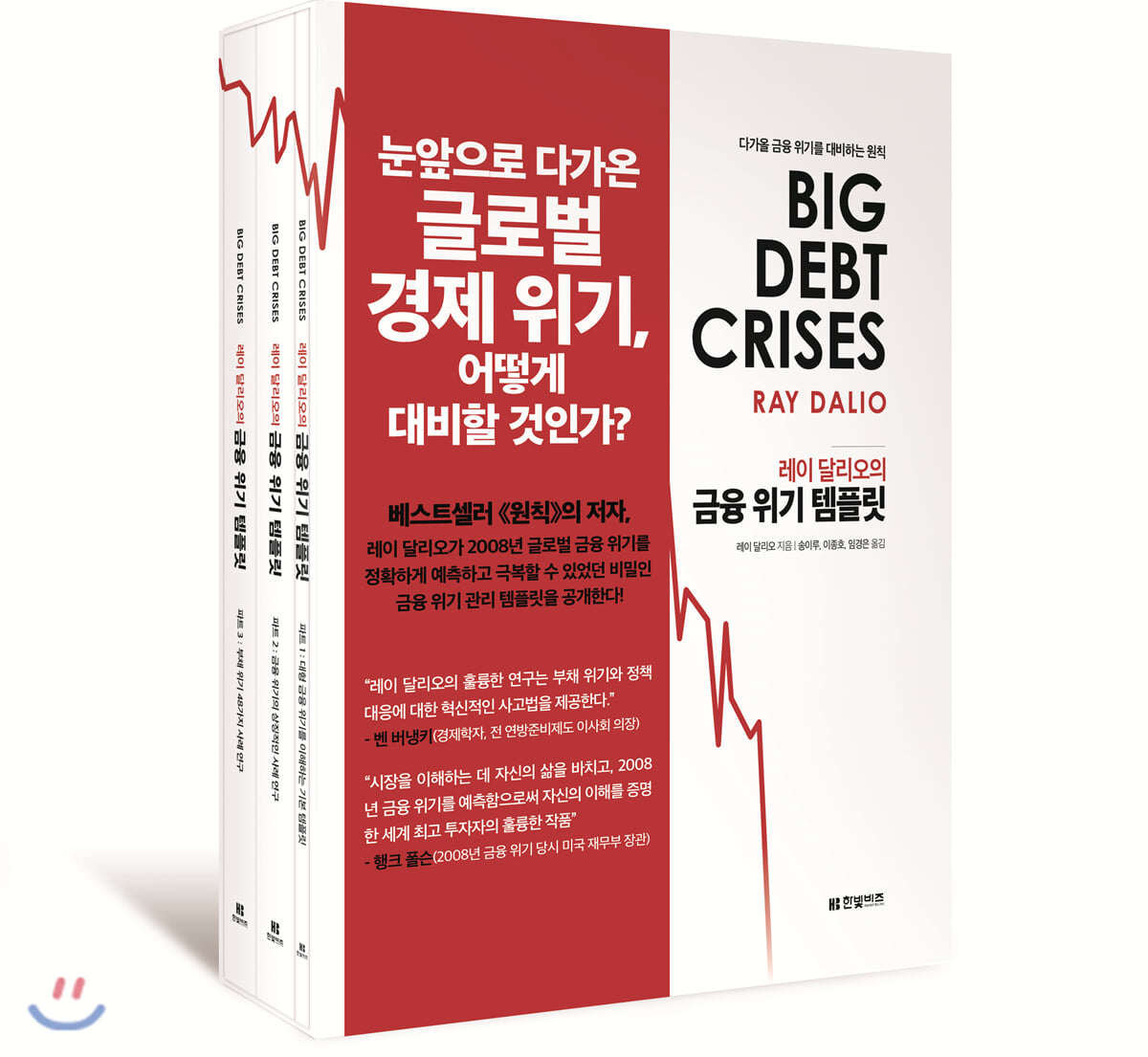

Ray Dalio's Financial Crisis Template

|

Description

Book Introduction

The very template that accurately predicted and overcame the 2008 financial crisis. Ray Dalio, one of the world's most successful investors, has released a template for how financial crises occur and how to deal with them, marking the 10th anniversary of the 2008 financial crisis. This template helped Bridgewater Associates anticipate and navigate the 2008 financial crisis, but it also helped most others weather the 2008 crisis. As Ray Dalio explains in his New York Times bestseller, "Principles," most things happen repeatedly over time. So, studying patterns allows us to understand cause and effect and deal with similar events when they occur. Ray Dalio's Financial Crisis Template consists of three volumes, as follows: It introduces a basic template for understanding typical major financial crisis cycles (Part 1), examines three specific cases in depth—the financial crisis of the Weimar Republic in Germany in the 1920s, the Great Depression in the United States in the 1930s, and the financial crisis of 2008 (Part 2), and provides a new understanding of the economy and markets by studying 48 cases of debt crises (Part 3). |

- You can preview some of the book's contents.

Preview

index

Part 1: A Basic Template for Understanding Major Financial Crises

Part 1: A Typical Large Debt Cycle

- Credit and Debt

- A typical large-scale long-term debt cycle template

- Cycle analysis

Typical debt cycle

- Early cycle

- Bubble

- Peak

- Recession

- Virtuous cycle deleveraging

- Excessive expansion policy

- Normalization

Inflationary depression and currency crisis

General inflation debt cycle phase

- Early stage of circulation

- Bubble

- Peak and exchange rate defense

- Recession (if exchange rate defense is abandoned)

- Normalization

A vicious cycle of temporary inflationary depression and hyperinflation

war economy

summation

Part 2: Iconic Case Studies of the Financial Crisis

German Debt Crisis and Hyperinflation (1918–1924)

The US Debt Crisis and Response (1928–1937, the Great Depression of the 1930s)

The US Debt Crisis and Response (2007–2011, 2008 Financial Crisis)

Part 3: 48 Case Studies of Debt Crises

Part 1: A Typical Large Debt Cycle

- Credit and Debt

- A typical large-scale long-term debt cycle template

- Cycle analysis

Typical debt cycle

- Early cycle

- Bubble

- Peak

- Recession

- Virtuous cycle deleveraging

- Excessive expansion policy

- Normalization

Inflationary depression and currency crisis

General inflation debt cycle phase

- Early stage of circulation

- Bubble

- Peak and exchange rate defense

- Recession (if exchange rate defense is abandoned)

- Normalization

A vicious cycle of temporary inflationary depression and hyperinflation

war economy

summation

Part 2: Iconic Case Studies of the Financial Crisis

German Debt Crisis and Hyperinflation (1918–1924)

The US Debt Crisis and Response (1928–1937, the Great Depression of the 1930s)

The US Debt Crisis and Response (2007–2011, 2008 Financial Crisis)

Part 3: 48 Case Studies of Debt Crises

Detailed image

.jpg)

Publisher's Review

A book filled with the aspirations of Ray Dalio, who has dedicated his life to understanding the market.

Ray Dalio announced in his book, Principles, published in September 2017 that he would write another book on economic and investment principles.

He stated that after these two books, he would have no more advice to give, and his mission of presenting principles would be over.

However, “Financial Crisis Template” was released while the second book had not yet been published.

So why did he release "The Financial Crisis Template"? Ray Dalio believes that most events repeat themselves over time, and studying those patterns can help us understand causality and develop principles for effectively managing them.

So, we've released a "template" that analyzes past major crises, understands their causal relationships, and establishes principles for preparing for crises, enabling us to predict future events.

By sharing this template, you can read Ray Dalio's hope that other investors will be able to reduce the likelihood of a larger financial crisis in the future and manage it.

Crises happen repeatedly.

Prepare for the 2020 financial crisis!

Ray Dalio is so well-versed in economic trends that he is called an "economist." He is famous for being asked by various media outlets to comment on various economic issues that arise overseas.

He is also an investor whom the world's media is eager to solicit for his opinion on the economic outlook.

He recently warned of an economic recession in the United States in 2020.

That's why investors and economically minded readers around the world have been waiting for Ray Dalio's Financial Crisis Template.

As our country is by no means immune from this financial crisis, this template will be helpful to many readers in preparing for and managing the crisis.

Reader Reviews

As Warren Buffett said, "Risk comes from not knowing what you're doing." We must strive to understand the game.

So this book is a must-read to understand the world we live in today.

I'm so grateful that Ray Dalio has provided a comprehensive review that explains the complex world of finance in simple language that even the average reader can understand, helping them understand cause and effect.

- From a review by MI* on Amazon

This is the best economics book I've ever read.

This book will help you decide for yourself what to do to protect yourself when a crisis strikes.

- Amazon Paul R.

From Chit***'s review

Well written and very informative.

This is a must-read for anyone interested in markets, government economic policies, etc.

- From Amazon reader reviews

Thanks to Ray Dalio for sharing his landmark research on the financial crisis.

This is clearly a lifelong task.

Through passionate and lucid writing, the author draws readers deeply into the analysis of the great financial crisis.

What makes this monumental work refreshing is the author's passion and talent for teaching, deciphering obscure economic jargon for non-specialists.

A highly recommended book for anyone interested in understanding how economic and financial systems shape our world.

- Amazon And*'s review

Ray Dalio announced in his book, Principles, published in September 2017 that he would write another book on economic and investment principles.

He stated that after these two books, he would have no more advice to give, and his mission of presenting principles would be over.

However, “Financial Crisis Template” was released while the second book had not yet been published.

So why did he release "The Financial Crisis Template"? Ray Dalio believes that most events repeat themselves over time, and studying those patterns can help us understand causality and develop principles for effectively managing them.

So, we've released a "template" that analyzes past major crises, understands their causal relationships, and establishes principles for preparing for crises, enabling us to predict future events.

By sharing this template, you can read Ray Dalio's hope that other investors will be able to reduce the likelihood of a larger financial crisis in the future and manage it.

Crises happen repeatedly.

Prepare for the 2020 financial crisis!

Ray Dalio is so well-versed in economic trends that he is called an "economist." He is famous for being asked by various media outlets to comment on various economic issues that arise overseas.

He is also an investor whom the world's media is eager to solicit for his opinion on the economic outlook.

He recently warned of an economic recession in the United States in 2020.

That's why investors and economically minded readers around the world have been waiting for Ray Dalio's Financial Crisis Template.

As our country is by no means immune from this financial crisis, this template will be helpful to many readers in preparing for and managing the crisis.

Reader Reviews

As Warren Buffett said, "Risk comes from not knowing what you're doing." We must strive to understand the game.

So this book is a must-read to understand the world we live in today.

I'm so grateful that Ray Dalio has provided a comprehensive review that explains the complex world of finance in simple language that even the average reader can understand, helping them understand cause and effect.

- From a review by MI* on Amazon

This is the best economics book I've ever read.

This book will help you decide for yourself what to do to protect yourself when a crisis strikes.

- Amazon Paul R.

From Chit***'s review

Well written and very informative.

This is a must-read for anyone interested in markets, government economic policies, etc.

- From Amazon reader reviews

Thanks to Ray Dalio for sharing his landmark research on the financial crisis.

This is clearly a lifelong task.

Through passionate and lucid writing, the author draws readers deeply into the analysis of the great financial crisis.

What makes this monumental work refreshing is the author's passion and talent for teaching, deciphering obscure economic jargon for non-specialists.

A highly recommended book for anyone interested in understanding how economic and financial systems shape our world.

- Amazon And*'s review

GOODS SPECIFICS

- Publication date: February 24, 2020

- Page count, weight, size: 668 pages | 2,174g | 214*270*44mm

- ISBN13: 9791157843886

- ISBN10: 1157843883

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)