Psychology of Wealth

|

Description

Book Introduction

- A word from MD

-

Psychologist Kim Kyung-il's View on Money and WorkMost of us have to work and earn money throughout our lives.

If I have to do it, I want to do it happily and well.

Let's get some help from the insights of psychologist Kim Kyung-il.

Everything in this book is a panacea for achieving success at work, making smart decisions, finding a balance between saving and spending, and making profitable trades.

July 15, 2025. Humanities PD Son Min-gyu

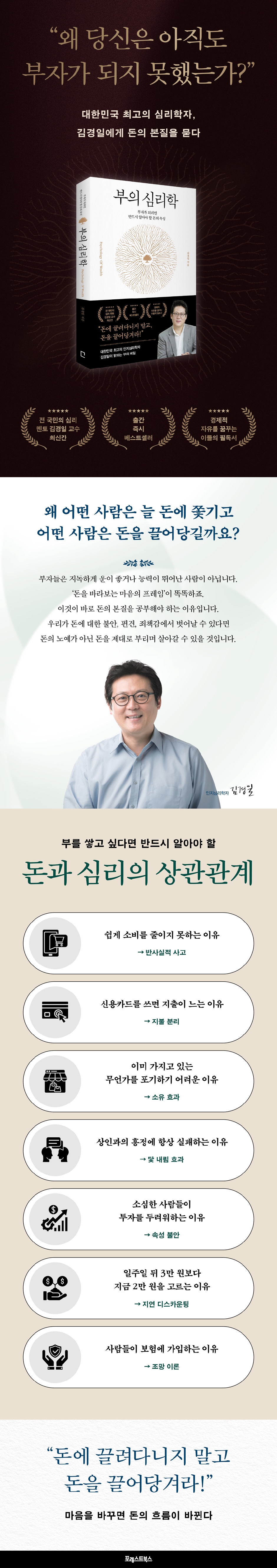

★ The latest book by Professor Kim Kyung-il, the nation's psychological mentor

★ Bestseller immediately after publication

★ A must-read for those who dream of financial freedom.

“Don’t be led by money, attract money to you!”

The Secret to Wealth Revealed by South Korea's Leading Cognitive Psychologist, Kim Kyung-il

Many people devour economic news and financial books, searching for investment information, hoping to become rich.

But we don't really think about why we have a hard time thinking rationally when it comes to money and why we fall into bad spending habits.

This book, “The Psychology of Wealth,” starts from this very question.

Professor Kim Kyung-il, the author of this book, discusses from a psychologist's perspective why we become anxious about money, why we imitate the spending habits of others, and how we can adopt the mindset of the rich.

As you follow Kim Kyung-il's characteristically cheerful and lively sentences that spill over from page to page, you will gain valuable insight into why we have not yet been able to become rich and why we have been so vulnerable to money.

What we want is not simply to make a lot of money, but to have the inner strength to attract money rather than being led by it.

Remember.

Only those who truly understand the nature of money can be free from money.

Let's begin our journey to becoming confident in front of money with this book.

★ Bestseller immediately after publication

★ A must-read for those who dream of financial freedom.

“Don’t be led by money, attract money to you!”

The Secret to Wealth Revealed by South Korea's Leading Cognitive Psychologist, Kim Kyung-il

Many people devour economic news and financial books, searching for investment information, hoping to become rich.

But we don't really think about why we have a hard time thinking rationally when it comes to money and why we fall into bad spending habits.

This book, “The Psychology of Wealth,” starts from this very question.

Professor Kim Kyung-il, the author of this book, discusses from a psychologist's perspective why we become anxious about money, why we imitate the spending habits of others, and how we can adopt the mindset of the rich.

As you follow Kim Kyung-il's characteristically cheerful and lively sentences that spill over from page to page, you will gain valuable insight into why we have not yet been able to become rich and why we have been so vulnerable to money.

What we want is not simply to make a lot of money, but to have the inner strength to attract money rather than being led by it.

Remember.

Only those who truly understand the nature of money can be free from money.

Let's begin our journey to becoming confident in front of money with this book.

- You can preview some of the book's contents.

Preview

index

prolog.

Why do poor psychologists study money?

Part 1.

Psychologist Asks About the Nature of Work

- Why do I become poor when I work hard?

01 How to break a three-day resolution

02 Anxiety is the truth, anger is the truth

03 Opportunity to develop autonomy

04 When stress and energy meet

05 Busy people are never easily satisfied.

06 Lies of a Prestigious University Student

07 Psychological tie effect

08 You have to be jealous to win

09 Why We Resist Small Changes So Strongly

10 Jo Sam Mo Sa, surprisingly true

11 Not the right argument, but the right words

12 After failure, a second attempt is framed as a recovery.

13 Describe your successes and explain your failures.

14 The mechanism of the same

15 To make an unasked subordinate open his mouth

16 The Law of Triviality

17 Reasons Why You Should Drink Kimchi Soup

18 Make important decisions in the morning

19 If there is no sincerity

The surprising reason why people are being pushed aside after breaking up 20 episodes

21 The most honest person is the most greedy person

22 Personality cannot be changed, but character can.

23 The Battle Between Hawks and Doves

24 Psychology of Weather

25 Before talking about work-life balance

26 To eliminate villains within a company

27 Why Coincidences Are Not Coincidences

28 How Brainstorming Is Disabled

29 If you're lonely and can't sleep, do this.

30 Rediscovery of Autumn

Part 2.

Psychologist Learns the Conditions of the Wealthy

- Your attitude toward money determines your wealth.

31 How much would you like to spend?

32 The Psychology of Waste

33 Spending is easy, saving is difficult

34 Go? No-Go?

35 The first and most important thing to do

36 Justice and Transparency

37 How a Lion Passes Down the Throne

38 hours bonus

39 Don't interrupt my vacation

40 The Difference Between Fair Compensation and Fair Benefit

41 The Allure of Uncertain Money

42 Negotiation Skills

If you don't want to become a 43rd generation

44 The Functional Relationship Between Money and Youth

45 Savings also have a first half and a second half.

46 Casinos and Department Stores

47 The WANT created by society, the LIKE that only I know

48 What to fill

49 If you want to make money, first overcome your anxiety.

50 Reasons Why You Should Create Lots of Loose Ties

51 The Fiction of Selective Welfare

52 The timid person is accurate, the generous person starts

53 Is this a reasonable amount?

54 Words to win and words to not lose

55 1 million won now vs. 1 million won a month from now

56 If you postpone it, it gets cheaper

57 To become an insurance king

58 Failure Celebration Party

59 The Crucial Difference Between Money and Coupons

60 Toothbrushes and Supercars

61 Next time I win the lottery?

62 The big money of the future has a specific title

63 How did you earn this money?

64 Good Money and Bad Money

References

Why do poor psychologists study money?

Part 1.

Psychologist Asks About the Nature of Work

- Why do I become poor when I work hard?

01 How to break a three-day resolution

02 Anxiety is the truth, anger is the truth

03 Opportunity to develop autonomy

04 When stress and energy meet

05 Busy people are never easily satisfied.

06 Lies of a Prestigious University Student

07 Psychological tie effect

08 You have to be jealous to win

09 Why We Resist Small Changes So Strongly

10 Jo Sam Mo Sa, surprisingly true

11 Not the right argument, but the right words

12 After failure, a second attempt is framed as a recovery.

13 Describe your successes and explain your failures.

14 The mechanism of the same

15 To make an unasked subordinate open his mouth

16 The Law of Triviality

17 Reasons Why You Should Drink Kimchi Soup

18 Make important decisions in the morning

19 If there is no sincerity

The surprising reason why people are being pushed aside after breaking up 20 episodes

21 The most honest person is the most greedy person

22 Personality cannot be changed, but character can.

23 The Battle Between Hawks and Doves

24 Psychology of Weather

25 Before talking about work-life balance

26 To eliminate villains within a company

27 Why Coincidences Are Not Coincidences

28 How Brainstorming Is Disabled

29 If you're lonely and can't sleep, do this.

30 Rediscovery of Autumn

Part 2.

Psychologist Learns the Conditions of the Wealthy

- Your attitude toward money determines your wealth.

31 How much would you like to spend?

32 The Psychology of Waste

33 Spending is easy, saving is difficult

34 Go? No-Go?

35 The first and most important thing to do

36 Justice and Transparency

37 How a Lion Passes Down the Throne

38 hours bonus

39 Don't interrupt my vacation

40 The Difference Between Fair Compensation and Fair Benefit

41 The Allure of Uncertain Money

42 Negotiation Skills

If you don't want to become a 43rd generation

44 The Functional Relationship Between Money and Youth

45 Savings also have a first half and a second half.

46 Casinos and Department Stores

47 The WANT created by society, the LIKE that only I know

48 What to fill

49 If you want to make money, first overcome your anxiety.

50 Reasons Why You Should Create Lots of Loose Ties

51 The Fiction of Selective Welfare

52 The timid person is accurate, the generous person starts

53 Is this a reasonable amount?

54 Words to win and words to not lose

55 1 million won now vs. 1 million won a month from now

56 If you postpone it, it gets cheaper

57 To become an insurance king

58 Failure Celebration Party

59 The Crucial Difference Between Money and Coupons

60 Toothbrushes and Supercars

61 Next time I win the lottery?

62 The big money of the future has a specific title

63 How did you earn this money?

64 Good Money and Bad Money

References

Detailed image

Into the book

'By today' and 'by OO time' are psychologically completely different types of deadlines.

Strictly speaking, 'by today' cannot be considered a deadline.

It's just a macroscopic final state.

But ‘until OO time’ is different.

If you think, 'I'll finish that task by 6 p.m.,' you'll naturally need to finish one of the sub-goals of that task by 4 p.m., before that.

And I need to finish my smaller goals before 2pm.

Naturally, this makes things easier to unpack.

Moreover, by dividing the work and focusing on it in this way, you can feel a greater sense of accomplishment.

--- p.20~21

Ultimately, the issue is authenticity.

If anyone in a relationship is low on this, unhappiness and conflict are likely to set in, and the relationship or organization will not last long.

If the sincerity of all those who have formed a relationship declines, the group will become like a grain of sand that is repeatedly united and broken only by self-interest, or in severe cases, it is highly likely that it will degenerate into a criminal or violent group.

--- p.92

People who are hungry while shopping greatly undervalue computers that have nothing to do with hunger.

So, even with a significantly discounted price, they react indifferently.

Also, while the message about global warming is persuasive in the hot summer, raising the issue of the Earth's heating in the winter, when we have to walk around in the bitter cold wind, is unlikely to capture people's attention.

Ultimately, in order to discuss the value of various future objects, we must first confirm whether our current needs, even if they seem trivial, are well-met.

--- p.153

When you ask wealth experts, “Which is more important to becoming wealthy: reducing spending or increasing income?” they unanimously answer that increasing income is more important.

But when you ask other wealth experts with similar skills and insight, “What’s the first thing you need to do to become rich?” they answer like this.

“We don’t need anything else, we need to start by reducing consumption.”

--- p.159~160

Lions are called the king of beasts and are the only cats that live in groups.

That group is called Pride.

A pride consists of 30 to 40 lions.

What's interesting, however, is that the pride leader never chooses his successor as the lion with the greatest hunting ability.

It is said that after a lion successfully catches a prey, he will watch to see if he can share the food with the other competitor's subordinates who helped him catch the prey.

Even if his hunting ability is relatively weak, he will hand over the top position to someone who shares his achievements with his rivals' subordinates.

--- p.168~169

If you're already earning some money, you should focus on broadening your network and forming loose connections with a variety of people.

Having money doesn't mean you should only date people who are of a higher status.

The key word here is 'diversity'.

Now that I have the mobility that I never had when I had little money, it means I get to see more of the world and more of the people.

In the process, you will create a virtuous cycle of accumulating meaningful wealth by gaining a broader perspective.

--- p.226

In the early stages, you need something that can give you the reassurance that everything will be alright before you decide what to do.

Psychologists call this the 'emotional stamp of approval for a decision.'

This is why patients with damage to the emotional areas of the brain have difficulty making decisions at work.

But if you've already started something and want to continue pursuing it, you need to eliminate any logic or reasons that might lead you astray and only show a clear path.

--- p.265

Most of us do not possess a great deal of wealth, but we earn our living in a normal and ethical manner.

In modern society, the ways to make money have become more diverse than in the past, and many people boast about making a lot of money easily.

But if you think you are making money in an honest and ethical way, then please be sure to let yourself, your family, and your children know that you are doing it right.

My respect and self-esteem for money can prevent me from wasting money.

Wouldn't this also be a way to free ourselves from all the negative habits and thoughts related to money?

Strictly speaking, 'by today' cannot be considered a deadline.

It's just a macroscopic final state.

But ‘until OO time’ is different.

If you think, 'I'll finish that task by 6 p.m.,' you'll naturally need to finish one of the sub-goals of that task by 4 p.m., before that.

And I need to finish my smaller goals before 2pm.

Naturally, this makes things easier to unpack.

Moreover, by dividing the work and focusing on it in this way, you can feel a greater sense of accomplishment.

--- p.20~21

Ultimately, the issue is authenticity.

If anyone in a relationship is low on this, unhappiness and conflict are likely to set in, and the relationship or organization will not last long.

If the sincerity of all those who have formed a relationship declines, the group will become like a grain of sand that is repeatedly united and broken only by self-interest, or in severe cases, it is highly likely that it will degenerate into a criminal or violent group.

--- p.92

People who are hungry while shopping greatly undervalue computers that have nothing to do with hunger.

So, even with a significantly discounted price, they react indifferently.

Also, while the message about global warming is persuasive in the hot summer, raising the issue of the Earth's heating in the winter, when we have to walk around in the bitter cold wind, is unlikely to capture people's attention.

Ultimately, in order to discuss the value of various future objects, we must first confirm whether our current needs, even if they seem trivial, are well-met.

--- p.153

When you ask wealth experts, “Which is more important to becoming wealthy: reducing spending or increasing income?” they unanimously answer that increasing income is more important.

But when you ask other wealth experts with similar skills and insight, “What’s the first thing you need to do to become rich?” they answer like this.

“We don’t need anything else, we need to start by reducing consumption.”

--- p.159~160

Lions are called the king of beasts and are the only cats that live in groups.

That group is called Pride.

A pride consists of 30 to 40 lions.

What's interesting, however, is that the pride leader never chooses his successor as the lion with the greatest hunting ability.

It is said that after a lion successfully catches a prey, he will watch to see if he can share the food with the other competitor's subordinates who helped him catch the prey.

Even if his hunting ability is relatively weak, he will hand over the top position to someone who shares his achievements with his rivals' subordinates.

--- p.168~169

If you're already earning some money, you should focus on broadening your network and forming loose connections with a variety of people.

Having money doesn't mean you should only date people who are of a higher status.

The key word here is 'diversity'.

Now that I have the mobility that I never had when I had little money, it means I get to see more of the world and more of the people.

In the process, you will create a virtuous cycle of accumulating meaningful wealth by gaining a broader perspective.

--- p.226

In the early stages, you need something that can give you the reassurance that everything will be alright before you decide what to do.

Psychologists call this the 'emotional stamp of approval for a decision.'

This is why patients with damage to the emotional areas of the brain have difficulty making decisions at work.

But if you've already started something and want to continue pursuing it, you need to eliminate any logic or reasons that might lead you astray and only show a clear path.

--- p.265

Most of us do not possess a great deal of wealth, but we earn our living in a normal and ethical manner.

In modern society, the ways to make money have become more diverse than in the past, and many people boast about making a lot of money easily.

But if you think you are making money in an honest and ethical way, then please be sure to let yourself, your family, and your children know that you are doing it right.

My respect and self-esteem for money can prevent me from wasting money.

Wouldn't this also be a way to free ourselves from all the negative habits and thoughts related to money?

--- p.286

Publisher's Review

“What we need to learn is not money,

“It is our mind that handles money.”

The Nature of Money You Must Know Before Becoming Rich

Is there anything more crucial to human happiness than money? While we can't say that having more money equates to happiness, it's clear that money provides us with freedom, protects us from danger, and provides a protective shield that allows us to exercise our basic rights.

So, what kind of people become wealthy? Do those who earn and save money possess a special talent? Professor Kim Kyung-il, considered Korea's leading cognitive psychologist, explains.

He has been interested in and researched the contradictory attitudes and behaviors of humans toward money for a long time, to the point that the topic of his doctoral dissertation was 'money.'

And while people say they want to make money, they don't really think about how humans perceive money. He explains in an interesting way from a cognitive psychology perspective why we waste our hard-earned money and regret it later, and why we become distant from money due to irrational choices. This book, "The Psychology of Wealth," contains this.

Professor Kim Kyung-il says this:

“Of all living creatures on Earth, only humans live with money.

That's why psychologists use money the most when studying humans.

Therefore, if we clearly understand our mind in handling money, we can control money more wisely and become free from money.” That’s right.

People who earn money well, manage it well, and create more are not smart people, but people who 'control their emotions well.'

In other words, becoming rich is a matter of understanding anxiety and lack, knowing when to move forward and when to stop, and overcoming greed and fear.

“Change your frame of mind before filling your wallet!”

With Kim Kyung-il, the nation's psychological mentor

An economics class that teaches the heart before money

This book is largely divided into two parts.

Part 1 seeks answers to the question of the nature of work.

The means by which humans earn money is labor, that is, work.

Therefore, acquiring the psychological insight to achieve work performance, achieve accomplishments, and work effectively in an organization is tantamount to laying the foundation for wealth.

In Part 2, we will redefine our perception of wealth by looking into the psychological habits and emotional patterns surrounding money, as well as the unconscious mind that operates without our awareness.

This book is not just an economics book.

Through the lens of psychology, this book explores why we repeatedly make mistakes with money and how we can make smarter financial decisions. It delves into our psychological framework for viewing wealth, our emotional habits around money, and the unconscious workings of spending and saving, all in a playful yet sharp manner.

Rather than directly telling you how to become rich, it examines the fears and desires inherent in our hearts, our attitudes toward money, and our spending habits, and imparts solid wisdom and insight that can help you reach true wealth.

And the moment we close the last chapter of the book, we will know.

The fact that true wealth doesn't start with saving or investing, but with a change in perspective on money.

“It is our mind that handles money.”

The Nature of Money You Must Know Before Becoming Rich

Is there anything more crucial to human happiness than money? While we can't say that having more money equates to happiness, it's clear that money provides us with freedom, protects us from danger, and provides a protective shield that allows us to exercise our basic rights.

So, what kind of people become wealthy? Do those who earn and save money possess a special talent? Professor Kim Kyung-il, considered Korea's leading cognitive psychologist, explains.

He has been interested in and researched the contradictory attitudes and behaviors of humans toward money for a long time, to the point that the topic of his doctoral dissertation was 'money.'

And while people say they want to make money, they don't really think about how humans perceive money. He explains in an interesting way from a cognitive psychology perspective why we waste our hard-earned money and regret it later, and why we become distant from money due to irrational choices. This book, "The Psychology of Wealth," contains this.

Professor Kim Kyung-il says this:

“Of all living creatures on Earth, only humans live with money.

That's why psychologists use money the most when studying humans.

Therefore, if we clearly understand our mind in handling money, we can control money more wisely and become free from money.” That’s right.

People who earn money well, manage it well, and create more are not smart people, but people who 'control their emotions well.'

In other words, becoming rich is a matter of understanding anxiety and lack, knowing when to move forward and when to stop, and overcoming greed and fear.

“Change your frame of mind before filling your wallet!”

With Kim Kyung-il, the nation's psychological mentor

An economics class that teaches the heart before money

This book is largely divided into two parts.

Part 1 seeks answers to the question of the nature of work.

The means by which humans earn money is labor, that is, work.

Therefore, acquiring the psychological insight to achieve work performance, achieve accomplishments, and work effectively in an organization is tantamount to laying the foundation for wealth.

In Part 2, we will redefine our perception of wealth by looking into the psychological habits and emotional patterns surrounding money, as well as the unconscious mind that operates without our awareness.

This book is not just an economics book.

Through the lens of psychology, this book explores why we repeatedly make mistakes with money and how we can make smarter financial decisions. It delves into our psychological framework for viewing wealth, our emotional habits around money, and the unconscious workings of spending and saving, all in a playful yet sharp manner.

Rather than directly telling you how to become rich, it examines the fears and desires inherent in our hearts, our attitudes toward money, and our spending habits, and imparts solid wisdom and insight that can help you reach true wealth.

And the moment we close the last chapter of the book, we will know.

The fact that true wealth doesn't start with saving or investing, but with a change in perspective on money.

GOODS SPECIFICS

- Date of issue: June 18, 2025

- Page count, weight, size: 292 pages | 518g | 152*225*20mm

- ISBN13: 9791194530466

- ISBN10: 119453046X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)