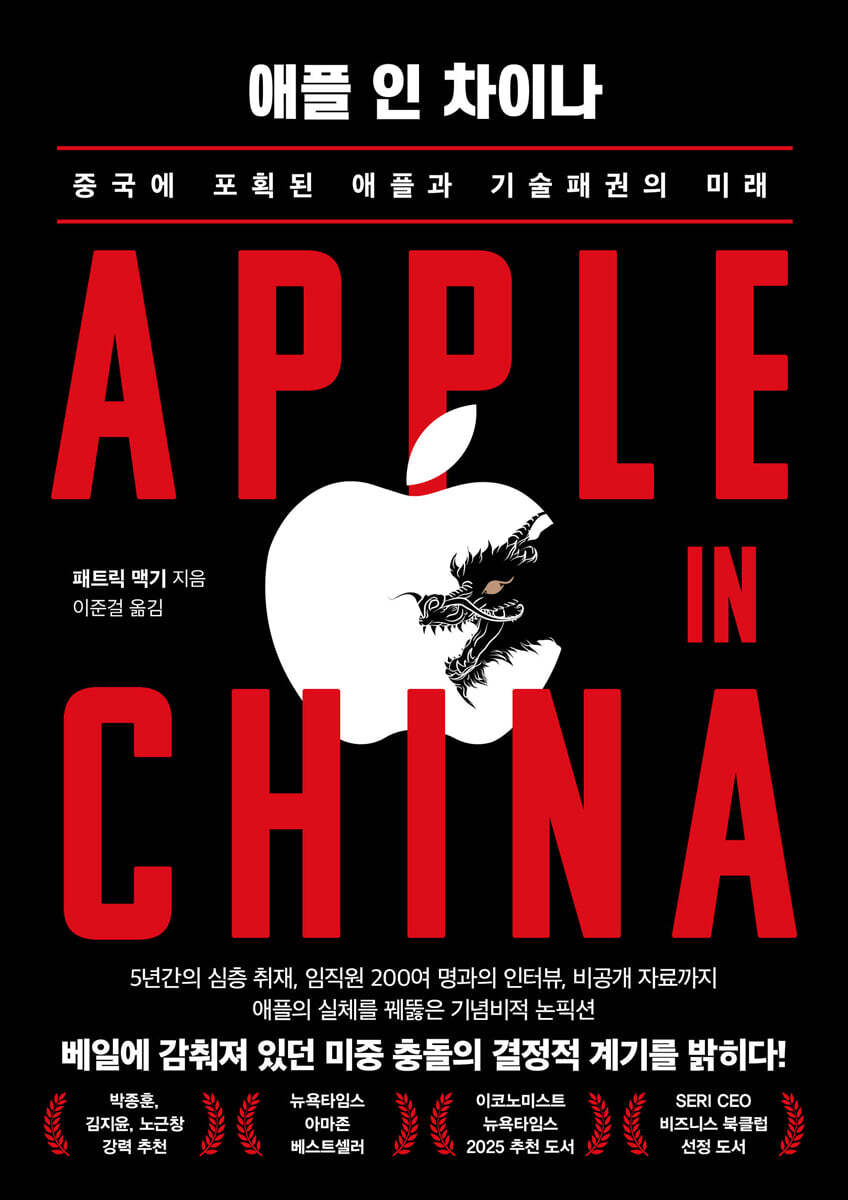

Apple in China

|

Description

Book Introduction

How did Apple lead China to become a tech powerhouse?

Five years of in-depth reporting, interviews with over 200 employees, and even unpublished data.

A monumental nonfiction book that delves into the true nature of Apple.

Strongly recommended by Dr. Kim Ji-yoon, Center Director Noh Geun-chang, and Director Park Jong-hoon

The Economist and the New York Times' 2025 Recommended Books

In August 2025, Apple CEO Tim Cook visited the White House and presented President Donald Trump with a glass disc inscribed with "Made in USA 2025."

The special gift, paired with a solid gold pedestal, symbolized Apple's commitment to manufacturing more products in the United States, where Cook unveiled plans to invest $600 billion in the country.

Interestingly, Cook visited China three times in 2024, promising senior government officials to increase local investment.

Why is Apple walking a tightrope between two superpowers?

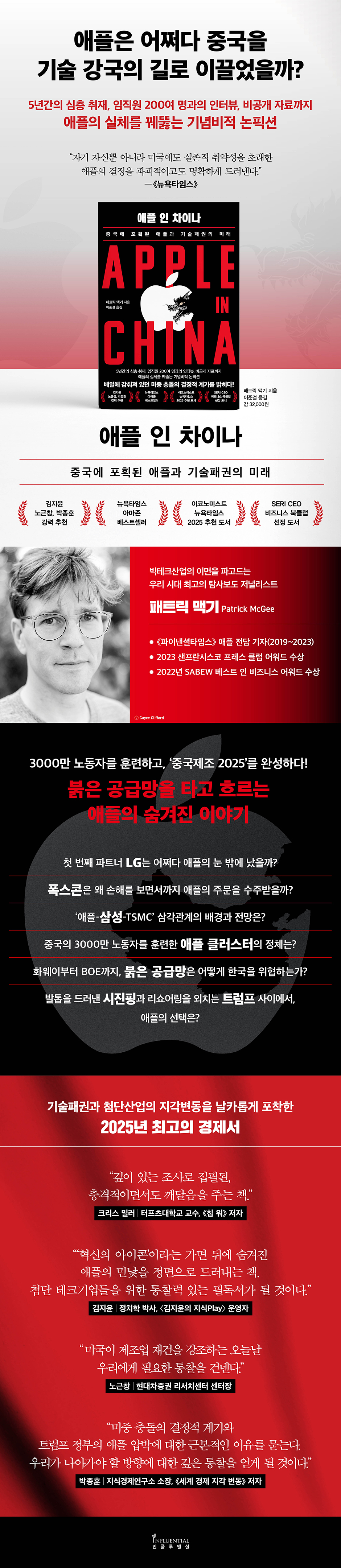

Patrick McGee, Apple reporter for the Financial Times, exposes that Apple pulled the trigger on the US-China conflict.

After five years of digging into the backstory of the world's leading companies, starting in 2019, he tells a story far beyond imagination in "Apple in China."

The very icon of innovation, Apple, has been 'captured' by the authoritarian state of China.

How did Apple become so entangled in China that it relies on over 90 percent of its production? What did China gain from this, and what will it aim for next? Can the United States truly turn this situation around? What will be the repercussions of this series of events on the global economy and on South Korea, home to Apple's partners and competitors like Samsung and LG? This book seeks answers to these questions that will determine Apple's fate, while sharply capturing the tectonic shifts in the global Big Tech industry and technological hegemony.

In a world where conflict between two superpowers, supply chain fragmentation, and growing uncertainty, this book, which traces Apple's path, will offer profound insights to business executives, policymakers, and individual investors alike.

Five years of in-depth reporting, interviews with over 200 employees, and even unpublished data.

A monumental nonfiction book that delves into the true nature of Apple.

Strongly recommended by Dr. Kim Ji-yoon, Center Director Noh Geun-chang, and Director Park Jong-hoon

The Economist and the New York Times' 2025 Recommended Books

In August 2025, Apple CEO Tim Cook visited the White House and presented President Donald Trump with a glass disc inscribed with "Made in USA 2025."

The special gift, paired with a solid gold pedestal, symbolized Apple's commitment to manufacturing more products in the United States, where Cook unveiled plans to invest $600 billion in the country.

Interestingly, Cook visited China three times in 2024, promising senior government officials to increase local investment.

Why is Apple walking a tightrope between two superpowers?

Patrick McGee, Apple reporter for the Financial Times, exposes that Apple pulled the trigger on the US-China conflict.

After five years of digging into the backstory of the world's leading companies, starting in 2019, he tells a story far beyond imagination in "Apple in China."

The very icon of innovation, Apple, has been 'captured' by the authoritarian state of China.

How did Apple become so entangled in China that it relies on over 90 percent of its production? What did China gain from this, and what will it aim for next? Can the United States truly turn this situation around? What will be the repercussions of this series of events on the global economy and on South Korea, home to Apple's partners and competitors like Samsung and LG? This book seeks answers to these questions that will determine Apple's fate, while sharply capturing the tectonic shifts in the global Big Tech industry and technological hegemony.

In a world where conflict between two superpowers, supply chain fragmentation, and growing uncertainty, this book, which traces Apple's path, will offer profound insights to business executives, policymakers, and individual investors alike.

- You can preview some of the book's contents.

Preview

index

Preface to the Korean edition

Prologue│Incomparable Arrogance

Part 1: The Birth of a Great Manufacturing Company

Chapter 1: IBM and Apple's PC War

Chapter 2: A Breakthrough Through Outsourcing

Chapter 3: Steve Jobs Returns

Chapter 4: Think Different

Chapter 5: iMac, Overwhelming with Design

Part 2: The Long March to China

Chapter 6 Korea Becomes the First Partner

Chapter 7: LG and Apple's Diverging Dreams

Chapter 8: Taiwan Becomes the Second Partner

Chapter 9: The Problem Solver: Foxconn

Chapter 10: The Magic of Tim Cook

Chapter 11: Achieving Zero Inventory

Chapter 12: Factories Disappearing in America

Part 3 iPod, iMac, iPhone

Chapter 13 From MP3 Player to iPod

Chapter 14: Apple Cluster for the iMac G4

Chapter 15: The iPod's Success and Inventec's Failure

Chapter 16: Foxconn's Secret Weapon

Chapter 17: The Most Certain Future: The iPhone

Chapter 18: A Strict Teacher and a Passionate Student

Chapter 19: The Sinicization of Apple, the Appleization of China

Part 4: Endless Demand

Chapter 20: The New Continent Called China

Chapter 21: The iPhone 4 That Went Continental

Chapter 22: The 1 Billion-Person Gray Market

Chapter 23: Not Understanding China

Chapter 24: Foxconn and TSMC's Bets

Chapter 25: The Great Trap of China

China's 5th Claw Revealed

Chapter 26: The Unmasked Dictator

Chapter 27: The Gang of Eight Against China

Chapter 28: Fooled by China

Chapter 29: Obey voluntarily

Chapter 30: Apple, a Self-Proclaimed Sponsor of China

Chapter 31: Apple's Victory? China's Victory!

Chapter 32: Protected as Much as Controlled

Part 6: The Red-Stained Apple

Chapter 33: China Oppresses, Apple Makes Money

Chapter 34: The Emergence of Chinese Managers

Chapter 35: Huawei, the Biggest Beneficiary of the Red Supply Chain

Chapter 36: What Tim Cook Didn't Tell You

Chapter 37: Donald Trump's Threat

Chapter 38: The YMTC Scandal That Opened America's Eyes

Chapter 39: Completely Captured

Chapter 40: Could India Be the Alternative?

Chapter 41: The Variable Called TSMC

Epilogue│Unrecorded Legacy

Acknowledgements

main

Search

Prologue│Incomparable Arrogance

Part 1: The Birth of a Great Manufacturing Company

Chapter 1: IBM and Apple's PC War

Chapter 2: A Breakthrough Through Outsourcing

Chapter 3: Steve Jobs Returns

Chapter 4: Think Different

Chapter 5: iMac, Overwhelming with Design

Part 2: The Long March to China

Chapter 6 Korea Becomes the First Partner

Chapter 7: LG and Apple's Diverging Dreams

Chapter 8: Taiwan Becomes the Second Partner

Chapter 9: The Problem Solver: Foxconn

Chapter 10: The Magic of Tim Cook

Chapter 11: Achieving Zero Inventory

Chapter 12: Factories Disappearing in America

Part 3 iPod, iMac, iPhone

Chapter 13 From MP3 Player to iPod

Chapter 14: Apple Cluster for the iMac G4

Chapter 15: The iPod's Success and Inventec's Failure

Chapter 16: Foxconn's Secret Weapon

Chapter 17: The Most Certain Future: The iPhone

Chapter 18: A Strict Teacher and a Passionate Student

Chapter 19: The Sinicization of Apple, the Appleization of China

Part 4: Endless Demand

Chapter 20: The New Continent Called China

Chapter 21: The iPhone 4 That Went Continental

Chapter 22: The 1 Billion-Person Gray Market

Chapter 23: Not Understanding China

Chapter 24: Foxconn and TSMC's Bets

Chapter 25: The Great Trap of China

China's 5th Claw Revealed

Chapter 26: The Unmasked Dictator

Chapter 27: The Gang of Eight Against China

Chapter 28: Fooled by China

Chapter 29: Obey voluntarily

Chapter 30: Apple, a Self-Proclaimed Sponsor of China

Chapter 31: Apple's Victory? China's Victory!

Chapter 32: Protected as Much as Controlled

Part 6: The Red-Stained Apple

Chapter 33: China Oppresses, Apple Makes Money

Chapter 34: The Emergence of Chinese Managers

Chapter 35: Huawei, the Biggest Beneficiary of the Red Supply Chain

Chapter 36: What Tim Cook Didn't Tell You

Chapter 37: Donald Trump's Threat

Chapter 38: The YMTC Scandal That Opened America's Eyes

Chapter 39: Completely Captured

Chapter 40: Could India Be the Alternative?

Chapter 41: The Variable Called TSMC

Epilogue│Unrecorded Legacy

Acknowledgements

main

Search

Detailed image

Publisher's Review

"Training 30 million workers and completing 'Made in China 2025'!"

Apple's Hidden Story Flowing Through the Red Supply Chain

The iPhone is Apple's biggest hit product and an electronic device that symbolizes the smartphone era.

Even at this very moment, one billion people are communicating with the world through their iPhones.

The iPhone's influence within Apple is also absolute.

As of 2024, more than 230 million iPhones had been produced, accounting for 51 percent of Apple's total revenue.

In short, if the iPhone didn't exist, Apple wouldn't exist.

Patrick McGee's first book, "Apple in China," which presents impressive economic articles with a sharp perspective that penetrates technology, economy, and security, points out that the shadow of China looms large behind the success of the iPhone and Apple.

Some might argue that China is simply responsible for the assembly of Apple products, but this analysis is incorrect. Apple's relationship with China, encompassing everything from manufacturing to R&D, is much deeper and more complex.

The author, an expert in investigative journalism, obtains meeting minutes, confidential reports, and emails between top executives, including Steve Jobs's voice, and interviews hundreds of insiders to piece together the puzzle of Apple's hidden story.

This tracker is not only fascinating, but also provides a deeper understanding of the issues shaking the world today, such as 'reshoring,' 'manufacturing renaissance,' and 'trade war.'

“You can’t believe it unless you make it yourself.”

The Birth of a Great Manufacturing Company

When we think of 'Apple', we usually think of beautiful design or excellent features.

But the book focuses on Apple as a 'manufacturing company'.

In fact, until the 1980s, American manufacturers abhorred the very concept of leaving production in someone else's hands.

Among them, the company that insisted on its own production until the very end was Apple.

This book vividly portrays Apple's manufacturing site, where the sound of machines constantly whirring is unparalleled, and reveals the origins of the innovation they have always boasted.

Jobs believed that to innovate design and functionality, manufacturing had to be innovated as well.

This spirit is fully reflected in Apple's iconic hit products.

For example, Apple spent a full six months simply devising an injection molding process to produce the translucent plastic case for the iMac G3. Companies like IBM dismissed this effort as inefficient.

They focused on designing and mass-producing products so that they could be assembled with their eyes closed.

Apple was able to establish itself as a unique presence by taking the opposite path.

The unique textured anodized aluminum case that led to the success of the iPod Mini and the full-screen touchscreen of the iPhone series were also products of that strategy.

While Apple's superior manufacturing technology is a unique strength, it also acts as a double-edged sword that increases production costs.

Apple solved this problem by working with several contract manufacturers, including LG, its first manufacturing partner, Inventec, Pegatron, and Quanta.

Apple has introduced a new level of outsourcing strategy by sending its engineers to contract manufacturers to supervise the production process and train workers.

This gave Apple, which maximized its profit margins, the effect of becoming “the world’s largest manufacturer without a single factory,” and gave contract manufacturers the opportunity to improve their technological capabilities.

“Sucked into China”

Apple clusters dominate China's eastern coast

The book explains that Apple's outsourcing strategy has changed the landscape of the entire global supply chain.

In particular, it had a decisive influence on the rise of Foxconn, which is now called the 'outsourcing empire'.

Foxconn was the most outstanding "student" among Apple's contract manufacturers.

They were smart enough to win Apple's orders by offering lower prices than LG, even at the risk of losing money; they were humble enough to focus solely on contract manufacturing, unlike Samsung, which had been a key Apple partner until Apple fell out with them when it developed its own smartphones; and they were proactive enough to say, "Of course we can do it," no matter what was asked of them.

Foxconn's strength was also its strong political sense.

This has been particularly helpful for Apple in taking advantage of China's cheap labor.

At the time, Chinese workers were mostly located inland, so the cooperation of local governments was essential to bring them to the eastern coastal cities where factories were located.

Foxconn facilitated Apple's entry into China by mobilizing its political connections to achieve this.

The author meticulously analyzes confidential Apple documents, such as balance sheets and bills of materials (BOMs), and reveals that Apple spends $55 billion annually training 30 million Chinese workers, providing cutting-edge equipment to outsourced manufacturers, and operating R&D centers.

In fact, since the mid-2000s, when the iPod and iPhone were released in succession, Apple began expanding its production in China at a frightening pace.

Soon, several production bases were established in eastern coastal cities such as Shanghai, Zhengzhou, Shenzhen, and Xiamen.

Each hub consisted of dozens or hundreds of contract manufacturers, with the largest having as many as 500,000 workers working two shifts to produce Apple products around the clock.

It was through this 'red supply chain' that Apple's technology, know-how, capital, and facilities were naturally transferred to China.

The proof is the iPhone.

Today, China is the only country capable of manufacturing 500,000 palm-sized, high-tech electronic devices per day with perfect, consistent quality.

For example, the glass disc that Cook gifted to Trump was made by Corning, an American manufacturer, but only China's Lens Technology and TPK can add touchscreen functionality to it.

It's shocking that the production of electronic devices, which have such a powerful impact on modern people's daily lives, is so completely dependent on China.

Apple's Rigidity vs. Samsung's Resilience

Conflicting technological hegemonies and reorganizing global supply chains

In the past, 'Made in China' symbolized cheap, poor quality products.

But Apple's red-hot supply chain is breaking that stereotype.

Huawei, BYD, BOE, DJI, and YMTC, which have grown into China's leading big tech companies by absorbing talent trained by Apple, already have world-class technological prowess.

China under Xi Jinping is using these as a spear and shield to push forward its "Made in China 2025" plan, challenging America's technological hegemony.

The American political world, surprised by this, is strongly criticizing Apple for helping the enemy.

Can Apple navigate the challenges of neither abandoning its supply chain in China nor ignoring political pressures at home, facing increasingly intense calls for reshoring?

The book highlights Samsung's decision to take a path diametrically opposed to Apple's, and suggests a survival strategy that will avoid being swept up in the conflicts of global supply chains and geopolitics.

While Apple made the “rookie but fatal mistake of concentrating its extensive manufacturing operations in a single location,” Samsung built a resilient supply chain across six countries.

This gave Apple high margins and top production efficiency, but left it vulnerable to geopolitical instability.

Even TSMC, which was entrusted with producing chips for iPhones instead of Samsung, is suffering from the threat of China's unification of Taiwan.

The recent expansion of production in India cannot serve as an exit strategy, as it only involves importing and reassembling products manufactured in China.

Can Apple escape the China swamp? If Apple chooses not to, or simply cannot, how will the global supply chain be restructured amid the deepening US-China conflict? What opportunities will Korea find in this chasm? If you're curious about the answers to the age-old questions Apple has posed, open this book.

You will find the clue in the footsteps of the world's best companies.

Apple's Hidden Story Flowing Through the Red Supply Chain

The iPhone is Apple's biggest hit product and an electronic device that symbolizes the smartphone era.

Even at this very moment, one billion people are communicating with the world through their iPhones.

The iPhone's influence within Apple is also absolute.

As of 2024, more than 230 million iPhones had been produced, accounting for 51 percent of Apple's total revenue.

In short, if the iPhone didn't exist, Apple wouldn't exist.

Patrick McGee's first book, "Apple in China," which presents impressive economic articles with a sharp perspective that penetrates technology, economy, and security, points out that the shadow of China looms large behind the success of the iPhone and Apple.

Some might argue that China is simply responsible for the assembly of Apple products, but this analysis is incorrect. Apple's relationship with China, encompassing everything from manufacturing to R&D, is much deeper and more complex.

The author, an expert in investigative journalism, obtains meeting minutes, confidential reports, and emails between top executives, including Steve Jobs's voice, and interviews hundreds of insiders to piece together the puzzle of Apple's hidden story.

This tracker is not only fascinating, but also provides a deeper understanding of the issues shaking the world today, such as 'reshoring,' 'manufacturing renaissance,' and 'trade war.'

“You can’t believe it unless you make it yourself.”

The Birth of a Great Manufacturing Company

When we think of 'Apple', we usually think of beautiful design or excellent features.

But the book focuses on Apple as a 'manufacturing company'.

In fact, until the 1980s, American manufacturers abhorred the very concept of leaving production in someone else's hands.

Among them, the company that insisted on its own production until the very end was Apple.

This book vividly portrays Apple's manufacturing site, where the sound of machines constantly whirring is unparalleled, and reveals the origins of the innovation they have always boasted.

Jobs believed that to innovate design and functionality, manufacturing had to be innovated as well.

This spirit is fully reflected in Apple's iconic hit products.

For example, Apple spent a full six months simply devising an injection molding process to produce the translucent plastic case for the iMac G3. Companies like IBM dismissed this effort as inefficient.

They focused on designing and mass-producing products so that they could be assembled with their eyes closed.

Apple was able to establish itself as a unique presence by taking the opposite path.

The unique textured anodized aluminum case that led to the success of the iPod Mini and the full-screen touchscreen of the iPhone series were also products of that strategy.

While Apple's superior manufacturing technology is a unique strength, it also acts as a double-edged sword that increases production costs.

Apple solved this problem by working with several contract manufacturers, including LG, its first manufacturing partner, Inventec, Pegatron, and Quanta.

Apple has introduced a new level of outsourcing strategy by sending its engineers to contract manufacturers to supervise the production process and train workers.

This gave Apple, which maximized its profit margins, the effect of becoming “the world’s largest manufacturer without a single factory,” and gave contract manufacturers the opportunity to improve their technological capabilities.

“Sucked into China”

Apple clusters dominate China's eastern coast

The book explains that Apple's outsourcing strategy has changed the landscape of the entire global supply chain.

In particular, it had a decisive influence on the rise of Foxconn, which is now called the 'outsourcing empire'.

Foxconn was the most outstanding "student" among Apple's contract manufacturers.

They were smart enough to win Apple's orders by offering lower prices than LG, even at the risk of losing money; they were humble enough to focus solely on contract manufacturing, unlike Samsung, which had been a key Apple partner until Apple fell out with them when it developed its own smartphones; and they were proactive enough to say, "Of course we can do it," no matter what was asked of them.

Foxconn's strength was also its strong political sense.

This has been particularly helpful for Apple in taking advantage of China's cheap labor.

At the time, Chinese workers were mostly located inland, so the cooperation of local governments was essential to bring them to the eastern coastal cities where factories were located.

Foxconn facilitated Apple's entry into China by mobilizing its political connections to achieve this.

The author meticulously analyzes confidential Apple documents, such as balance sheets and bills of materials (BOMs), and reveals that Apple spends $55 billion annually training 30 million Chinese workers, providing cutting-edge equipment to outsourced manufacturers, and operating R&D centers.

In fact, since the mid-2000s, when the iPod and iPhone were released in succession, Apple began expanding its production in China at a frightening pace.

Soon, several production bases were established in eastern coastal cities such as Shanghai, Zhengzhou, Shenzhen, and Xiamen.

Each hub consisted of dozens or hundreds of contract manufacturers, with the largest having as many as 500,000 workers working two shifts to produce Apple products around the clock.

It was through this 'red supply chain' that Apple's technology, know-how, capital, and facilities were naturally transferred to China.

The proof is the iPhone.

Today, China is the only country capable of manufacturing 500,000 palm-sized, high-tech electronic devices per day with perfect, consistent quality.

For example, the glass disc that Cook gifted to Trump was made by Corning, an American manufacturer, but only China's Lens Technology and TPK can add touchscreen functionality to it.

It's shocking that the production of electronic devices, which have such a powerful impact on modern people's daily lives, is so completely dependent on China.

Apple's Rigidity vs. Samsung's Resilience

Conflicting technological hegemonies and reorganizing global supply chains

In the past, 'Made in China' symbolized cheap, poor quality products.

But Apple's red-hot supply chain is breaking that stereotype.

Huawei, BYD, BOE, DJI, and YMTC, which have grown into China's leading big tech companies by absorbing talent trained by Apple, already have world-class technological prowess.

China under Xi Jinping is using these as a spear and shield to push forward its "Made in China 2025" plan, challenging America's technological hegemony.

The American political world, surprised by this, is strongly criticizing Apple for helping the enemy.

Can Apple navigate the challenges of neither abandoning its supply chain in China nor ignoring political pressures at home, facing increasingly intense calls for reshoring?

The book highlights Samsung's decision to take a path diametrically opposed to Apple's, and suggests a survival strategy that will avoid being swept up in the conflicts of global supply chains and geopolitics.

While Apple made the “rookie but fatal mistake of concentrating its extensive manufacturing operations in a single location,” Samsung built a resilient supply chain across six countries.

This gave Apple high margins and top production efficiency, but left it vulnerable to geopolitical instability.

Even TSMC, which was entrusted with producing chips for iPhones instead of Samsung, is suffering from the threat of China's unification of Taiwan.

The recent expansion of production in India cannot serve as an exit strategy, as it only involves importing and reassembling products manufactured in China.

Can Apple escape the China swamp? If Apple chooses not to, or simply cannot, how will the global supply chain be restructured amid the deepening US-China conflict? What opportunities will Korea find in this chasm? If you're curious about the answers to the age-old questions Apple has posed, open this book.

You will find the clue in the footsteps of the world's best companies.

GOODS SPECIFICS

- Date of issue: September 25, 2025

- Page count, weight, size: 640 pages | 1,012g | 152*215*37mm

- ISBN13: 9791168343184

- ISBN10: 1168343186

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)