The Joy of Stock Investing

|

Description

Book Introduction

- A word from MD

-

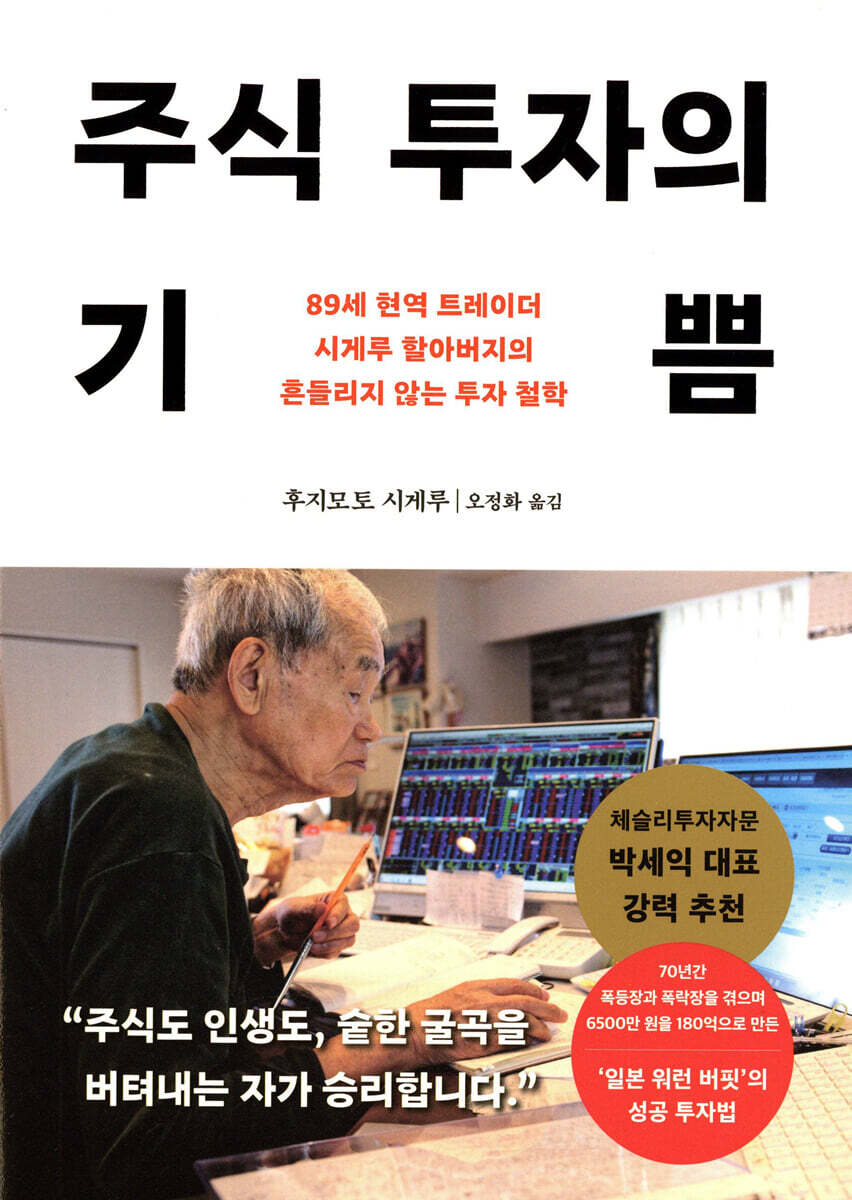

In the end, the one who endures wins.The first book by Shigeru Fujimoto, an 89-year-old active trader known as Japan's Warren Buffett.

His investment philosophy, cultivated through a lifetime of working in the market, is surprisingly simple and clear, yet it has been the driving force that has allowed him to survive countless crises without wavering.

A book that delves deeply into the nature and sustainability of investment.

August 26, 2025. Economics and Management PD Oh Da-eun

★ Highly recommended by Chesley Investment Consulting CEO Park Se-ik ★

★ EBS Documentary Prime [The Face of Money] Investors in the News ★

★ The only investment book by 'Japanese Warren Buffett' officially published in Korea ★

“In stocks and life, those who persevere through countless twists and turns are victorious.”

After going through 70 years of booms and busts, he turned 65 million won into 18 billion won.

Practical Investment Lessons from an 89-Year-Old Active Trader

“I believe that stocks require ‘mind, skill, and body.’

'Mind' is a cool-headed mind that can take the best action on the spot without being swayed by the movements of stock prices.

'Technology' refers to the skill of trading when you think 'now is the time!'

'Body' refers to both a healthy body and financial flexibility.

If even one of these elements is lacking, the results will not be satisfactory.”

There's a person who endured countless economic crises, including Black Monday, the bubble burst, the Lehman Brothers shock, the Great East Japan Earthquake, and the COVID-19 pandemic, and ultimately amassed 18 billion won in assets.

Shigeru Fujimoto is Japan's Warren Buffett, who has been investing in stocks with his own routine for 70 years.

He started investing in stocks at the age of 19, and even now, at the age of 89, he wakes up at 2 a.m. every day to check economic news, the U.S. stock market, and futures trends, and is still an active trader.

During the Great Hanshin-Awaji Earthquake, he fled his home with nothing and lost all his belongings. He also lost 80% of his hard-earned assets in one fell swoop due to the bubble burst. However, he eventually made 18 billion won in profits through stocks and has become a role model for many young investors.

Shigeru, who still sits in front of three monitors and continues to trade fiercely, says, "I've continued investing because I truly enjoy investing in stocks."

He has revealed the secrets to his continued enjoyment of investing and ultimately achieving tremendous returns in his book, The Joy of Stock Investment.

“Buy stocks that have fallen in price and sell stocks that have risen in price.

This is all I'm doing.

“This is the truth about investing that will not change 70 years ago, now, or even in the next 100 years.”

This book, "The Joy of Stock Investment," is so simple, yet it makes us reflect on the things we often overlook and the moments when we make wrong decisions, dazzled by market movements. It also generously shares living lessons and investment secrets with Korean investors who have forgotten the thrill of seeing stock prices move as predicted and the joy of seeing returns soar.

★ EBS Documentary Prime [The Face of Money] Investors in the News ★

★ The only investment book by 'Japanese Warren Buffett' officially published in Korea ★

“In stocks and life, those who persevere through countless twists and turns are victorious.”

After going through 70 years of booms and busts, he turned 65 million won into 18 billion won.

Practical Investment Lessons from an 89-Year-Old Active Trader

“I believe that stocks require ‘mind, skill, and body.’

'Mind' is a cool-headed mind that can take the best action on the spot without being swayed by the movements of stock prices.

'Technology' refers to the skill of trading when you think 'now is the time!'

'Body' refers to both a healthy body and financial flexibility.

If even one of these elements is lacking, the results will not be satisfactory.”

There's a person who endured countless economic crises, including Black Monday, the bubble burst, the Lehman Brothers shock, the Great East Japan Earthquake, and the COVID-19 pandemic, and ultimately amassed 18 billion won in assets.

Shigeru Fujimoto is Japan's Warren Buffett, who has been investing in stocks with his own routine for 70 years.

He started investing in stocks at the age of 19, and even now, at the age of 89, he wakes up at 2 a.m. every day to check economic news, the U.S. stock market, and futures trends, and is still an active trader.

During the Great Hanshin-Awaji Earthquake, he fled his home with nothing and lost all his belongings. He also lost 80% of his hard-earned assets in one fell swoop due to the bubble burst. However, he eventually made 18 billion won in profits through stocks and has become a role model for many young investors.

Shigeru, who still sits in front of three monitors and continues to trade fiercely, says, "I've continued investing because I truly enjoy investing in stocks."

He has revealed the secrets to his continued enjoyment of investing and ultimately achieving tremendous returns in his book, The Joy of Stock Investment.

“Buy stocks that have fallen in price and sell stocks that have risen in price.

This is all I'm doing.

“This is the truth about investing that will not change 70 years ago, now, or even in the next 100 years.”

This book, "The Joy of Stock Investment," is so simple, yet it makes us reflect on the things we often overlook and the moments when we make wrong decisions, dazzled by market movements. It also generously shares living lessons and investment secrets with Korean investors who have forgotten the thrill of seeing stock prices move as predicted and the joy of seeing returns soar.

- You can preview some of the book's contents.

Preview

index

Reviewer's note

Prologue: 89-Year-Old Active Day Trader

PART 1 I started investing at nineteen, and now it's been 70 years.

A poor childhood

Meet the stock at the pet store

Achieving monthly income of 20 million won through mahjong parlor management

Become a full-time investor after being lured by the allure of convertible bonds.

Lost 8 billion won due to the bubble burst

Started online trading at age 66

[Column] The Power to Read the Times is Crucial

PART 2 Trading 80 stocks for 6 billion won per month

Four Charms of Day Trading

Day Trading Basics ① Market Orders and Limit Orders

Day Trading Basics ② Cash and Credit Transactions

The match begins at 2 a.m.

Predicting Japanese prices based on US price fluctuations

Why does the intercom ring at 4 a.m.?

Every morning, I gauge my "today's winning moves."

'One Day's Deal' Revealed

When the market closes, I reflect on the day.

Trading approximately 80 stocks at all times

Three computers and three monitors

[Column] My hobby is collecting antique coins.

PART 3: Grandpa Shigeru's '1:2:6' Rule

Focus on 'increased sales, profits, and dividends'

Stock trading is based on the '1:2:6' rule.

Understand and buy the business model

Suitable and unsuitable stocks for day trading

Small and mid-cap stocks are the main battleground.

Timing with technical analysis

His specialty is 'closing play'

Making the most of your company's genealogy

[Column] Picking Up Investment Hints from Your Morning Walk

PART 4 Sell when it goes up, buy when it goes down

It's not the 'materials' that move stock prices.

Don't rely on feelings or experiences of success

Even if it goes up, I won't buy it

There's a purpose behind a famous investor's remarks.

Water riding is not scary

Not losing out in competition with institutional investors

Why Individual Investors Can Beat Institutional Investors

Beware of the powerful stocks

IPO secondary investment is also attracting attention.

Don't be anxious even if you suffer a loss

Japanese stocks can grow further

[Column] Many investors are exiting the market.

PART 5: Day Trading is the Best Brain Training

Mind, Skill, and Body: The Key to Winning in Stocks

Judgment doesn't decline with age.

My own way to relieve investment fatigue

A question for those who want to make money

[Column] Senior investor Warren Buffett and I

Epilogue: Stock Investing is Good

Prologue: 89-Year-Old Active Day Trader

PART 1 I started investing at nineteen, and now it's been 70 years.

A poor childhood

Meet the stock at the pet store

Achieving monthly income of 20 million won through mahjong parlor management

Become a full-time investor after being lured by the allure of convertible bonds.

Lost 8 billion won due to the bubble burst

Started online trading at age 66

[Column] The Power to Read the Times is Crucial

PART 2 Trading 80 stocks for 6 billion won per month

Four Charms of Day Trading

Day Trading Basics ① Market Orders and Limit Orders

Day Trading Basics ② Cash and Credit Transactions

The match begins at 2 a.m.

Predicting Japanese prices based on US price fluctuations

Why does the intercom ring at 4 a.m.?

Every morning, I gauge my "today's winning moves."

'One Day's Deal' Revealed

When the market closes, I reflect on the day.

Trading approximately 80 stocks at all times

Three computers and three monitors

[Column] My hobby is collecting antique coins.

PART 3: Grandpa Shigeru's '1:2:6' Rule

Focus on 'increased sales, profits, and dividends'

Stock trading is based on the '1:2:6' rule.

Understand and buy the business model

Suitable and unsuitable stocks for day trading

Small and mid-cap stocks are the main battleground.

Timing with technical analysis

His specialty is 'closing play'

Making the most of your company's genealogy

[Column] Picking Up Investment Hints from Your Morning Walk

PART 4 Sell when it goes up, buy when it goes down

It's not the 'materials' that move stock prices.

Don't rely on feelings or experiences of success

Even if it goes up, I won't buy it

There's a purpose behind a famous investor's remarks.

Water riding is not scary

Not losing out in competition with institutional investors

Why Individual Investors Can Beat Institutional Investors

Beware of the powerful stocks

IPO secondary investment is also attracting attention.

Don't be anxious even if you suffer a loss

Japanese stocks can grow further

[Column] Many investors are exiting the market.

PART 5: Day Trading is the Best Brain Training

Mind, Skill, and Body: The Key to Winning in Stocks

Judgment doesn't decline with age.

My own way to relieve investment fatigue

A question for those who want to make money

[Column] Senior investor Warren Buffett and I

Epilogue: Stock Investing is Good

Detailed image

Into the book

Buy stocks that have fallen in price and sell stocks that have risen in price.

This is all I'm doing.

Because this is the truth about investing that hasn't changed in 70 years, now, or even in 100 years.

---From the "Prologue"

Looking back, stock prices during the bubble period were certainly abnormal.

There were many aspects of the company that were overvalued.

However, when you are in the whirlpool, you hardly notice the strangeness.

The bubble economy is something that can only be judged after looking back on the results.

I didn't even notice the sound of the bubble bursting.

---From "PART 1: I started investing at nineteen, and now it's been 70 years"

As an investor, it is natural to want to 'sell as high as possible and buy as low as possible.'

However, when you think 'now is the highest price', it goes up more, and when you think 'now is the lowest price', it goes down more.

If you try to force yourself to hit a high or low, you will likely end up with a bad result.

Let's keep in mind that it is more certain to wait for the moment when the chart starts to reverse.

---From "PART 2 Trading 80 stocks for 6 billion won per month"

Just as important as the transaction itself is the post-transaction review.

If you simply rejoice in the profits you make, you will not grow as an investor.

You can grow little by little by thinking about things like, "Why did I win?", "Why did I lose?", and "Wouldn't there have been better buying (selling) times?"

---From "PART 2 Trading 80 stocks for 6 billion won per month"

The stock market does have its ups and downs, but I rarely go with the flow.

Even if smartphone games become popular, I don't have a smartphone and don't know how to use it, so I don't understand the business model.

In this case, even if the stock price rises due to favorable reviews in the market, I do not buy it.

It is important to compete in areas where you can showcase your strengths.

---From "PART 3 Grandpa Shigeru's '1:2:6' Rule"

Technical analysis, which examines past price fluctuations and predicts future trends, is a method that anyone can perform, given the conditions are fair and all the necessary materials are already available.

This is where charts come into play, but no matter how skilled you are at technical analysis, not all readings can be correct.

However, if you utilize charts, which are visible materials, you will be less likely to suffer losses after buying because you "feel like it will go up."

---From "PART 3 Grandpa Shigeru's '1:2:6' Rule"

While reading charts well is important, gathering information should not be neglected.

Let's think of the charts of individual stocks as 'leaves'.

To read the movement of a leaf, you have to look at the movement of the entire tree, the movement of the entire forest.

The branches can be said to represent 'settlement', the trees can be said to represent 'a country's economy', and the forest can be said to represent 'the world economy'.

---From "PART 3 Grandpa Shigeru's '1:2:6' Rule"

The reason stock prices move is because someone is buying or selling.

Stock prices don't move based on materials alone.

So what's really important is not the 'material itself', but 'how people react (buy) when they see that material'.

This is all I'm doing.

Because this is the truth about investing that hasn't changed in 70 years, now, or even in 100 years.

---From the "Prologue"

Looking back, stock prices during the bubble period were certainly abnormal.

There were many aspects of the company that were overvalued.

However, when you are in the whirlpool, you hardly notice the strangeness.

The bubble economy is something that can only be judged after looking back on the results.

I didn't even notice the sound of the bubble bursting.

---From "PART 1: I started investing at nineteen, and now it's been 70 years"

As an investor, it is natural to want to 'sell as high as possible and buy as low as possible.'

However, when you think 'now is the highest price', it goes up more, and when you think 'now is the lowest price', it goes down more.

If you try to force yourself to hit a high or low, you will likely end up with a bad result.

Let's keep in mind that it is more certain to wait for the moment when the chart starts to reverse.

---From "PART 2 Trading 80 stocks for 6 billion won per month"

Just as important as the transaction itself is the post-transaction review.

If you simply rejoice in the profits you make, you will not grow as an investor.

You can grow little by little by thinking about things like, "Why did I win?", "Why did I lose?", and "Wouldn't there have been better buying (selling) times?"

---From "PART 2 Trading 80 stocks for 6 billion won per month"

The stock market does have its ups and downs, but I rarely go with the flow.

Even if smartphone games become popular, I don't have a smartphone and don't know how to use it, so I don't understand the business model.

In this case, even if the stock price rises due to favorable reviews in the market, I do not buy it.

It is important to compete in areas where you can showcase your strengths.

---From "PART 3 Grandpa Shigeru's '1:2:6' Rule"

Technical analysis, which examines past price fluctuations and predicts future trends, is a method that anyone can perform, given the conditions are fair and all the necessary materials are already available.

This is where charts come into play, but no matter how skilled you are at technical analysis, not all readings can be correct.

However, if you utilize charts, which are visible materials, you will be less likely to suffer losses after buying because you "feel like it will go up."

---From "PART 3 Grandpa Shigeru's '1:2:6' Rule"

While reading charts well is important, gathering information should not be neglected.

Let's think of the charts of individual stocks as 'leaves'.

To read the movement of a leaf, you have to look at the movement of the entire tree, the movement of the entire forest.

The branches can be said to represent 'settlement', the trees can be said to represent 'a country's economy', and the forest can be said to represent 'the world economy'.

---From "PART 3 Grandpa Shigeru's '1:2:6' Rule"

The reason stock prices move is because someone is buying or selling.

Stock prices don't move based on materials alone.

So what's really important is not the 'material itself', but 'how people react (buy) when they see that material'.

---From "PART 4 Sell when it goes up, buy when it goes down"

Publisher's Review

“Buy stocks of good companies.

I enjoy trading stocks.

“This is all my investment.”

An ordinary person who didn't even graduate from college

Simple and clear principles that helped me become one of Japan's best stock investors.

Shigeru Fujimoto says this:

“If there are ten people, there are ten ways to invest.” That’s how many different investment methods there are in the world.

So, what are Shigeru's investment principles, having invested in stocks for 70 years? What criteria does he use to select stocks and determine trading timing? How does he maintain his composure in competition with institutional investors?

Shigeru's investment method has clear characteristics.

It's not flashy or complicated, he just sticks to the basics.

'Don't invest in areas you don't know well', 'Don't be swayed by what others say', 'It doesn't matter if it's 3 yen or 5 yen, as long as it goes up.

'It is forbidden to be too greedy', 'Stocks with promising future prospects are always good', 'Don't pour your investment money into a good stock all at once just because you found it.

‘I always follow the 1:2:6 rule’, ‘I don’t rely on my experience of success.

His investment methods, such as 'determining investment timing through technical analysis', are famous sayings that become our blood and flesh that we, who invest in stocks, must remember and practice.

As you learn about Shigeru's solid investment principles, you'll find yourself reflecting on your own investment methods.

Let's examine whether we have neglected the fundamentals of investing by dismissing them as obvious, or whether we have invested without careful judgment, swayed by the flashy words of others.

The investment method of a master is simple and clear.

Even in the world of investing, those who stick to the basics ultimately win.

“It is right to buy, it is right to sell,

And you deserve to rest.”

Individual investors against institutions

Why You Can Win in the Market

The structural gap between individual and institutional investors is clear, including the size of their funds, transaction costs, market influence, and decision-making consistency.

But Shigeru Fujimoto has been making huge profits by going against institutional investors for 70 years.

And many individual investors who came across this move became his ardent fans.

In his book, "The Joy of Stock Investors," Shigeru also provides specific tips on how to win in competition with institutional investors.

One of the most impressive pieces of advice is about ‘mindset.’

While it's certainly important to read charts carefully and diligently gather information, he says you should be careful not to get carried away by trends created by institutional investors.

In a market where everyone is competing—from investment banks and hedge funds to big shareholders, veteran individual investors, and even just-beginners—to profit, you need to understand what your opponents are thinking.

It is said that when you try to read the minds of other investors, you naturally become wary of moves that might deceive you.

“The expression ‘Should I buy, sell, or take a break?’ may seem like an all-too-familiar and obvious question.

But I would like to use this as a proverb that talks about the importance of rest.

When you think of day trading, you might picture yourself constantly trading in front of a computer monitor, but that's not necessarily the case.

'When the market is not active, I don't touch it.

Reflect on each and every transaction.

"Check the flow of the larger economy. Only by striking that balance can you generate profits."

Shigeru also provides insight into the strengths of individual investors.

Unlike institutional investors, individual investors' greatest advantage is that they can freely use the weapon called "rest" and react quickly to situations.

It emphasizes that individual investors can also achieve an advantageous position if they can choose stocks and trading timing wisely through an investment method that flexibly adapts to the massive entity and flow of the "market" rather than resisting it.

“Do you want to make money?

Then think for yourself.”

Unshaken by loss and failure

The true joy of building wealth through investment

“It is a saying that the more profitable an investor is, the more he or she invests in solitude, without being influenced by what others say.

The internet makes it easy to access information and build connections, but are those information and connections truly meaningful? The more you struggle with stocks on your own, the more you rely on your own judgment.

The author says he feels the "joy of stock investment" by facing the market solely with "my routine," "my analysis," and "my judgment" without relying on anyone else.

In a capitalist society where it is difficult to build the life we want with earned income alone, we ultimately have no choice but to continue investing.

This book provides a way to enjoyably continue investing, something you must do anyway.

What investments am I making now? What are my criteria for making those decisions? How confident am I in my judgment? Am I simply making excuses like lack of time, age, a short attention span, or a poor market? Shigeru Fujimoto, who has been fiercely competing in the stock market for over half a century, poses fundamental questions about investing.

Now is the time to face that question squarely and answer it.

I enjoy trading stocks.

“This is all my investment.”

An ordinary person who didn't even graduate from college

Simple and clear principles that helped me become one of Japan's best stock investors.

Shigeru Fujimoto says this:

“If there are ten people, there are ten ways to invest.” That’s how many different investment methods there are in the world.

So, what are Shigeru's investment principles, having invested in stocks for 70 years? What criteria does he use to select stocks and determine trading timing? How does he maintain his composure in competition with institutional investors?

Shigeru's investment method has clear characteristics.

It's not flashy or complicated, he just sticks to the basics.

'Don't invest in areas you don't know well', 'Don't be swayed by what others say', 'It doesn't matter if it's 3 yen or 5 yen, as long as it goes up.

'It is forbidden to be too greedy', 'Stocks with promising future prospects are always good', 'Don't pour your investment money into a good stock all at once just because you found it.

‘I always follow the 1:2:6 rule’, ‘I don’t rely on my experience of success.

His investment methods, such as 'determining investment timing through technical analysis', are famous sayings that become our blood and flesh that we, who invest in stocks, must remember and practice.

As you learn about Shigeru's solid investment principles, you'll find yourself reflecting on your own investment methods.

Let's examine whether we have neglected the fundamentals of investing by dismissing them as obvious, or whether we have invested without careful judgment, swayed by the flashy words of others.

The investment method of a master is simple and clear.

Even in the world of investing, those who stick to the basics ultimately win.

“It is right to buy, it is right to sell,

And you deserve to rest.”

Individual investors against institutions

Why You Can Win in the Market

The structural gap between individual and institutional investors is clear, including the size of their funds, transaction costs, market influence, and decision-making consistency.

But Shigeru Fujimoto has been making huge profits by going against institutional investors for 70 years.

And many individual investors who came across this move became his ardent fans.

In his book, "The Joy of Stock Investors," Shigeru also provides specific tips on how to win in competition with institutional investors.

One of the most impressive pieces of advice is about ‘mindset.’

While it's certainly important to read charts carefully and diligently gather information, he says you should be careful not to get carried away by trends created by institutional investors.

In a market where everyone is competing—from investment banks and hedge funds to big shareholders, veteran individual investors, and even just-beginners—to profit, you need to understand what your opponents are thinking.

It is said that when you try to read the minds of other investors, you naturally become wary of moves that might deceive you.

“The expression ‘Should I buy, sell, or take a break?’ may seem like an all-too-familiar and obvious question.

But I would like to use this as a proverb that talks about the importance of rest.

When you think of day trading, you might picture yourself constantly trading in front of a computer monitor, but that's not necessarily the case.

'When the market is not active, I don't touch it.

Reflect on each and every transaction.

"Check the flow of the larger economy. Only by striking that balance can you generate profits."

Shigeru also provides insight into the strengths of individual investors.

Unlike institutional investors, individual investors' greatest advantage is that they can freely use the weapon called "rest" and react quickly to situations.

It emphasizes that individual investors can also achieve an advantageous position if they can choose stocks and trading timing wisely through an investment method that flexibly adapts to the massive entity and flow of the "market" rather than resisting it.

“Do you want to make money?

Then think for yourself.”

Unshaken by loss and failure

The true joy of building wealth through investment

“It is a saying that the more profitable an investor is, the more he or she invests in solitude, without being influenced by what others say.

The internet makes it easy to access information and build connections, but are those information and connections truly meaningful? The more you struggle with stocks on your own, the more you rely on your own judgment.

The author says he feels the "joy of stock investment" by facing the market solely with "my routine," "my analysis," and "my judgment" without relying on anyone else.

In a capitalist society where it is difficult to build the life we want with earned income alone, we ultimately have no choice but to continue investing.

This book provides a way to enjoyably continue investing, something you must do anyway.

What investments am I making now? What are my criteria for making those decisions? How confident am I in my judgment? Am I simply making excuses like lack of time, age, a short attention span, or a poor market? Shigeru Fujimoto, who has been fiercely competing in the stock market for over half a century, poses fundamental questions about investing.

Now is the time to face that question squarely and answer it.

GOODS SPECIFICS

- Date of issue: August 11, 2025

- Page count, weight, size: 312 pages | 562g | 152*215*20mm

- ISBN13: 9791130668895

- ISBN10: 1130668894

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)