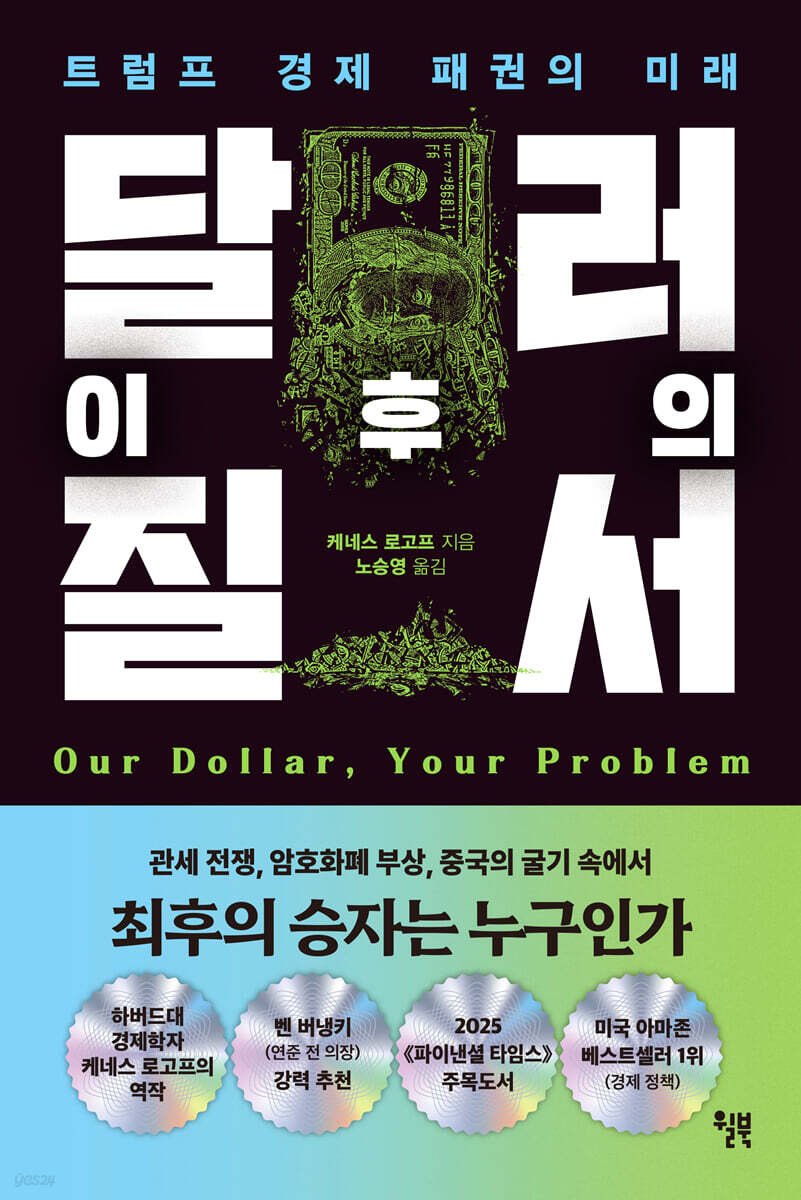

Post-dollar order

|

Description

Book Introduction

- A word from MD

-

The dollar crisis: This time it's really different.A Harvard economics professor who predicted the 2008 global financial crisis diagnoses the dollar crisis.

We analyze the impact on the global economy of the rise of the Chinese yuan, which is triggering a crack in the entrenched dollar hegemony, and the spread of cryptocurrencies.

The dollar is now at an inflection point, heading towards a new order.

October 28, 2025. Economics and Management PD Oh Da-eun

★ “The dollar's purchasing power could shrink significantly within 10 years.”

★ Sharp insights from a Harvard University economics professor and former IMF chief economist.

★ #1 Bestseller on Amazon in the US (Economic Policy), a Financial Times Notable Book of 2025, recommended by former Federal Reserve Chairman Ben Bernanke!

Is the dollar truly a perpetual safe haven? Amidst the growing alarm of crisis, from the rise of various cryptocurrencies and China's pursuit of independence from the dollar bloc to inflation risks and political instability in the United States, economics guru Kenneth Rogoff has stepped forward to answer the anxiety of our times, teetering between the belief that "the dollar is still good" and the suspicion that "this time is different."

With his exceptional ability to read global financial trends, he predicted and warned of the collapse of the US housing market, the European debt crisis, and the 2015 Chinese financial crisis years in advance. In his new book, “Order After the Dollar,” he explores the process by which the dollar rose to become the dominant currency over the past 70 years, examines the current status of countries under the dollar’s influence, and forecasts the path the dollar will take in the future.

This book seeks answers to these questions based on diverse data, meticulous analysis, and conversations with leaders and economic experts from around the world.

How did the dollar become the dominant currency? Why did past challengers like the Soviet ruble, Japan's yen, and Europe's euro ultimately fail? What is the status of China, the current challenger? Can cryptocurrencies become an alternative to the dollar? Of course, the dollar's dominance still holds.

Still, in 90 percent of all foreign exchange transactions worldwide, one currency is the dollar, and 80 percent of oil transactions are priced in dollars.

However, the author sharply points out the reality that we cannot be completely optimistic about.

"Today, the global financial system has reached a critical turning point." Translator Noh Seung-young's accurate and smooth translation of "Order After the Dollar" is the best book for thoroughly understanding the international order surrounding currency hegemony and the currents of the modern economy.

★ Sharp insights from a Harvard University economics professor and former IMF chief economist.

★ #1 Bestseller on Amazon in the US (Economic Policy), a Financial Times Notable Book of 2025, recommended by former Federal Reserve Chairman Ben Bernanke!

Is the dollar truly a perpetual safe haven? Amidst the growing alarm of crisis, from the rise of various cryptocurrencies and China's pursuit of independence from the dollar bloc to inflation risks and political instability in the United States, economics guru Kenneth Rogoff has stepped forward to answer the anxiety of our times, teetering between the belief that "the dollar is still good" and the suspicion that "this time is different."

With his exceptional ability to read global financial trends, he predicted and warned of the collapse of the US housing market, the European debt crisis, and the 2015 Chinese financial crisis years in advance. In his new book, “Order After the Dollar,” he explores the process by which the dollar rose to become the dominant currency over the past 70 years, examines the current status of countries under the dollar’s influence, and forecasts the path the dollar will take in the future.

This book seeks answers to these questions based on diverse data, meticulous analysis, and conversations with leaders and economic experts from around the world.

How did the dollar become the dominant currency? Why did past challengers like the Soviet ruble, Japan's yen, and Europe's euro ultimately fail? What is the status of China, the current challenger? Can cryptocurrencies become an alternative to the dollar? Of course, the dollar's dominance still holds.

Still, in 90 percent of all foreign exchange transactions worldwide, one currency is the dollar, and 80 percent of oil transactions are priced in dollars.

However, the author sharply points out the reality that we cannot be completely optimistic about.

"Today, the global financial system has reached a critical turning point." Translator Noh Seung-young's accurate and smooth translation of "Order After the Dollar" is the best book for thoroughly understanding the international order surrounding currency hegemony and the currents of the modern economy.

- You can preview some of the book's contents.

Preview

index

Preface to the Korean edition: "Key Countries in the Asian Dollar Bloc"

Introduction

Chapter 1.

The Birth of a Dominant Currency

Part 1.

Past Challengers to the Dollar's Hegemony

Chapter 2.

The Soviet Challenge

Chapter 3.

Japan and the yen

Chapter 4.

Europe's single currency

Part 2.

China: The Current Challenger

Chapter 5.

This time it's different

Chapter 6.

Zhu Rongji's chilling prediction

Chapter 7.

People's Bank of China

Chapter 8.

Prelude to a crisis

Chapter 9.

The end of high growth

Chapter 10.

The Inevitability of Dollar Decoupling

Part 3.

Everyone else's problem: living with the dollar

Chapter 11.

The temptation of a fixed exchange rate system

Chapter 12.

hyperinflation

Chapter 13.

When the exchange rate peg expires

Chapter 14.

Lebanon and Argentina: Unique Cases or Typical Cases?

Chapter 15.

Tokyo Agreement

Chapter 16.

Return of the fixed exchange rate system

Part 4.

alternative currencies

Chapter 17.

World currency

Chapter 18.

Cryptocurrency and the Future of Money

Chapter 19.

Central bank digital currency

Part 5.

The benefits and burdens of a dominant currency

Chapter 20.

The benefits of currency hegemony

Chapter 21.

Excessive privilege or taxation without representation?

Chapter 22.

Small Ways the US Can Help Countries Counter Dollar Hegemony

Chapter 23.

Cost of the dominant currency

Part 6.

The pinnacle of dollar hegemony

Chapter 24.

Central Bank Independence: A Bulwark of Monetary Hegemony

Chapter 25.

The Debtor's Empire: America's Achilles' Heel

Chapter 26.

The Siren's Temptation: "Forever Low"

Chapter 27.

The End of the Pax Dollar Era?

Acknowledgements

Source of diagram

main

Search

Detailed image

Into the book

Indeed, there is good reason to believe that within the next decade the world will experience high interest rates and inflation, a destabilizing global financial system, and a significant decline in the dollar's overwhelming purchasing power.

The era in which the dollar wielded absolute hegemony and boasted solid stability may have already passed its peak.

If so, the frequency and intensity of debt crises, inflation crises, financial crises, and currency crises will increase worldwide.

--- p.21, from “Introduction”

The most disturbing aspect of the current system is that even if the United States does not default on its debt, it has ample room to use inflation to reduce the real value of its debt.

After all, unexpected sudden inflation is no different from partial default.

This is because the purchasing power of the loan repaid in dollars is much lower than when the loan was taken out.

This is exactly what happened in the 1970s.

--- p.26, from “Chapter 1: The Birth of a Dominant Currency”

Why did Japan collapse? Many believe it was because, under pressure from the United States in the mid-1980s, it rapidly appreciated its yen.

As a result, the export engine was damaged.

As Japan's example shows, the United States tolerates other economies doing well to some extent, but it does not tolerate them doing too well.

Many countries agree with this view.

But I have long thought that this interpretation is overblown.

--- p.57, from “Chapter 3 Japan and the Yen”

Although the dollar currently holds hegemony and the Chinese yuan is on the rise, this does not mean that the euro will continue to decline.

If the dollar stumbles, perhaps because of a gridlocked U.S. Congress determined to continue pushing for a technical default for months and create financial chaos, the currency that will benefit most is the euro.

--- p.102, from “Chapter 4: Europe’s Single Currency”

Just how impressive was China's growth? Official figures show an average real growth rate of 9.9 percent between 1980 and 2012, and while it slowed down, it still achieved a respectable 7.0 percent between 2012 and 2019.

There is little debate among economists that China's growth rate will inevitably slow down at some point.

The current economic growth rate of advanced countries could drop to an average of 1 to 2 percent.

The question is when.

Will it be in 10 years, 20 years, or even by the end of the 21st century?

--- p.145~146, from “Chapter 9: The End of High Growth”

For most countries, the question is not how to compete with the dollar, but how to live with it.

A common starting point was to fix the exchange rate between the dollar and the domestic currency.

In the postwar period, virtually all developed and emerging markets attempted this system.

These days, only a few countries strictly peg their currencies to the dollar, but many tightly control their short-term (and even medium-term) movements.

Understanding the potential problems here will allow us to delve into the core of modern international economics and serve as a valuable starting point for envisioning the future direction of the global financial system.

--- p.171, from “Chapter 11: The Temptation of a Fixed Exchange Rate System”

In Zimbabwe, inflation reached 50,000 percent annually in 2008-2009, the result of decades of catastrophic autocratic rule that destroyed a once thriving economy in the name of socialism.

One of my most outstanding undergraduate students at the time was from Harare, the capital of Zimbabwe.

She pinched it like this.

“I don’t know what data the government or the IMF uses when calculating inflation rates.

“The store is empty, so there are no price tags to check.”

--- p.184, from “Chapter 12 Hyperinflation”

Cryptocurrencies like Bitcoin are crucial to the global underground economy, giving them undeniable long-term value.

The global underground economy is huge.

It easily accounts for 20 percent of the world's GDP, boasting an economic scale comparable to that of Europe.

But unless it's a dystopian future like the apocalyptic Mad Max movie depicting a post-nuclear war, it's unlikely that cryptocurrencies will ever replace the dollar as the dominant currency in legal taxable transactions.

--- p.254, from “Chapter 18 Cryptocurrency and the Future of Money”

The greatest danger facing the dollar hegemony lies within.

It's the same no matter which party is in power.

The problem is that the ruling party has too much power.

As the dollar's hegemony has grown over the past several decades, American politicians (and many economists) have been under the illusion that ultra-low interest rates will almost certainly remain the norm for the foreseeable future.

Their comfort is the classic 'this time is different' mentality.

The era in which the dollar wielded absolute hegemony and boasted solid stability may have already passed its peak.

If so, the frequency and intensity of debt crises, inflation crises, financial crises, and currency crises will increase worldwide.

--- p.21, from “Introduction”

The most disturbing aspect of the current system is that even if the United States does not default on its debt, it has ample room to use inflation to reduce the real value of its debt.

After all, unexpected sudden inflation is no different from partial default.

This is because the purchasing power of the loan repaid in dollars is much lower than when the loan was taken out.

This is exactly what happened in the 1970s.

--- p.26, from “Chapter 1: The Birth of a Dominant Currency”

Why did Japan collapse? Many believe it was because, under pressure from the United States in the mid-1980s, it rapidly appreciated its yen.

As a result, the export engine was damaged.

As Japan's example shows, the United States tolerates other economies doing well to some extent, but it does not tolerate them doing too well.

Many countries agree with this view.

But I have long thought that this interpretation is overblown.

--- p.57, from “Chapter 3 Japan and the Yen”

Although the dollar currently holds hegemony and the Chinese yuan is on the rise, this does not mean that the euro will continue to decline.

If the dollar stumbles, perhaps because of a gridlocked U.S. Congress determined to continue pushing for a technical default for months and create financial chaos, the currency that will benefit most is the euro.

--- p.102, from “Chapter 4: Europe’s Single Currency”

Just how impressive was China's growth? Official figures show an average real growth rate of 9.9 percent between 1980 and 2012, and while it slowed down, it still achieved a respectable 7.0 percent between 2012 and 2019.

There is little debate among economists that China's growth rate will inevitably slow down at some point.

The current economic growth rate of advanced countries could drop to an average of 1 to 2 percent.

The question is when.

Will it be in 10 years, 20 years, or even by the end of the 21st century?

--- p.145~146, from “Chapter 9: The End of High Growth”

For most countries, the question is not how to compete with the dollar, but how to live with it.

A common starting point was to fix the exchange rate between the dollar and the domestic currency.

In the postwar period, virtually all developed and emerging markets attempted this system.

These days, only a few countries strictly peg their currencies to the dollar, but many tightly control their short-term (and even medium-term) movements.

Understanding the potential problems here will allow us to delve into the core of modern international economics and serve as a valuable starting point for envisioning the future direction of the global financial system.

--- p.171, from “Chapter 11: The Temptation of a Fixed Exchange Rate System”

In Zimbabwe, inflation reached 50,000 percent annually in 2008-2009, the result of decades of catastrophic autocratic rule that destroyed a once thriving economy in the name of socialism.

One of my most outstanding undergraduate students at the time was from Harare, the capital of Zimbabwe.

She pinched it like this.

“I don’t know what data the government or the IMF uses when calculating inflation rates.

“The store is empty, so there are no price tags to check.”

--- p.184, from “Chapter 12 Hyperinflation”

Cryptocurrencies like Bitcoin are crucial to the global underground economy, giving them undeniable long-term value.

The global underground economy is huge.

It easily accounts for 20 percent of the world's GDP, boasting an economic scale comparable to that of Europe.

But unless it's a dystopian future like the apocalyptic Mad Max movie depicting a post-nuclear war, it's unlikely that cryptocurrencies will ever replace the dollar as the dominant currency in legal taxable transactions.

--- p.254, from “Chapter 18 Cryptocurrency and the Future of Money”

The greatest danger facing the dollar hegemony lies within.

It's the same no matter which party is in power.

The problem is that the ruling party has too much power.

As the dollar's hegemony has grown over the past several decades, American politicians (and many economists) have been under the illusion that ultra-low interest rates will almost certainly remain the norm for the foreseeable future.

Their comfort is the classic 'this time is different' mentality.

--- p.392~393, from "The End of the Pax Dollar Era?"

Publisher's Review

"The dollar has held its own despite previous crises, but this time it's truly different." ―Forbes

The Rise and Fall of the Dollar: A 70-Year History of Global Finance

The US dollar faces challenges on several fronts.

The BRICS economic bloc, which includes Russia and China, is moving away from the dollar, including using the yuan instead of the dollar for trade settlements.

The Trump administration's recent tariff war has prompted other countries to pursue more multipolar exchange rate regimes, and cryptocurrencies and central bank digital currencies are emerging as allies attempt to establish non-dollar pipelines.

Additionally, there is a possibility that the United States will pursue a weak dollar policy called the Mar-a-Lago agreement as a card to resolve the trade deficit.

Meanwhile, the national debt, the Achilles' heel of the United States, has reached 500 trillion won, and the interest cost alone is over 1 trillion dollars per year, making it unsustainable.

Will the dollar's dominance continue? World-renowned economist Kenneth Rogoff's new book, "The Post-Dollar Order," examines the 70-year history of global finance, dominated by the dollar since World War II, and forecasts the future of this reserve currency and the international order.

The author points out clearly:

“Actually, by many figures, the dollar hegemony peaked in 2015 and has been in decline since.” This book comprehensively analyzes decades of data on changes in the U.S. share of global GDP, government debt, and the current account, and predicts that financial instability will increase as the “excessive privilege” enjoyed by the U.S. gradually diminishes.

Is this a cautious stance, or simply excessive pessimism and hysteria? Amidst the turbulent international situation, a very prudent and timely economic book has been published.

"Unraveling complex financial stories in an accessible way." —The Wall Street Journal

A compelling work that weaves together personal experiences and the narrative of macroeconomic development.

It was August 19, 2008, just weeks before Lehman Brothers collapsed.

Kenneth Rogoff, attending a conference in Singapore, issued a warning to an audience of about 60 to 70 people.

“I would say the worst is yet to come.

“One of the big investment banks is going to collapse.” It was an honest assessment of the current situation, and one I have consistently said.

Mid-sized banks reacted by saying the analysis was too gloomy, while Asian and European newspapers gave his remarks major coverage.

At the time, the New York Times commented:

“Of all economists, Logoff is the one least likely to make a heated statement.

That is what makes these articles all the more terrifying.” It was not long before his prediction became reality….

The author describes his experiences as a former chief economist at the IMF and an insider directly involved in economic policies of various countries.

The book delivers an interesting economic story that could easily feel dry and heavy, such as the story of how he felt China's development when he witnessed the 9 million bicycles that dominated the streets in China in 2002 turn into 5 million cars in 2016, and the story of meeting Samuel Bankman-Fried, the founder of FTX, a cryptocurrency exchange that was once one of the top five in the world, just before it went bankrupt.

Yet, he never lost his sharp eye for accurately analyzing global finance, producing a book that possesses both the breadth of a popular book and the depth of an academic work.

"Korea is the most crucial country for the future of the dollar bloc."

Includes a special preface for the Korean edition for readers in our country.

“Our dollar is your problem.” In 1971, the United States suddenly declared that it would not exchange its dollars for gold.

At the time, European leaders were furious, worried that their large holdings of US Treasury bonds and dollar reserves would become worthless.

John Connally, who had become the U.S. Treasury Secretary at the time, gave them the above famous quote.

It was a counterproductive remark, telling them to take care of themselves because if the dollar value falls, they will suffer more than the United States.

Many countries still feel a sense of love and hate for this oppressive American hegemony today.

Korea cannot be an exception.

The US dollar is also our problem.

Along with his boast about his love for bibimbap, the author also clearly touches on the Korean economy.

It is a representative example of an emerging Asian economy that grew through innovation and competition while its neighboring country, Japan, was in decline, and a rare example of a country that has overcome the so-called "middle-income trap," where developing countries are unable to catch up with developed countries.

Moreover, the preface to this Korean edition reiterates the importance of Korea by pointing out Trump's self-centered diplomacy, while also offering timely advice, expressing concern about the potential problems that could arise if emerging stablecoins penetrate deeply into the Korean economy.

Weak vs. strong dollar: What is the future of the dollar? How are advanced economies like the US, Europe, and China responding? What direction should Korea take? "The Post-Dollar Order" is a must-read macroeconomics book that addresses all these questions.

The Rise and Fall of the Dollar: A 70-Year History of Global Finance

The US dollar faces challenges on several fronts.

The BRICS economic bloc, which includes Russia and China, is moving away from the dollar, including using the yuan instead of the dollar for trade settlements.

The Trump administration's recent tariff war has prompted other countries to pursue more multipolar exchange rate regimes, and cryptocurrencies and central bank digital currencies are emerging as allies attempt to establish non-dollar pipelines.

Additionally, there is a possibility that the United States will pursue a weak dollar policy called the Mar-a-Lago agreement as a card to resolve the trade deficit.

Meanwhile, the national debt, the Achilles' heel of the United States, has reached 500 trillion won, and the interest cost alone is over 1 trillion dollars per year, making it unsustainable.

Will the dollar's dominance continue? World-renowned economist Kenneth Rogoff's new book, "The Post-Dollar Order," examines the 70-year history of global finance, dominated by the dollar since World War II, and forecasts the future of this reserve currency and the international order.

The author points out clearly:

“Actually, by many figures, the dollar hegemony peaked in 2015 and has been in decline since.” This book comprehensively analyzes decades of data on changes in the U.S. share of global GDP, government debt, and the current account, and predicts that financial instability will increase as the “excessive privilege” enjoyed by the U.S. gradually diminishes.

Is this a cautious stance, or simply excessive pessimism and hysteria? Amidst the turbulent international situation, a very prudent and timely economic book has been published.

"Unraveling complex financial stories in an accessible way." —The Wall Street Journal

A compelling work that weaves together personal experiences and the narrative of macroeconomic development.

It was August 19, 2008, just weeks before Lehman Brothers collapsed.

Kenneth Rogoff, attending a conference in Singapore, issued a warning to an audience of about 60 to 70 people.

“I would say the worst is yet to come.

“One of the big investment banks is going to collapse.” It was an honest assessment of the current situation, and one I have consistently said.

Mid-sized banks reacted by saying the analysis was too gloomy, while Asian and European newspapers gave his remarks major coverage.

At the time, the New York Times commented:

“Of all economists, Logoff is the one least likely to make a heated statement.

That is what makes these articles all the more terrifying.” It was not long before his prediction became reality….

The author describes his experiences as a former chief economist at the IMF and an insider directly involved in economic policies of various countries.

The book delivers an interesting economic story that could easily feel dry and heavy, such as the story of how he felt China's development when he witnessed the 9 million bicycles that dominated the streets in China in 2002 turn into 5 million cars in 2016, and the story of meeting Samuel Bankman-Fried, the founder of FTX, a cryptocurrency exchange that was once one of the top five in the world, just before it went bankrupt.

Yet, he never lost his sharp eye for accurately analyzing global finance, producing a book that possesses both the breadth of a popular book and the depth of an academic work.

"Korea is the most crucial country for the future of the dollar bloc."

Includes a special preface for the Korean edition for readers in our country.

“Our dollar is your problem.” In 1971, the United States suddenly declared that it would not exchange its dollars for gold.

At the time, European leaders were furious, worried that their large holdings of US Treasury bonds and dollar reserves would become worthless.

John Connally, who had become the U.S. Treasury Secretary at the time, gave them the above famous quote.

It was a counterproductive remark, telling them to take care of themselves because if the dollar value falls, they will suffer more than the United States.

Many countries still feel a sense of love and hate for this oppressive American hegemony today.

Korea cannot be an exception.

The US dollar is also our problem.

Along with his boast about his love for bibimbap, the author also clearly touches on the Korean economy.

It is a representative example of an emerging Asian economy that grew through innovation and competition while its neighboring country, Japan, was in decline, and a rare example of a country that has overcome the so-called "middle-income trap," where developing countries are unable to catch up with developed countries.

Moreover, the preface to this Korean edition reiterates the importance of Korea by pointing out Trump's self-centered diplomacy, while also offering timely advice, expressing concern about the potential problems that could arise if emerging stablecoins penetrate deeply into the Korean economy.

Weak vs. strong dollar: What is the future of the dollar? How are advanced economies like the US, Europe, and China responding? What direction should Korea take? "The Post-Dollar Order" is a must-read macroeconomics book that addresses all these questions.

GOODS SPECIFICS

- Date of issue: October 28, 2025

- Page count, weight, size: 456 pages | 684g | 150*225*28mm

- ISBN13: 9791155818749

- ISBN10: 1155818741

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)