Money explosion

|

Description

Book Introduction

The world has already entered an era of asset inequality,

We must understand the meaning of money supply to survive.

Author of "Rich America, Poor Europe"

Reporter Jinseok Son, former editor-in-chief of Chosun Ilbo Weekly Biz, reports.

The rapidly changing economic formula

Korea is having a money party right now.

In the 2020s, with excessive money being released into the market, people began to make tens or hundreds of billions of won through real estate, stocks, and cryptocurrencies.

Those who witnessed this were captivated by the idea of buying and selling stocks, taking bold steps to borrow and invest, while the government continued to pour money into the market.

As a result, the money supply exploded and money became common.

In the age of easy money, how should we navigate this massive flow?

“Inequality caused by the time difference in the movement of money can be overcome through individual effort.

The lives of people who live with the concept of 'money street' and those who do not can be very different.

“It is a universal truth that does not change with the passage of time.” (p. 60)

Reporter Jinseok Son, who analyzed the current state of politics and economy in the United States and Europe in "Rich America, Poor Europe," now unfolds the story focusing on money supply.

This in-depth analysis of the massive lending and money parties taking place in Korea, the various phenomena caused by the global money supply explosion, and the patterns of money flows in the United States are closely analyzed based on accurate data.

This will allow us to understand the principles by which changes in the money supply affect the overall economy.

It also provides guidance on how individuals should respond to the influx of money in an era of explosive money supply.

We must understand the meaning of money supply to survive.

Author of "Rich America, Poor Europe"

Reporter Jinseok Son, former editor-in-chief of Chosun Ilbo Weekly Biz, reports.

The rapidly changing economic formula

Korea is having a money party right now.

In the 2020s, with excessive money being released into the market, people began to make tens or hundreds of billions of won through real estate, stocks, and cryptocurrencies.

Those who witnessed this were captivated by the idea of buying and selling stocks, taking bold steps to borrow and invest, while the government continued to pour money into the market.

As a result, the money supply exploded and money became common.

In the age of easy money, how should we navigate this massive flow?

“Inequality caused by the time difference in the movement of money can be overcome through individual effort.

The lives of people who live with the concept of 'money street' and those who do not can be very different.

“It is a universal truth that does not change with the passage of time.” (p. 60)

Reporter Jinseok Son, who analyzed the current state of politics and economy in the United States and Europe in "Rich America, Poor Europe," now unfolds the story focusing on money supply.

This in-depth analysis of the massive lending and money parties taking place in Korea, the various phenomena caused by the global money supply explosion, and the patterns of money flows in the United States are closely analyzed based on accurate data.

This will allow us to understand the principles by which changes in the money supply affect the overall economy.

It also provides guidance on how individuals should respond to the influx of money in an era of explosive money supply.

- You can preview some of the book's contents.

Preview

index

Prologue | The Era of Separation of Government and Money

I.

Money explodes

The money supply increased by 1,230 trillion won over the five years of the 2020s.

Why the 21st Century is an Era of Money Explosion

In an era of a 700 trillion won budget, the Lee Jae-myung administration is spending more.

Why the Rich Are Concerned with Increasing the Money Supply

As the money supply increases, incorporate the concept of "money distance."

Ⅱ.

South Korea is in the midst of a 'loan feast'

How did Koreans end up living in a "loan republic"?

Regular employees at large corporations, the "new aristocracy of the financial age"

Did anti-workplace bullying laws drive up apartment prices?

Ⅲ.

The world is in a race to loosen its purse strings

The global money supply has quadrupled over the past 20 years.

Why the US Money Supply Will Be Larger in 2025 Than During the COVID-19 Era

China, trapped in a low-growth trap, has a money supply that exceeds twice its GDP.

Europe announces 1000 trillion won investment for rearmament

A new money-spraying machine: the far-right party

Ⅳ.

Money is heading to America

The New York Stock Exchange, which accounts for 48.5% of the world's market capitalization

89% of the foreign stocks held by K-Ants are US stocks

Koreans own more U.S. stocks than Japanese or Germans.

Why China's WeRide and Britain's ARM Listed in New York

Is Europe's dream of a "single capital market" actually feasible?

V.

America is an 'empire of debt'

Will the US, with its 50-year trade deficit, issue interest-free bonds?

Is the American's net worth $620,000 or $120,000?

Can the dollar's hegemony last another 100 years?

Ⅵ.

The emergence of new money

Cryptocurrency: Money that Political Power Can't Touch

Will Bitcoin Wither Like 17th-Century Tulips?

Why Trump Became a Cryptocurrency Advocate

Putin, dreaming of becoming a "digital tsar," launches "BRICS Pay."

Ⅶ.

Money Showdown

Are stablecoins the "flammable agent" that will explode the money supply?

Central Banks' Counterattack: Will CBDCs Ever Become Commercially Available?

Why Are Xi Jinping and Trump Taking Opposite Actions on CBDCs?

Ⅷ.

The overturned economic formula

The 30 years of unusually low inflation and low interest rates have come to an end.

The Yen's Humiliation, Japan's Crumbling Pride

Which country is Stellantis from?

The era of global diplomacy: "The managing director is a former diplomat."

IX.

How to Respond to the Money Explosion

Knowing the money supply reveals stock, real estate, and gold prices.

In the age of the "flood of money," merchants outnumber scholars.

Will the massive household debt time bomb collapse?

Will Seoul Apartment Prices Ever Be Unbeatable?

Preparing for the future starts with distinguishing between slowing down and going backwards.

Epilogue | No More 'Show-Off Capitalism'

I.

Money explodes

The money supply increased by 1,230 trillion won over the five years of the 2020s.

Why the 21st Century is an Era of Money Explosion

In an era of a 700 trillion won budget, the Lee Jae-myung administration is spending more.

Why the Rich Are Concerned with Increasing the Money Supply

As the money supply increases, incorporate the concept of "money distance."

Ⅱ.

South Korea is in the midst of a 'loan feast'

How did Koreans end up living in a "loan republic"?

Regular employees at large corporations, the "new aristocracy of the financial age"

Did anti-workplace bullying laws drive up apartment prices?

Ⅲ.

The world is in a race to loosen its purse strings

The global money supply has quadrupled over the past 20 years.

Why the US Money Supply Will Be Larger in 2025 Than During the COVID-19 Era

China, trapped in a low-growth trap, has a money supply that exceeds twice its GDP.

Europe announces 1000 trillion won investment for rearmament

A new money-spraying machine: the far-right party

Ⅳ.

Money is heading to America

The New York Stock Exchange, which accounts for 48.5% of the world's market capitalization

89% of the foreign stocks held by K-Ants are US stocks

Koreans own more U.S. stocks than Japanese or Germans.

Why China's WeRide and Britain's ARM Listed in New York

Is Europe's dream of a "single capital market" actually feasible?

V.

America is an 'empire of debt'

Will the US, with its 50-year trade deficit, issue interest-free bonds?

Is the American's net worth $620,000 or $120,000?

Can the dollar's hegemony last another 100 years?

Ⅵ.

The emergence of new money

Cryptocurrency: Money that Political Power Can't Touch

Will Bitcoin Wither Like 17th-Century Tulips?

Why Trump Became a Cryptocurrency Advocate

Putin, dreaming of becoming a "digital tsar," launches "BRICS Pay."

Ⅶ.

Money Showdown

Are stablecoins the "flammable agent" that will explode the money supply?

Central Banks' Counterattack: Will CBDCs Ever Become Commercially Available?

Why Are Xi Jinping and Trump Taking Opposite Actions on CBDCs?

Ⅷ.

The overturned economic formula

The 30 years of unusually low inflation and low interest rates have come to an end.

The Yen's Humiliation, Japan's Crumbling Pride

Which country is Stellantis from?

The era of global diplomacy: "The managing director is a former diplomat."

IX.

How to Respond to the Money Explosion

Knowing the money supply reveals stock, real estate, and gold prices.

In the age of the "flood of money," merchants outnumber scholars.

Will the massive household debt time bomb collapse?

Will Seoul Apartment Prices Ever Be Unbeatable?

Preparing for the future starts with distinguishing between slowing down and going backwards.

Epilogue | No More 'Show-Off Capitalism'

Detailed image

Into the book

Now, with global inflation in 2022 driving up interest rates, the craze for "easy money" has calmed down compared to the time of the coronavirus outbreak.

However, once the wealth gap has opened, it is not easily narrowed.

Moreover, due to the economic downturn, major countries are lowering interest rates again starting in 2024.

The Bank of Korea is also among them.

You must be able to read the flow of these changes well yourself.

--- p.53

It is highly likely that the companies that will continue to dominate the global market will continue to be those from the United States.

When a service that excites Americans comes out, don't just read about it as news and ignore it.

Consider investing.

Exploring whether that has the potential to become a world standard.

--- p.140

Now, no one can easily deny the existence and value of virtual currency.

Some economists predict that Bitcoin's value could reach zero by the 2030s.

If we base it solely on conventional economic principles, it might seem that way.

However, virtual currency has already been institutionalized at various levels.

And it has seeped deep into our lives like a huge wave.

--- p.204

In an age of overflowing money, money is ready to fly towards any new bundle of charm.

The similarities between tulips and Bitcoin as commodities are more telling than the similarities between early 17th-century Netherlands and early 21st-century America.

We must pay attention to the current situation, where liquidity is overflowing in the market and, coupled with this, the desire of the wealthy to find investment targets that did not exist in the past is overflowing.

Only then can you develop the insight to make money.

Even if it wasn't necessarily Bitcoin, the 2010s, a decade overflowing with money, was a time when new, comet-like investment targets were bound to emerge.

However, once the wealth gap has opened, it is not easily narrowed.

Moreover, due to the economic downturn, major countries are lowering interest rates again starting in 2024.

The Bank of Korea is also among them.

You must be able to read the flow of these changes well yourself.

--- p.53

It is highly likely that the companies that will continue to dominate the global market will continue to be those from the United States.

When a service that excites Americans comes out, don't just read about it as news and ignore it.

Consider investing.

Exploring whether that has the potential to become a world standard.

--- p.140

Now, no one can easily deny the existence and value of virtual currency.

Some economists predict that Bitcoin's value could reach zero by the 2030s.

If we base it solely on conventional economic principles, it might seem that way.

However, virtual currency has already been institutionalized at various levels.

And it has seeped deep into our lives like a huge wave.

--- p.204

In an age of overflowing money, money is ready to fly towards any new bundle of charm.

The similarities between tulips and Bitcoin as commodities are more telling than the similarities between early 17th-century Netherlands and early 21st-century America.

We must pay attention to the current situation, where liquidity is overflowing in the market and, coupled with this, the desire of the wealthy to find investment targets that did not exist in the past is overflowing.

Only then can you develop the insight to make money.

Even if it wasn't necessarily Bitcoin, the 2010s, a decade overflowing with money, was a time when new, comet-like investment targets were bound to emerge.

--- p.211

Publisher's Review

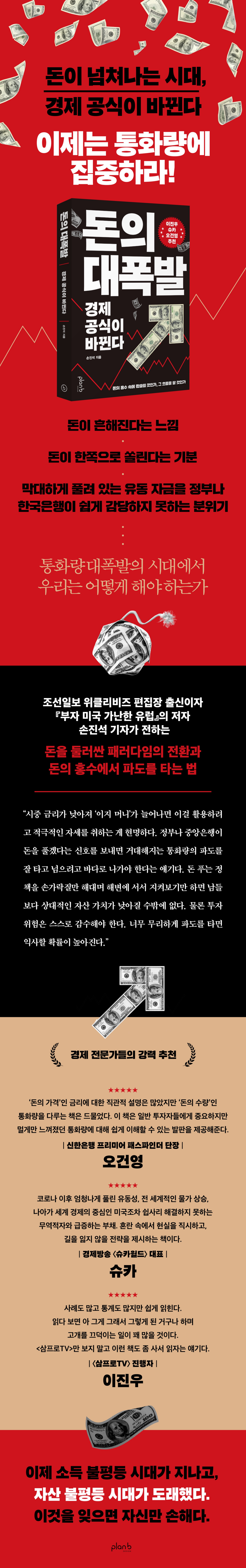

A paradigm shift surrounding money

How to Ride the Wave of Money

During the coronavirus outbreak, people's joys and sorrows were starkly divided.

Since the outbreak of COVID-19, the amount of money in circulation has increased explosively.

Those who guessed that a lot of money would be released realized that the value of currency was meaningless and started investing in real estate, stocks, and coins.

So, even though they received wages for the same work, some people were paid hundreds of millions of won while others were continuously pushed back.

Money keeps flowing in, and someone is taking advantage of this opportunity to make a fortune.

Now it has become important to cleverly attract huge amounts of money and put them in my pocket.

Now is not an era of income inequality, but an era of capital inequality.

The paradigm surrounding money has shifted, and only those who grasp the flow first can use it as a springboard to leap forward.

And at the heart of it all is money supply.

In this regard, reporter Jinseok Son, with his keen eye and accurate data, presents the international economy, finance, and individual response strategies centered on money supply in "The Money Explosion."

This book examines the current state of affairs in the era of easy money, a situation characterized by an explosion in money supply, and explains "money distance," a key variable in asset inequality.

In particular, it pointed out the impact of lending on the money supply and the phenomenon that is particularly prominent in Korea, and analyzed the competition to release money around the world.

Additionally, it presents the structural characteristics of the United States, which maintains dollar hegemony and stands at the center of global finance, the impact of virtual currencies, stablecoins, and CBDCs, which are difficult for central banks to control, on the existing financial order, and scenarios for changes in the global corporate structure.

If you want to accurately understand and interpret the economic trends that have flowed so far and will unfold in the future, I recommend this book.

It's up to you to know the flow of money and jump in properly.

How to Ride the Wave of Money

During the coronavirus outbreak, people's joys and sorrows were starkly divided.

Since the outbreak of COVID-19, the amount of money in circulation has increased explosively.

Those who guessed that a lot of money would be released realized that the value of currency was meaningless and started investing in real estate, stocks, and coins.

So, even though they received wages for the same work, some people were paid hundreds of millions of won while others were continuously pushed back.

Money keeps flowing in, and someone is taking advantage of this opportunity to make a fortune.

Now it has become important to cleverly attract huge amounts of money and put them in my pocket.

Now is not an era of income inequality, but an era of capital inequality.

The paradigm surrounding money has shifted, and only those who grasp the flow first can use it as a springboard to leap forward.

And at the heart of it all is money supply.

In this regard, reporter Jinseok Son, with his keen eye and accurate data, presents the international economy, finance, and individual response strategies centered on money supply in "The Money Explosion."

This book examines the current state of affairs in the era of easy money, a situation characterized by an explosion in money supply, and explains "money distance," a key variable in asset inequality.

In particular, it pointed out the impact of lending on the money supply and the phenomenon that is particularly prominent in Korea, and analyzed the competition to release money around the world.

Additionally, it presents the structural characteristics of the United States, which maintains dollar hegemony and stands at the center of global finance, the impact of virtual currencies, stablecoins, and CBDCs, which are difficult for central banks to control, on the existing financial order, and scenarios for changes in the global corporate structure.

If you want to accurately understand and interpret the economic trends that have flowed so far and will unfold in the future, I recommend this book.

It's up to you to know the flow of money and jump in properly.

GOODS SPECIFICS

- Date of issue: October 31, 2025

- Page count, weight, size: 344 pages | 548g | 145*215*21mm

- ISBN13: 9791168322165

- ISBN10: 1168322162

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)