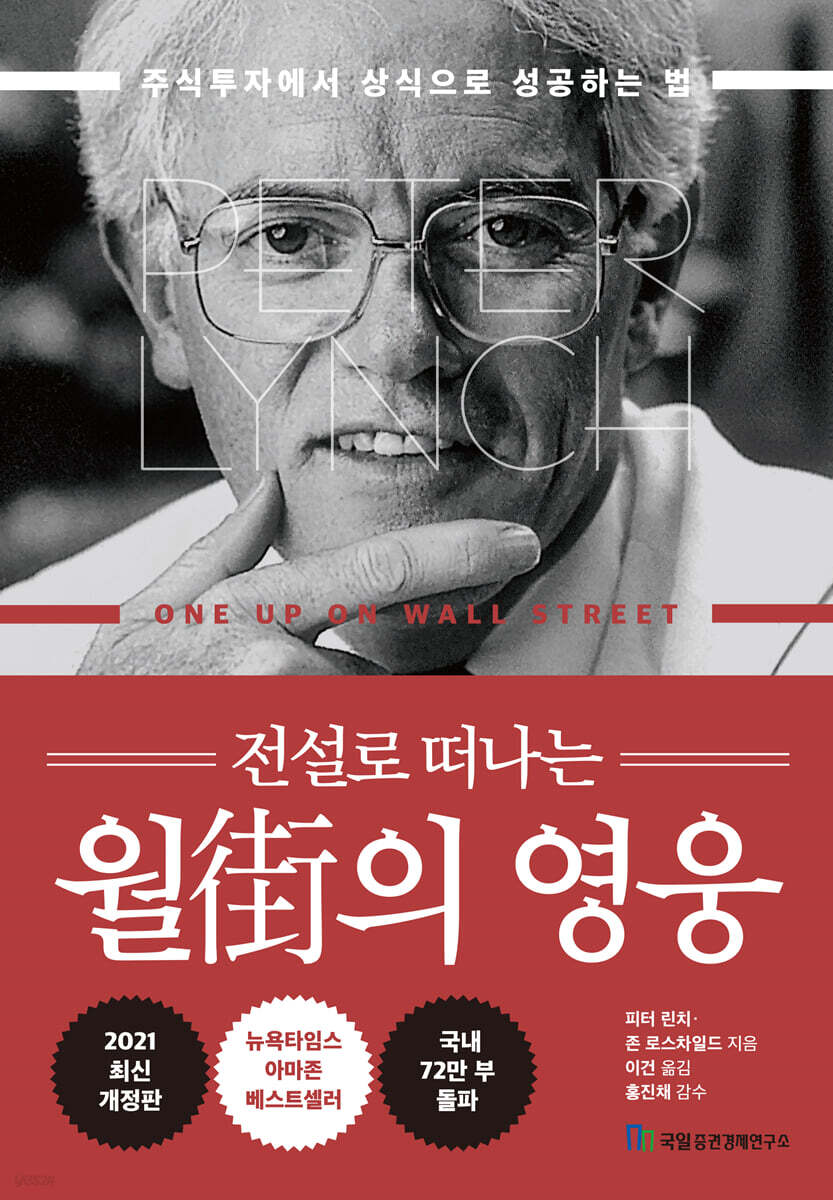

The Wall Street Hero Who Departed as a Legend

|

Description

Book Introduction

A classic on stock investing written by legendary Wall Street investor Peter Lynch!

“Buying stocks in any company without studying them is like playing poker without looking at your cards.

There's a reason people make money in real estate and lose money in stocks.

“They spend months choosing a house, but they pick stocks in minutes.” Peter Lynch says that stock investing is not a gamble that wins by luck, but rather a process of endless research and analysis to find stocks that will grow.

Is there a way to find and invest in growth stocks and achieve returns hundreds of times greater? This book is the latest revised edition of "Heroes of Wall Street," a book by Wall Street legend Peter Lynch published in 1989 for individual investors.

This is the first book he wrote after retiring from Wall Street. It is an investment guide that humorously describes the author's philosophy on stock investment while being written in the form of an autobiography.

It contains the secrets of acquiring the Magellan Fund with only $20 million and growing it into a $14 billion mutual fund, a 660-fold increase over 13 years of operation.

Peter Lynch adopted value investing, focusing on growth stocks, as his investment principle.

Rather than focusing on market trends, he focused on the value of individual companies and sought out new investment targets directly from his daily life.

His wife's shopping list and resorts he found on vacation also became his investment targets.

With these principles, he proves that individual investors have a greater advantage than professional investors.

Peter Lynch reveals in detail the stocks that have made profits dozens of times over the years, as well as those that have suffered losses, and discusses the mindset and attitude one should have when investing.

He introduces six types of stocks—low-growth stocks, large-cap blue chips, cyclical stocks, high-growth stocks, turnaround stocks, and asset stocks—and their characteristics, optimal trading times, and a final checklist, revealing his own investment know-how.

It encourages individual investors to break free from stereotypes about stock investment by emphasizing that they have better investment conditions and can generate higher returns than professional investors.

“Buying stocks in any company without studying them is like playing poker without looking at your cards.

There's a reason people make money in real estate and lose money in stocks.

“They spend months choosing a house, but they pick stocks in minutes.” Peter Lynch says that stock investing is not a gamble that wins by luck, but rather a process of endless research and analysis to find stocks that will grow.

Is there a way to find and invest in growth stocks and achieve returns hundreds of times greater? This book is the latest revised edition of "Heroes of Wall Street," a book by Wall Street legend Peter Lynch published in 1989 for individual investors.

This is the first book he wrote after retiring from Wall Street. It is an investment guide that humorously describes the author's philosophy on stock investment while being written in the form of an autobiography.

It contains the secrets of acquiring the Magellan Fund with only $20 million and growing it into a $14 billion mutual fund, a 660-fold increase over 13 years of operation.

Peter Lynch adopted value investing, focusing on growth stocks, as his investment principle.

Rather than focusing on market trends, he focused on the value of individual companies and sought out new investment targets directly from his daily life.

His wife's shopping list and resorts he found on vacation also became his investment targets.

With these principles, he proves that individual investors have a greater advantage than professional investors.

Peter Lynch reveals in detail the stocks that have made profits dozens of times over the years, as well as those that have suffered losses, and discusses the mindset and attitude one should have when investing.

He introduces six types of stocks—low-growth stocks, large-cap blue chips, cyclical stocks, high-growth stocks, turnaround stocks, and asset stocks—and their characteristics, optimal trading times, and a final checklist, revealing his own investment know-how.

It encourages individual investors to break free from stereotypes about stock investment by emphasizing that they have better investment conditions and can generate higher returns than professional investors.

- You can preview some of the book's contents.

Preview

index

Recommendation

Preface to the Millennium Edition

Preface - Travelogue of Ireland

Introduction - Advantages for Amateur Investors

Part 1: Investment Preparation

Chapter 1: Becoming a Fund Manager

Chapter 2: The Smart Fools of Wall Street

Chapter 3: Investment or Gambling?

Chapter 4 Self-Diagnosis

Chapter 5: Don't Ask If the Market Is Good Now

Part 2 event selection

Chapter 6 Find the 10-base hit item

Chapter 7 I bought stocks, I bought them.

But what type is it?

Chapter 8: Really cool perfect stocks!

Chapter 9: Stocks I Avoid

Chapter 10: Profit is the Most Important Thing

Chapter 11 2-minute practice

Chapter 12: Check the Facts

Chapter 13: Famous Numbers

Chapter 14: Reconfirm the Story

Chapter 15 Final Checklist

Part 3: Long-Term Perspective

Chapter 16 Portfolio Design

Chapter 17: The Best Time to Buy and Sell

Chapter 18: The Twelve Most Foolish and Dangerous Ideas

Chapter 19: Futures, Options, and Short Selling

Chapter 20: 50,000 Experts Could All Be Wrong

Conclusion: Always be fully prepared.

Acknowledgements

Preface to the Millennium Edition

Preface - Travelogue of Ireland

Introduction - Advantages for Amateur Investors

Part 1: Investment Preparation

Chapter 1: Becoming a Fund Manager

Chapter 2: The Smart Fools of Wall Street

Chapter 3: Investment or Gambling?

Chapter 4 Self-Diagnosis

Chapter 5: Don't Ask If the Market Is Good Now

Part 2 event selection

Chapter 6 Find the 10-base hit item

Chapter 7 I bought stocks, I bought them.

But what type is it?

Chapter 8: Really cool perfect stocks!

Chapter 9: Stocks I Avoid

Chapter 10: Profit is the Most Important Thing

Chapter 11 2-minute practice

Chapter 12: Check the Facts

Chapter 13: Famous Numbers

Chapter 14: Reconfirm the Story

Chapter 15 Final Checklist

Part 3: Long-Term Perspective

Chapter 16 Portfolio Design

Chapter 17: The Best Time to Buy and Sell

Chapter 18: The Twelve Most Foolish and Dangerous Ideas

Chapter 19: Futures, Options, and Short Selling

Chapter 20: 50,000 Experts Could All Be Wrong

Conclusion: Always be fully prepared.

Acknowledgements

Detailed image

Into the book

Since I didn't want my mother-in-law, Charles Hope, to invest in risky stocks, I advised him to buy Houston Industries, a very "safe" company.

This stock has been holding steady for over a decade, so it's definitely safe.

I thought it would be better to invest my mother's money in something more 'gambling', so I bought her a more 'risky' stock called Consolidated Edison.

This stock has risen sixfold.

This stock was not very risky for those who kept an eye on the company's basic operations.

While jackpot stocks come from so-called high-risk sectors, the risk depends more on the type of investor than the sector the company belongs to.

The biggest advantage for those who embrace uncertainty and invest in stocks is that they are exceptionally rewarded for making the right choices.

---From Chapter 3, “Investment or Gambling?”

If you can't stand it and buy a stock at $50, buy more at $60 ("See, it's going up just like I expected"), and then get desperate and sell it all at $40 ("I guess not.

If you are the type of investor who says, “The damn thing is going down.”, then reading investment books will not help you.

When someone predicts the market, we should snore instead of listening.

The secret is not to trust your gut instinct, but rather to exercise self-control and ignore it.

As long as the company's fundamentals don't change, keep holding the stock.

Otherwise, the only way you can increase your wealth is to buy J.

There is no other surefire formula for success than the one presented by Paul Getty.

“Get up early, work hard, and catch a windfall.”

---From Chapter 4, Self-Diagnosis

If you choose the right stocks, the market will take care of itself.

If you can't find a single company that's reasonably priced or meets your investment criteria, the market is considered overvalued.

Buffett said he returned the money to his partner because he couldn't find any stocks worth holding.

He looked at hundreds of companies, but couldn't find a single one that was worth buying based on its fundamental merits.

The only buy signal I need is to find a company I like.

When you find a company like this, there's no need to worry about whether it's too early or too late to buy.

---From Chapter 5, “Don’t Ask If the Market is Good Now”

There has been a long-running dispute between the two factions of investment advisors.

The Gerald Loeb school argued, “You should put all your eggs in one basket,” while the Andrew Tobias school said, “Don’t put all your eggs in one basket.

“There might be a hole in the basket,” he replied.

If my one basket was Walmart stock, I would have put all my eggs in it.

On the other hand, if you had put all your eggs in a basket called Continental Illinois, you would have been in for trouble.

If I had been given five baskets—Shawn's, Limited, Pep Boys, Taco Bell, and Service Corporation International—I bet I would have divided my eggs evenly among them.

But if this diversification had included Avon Products or Johns Manville (which went bankrupt because of the asbestos lawsuit), I would have been more inclined to have a solid basket of Dunkin' Donuts.

The point is, don't get hung up on the number of items, but examine the content of each item on a case-by-case basis.

This stock has been holding steady for over a decade, so it's definitely safe.

I thought it would be better to invest my mother's money in something more 'gambling', so I bought her a more 'risky' stock called Consolidated Edison.

This stock has risen sixfold.

This stock was not very risky for those who kept an eye on the company's basic operations.

While jackpot stocks come from so-called high-risk sectors, the risk depends more on the type of investor than the sector the company belongs to.

The biggest advantage for those who embrace uncertainty and invest in stocks is that they are exceptionally rewarded for making the right choices.

---From Chapter 3, “Investment or Gambling?”

If you can't stand it and buy a stock at $50, buy more at $60 ("See, it's going up just like I expected"), and then get desperate and sell it all at $40 ("I guess not.

If you are the type of investor who says, “The damn thing is going down.”, then reading investment books will not help you.

When someone predicts the market, we should snore instead of listening.

The secret is not to trust your gut instinct, but rather to exercise self-control and ignore it.

As long as the company's fundamentals don't change, keep holding the stock.

Otherwise, the only way you can increase your wealth is to buy J.

There is no other surefire formula for success than the one presented by Paul Getty.

“Get up early, work hard, and catch a windfall.”

---From Chapter 4, Self-Diagnosis

If you choose the right stocks, the market will take care of itself.

If you can't find a single company that's reasonably priced or meets your investment criteria, the market is considered overvalued.

Buffett said he returned the money to his partner because he couldn't find any stocks worth holding.

He looked at hundreds of companies, but couldn't find a single one that was worth buying based on its fundamental merits.

The only buy signal I need is to find a company I like.

When you find a company like this, there's no need to worry about whether it's too early or too late to buy.

---From Chapter 5, “Don’t Ask If the Market is Good Now”

There has been a long-running dispute between the two factions of investment advisors.

The Gerald Loeb school argued, “You should put all your eggs in one basket,” while the Andrew Tobias school said, “Don’t put all your eggs in one basket.

“There might be a hole in the basket,” he replied.

If my one basket was Walmart stock, I would have put all my eggs in it.

On the other hand, if you had put all your eggs in a basket called Continental Illinois, you would have been in for trouble.

If I had been given five baskets—Shawn's, Limited, Pep Boys, Taco Bell, and Service Corporation International—I bet I would have divided my eggs evenly among them.

But if this diversification had included Avon Products or Johns Manville (which went bankrupt because of the asbestos lawsuit), I would have been more inclined to have a solid basket of Dunkin' Donuts.

The point is, don't get hung up on the number of items, but examine the content of each item on a case-by-case basis.

---From Chapter 16, Portfolio Design

Publisher's Review

Don't ask if the market is good now.

“The market has nothing to do with investing.

“I’ve made money in terrible markets, and I’ve lost money in good ones.” Peter Lynch makes it clear that you don’t have to predict the stock market to make money in stocks.

He states that no one warned him of the 1973 stock market crash in advance, and that he himself never foresaw the crash.

However, Peter Lynch traded 12,000 stocks during his time as a fund manager, and grew the Magellan Fund to $14 billion, a 660-fold increase in size in just 13 years.

Because I followed just one investment rule.

Instead of focusing on macroeconomic and market trends, we focused on the value of individual companies, analyzed them, tracked their stories, and diversified our portfolio by increasing the proportion of small- and mid-cap growth stocks.

By diligently following this simple rule for a long time, he became a legendary investor who never suffered a loss for 13 years.

In this book, Peter Lynch explains in detail the techniques for determining the size of a company and analyzing its price-to-earnings ratio, debt ratio, cash holdings, dividends, and book value.

He also helps readers understand by revealing which stocks he invested in, how many times he made a profit, and how many times he failed.

Amateur investors have the advantage

It is a widely known fact in the stock market that individual investors are easy prey for professional investors.

This is because when foreigners and institutional investors engage in speculation based on their huge capital, individual investors become anxious about the constantly fluctuating stock prices and end up buying and selling, ultimately suffering huge losses.

But in this book, the author, a professional investor, promises to share his secrets to success with individual investors.

The first of these is to not listen to experts.

He explains that amateur investors become foolish investors when they listen to professional investors, and that individual investors can achieve performance that surpasses that of professionals when they properly utilize their advantages.

Fund managers, who are institutional investors, find it difficult to make long-term investments that take a long time to generate profits because their monthly returns are their own performance. Instead, they make short-term investments chasing good and bad news.

However, individual investors do not need to make short-term investments chasing performance. They can use their spare money to carefully research and analyze the value of a company and make long-term investments.

Peter Lynch reiterates that a normal person who uses 3% of their brain can pick stocks just as well as a Wall Street expert.

If you examine Peter Lynch's investment guidelines through this book, you will understand why Peter Lynch is a Wall Street hero who transcends time and space, and why renowned experts unanimously recommend this book, which has now become a "must-read classic."

“The market has nothing to do with investing.

“I’ve made money in terrible markets, and I’ve lost money in good ones.” Peter Lynch makes it clear that you don’t have to predict the stock market to make money in stocks.

He states that no one warned him of the 1973 stock market crash in advance, and that he himself never foresaw the crash.

However, Peter Lynch traded 12,000 stocks during his time as a fund manager, and grew the Magellan Fund to $14 billion, a 660-fold increase in size in just 13 years.

Because I followed just one investment rule.

Instead of focusing on macroeconomic and market trends, we focused on the value of individual companies, analyzed them, tracked their stories, and diversified our portfolio by increasing the proportion of small- and mid-cap growth stocks.

By diligently following this simple rule for a long time, he became a legendary investor who never suffered a loss for 13 years.

In this book, Peter Lynch explains in detail the techniques for determining the size of a company and analyzing its price-to-earnings ratio, debt ratio, cash holdings, dividends, and book value.

He also helps readers understand by revealing which stocks he invested in, how many times he made a profit, and how many times he failed.

Amateur investors have the advantage

It is a widely known fact in the stock market that individual investors are easy prey for professional investors.

This is because when foreigners and institutional investors engage in speculation based on their huge capital, individual investors become anxious about the constantly fluctuating stock prices and end up buying and selling, ultimately suffering huge losses.

But in this book, the author, a professional investor, promises to share his secrets to success with individual investors.

The first of these is to not listen to experts.

He explains that amateur investors become foolish investors when they listen to professional investors, and that individual investors can achieve performance that surpasses that of professionals when they properly utilize their advantages.

Fund managers, who are institutional investors, find it difficult to make long-term investments that take a long time to generate profits because their monthly returns are their own performance. Instead, they make short-term investments chasing good and bad news.

However, individual investors do not need to make short-term investments chasing performance. They can use their spare money to carefully research and analyze the value of a company and make long-term investments.

Peter Lynch reiterates that a normal person who uses 3% of their brain can pick stocks just as well as a Wall Street expert.

If you examine Peter Lynch's investment guidelines through this book, you will understand why Peter Lynch is a Wall Street hero who transcends time and space, and why renowned experts unanimously recommend this book, which has now become a "must-read classic."

GOODS SPECIFICS

- Publication date: July 30, 2021

- Format: Hardcover book binding method guide

- Page count, weight, size: 464 pages | 950g | 153*225*30mm

- ISBN13: 9788957825945

- ISBN10: 8957825940

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)