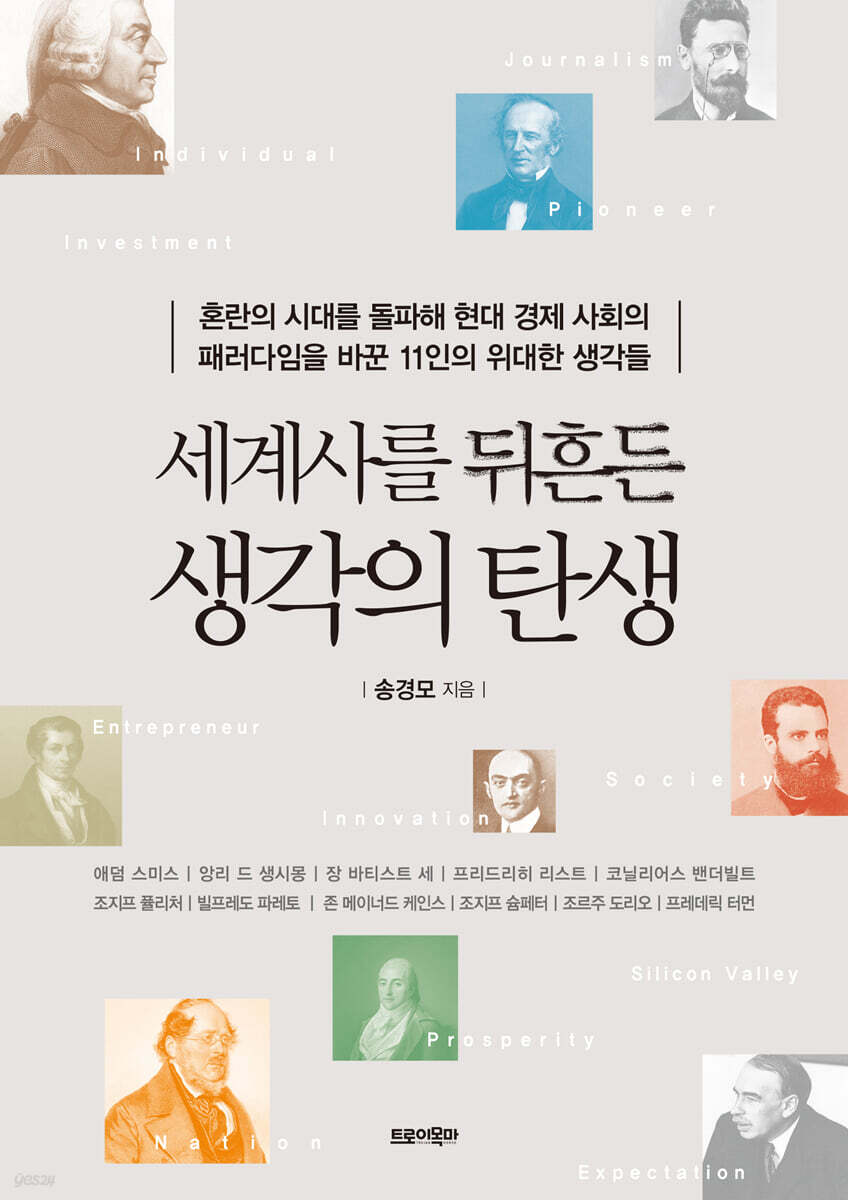

The Birth of an Idea That Shook World History

|

Description

Book Introduction

War, Great Depression, Democratic Revolution, Industrial Revolution, Cold War The lives and thoughts of 11 great thinkers and entrepreneurs who shook up world history with innovative paradigms in times of turmoil. Professor Song Kyung-mo, an adjunct professor at Korea University's Graduate School of Technology Management and the CEO of Mirawiz, a research and development and consulting firm specializing in economics and management strategy, and renowned in Korea as a Peter Drucker expert, has published a new book titled "The Birth of an Idea That Shook World History." This book is a classic liberal arts textbook that focuses on the lives and ideas of eleven thinkers and entrepreneurs whom the author studied and researched for his humanities lectures to business managers. It particularly examines how the ideas that have had the greatest influence on modern society and economic development came to be. It lists the protagonists of the new paradigm that emerged over the course of about 200 years from the 18th century to the 20th century in chronological order. It covers not only Adam Smith of the 'invisible hand', who most people have heard of through books or the media, but whose true nature is not well known, Keynes of the 'defense of fiscal spending', and Pareto of the '80/20 rule', but also figures such as Saint-Simon, Jean-Baptiste Say, Friedrich List, and Frederick Terman, who are not well known even to those who have studied economics or sociology, but who have left a great mark on the lives of modern people. |

- You can preview some of the book's contents.

Preview

index

To the readers who chose this book

· CHAPTER 1 · Individual _ Adam Smith, the moral philosopher of harmony (Scotland (UK))

· CHAPTER 2 · Prosperity _ Henri de Saint-Simon (France), who dreamed of an ideal industrial society

· CHAPTER 3 · Entrepreneurs _ Jean-Baptiste Say (France), a pioneer in entrepreneurship

· CHAPTER 4 · NATIONALITY _ Friedrich List (Germany), the orator of the national system

· CHAPTER 5 · Pioneering _ Cornelius Vanderbilt (USA), a role model for entrepreneurs who immigrated to the New World

· CHAPTER 6 · Information _ Joseph Pulitzer (USA), the innovator of newspaper content

· CHAPTER 7 · Society _ Vilfredo Pareto (Italy), who returned to reality after wandering around the world of morality and reason

· CHAPTER 8 · Expectations _ John Maynard Keynes, the multi-faceted social thinker (UK)

· CHAPTER 9 · Change _ Joseph Schumpeter, the thinker of creative destruction (Austria)

· CHAPTER 10 · Finance _ Georges Doriot (USA), the pioneer of modern venture capital

· CHAPTER 11 · Entrepreneurship _ Frederick Terman, the Father of Silicon Valley (USA)

Epilogue

Acknowledgements

Endnotes

Search

· CHAPTER 1 · Individual _ Adam Smith, the moral philosopher of harmony (Scotland (UK))

· CHAPTER 2 · Prosperity _ Henri de Saint-Simon (France), who dreamed of an ideal industrial society

· CHAPTER 3 · Entrepreneurs _ Jean-Baptiste Say (France), a pioneer in entrepreneurship

· CHAPTER 4 · NATIONALITY _ Friedrich List (Germany), the orator of the national system

· CHAPTER 5 · Pioneering _ Cornelius Vanderbilt (USA), a role model for entrepreneurs who immigrated to the New World

· CHAPTER 6 · Information _ Joseph Pulitzer (USA), the innovator of newspaper content

· CHAPTER 7 · Society _ Vilfredo Pareto (Italy), who returned to reality after wandering around the world of morality and reason

· CHAPTER 8 · Expectations _ John Maynard Keynes, the multi-faceted social thinker (UK)

· CHAPTER 9 · Change _ Joseph Schumpeter, the thinker of creative destruction (Austria)

· CHAPTER 10 · Finance _ Georges Doriot (USA), the pioneer of modern venture capital

· CHAPTER 11 · Entrepreneurship _ Frederick Terman, the Father of Silicon Valley (USA)

Epilogue

Acknowledgements

Endnotes

Search

Detailed image

.jpg)

Into the book

Throughout history, across the globe, few phrases have been as famous as Adam Smith's "invisible hand."

However, this passage is not something that has been painstakingly described as the title of an independent chapter or section.

In fact, it was a metaphor that appeared only once in The Wealth of Nations and once in passing in The Theory of Moral Sentiments.

(Omitted) Ultimately, the point is that when individuals strive to maximize their own performance from their labor and capital investment, this results in promoting the interests of society as a whole, and this intermediate mechanism is simply expressed as a metaphor of the 'invisible hand'.

Even to Adam Smith, the exact workings of that invisible hand were still a black box.

Because it wasn't visible.

(syncopation)

This is what this entire chapter of The Theory of Moral Sentiments is trying to say.

Everyone seeks to pursue a happy, beautiful, and better state, and to avoid painful and inferior things. When the efforts and will of numerous individuals working throughout society work to achieve this, improved civilization is produced, and this is distributed appropriately to all members of society.

The "invisible hand" mentioned in this paragraph presupposes differences in resources and status distributed among members of society. However, the entire content of Chapter 2 of Part 4 states that each individual's efforts to pursue utility promote the interests of society, and thus, in a broad sense, it is in line with that of The Wealth of Nations.

---「CHAPTER 1.

Personal _ From the moral philosopher of harmony, 'Adam Smith' (Scotland (UK))

Entrepreneurs were first granted the status of a fourth class when they reached the age of 3.

Since Adam Smith, economic entities have been divided into three classes: landowners, workers, and capitalists.

A landowner is someone who owns land, a worker is someone who owns labor power, and a capitalist is someone who owns capital.

There were no entrepreneurs there.

(Omitted) However, Se saw the possibility of a fourth class emerging here.

Until a farmer has worked hard to cultivate and harvest the crops, he is still a producer.

If he sells his crops at the usual market, he is also acting as a merchant.

But if someone comes to that farmer and brokers a completely new market for his grain, or rents him better equipment instead of his oxen and plow, and receives a reasonable profit in return, then he is acting as an entrepreneur in a completely different class of people.

If the farmer himself takes on that role, he is already an entrepreneur.

There is definitely a special class of people in this world who do this kind of thing.

If common economics textbooks only talk about the supply and demand curves simply "meeting" for the two groups of producers and consumers, they are overlooking the existence of entrepreneurs as intermediaries who actively facilitate this meeting.

---「CHAPTER 3.

Entrepreneur _ From "Jean-Baptiste Say (France), a pioneer of entrepreneurship"

According to the list, for an individual to become a true individual, it is not enough to be an individual alone; the appropriate conditions must be in place within the community to which he belongs.

However, Smith ignored these very conditions and portrayed the wealth of the nation as being created spontaneously by free individuals.

No matter how excellent an individual's potential may be, if the ultimate form of unification, the nation, does not support him, it will be difficult for him to have the opportunity to demonstrate his abilities.

It would be irresponsible to simply attribute this social cohesion to the power of the 'invisible hand.'

Next, List criticized Smith for ignoring the specific historical stages of each country and for regarding the experiences of Scotland and England at the time as a universal phenomenon applicable to all countries.

Any society has generally gone through the stages of development of 'wildlife → livestock → agriculture → agriculture/manufacturing → agriculture/manufacturing/commerce', but there is a difference between countries that reached it first and those that did not.

Through trade and exchange, knowledge from advanced countries is passed on to less developed countries.

A country that was behind will overtake a country that was ahead.

This process repeats itself as another backward country emerges.

But is all this knowledge transfer possible through "free trade" alone? List's view was absolutely not the case.

He believed that this could only be possible if active measures were taken at the national level to transfer knowledge and build up production capacity.

---「CHAPTER 4.

From "The Nation _ The Orator of the National System, 'Friedrich List' (Germany)

When people think of the Gilded Age, they usually think of greedy and evil businessmen.

In fact, there were many entrepreneurs like that.

Vanderbilt was by no means a moralistic manager, but he certainly understood that he was not running for profit, but for his customers and for the continuation and growth of the business itself.

(Omitted) He despised his industry competitors who resorted to all sorts of illegal means to gain profits.

He declared that he would never do business through illegal means and always emphasized legal management.

It did not follow the numerous unfair insider trading practices that were prevalent in the railroad industry at the time, such as bribery of suppliers and free railroad tickets given to politicians.

To his competitors in the industry, Vanderbilt's rigidity may have seemed outrageous, but it was this level of management that allowed him to surpass the star railroad entrepreneurs of his time and earn him the respect he deserves in American society to this day.

---「CHAPTER 5.

From "Pioneer _ The role model of the New World immigrant businessman, 'Cornelius Vanderbilt' (USA)"

In any era, leaders have generally been incompetent and misjudged, rather than managing national affairs rationally and wisely as we expect, and governing the world properly.

According to Pareto, such misjudgments and incompetence always appeared regardless of whether it was a Type I or Type II elite.

Typical symptoms of malfunction include:

First, the rate of turnover of the people who make up the elite group is gradually slowing down.

The ruling class is becoming increasingly closed and entrenched, using people only within its own network rather than recruiting people from new classes.

Second, external feedback channels to leaders are biased towards voices representing specific interests.

The messages that people around the leader convey to the leader begin to be distorted and different from reality.

The various feedback channels for leaders disappear.

When society faces a difficult problem, the insightful voices of experts with sound knowledge are silenced.

At the same time, the leader's political power and intelligence itself deteriorate.

Third, key positions in society begin to be filled with incompetent people.

Instead of people with the ability and knowledge to perform the job, positions are filled by people who suit the tastes of the leader and those around him.

Fourth, leaders become absorbed in a particular ideology and are quick to make short-sighted decisions.

They avoid change and are afraid of being criticized later, so they cannot make good decisions.

---「CHAPTER 7.

Society _ From "Vilfredo Pareto (Italy), who returned to reality from the world of morality and reason"

The consistent themes of 《General Theory》 are ‘expectation’ and ‘uncertainty.’

In some ways, this article focuses on the human psychology behind the economic phenomenon itself rather than the economic phenomenon itself.

(syncopation)

Effective demand is not the amount that consumers actually buy, but rather the current expectation of how much actual purchases will be made across the economy.

Entrepreneurs decide how many people to hire, how much machinery to buy, and how much to produce based on anticipated demand, not actual demand.

Consumption propensity is also a matter of expectations and psychology.

When people receive income, how much do they spend? Conversely, how much do they save, or leave unused? This decision also depends on psychology.

If you expect your income to continue to rise in the future, you will increase your consumption, but if not, you will decrease your consumption due to anxiety.

An entrepreneur's production decisions also depend on expectations.

New investments, new business ventures, and the like are all determined by expectations of long-term future demand.

---「CHAPTER 8.

Expectations _ From the all-rounder social thinker 'John Maynard Keynes' (UK)

Ultimately, Schumpeter believed that the essence of profit lies in the amount of money an entrepreneur receives in return for disrupting the equilibrium.

Economic thinkers before Schumpeter interpreted the nature of the profits received by entrepreneurs differently.

Marx believed that profit was the result of capitalists exploiting workers in the production process.

For him, profit was the result of human immorality.

This kind of immoral self-interest later became a major cause of anti-corporate sentiment.

According to Marx's thinking, profits came from the evil motives of capitalists, and a company that represented only the interests of capitalists could only be an evil entity.

(Omitted) Alfred Marshall, Keynes's teacher, discovered at least one element of morality in profit.

He saw profit as the price of 'abstinence'.

The price paid for restraining present consumption and converting it into capital, and for patience until utility arose in the future, was profit.

(Omitted) Schumpeter went one step further and discovered that profit is the price of innovation.

By doing so, he fully restored the morality of profit that had been thoroughly denied by Marx.

He also established a new perspective that entrepreneurs are not exploiters but innovators, and furthermore, that they should not be exploiters but innovators.

---「CHAPTER 9.

Change _ From the thinker of creative destruction, 'Joseph Schumpeter' (Austria)

In 1946, the year after the war ended, he founded the American Research and Development Corporation (ARDC).

The co-founders included Dorio, Ralph Flanders (1880-1970), and Karl T.

Compton, 1887-1954).

(Omitted) Dorio said this.

“ARDC does not make investments in the general sense.

Instead, we create new value by taking calculated risks on a select few companies that we believe have growth potential.” The purpose of the business was not simply to invest money and make a profit, but to grow the company by supporting management and providing technical advice.

This is precisely the essence of venture capital business today.

From this perspective, the ideal type of venture capital is not a 'financier' with the image of Shylock (a vicious Jewish moneylender in Shakespeare's play), but a 'businessman' and 'manager' like Ron Conway (1951~), who is literally referred to as an 'angel' investor.

---「CHAPTER 10.

Finance _ From "George Doriot (USA), the pioneer of modern venture capital"

John, USA, 1961.

John F. Kennedy

President Kennedy (1917-1963) established the United States Agency for International Development (USAID) as a direct agency.

In 1969, he was appointed as the Secretary of the Office of the President of Michigan State University, John A.

Hannah (1902-1991) took office.

(Omitted) Director Hanna met with Professor Jeong Geun-mo and asked if there was anything he could do for Korea, as he was currently looking for various projects that could provide support to developing countries overseas.

Professor Jeong Geun-mo, who has always been interested in the American science and technology ecosystem, argued for the introduction of a new science and technology education system in Korea. He summarized his argument in writing and delivered it to Director Hannah. Based on this, USAID developed a proposal to establish a specialized graduate school for science and technology in Korea.

This proposal was prepared by Howard E. Houston, USAID Korea.

It was delivered to Kim Hak-ryeol (1923-1972), Deputy Prime Minister and Minister of Economic Planning, through the head of the Houston branch.

(syncopation)

In this way, USAID's 'Survey Report on the Establishment of the Korea Advanced Institute of Science' was completed in January 1971.

In the same year, the Korea Advanced Institute of Science (KAIS) was established as a specialized graduate school for science and technology.

The educational institution KAIS merged with the research institute Korea Institute of Science and Technology (KIST) in 1981 to become KAIST, which continues to this day. KAIST later played a significant role in shaping Korea's venture startup ecosystem.

However, this passage is not something that has been painstakingly described as the title of an independent chapter or section.

In fact, it was a metaphor that appeared only once in The Wealth of Nations and once in passing in The Theory of Moral Sentiments.

(Omitted) Ultimately, the point is that when individuals strive to maximize their own performance from their labor and capital investment, this results in promoting the interests of society as a whole, and this intermediate mechanism is simply expressed as a metaphor of the 'invisible hand'.

Even to Adam Smith, the exact workings of that invisible hand were still a black box.

Because it wasn't visible.

(syncopation)

This is what this entire chapter of The Theory of Moral Sentiments is trying to say.

Everyone seeks to pursue a happy, beautiful, and better state, and to avoid painful and inferior things. When the efforts and will of numerous individuals working throughout society work to achieve this, improved civilization is produced, and this is distributed appropriately to all members of society.

The "invisible hand" mentioned in this paragraph presupposes differences in resources and status distributed among members of society. However, the entire content of Chapter 2 of Part 4 states that each individual's efforts to pursue utility promote the interests of society, and thus, in a broad sense, it is in line with that of The Wealth of Nations.

---「CHAPTER 1.

Personal _ From the moral philosopher of harmony, 'Adam Smith' (Scotland (UK))

Entrepreneurs were first granted the status of a fourth class when they reached the age of 3.

Since Adam Smith, economic entities have been divided into three classes: landowners, workers, and capitalists.

A landowner is someone who owns land, a worker is someone who owns labor power, and a capitalist is someone who owns capital.

There were no entrepreneurs there.

(Omitted) However, Se saw the possibility of a fourth class emerging here.

Until a farmer has worked hard to cultivate and harvest the crops, he is still a producer.

If he sells his crops at the usual market, he is also acting as a merchant.

But if someone comes to that farmer and brokers a completely new market for his grain, or rents him better equipment instead of his oxen and plow, and receives a reasonable profit in return, then he is acting as an entrepreneur in a completely different class of people.

If the farmer himself takes on that role, he is already an entrepreneur.

There is definitely a special class of people in this world who do this kind of thing.

If common economics textbooks only talk about the supply and demand curves simply "meeting" for the two groups of producers and consumers, they are overlooking the existence of entrepreneurs as intermediaries who actively facilitate this meeting.

---「CHAPTER 3.

Entrepreneur _ From "Jean-Baptiste Say (France), a pioneer of entrepreneurship"

According to the list, for an individual to become a true individual, it is not enough to be an individual alone; the appropriate conditions must be in place within the community to which he belongs.

However, Smith ignored these very conditions and portrayed the wealth of the nation as being created spontaneously by free individuals.

No matter how excellent an individual's potential may be, if the ultimate form of unification, the nation, does not support him, it will be difficult for him to have the opportunity to demonstrate his abilities.

It would be irresponsible to simply attribute this social cohesion to the power of the 'invisible hand.'

Next, List criticized Smith for ignoring the specific historical stages of each country and for regarding the experiences of Scotland and England at the time as a universal phenomenon applicable to all countries.

Any society has generally gone through the stages of development of 'wildlife → livestock → agriculture → agriculture/manufacturing → agriculture/manufacturing/commerce', but there is a difference between countries that reached it first and those that did not.

Through trade and exchange, knowledge from advanced countries is passed on to less developed countries.

A country that was behind will overtake a country that was ahead.

This process repeats itself as another backward country emerges.

But is all this knowledge transfer possible through "free trade" alone? List's view was absolutely not the case.

He believed that this could only be possible if active measures were taken at the national level to transfer knowledge and build up production capacity.

---「CHAPTER 4.

From "The Nation _ The Orator of the National System, 'Friedrich List' (Germany)

When people think of the Gilded Age, they usually think of greedy and evil businessmen.

In fact, there were many entrepreneurs like that.

Vanderbilt was by no means a moralistic manager, but he certainly understood that he was not running for profit, but for his customers and for the continuation and growth of the business itself.

(Omitted) He despised his industry competitors who resorted to all sorts of illegal means to gain profits.

He declared that he would never do business through illegal means and always emphasized legal management.

It did not follow the numerous unfair insider trading practices that were prevalent in the railroad industry at the time, such as bribery of suppliers and free railroad tickets given to politicians.

To his competitors in the industry, Vanderbilt's rigidity may have seemed outrageous, but it was this level of management that allowed him to surpass the star railroad entrepreneurs of his time and earn him the respect he deserves in American society to this day.

---「CHAPTER 5.

From "Pioneer _ The role model of the New World immigrant businessman, 'Cornelius Vanderbilt' (USA)"

In any era, leaders have generally been incompetent and misjudged, rather than managing national affairs rationally and wisely as we expect, and governing the world properly.

According to Pareto, such misjudgments and incompetence always appeared regardless of whether it was a Type I or Type II elite.

Typical symptoms of malfunction include:

First, the rate of turnover of the people who make up the elite group is gradually slowing down.

The ruling class is becoming increasingly closed and entrenched, using people only within its own network rather than recruiting people from new classes.

Second, external feedback channels to leaders are biased towards voices representing specific interests.

The messages that people around the leader convey to the leader begin to be distorted and different from reality.

The various feedback channels for leaders disappear.

When society faces a difficult problem, the insightful voices of experts with sound knowledge are silenced.

At the same time, the leader's political power and intelligence itself deteriorate.

Third, key positions in society begin to be filled with incompetent people.

Instead of people with the ability and knowledge to perform the job, positions are filled by people who suit the tastes of the leader and those around him.

Fourth, leaders become absorbed in a particular ideology and are quick to make short-sighted decisions.

They avoid change and are afraid of being criticized later, so they cannot make good decisions.

---「CHAPTER 7.

Society _ From "Vilfredo Pareto (Italy), who returned to reality from the world of morality and reason"

The consistent themes of 《General Theory》 are ‘expectation’ and ‘uncertainty.’

In some ways, this article focuses on the human psychology behind the economic phenomenon itself rather than the economic phenomenon itself.

(syncopation)

Effective demand is not the amount that consumers actually buy, but rather the current expectation of how much actual purchases will be made across the economy.

Entrepreneurs decide how many people to hire, how much machinery to buy, and how much to produce based on anticipated demand, not actual demand.

Consumption propensity is also a matter of expectations and psychology.

When people receive income, how much do they spend? Conversely, how much do they save, or leave unused? This decision also depends on psychology.

If you expect your income to continue to rise in the future, you will increase your consumption, but if not, you will decrease your consumption due to anxiety.

An entrepreneur's production decisions also depend on expectations.

New investments, new business ventures, and the like are all determined by expectations of long-term future demand.

---「CHAPTER 8.

Expectations _ From the all-rounder social thinker 'John Maynard Keynes' (UK)

Ultimately, Schumpeter believed that the essence of profit lies in the amount of money an entrepreneur receives in return for disrupting the equilibrium.

Economic thinkers before Schumpeter interpreted the nature of the profits received by entrepreneurs differently.

Marx believed that profit was the result of capitalists exploiting workers in the production process.

For him, profit was the result of human immorality.

This kind of immoral self-interest later became a major cause of anti-corporate sentiment.

According to Marx's thinking, profits came from the evil motives of capitalists, and a company that represented only the interests of capitalists could only be an evil entity.

(Omitted) Alfred Marshall, Keynes's teacher, discovered at least one element of morality in profit.

He saw profit as the price of 'abstinence'.

The price paid for restraining present consumption and converting it into capital, and for patience until utility arose in the future, was profit.

(Omitted) Schumpeter went one step further and discovered that profit is the price of innovation.

By doing so, he fully restored the morality of profit that had been thoroughly denied by Marx.

He also established a new perspective that entrepreneurs are not exploiters but innovators, and furthermore, that they should not be exploiters but innovators.

---「CHAPTER 9.

Change _ From the thinker of creative destruction, 'Joseph Schumpeter' (Austria)

In 1946, the year after the war ended, he founded the American Research and Development Corporation (ARDC).

The co-founders included Dorio, Ralph Flanders (1880-1970), and Karl T.

Compton, 1887-1954).

(Omitted) Dorio said this.

“ARDC does not make investments in the general sense.

Instead, we create new value by taking calculated risks on a select few companies that we believe have growth potential.” The purpose of the business was not simply to invest money and make a profit, but to grow the company by supporting management and providing technical advice.

This is precisely the essence of venture capital business today.

From this perspective, the ideal type of venture capital is not a 'financier' with the image of Shylock (a vicious Jewish moneylender in Shakespeare's play), but a 'businessman' and 'manager' like Ron Conway (1951~), who is literally referred to as an 'angel' investor.

---「CHAPTER 10.

Finance _ From "George Doriot (USA), the pioneer of modern venture capital"

John, USA, 1961.

John F. Kennedy

President Kennedy (1917-1963) established the United States Agency for International Development (USAID) as a direct agency.

In 1969, he was appointed as the Secretary of the Office of the President of Michigan State University, John A.

Hannah (1902-1991) took office.

(Omitted) Director Hanna met with Professor Jeong Geun-mo and asked if there was anything he could do for Korea, as he was currently looking for various projects that could provide support to developing countries overseas.

Professor Jeong Geun-mo, who has always been interested in the American science and technology ecosystem, argued for the introduction of a new science and technology education system in Korea. He summarized his argument in writing and delivered it to Director Hannah. Based on this, USAID developed a proposal to establish a specialized graduate school for science and technology in Korea.

This proposal was prepared by Howard E. Houston, USAID Korea.

It was delivered to Kim Hak-ryeol (1923-1972), Deputy Prime Minister and Minister of Economic Planning, through the head of the Houston branch.

(syncopation)

In this way, USAID's 'Survey Report on the Establishment of the Korea Advanced Institute of Science' was completed in January 1971.

In the same year, the Korea Advanced Institute of Science (KAIS) was established as a specialized graduate school for science and technology.

The educational institution KAIS merged with the research institute Korea Institute of Science and Technology (KIST) in 1981 to become KAIST, which continues to this day. KAIST later played a significant role in shaping Korea's venture startup ecosystem.

---「CHAPTER 11.

Entrepreneurship - From "Frederick Terman (USA), the father of Silicon Valley"

Entrepreneurship - From "Frederick Terman (USA), the father of Silicon Valley"

Publisher's Review

What great ideas did Adam Smith, Saint-Simon, Pulitzer, List, Vanderbilt, Keynes, Pareto, and Terman have that turned the era of chaos and crisis into opportunity?

√ A book that examines the lives and thoughts of 11 thinkers and entrepreneurs who led the modern social and economic paradigm.

《The Birth of an Idea That Shook World History》 is a humanities textbook written by Professor Song Kyung-mo, an adjunct professor at Korea University's Graduate School of Technology Management and an expert on Peter Drucker, based on lectures on humanities for business managers.

The author, a doctorate in economics, has researched 11 well-known and little-known figures who have shaped modern society and the economic paradigm.

In particular, this book is the first general education book to cover in a colorful and comprehensive way the circumstances of the times in which they lived, their individual lives, the flow of their thoughts, and the influence their ideas have had on the modern era.

It provides an opportunity to encounter the lives and thoughts of people who are only known in fragments through books or media articles, or whose names are even unfamiliar, through general books rather than economics or sociology papers or specialized books.

√ We uncovered the misunderstandings and truths about the ideas of 11 people who were either misunderstood or completely unknown.

Professor Song Kyung-mo says this about the 11 people selected in “The Birth of Ideas That Shook World History.”

“It is impossible to cover all the great ancient figures in world history.

So I picked 11 people.

There are two reasons why I chose them:

First, these are people whose names appear countless times in textbooks and elsewhere, but whose thoughts are known in an exaggerated, distorted, and biased way that is different from their original intention, and whose names are even misused.

Adam Smith, Friedrich List, Vilfredo Pareto, John Maynard Keynes, and Joseph Schumpeter are known only by their modernized versions of the "invisible hand," "protectionism," the "80/20 rule," the "omnipotent fiscal spending theory," and "creative destruction," respectively, but despite the importance of the ideas they held at the time, little is known about their true nature.

Second, these are people whose names are only vaguely familiar to everyone, or whose names are difficult to hear, but whose influence on modern society, both in terms of ideology and business performance, is so great that I believe it is absolutely necessary to make them known.

Cornelius Vanderbilt and Joseph Pulitzer are usually known only through their names, Vanderbilt University and the Pulitzer Prize.

Even among today's tech entrepreneurs and venture ecosystems, few even know the names of Frederick Terman and Georges Doriot, let alone how much they owe to them.

The names of Jean-Baptiste Senna and Henri de Saint-Simon, thinkers who provided the great foundation for the opening of modern industrial society, are very unfamiliar to most people.

Let's forget everything we've heard about them, even briefly, at school or in news articles.

And let's see again.

“Whether it’s economics, business administration, sociology, or philosophy.”

√ Insights and lessons from the great thinkers and entrepreneurs who shook up world history.

The book presents the legacies of 11 thinkers and entrepreneurs to the modern era through 11 keywords.

'Individual', 'Industry', 'Entrepreneur', 'Nation', 'Pioneer', 'Journalism', 'Society', 'Expectation', 'Innovation', 'Venture Capital', and 'Silicon Valley'.

From keywords that emerged over 200 years ago and continue to influence the modern business landscape, to those that have provided a new paradigm for the modern business environment, you can gain insights to overcome the current crisis from thinkers and entrepreneurs who have advanced history through turbulent times.

√ A book that examines the lives and thoughts of 11 thinkers and entrepreneurs who led the modern social and economic paradigm.

《The Birth of an Idea That Shook World History》 is a humanities textbook written by Professor Song Kyung-mo, an adjunct professor at Korea University's Graduate School of Technology Management and an expert on Peter Drucker, based on lectures on humanities for business managers.

The author, a doctorate in economics, has researched 11 well-known and little-known figures who have shaped modern society and the economic paradigm.

In particular, this book is the first general education book to cover in a colorful and comprehensive way the circumstances of the times in which they lived, their individual lives, the flow of their thoughts, and the influence their ideas have had on the modern era.

It provides an opportunity to encounter the lives and thoughts of people who are only known in fragments through books or media articles, or whose names are even unfamiliar, through general books rather than economics or sociology papers or specialized books.

√ We uncovered the misunderstandings and truths about the ideas of 11 people who were either misunderstood or completely unknown.

Professor Song Kyung-mo says this about the 11 people selected in “The Birth of Ideas That Shook World History.”

“It is impossible to cover all the great ancient figures in world history.

So I picked 11 people.

There are two reasons why I chose them:

First, these are people whose names appear countless times in textbooks and elsewhere, but whose thoughts are known in an exaggerated, distorted, and biased way that is different from their original intention, and whose names are even misused.

Adam Smith, Friedrich List, Vilfredo Pareto, John Maynard Keynes, and Joseph Schumpeter are known only by their modernized versions of the "invisible hand," "protectionism," the "80/20 rule," the "omnipotent fiscal spending theory," and "creative destruction," respectively, but despite the importance of the ideas they held at the time, little is known about their true nature.

Second, these are people whose names are only vaguely familiar to everyone, or whose names are difficult to hear, but whose influence on modern society, both in terms of ideology and business performance, is so great that I believe it is absolutely necessary to make them known.

Cornelius Vanderbilt and Joseph Pulitzer are usually known only through their names, Vanderbilt University and the Pulitzer Prize.

Even among today's tech entrepreneurs and venture ecosystems, few even know the names of Frederick Terman and Georges Doriot, let alone how much they owe to them.

The names of Jean-Baptiste Senna and Henri de Saint-Simon, thinkers who provided the great foundation for the opening of modern industrial society, are very unfamiliar to most people.

Let's forget everything we've heard about them, even briefly, at school or in news articles.

And let's see again.

“Whether it’s economics, business administration, sociology, or philosophy.”

√ Insights and lessons from the great thinkers and entrepreneurs who shook up world history.

The book presents the legacies of 11 thinkers and entrepreneurs to the modern era through 11 keywords.

'Individual', 'Industry', 'Entrepreneur', 'Nation', 'Pioneer', 'Journalism', 'Society', 'Expectation', 'Innovation', 'Venture Capital', and 'Silicon Valley'.

From keywords that emerged over 200 years ago and continue to influence the modern business landscape, to those that have provided a new paradigm for the modern business environment, you can gain insights to overcome the current crisis from thinkers and entrepreneurs who have advanced history through turbulent times.

GOODS SPECIFICS

- Publication date: November 23, 2022

- Page count, weight, size: 472 pages | 698g | 152*215*30mm

- ISBN13: 9791187440031

- ISBN10: 1187440035

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)