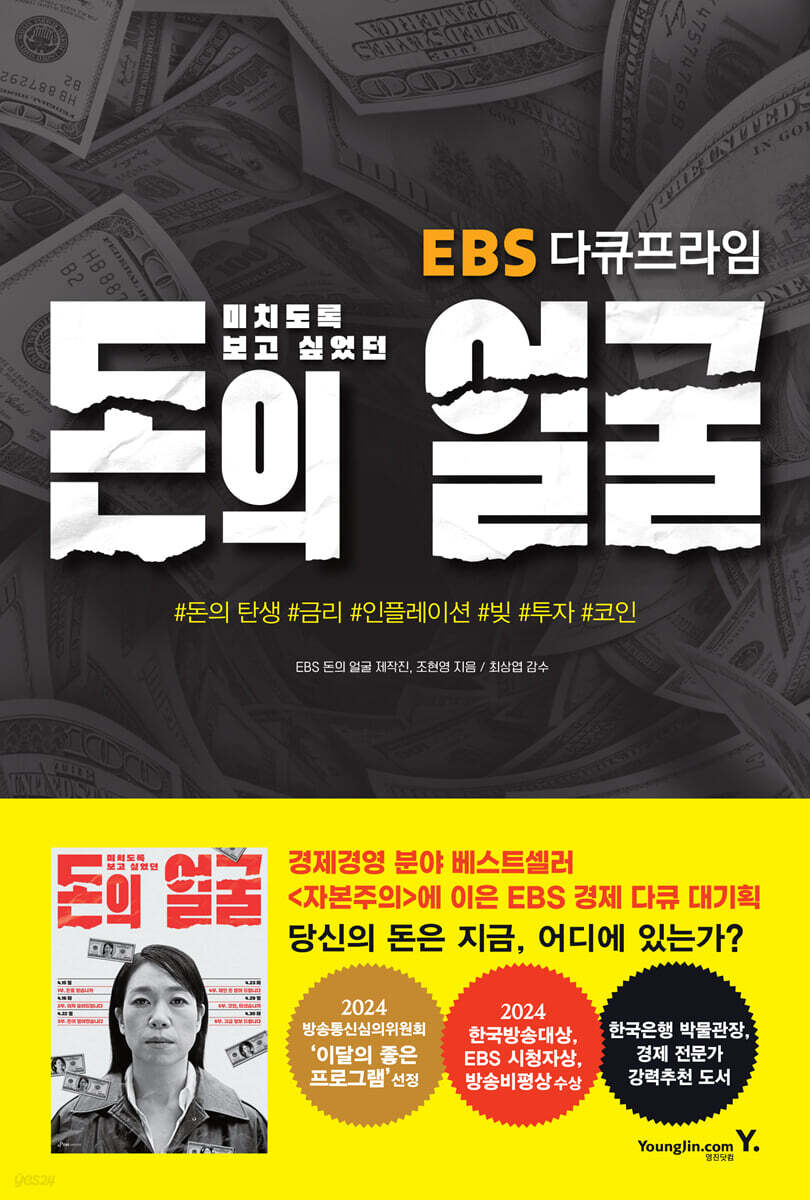

The face of money that I desperately wanted to see

|

Description

Book Introduction

The reason why people are poor despite working hard is because of the structure of money.

Will you be driven by money or follow the flow?

We live every day spending money and working to earn money.

But we don't delve deeply into where money comes from and where it flows. "The Face of Money," based on the hit EBS documentary Prime, begins with this very question.

This book examines the structure of capitalist society and the realities of individuals within it through six topics surrounding money, from the birth of money to interest, inflation, debt, cryptocurrency, and investment psychology.

The most notable feature of this book is that it explains complex economic concepts through stories of real people, rather than through theories or formulas.

The production team traveled to nine countries, including Lebanon, Japan, Nigeria, and the United States, and met with a diverse range of people, from prominent economists to those involved in a bank hostage crisis, young investors, and housewives.

It shows how economic concepts are realized in their lives, and interprets the economic principles hidden in expressions we vaguely know, such as 'money makes money', 'time is money', and 'money goes around and around', into everyday language.

It specifically touches on concepts closely related to our lives, such as nominal and real wages, interest rates, liquidity, and debt structure, and shows the structure beyond numbers.

If your life feels burdensome right now, it may be because you don't know how your money is flowing.

"The Face of Money" will serve as a starting point for those seeking to understand the world through money.

Will you be driven by money or follow the flow?

We live every day spending money and working to earn money.

But we don't delve deeply into where money comes from and where it flows. "The Face of Money," based on the hit EBS documentary Prime, begins with this very question.

This book examines the structure of capitalist society and the realities of individuals within it through six topics surrounding money, from the birth of money to interest, inflation, debt, cryptocurrency, and investment psychology.

The most notable feature of this book is that it explains complex economic concepts through stories of real people, rather than through theories or formulas.

The production team traveled to nine countries, including Lebanon, Japan, Nigeria, and the United States, and met with a diverse range of people, from prominent economists to those involved in a bank hostage crisis, young investors, and housewives.

It shows how economic concepts are realized in their lives, and interprets the economic principles hidden in expressions we vaguely know, such as 'money makes money', 'time is money', and 'money goes around and around', into everyday language.

It specifically touches on concepts closely related to our lives, such as nominal and real wages, interest rates, liquidity, and debt structure, and shows the structure beyond numbers.

If your life feels burdensome right now, it may be because you don't know how your money is flowing.

"The Face of Money" will serve as a starting point for those seeking to understand the world through money.

- You can preview some of the book's contents.

Preview

index

Part 1: The Birth and Flow of Money

01 The Identity of Money - What on Earth is Money?

02 Deposit Withdrawal Crisis - Do you trust money?

03 The Value of Money - What is Liquidity?

04 The Emergence of Money - The Face of Early Money

05 The Birth of Banknotes - From Pieces of Paper to Money

06 Freedom of Money - Saying Goodbye to Money, 'Gold' and Embracing 'Credit'

07 The Velocity of Money - How Does Money Grow?

08 Inflation - The Enormous Swamp of Money

I will give you the second part of the interest.

01 The Reality of Interest - What is Interest?

02 The Law of Interest Rate Fluctuations - Interest rates move.

03 Interest Rates and Inflation - The Correlation Between Interest Rates and Inflation

04 The Impact of Interest Rates - How Interest Rates Change the World

Part 3: Stagnation of Inflation

01 Stagnation of Inflation - Why Are Prices Rising?

02 The Impact of Inflation - How Inflation Changes Our Lives

03 Inflation and Income - How Much Did My Salary Go Up?

04 The History of Inflation - Inflation That Changed Human History

05 Reserve Currencies and Inflation - Why Are We Hungry for the Dollar?

06 The Future of Inflation - Inflation is still ing

Part 4 Are you paying off your debt?

01 The Identity of Money - Why Do We Get Into Debt?

02 The World of Debt Collection - What if I don't pay my debt?

03 The Added Value of Debt - A Bank That Makes Money with Your Debt

04 Loans and Assets - Is My Mortgage Loan Safe?

05 The Shadow of Debt - What Price Does a Debt-Inflected Society Pay?

Part 5: The Other Side of Money: Cryptocurrency

01 The Journey of Money - Where Does Money Go?

02 The Front Line of Money - A Government Trying to Monopolize Money

03 Digitizing Money - Eliminate Accounts

04 The Emergence of Cryptocurrency - Those Who Believe in Blockchain

05 The Future of Cryptocurrency - Which Face of Money Will You Choose?

Part 6: Why do you invest?

01 What is Investment? - What is Investment?

02 How to Invest - How should I invest?

03 My Investment - Which Investment is Right for Me?

01 The Identity of Money - What on Earth is Money?

02 Deposit Withdrawal Crisis - Do you trust money?

03 The Value of Money - What is Liquidity?

04 The Emergence of Money - The Face of Early Money

05 The Birth of Banknotes - From Pieces of Paper to Money

06 Freedom of Money - Saying Goodbye to Money, 'Gold' and Embracing 'Credit'

07 The Velocity of Money - How Does Money Grow?

08 Inflation - The Enormous Swamp of Money

I will give you the second part of the interest.

01 The Reality of Interest - What is Interest?

02 The Law of Interest Rate Fluctuations - Interest rates move.

03 Interest Rates and Inflation - The Correlation Between Interest Rates and Inflation

04 The Impact of Interest Rates - How Interest Rates Change the World

Part 3: Stagnation of Inflation

01 Stagnation of Inflation - Why Are Prices Rising?

02 The Impact of Inflation - How Inflation Changes Our Lives

03 Inflation and Income - How Much Did My Salary Go Up?

04 The History of Inflation - Inflation That Changed Human History

05 Reserve Currencies and Inflation - Why Are We Hungry for the Dollar?

06 The Future of Inflation - Inflation is still ing

Part 4 Are you paying off your debt?

01 The Identity of Money - Why Do We Get Into Debt?

02 The World of Debt Collection - What if I don't pay my debt?

03 The Added Value of Debt - A Bank That Makes Money with Your Debt

04 Loans and Assets - Is My Mortgage Loan Safe?

05 The Shadow of Debt - What Price Does a Debt-Inflected Society Pay?

Part 5: The Other Side of Money: Cryptocurrency

01 The Journey of Money - Where Does Money Go?

02 The Front Line of Money - A Government Trying to Monopolize Money

03 Digitizing Money - Eliminate Accounts

04 The Emergence of Cryptocurrency - Those Who Believe in Blockchain

05 The Future of Cryptocurrency - Which Face of Money Will You Choose?

Part 6: Why do you invest?

01 What is Investment? - What is Investment?

02 How to Invest - How should I invest?

03 My Investment - Which Investment is Right for Me?

Detailed image

Publisher's Review

EBS Documentary Prime's hit series "The Face of Money" has been made into a book!

EBS DocuPrime's economic documentary "The Face of Money" has been reborn as a book.

On top of the vivid stories from the field captured in the program, the book adds deeper questions and thoughts.

Scenes that passed quickly and concepts that felt complicated become clearer as you read the book.

In an era where understanding the structure of money is more important than ever, "The Face of Money" continues the questions that began in the video, taking them to a longer and deeper level through the medium of a book.

Where and how does money work in our lives?

We spend money every day.

We live each day by receiving our salary, paying our credit card bills, and paying off loans.

But few people actually ask where money comes from, how it works, and why it affects our lives.

Economics is difficult, complex, and often feels like the domain of experts only.

So we live without knowing.

But in an era like today, where interest rates and prices fluctuate, and words like debt, investment, and cryptocurrency have become deeply ingrained in our daily lives, it's difficult to live without ignorance.

Now is the time to understand 'structure' rather than 'feeling'.

"The Face of Money" starts from this very point.

Through the familiar entity called money, we look into the flow and structure of the capitalist society we live in, as well as the lives of individuals within it.

It is not a simple economic manual, but a socioeconomic exploration that illuminates human behavior and psychology, and the workings of society and institutions, through the medium of money.

Familiar yet unfamiliar: Asking the true face of money

The book consists of six parts in total.

Part 1 examines the origin and history of money, and how it has functioned based on 'trust' in human society.

Part 2 examines in detail how interest can be a means of increasing assets or, conversely, a trap that increases debt.

Part 3 explains the relationship between inflation, nominal wages, and real purchasing power, and explains why we feel poor even when our wages rise.

Part 4 shows how personal debt is not simply a choice, but is systematically created.

Part 5 examines the questions the emergence of cryptocurrencies poses for the existing monetary system, while Part 6 explores the relationship between investment and human psychology from a behavioral economics perspective.

The greatest strength of this book is that it focuses on ‘people.’

The production team traveled to nine countries, including Lebanon, Nigeria, Japan, and the United States, and met with countless people.

From renowned economists to housewives, young investors, and even those involved in bank hostage situations, their experiences and voices vividly reveal how money works in real life.

These are the moments when economic concepts become concrete realities within an individual's emotions and choices.

Defining interest rates as the "price of time," viewing money as a "structure of trust," and connecting the rise of debt, inflation, and cryptocurrencies to individual lives, this book goes beyond simply imparting knowledge.

It makes the reader ask himself:

Where does the money I spend now come from and where does it go? Do I truly understand money and live accordingly?

"The Face of Money" is structured so that even readers new to economics can easily read it.

Complex concepts are explained in everyday language, and examples are filled with vivid life stories.

But the questions and insights this book raises are by no means light.

It makes us reflect on the position of individuals within the current capitalist structure and ask ourselves again about our labor, consumption, savings, investments, and the direction of our lives.

This book says:

If your life feels burdensome right now, it may not be because you don't know about money, but because you don't properly understand how money works.

And the moment you understand that structure, many aspects of life will look different.

I recommend this book to anyone who wants to face the real face of money, which is familiar yet unfamiliar.

EBS DocuPrime's economic documentary "The Face of Money" has been reborn as a book.

On top of the vivid stories from the field captured in the program, the book adds deeper questions and thoughts.

Scenes that passed quickly and concepts that felt complicated become clearer as you read the book.

In an era where understanding the structure of money is more important than ever, "The Face of Money" continues the questions that began in the video, taking them to a longer and deeper level through the medium of a book.

Where and how does money work in our lives?

We spend money every day.

We live each day by receiving our salary, paying our credit card bills, and paying off loans.

But few people actually ask where money comes from, how it works, and why it affects our lives.

Economics is difficult, complex, and often feels like the domain of experts only.

So we live without knowing.

But in an era like today, where interest rates and prices fluctuate, and words like debt, investment, and cryptocurrency have become deeply ingrained in our daily lives, it's difficult to live without ignorance.

Now is the time to understand 'structure' rather than 'feeling'.

"The Face of Money" starts from this very point.

Through the familiar entity called money, we look into the flow and structure of the capitalist society we live in, as well as the lives of individuals within it.

It is not a simple economic manual, but a socioeconomic exploration that illuminates human behavior and psychology, and the workings of society and institutions, through the medium of money.

Familiar yet unfamiliar: Asking the true face of money

The book consists of six parts in total.

Part 1 examines the origin and history of money, and how it has functioned based on 'trust' in human society.

Part 2 examines in detail how interest can be a means of increasing assets or, conversely, a trap that increases debt.

Part 3 explains the relationship between inflation, nominal wages, and real purchasing power, and explains why we feel poor even when our wages rise.

Part 4 shows how personal debt is not simply a choice, but is systematically created.

Part 5 examines the questions the emergence of cryptocurrencies poses for the existing monetary system, while Part 6 explores the relationship between investment and human psychology from a behavioral economics perspective.

The greatest strength of this book is that it focuses on ‘people.’

The production team traveled to nine countries, including Lebanon, Nigeria, Japan, and the United States, and met with countless people.

From renowned economists to housewives, young investors, and even those involved in bank hostage situations, their experiences and voices vividly reveal how money works in real life.

These are the moments when economic concepts become concrete realities within an individual's emotions and choices.

Defining interest rates as the "price of time," viewing money as a "structure of trust," and connecting the rise of debt, inflation, and cryptocurrencies to individual lives, this book goes beyond simply imparting knowledge.

It makes the reader ask himself:

Where does the money I spend now come from and where does it go? Do I truly understand money and live accordingly?

"The Face of Money" is structured so that even readers new to economics can easily read it.

Complex concepts are explained in everyday language, and examples are filled with vivid life stories.

But the questions and insights this book raises are by no means light.

It makes us reflect on the position of individuals within the current capitalist structure and ask ourselves again about our labor, consumption, savings, investments, and the direction of our lives.

This book says:

If your life feels burdensome right now, it may not be because you don't know about money, but because you don't properly understand how money works.

And the moment you understand that structure, many aspects of life will look different.

I recommend this book to anyone who wants to face the real face of money, which is familiar yet unfamiliar.

GOODS SPECIFICS

- Date of issue: July 5, 2025

- Page count, weight, size: 308 pages | 574g | 154*225*19mm

- ISBN13: 9788931479867

- ISBN10: 8931479867

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)