capitalism

|

Description

Book Introduction

32 world-renowned scholars reveal

33 Secrets About Finance, Consumption, and Money

Thanks to capitalism, humanity has been able to experience the production of more wealth than any other system.

We still live in a capitalist society.

But do we really understand capitalism? Capitalism is at a crossroads.

Should we continue like this or should we seek a new path?

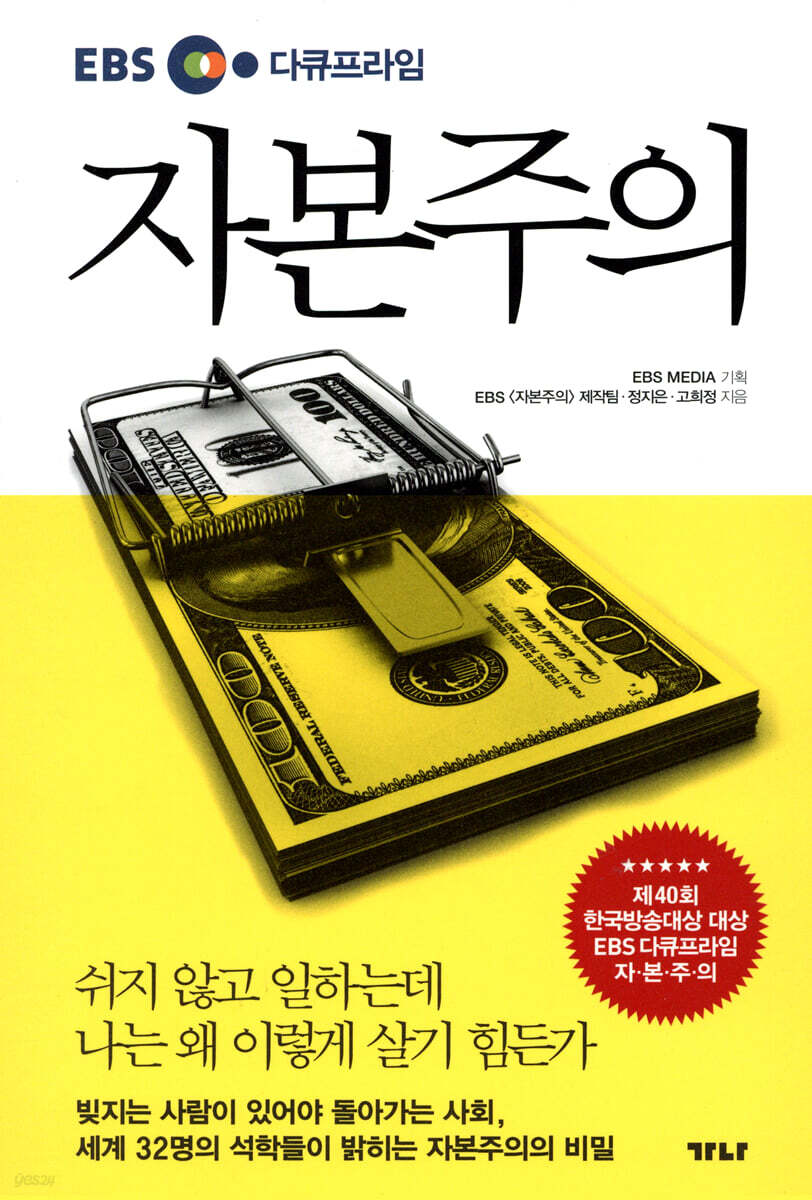

This book is a book version of the 5-part EBS Documentary Prime “Capitalism,” a broadcast that easily explains the current crisis of “capitalism.”

The content that was not fully shown in the 5-part broadcast was supplemented in depth.

The book warns about the hidden truths and fears of capitalist society, such as what the "subprime mortgage" that appears in the news is and why it became a problem, why the savings bank crisis occurred, and why we unconsciously buy too much when we go to the supermarket.

And it tells us how to survive the temptations and threats of capitalism that unconsciously pull us into the abyss.

Going back to Adam Smith's "The Wealth of Nations" in 1776, it examines today's capitalism from the perspectives of Smith and Marx, and moves beyond the debate between Keynes and Hayek over "market" or "government," ultimately concluding that "people" are the most important.

If you look at high school economics textbooks, the laws of supply and demand are explained.

When prices go down, consumers' demand increases, and when prices go up, producers increase production.

And we learn that prices are determined at the point where supply and demand meet.

So, can this explain the principle of persistent price increases? We tend to think that prices fluctuate, but that's not actually the case.

Prices only go up and never go down.

This book delves into the hidden truths about the capitalist economy, which we have taken for granted.

33 Secrets About Finance, Consumption, and Money

Thanks to capitalism, humanity has been able to experience the production of more wealth than any other system.

We still live in a capitalist society.

But do we really understand capitalism? Capitalism is at a crossroads.

Should we continue like this or should we seek a new path?

This book is a book version of the 5-part EBS Documentary Prime “Capitalism,” a broadcast that easily explains the current crisis of “capitalism.”

The content that was not fully shown in the 5-part broadcast was supplemented in depth.

The book warns about the hidden truths and fears of capitalist society, such as what the "subprime mortgage" that appears in the news is and why it became a problem, why the savings bank crisis occurred, and why we unconsciously buy too much when we go to the supermarket.

And it tells us how to survive the temptations and threats of capitalism that unconsciously pull us into the abyss.

Going back to Adam Smith's "The Wealth of Nations" in 1776, it examines today's capitalism from the perspectives of Smith and Marx, and moves beyond the debate between Keynes and Hayek over "market" or "government," ultimately concluding that "people" are the most important.

If you look at high school economics textbooks, the laws of supply and demand are explained.

When prices go down, consumers' demand increases, and when prices go up, producers increase production.

And we learn that prices are determined at the point where supply and demand meet.

So, can this explain the principle of persistent price increases? We tend to think that prices fluctuate, but that's not actually the case.

Prices only go up and never go down.

This book delves into the hidden truths about the capitalist economy, which we have taken for granted.

- You can preview some of the book's contents.

Preview

index

Prologue: Lost Capitalism: What Can We Do?

Chapter 1: A Society That Runs on Debt: The Secret of Capitalism

1.

Prices never go down│2.

Banks create money that doesn't exist|3.

Many people do not seek deposits all at once│4.

The central bank has no choice but to continuously print money│5.

When the inflation bubble bursts, a financial crisis comes│6.

When I pay off my loan, someone else goes bankrupt│7.

Banks lend money even to people who cannot repay it│8.

The Federal Reserve, which prints dollars, is a private bank.

Chapter 2: The Secrets of Financial Products You Must Know in Times of Crisis

1.

The investment fever wasn't for us│2.

Banks are simply businesses that need to make profits│3.

The Secret of Subordinated Bonds Paying 8% Interest│4.

Banks recommend funds with high sales commissions│5.

Insurance, if you don't ask or inquire, you'll end up with a big nosebleed│6.

Derivatives are like gambling disguised as investment│7.

Saving alone cannot make you happy│8.

Financial intelligence is essential for survival.

Chapter 3: The Secret of Consumer Marketing That Empty Your Wallet Without You Knowing

1.

From childhood we are tempted│2.

Women are much weaker when it comes to shopping│3.

Security CCTV is watching you│

4.

If you feel like you ‘want to buy it’, you probably ‘need it’│5.

Consumption begins with anxiety│6.

Even if I don't need it, if my friend buys it, I buy it too│

7.

Overconsumption is a wounded heart│8.

People with low self-esteem spend more money.

Chapter 4: Are there any ideas to save capitalism from crisis?

1.

Financial crises happen again and again│2.

Labor is the only value _ Adam Smith's 『The Wealth of Nations』│3.

Why are we poor even though we work tirelessly? _ Karl Marx's 『Capital』|4.

Recommending government intervention to lower unemployment rates _ Keynes's macroeconomics│5.

As government grows, so do its costs - Hayek's neoliberalism

Chapter 5: Rethinking Welfare Capitalism

1.

If national income rises, will my income rise too?│2.

‘Welfare = distribution’ is a misunderstanding│3.

Welfare is the source of creativity│4.

The people, not the market or the government, are the masters.

Chapter 1: A Society That Runs on Debt: The Secret of Capitalism

1.

Prices never go down│2.

Banks create money that doesn't exist|3.

Many people do not seek deposits all at once│4.

The central bank has no choice but to continuously print money│5.

When the inflation bubble bursts, a financial crisis comes│6.

When I pay off my loan, someone else goes bankrupt│7.

Banks lend money even to people who cannot repay it│8.

The Federal Reserve, which prints dollars, is a private bank.

Chapter 2: The Secrets of Financial Products You Must Know in Times of Crisis

1.

The investment fever wasn't for us│2.

Banks are simply businesses that need to make profits│3.

The Secret of Subordinated Bonds Paying 8% Interest│4.

Banks recommend funds with high sales commissions│5.

Insurance, if you don't ask or inquire, you'll end up with a big nosebleed│6.

Derivatives are like gambling disguised as investment│7.

Saving alone cannot make you happy│8.

Financial intelligence is essential for survival.

Chapter 3: The Secret of Consumer Marketing That Empty Your Wallet Without You Knowing

1.

From childhood we are tempted│2.

Women are much weaker when it comes to shopping│3.

Security CCTV is watching you│

4.

If you feel like you ‘want to buy it’, you probably ‘need it’│5.

Consumption begins with anxiety│6.

Even if I don't need it, if my friend buys it, I buy it too│

7.

Overconsumption is a wounded heart│8.

People with low self-esteem spend more money.

Chapter 4: Are there any ideas to save capitalism from crisis?

1.

Financial crises happen again and again│2.

Labor is the only value _ Adam Smith's 『The Wealth of Nations』│3.

Why are we poor even though we work tirelessly? _ Karl Marx's 『Capital』|4.

Recommending government intervention to lower unemployment rates _ Keynes's macroeconomics│5.

As government grows, so do its costs - Hayek's neoliberalism

Chapter 5: Rethinking Welfare Capitalism

1.

If national income rises, will my income rise too?│2.

‘Welfare = distribution’ is a misunderstanding│3.

Welfare is the source of creativity│4.

The people, not the market or the government, are the masters.

Publisher's Review

Swept the 40th Korea Broadcasting Awards

Meet EBS Documentary Prime's "Capitalism" in book form!

When 5 million years of human history are converted to 24 hours a day,

The time when capitalism emerged was 23:59:56.

The economy changed from status to contract, from an exchange economy to a capitalist economy, and from land to capital.

A place where necessary goods are commercialized through labor and private property is recognized.

How does capitalism work?

Where did competition come from?

Have people become happier in the capitalist era?

Why We Provide Loans Even to People with Low Credit Ratings

The central bank can never lower prices.

The Federal Reserve, which issues the dollar, the world's reserve currency, is not a government agency.

Have you made money from the investment boom?

Consumption is unconscious

Overconsumption is a wounded heart

Secrets About Finance, Consumption, and Money You Need to Know in Times of Crisis

The dictionary definition of capitalism is 'an economic system dominated by capital for the purpose of pursuing profit.'

About 250 years have passed since Adam Smith described the free market economic system in The Wealth of Nations.

We still live in a capitalist society.

So, do we really understand capitalism?

The capitalist world, which has demonstrated a greater capacity to produce wealth than any other system that humanity has ever experienced,

However, it is a system that is bound to periodically fall into crisis due to structural contradictions.

Is it okay for capitalism to continue like this?

How can we overcome the current crisis?

How will the Lehman Brothers crisis affect my wallet?

Capitalism is now at a crossroads.

Should we continue like this or should we seek a new path?

In a 2012 lecture, Yale University professor Emmanuel Wallerstein said, “Capitalism has reached its limits,” and in 2012, Kang Man-soo, former president of the Korea Development Bank and then chairman of the Korea Development Bank, said, “The current crisis will be bigger and longer-lasting than the Great Depression.

“Capitalism is over,” he said.

The 5-part EBS Documentary Prime Capitalism series, which easily explains the 'capitalism' that has dominated our society for about 250 years and is currently in crisis, has been published as a book (Gana Publishing/388 pages/17,000 won).

The 5-part EBS Documentary Prime series “Capitalism,” which once again received attention after winning the grand prize at the 2013 Korea Broadcasting Awards, actually originated from a trivial yet fundamental question posed by a housewife PD.

“I was wondering why the Lehman Brothers crisis in the US affected the money in my wallet, why the US economy affected my household finances.

“Why have prices only been rising for decades?” said PD Ji-eun Jeong, the PD in charge.

Although she is not an economics major, she has read over a thousand different economics books over the past decade to answer these questions.

Nevertheless, there were still unresolved questions.

“Why do economic outlooks differ across news, articles, and books?”

She believed that the fundamental principle that runs through all of this was 'capitalism', and decided to address this on the air.

But capitalism is so broad and has so much to say that it's a bit confusing.

First, we met with and surveyed people in their 30s to 50s and found that their biggest concerns were finance and consumption.

Having set her goals, she went to England, the birthplace of capitalism, and America, where capitalism flourished.

I was curious to see how British and American scholars, who are the very history of capitalism, view current capitalism.

We interviewed Professor Eric Maskin of Princeton University, winner of the 2007 Nobel Prize in Economics, and Professor Raghuram Rajan of the University of Chicago Business School, who was ranked as the world's most influential economist by the British magazine The Economist in 2011.

I selected several experts with different perspectives on capitalism and secretly expected a heated debate, but in the end, similar stories emerged.

"sorry.

“It is time to reconsider the path that capitalism should take.”

In the new book, “Capitalism,” the content that was not fully shown in the five-part broadcast is supplemented and organized in depth.

The book warns about the hidden truths and fears of capitalist society, such as how 'paying off debt to the bank' means breaking free from bondage and shackles for an individual, but for the national economy, it means a reduction in economic scale; what exactly is the 'subprime mortgage' that we see in the news and why it became a problem; why the savings bank crisis occurred; and why we unconsciously buy a lot when we go to the supermarket.

And it tells us how to survive the temptations and threats of capitalism that unconsciously pull us into the abyss.

Going back to Adam Smith's "The Wealth of Nations" from 1776, which first described the current capitalist market economy, it looks at current capitalism from the perspectives of Smith and Marx, and moves beyond the debate between Keynes and Hayek over "market" or "government," ultimately concluding that "people" are the most important.

From the fundamentals of economics to the future of capitalism

In this book, 32 world-renowned scholars helped to unravel the truth and questions about capitalism.

Ellen Brown, president of the Public Banking Institute and also an attorney, says:

"Do you think adults know where money comes from? More 10-year-olds probably know where babies come from than adults.

We didn't learn these things in school.

It doesn't teach you how money comes into the system.

People look at the government printing press and think that the government creates and spends money.

But that's not how money is made.

In fact, the Federal Reserve System (officially known as the Federal Reserve Banks (FRB)) issues money.

Like everyone else, the government has to borrow money.

The Federal Reserve is a federation of banks and works for them (not a government agency).

Why don't schools offer classes like this? There are a lot of economics and business school students at universities.

But I don't know about this stuff.

you're right.

I think it was hidden intentionally.

My son is a graduate student studying economics.

I'm majoring in econometrics, and I was having trouble writing my thesis.

When I asked him to write about such an important issue, he said he had never taken a banking (finance) class.

I haven't taken any banking classes in the past five years while studying economics and attending graduate school.

Because it is a major subject, not a required subject.

“This is the situation.”

If you look at high school economics textbooks, the laws of supply and demand are explained.

When prices go down, consumers' demand increases, and when prices go up, producers increase production.

And we learn that prices are determined at the point where supply and demand meet.

So, can this explain the principle of persistent price increases? We tend to think that prices fluctuate, but that's not actually the case.

Prices only go up and never go down.

50 years ago, jajangmyeon cost 15 won, but now you have to pay at least 4,000 won to eat a bowl.

If the price of jajangmyeon had continued to rise, either the supply of jajangmyeon would have been continuously insufficient or the consumption of jajangmyeon would have continued to increase.

Could that really be true?

It's not easy to understand.

The book uncovers hidden truths about the capitalist economy that we have taken for granted.

The book explains that the reason why the price of jajangmyeon continues to rise is actually because money is increasing through 'credit creation.'

Professor Niall Ferguson of the Department of History at Harvard University puts it this way:

“We think the money is in the bank.

Because you can get it right away at an ATM.

But in reality, in theory, it's in the bank.

“Money is almost invisible, just numbers on a computer screen,” says Geoffrey Ingham, professor of sociology at the University of Cambridge.

“It is a promise to pay.

It's credit.

“All money is credit.”

Only those who know the truth will survive.

“Funds? Insurance? Finance? It’s so complicated.

Some people say, "How would I know if you studied? I don't know."

But now it's the 21st century.

Nowadays, the daily lives of modern people have become inseparable from ‘finance.’

Financial services have become a product used by the majority of the population, just like general products.

It is no exaggeration to say that there are very few people who are not connected to finance.

Moreover, its importance will only increase in the future.

Let's hear from Niall Ferguson, a professor of history at Harvard University.

“Whether we like it or not, as societies and economies become more complex, the financial sector grows.

It's a simple fact.

As societies become wealthier, their needs for products like insurance, mortgages, credit cards, various savings accounts, and pensions become more complex.

As the world becomes richer, the financial sector grows larger.

Therefore, we must recognize that in ten years we will live in a world where finance is even more important than it is today.

Just as finance is much more important now than it was 10 years ago.”

And what about our children?

According to Dr. Cheon Gyu-seung, a specialist at the Korea Development Institute's Economic Information Center, "A person's financial tendencies from childhood are solidified."

Children's financial decision-making will be proportional to the depth and breadth of financial education they receive at school, in society, and at home during their adolescence.

It is now clear that financial knowledge and the ability to utilize it will lead to a difference in the gap between rich and poor.

Therefore, financial literacy is an essential skill that we must possess.

“Home education is not possible because parents are not educated.

“Parents need to be able to talk to their children about what they should be teaching them and what they shouldn’t be teaching them,” says Dr. Cheon Gyu-seung.

The book reveals shocking facts about not only bank loans and saving money, but also spending money.

It is said that babies can already remember 100 brands by the time they are over one year old.

When I go to the supermarket, I find myself making left turns without realizing it, and my shopping cart is getting bigger and bigger.

Have you ever found yourself buying other items that weren't in your plans while sampling?

Are we helpless against the relentless onslaught of marketing that permeates our minds and subconscious?

In this book, readers can check whether they are spending appropriately and find ways to protect themselves and spend happily.

Opinions on the EBS documentary "Capitalism"

I'm very interested in the principles of money, so I read books about them, but I couldn't quite figure them out. Thank you for organizing them in an easy and beautiful way.

It has more power than 100 books on money-making economics and management.

_ insxxx

I studied capitalism, which I had never understood even after studying hard in my major subjects for three semesters in the economics department, with my elementary school-aged younger sibling.

It was so much fun.

_ ekgpxxxx

I graduated from business school, right? But I didn't know about the concepts of money creation and credit multipliers.

Shocking! _ RELxxx

Thanks to this, I plan to buy and read books written by economists I had never been interested in before, and who I only learned about in middle and high school and then forgot.

My vague interest in the world and society has turned into a clear curiosity and passion.

_ sooxxx

This is the best show of the year, showing that welfare is not just an expense, but an investment in human capital.

_ Hyunx

This is more important than the textbooks taught in school.

I hear these days, monetary theory has disappeared from economics textbooks. They say they don't even cover non-mainstream economics. Your explanations are incredibly detailed and thoughtful.

I was so ignorant about economics, but this was so helpful.

My father also said that the content was so good that he told me to listen and take notes.

_ sangxxxx7382

Thank you so much for the screen editing and narration, which is easy to understand even for non-economics students.

I think it could be used as an economics textbook in college.

I hope people who are house poor or struggling with credit card debt see this.

I was able to see straight through the reality of capitalism, which no one had taught me about and which therefore seemed like a gigantic conspiracy.

This broadcast seems more effective than taking a semester-long economics class.

_ polxxx1004

You interviewed all the best scholars, that's amazing.

I was really impressed by your efforts.

I know how great they are and how they are the best economists in the world.

It's been a long time since I felt like I was growing intellectually while watching a documentary.

It's amazing how a five-part series can explain capitalism, a subject that can be incredibly difficult.

_ zzzxxxxha

Meet EBS Documentary Prime's "Capitalism" in book form!

When 5 million years of human history are converted to 24 hours a day,

The time when capitalism emerged was 23:59:56.

The economy changed from status to contract, from an exchange economy to a capitalist economy, and from land to capital.

A place where necessary goods are commercialized through labor and private property is recognized.

How does capitalism work?

Where did competition come from?

Have people become happier in the capitalist era?

Why We Provide Loans Even to People with Low Credit Ratings

The central bank can never lower prices.

The Federal Reserve, which issues the dollar, the world's reserve currency, is not a government agency.

Have you made money from the investment boom?

Consumption is unconscious

Overconsumption is a wounded heart

Secrets About Finance, Consumption, and Money You Need to Know in Times of Crisis

The dictionary definition of capitalism is 'an economic system dominated by capital for the purpose of pursuing profit.'

About 250 years have passed since Adam Smith described the free market economic system in The Wealth of Nations.

We still live in a capitalist society.

So, do we really understand capitalism?

The capitalist world, which has demonstrated a greater capacity to produce wealth than any other system that humanity has ever experienced,

However, it is a system that is bound to periodically fall into crisis due to structural contradictions.

Is it okay for capitalism to continue like this?

How can we overcome the current crisis?

How will the Lehman Brothers crisis affect my wallet?

Capitalism is now at a crossroads.

Should we continue like this or should we seek a new path?

In a 2012 lecture, Yale University professor Emmanuel Wallerstein said, “Capitalism has reached its limits,” and in 2012, Kang Man-soo, former president of the Korea Development Bank and then chairman of the Korea Development Bank, said, “The current crisis will be bigger and longer-lasting than the Great Depression.

“Capitalism is over,” he said.

The 5-part EBS Documentary Prime Capitalism series, which easily explains the 'capitalism' that has dominated our society for about 250 years and is currently in crisis, has been published as a book (Gana Publishing/388 pages/17,000 won).

The 5-part EBS Documentary Prime series “Capitalism,” which once again received attention after winning the grand prize at the 2013 Korea Broadcasting Awards, actually originated from a trivial yet fundamental question posed by a housewife PD.

“I was wondering why the Lehman Brothers crisis in the US affected the money in my wallet, why the US economy affected my household finances.

“Why have prices only been rising for decades?” said PD Ji-eun Jeong, the PD in charge.

Although she is not an economics major, she has read over a thousand different economics books over the past decade to answer these questions.

Nevertheless, there were still unresolved questions.

“Why do economic outlooks differ across news, articles, and books?”

She believed that the fundamental principle that runs through all of this was 'capitalism', and decided to address this on the air.

But capitalism is so broad and has so much to say that it's a bit confusing.

First, we met with and surveyed people in their 30s to 50s and found that their biggest concerns were finance and consumption.

Having set her goals, she went to England, the birthplace of capitalism, and America, where capitalism flourished.

I was curious to see how British and American scholars, who are the very history of capitalism, view current capitalism.

We interviewed Professor Eric Maskin of Princeton University, winner of the 2007 Nobel Prize in Economics, and Professor Raghuram Rajan of the University of Chicago Business School, who was ranked as the world's most influential economist by the British magazine The Economist in 2011.

I selected several experts with different perspectives on capitalism and secretly expected a heated debate, but in the end, similar stories emerged.

"sorry.

“It is time to reconsider the path that capitalism should take.”

In the new book, “Capitalism,” the content that was not fully shown in the five-part broadcast is supplemented and organized in depth.

The book warns about the hidden truths and fears of capitalist society, such as how 'paying off debt to the bank' means breaking free from bondage and shackles for an individual, but for the national economy, it means a reduction in economic scale; what exactly is the 'subprime mortgage' that we see in the news and why it became a problem; why the savings bank crisis occurred; and why we unconsciously buy a lot when we go to the supermarket.

And it tells us how to survive the temptations and threats of capitalism that unconsciously pull us into the abyss.

Going back to Adam Smith's "The Wealth of Nations" from 1776, which first described the current capitalist market economy, it looks at current capitalism from the perspectives of Smith and Marx, and moves beyond the debate between Keynes and Hayek over "market" or "government," ultimately concluding that "people" are the most important.

From the fundamentals of economics to the future of capitalism

In this book, 32 world-renowned scholars helped to unravel the truth and questions about capitalism.

Ellen Brown, president of the Public Banking Institute and also an attorney, says:

"Do you think adults know where money comes from? More 10-year-olds probably know where babies come from than adults.

We didn't learn these things in school.

It doesn't teach you how money comes into the system.

People look at the government printing press and think that the government creates and spends money.

But that's not how money is made.

In fact, the Federal Reserve System (officially known as the Federal Reserve Banks (FRB)) issues money.

Like everyone else, the government has to borrow money.

The Federal Reserve is a federation of banks and works for them (not a government agency).

Why don't schools offer classes like this? There are a lot of economics and business school students at universities.

But I don't know about this stuff.

you're right.

I think it was hidden intentionally.

My son is a graduate student studying economics.

I'm majoring in econometrics, and I was having trouble writing my thesis.

When I asked him to write about such an important issue, he said he had never taken a banking (finance) class.

I haven't taken any banking classes in the past five years while studying economics and attending graduate school.

Because it is a major subject, not a required subject.

“This is the situation.”

If you look at high school economics textbooks, the laws of supply and demand are explained.

When prices go down, consumers' demand increases, and when prices go up, producers increase production.

And we learn that prices are determined at the point where supply and demand meet.

So, can this explain the principle of persistent price increases? We tend to think that prices fluctuate, but that's not actually the case.

Prices only go up and never go down.

50 years ago, jajangmyeon cost 15 won, but now you have to pay at least 4,000 won to eat a bowl.

If the price of jajangmyeon had continued to rise, either the supply of jajangmyeon would have been continuously insufficient or the consumption of jajangmyeon would have continued to increase.

Could that really be true?

It's not easy to understand.

The book uncovers hidden truths about the capitalist economy that we have taken for granted.

The book explains that the reason why the price of jajangmyeon continues to rise is actually because money is increasing through 'credit creation.'

Professor Niall Ferguson of the Department of History at Harvard University puts it this way:

“We think the money is in the bank.

Because you can get it right away at an ATM.

But in reality, in theory, it's in the bank.

“Money is almost invisible, just numbers on a computer screen,” says Geoffrey Ingham, professor of sociology at the University of Cambridge.

“It is a promise to pay.

It's credit.

“All money is credit.”

Only those who know the truth will survive.

“Funds? Insurance? Finance? It’s so complicated.

Some people say, "How would I know if you studied? I don't know."

But now it's the 21st century.

Nowadays, the daily lives of modern people have become inseparable from ‘finance.’

Financial services have become a product used by the majority of the population, just like general products.

It is no exaggeration to say that there are very few people who are not connected to finance.

Moreover, its importance will only increase in the future.

Let's hear from Niall Ferguson, a professor of history at Harvard University.

“Whether we like it or not, as societies and economies become more complex, the financial sector grows.

It's a simple fact.

As societies become wealthier, their needs for products like insurance, mortgages, credit cards, various savings accounts, and pensions become more complex.

As the world becomes richer, the financial sector grows larger.

Therefore, we must recognize that in ten years we will live in a world where finance is even more important than it is today.

Just as finance is much more important now than it was 10 years ago.”

And what about our children?

According to Dr. Cheon Gyu-seung, a specialist at the Korea Development Institute's Economic Information Center, "A person's financial tendencies from childhood are solidified."

Children's financial decision-making will be proportional to the depth and breadth of financial education they receive at school, in society, and at home during their adolescence.

It is now clear that financial knowledge and the ability to utilize it will lead to a difference in the gap between rich and poor.

Therefore, financial literacy is an essential skill that we must possess.

“Home education is not possible because parents are not educated.

“Parents need to be able to talk to their children about what they should be teaching them and what they shouldn’t be teaching them,” says Dr. Cheon Gyu-seung.

The book reveals shocking facts about not only bank loans and saving money, but also spending money.

It is said that babies can already remember 100 brands by the time they are over one year old.

When I go to the supermarket, I find myself making left turns without realizing it, and my shopping cart is getting bigger and bigger.

Have you ever found yourself buying other items that weren't in your plans while sampling?

Are we helpless against the relentless onslaught of marketing that permeates our minds and subconscious?

In this book, readers can check whether they are spending appropriately and find ways to protect themselves and spend happily.

Opinions on the EBS documentary "Capitalism"

I'm very interested in the principles of money, so I read books about them, but I couldn't quite figure them out. Thank you for organizing them in an easy and beautiful way.

It has more power than 100 books on money-making economics and management.

_ insxxx

I studied capitalism, which I had never understood even after studying hard in my major subjects for three semesters in the economics department, with my elementary school-aged younger sibling.

It was so much fun.

_ ekgpxxxx

I graduated from business school, right? But I didn't know about the concepts of money creation and credit multipliers.

Shocking! _ RELxxx

Thanks to this, I plan to buy and read books written by economists I had never been interested in before, and who I only learned about in middle and high school and then forgot.

My vague interest in the world and society has turned into a clear curiosity and passion.

_ sooxxx

This is the best show of the year, showing that welfare is not just an expense, but an investment in human capital.

_ Hyunx

This is more important than the textbooks taught in school.

I hear these days, monetary theory has disappeared from economics textbooks. They say they don't even cover non-mainstream economics. Your explanations are incredibly detailed and thoughtful.

I was so ignorant about economics, but this was so helpful.

My father also said that the content was so good that he told me to listen and take notes.

_ sangxxxx7382

Thank you so much for the screen editing and narration, which is easy to understand even for non-economics students.

I think it could be used as an economics textbook in college.

I hope people who are house poor or struggling with credit card debt see this.

I was able to see straight through the reality of capitalism, which no one had taught me about and which therefore seemed like a gigantic conspiracy.

This broadcast seems more effective than taking a semester-long economics class.

_ polxxx1004

You interviewed all the best scholars, that's amazing.

I was really impressed by your efforts.

I know how great they are and how they are the best economists in the world.

It's been a long time since I felt like I was growing intellectually while watching a documentary.

It's amazing how a five-part series can explain capitalism, a subject that can be incredibly difficult.

_ zzzxxxxha

GOODS SPECIFICS

- Date of publication: September 27, 2013

- Page count, weight, size: 388 pages | 710g | 153*224*30mm

- ISBN13: 9788957365793

- ISBN10: 8957365796

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)