AI Trading for Quantitative Strategies

|

Description

Book Introduction

AI Quantitative Investment Learning Method for Implementing Your Own Investment Strategy

Since AlphaGo, artificial intelligence technology has been introduced into various industries, including manufacturing, healthcare, education, gaming, and security, and services based on machine learning and deep learning have emerged. The financial sector is also evolving with the wings of artificial intelligence. We provide a wide range of services in various fields, including customer service, asset management, stock analysis, and stock trading, utilizing intelligent systems and big data. It explains in detail everything from data collection for stock trading to quantitative investment strategies and investment strategies using machine learning/deep learning. It clearly explains the limitations and potential of machine learning and deep learning methods for algorithmic trading, and introduces cutting-edge modeling techniques applicable in practice. The example code is kept short and simple for easy understanding. By following this book closely, you can validate your own investment hypotheses, implement your own investment techniques using machine learning tools, and solve problems encountered while implementing quantitative investment strategies. |

- You can preview some of the book's contents.

Preview

index

CHAPTER 1 Machine Learning in Finance and Investment

1.1 The Trilateral Relationship of AI, Finance, and Investment

1.2 Applications of Machine Learning in Real Investment Fields

1.3 Algorithms used in the investment field

1.4 Data used in the investment field

1.5 In conclusion

CHAPTER 2: Using Python for Financial Data Analysis

2.1 Date and Time

2.2 Using Pandas for Financial Data Preprocessing and Analysis

2.3 Utilizing Open APIs for Financial Data Analysis

2.4 In conclusion

CHAPTER 3: Investment Strategies and Key Indicators Created with Python

3.1 Buy-and-Hold Strategy

3.2 Investment Performance Analysis Indicators

3.3 In conclusion

CHAPTER 4 Traditional Quantitative Investment Strategies

4.1 Introduction to Traditional Quantitative Methodology

4.2 Mean Reversion Strategy

4.3 Dual Momentum Strategy

4.4 Value Investing Quant Strategies

4.5 In conclusion

CHAPTER 5 Machine Learning in Finance

5.1 Why Use Machine Learning?

5.2 Introduction to Machine Learning Algorithms

5.3 Cross-validation methods for financial time series data

5.4 Data Preprocessing in Finance

5.5 Evaluation Criteria for Strategies Using Machine Learning

5.6 Backtesting

5.7 Scikit-learn for implementing machine learning algorithms

5.8 In conclusion

CHAPTER 6: Investment Strategies Using Machine Learning

6.1 Predicting Stock Price Direction Using ETFs

6.2 Investment Strategies Using the k-Nearest Neighbor Algorithm

6.3 Classification of stocks using clustering algorithms

6.4 In conclusion

CHAPTER 7 Deep Learning in Finance

7.1 Deep Learning

7.2 Keras for implementing deep learning algorithms

7.3 In conclusion

CHAPTER 8: Investment Strategies Using Deep Learning

8.1 Candlestick Chart Prediction Analysis Using CNN

8.2 Predicting stock price direction using RNN

8.3 Generating stock price data using autoencoders

8.4 In conclusion

Appendix A Python Time/Date Library

Appendix B Backtesting API Using Python

Appendix C Financial Terms and Key Macroeconomic Indicators

Appendix D: Financial Python Libraries

1.1 The Trilateral Relationship of AI, Finance, and Investment

1.2 Applications of Machine Learning in Real Investment Fields

1.3 Algorithms used in the investment field

1.4 Data used in the investment field

1.5 In conclusion

CHAPTER 2: Using Python for Financial Data Analysis

2.1 Date and Time

2.2 Using Pandas for Financial Data Preprocessing and Analysis

2.3 Utilizing Open APIs for Financial Data Analysis

2.4 In conclusion

CHAPTER 3: Investment Strategies and Key Indicators Created with Python

3.1 Buy-and-Hold Strategy

3.2 Investment Performance Analysis Indicators

3.3 In conclusion

CHAPTER 4 Traditional Quantitative Investment Strategies

4.1 Introduction to Traditional Quantitative Methodology

4.2 Mean Reversion Strategy

4.3 Dual Momentum Strategy

4.4 Value Investing Quant Strategies

4.5 In conclusion

CHAPTER 5 Machine Learning in Finance

5.1 Why Use Machine Learning?

5.2 Introduction to Machine Learning Algorithms

5.3 Cross-validation methods for financial time series data

5.4 Data Preprocessing in Finance

5.5 Evaluation Criteria for Strategies Using Machine Learning

5.6 Backtesting

5.7 Scikit-learn for implementing machine learning algorithms

5.8 In conclusion

CHAPTER 6: Investment Strategies Using Machine Learning

6.1 Predicting Stock Price Direction Using ETFs

6.2 Investment Strategies Using the k-Nearest Neighbor Algorithm

6.3 Classification of stocks using clustering algorithms

6.4 In conclusion

CHAPTER 7 Deep Learning in Finance

7.1 Deep Learning

7.2 Keras for implementing deep learning algorithms

7.3 In conclusion

CHAPTER 8: Investment Strategies Using Deep Learning

8.1 Candlestick Chart Prediction Analysis Using CNN

8.2 Predicting stock price direction using RNN

8.3 Generating stock price data using autoencoders

8.4 In conclusion

Appendix A Python Time/Date Library

Appendix B Backtesting API Using Python

Appendix C Financial Terms and Key Macroeconomic Indicators

Appendix D: Financial Python Libraries

Detailed image

Publisher's Review

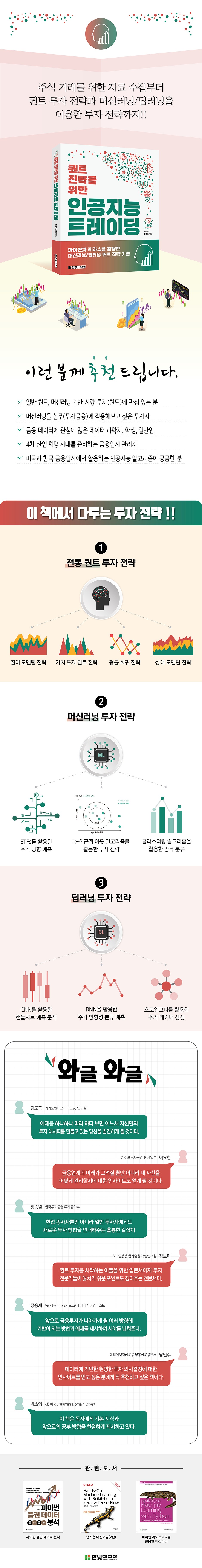

Investment Cases Using Machine Learning and Deep Learning

· Using NumPy and Pandas for Financial Data Analysis

· Investment strategies and key indicators created with Python

· Implementing traditional quantitative strategies using financial data

· Implementing investment strategies using machine learning

· Implementing investment strategies using deep learning

In the 1990s, individual investors usually relied on a single chart on an electronic board to make their investments.

At the time, I had an acquaintance who was helping with system management in the securities industry. He was able to quickly check chart data and make investments himself, which allowed him to generate higher returns than individual investors who relied on electronic charts.

However, as computers became more widespread and even ordinary people could easily analyze charts, the alpha enjoyed so far gradually disappeared.

Isn't the same true for machine learning? Hedge funds armed with machine learning and computer science knowledge and a wealth of data might seem to have a significant advantage.

However, with the democratization of data and the release of many useful open-source resources, ordinary people can now implement machine learning-based quantitative strategies using financial libraries that provide data and convenient functions.

If you don't prepare now, it might be too late.

‘Now’ is your time.

I sincerely hope that this book will spark more people's interest in developing machine learning-based investment strategies and encourage them to consider the potential impact of artificial intelligence on investment finance.

Who is this book for?

· Those interested in general quant and machine learning-based quantitative investment (quant)

Investors who want to apply machine learning to practical applications (investment finance)

· Data scientists, students, and the general public interested in financial data

· Financial industry managers preparing for the Fourth Industrial Revolution

· Anyone curious about machine learning algorithms used in the US and Korean financial industries

· Using NumPy and Pandas for Financial Data Analysis

· Investment strategies and key indicators created with Python

· Implementing traditional quantitative strategies using financial data

· Implementing investment strategies using machine learning

· Implementing investment strategies using deep learning

In the 1990s, individual investors usually relied on a single chart on an electronic board to make their investments.

At the time, I had an acquaintance who was helping with system management in the securities industry. He was able to quickly check chart data and make investments himself, which allowed him to generate higher returns than individual investors who relied on electronic charts.

However, as computers became more widespread and even ordinary people could easily analyze charts, the alpha enjoyed so far gradually disappeared.

Isn't the same true for machine learning? Hedge funds armed with machine learning and computer science knowledge and a wealth of data might seem to have a significant advantage.

However, with the democratization of data and the release of many useful open-source resources, ordinary people can now implement machine learning-based quantitative strategies using financial libraries that provide data and convenient functions.

If you don't prepare now, it might be too late.

‘Now’ is your time.

I sincerely hope that this book will spark more people's interest in developing machine learning-based investment strategies and encourage them to consider the potential impact of artificial intelligence on investment finance.

Who is this book for?

· Those interested in general quant and machine learning-based quantitative investment (quant)

Investors who want to apply machine learning to practical applications (investment finance)

· Data scientists, students, and the general public interested in financial data

· Financial industry managers preparing for the Fourth Industrial Revolution

· Anyone curious about machine learning algorithms used in the US and Korean financial industries

GOODS SPECIFICS

- Date of publication: August 20, 2020

- Page count, weight, size: 380 pages | 183*235*30mm

- ISBN13: 9791162243312

- ISBN10: 1162243317

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)