as Taught by Kiyosaki and Seino | Self-Confidence Is More Powerful Than Talent or Hard Work | The Fastest Way to Riches

2.

My real seed money was desperation.

The Power of Saying What You Want 100 Times | Three Conditions for Making Your Dreams Come True | It's Not That You Can't Do It, It's That You Don't Do It

3.

When I felt I had achieved financial freedom

Earning 10 Billion Won | Investment knowledge or experience alone won't get you rich | The right attitude toward life brings wealth.

4.

Fundamentals of Investing for True FIRE Tribes

What Career Choice and Stock Investing Have in Common | Focus on Future Gains Over Immediate Profits

Chapter 2: Growing Your Investment Potential and Enlarging Your Assets: The Investment Mindset of Santa, the Gift-Giving Man

1.

Don't recommend stocks carelessly.

Why People Close to You Don't Recommend Stocks | Why Big Money Easily Disappears | Wealth Can Only Be Held in Your Investment Container

2.

As your investment horizon grows, so too will your assets.

Good begets good | The more people who share the profits, the bigger the investment pot becomes.

3.

Investors' perspectives must be broader and more far-sighted.

How many sheep are left in the pasture? | The dangers of investing with a single focus

4.

Investing that follows the money, investing that money follows

Why Wall Street Giants Invest Safely | The Magic of Compound Interest Works in Investing, Too

5.

My investment is a matter of life and death for my family.

What Hedge Fund Godfather Ray Dalio Feared | Anyone Can Be Wrong | Fearless Investing Is Like Gambling

6.

Would you lend money to someone you just met?

What Happens Every Day in the Stock Market | Choosing the Right Lender

7.

If you could only invest twenty times in your life

Can you succeed simply by picking the right stocks? | The more investment opportunities you think you have, the greater the chance of failure.

8.

How to Use Books for Beginners in Stock Market Studies

Why Individual Investors Fail at Investing | Standing on the Shoulders of Giants | Business and Stocks Are Ultimately Human-Driven

Chapter 3: Breaking the Stock Market's Common Sense and Frameworks: Increased Returns: Even Santa Claus Experienced It! Investment Traps

1.

When the investment process is slow, assets grow faster.

Changing lanes in the stock market is a surefire way to failure | You can't make 10 billion won with short-term investing | Investors who are too busy are prey to the market | Finding the right direction is the key to getting there quickly.

2.

Breaking free from the illusion of valuation

Valuation isn't the answer to the investment equation | It's the market's valuation, not yours, that matters.

3.

There is no magic indicator to predict the market.

Investment analysis tools also have trends | See what investment indicators don't tell you.

4.

It's wrong to say that you can buy stocks cheaply.

The Illusion of Buying Stocks Cheap | The Market Determines Prices

5.

Do a business evaluation, not a valuation.

Business models must be simple | Find the absolute market leader.

6.

Stay away from Naver Securities' stock discussion room.

The illusion that a single post can sway shareholders | Don't be swayed by negative critics | People who move big money don't read message boards.

7.

Be wary of information that comes easily.

Information obtained without effort is just spam | Good investment opportunities begin before information spreads.

8.

Things to know before reading analyst material

Analyst Analysis Fallacies | What Analysts Really Need to Know | Buying Stocks with the Mindset of Buying My Company

Chapter 4: Finding Companies You Want to Buy, Not Companies You Want to Invest in: Santa's Stock Picking Guide

1.

Why You Should Buy an Apartment in Gangnam, Even if It's the Same Brand

Where there are wealthy people, there are opportunities for wealth. | How to develop market analysis acumen. | Investment opportunities are hidden in everyday life.

2.

No matter how good an umbrella is, it's useless on a clear day.

Even top-tier companies can't avoid collapse when their industries are in recession. Aim for synergy between business and industry, fostering shared growth.

3.

Invest in popular technologies, not cutting-edge ones.

The smartphone market is bigger than the touchscreen market.

4.

Don't even look at companies with less than 30 percent management ownership.

Minimum safety margin, management's stake | A measure that reflects management's sense of responsibility

5.

A good company is one whose expected performance can be easily drawn.

The market moves faster than securities reports | Companies with easy-to-tell stories are good investments.

6.

Invest in companies that will make you rich

Which Companies Will Get Rich | Grasp the Core | Be Sensitive to Wealth Transfers | Look at Industries to Spot Rich Companies

7.

What do ten-bagger companies have in common?

The Explosive Power of Tenbagger Companies | Stocks with High Growth Potential

Chapter 5: Before Analyzing Charts, Read Between the Lines: Santa's Gift-Giving Trading Method for a 10-Fold Rise

1.

Look at market capitalization, not stock price

The shorter the payback period, the better. Focus on operating cash flow, not net income.

2.

The best timing is when the market changes

Focus on "what" instead of "when." Focus on the issue, not the timing.

3.

Why We Always Miss Opportunities

Information floats through the cracks | If you don't read the company's story, you'll always be one step behind.

4.

Don't confuse value stocks with undervalued stocks.

Everyone sets a rough estimate of undervaluation | The pitfalls of investing in undervalued stocks | There are separate metrics for evaluating value stocks.

5.

I recommend value investing to office workers.

Three Questions for Working Investors | How to Sell at a High Without Looking at the Market

6.

Read stock prices in cycles, not prices.

Economic change begins with the stock market | Understanding stock price cycles will ease anxiety.

Chapter 6: How I Earned 10 Billion Won by Investing: Following Santa's Value Investing Principles

Step 1: Finding Future Growth Industries

Step 2: Create a list of related stocks

Step 3: Select a company to acquire

Step 4: Determine the optimal acquisition price

Step 5: Wait patiently

Chapter 7: The Road to Riches is Near: Santa's Final Request

1.

Opportunities for wealth lie beyond Gangnam and Samsung, in America.

#1 in the US is #1 in the world | The US has emerged as an alternative to the volatile domestic stock market | Big Korean investors are flocking to the US market.

2.

Start right now and you'll be on your way to wealth.

Just give it a try

3.

Learn the life attitudes of successful people.

Respect those who have become wealthy through legitimate effort | My actions come back to me | Invest with a good attitude and wealth will follow.

Conclusion | I'm not just saying this, really don't give up.

Chapter 1: Eight Years After Quitting My Job, I Gained Financial Freedom Through Stocks: The Rich Mindset of Santa, the Gift-Giving Man

1.

I didn't want to be a poor father.

Why I Never Put Down My Books Even When I Was Poor | The Path to Wealth as Taught by Kiyosaki and Seino | Self-Confidence Is More Powerful Than Talent or Hard Work | The Fastest Way to Riches

2.

My real seed money was desperation.

The Power of Saying What You Want 100 Times | Three Conditions for Making Your Dreams Come True | It's Not That You Can't Do It, It's That You Don't Do It

3.

When I felt I had achieved financial freedom

Earning 10 Billion Won | Investment knowledge or experience alone won't get you rich | The right attitude toward life brings wealth.

4.

Fundamentals of Investing for True FIRE Tribes

What Career Choice and Stock Investing Have in Common | Focus on Future Gains Over Immediate Profits

Chapter 2: Growing Your Investment Potential and Enlarging Your Assets: The Investment Mindset of Santa, the Gift-Giving Man

1.

Don't recommend stocks carelessly.

Why People Close to You Don't Recommend Stocks | Why Big Money Easily Disappears | Wealth Can Only Be Held in Your Investment Container

2.

As your investment horizon grows, so too will your assets.

Good begets good | The more people who share the profits, the bigger the investment pot becomes.

3.

Investors' perspectives must be broader and more far-sighted.

How many sheep are left in the pasture? | The dangers of investing with a single focus

4.

Investing that follows the money, investing that money follows

Why Wall Street Giants Invest Safely | The Magic of Compound Interest Works in Investing, Too

5.

My investment is a matter of life and death for my family.

What Hedge Fund Godfather Ray Dalio Feared | Anyone Can Be Wrong | Fearless Investing Is Like Gambling

6.

Would you lend money to someone you just met?

What Happens Every Day in the Stock Market | Choosing the Right Lender

7.

If you could only invest twenty times in your life

Can you succeed simply by picking the right stocks? | The more investment opportunities you think you have, the greater the chance of failure.

8.

How to Use Books for Beginners in Stock Market Studies

Why Individual Investors Fail at Investing | Standing on the Shoulders of Giants | Business and Stocks Are Ultimately Human-Driven

Chapter 3: Breaking the Stock Market's Common Sense and Frameworks: Increased Returns: Even Santa Claus Experienced It! Investment Traps

1.

When the investment process is slow, assets grow faster.

Changing lanes in the stock market is a surefire way to failure | You can't make 10 billion won with short-term investing | Investors who are too busy are prey to the market | Finding the right direction is the key to getting there quickly.

2.

Breaking free from the illusion of valuation

Valuation isn't the answer to the investment equation | It's the market's valuation, not yours, that matters.

3.

There is no magic indicator to predict the market.

Investment analysis tools also have trends | See what investment indicators don't tell you.

4.

It's wrong to say that you can buy stocks cheaply.

The Illusion of Buying Stocks Cheap | The Market Determines Prices

5.

Do a business evaluation, not a valuation.

Business models must be simple | Find the absolute market leader.

6.

Stay away from Naver Securities' stock discussion room.

The illusion that a single post can sway shareholders | Don't be swayed by negative critics | People who move big money don't read message boards.

7.

Be wary of information that comes easily.

Information obtained without effort is just spam | Good investment opportunities begin before information spreads.

8.

Things to know before reading analyst material

Analyst Analysis Fallacies | What Analysts Really Need to Know | Buying Stocks with the Mindset of Buying My Company

Chapter 4: Finding Companies You Want to Buy, Not Companies You Want to Invest in: Santa's Stock Picking Guide

1.

Why You Should Buy an Apartment in Gangnam, Even if It's the Same Brand

Where there are wealthy people, there are opportunities for wealth. | How to develop market analysis acumen. | Investment opportunities are hidden in everyday life.

2.

No matter how good an umbrella is, it's useless on a clear day.

Even top-tier companies can't avoid collapse when their industries are in recession. Aim for synergy between business and industry, fostering shared growth.

3.

Invest in popular technologies, not cutting-edge ones.

The smartphone market is bigger than the touchscreen market.

4.

Don't even look at companies with less than 30 percent management ownership.

Minimum safety margin, management's stake | A measure that reflects management's sense of responsibility

5.

A good company is one whose expected performance can be easily drawn.

The market moves faster than securities reports | Companies with easy-to-tell stories are good investments.

6.

Invest in companies that will make you rich

Which Companies Will Get Rich | Grasp the Core | Be Sensitive to Wealth Transfers | Look at Industries to Spot Rich Companies

7.

What do ten-bagger companies have in common?

The Explosive Power of Tenbagger Companies | Stocks with High Growth Potential

Chapter 5: Before Analyzing Charts, Read Between the Lines: Santa's Gift-Giving Trading Method for a 10-Fold Rise

1.

Look at market capitalization, not stock price

The shorter the payback period, the better. Focus on operating cash flow, not net income.

2.

The best timing is when the market changes

Focus on "what" instead of "when." Focus on the issue, not the timing.

3.

Why We Always Miss Opportunities

Information floats through the cracks | If you don't read the company's story, you'll always be one step behind.

4.

Don't confuse value stocks with undervalued stocks.

Everyone sets a rough estimate of undervaluation | The pitfalls of investing in undervalued stocks | There are separate metrics for evaluating value stocks.

5.

I recommend value investing to office workers.

Three Questions for Working Investors | How to Sell at a High Without Looking at the Market

6.

Read stock prices in cycles, not prices.

Economic change begins with the stock market | Understanding stock price cycles will ease anxiety.

Chapter 6: How I Earned 10 Billion Won by Investing: Following Santa's Value Investing Principles

Step 1: Finding Future Growth Industries

Step 2: Create a list of related stocks

Step 3: Select a company to acquire

Step 4: Determine the optimal acquisition price

Step 5: Wait patiently

Chapter 7: The Road to Riches is Near: Santa's Final Request

1.

Opportunities for wealth lie beyond Gangnam and Samsung, in America.

#1 in the US is #1 in the world | The US has emerged as an alternative to the volatile domestic stock market | Big Korean investors are flocking to the US market.

2.

Start right now and you'll be on your way to wealth.

Just give it a try

3.

Learn the life attitudes of successful people.

Respect those who have become wealthy through legitimate effort | My actions come back to me | Invest with a good attitude and wealth will follow.

Conclusion | I'm not just saying this, really don't give up.

Detailed image

Into the book

To increase the size of your assets, you must first increase the size of your investment vessel through experience and internal growth.

If the bowl is small, it will overflow and return to its original position.

Your assets will be reduced according to your level of ability.

If you have a vessel that can only hold 20 million won and you are lucky enough to make a profit of 100 million won, how will you handle that amount?

It's a vessel that can't even hold 50 million won, so if you have 100 million won, it's natural that the money will disappear sooner or later.

For me too, the process of going from 80 million won to 200 million won was extremely difficult.

If you barely make 200 million won, it goes down again, and if you struggle to get back up again, it goes down again as expected.

I even felt a sense of emptiness when it came down to near the principal.

Fortunately, as I grew internally and became more adept at handling 200 million won, I was able to maintain that amount no matter how difficult the market conditions became.

--- From "Chapter 2: The Size of Assets Increased Only After Expanding the Investment Pot"

I now invest about once every one or two years.

Although I sometimes make small, short-term investments to appease boredom, I only make significant investments that move large assets once every year or two.

If you invest in a certain industry and company from the beginning, even if there is a -5% drop or more in the middle, you will wait without wavering because you planned to invest in that industry and company for 2-3 years.

Then, later, when a good time comes and you make enough profit and sell it, 500 million won becomes 1 billion won, and then 2 billion won.

Sometimes, while investing like that, you see stocks that suddenly rise sharply.

--- From "Chapter 3: Breaking the mold and common sense of the stock market, the return on investment increased"

You don't need specialized knowledge to analyze a company.

If people use it, the company will naturally make a lot of money, and a company that makes it easy to understand the process of making money is a good company.

This is not something that is done through valuation or technical analysis, but rather through a business model approach.

Before you do a valuation, make sure the business model is easy to understand.

First, select a company whose money-inflow structure is easy and clear to understand, and then begin your valuation.

The same goes for looking at charts.

This order must not be changed.

--- From "Chapter 3: Breaking the mold and common sense of the stock market, the return on investment increased"

If you buy stocks and sell them when the price goes up, you will only be chasing after stock supply and demand, immediate popularity, and information that is not sure if it is accurate.

You can't get rich by investing in things that look good on the charts, things with low PERs, and things predicted by TV economic broadcasts or online experts based solely on investment indicators.

On the other hand, if you invest in a company that you actually want to acquire, one with a high management stake, a company that is currently wealthy, and has the potential to generate even more wealth in the future, you will rarely suffer significant losses or mental anguish from the stock.

Don't approach stocks with the simple concept of buying and selling.

You have to approach it with the mindset of paying attention to how the world works, finding industries that will grow, and then looking for companies within those industries to acquire whole companies.

Then, you will undoubtedly experience psychological stability and superior returns that you have never experienced before while investing.

--- From "Chapter 4: Finding Companies You Want to Buy, Not Companies You Want to Invest in"

A company that grew into a ten-bagger is a small, strong company that already had the necessary human resources, infrastructure, and financial resources by focusing on a single well within its industry, but then suddenly benefited from the growth of the upstream industry.

What I'm saying is that the company didn't grow explosively by working hard alone.

--- From "Chapter 4: Finding Companies You Want to Buy, Not Companies You Want to Invest in"

There are various analysis methods, but ultimately, you need to look at the money the company is currently making from its operations and see how many times that money it is calling for.

The price I'm asking for is the current market capitalization, so it's important to look at it from the buyer's perspective.

From the buyer's perspective, the key is to consider what multiple of the company's operating cash flow is a reasonable and good deal to purchase.

If the bowl is small, it will overflow and return to its original position.

Your assets will be reduced according to your level of ability.

If you have a vessel that can only hold 20 million won and you are lucky enough to make a profit of 100 million won, how will you handle that amount?

It's a vessel that can't even hold 50 million won, so if you have 100 million won, it's natural that the money will disappear sooner or later.

For me too, the process of going from 80 million won to 200 million won was extremely difficult.

If you barely make 200 million won, it goes down again, and if you struggle to get back up again, it goes down again as expected.

I even felt a sense of emptiness when it came down to near the principal.

Fortunately, as I grew internally and became more adept at handling 200 million won, I was able to maintain that amount no matter how difficult the market conditions became.

--- From "Chapter 2: The Size of Assets Increased Only After Expanding the Investment Pot"

I now invest about once every one or two years.

Although I sometimes make small, short-term investments to appease boredom, I only make significant investments that move large assets once every year or two.

If you invest in a certain industry and company from the beginning, even if there is a -5% drop or more in the middle, you will wait without wavering because you planned to invest in that industry and company for 2-3 years.

Then, later, when a good time comes and you make enough profit and sell it, 500 million won becomes 1 billion won, and then 2 billion won.

Sometimes, while investing like that, you see stocks that suddenly rise sharply.

--- From "Chapter 3: Breaking the mold and common sense of the stock market, the return on investment increased"

You don't need specialized knowledge to analyze a company.

If people use it, the company will naturally make a lot of money, and a company that makes it easy to understand the process of making money is a good company.

This is not something that is done through valuation or technical analysis, but rather through a business model approach.

Before you do a valuation, make sure the business model is easy to understand.

First, select a company whose money-inflow structure is easy and clear to understand, and then begin your valuation.

The same goes for looking at charts.

This order must not be changed.

--- From "Chapter 3: Breaking the mold and common sense of the stock market, the return on investment increased"

If you buy stocks and sell them when the price goes up, you will only be chasing after stock supply and demand, immediate popularity, and information that is not sure if it is accurate.

You can't get rich by investing in things that look good on the charts, things with low PERs, and things predicted by TV economic broadcasts or online experts based solely on investment indicators.

On the other hand, if you invest in a company that you actually want to acquire, one with a high management stake, a company that is currently wealthy, and has the potential to generate even more wealth in the future, you will rarely suffer significant losses or mental anguish from the stock.

Don't approach stocks with the simple concept of buying and selling.

You have to approach it with the mindset of paying attention to how the world works, finding industries that will grow, and then looking for companies within those industries to acquire whole companies.

Then, you will undoubtedly experience psychological stability and superior returns that you have never experienced before while investing.

--- From "Chapter 4: Finding Companies You Want to Buy, Not Companies You Want to Invest in"

A company that grew into a ten-bagger is a small, strong company that already had the necessary human resources, infrastructure, and financial resources by focusing on a single well within its industry, but then suddenly benefited from the growth of the upstream industry.

What I'm saying is that the company didn't grow explosively by working hard alone.

--- From "Chapter 4: Finding Companies You Want to Buy, Not Companies You Want to Invest in"

There are various analysis methods, but ultimately, you need to look at the money the company is currently making from its operations and see how many times that money it is calling for.

The price I'm asking for is the current market capitalization, so it's important to look at it from the buyer's perspective.

From the buyer's perspective, the key is to consider what multiple of the company's operating cash flow is a reasonable and good deal to purchase.

--- From "Chapter 5: Reading Between the Lines of the Market Before Analyzing Charts"

Publisher's Review

Worst crash ever vs.

The largest stock trading account ever

In the stock market fluctuating due to the COVID-19 situation,

How should we invest?

Retail investors are flocking to the stock market, which has suffered its worst-ever plunge due to the COVID-19 pandemic.

As of March 26, 2020, the number of active stock trading accounts reached an all-time high of 30.59 million.

Deposits in securities accounts also reached 45.169 trillion won.

These newly emerging investors, dreaming of a windfall, are rushing in, chanting only for "Samsung Electronics." But is Samsung Electronics truly the only company that will make us rich after the COVID-19 crisis? Which industries should we be one step ahead and focus on?

Deputy Prime Minister and Minister of Economy and Finance Hong Nam-ki announced at the 13th COVID-19 Response Economic-Related Ministerial Meeting and 3rd Crisis Management Meeting (9th Economic Revitalization Meeting) on April 1, 2020, “We plan to increase telecommunication companies’ investment in 5G, etc. in the first half of the year by 50% compared to the previous plan, from 2.7 trillion won to 4 trillion won.”

In fact, the 5G industry already emerged in the stock market in 2019.

With the launch of the world's first 5G network, domestic telecommunications companies have made significant investments in facilities, and the companies that benefited from this have begun to make a lot of money.

Unsurprisingly, these companies saw their stock prices rise dramatically.

For example, Ubiquitous Holdings, known as the hidden value stock of 5G, was priced at around 8,600 won at the end of 2018, but in just six months, it hit a high of 53,100 won, showing a growth rate of over 500%.

And there are investors who predicted the growth of the 5G industry and began investing in it even when many investors were negatively predicting that it was not yet time to invest in the industry.

He is a stock investment expert named 'Gift-Giving Santa' who built up assets of 10 billion won in 8 years with a seed capital of 80 million won.

The principles of stock investment that ensure absolute returns even in unpredictable markets!

Relearn the fundamentals of stock investing that anyone can follow!

The investment philosophy of 'Gift-Giving Santa' is simple.

'Invest in companies that will make you rich in the future.'

To do this, the author says, 'Look at the industry first.'

It's the same principle that even the best umbrellas don't sell well on sunny days, but on rainy days, even disposable umbrellas sold at convenience stores sell well.

Companies in growing industries have the opportunity to become wealthy.

To know which industries will grow, you need the perspective of an investor who carefully observes their surroundings and understands the direction in which the world is changing.

It's about keeping an eye on technologies and services that bring small changes to our daily lives, imagining the ripple effects they will have, and analyzing which industries and companies will benefit most from them.

That's why, despite being an investment book, it talks a lot about cultivating insight through cherishing and carefully observing people and their daily lives.

Based on this investment philosophy, the author discovered and invested in one new stock every one to two years, increasing his assets by two to ten times.

When I first encountered the fine dust issue, I discovered the filter company Clean & Science and started investing in it.

At the time, the market capitalization was around 30 billion won, but by the end of January 2020, the market capitalization had exceeded 200 billion won, an increase of approximately 700%.

In 2019, waste management company Coentech, which began to attract attention after the waste issue broke out, also showed a 200% increase in less than a year.

The book details the commonalities of the ten-bagger (10-bagger) stocks discovered by the author and how he found them, using a five-step thinking method.

The author explains how to find stocks and presents criteria that deviate from common sense and the framework of the stock market, such as, "Look at market capitalization, not stock price," "Look at issues, not timing," "Evaluate the business, not valuation," "Read the stock price cycle, not the market price," and "Don't fall for the illusion of cheap stocks."

However, if you look closely, these principles faithfully follow the basic logic of value investing, and the author has incorporated his own investment philosophy into them.

The Hidden Master of Stock Investment Who Gained 124 Times the Return with an Initial Investment of 80 Million Won

On the blog of 'Gift-Giving Santa'

Why do tens of thousands of investors come to us several times a day?

'Gift-Giving Santa' is a hidden expert in the stock investment world who shares investment philosophy and methods through his blog.

He started a blog in the second half of 2018 to share his journey of identifying industries with potential for growth and the companies he invested in within them.

Rather than simply recommending investment opportunities, I consistently monitored the investments and analyzed their growth potential, sharing information I gained through my own efforts and writing down my investment diary.

Soon, the blog received an explosive response, attracting numerous individual investors and recording 2.5 million views in just one year.

Investors who own stocks like 'Gift-Giving Santa' have gained confidence in their investments through the information he posts.

Beginner investors who are just starting out in the stock market have become accustomed to reading the stock market by observing the author's predictions, which have a high accuracy rate.

Most investors, who had been repeatedly buying and selling according to the market price and had not been able to increase their returns, changed their investment methods by gradually practicing the investment know-how of 'Gift-Giving Santa'.

Although the stocks he invests in are different, investors who pursue value investing find the strength to wait, using his writing as a stabilizing agent whenever the stock market fluctuates.

Before we knew it, the blog of 'Gift-Giving Santa' had become a sanctuary visited at least once a day by individual investors.

These articles, which received a warm response from investors, were refined and compiled into a book.

The author has compiled all of the core know-how and investment philosophy of stock investment that he has learned through firsthand experience into "Gift-Giving Santa's Stock Investment Secrets."

We discuss how to read the stock market trends through small, everyday interests, how to find a company you can trust with your entire investment, and how to stick to investment principles without being swayed by online bulletin boards, investment indicators, or market prices.

This book is full of investment wisdom that will help both novice and experienced investors stay calm in an uncertain market.

In a market as volatile as today, it is more important than ever to have an eye for reading the overall flow.

It is also essential to have the courage to control your mind and stick to sound investment principles.

The investment principles introduced in "Gift-Giving Santa's Stock Investment Secrets" are based on the author's own experience and success, so I'm confident they will provide investors with brilliant ideas.

I hope that through this book, many investors will enjoy the benefits of leisurely value investing.

“Thanks to Santa, I learned a lot today.”

Tens of thousands of investors have been met with a passionate response to the "Gift-Giving Santa"!

* “Every time I visit Santa’s blog, I get goosebumps.

I can't help but be amazed at how every scenario unfolds as expected." _dlt***

* “I think it is an investment philosophy that is easy for individual investors to utilize and allows them to invest in stocks without experiencing major failures.

Thank you for sharing” _mkw***

* “I am a beginner who is receiving a lot of help in studying stocks.

I'm reminded of how much effort it takes to invest in a single company.

“I always feel grateful and sorry that I feel like I am taking away all the hard-earned information in a matter of minutes” _iam***

* “I want to learn Santa’s investment habits.” _edm***

* “Every time I read the article, I feel like my perspective on the stock market and companies has improved significantly, so I read it over and over again.” _ith***

The largest stock trading account ever

In the stock market fluctuating due to the COVID-19 situation,

How should we invest?

Retail investors are flocking to the stock market, which has suffered its worst-ever plunge due to the COVID-19 pandemic.

As of March 26, 2020, the number of active stock trading accounts reached an all-time high of 30.59 million.

Deposits in securities accounts also reached 45.169 trillion won.

These newly emerging investors, dreaming of a windfall, are rushing in, chanting only for "Samsung Electronics." But is Samsung Electronics truly the only company that will make us rich after the COVID-19 crisis? Which industries should we be one step ahead and focus on?

Deputy Prime Minister and Minister of Economy and Finance Hong Nam-ki announced at the 13th COVID-19 Response Economic-Related Ministerial Meeting and 3rd Crisis Management Meeting (9th Economic Revitalization Meeting) on April 1, 2020, “We plan to increase telecommunication companies’ investment in 5G, etc. in the first half of the year by 50% compared to the previous plan, from 2.7 trillion won to 4 trillion won.”

In fact, the 5G industry already emerged in the stock market in 2019.

With the launch of the world's first 5G network, domestic telecommunications companies have made significant investments in facilities, and the companies that benefited from this have begun to make a lot of money.

Unsurprisingly, these companies saw their stock prices rise dramatically.

For example, Ubiquitous Holdings, known as the hidden value stock of 5G, was priced at around 8,600 won at the end of 2018, but in just six months, it hit a high of 53,100 won, showing a growth rate of over 500%.

And there are investors who predicted the growth of the 5G industry and began investing in it even when many investors were negatively predicting that it was not yet time to invest in the industry.

He is a stock investment expert named 'Gift-Giving Santa' who built up assets of 10 billion won in 8 years with a seed capital of 80 million won.

The principles of stock investment that ensure absolute returns even in unpredictable markets!

Relearn the fundamentals of stock investing that anyone can follow!

The investment philosophy of 'Gift-Giving Santa' is simple.

'Invest in companies that will make you rich in the future.'

To do this, the author says, 'Look at the industry first.'

It's the same principle that even the best umbrellas don't sell well on sunny days, but on rainy days, even disposable umbrellas sold at convenience stores sell well.

Companies in growing industries have the opportunity to become wealthy.

To know which industries will grow, you need the perspective of an investor who carefully observes their surroundings and understands the direction in which the world is changing.

It's about keeping an eye on technologies and services that bring small changes to our daily lives, imagining the ripple effects they will have, and analyzing which industries and companies will benefit most from them.

That's why, despite being an investment book, it talks a lot about cultivating insight through cherishing and carefully observing people and their daily lives.

Based on this investment philosophy, the author discovered and invested in one new stock every one to two years, increasing his assets by two to ten times.

When I first encountered the fine dust issue, I discovered the filter company Clean & Science and started investing in it.

At the time, the market capitalization was around 30 billion won, but by the end of January 2020, the market capitalization had exceeded 200 billion won, an increase of approximately 700%.

In 2019, waste management company Coentech, which began to attract attention after the waste issue broke out, also showed a 200% increase in less than a year.

The book details the commonalities of the ten-bagger (10-bagger) stocks discovered by the author and how he found them, using a five-step thinking method.

The author explains how to find stocks and presents criteria that deviate from common sense and the framework of the stock market, such as, "Look at market capitalization, not stock price," "Look at issues, not timing," "Evaluate the business, not valuation," "Read the stock price cycle, not the market price," and "Don't fall for the illusion of cheap stocks."

However, if you look closely, these principles faithfully follow the basic logic of value investing, and the author has incorporated his own investment philosophy into them.

The Hidden Master of Stock Investment Who Gained 124 Times the Return with an Initial Investment of 80 Million Won

On the blog of 'Gift-Giving Santa'

Why do tens of thousands of investors come to us several times a day?

'Gift-Giving Santa' is a hidden expert in the stock investment world who shares investment philosophy and methods through his blog.

He started a blog in the second half of 2018 to share his journey of identifying industries with potential for growth and the companies he invested in within them.

Rather than simply recommending investment opportunities, I consistently monitored the investments and analyzed their growth potential, sharing information I gained through my own efforts and writing down my investment diary.

Soon, the blog received an explosive response, attracting numerous individual investors and recording 2.5 million views in just one year.

Investors who own stocks like 'Gift-Giving Santa' have gained confidence in their investments through the information he posts.

Beginner investors who are just starting out in the stock market have become accustomed to reading the stock market by observing the author's predictions, which have a high accuracy rate.

Most investors, who had been repeatedly buying and selling according to the market price and had not been able to increase their returns, changed their investment methods by gradually practicing the investment know-how of 'Gift-Giving Santa'.

Although the stocks he invests in are different, investors who pursue value investing find the strength to wait, using his writing as a stabilizing agent whenever the stock market fluctuates.

Before we knew it, the blog of 'Gift-Giving Santa' had become a sanctuary visited at least once a day by individual investors.

These articles, which received a warm response from investors, were refined and compiled into a book.

The author has compiled all of the core know-how and investment philosophy of stock investment that he has learned through firsthand experience into "Gift-Giving Santa's Stock Investment Secrets."

We discuss how to read the stock market trends through small, everyday interests, how to find a company you can trust with your entire investment, and how to stick to investment principles without being swayed by online bulletin boards, investment indicators, or market prices.

This book is full of investment wisdom that will help both novice and experienced investors stay calm in an uncertain market.

In a market as volatile as today, it is more important than ever to have an eye for reading the overall flow.

It is also essential to have the courage to control your mind and stick to sound investment principles.

The investment principles introduced in "Gift-Giving Santa's Stock Investment Secrets" are based on the author's own experience and success, so I'm confident they will provide investors with brilliant ideas.

I hope that through this book, many investors will enjoy the benefits of leisurely value investing.

“Thanks to Santa, I learned a lot today.”

Tens of thousands of investors have been met with a passionate response to the "Gift-Giving Santa"!

* “Every time I visit Santa’s blog, I get goosebumps.

I can't help but be amazed at how every scenario unfolds as expected." _dlt***

* “I think it is an investment philosophy that is easy for individual investors to utilize and allows them to invest in stocks without experiencing major failures.

Thank you for sharing” _mkw***

* “I am a beginner who is receiving a lot of help in studying stocks.

I'm reminded of how much effort it takes to invest in a single company.

“I always feel grateful and sorry that I feel like I am taking away all the hard-earned information in a matter of minutes” _iam***

* “I want to learn Santa’s investment habits.” _edm***

* “Every time I read the article, I feel like my perspective on the stock market and companies has improved significantly, so I read it over and over again.” _ith***

GOODS SPECIFICS

- Date of issue: April 16, 2020

- Page count, weight, size: 276 pages | 502g | 152*225*20mm

- ISBN13: 9791162541395

- ISBN10: 1162541393

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)