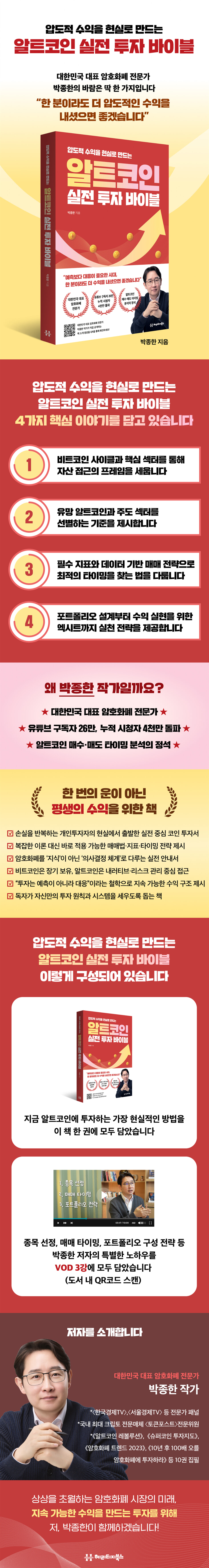

The Altcoin Investment Bible

|

Description

Book Introduction

In an era where response is more important than prediction,

I hope at least one more person makes a profit!

★ Korea's Leading Cryptocurrency Expert ★

★ YouTube subscribers exceed 260,000, cumulative viewers exceed 40 million ★

★ The Basics of Altcoin Buy/Sell Timing Analysis ★

For a lifetime of profits, not just one lucky break.

This book begins with an awareness of the current situation in the coin market, where countless opportunities exist, yet countless people miss the right trading opportunity and suffer losses.

There are countless things to study, including charts, indicators, and trading methods. However, considering the situation of individual investors who are short on time and money, we have eliminated complex theories and summarized only trading methods that can be applied immediately in real life.

For investors who suffer losses due to short-term trends and misinformation, this practical guide addresses cryptocurrency not as a mere "knowledge" but as a "sound decision-making system."

The author defines cryptocurrency not as a temporary investment target, but as a "new investment paradigm" that will lead the future financial order. He presents principles and response strategies for building sustainable profits without being swayed by powerful forces.

Bitcoin recommends a long-term buy-and-hold strategy based on its limited issuance. Regarding altcoins, which face high difficulty due to information asymmetry and the absence of official valuation, the book systematically addresses stock selection, timing, and risk management within narratives and volatility.

In a market environment expanding with the convergence of blockchain and traditional finance and the influx of institutional investors, our goal is to help readers establish their own principles and consistently achieve results, based on the principle that "investment is about response, not prediction."

The book is divided into four parts. Part 1 establishes a framework for approaching assets through the Bitcoin cycle and key sectors. Part 2 presents criteria for selecting promising altcoins and leading sectors. Part 3 covers how to find optimal timing using essential indicators and data-driven trading strategies. Part 4 provides practical strategies from portfolio design to exit for profit realization.

Beginners can start with the basic principles in Parts 1 and 2, while experienced users can start with the practical strategies in Parts 3 and 4. The more you refer to the necessary parts repeatedly, the more you can realize overwhelming profits. "Altcoin Practical Investment Bible" is designed to be a practical investment weapon.

I hope at least one more person makes a profit!

★ Korea's Leading Cryptocurrency Expert ★

★ YouTube subscribers exceed 260,000, cumulative viewers exceed 40 million ★

★ The Basics of Altcoin Buy/Sell Timing Analysis ★

For a lifetime of profits, not just one lucky break.

This book begins with an awareness of the current situation in the coin market, where countless opportunities exist, yet countless people miss the right trading opportunity and suffer losses.

There are countless things to study, including charts, indicators, and trading methods. However, considering the situation of individual investors who are short on time and money, we have eliminated complex theories and summarized only trading methods that can be applied immediately in real life.

For investors who suffer losses due to short-term trends and misinformation, this practical guide addresses cryptocurrency not as a mere "knowledge" but as a "sound decision-making system."

The author defines cryptocurrency not as a temporary investment target, but as a "new investment paradigm" that will lead the future financial order. He presents principles and response strategies for building sustainable profits without being swayed by powerful forces.

Bitcoin recommends a long-term buy-and-hold strategy based on its limited issuance. Regarding altcoins, which face high difficulty due to information asymmetry and the absence of official valuation, the book systematically addresses stock selection, timing, and risk management within narratives and volatility.

In a market environment expanding with the convergence of blockchain and traditional finance and the influx of institutional investors, our goal is to help readers establish their own principles and consistently achieve results, based on the principle that "investment is about response, not prediction."

The book is divided into four parts. Part 1 establishes a framework for approaching assets through the Bitcoin cycle and key sectors. Part 2 presents criteria for selecting promising altcoins and leading sectors. Part 3 covers how to find optimal timing using essential indicators and data-driven trading strategies. Part 4 provides practical strategies from portfolio design to exit for profit realization.

Beginners can start with the basic principles in Parts 1 and 2, while experienced users can start with the practical strategies in Parts 3 and 4. The more you refer to the necessary parts repeatedly, the more you can realize overwhelming profits. "Altcoin Practical Investment Bible" is designed to be a practical investment weapon.

index

Prologue: I hope at least one more person makes a profit.

PART 1: Basic Strategies for Maximizing Profits with Limited Cash Seeds

Chapter 1.

Why Cryptocurrency Is the Asset That Will Bring You the Highest Returns

- The essential difference between Bitcoin and altcoins

- So why do we invest in altcoins?

- The basic principle of altcoin investment: Buy the best coins at the lowest price and sell them at the highest price.

- Three Key Factors for Altcoin Investment

- Market volatility and strategic flexibility

Macroeconomic Outlook for Major Altcoins

Chapter 2.

Macroeconomics: Reading the Cryptocurrency Cycle Through the Fed, Interest Rates, the Dollar, and M2

- Dual Mandate with the Fed

- Macroeconomic indicators: prices and employment

- Interest rates and liquidity

Bond yields, tariffs, and signals of a policy shift

- Another weapon of the central bank

- The relationship between the dollar index and Bitcoin

- Global M2 money and liquidity

Chapter 3.

Investment strategies that yield the highest returns based on cycles alone

Why the Bitcoin Halving Matters

- You need to know dominance to understand the cycle.

- Altcoin trend upward trend predicted through dominance

- Developing an investment strategy that leverages the Bitcoin bull market.

Chapter 4.

Basic Core Strategies for a Bull Market

- Indicators showing demand and sentiment

Altcoin investment is all about a response strategy.

- To minimize losses from volatility

An infrastructure project that offers both growth and safety.

- Smart contract platform and dApp

- Infrastructure project items currently receiving attention

- Important points for trading timing and stock selection

PART 2.

How to Identify Leading Altcoins That Will Bring Great Opportunities

Chapter 5.

Top 5 Altcoins Leading the Way to Wealth Expansion in 2025

How to increase the stability of altcoin investments

Cryptocurrency Classification and the Solana/Ethereum Ecosystem

- What is a layer?

- Major Altcoin Investment Analysis

Chapter 6.

The market-leading cryptocurrency sector

- How to find projects that belong to the ecosystem

- Sector and DeFi analysis by ecosystem

- Sector-specific selection criteria for successful investment

Chapter 7.

Three Tips for Choosing High-Growth Coins

- Narrative-centered selection criteria

- Practical selection strategy through fundamental analysis

- Analysis of coin holdings by institution

- Whether it is undervalued or not, based on various factors

PART 3.

How to accurately identify undervalued stocks and timing purchases to generate profits.

Chapter 8.

Trend analysis for reliable trading decisions

- The importance and types of technical analysis

- What is a candlestick chart?

- Reading trading timing through trend analysis

- How price defense lines, support lines, and resistance lines work

Chapter 9.

Identifying trading timing using moving averages

- What is a moving average?

- Moving average arrangement and usage

- Indicator analysis using Fibonacci retracement

Chapter 10.

Analysis of key indicators that determine profits

- Key auxiliary indicators for indicator analysis

- Characteristics and applications of pattern analysis

- Notes on technical analysis

PART 4.

The easiest on-chain analysis method for timing trades

Chapter 11.

How to Use Short-Term Indicators to Determine Buy Timing

- Why are on-chain metrics important?

Key investment players and on-chain indicators to watch

- An indicator that reflects the short-term flow of the market

- On-chain indicator verification site

- On-chain indicator analysis_short-term holders

- On-chain indicator analysis_Large investors

- On-chain indicator analysis_futures trading

- Psychological analysis

Chapter 12.

How to Use Long-Term Indicators to Identify Bullish Market Cycles

- Macro perspective

- Mining perspective

- Adoption perspective

- Liquidity perspective

Chapter 13.

Customized buying and exit strategies based on market conditions

- Three strategies for trading cryptocurrency

- Buy-the-dip strategy

- How to find the optimal low-price buying range

- Breakout Buy (Trend Following) Strategy

- DCA (fixed-amount installment purchase) strategy

PART 5.

Portfolio Strategies You Can Implement Immediately

Chapter 14.

How to Determine When to Sell Using Four Indicators

- Four indicators needed to identify selling points

Finding sell points using on-chain indicators

- Finding sell points using psychological indicators

- Finding sell points from a chart perspective

- Finding sell points using futures trading indicators

- Four criteria for exit strategy

- The most useful indicator for exit strategies

Chapter 15.

Successful Portfolio Strategies

Five Basic Principles of Portfolio Strategy

- Why is diversification important?

- Analysis of correlation coefficients within cryptocurrencies: Coin-centric portfolio strategies

- Practical strategies for concentrated investment and cash holdings

- How to construct a portfolio by strategy

- Portfolio rebalancing is a bonus!

- Shannon's Goblin Strategy

Chapter 16.

Five Coin Investing Tips for Extra Profits

- Understanding Centralized and Decentralized Exchanges

- Domestic vs. foreign exchanges

- Cold wallets and hot wallets

- Four ways to use DeFi

- Airdrops require careful selection

- Unlisted coin investment strategy centered on memecoins

Two Approaches to Memecoin Investment Strategies

PART 1: Basic Strategies for Maximizing Profits with Limited Cash Seeds

Chapter 1.

Why Cryptocurrency Is the Asset That Will Bring You the Highest Returns

- The essential difference between Bitcoin and altcoins

- So why do we invest in altcoins?

- The basic principle of altcoin investment: Buy the best coins at the lowest price and sell them at the highest price.

- Three Key Factors for Altcoin Investment

- Market volatility and strategic flexibility

Macroeconomic Outlook for Major Altcoins

Chapter 2.

Macroeconomics: Reading the Cryptocurrency Cycle Through the Fed, Interest Rates, the Dollar, and M2

- Dual Mandate with the Fed

- Macroeconomic indicators: prices and employment

- Interest rates and liquidity

Bond yields, tariffs, and signals of a policy shift

- Another weapon of the central bank

- The relationship between the dollar index and Bitcoin

- Global M2 money and liquidity

Chapter 3.

Investment strategies that yield the highest returns based on cycles alone

Why the Bitcoin Halving Matters

- You need to know dominance to understand the cycle.

- Altcoin trend upward trend predicted through dominance

- Developing an investment strategy that leverages the Bitcoin bull market.

Chapter 4.

Basic Core Strategies for a Bull Market

- Indicators showing demand and sentiment

Altcoin investment is all about a response strategy.

- To minimize losses from volatility

An infrastructure project that offers both growth and safety.

- Smart contract platform and dApp

- Infrastructure project items currently receiving attention

- Important points for trading timing and stock selection

PART 2.

How to Identify Leading Altcoins That Will Bring Great Opportunities

Chapter 5.

Top 5 Altcoins Leading the Way to Wealth Expansion in 2025

How to increase the stability of altcoin investments

Cryptocurrency Classification and the Solana/Ethereum Ecosystem

- What is a layer?

- Major Altcoin Investment Analysis

Chapter 6.

The market-leading cryptocurrency sector

- How to find projects that belong to the ecosystem

- Sector and DeFi analysis by ecosystem

- Sector-specific selection criteria for successful investment

Chapter 7.

Three Tips for Choosing High-Growth Coins

- Narrative-centered selection criteria

- Practical selection strategy through fundamental analysis

- Analysis of coin holdings by institution

- Whether it is undervalued or not, based on various factors

PART 3.

How to accurately identify undervalued stocks and timing purchases to generate profits.

Chapter 8.

Trend analysis for reliable trading decisions

- The importance and types of technical analysis

- What is a candlestick chart?

- Reading trading timing through trend analysis

- How price defense lines, support lines, and resistance lines work

Chapter 9.

Identifying trading timing using moving averages

- What is a moving average?

- Moving average arrangement and usage

- Indicator analysis using Fibonacci retracement

Chapter 10.

Analysis of key indicators that determine profits

- Key auxiliary indicators for indicator analysis

- Characteristics and applications of pattern analysis

- Notes on technical analysis

PART 4.

The easiest on-chain analysis method for timing trades

Chapter 11.

How to Use Short-Term Indicators to Determine Buy Timing

- Why are on-chain metrics important?

Key investment players and on-chain indicators to watch

- An indicator that reflects the short-term flow of the market

- On-chain indicator verification site

- On-chain indicator analysis_short-term holders

- On-chain indicator analysis_Large investors

- On-chain indicator analysis_futures trading

- Psychological analysis

Chapter 12.

How to Use Long-Term Indicators to Identify Bullish Market Cycles

- Macro perspective

- Mining perspective

- Adoption perspective

- Liquidity perspective

Chapter 13.

Customized buying and exit strategies based on market conditions

- Three strategies for trading cryptocurrency

- Buy-the-dip strategy

- How to find the optimal low-price buying range

- Breakout Buy (Trend Following) Strategy

- DCA (fixed-amount installment purchase) strategy

PART 5.

Portfolio Strategies You Can Implement Immediately

Chapter 14.

How to Determine When to Sell Using Four Indicators

- Four indicators needed to identify selling points

Finding sell points using on-chain indicators

- Finding sell points using psychological indicators

- Finding sell points from a chart perspective

- Finding sell points using futures trading indicators

- Four criteria for exit strategy

- The most useful indicator for exit strategies

Chapter 15.

Successful Portfolio Strategies

Five Basic Principles of Portfolio Strategy

- Why is diversification important?

- Analysis of correlation coefficients within cryptocurrencies: Coin-centric portfolio strategies

- Practical strategies for concentrated investment and cash holdings

- How to construct a portfolio by strategy

- Portfolio rebalancing is a bonus!

- Shannon's Goblin Strategy

Chapter 16.

Five Coin Investing Tips for Extra Profits

- Understanding Centralized and Decentralized Exchanges

- Domestic vs. foreign exchanges

- Cold wallets and hot wallets

- Four ways to use DeFi

- Airdrops require careful selection

- Unlisted coin investment strategy centered on memecoins

Two Approaches to Memecoin Investment Strategies

Detailed image

Into the book

To conclude, individual investors must keep in mind that they can never beat the market.

If you insist on a strategy that is different from the market direction, you will end up going against the market, which will ultimately lead to a failed investment.

--- From "Why Cryptocurrency is the Asset That Will Bring You the Highest Returns"

Macroeconomics continues to influence the markets.

So why is macroeconomics important in investing?

Not only because it indicates the direction of the game, but also because it is a key factor in determining liquidity.

The market has not yet received the liquidity it needs, and the question of whether more liquidity can be provided is a critical juncture.

--- From "Macroeconomics: Reading the Cryptocurrency Cycle with the Fed, Interest Rates, the Dollar, and M2"

Cycles are very useful not only for developing detailed strategies to successfully conclude this major bull market, but also for creating a long-term picture to prepare for the next bull market.

Understanding the structure of the cycle will help you prepare not only for this season's returns but also for the next season.

--- From "Investment Strategies for Highest Returns Through Cycles"

It is not advisable to rush to sell and swap your holdings or use up all your cash at once just because a particular coin suddenly surges.

The important thing is to always maintain your own principles and direction while developing your portfolio.

Oh, from a strategic perspective, we will continue to invest.

--- From "Basic Core Strategies for a Rising Market"

Of course, we don't know if all of these scenarios are correct.

However, looking at the cryptocurrency market trends this season, it is observed that there has been a divergence from past cycles since the launch of the Bitcoin spot ETF in 2024.

Another thing that is clear is that we can no longer invest based solely on what others say without any basis.

If you're looking for stable returns, you should focus on stocks with long-term growth potential, not short-term surge stocks.

--- Among the "Top 5 Altcoins That Will Expand Wealth in 2025"

Once you've chosen a good platform, the next step is to expand your altcoin selection by sector.

Because the altcoin market exhibits a cyclical pattern, coins belonging to the same sector or ecosystem often exhibit similar price movements.

While capital sometimes flows into specific coins, most of it circulates around sectors or ecosystems.

--- Among the "Market-Leading Cryptocurrency Sectors"

The problem is that there are too many choices.

If you're feeling overwhelmed by the sheer number of altcoins out there, you should first learn how to narrow down your choices.

One way to do this is to use a standard coin that is commonly mentioned by various institutions, indices, media, etc.

For example, the coins chosen by BlackRock were also mentioned by JP Morgan and other major institutions.

If so, the coin can be considered a trustworthy candidate.

By selecting key stocks through cross-validation like this, you can build a more reliable portfolio.

--- From "Three Tips for Choosing a Coin with High Growth Potential"

It is important to have an attitude of entering only in sections that are judged to be certain.

Even if it looks like a buy-the-dip zone, avoid excessive buying unless the indicators are pointing in the same direction at the same time.

Conversely, if you enter late at the high point, it will be difficult to withstand unrealized losses during the adjustment, and you may repeat the mistake of cutting losses due to fear.

While it's impossible to perfectly predict highs and lows, the skill of trading near them can be acquired with practice.

--- From "Trend Analysis for Reliable Trading Decisions"

Cryptocurrency investments are unique in that they offer a different way to generate additional income than traditional assets.

In this chapter, we'll explore five investment strategies that can increase your profits simply by holding coins, along with how to put them into practice.

The biggest difference between traditional assets and cryptocurrencies is blockchain-based transparency.

Additionally, cryptocurrencies offer much broader possibilities in terms of ownership and usability.

Traditional assets like stocks and bonds are mostly traded only on centralized exchanges, but cryptocurrencies can be freely traded on various platforms, including decentralized exchanges.

If you insist on a strategy that is different from the market direction, you will end up going against the market, which will ultimately lead to a failed investment.

--- From "Why Cryptocurrency is the Asset That Will Bring You the Highest Returns"

Macroeconomics continues to influence the markets.

So why is macroeconomics important in investing?

Not only because it indicates the direction of the game, but also because it is a key factor in determining liquidity.

The market has not yet received the liquidity it needs, and the question of whether more liquidity can be provided is a critical juncture.

--- From "Macroeconomics: Reading the Cryptocurrency Cycle with the Fed, Interest Rates, the Dollar, and M2"

Cycles are very useful not only for developing detailed strategies to successfully conclude this major bull market, but also for creating a long-term picture to prepare for the next bull market.

Understanding the structure of the cycle will help you prepare not only for this season's returns but also for the next season.

--- From "Investment Strategies for Highest Returns Through Cycles"

It is not advisable to rush to sell and swap your holdings or use up all your cash at once just because a particular coin suddenly surges.

The important thing is to always maintain your own principles and direction while developing your portfolio.

Oh, from a strategic perspective, we will continue to invest.

--- From "Basic Core Strategies for a Rising Market"

Of course, we don't know if all of these scenarios are correct.

However, looking at the cryptocurrency market trends this season, it is observed that there has been a divergence from past cycles since the launch of the Bitcoin spot ETF in 2024.

Another thing that is clear is that we can no longer invest based solely on what others say without any basis.

If you're looking for stable returns, you should focus on stocks with long-term growth potential, not short-term surge stocks.

--- Among the "Top 5 Altcoins That Will Expand Wealth in 2025"

Once you've chosen a good platform, the next step is to expand your altcoin selection by sector.

Because the altcoin market exhibits a cyclical pattern, coins belonging to the same sector or ecosystem often exhibit similar price movements.

While capital sometimes flows into specific coins, most of it circulates around sectors or ecosystems.

--- Among the "Market-Leading Cryptocurrency Sectors"

The problem is that there are too many choices.

If you're feeling overwhelmed by the sheer number of altcoins out there, you should first learn how to narrow down your choices.

One way to do this is to use a standard coin that is commonly mentioned by various institutions, indices, media, etc.

For example, the coins chosen by BlackRock were also mentioned by JP Morgan and other major institutions.

If so, the coin can be considered a trustworthy candidate.

By selecting key stocks through cross-validation like this, you can build a more reliable portfolio.

--- From "Three Tips for Choosing a Coin with High Growth Potential"

It is important to have an attitude of entering only in sections that are judged to be certain.

Even if it looks like a buy-the-dip zone, avoid excessive buying unless the indicators are pointing in the same direction at the same time.

Conversely, if you enter late at the high point, it will be difficult to withstand unrealized losses during the adjustment, and you may repeat the mistake of cutting losses due to fear.

While it's impossible to perfectly predict highs and lows, the skill of trading near them can be acquired with practice.

--- From "Trend Analysis for Reliable Trading Decisions"

Cryptocurrency investments are unique in that they offer a different way to generate additional income than traditional assets.

In this chapter, we'll explore five investment strategies that can increase your profits simply by holding coins, along with how to put them into practice.

The biggest difference between traditional assets and cryptocurrencies is blockchain-based transparency.

Additionally, cryptocurrencies offer much broader possibilities in terms of ownership and usability.

Traditional assets like stocks and bonds are mostly traded only on centralized exchanges, but cryptocurrencies can be freely traded on various platforms, including decentralized exchanges.

--- From "Five Coin Investment Secrets for Extra Profits"

Publisher's Review

A Practical Blueprint for Altcoins: "Strategy, Not Speculation"

"The Altcoin Investment Bible," which makes overwhelming profits a reality, is a cryptocurrency investment textbook complete with data, cycles, psychology, and strategy.

He dissects cryptocurrency investment, once considered a craze, and declares that "we are now in an era where you can make money through learning."

Based on years of market analysis and practical data, the author has systematically organized "cryptocurrency as an investment system," rather than simply providing information on coins.

From "Why Altcoins?" to "How to Profit from Them"

This book begins with the structural differences between Bitcoin and altcoins.

While Bitcoin is an asset that accumulates value through long-term holding, altcoins emphasize the importance of strategy in volatility and difficulty.

Following fundamental and narrative analysis, it includes coin analysis by growth sector, including infrastructure, DeFi, AI, and RWA, as well as timing strategies based on cycles, dominance, and MVRV.

When On-Chain and Technical Analysis Meet

The author doesn't separate charts from data. He combines technical analysis, such as the RSI, MACD, and moving averages, with on-chain indicators (such as the price-to-performance ratio (SOPR), realized price, and fuel multiple) to translate them into actual buy and sell signals.

It doesn't simply teach you how to 'read indicators', but also helps you determine 'when to buy and when to sell' using numbers.

This is a passage that makes us realize that investment is not a matter of prediction but of 'response'.

The classic formula for a portfolio built with limited seeds

"The Altcoin Investment Bible," which makes overwhelming profits a reality, asks "How much, when, and in what proportion" to hold, rather than "What should I buy?"

We present a risk-management cryptocurrency portfolio, introducing strategies that allocate core assets (Ethereum, Solana, XRP) and satellite assets (DeFi, AI sector, etc.) centered around Bitcoin, as well as regular rebalancing, cash holding ratio, and Shannon's Dokkaebi strategy.

5 Secrets to Extra Income

"Just holding it makes money flow." The final section, which outlines all practical routes in the cryptocurrency market, including exchanges, wallets, DeFi, airdrops, and meme coins, is the highlight of this book.

It provides specific suggestions on ‘where to place it safely and how to operate it to make a profit.’

Beyond speculation and gambling, it presents a world of rational profits proven by data.

The first "real" coin investing textbook you've been waiting for.

"The Altcoin Investment Bible," which makes overwhelming profits a reality, is not a book that tells you to "trust in coins one more time."

This is a practical guidebook that integrates markets, data, psychology, cycles, and portfolios.

It provides the language of strategy to investors who trade with their fingertips, and the weapon of analysis to investors who move by intuition.

The moment you read this book, the coin market, which was previously based on 'luck', will begin to move according to 'formula'.

"The Altcoin Investment Bible," which makes overwhelming profits a reality, is a cryptocurrency investment textbook complete with data, cycles, psychology, and strategy.

He dissects cryptocurrency investment, once considered a craze, and declares that "we are now in an era where you can make money through learning."

Based on years of market analysis and practical data, the author has systematically organized "cryptocurrency as an investment system," rather than simply providing information on coins.

From "Why Altcoins?" to "How to Profit from Them"

This book begins with the structural differences between Bitcoin and altcoins.

While Bitcoin is an asset that accumulates value through long-term holding, altcoins emphasize the importance of strategy in volatility and difficulty.

Following fundamental and narrative analysis, it includes coin analysis by growth sector, including infrastructure, DeFi, AI, and RWA, as well as timing strategies based on cycles, dominance, and MVRV.

When On-Chain and Technical Analysis Meet

The author doesn't separate charts from data. He combines technical analysis, such as the RSI, MACD, and moving averages, with on-chain indicators (such as the price-to-performance ratio (SOPR), realized price, and fuel multiple) to translate them into actual buy and sell signals.

It doesn't simply teach you how to 'read indicators', but also helps you determine 'when to buy and when to sell' using numbers.

This is a passage that makes us realize that investment is not a matter of prediction but of 'response'.

The classic formula for a portfolio built with limited seeds

"The Altcoin Investment Bible," which makes overwhelming profits a reality, asks "How much, when, and in what proportion" to hold, rather than "What should I buy?"

We present a risk-management cryptocurrency portfolio, introducing strategies that allocate core assets (Ethereum, Solana, XRP) and satellite assets (DeFi, AI sector, etc.) centered around Bitcoin, as well as regular rebalancing, cash holding ratio, and Shannon's Dokkaebi strategy.

5 Secrets to Extra Income

"Just holding it makes money flow." The final section, which outlines all practical routes in the cryptocurrency market, including exchanges, wallets, DeFi, airdrops, and meme coins, is the highlight of this book.

It provides specific suggestions on ‘where to place it safely and how to operate it to make a profit.’

Beyond speculation and gambling, it presents a world of rational profits proven by data.

The first "real" coin investing textbook you've been waiting for.

"The Altcoin Investment Bible," which makes overwhelming profits a reality, is not a book that tells you to "trust in coins one more time."

This is a practical guidebook that integrates markets, data, psychology, cycles, and portfolios.

It provides the language of strategy to investors who trade with their fingertips, and the weapon of analysis to investors who move by intuition.

The moment you read this book, the coin market, which was previously based on 'luck', will begin to move according to 'formula'.

GOODS SPECIFICS

- Date of issue: November 5, 2025

- Page count, weight, size: 304 pages | 152*225*30mm

- ISBN13: 9791198404213

- ISBN10: 1198404213

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)