Park Gom-hee's Pension Rich Class

|

Description

Book Introduction

- A word from MD

-

Is your retirement secure?The latest book by author Park Gom-hee, who runs the financial YouTube channel 'Park Gom-hee TV' with 810,000 subscribers.

We present a practical way to secure a stable cash flow in retirement through pension investments.

From how to use tax-saving accounts to the principles of the 4% rule.

A book that easily explains the core of pension planning that anyone can easily follow.

July 1, 2025. Economics and Management PD Oh Da-eun

“Pension investment is something that ordinary people can do.

“It’s a sure way to get rich!”

Everything about pensions, compiled in one volume by 810,000 investment mentor "Park Gom-hee TV."

Now that South Korea has entered a super-aged society, an even more shocking reality has been revealed.

According to an analysis by the Seoul Financial Welfare Counseling Center, 86% of those filing for personal bankruptcy are middle-aged or older, aged 50 or older, and according to Statistics Korea, one in four adults has given up on preparing for retirement altogether.

Unprepared old age is no longer someone else's problem.

Faced with this desperate reality, financial YouTuber Park Gom-hee, who has returned five years after publishing her best-selling book, "Park Gom-hee's Investment Method," now reveals the secret to receiving a lifetime salary through pension.

The author, who came from a securities firm, has been a financial YouTuber for five years and has personally listened to the pension concerns of numerous subscribers.

"I don't know much about investing, so how should I prepare for my pension?", "Is it really possible to live off of 300 million won for retirement?", "Is it too late to prepare for my pension at 55?", and other pressing questions are answered in "Park Gom-hee's Pension Wealth Class."

We've completed a pension wealth roadmap that anyone can follow, using just four tax-saving accounts and proven investment methods, without complex investment knowledge or a large sum of money.

The most innovative part of this book is that it applies the '4% rule' as a stable asset withdrawal strategy after retirement.

The author presents a concrete method for creating an "endless cash flow" that preserves principal while living solely on earnings, utilizing a proven methodology that states that withdrawing 4% of your retirement funds annually will keep your funds from depleting for 30 years or more, or even your entire life.

In fact, the Nobel Foundation, which awards the Nobel Prize, has been consistently paying out prize money for 120 years based on a similar principle.

Based on this scientific evidence, the author has developed a strategy that can be used for life by withdrawing only 4-6% of pension assets annually.

It also presents specific portfolios and payment strategies based on an individual's investment capacity, ranging from 500,000 won to 2 million won per month, and shows how actual cash flow is generated by asset size.

It goes beyond simply saving money, and provides detailed guidance on the entire pension receipt process, divided into five steps: from pension initiation to portfolio conversion to monthly dividends, tax optimization, and selecting a payment method.

The author emphasizes that “it is more important to start, even if it is imperfect, than to make a perfect plan.”

From office workers in their 30s and 40s to those in their 50s preparing for retirement, this book offers the most realistic and proven solutions for beginner investors who want to start preparing for retirement but don't know where to start.

“It’s a sure way to get rich!”

Everything about pensions, compiled in one volume by 810,000 investment mentor "Park Gom-hee TV."

Now that South Korea has entered a super-aged society, an even more shocking reality has been revealed.

According to an analysis by the Seoul Financial Welfare Counseling Center, 86% of those filing for personal bankruptcy are middle-aged or older, aged 50 or older, and according to Statistics Korea, one in four adults has given up on preparing for retirement altogether.

Unprepared old age is no longer someone else's problem.

Faced with this desperate reality, financial YouTuber Park Gom-hee, who has returned five years after publishing her best-selling book, "Park Gom-hee's Investment Method," now reveals the secret to receiving a lifetime salary through pension.

The author, who came from a securities firm, has been a financial YouTuber for five years and has personally listened to the pension concerns of numerous subscribers.

"I don't know much about investing, so how should I prepare for my pension?", "Is it really possible to live off of 300 million won for retirement?", "Is it too late to prepare for my pension at 55?", and other pressing questions are answered in "Park Gom-hee's Pension Wealth Class."

We've completed a pension wealth roadmap that anyone can follow, using just four tax-saving accounts and proven investment methods, without complex investment knowledge or a large sum of money.

The most innovative part of this book is that it applies the '4% rule' as a stable asset withdrawal strategy after retirement.

The author presents a concrete method for creating an "endless cash flow" that preserves principal while living solely on earnings, utilizing a proven methodology that states that withdrawing 4% of your retirement funds annually will keep your funds from depleting for 30 years or more, or even your entire life.

In fact, the Nobel Foundation, which awards the Nobel Prize, has been consistently paying out prize money for 120 years based on a similar principle.

Based on this scientific evidence, the author has developed a strategy that can be used for life by withdrawing only 4-6% of pension assets annually.

It also presents specific portfolios and payment strategies based on an individual's investment capacity, ranging from 500,000 won to 2 million won per month, and shows how actual cash flow is generated by asset size.

It goes beyond simply saving money, and provides detailed guidance on the entire pension receipt process, divided into five steps: from pension initiation to portfolio conversion to monthly dividends, tax optimization, and selecting a payment method.

The author emphasizes that “it is more important to start, even if it is imperfect, than to make a perfect plan.”

From office workers in their 30s and 40s to those in their 50s preparing for retirement, this book offers the most realistic and proven solutions for beginner investors who want to start preparing for retirement but don't know where to start.

- You can preview some of the book's contents.

Preview

index

Prologue_30 Years Later, I'm Waiting for Your Comments

A glance at Park Gom-hee's Pension Rich Class

Part 1.

Start now to create a lifelong, never-ending flow of money.

Chapter 1.

Become a pensioner who can change your life in retirement

Is your retirement really secure?

3 Mistakes That Will Make You Poverty in Retirement

The Secret of the Nobel Prize: Why Tax-Free Accounts Are the Answer

How to Create Your Own Nobel Foundation

Chapter 2.

How much retirement savings do you need?

National Pension: How Much Can You Actually Receive?

Pension Preparation Roadmap for My Age

What's Your Retirement Goal?: A Realistic $300 Million vs.

A pretty decent 500 million won

[Just this? Absolutely!] “Is it too late to prepare for pension at 55?”

Part 2.

[Deposit] The Secret to Receiving Your Salary for Life in 4 Accounts

Chapter 3.

The Beginning of Pension Wealth: 4 Tax-Saving Accounts

4 Account Design Methods Even Ordinary Office Workers Can Use

Account 1 | Pension Savings (Tax Deduction ○): The backbone of a solid pension

Account 2 | Pension Savings (No Tax Deduction): The Key to Flexible Fund Management

Account 3 | Savings IRP: A tax-saving account for efficient pension management.

Savings Account 4 | ISA: The Golden Bridge Between Interim Goals and Pensions

Chapter 4.

Payment scenarios by investment amount

What if the investment amount is 500,000 won per month?

What if the investment amount is 1 million won per month?

What if the investment amount is 1.5 million won per month?

What if the investment amount is 2 million won per month?

Part 3.

[Operation] Investment Strategies That Make Your Money Work for You

Chapter 5.

Pension investment methods that even beginners can follow

How to Start Investing Safely with MMFs and Interest-Type ETFs

Smart operation of TDF that moves on my behalf

Monthly Dividend ETF Strategy that Delivers Reliably Every Month

An asset allocation portfolio that remains unshaken even when the market fluctuates

[This is a must!] Everything you need to know about ETFs

Chapter 6.

Maximize returns with customized investments for each account.

Setting up an asset allocation portfolio in Account 1 and Account 2

Setting up TDF in Tongjang 3

Setting up a monthly dividend portfolio in Account 4

[This is a must!] How to choose the right ETF for your pension investment.

Part 4.

[Receipt] Creating a cash flow that won't dry up in retirement

Chapter 7.

The Golden Formula for Receiving Pensions: A 5-Step Strategy

Receiving a pension is as important as investing.

Step 1: Merging Your Pension Accounts

Step 2: Change your portfolio to focus on monthly dividends.

Step 3: Set monthly dividends and check taxes.

Step 4: Choose your payment method

Step 5: Determine whether to pay dividends and the proportion of stocks.

Chapter 8.

Cash flow and receipt scenarios by asset

A realistic 300 million won retirement scenario

A comfortable 500 million won retirement scenario

A Prosperous 900 Million Won Retirement Scenario

Epilogue: Starting retirement preparation now is the fastest way to prepare for retirement.

A glance at Park Gom-hee's Pension Rich Class

Part 1.

Start now to create a lifelong, never-ending flow of money.

Chapter 1.

Become a pensioner who can change your life in retirement

Is your retirement really secure?

3 Mistakes That Will Make You Poverty in Retirement

The Secret of the Nobel Prize: Why Tax-Free Accounts Are the Answer

How to Create Your Own Nobel Foundation

Chapter 2.

How much retirement savings do you need?

National Pension: How Much Can You Actually Receive?

Pension Preparation Roadmap for My Age

What's Your Retirement Goal?: A Realistic $300 Million vs.

A pretty decent 500 million won

[Just this? Absolutely!] “Is it too late to prepare for pension at 55?”

Part 2.

[Deposit] The Secret to Receiving Your Salary for Life in 4 Accounts

Chapter 3.

The Beginning of Pension Wealth: 4 Tax-Saving Accounts

4 Account Design Methods Even Ordinary Office Workers Can Use

Account 1 | Pension Savings (Tax Deduction ○): The backbone of a solid pension

Account 2 | Pension Savings (No Tax Deduction): The Key to Flexible Fund Management

Account 3 | Savings IRP: A tax-saving account for efficient pension management.

Savings Account 4 | ISA: The Golden Bridge Between Interim Goals and Pensions

Chapter 4.

Payment scenarios by investment amount

What if the investment amount is 500,000 won per month?

What if the investment amount is 1 million won per month?

What if the investment amount is 1.5 million won per month?

What if the investment amount is 2 million won per month?

Part 3.

[Operation] Investment Strategies That Make Your Money Work for You

Chapter 5.

Pension investment methods that even beginners can follow

How to Start Investing Safely with MMFs and Interest-Type ETFs

Smart operation of TDF that moves on my behalf

Monthly Dividend ETF Strategy that Delivers Reliably Every Month

An asset allocation portfolio that remains unshaken even when the market fluctuates

[This is a must!] Everything you need to know about ETFs

Chapter 6.

Maximize returns with customized investments for each account.

Setting up an asset allocation portfolio in Account 1 and Account 2

Setting up TDF in Tongjang 3

Setting up a monthly dividend portfolio in Account 4

[This is a must!] How to choose the right ETF for your pension investment.

Part 4.

[Receipt] Creating a cash flow that won't dry up in retirement

Chapter 7.

The Golden Formula for Receiving Pensions: A 5-Step Strategy

Receiving a pension is as important as investing.

Step 1: Merging Your Pension Accounts

Step 2: Change your portfolio to focus on monthly dividends.

Step 3: Set monthly dividends and check taxes.

Step 4: Choose your payment method

Step 5: Determine whether to pay dividends and the proportion of stocks.

Chapter 8.

Cash flow and receipt scenarios by asset

A realistic 300 million won retirement scenario

A comfortable 500 million won retirement scenario

A Prosperous 900 Million Won Retirement Scenario

Epilogue: Starting retirement preparation now is the fastest way to prepare for retirement.

Detailed image

Into the book

Retirement assets must be 'invested', and pension accounts are the best way to accumulate retirement assets.

This simple truth will change your life 30 years from now.

Don't be difficult.

I designed this book to be simple and clear so that even beginners in financial management can easily follow it.

Simply create four tax-advantaged accounts and follow the path I'll guide you on your journey to long-term investing.

Our primary goal is to create a savings account of at least 300 million won in retirement by utilizing investment methods appropriate for each account.

Next, I will propose a scenario that generates a monthly cash flow of 3 million won while maintaining assets by utilizing monthly dividend ETFs.

This is the most practical pension strategy I've found through years of experience and research.

It's more important to start with an imperfect plan than to make a perfect one.

Even a small amount of money can make a big difference 30 years from now.

---From the "Prologue"

I saved up to prepare for my own retirement, but there is a strange system in place where the government gives me money.

This is the tax deduction for pension savings.

A tax deduction is a benefit that allows you to receive a tax refund of a certain percentage of the amount paid into pension savings each year.

If you sign up for pension savings, you can receive a tax deduction of up to 16.5% of your annual contributions, up to 6 million won.

In simple terms, if you pay 6 million won, you can get up to 990,000 won back at the end of the year.

Tax deductions can be viewed as 'government-supported retirement preparation subsidies.'

This means you get an immediate 'guaranteed return' of up to 16.5%.

No investment guarantees such certain returns.

If you think of tax deductions as income, pension savings have benefits that are completely absurd and do not fit with market logic.

In addition, if you utilize IRP, you can receive a tax deduction of up to 9 million won per year, which means you can enjoy a tax saving effect of up to 1,485,000 won.

If you consistently receive tax deduction benefits like this for 30 years, you can save a total of 44.55 million won in taxes.

If you reinvest the money you save, the effect will be even greater.

---From "How to Create Your Own Nobel Foundation"

How much more should we prepare beyond the national pension? How much is realistically needed? Many experts suggest various amounts, but setting goals that are too high can only lead to frustration.

The advice to save 2 billion won or 3 billion won is unrealistic for most people.

Realistically speaking, 300 to 500 million won would be appropriate.

Let's take a closer look at why this amount of money is needed.

The key to preparing for retirement is creating a 'cash flow that will last a lifetime.'

It's not just about saving money; it's about making sure that money generates steady income so you can receive a steady, fixed amount every month.

Let's apply the '4% rule' explained earlier.

Considering that interest rates are higher than in the past, and calculating at 6%, if you have 300 million won saved for retirement, you can withdraw about 18 million won per year (1.5 million won per month).

When it is 500 million won, you can withdraw 30 million won per year (2.5 million won per month).

If you add 1 million won in national pension per month to this, you get a basic cash flow of 2.5 million won per month for 300 million won and 3.5 million won per month for 500 million won.

If you have an account or retirement pension that does not receive tax deductions, and both spouses receive national pension, you can easily achieve 3 million won per month with 300 million won.

---From "What are your retirement financial goals?"

In the United States, companies that have increased their dividends for 25 consecutive years or more are called "Dividend Aristocrats," and companies that have increased their dividends for 50 consecutive years or more are called "Dividend Kings."

There are currently about 50 Dividend Kings worldwide, the most well-known of which are Coca-Cola and Pepsi.

(…) Coca-Cola maintains a policy of providing shareholders with a consistent dividend yield of approximately 3%.

What's important to note here is that while the visible yield may be low, the dividend itself is steadily increasing.

Looking at the dividend per share over the past three years in the table above, it was $0.46, $0.49, and exceeded $0.50 for the first time in 2025.

What does this mean? Investors buying Coca-Cola stock as of June 2025 will receive a 3% dividend yield, but those who bought the stock 10, 20, or 30 years ago will receive a significantly higher dividend yield relative to their initial investment.

Warren Buffett, chairman and CEO of Berkshire Hathaway, has not sold a single share of Coca-Cola stock for this very reason.

It is known that the dividend yield of Buffett's Coca-Cola stock is 60-80% of the initial investment amount.

In other words, Buffett has almost recovered the amount he initially invested just from the dividends he receives each year.

This is the allure of investing in dividend growth stocks.

Even if the current dividend yield isn't high, holding it for a long period of time will allow you to enjoy a high return compared to your initial investment as the dividends steadily increase.

---From "Monthly Dividend ETF Strategy that Delivers Steady Profits Every Month"

One thing I've learned over the years working in the investment industry is that there are no right answers in investing, but there are good examples.

Asset allocation investing is one good example.

Even professional investors recognize the value of asset allocation investing, and even if they themselves prefer a different investment approach, they often recommend asset allocation investing when giving investment advice to others.

Of course, even if you hold a variety of assets, you may experience losses in the short term.

However, the appeal of asset allocation investing is that it recovers over time and the cumulative return gradually increases.

It can be said to be an investment method that moves forward slowly but steadily, like a turtle.

Asset allocation investing can be done by constructing a portfolio directly, or by utilizing indirect investment products such as ETFs or funds that perform asset allocation on your behalf.

This strategy can be invested all at once or in small amounts each month, and is particularly suitable for pension investments aimed at building long-term assets.

---From "An Asset Allocation Portfolio That Remains Unshaken Even When the Market Fluctuates"

The first step in your pension strategy is to merge your pension accounts.

It's about combining pension accounts that have received tax deductions into one.

Both pension savings and savings IRPs that receive tax deductions not only receive tax deductions, but also share annual and total limits, so it is advantageous to merge accounts into one through pension transfer.

On the other hand, retirement IRPs containing pension savings and retirement benefits that are not tax deductible must be managed separately.

Why do we need to divide it this way? Because annual and total limits apply separately depending on the account type.

Pension accounts with and without tax deductions have different tax structures and should be managed separately to optimize taxation.

Pension accounts that have received tax deductions are subject to pension income tax (3.3-5.5%), pension savings that have not received tax deductions are tax-exempt (profits are subject to pension income tax), and retirement IRPs are subject to retirement income tax.

Combining your tax-deductible pension savings and savings IRP makes it easier to identify key assets in one account.

Additionally, asset allocation and rebalancing become much easier, making portfolio adjustments simpler.

Plus, you can be more flexible with your withdrawal plans.

Since it is in one account, it is easy to efficiently adjust the amount received within the total limit.

Especially when planning how much you will receive each month after retirement, it is much more convenient to manage it in one account rather than dividing it into smaller amounts from several accounts.

---From "Step 1: Merging Pension Accounts"

“Mr. Park Gom-hee, is it really possible to live off of 300 million won after retirement?”

“Yes, it is possible.”

Many people ask this question in lectures or YouTube comments, and I always answer it like this.

If I invested 500,000 won per month in four accounts for 22 years at a 7% annual return, what would happen to my funds? The changes would seem minimal for the first few years.

In the first year, the deposit amount increases by only 230,000 won, from 6 million won to 6.23 million won.

In the second year, the profit is only 910,000 won, with 12.91 million won paid in 12 million won.

But from the fifth year onwards, the pace of change accelerates.

If you put in 30 million won, it becomes 36 million won, so you make a profit of 6 million won.

From this point on, the compound interest effect of 'money making money' begins to appear in earnest.

When you reach the 10th year, something even more amazing happens.

I put in 60 million won, but it turned out to be 87.04 million won.

This means that a whopping 27.04 million won in profit was generated.

The money I earn from my investments starts to account for more than half of the principal I put in.

The real magic happens in the second half.

In the 15th year, 90 million won is paid, which makes it 159.4 million won, and in the 22nd year, it finally exceeds 300 million won.

I only put in 114 million won, but it became 314.14 million won.

Of particular note are the changes during the latter 10 years (13th to 22nd years).

During this period alone, assets increased by 186.74 million won, from 127.4 million won to 314.14 million won.

Most of the total profits were concentrated in the latter 10 years.

This is the true power of compound interest: 'time makes money'.

This simple truth will change your life 30 years from now.

Don't be difficult.

I designed this book to be simple and clear so that even beginners in financial management can easily follow it.

Simply create four tax-advantaged accounts and follow the path I'll guide you on your journey to long-term investing.

Our primary goal is to create a savings account of at least 300 million won in retirement by utilizing investment methods appropriate for each account.

Next, I will propose a scenario that generates a monthly cash flow of 3 million won while maintaining assets by utilizing monthly dividend ETFs.

This is the most practical pension strategy I've found through years of experience and research.

It's more important to start with an imperfect plan than to make a perfect one.

Even a small amount of money can make a big difference 30 years from now.

---From the "Prologue"

I saved up to prepare for my own retirement, but there is a strange system in place where the government gives me money.

This is the tax deduction for pension savings.

A tax deduction is a benefit that allows you to receive a tax refund of a certain percentage of the amount paid into pension savings each year.

If you sign up for pension savings, you can receive a tax deduction of up to 16.5% of your annual contributions, up to 6 million won.

In simple terms, if you pay 6 million won, you can get up to 990,000 won back at the end of the year.

Tax deductions can be viewed as 'government-supported retirement preparation subsidies.'

This means you get an immediate 'guaranteed return' of up to 16.5%.

No investment guarantees such certain returns.

If you think of tax deductions as income, pension savings have benefits that are completely absurd and do not fit with market logic.

In addition, if you utilize IRP, you can receive a tax deduction of up to 9 million won per year, which means you can enjoy a tax saving effect of up to 1,485,000 won.

If you consistently receive tax deduction benefits like this for 30 years, you can save a total of 44.55 million won in taxes.

If you reinvest the money you save, the effect will be even greater.

---From "How to Create Your Own Nobel Foundation"

How much more should we prepare beyond the national pension? How much is realistically needed? Many experts suggest various amounts, but setting goals that are too high can only lead to frustration.

The advice to save 2 billion won or 3 billion won is unrealistic for most people.

Realistically speaking, 300 to 500 million won would be appropriate.

Let's take a closer look at why this amount of money is needed.

The key to preparing for retirement is creating a 'cash flow that will last a lifetime.'

It's not just about saving money; it's about making sure that money generates steady income so you can receive a steady, fixed amount every month.

Let's apply the '4% rule' explained earlier.

Considering that interest rates are higher than in the past, and calculating at 6%, if you have 300 million won saved for retirement, you can withdraw about 18 million won per year (1.5 million won per month).

When it is 500 million won, you can withdraw 30 million won per year (2.5 million won per month).

If you add 1 million won in national pension per month to this, you get a basic cash flow of 2.5 million won per month for 300 million won and 3.5 million won per month for 500 million won.

If you have an account or retirement pension that does not receive tax deductions, and both spouses receive national pension, you can easily achieve 3 million won per month with 300 million won.

---From "What are your retirement financial goals?"

In the United States, companies that have increased their dividends for 25 consecutive years or more are called "Dividend Aristocrats," and companies that have increased their dividends for 50 consecutive years or more are called "Dividend Kings."

There are currently about 50 Dividend Kings worldwide, the most well-known of which are Coca-Cola and Pepsi.

(…) Coca-Cola maintains a policy of providing shareholders with a consistent dividend yield of approximately 3%.

What's important to note here is that while the visible yield may be low, the dividend itself is steadily increasing.

Looking at the dividend per share over the past three years in the table above, it was $0.46, $0.49, and exceeded $0.50 for the first time in 2025.

What does this mean? Investors buying Coca-Cola stock as of June 2025 will receive a 3% dividend yield, but those who bought the stock 10, 20, or 30 years ago will receive a significantly higher dividend yield relative to their initial investment.

Warren Buffett, chairman and CEO of Berkshire Hathaway, has not sold a single share of Coca-Cola stock for this very reason.

It is known that the dividend yield of Buffett's Coca-Cola stock is 60-80% of the initial investment amount.

In other words, Buffett has almost recovered the amount he initially invested just from the dividends he receives each year.

This is the allure of investing in dividend growth stocks.

Even if the current dividend yield isn't high, holding it for a long period of time will allow you to enjoy a high return compared to your initial investment as the dividends steadily increase.

---From "Monthly Dividend ETF Strategy that Delivers Steady Profits Every Month"

One thing I've learned over the years working in the investment industry is that there are no right answers in investing, but there are good examples.

Asset allocation investing is one good example.

Even professional investors recognize the value of asset allocation investing, and even if they themselves prefer a different investment approach, they often recommend asset allocation investing when giving investment advice to others.

Of course, even if you hold a variety of assets, you may experience losses in the short term.

However, the appeal of asset allocation investing is that it recovers over time and the cumulative return gradually increases.

It can be said to be an investment method that moves forward slowly but steadily, like a turtle.

Asset allocation investing can be done by constructing a portfolio directly, or by utilizing indirect investment products such as ETFs or funds that perform asset allocation on your behalf.

This strategy can be invested all at once or in small amounts each month, and is particularly suitable for pension investments aimed at building long-term assets.

---From "An Asset Allocation Portfolio That Remains Unshaken Even When the Market Fluctuates"

The first step in your pension strategy is to merge your pension accounts.

It's about combining pension accounts that have received tax deductions into one.

Both pension savings and savings IRPs that receive tax deductions not only receive tax deductions, but also share annual and total limits, so it is advantageous to merge accounts into one through pension transfer.

On the other hand, retirement IRPs containing pension savings and retirement benefits that are not tax deductible must be managed separately.

Why do we need to divide it this way? Because annual and total limits apply separately depending on the account type.

Pension accounts with and without tax deductions have different tax structures and should be managed separately to optimize taxation.

Pension accounts that have received tax deductions are subject to pension income tax (3.3-5.5%), pension savings that have not received tax deductions are tax-exempt (profits are subject to pension income tax), and retirement IRPs are subject to retirement income tax.

Combining your tax-deductible pension savings and savings IRP makes it easier to identify key assets in one account.

Additionally, asset allocation and rebalancing become much easier, making portfolio adjustments simpler.

Plus, you can be more flexible with your withdrawal plans.

Since it is in one account, it is easy to efficiently adjust the amount received within the total limit.

Especially when planning how much you will receive each month after retirement, it is much more convenient to manage it in one account rather than dividing it into smaller amounts from several accounts.

---From "Step 1: Merging Pension Accounts"

“Mr. Park Gom-hee, is it really possible to live off of 300 million won after retirement?”

“Yes, it is possible.”

Many people ask this question in lectures or YouTube comments, and I always answer it like this.

If I invested 500,000 won per month in four accounts for 22 years at a 7% annual return, what would happen to my funds? The changes would seem minimal for the first few years.

In the first year, the deposit amount increases by only 230,000 won, from 6 million won to 6.23 million won.

In the second year, the profit is only 910,000 won, with 12.91 million won paid in 12 million won.

But from the fifth year onwards, the pace of change accelerates.

If you put in 30 million won, it becomes 36 million won, so you make a profit of 6 million won.

From this point on, the compound interest effect of 'money making money' begins to appear in earnest.

When you reach the 10th year, something even more amazing happens.

I put in 60 million won, but it turned out to be 87.04 million won.

This means that a whopping 27.04 million won in profit was generated.

The money I earn from my investments starts to account for more than half of the principal I put in.

The real magic happens in the second half.

In the 15th year, 90 million won is paid, which makes it 159.4 million won, and in the 22nd year, it finally exceeds 300 million won.

I only put in 114 million won, but it became 314.14 million won.

Of particular note are the changes during the latter 10 years (13th to 22nd years).

During this period alone, assets increased by 186.74 million won, from 127.4 million won to 314.14 million won.

Most of the total profits were concentrated in the latter 10 years.

This is the true power of compound interest: 'time makes money'.

---From "A Realistic 300 Million Won Retirement Scenario"

Publisher's Review

“How to earn a lifetime income, like a salary, even after retirement!”

A new series from Park Gom-hee TV, Korea's top pension mentor, verified by 810,000 subscribers.

“I’m preparing for retirement, but am I doing it right?” This is a question that most working people have.

Tens of millions of won are accumulating in retirement pension accounts, but the reality is that they are left as cash, and the stock investments are only made at the level of allowance.

I signed up for pension savings, but I don't know which product to choose, so I'm relying solely on recommendations from bank employees.

As these concerns piled up, many people began to look for answers on YouTube, and 'Park Gom-hee TV' was at the center of them.

Park Gom-hee, who built trust with individual investors with her bestseller “Park Gom-hee Investment Method,” is finally publishing her new book, “Park Gom-hee Pension Rich Class,” five years after her publication.

This book is a compilation of pension investment know-how verified by 810,000 subscribers. It goes beyond simple investment techniques and presents fundamental solutions for designing a life free from bankruptcy in retirement.

The most notable feature of this book is that it incorporates the principles of the "4% rule," a stable asset withdrawal strategy, into pension planning.

Using this proven methodology that states that withdrawing 4% of your retirement funds annually will keep your funds from depleting for over 30 years, we present a concrete method for creating an "endless cash flow" that allows you to live solely on earnings while preserving your principal.

The key is to systematically utilize the four accounts.

We introduce a method to strategically manage pension savings, IRPs, ISAs, etc. to maximize tax benefits while preparing stable retirement funds.

“A roadmap to becoming a pensioner with just four accounts!”

How to earn 3 million won a month for life, like a salary, even after retirement.

"Park Gom-hee's Pension Rich Class" systematizes pension preparation into three stages: payment, management, and receipt.

First, in the payment stage, we introduce a method for strategically utilizing 'four tax-saving accounts', including two pension savings funds, savings IRP, and ISA.

This is a wise plan that secures both tax benefits and liquidity by managing pension savings that are eligible for tax deductions separately from pension savings that are not.

The author presents a step-by-step, specific portfolio and payment strategy based on an individual's investment capacity, ranging from 500,000 won to 2 million won per month.

The operation stage provides guidance on five investment methods, each with varying levels of difficulty, that even beginners can easily follow. Begin safely with MMFs and interest-type ETFs, then move on to the automated investment system of TDFs, and finally, choose from monthly dividend ETF strategies and asset allocation portfolios.

In particular, it covers in detail how to maximize returns through customized investment strategies for each account.

We suggest investment methods optimized for the characteristics of each account, such as asset allocation for pension savings, TDF for savings IRP, and monthly dividend ETF for ISA.

At the receiving stage, the '5-step golden formula' known only to the pension rich is revealed.

We systematically guide you through every step after pension commencement, from merging pension accounts to switching to a monthly dividend-focused portfolio, optimizing taxes, choosing a payment method, and deciding whether to self-pay.

According to the author's scenario, if you invest 500,000 won per month for 22 years at an annual return of 7%, you can accumulate 300 million won. If you manage this in a monthly dividend ETF, you can combine it with the national pension to create a stable cash flow of 3 million won per month.

This is a realistic roadmap for ordinary office workers to become pension rich without complex investment knowledge or a large sum of money.

1.

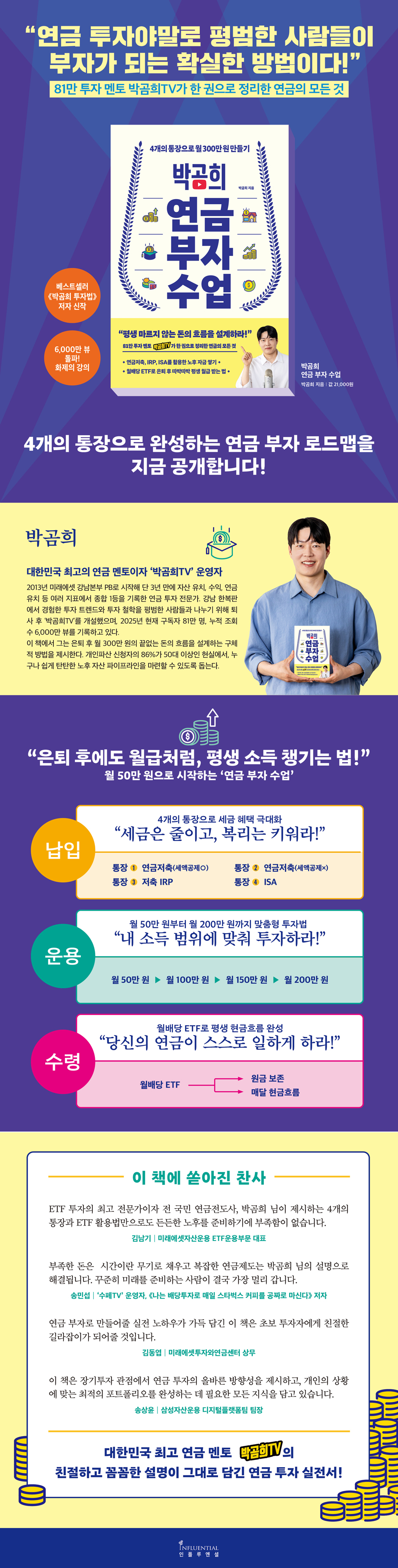

Deposit: Maximize your tax benefits with four accounts.

“Reduce taxes and increase welfare!”

· Account 1 Pension Savings (tax deduction ○)

· Account 2 Pension Savings (tax deduction ×)

· Savings IRP for account 3

· Passbook 4 ISA

2.

Investment: Customized investment method from 500,000 won to 2 million won per month

“Invest within your income range!”

500,000 won per month ▶ 1 million won per month ▶ 1.5 million won per month ▶ 2 million won per month

3.

Receipt: Complete lifetime cash flow with monthly dividend ETFs.

“Let your pension work for you!”

Monthly Dividend ETF ▶ Principal Preservation & Monthly Cash Flow

“If you start now, you too will be a pension millionaire in 20 years!”

Pension Wealth Class: Starting at 500,000 Won a Month

The greatest appeal of this book is its ‘feasibility.’

The author asserts that “the path to pension wealth is not a complicated or difficult secret.”

In fact, America's pension rich have achieved success not through special investment knowledge, but through the pension system and 'consistent practice' within that system.

The author is confident that our country already has all the infrastructure in place.

What's even more surprising is that the barrier to entry is lower than you might think.

The author clearly answers the question, "I don't know much about bonds, so how can I buy bond ETFs?"

“Just as you don’t learn to drive without fully understanding the engine’s structure, investing can begin with a simple realization: ‘Oh, if I step on the right pedal, it’ll go!’” This means that a courageous first step is more important than perfect knowledge.

The author delivers a powerful message to the readers.

“Going forward, you will be constantly surrounded by new investment themes like semiconductors, Bitcoin, and Neom City, and stories of people making a fortune will be sure to disturb you.

But where we should entrust our retirement lies within the obvious principles of asset allocation and dividend investing.”

Do it now.

If you're in your 30s, you still have 30 years left, and if you're in your 40s, you still have 20 years left.

It's not too late, even if you're in your 50s.

The moment you take the first step according to the strategies in this book, your retirement will change.

If 500,000 won per month is too much for you, you can start with 200,000 won per month, and if that's too difficult, you can start with 100,000 won per month.

The important thing is not the 'perfect plan' but 'acting now'.

A new series from Park Gom-hee TV, Korea's top pension mentor, verified by 810,000 subscribers.

“I’m preparing for retirement, but am I doing it right?” This is a question that most working people have.

Tens of millions of won are accumulating in retirement pension accounts, but the reality is that they are left as cash, and the stock investments are only made at the level of allowance.

I signed up for pension savings, but I don't know which product to choose, so I'm relying solely on recommendations from bank employees.

As these concerns piled up, many people began to look for answers on YouTube, and 'Park Gom-hee TV' was at the center of them.

Park Gom-hee, who built trust with individual investors with her bestseller “Park Gom-hee Investment Method,” is finally publishing her new book, “Park Gom-hee Pension Rich Class,” five years after her publication.

This book is a compilation of pension investment know-how verified by 810,000 subscribers. It goes beyond simple investment techniques and presents fundamental solutions for designing a life free from bankruptcy in retirement.

The most notable feature of this book is that it incorporates the principles of the "4% rule," a stable asset withdrawal strategy, into pension planning.

Using this proven methodology that states that withdrawing 4% of your retirement funds annually will keep your funds from depleting for over 30 years, we present a concrete method for creating an "endless cash flow" that allows you to live solely on earnings while preserving your principal.

The key is to systematically utilize the four accounts.

We introduce a method to strategically manage pension savings, IRPs, ISAs, etc. to maximize tax benefits while preparing stable retirement funds.

“A roadmap to becoming a pensioner with just four accounts!”

How to earn 3 million won a month for life, like a salary, even after retirement.

"Park Gom-hee's Pension Rich Class" systematizes pension preparation into three stages: payment, management, and receipt.

First, in the payment stage, we introduce a method for strategically utilizing 'four tax-saving accounts', including two pension savings funds, savings IRP, and ISA.

This is a wise plan that secures both tax benefits and liquidity by managing pension savings that are eligible for tax deductions separately from pension savings that are not.

The author presents a step-by-step, specific portfolio and payment strategy based on an individual's investment capacity, ranging from 500,000 won to 2 million won per month.

The operation stage provides guidance on five investment methods, each with varying levels of difficulty, that even beginners can easily follow. Begin safely with MMFs and interest-type ETFs, then move on to the automated investment system of TDFs, and finally, choose from monthly dividend ETF strategies and asset allocation portfolios.

In particular, it covers in detail how to maximize returns through customized investment strategies for each account.

We suggest investment methods optimized for the characteristics of each account, such as asset allocation for pension savings, TDF for savings IRP, and monthly dividend ETF for ISA.

At the receiving stage, the '5-step golden formula' known only to the pension rich is revealed.

We systematically guide you through every step after pension commencement, from merging pension accounts to switching to a monthly dividend-focused portfolio, optimizing taxes, choosing a payment method, and deciding whether to self-pay.

According to the author's scenario, if you invest 500,000 won per month for 22 years at an annual return of 7%, you can accumulate 300 million won. If you manage this in a monthly dividend ETF, you can combine it with the national pension to create a stable cash flow of 3 million won per month.

This is a realistic roadmap for ordinary office workers to become pension rich without complex investment knowledge or a large sum of money.

1.

Deposit: Maximize your tax benefits with four accounts.

“Reduce taxes and increase welfare!”

· Account 1 Pension Savings (tax deduction ○)

· Account 2 Pension Savings (tax deduction ×)

· Savings IRP for account 3

· Passbook 4 ISA

2.

Investment: Customized investment method from 500,000 won to 2 million won per month

“Invest within your income range!”

500,000 won per month ▶ 1 million won per month ▶ 1.5 million won per month ▶ 2 million won per month

3.

Receipt: Complete lifetime cash flow with monthly dividend ETFs.

“Let your pension work for you!”

Monthly Dividend ETF ▶ Principal Preservation & Monthly Cash Flow

“If you start now, you too will be a pension millionaire in 20 years!”

Pension Wealth Class: Starting at 500,000 Won a Month

The greatest appeal of this book is its ‘feasibility.’

The author asserts that “the path to pension wealth is not a complicated or difficult secret.”

In fact, America's pension rich have achieved success not through special investment knowledge, but through the pension system and 'consistent practice' within that system.

The author is confident that our country already has all the infrastructure in place.

What's even more surprising is that the barrier to entry is lower than you might think.

The author clearly answers the question, "I don't know much about bonds, so how can I buy bond ETFs?"

“Just as you don’t learn to drive without fully understanding the engine’s structure, investing can begin with a simple realization: ‘Oh, if I step on the right pedal, it’ll go!’” This means that a courageous first step is more important than perfect knowledge.

The author delivers a powerful message to the readers.

“Going forward, you will be constantly surrounded by new investment themes like semiconductors, Bitcoin, and Neom City, and stories of people making a fortune will be sure to disturb you.

But where we should entrust our retirement lies within the obvious principles of asset allocation and dividend investing.”

Do it now.

If you're in your 30s, you still have 30 years left, and if you're in your 40s, you still have 20 years left.

It's not too late, even if you're in your 50s.

The moment you take the first step according to the strategies in this book, your retirement will change.

If 500,000 won per month is too much for you, you can start with 200,000 won per month, and if that's too difficult, you can start with 100,000 won per month.

The important thing is not the 'perfect plan' but 'acting now'.

GOODS SPECIFICS

- Date of issue: June 25, 2025

- Page count, weight, size: 296 pages | 524g | 152*225*19mm

- ISBN13: 9791168342941

- ISBN10: 1168342945

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)