The Essential Stock Investment Course: Transforming Beginners into Experts in No Time

|

Description

Book Introduction

Super Ant's Stock Market Lessons for Beginners, Revised and Expanded Edition, 2025

Read the flow of change first and seize opportunities

Tax accountant Lee Jeong-yoon's investment guide

"KOSPI breaking through 3000 is just the beginning. Prepare for the coming 5000 era!" Super Ant Tax Accountant Lee Jeong-yoon's "Super Ant's Stock Class for Absolute Beginners" has been revised and expanded to become "The Essential Stock Investment Class that Turns Beginners into Experts in an Instant."

This book, which has been greatly loved by novice investors for many years, has been newly revised to include 'investment strategies for key sectors' that will lead the market, such as pharmaceutical and biotechnology, AI, robotics, and medical devices, as well as '8 Tech, a practical investment technique' by Lee Se-moo-sa.

It also provides essential knowledge that beginner investors need to know, from how to find materials in everyday life to analyzing companies through financial statements and reading charts at a glance.

In the end, who you learn from determines your returns on stocks.

Tax accountant Lee Jeong-yoon, a "super ant" with a strong track record, including winning the Kiwoom Securities Real Investment Competition for four consecutive years and disclosing a 9% stake in Samyang Foods, will provide the clearest guidance for those preparing for the KOSPI 5000 era.

Read the flow of change first and seize opportunities

Tax accountant Lee Jeong-yoon's investment guide

"KOSPI breaking through 3000 is just the beginning. Prepare for the coming 5000 era!" Super Ant Tax Accountant Lee Jeong-yoon's "Super Ant's Stock Class for Absolute Beginners" has been revised and expanded to become "The Essential Stock Investment Class that Turns Beginners into Experts in an Instant."

This book, which has been greatly loved by novice investors for many years, has been newly revised to include 'investment strategies for key sectors' that will lead the market, such as pharmaceutical and biotechnology, AI, robotics, and medical devices, as well as '8 Tech, a practical investment technique' by Lee Se-moo-sa.

It also provides essential knowledge that beginner investors need to know, from how to find materials in everyday life to analyzing companies through financial statements and reading charts at a glance.

In the end, who you learn from determines your returns on stocks.

Tax accountant Lee Jeong-yoon, a "super ant" with a strong track record, including winning the Kiwoom Securities Real Investment Competition for four consecutive years and disclosing a 9% stake in Samyang Foods, will provide the clearest guidance for those preparing for the KOSPI 5000 era.

- You can preview some of the book's contents.

Preview

index

Part 1 | Essential Knowledge for Stock Beginners

Chapter 1: Motivation for Beginners in Stock Trading

Investing in stocks is essential to becoming rich.

The purpose of stock investment is to make a lot of money easily.

Successful investors are given three freedoms.

In the age of 100, stock investment is not an option, but a necessity.

Chapter 2 How to Start Investing in Stocks Properly

Should I study first or open an account first?

Which brokerage firm should I open an account with?

Should I do it on my phone or on my PC?

How to start your first trade?

Chapter 3: Don't be afraid of unfamiliar terms

Is stock investing difficult because of the terminology?

Are economics, business administration, and accounting the foundation of stock investing?

Always distinguish between stock price and market capitalization.

Profit-related terms you should definitely know

Chapter 4: Stock Investor Styles and Stock Investment Methods Vary

Where am I among the beginner, the intermediate, the intermediate, the advanced, and the super ant?

Should I trade short-term or invest long-term?

Let's learn the pros and cons of Donghak and Seohak ants.

The biggest difference between stock investment and ETF investment is this.

Chapter 5: Remember the Absolute Rules of Successful Investing

Why You Should Diversify Rather Than Concentrate Your Investments

Let's analyze the stock market from the top down.

Stock selection is far more important than timing.

Studying stock investing can lead to successful investing.

Chapter 6: Smart Study Methods for Successful Investing

Be sure to check out the stock-related steady sellers.

Are securities reports medicine or poison?

There's a dart system for search terms...

Don't be swayed by fluctuating economic news.

Chapter 7: Invest in Growth Stocks

What is the biggest difference between common stock and preferred stock?

Are high-dividend stocks good and low-dividend stocks bad?

Large cap vs.

Where should I invest in small and mid-cap stocks?

Several Ways to Find Growth Stocks

Chapter 8: What are the real growth industries of this era?

Our country's number one industry is semiconductors.

Why the domestic pharmaceutical and biotechnology industries are bound to grow

What are the five major K-industries related to the Korean Wave?

AI and robotics industries that make imagination a reality

Part 2 | How to Analyze Information

Chapter 1: How to Analyze Information Effectively

Efficient market hypothesis and random walk theory

Do public and private information affect stock prices?

More important than getting information!

How do we categorize the information we collect?

Chapter 2: Information Analysis Begins with Securities Firm Reports!

Securities firm reports are good teachers.

Let's analyze the stock market situation.

Why Industry Analysis Matters More Than Stock Analysis

How to select stocks yourself

Chapter 3: Let's search the news properly

Search News

Information you must check if you want to predict the future

Sometimes there is helpful information.

Trading strategies using news

Chapter 4: Searching for Useful Disclosures for Practical Investment

Let's take a look at four types of public information.

Review the most important periodic disclosure reports

There is a way to search for public notices.

Important disclosures found in the article

Chapter 5: Difficult and important issues of capital increase, capital reduction, merger, and division

Is increased capital necessarily a bad thing in the market?

Potato to reduce capital

What to consider when merging

3 Things You Must Know When Splitting a Property

Chapter 6: Get information by properly utilizing HTS

Differences in trading by time zone

There is information that distinguishes jade from stone.

I need to know who lives there now

What you can learn by looking at KOSPI 200 stocks!

Chapter 7: How to Use Information Obtained in Daily Life

Be careful when watching the news!

Do you also obtain information through consumer activities?

Information that allows for practical and accurate analysis

Let's check four things about information given by acquaintances.

Chapter 8: Theme stocks that follow the ups and downs of stock prices

How to identify and analyze theme stocks?

This is how to trade theme stocks!

Practical Investment! Robot-Related Stocks

Practical Investment! Medical Device Stocks

Part 3 | How to Analyze Prices Properly

Chapter 1: Why Technical Analysis Is Necessary

What is technical analysis?

Stock prices lead the economy by 6 months?!

4 Ways to Read Market Flows

Three Investment Strategies You Must Know

Chapter 2: Stock prices are determined by supply and demand.

Price is important

What affects supply and demand

This kind of analysis is necessary for short-term stock price movements!

Public sentiment is reflected in the charts.

Chapter 3: The Basics of Technical Analysis: Candlestick Charts

Analysis is easy if you know just 6 shapes!

You must be able to see the body and tail.

The pattern of the seal is divided into four types.

Preparation for real-world, chart analysis

Chapter 4: Predicting Stock Price Movements

Types and Meanings of Moving Averages

Convergence, Breakthrough, and Divergence: Learning from Real-Life Cases

Breakout of Moving Averages, Granville's Eight Rules

The difference between a good encounter and a bad encounter

Chapter 5: The Crucial Reasons for Chart Analysis

You must know the secret of inflection!

3 Ways to Identify Trends

If the resistance line is broken, there is a possibility of an upward turn?!

Trading techniques should also vary depending on the trend.

Chapter 6: Knowing the Past Can Help You See the Present

Patterns are imbued with human psychology.

4 Patterns That Can Help You Know When to Buy

4 Patterns That Can Help You Know When to Sell

Trend continuity that increases the probability of success

Chapter 7: You can fool the stock price, but you can't fool the trading volume?!

When the opinions of buyers and sellers clash

Four Characteristics of Trading Volume

When past trading volume affects current stock prices

Practical trading strategy using trading volume

Chapter 8: 4 charts recommended by Super Ants!

A chart that breaks through the highest price and renews the new high

A chart that is worth looking forward to if you pay a little attention

Amazing returns that make you forget the fatal flaws

The life of the chart is visible

Part 4 | Valuable Stocks: Investing Together

Chapter 1: Why a Company's Value and Stock Price Differ

Value and price are different

What is the stock price today?

How to Value a Company Based on Assets

Let's figure out cash flow

Chapter 2: Accounting: The Basics of Reading Financial Statements

You need to know how to prepare accounting statements.

Practice examples of resentment when starting a new business

Three Key Accounting Principles

If you understand the principles of preparing financial statements, you can read them.

Chapter 3: Basics of Financial Statements, Assets

A table showing financial status at a specific point in time

3 Assets That Can Be Converted into Cash

The purpose is to gain investment profits

Is it an asset that contributes to profits?

Chapter 4: In-Depth Study of Financial Statements, Liabilities and Equity

Money that must be repaid within one year

What companies does Warren Buffett prefer?

The last item on the balance sheet

Retained earnings are more important than capital surplus

Chapter 5: Income Statement, which shows business performance over a certain period of time

The three most important figures

Located at the top of the income statement

How to Find Companies with High Operating Profits

Even though it's difficult, it's good to know about net income!

Chapter 6: How to Check the Statement of Cash Flows and the Statement of Changes in Equity

A table showing cash flows over a period of time

Let's compare operating activities and cash flow.

The essence of business activity is sales!

Check the capital fluctuations over a certain period of time

Chapter 7: Investing without even knowing the financial ratios?

Compare the value of a company by quantifying it as a ratio

You can see the ability to show profit

Let's predict the future with past and present growth rates.

How stable is this company's financial position?

Chapter 8: How did the masters of value investing invest?

Quantitative Analysis vs.

The Importance of Qualitative Analysis

Invest in great companies, Philip Fisher

Warren Buffett, the Sage of Omaha

Peter Lynch, the master of unwavering investment

Part 5 | Lee Se-moo's Practical Investment Techniques, 8 Tech

Chapter 1: Three-Beat Investment Method

What is the triple-beat analysis method?

Starting with financial statement analysis

Starting with chart analysis

Starting with material analysis

In the end, what you need is knowledge and experience.

Chapter 2: Market Capitalization Comparison

Let's compare stock price and market capitalization.

Let's compare PER vs. market capitalization.

Let's compare and analyze the rankings of the top stocks by market capitalization.

Let's compare and analyze the market capitalization rankings of similar industries.

Small-cap or large-cap stocks, which one is better to target?

Chapter 3: Diversification Techniques

What is diversification?

There are unique advantages to diversifying investments.

How to Build a Portfolio - Sector or Stock?

Diversification at the time of purchase vs. at the price of purchase

Chapter 4: Upper Limit Trading Techniques

Why do we do upper limit analysis?

How do I analyze stocks that are trading at the upper limit?

Direct Trading Application I - Strategy for Stocks with Consecutive Upper Limits

Direct Trading Application II - Strategy for Stocks with Strong Gap Limits

Indirect Trading Application - Theme Stock Strategy

Chapter 5: Matchmaking Trading Techniques

Let's understand the concepts of complementary goods and substitute goods.

Pair Trading I - Theme Stock Trading

Matching Trading II - Equity-Related Companies

Chapter 6: Reporting Stock Trading Techniques

What is trend trading?

How to spot rising trend stocks?

What is the reporting stock trading technique?

Will you ride fire or water?

Chapter 7: Newly Listed Stock Strategy

What is IPO investing? What is newly listed stock investing?

The True Meaning of Targeting Newly Listed Stocks

Direct strategy for newly listed stocks

Indirect strategy for newly listed stocks

Chapter 8: How to Discover Stocks in Your Life

Even everyday life should be focused on stock investment.

How do you discover stocks in your daily life?

What should I be careful of when buying stocks in my daily life?

Chapter 1: Motivation for Beginners in Stock Trading

Investing in stocks is essential to becoming rich.

The purpose of stock investment is to make a lot of money easily.

Successful investors are given three freedoms.

In the age of 100, stock investment is not an option, but a necessity.

Chapter 2 How to Start Investing in Stocks Properly

Should I study first or open an account first?

Which brokerage firm should I open an account with?

Should I do it on my phone or on my PC?

How to start your first trade?

Chapter 3: Don't be afraid of unfamiliar terms

Is stock investing difficult because of the terminology?

Are economics, business administration, and accounting the foundation of stock investing?

Always distinguish between stock price and market capitalization.

Profit-related terms you should definitely know

Chapter 4: Stock Investor Styles and Stock Investment Methods Vary

Where am I among the beginner, the intermediate, the intermediate, the advanced, and the super ant?

Should I trade short-term or invest long-term?

Let's learn the pros and cons of Donghak and Seohak ants.

The biggest difference between stock investment and ETF investment is this.

Chapter 5: Remember the Absolute Rules of Successful Investing

Why You Should Diversify Rather Than Concentrate Your Investments

Let's analyze the stock market from the top down.

Stock selection is far more important than timing.

Studying stock investing can lead to successful investing.

Chapter 6: Smart Study Methods for Successful Investing

Be sure to check out the stock-related steady sellers.

Are securities reports medicine or poison?

There's a dart system for search terms...

Don't be swayed by fluctuating economic news.

Chapter 7: Invest in Growth Stocks

What is the biggest difference between common stock and preferred stock?

Are high-dividend stocks good and low-dividend stocks bad?

Large cap vs.

Where should I invest in small and mid-cap stocks?

Several Ways to Find Growth Stocks

Chapter 8: What are the real growth industries of this era?

Our country's number one industry is semiconductors.

Why the domestic pharmaceutical and biotechnology industries are bound to grow

What are the five major K-industries related to the Korean Wave?

AI and robotics industries that make imagination a reality

Part 2 | How to Analyze Information

Chapter 1: How to Analyze Information Effectively

Efficient market hypothesis and random walk theory

Do public and private information affect stock prices?

More important than getting information!

How do we categorize the information we collect?

Chapter 2: Information Analysis Begins with Securities Firm Reports!

Securities firm reports are good teachers.

Let's analyze the stock market situation.

Why Industry Analysis Matters More Than Stock Analysis

How to select stocks yourself

Chapter 3: Let's search the news properly

Search News

Information you must check if you want to predict the future

Sometimes there is helpful information.

Trading strategies using news

Chapter 4: Searching for Useful Disclosures for Practical Investment

Let's take a look at four types of public information.

Review the most important periodic disclosure reports

There is a way to search for public notices.

Important disclosures found in the article

Chapter 5: Difficult and important issues of capital increase, capital reduction, merger, and division

Is increased capital necessarily a bad thing in the market?

Potato to reduce capital

What to consider when merging

3 Things You Must Know When Splitting a Property

Chapter 6: Get information by properly utilizing HTS

Differences in trading by time zone

There is information that distinguishes jade from stone.

I need to know who lives there now

What you can learn by looking at KOSPI 200 stocks!

Chapter 7: How to Use Information Obtained in Daily Life

Be careful when watching the news!

Do you also obtain information through consumer activities?

Information that allows for practical and accurate analysis

Let's check four things about information given by acquaintances.

Chapter 8: Theme stocks that follow the ups and downs of stock prices

How to identify and analyze theme stocks?

This is how to trade theme stocks!

Practical Investment! Robot-Related Stocks

Practical Investment! Medical Device Stocks

Part 3 | How to Analyze Prices Properly

Chapter 1: Why Technical Analysis Is Necessary

What is technical analysis?

Stock prices lead the economy by 6 months?!

4 Ways to Read Market Flows

Three Investment Strategies You Must Know

Chapter 2: Stock prices are determined by supply and demand.

Price is important

What affects supply and demand

This kind of analysis is necessary for short-term stock price movements!

Public sentiment is reflected in the charts.

Chapter 3: The Basics of Technical Analysis: Candlestick Charts

Analysis is easy if you know just 6 shapes!

You must be able to see the body and tail.

The pattern of the seal is divided into four types.

Preparation for real-world, chart analysis

Chapter 4: Predicting Stock Price Movements

Types and Meanings of Moving Averages

Convergence, Breakthrough, and Divergence: Learning from Real-Life Cases

Breakout of Moving Averages, Granville's Eight Rules

The difference between a good encounter and a bad encounter

Chapter 5: The Crucial Reasons for Chart Analysis

You must know the secret of inflection!

3 Ways to Identify Trends

If the resistance line is broken, there is a possibility of an upward turn?!

Trading techniques should also vary depending on the trend.

Chapter 6: Knowing the Past Can Help You See the Present

Patterns are imbued with human psychology.

4 Patterns That Can Help You Know When to Buy

4 Patterns That Can Help You Know When to Sell

Trend continuity that increases the probability of success

Chapter 7: You can fool the stock price, but you can't fool the trading volume?!

When the opinions of buyers and sellers clash

Four Characteristics of Trading Volume

When past trading volume affects current stock prices

Practical trading strategy using trading volume

Chapter 8: 4 charts recommended by Super Ants!

A chart that breaks through the highest price and renews the new high

A chart that is worth looking forward to if you pay a little attention

Amazing returns that make you forget the fatal flaws

The life of the chart is visible

Part 4 | Valuable Stocks: Investing Together

Chapter 1: Why a Company's Value and Stock Price Differ

Value and price are different

What is the stock price today?

How to Value a Company Based on Assets

Let's figure out cash flow

Chapter 2: Accounting: The Basics of Reading Financial Statements

You need to know how to prepare accounting statements.

Practice examples of resentment when starting a new business

Three Key Accounting Principles

If you understand the principles of preparing financial statements, you can read them.

Chapter 3: Basics of Financial Statements, Assets

A table showing financial status at a specific point in time

3 Assets That Can Be Converted into Cash

The purpose is to gain investment profits

Is it an asset that contributes to profits?

Chapter 4: In-Depth Study of Financial Statements, Liabilities and Equity

Money that must be repaid within one year

What companies does Warren Buffett prefer?

The last item on the balance sheet

Retained earnings are more important than capital surplus

Chapter 5: Income Statement, which shows business performance over a certain period of time

The three most important figures

Located at the top of the income statement

How to Find Companies with High Operating Profits

Even though it's difficult, it's good to know about net income!

Chapter 6: How to Check the Statement of Cash Flows and the Statement of Changes in Equity

A table showing cash flows over a period of time

Let's compare operating activities and cash flow.

The essence of business activity is sales!

Check the capital fluctuations over a certain period of time

Chapter 7: Investing without even knowing the financial ratios?

Compare the value of a company by quantifying it as a ratio

You can see the ability to show profit

Let's predict the future with past and present growth rates.

How stable is this company's financial position?

Chapter 8: How did the masters of value investing invest?

Quantitative Analysis vs.

The Importance of Qualitative Analysis

Invest in great companies, Philip Fisher

Warren Buffett, the Sage of Omaha

Peter Lynch, the master of unwavering investment

Part 5 | Lee Se-moo's Practical Investment Techniques, 8 Tech

Chapter 1: Three-Beat Investment Method

What is the triple-beat analysis method?

Starting with financial statement analysis

Starting with chart analysis

Starting with material analysis

In the end, what you need is knowledge and experience.

Chapter 2: Market Capitalization Comparison

Let's compare stock price and market capitalization.

Let's compare PER vs. market capitalization.

Let's compare and analyze the rankings of the top stocks by market capitalization.

Let's compare and analyze the market capitalization rankings of similar industries.

Small-cap or large-cap stocks, which one is better to target?

Chapter 3: Diversification Techniques

What is diversification?

There are unique advantages to diversifying investments.

How to Build a Portfolio - Sector or Stock?

Diversification at the time of purchase vs. at the price of purchase

Chapter 4: Upper Limit Trading Techniques

Why do we do upper limit analysis?

How do I analyze stocks that are trading at the upper limit?

Direct Trading Application I - Strategy for Stocks with Consecutive Upper Limits

Direct Trading Application II - Strategy for Stocks with Strong Gap Limits

Indirect Trading Application - Theme Stock Strategy

Chapter 5: Matchmaking Trading Techniques

Let's understand the concepts of complementary goods and substitute goods.

Pair Trading I - Theme Stock Trading

Matching Trading II - Equity-Related Companies

Chapter 6: Reporting Stock Trading Techniques

What is trend trading?

How to spot rising trend stocks?

What is the reporting stock trading technique?

Will you ride fire or water?

Chapter 7: Newly Listed Stock Strategy

What is IPO investing? What is newly listed stock investing?

The True Meaning of Targeting Newly Listed Stocks

Direct strategy for newly listed stocks

Indirect strategy for newly listed stocks

Chapter 8: How to Discover Stocks in Your Life

Even everyday life should be focused on stock investment.

How do you discover stocks in your daily life?

What should I be careful of when buying stocks in my daily life?

Detailed image

Into the book

The reason your first trade is important is because your future investment philosophy and motivation to study investment will vary depending on who selected the stock.

--- p.40

For investors who analyze, predict, and respond to the market with HTS in one hand and DART in the other, time will be turned into money.

--- p.67

Finding companies that offer products and services that are popular overseas is the shortcut to catching a TenBagger.

--- p.92

To become a rational stock investor, it is important not to determine where information is obtained, but to clearly distinguish between reflected and unreflected information, whether that information is reflected in the stock price.

--- p.108

When selecting stocks, remember that by creating an optimal portfolio of stocks with the right balance of financial statements, materials, and charts, you can protect yourself from overall market risk.

--- p.110

Even if price analysis yields temporary profits when value and price move separately, neglecting value analysis carries the risk of being out of the market. Therefore, it is not too late to conduct price analysis after establishing value analysis as the foundation.

--- p.230

According to the law of supply and demand, the stock price and trading volume are determined at the point where buying and selling meet.

In other words, trading volume occurs when the opinions of buyers and sellers clash, and the greater the strength of the clash, the greater the trading volume.

--- p.293

The biggest reason why price and value do not match is because information has arisen that was not reflected in the valuation at a specific point in time.

--- p.325

The biggest risk for stock investors is that the stocks they have invested in will be delisted.

For delisted stocks, you can only recover about 5% of your investment at best, but if you fail to sell even that amount during the liquidation period, your investment could be lost in the worst case scenario.

Even just a little bit of financial statement knowledge can help you avoid these stocks.

--- p.40

For investors who analyze, predict, and respond to the market with HTS in one hand and DART in the other, time will be turned into money.

--- p.67

Finding companies that offer products and services that are popular overseas is the shortcut to catching a TenBagger.

--- p.92

To become a rational stock investor, it is important not to determine where information is obtained, but to clearly distinguish between reflected and unreflected information, whether that information is reflected in the stock price.

--- p.108

When selecting stocks, remember that by creating an optimal portfolio of stocks with the right balance of financial statements, materials, and charts, you can protect yourself from overall market risk.

--- p.110

Even if price analysis yields temporary profits when value and price move separately, neglecting value analysis carries the risk of being out of the market. Therefore, it is not too late to conduct price analysis after establishing value analysis as the foundation.

--- p.230

According to the law of supply and demand, the stock price and trading volume are determined at the point where buying and selling meet.

In other words, trading volume occurs when the opinions of buyers and sellers clash, and the greater the strength of the clash, the greater the trading volume.

--- p.293

The biggest reason why price and value do not match is because information has arisen that was not reflected in the valuation at a specific point in time.

--- p.325

The biggest risk for stock investors is that the stocks they have invested in will be delisted.

For delisted stocks, you can only recover about 5% of your investment at best, but if you fail to sell even that amount during the liquidation period, your investment could be lost in the worst case scenario.

Even just a little bit of financial statement knowledge can help you avoid these stocks.

--- p.345

Publisher's Review

One book properly read can change your account.

Learn stock investment directly from Super Ant tax accountant Lee Jeong-yoon.

"The Essential Stock Investment Course: Transforming Beginners into Experts in an Instant" explains the essential fundamentals for beginner investors, from account opening to understanding terminology and industry trends, in an easy-to-understand manner.

Additionally, it addresses beginners' concerns one by one, from "Should I use MTS or HTS?" to "How do I find growth stocks?", and also provides insight into industries that will lead the future, such as AI, semiconductors, and pharmaceutical bio.

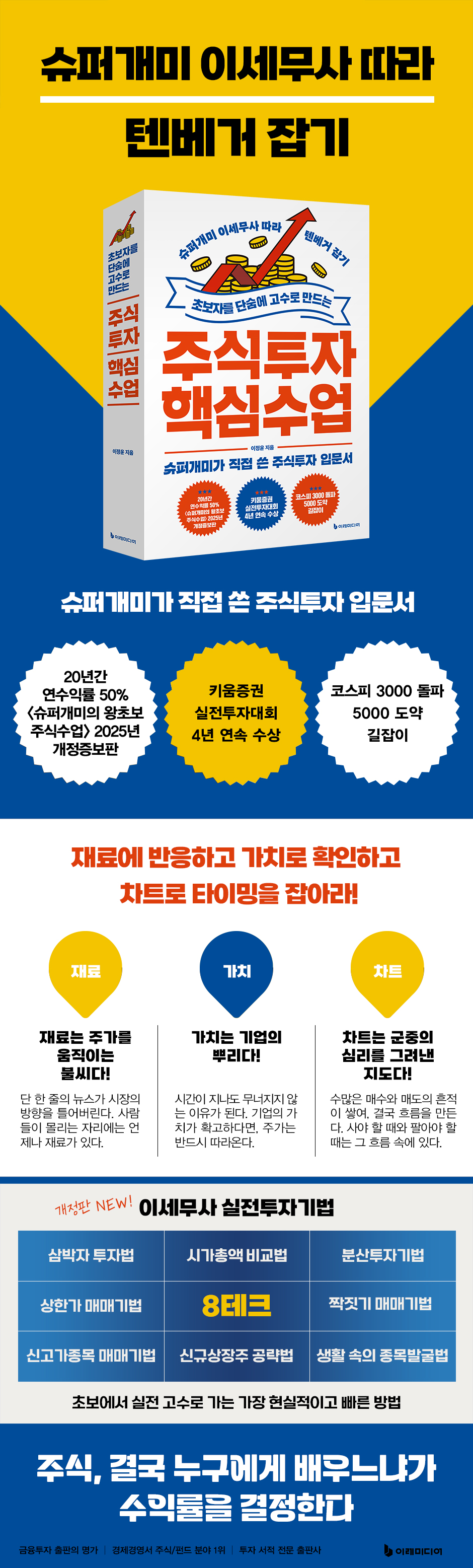

React to the material and identify it with value

Timing with charts!

Super Ant author does not make buy or sell decisions based on just one criterion.

He uses his "Three-Way Investment Method," which considers three key elements: materials, value, and charts, to read the market and capture opportunities.

It organically combines "materials" such as everyday issues and themes, "corporate value analysis" based on financial statements, and "chart analysis" to understand technical trends, enabling wise investment decisions.

The three-pronged investment method, which simultaneously provides the logic behind "why prices rise" and the timing for "when to buy and sell," will serve as the clearest standard for novice investors.

The most realistic and fastest way to go from beginner to expert.

8-Tech Strategy

This revised edition includes tax accountant Lee Jeong-yoon's '8 Tech' technique.

This book condenses the essential knowledge for investors jumping into the market, including the three-beat investment method, market capitalization comparison method, upper-price trading technique, pairing trading technique, new-price stock trading technique, and newly listed stock strategy, along with the author's experience.

There are many books full of theory, but it is rare to find books that contain strategies that directly lead to profits.

"The Essential Stock Investment Course: Transforming Beginners into Experts in an Instant" presents investment principles that remain unwavering even in complex markets.

For beginners just starting out, it will be a starting point for practical experience, and for experienced investors, it will be an opportunity to redefine their standards.

Learn stock investment directly from Super Ant tax accountant Lee Jeong-yoon.

"The Essential Stock Investment Course: Transforming Beginners into Experts in an Instant" explains the essential fundamentals for beginner investors, from account opening to understanding terminology and industry trends, in an easy-to-understand manner.

Additionally, it addresses beginners' concerns one by one, from "Should I use MTS or HTS?" to "How do I find growth stocks?", and also provides insight into industries that will lead the future, such as AI, semiconductors, and pharmaceutical bio.

React to the material and identify it with value

Timing with charts!

Super Ant author does not make buy or sell decisions based on just one criterion.

He uses his "Three-Way Investment Method," which considers three key elements: materials, value, and charts, to read the market and capture opportunities.

It organically combines "materials" such as everyday issues and themes, "corporate value analysis" based on financial statements, and "chart analysis" to understand technical trends, enabling wise investment decisions.

The three-pronged investment method, which simultaneously provides the logic behind "why prices rise" and the timing for "when to buy and sell," will serve as the clearest standard for novice investors.

The most realistic and fastest way to go from beginner to expert.

8-Tech Strategy

This revised edition includes tax accountant Lee Jeong-yoon's '8 Tech' technique.

This book condenses the essential knowledge for investors jumping into the market, including the three-beat investment method, market capitalization comparison method, upper-price trading technique, pairing trading technique, new-price stock trading technique, and newly listed stock strategy, along with the author's experience.

There are many books full of theory, but it is rare to find books that contain strategies that directly lead to profits.

"The Essential Stock Investment Course: Transforming Beginners into Experts in an Instant" presents investment principles that remain unwavering even in complex markets.

For beginners just starting out, it will be a starting point for practical experience, and for experienced investors, it will be an opportunity to redefine their standards.

GOODS SPECIFICS

- Date of issue: August 14, 2025

- Page count, weight, size: 544 pages | 918g | 152*225*34mm

- ISBN13: 9791193394755

- ISBN10: 1193394759

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)