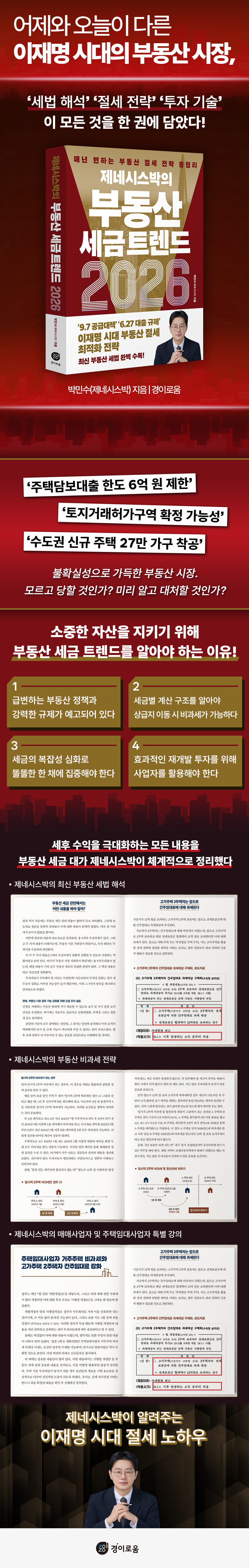

Genesis Park's Real Estate Tax Trends 2026

|

Description

Book Introduction

** Includes real estate regulation response laws such as the '9.7 supply measures' and '6.27 loan regulations'

** Summary of key tax-free strategies for switching to a higher-tier property

In the era of the Lee Jae-myung administration, which is shaking up the real estate market,

Avoid tax traps and maximize your assets wisely!

With the launch of the new government, the real estate market in 2025 is in turmoil.

A barrage of policies and historically recurring tax regulations are penetrating the market faster than ever before.

At this crucial turning point, Genesis Park, the undisputed leader in real estate tax, has published its new book, "Genesis Park's Real Estate Tax Trends 2026."

There have always been government attempts to control housing prices, regardless of whether actual housing prices rise or fall.

But this year, the policy will to lower housing prices is stronger than ever.

The current government's goals are clear.

It is about cooling down the overheated market and restoring order centered on real demand.

The market became even more confused as the 'June 27 loan regulations', 'September 7 supply measures', and 'October 15 real estate measures' were announced one after another.

The author warns that if this trend continues, the preference for smart single-family homes will intensify and real estate polarization could occur.

In this context, he argues that “taxes have now become a key variable in real estate investment,” and that both “transferring to higher-end properties” and “tax-free opportunities” must be seized simultaneously.

Simply paying less tax is not a tax-saving strategy.

The tax-saving strategy pursued in this book is to simultaneously achieve tax savings and increase asset value.

You need to understand the government's real estate policy keynote and direction to determine the optimal tax-saving period.

Investors dreaming of moving to new apartments and upscale properties should pay close attention to pre-sale and occupancy rights, and thoroughly understand the tax calculation structure before selecting a suitable property.

In addition, it is necessary to consider long-term asset succession strategies in accordance with the inheritance tax reform plan, taking into account decades into the future.

For Koreans, ‘real estate’ accounts for the largest proportion of their assets.

Therefore, if you live without knowing anything about the real estate market, you may naturally end up becoming a 'sudden beggar'.

I encourage you to develop a real estate tax strategy today to maximize your after-tax, not pre-tax, returns, along with this book.

** Summary of key tax-free strategies for switching to a higher-tier property

In the era of the Lee Jae-myung administration, which is shaking up the real estate market,

Avoid tax traps and maximize your assets wisely!

With the launch of the new government, the real estate market in 2025 is in turmoil.

A barrage of policies and historically recurring tax regulations are penetrating the market faster than ever before.

At this crucial turning point, Genesis Park, the undisputed leader in real estate tax, has published its new book, "Genesis Park's Real Estate Tax Trends 2026."

There have always been government attempts to control housing prices, regardless of whether actual housing prices rise or fall.

But this year, the policy will to lower housing prices is stronger than ever.

The current government's goals are clear.

It is about cooling down the overheated market and restoring order centered on real demand.

The market became even more confused as the 'June 27 loan regulations', 'September 7 supply measures', and 'October 15 real estate measures' were announced one after another.

The author warns that if this trend continues, the preference for smart single-family homes will intensify and real estate polarization could occur.

In this context, he argues that “taxes have now become a key variable in real estate investment,” and that both “transferring to higher-end properties” and “tax-free opportunities” must be seized simultaneously.

Simply paying less tax is not a tax-saving strategy.

The tax-saving strategy pursued in this book is to simultaneously achieve tax savings and increase asset value.

You need to understand the government's real estate policy keynote and direction to determine the optimal tax-saving period.

Investors dreaming of moving to new apartments and upscale properties should pay close attention to pre-sale and occupancy rights, and thoroughly understand the tax calculation structure before selecting a suitable property.

In addition, it is necessary to consider long-term asset succession strategies in accordance with the inheritance tax reform plan, taking into account decades into the future.

For Koreans, ‘real estate’ accounts for the largest proportion of their assets.

Therefore, if you live without knowing anything about the real estate market, you may naturally end up becoming a 'sudden beggar'.

I encourage you to develop a real estate tax strategy today to maximize your after-tax, not pre-tax, returns, along with this book.

- You can preview some of the book's contents.

Preview

index

Introduction

Chapter 1: Rapidly Changing Policies and the 2026 Real Estate Outlook

What will happen to real estate taxes under the Lee Jae-myung administration?

9.7 Supply Measures and Future Regulatory Directions

6.27 Analysis of Loan Regulations and Future Response Strategies

Inheritance tax reform and its impact on the real estate market

How to Prepare for Real Estate Tax Changes Due to Regulated Area Designations

3 Steps to Successful Investments and Tax Savings in a Rapidly Changing Real Estate Policy

Chapter 2 Smart Holding Strategies - Acquisition and Holding Taxes

Understanding acquisition tax reveals investment strategies.

Gangnam's "property tax bomb" has caused housing prices to soar, and future countermeasures are needed.

Chapter 3: The Key to Tax Savings - Transfer Tax and Tax-Free Strategies

5 Ways to Get Tax-Free on Your First Home Despite Loan Regulations

Why do I have to live in a non-regulated area?

Why You Should Be Caution 3-4 Months After Selling a Home

Tax exemption for two houses using carryover tax and low-price transfer

The temporary tax exemption for two homes is the biggest concern for those who own two homes.

Chapter 4 Tax Exemption for Pre-sale Rights and Special Circumstances

Everything you need to know about tax exemptions for transferring to higher-end properties

Tax-free strategies when you have subscription rights

8 Common Mistakes to Avoid with the Tax-Exemption of Sangsaeng Rental Housing

Complete Guide to Tax-Free Transfers Using Residential Tenancy Rights

Chapter 5: The Art of Asset Succession - Gifts and Inheritance

How to Protect Your Valuable Assets, Gifts, or Inheritances

Five Tax-Saving Tips for Gifts and How to Secure Funds for Tax Payments

Three Ways to Leave a Billion Won Apartment to Your Children

Chapter 6 Housing Rental Businesses and Sales Businesses

The trading business has become a trend.

The revival of the six-year short-term lease and how it can be utilized by housing rental business operators.

Tax exemption for residential housing for housing rental business operators and strengthening of deemed rental rates for owners of two expensive homes

Housing Rental Income Tax and Yield Optimization Strategies

Chapter 1: Rapidly Changing Policies and the 2026 Real Estate Outlook

What will happen to real estate taxes under the Lee Jae-myung administration?

9.7 Supply Measures and Future Regulatory Directions

6.27 Analysis of Loan Regulations and Future Response Strategies

Inheritance tax reform and its impact on the real estate market

How to Prepare for Real Estate Tax Changes Due to Regulated Area Designations

3 Steps to Successful Investments and Tax Savings in a Rapidly Changing Real Estate Policy

Chapter 2 Smart Holding Strategies - Acquisition and Holding Taxes

Understanding acquisition tax reveals investment strategies.

Gangnam's "property tax bomb" has caused housing prices to soar, and future countermeasures are needed.

Chapter 3: The Key to Tax Savings - Transfer Tax and Tax-Free Strategies

5 Ways to Get Tax-Free on Your First Home Despite Loan Regulations

Why do I have to live in a non-regulated area?

Why You Should Be Caution 3-4 Months After Selling a Home

Tax exemption for two houses using carryover tax and low-price transfer

The temporary tax exemption for two homes is the biggest concern for those who own two homes.

Chapter 4 Tax Exemption for Pre-sale Rights and Special Circumstances

Everything you need to know about tax exemptions for transferring to higher-end properties

Tax-free strategies when you have subscription rights

8 Common Mistakes to Avoid with the Tax-Exemption of Sangsaeng Rental Housing

Complete Guide to Tax-Free Transfers Using Residential Tenancy Rights

Chapter 5: The Art of Asset Succession - Gifts and Inheritance

How to Protect Your Valuable Assets, Gifts, or Inheritances

Five Tax-Saving Tips for Gifts and How to Secure Funds for Tax Payments

Three Ways to Leave a Billion Won Apartment to Your Children

Chapter 6 Housing Rental Businesses and Sales Businesses

The trading business has become a trend.

The revival of the six-year short-term lease and how it can be utilized by housing rental business operators.

Tax exemption for residential housing for housing rental business operators and strengthening of deemed rental rates for owners of two expensive homes

Housing Rental Income Tax and Yield Optimization Strategies

Detailed image

Into the book

This trend could lead to instability in the rental market, and it cannot be ruled out that some rental demand may shift to sales demand.

In particular, since new supply in central areas, including Seoul, remains insufficient and the preference for central areas continues, it is highly likely that price increases will begin first in key residential areas.

The trend could begin in earnest in the first half of 2026, but could begin as early as the end of 2025.

--- p.18

The Ministry of Land, Infrastructure and Transport and the Seoul Metropolitan Government announced that they will strengthen crackdowns on unfair transactions such as ‘inflating housing prices.’

“If illegal activities are confirmed, we plan to respond strictly with a zero-tolerance policy,” he said, adding that they plan to check whether there are violations of the actual residency requirement for apartments subject to land transaction permits and impose a performance enforcement fine of up to 10% of the actual transaction price on violators.

If the actual transaction price of an apartment is 2 billion won, this means that a performance enforcement fine of up to 200 million won must be paid, which is by no means a level that can be taken lightly.

--- p.55

When it comes to saving on capital gains tax, it is important to receive a lot of necessary expenses and hold the property for at least two years.

If you include joint ownership here, it is safe to say that you have saved at least 80% of the tax you can on general transfer taxes.

But what are the things I need to be aware of when filing a capital gains tax return after selling a home? For example, when is the filing deadline, and if it's exempt, is it absolutely necessary? I heard that if I sell more than two properties in a year, they're combined for tax purposes. How do I handle that?

--- p.139

Pre-sale rights are one of the most popular products, both past and present.

Above all, this is because of the recent worsening trend of preference for new construction, also known as 'freezing to death to build', and in the case of complexes with a maximum sale price, a certain level of price difference is possible from the time of purchase.

The problem is that the tax-free strategy we must take advantage of when we have these housing subscription rights may be completely different from what we knew.

In other words, if I acquire the right to purchase a house while I already have a previous house, does that mean that if I dispose of it within 3 years, the previous house will be exempt from taxation?

--- p.200

Interest in and popularity of individual traders remains strong.

In particular, using auctions and public sales to find items at prices lower than market prices is currently the most useful method.

As the name suggests, a real estate brokerage is a business that buys and sells real estate. However, it is very different from the existing gap investment method of investing with taxes, and there are many things to be careful about.

--- p.283

The government releases a 'tax law amendment' around the end of July every year.

And when the law is revised in the National Assembly at the end of the year, as a follow-up measure, the ‘Enforcement Decree Revision (Draft)’ is announced at the beginning of the following year.

Unlike tax law revisions, enforcement ordinance revisions are likely to pass without major issues, as the government only needs to hold a cabinet meeting and then promulgate them.

And usually the final decision is made in February (of course this is subject to change).

Because of these procedural characteristics, it is very important for investors to understand and prepare the contents of the revised enforcement ordinance in advance.

In particular, since new supply in central areas, including Seoul, remains insufficient and the preference for central areas continues, it is highly likely that price increases will begin first in key residential areas.

The trend could begin in earnest in the first half of 2026, but could begin as early as the end of 2025.

--- p.18

The Ministry of Land, Infrastructure and Transport and the Seoul Metropolitan Government announced that they will strengthen crackdowns on unfair transactions such as ‘inflating housing prices.’

“If illegal activities are confirmed, we plan to respond strictly with a zero-tolerance policy,” he said, adding that they plan to check whether there are violations of the actual residency requirement for apartments subject to land transaction permits and impose a performance enforcement fine of up to 10% of the actual transaction price on violators.

If the actual transaction price of an apartment is 2 billion won, this means that a performance enforcement fine of up to 200 million won must be paid, which is by no means a level that can be taken lightly.

--- p.55

When it comes to saving on capital gains tax, it is important to receive a lot of necessary expenses and hold the property for at least two years.

If you include joint ownership here, it is safe to say that you have saved at least 80% of the tax you can on general transfer taxes.

But what are the things I need to be aware of when filing a capital gains tax return after selling a home? For example, when is the filing deadline, and if it's exempt, is it absolutely necessary? I heard that if I sell more than two properties in a year, they're combined for tax purposes. How do I handle that?

--- p.139

Pre-sale rights are one of the most popular products, both past and present.

Above all, this is because of the recent worsening trend of preference for new construction, also known as 'freezing to death to build', and in the case of complexes with a maximum sale price, a certain level of price difference is possible from the time of purchase.

The problem is that the tax-free strategy we must take advantage of when we have these housing subscription rights may be completely different from what we knew.

In other words, if I acquire the right to purchase a house while I already have a previous house, does that mean that if I dispose of it within 3 years, the previous house will be exempt from taxation?

--- p.200

Interest in and popularity of individual traders remains strong.

In particular, using auctions and public sales to find items at prices lower than market prices is currently the most useful method.

As the name suggests, a real estate brokerage is a business that buys and sells real estate. However, it is very different from the existing gap investment method of investing with taxes, and there are many things to be careful about.

--- p.283

The government releases a 'tax law amendment' around the end of July every year.

And when the law is revised in the National Assembly at the end of the year, as a follow-up measure, the ‘Enforcement Decree Revision (Draft)’ is announced at the beginning of the following year.

Unlike tax law revisions, enforcement ordinance revisions are likely to pass without major issues, as the government only needs to hold a cabinet meeting and then promulgate them.

And usually the final decision is made in February (of course this is subject to change).

Because of these procedural characteristics, it is very important for investors to understand and prepare the contents of the revised enforcement ordinance in advance.

--- p.315

Publisher's Review

'It's a non-regulated area, so why do I need to reside there for two years to be tax-exempt?'

What are the pitfalls of tax exemption for shared rental housing that are easy to miss?

'I own two homes. Is there really no way to get both of them tax-exempt?'

Who survives in the real estate market is determined by 'taxes'!

Genesis Park's tax-saving technology turns tax regulations into opportunities for asset growth.

Real estate taxes are visible as much as you know, and you can save as much as you know.

In this volatile real estate market, how much do you know about tax savings? Most real estate investors focus on analyzing locations and predicting prices, but they don't pay much attention to calculating taxes, which determines investment returns.

In a world of increasingly stringent regulations, we must realize that differences in tax knowledge can make a difference of hundreds of millions of won in profits and losses.

The real estate market in 2026 is expected to see further polarization and concentration of "smart" properties due to various regulations and measures.

In a climate of heavy acquisition and transfer taxes, one wrong decision can wipe out assets accumulated over many years.

Not only those without homes, but also those with one or multiple homes all need new survival strategies in their respective positions.

Therefore, you need to develop a realistic tax saving strategy that is best for you.

Genesis Park, a leading expert in real estate tax, has thoroughly analyzed the latest policies and tax law amendments in "Genesis Park's Real Estate Tax Trends 2026," including tips for simultaneously seizing both "tax-saving opportunities" and "investment opportunities."

First, we predicted the direction of the new government's real estate tax policy, identified the hidden meaning behind the policy, and drew up a blueprint for the market.

Next, we summarized the techniques for ‘well’ holding assets and the methods for ‘well’ selling them in the ‘smart one-chae’ era.

We've completely explained all the possible scenarios, from how to avoid excessive acquisition tax to the "temporary second home tax exemption" that many investors miss.

In addition, as the complexity of investment increases, complex tax-free regulations that vary depending on the order and timing of acquisition, such as 'house + subscription right' and 'subscription right + house', have been organized.

In particular, we have revealed all the tax-free strategies that many people make mistakes with, including the tax-free 'mutual rental housing', 'carryover taxation', and 'low-price transfer'.

Finally, it generously includes expert-level techniques known only to those in the know, such as how to maximize profits by linking redevelopment investment with the revived '6-year short-term lease' system and how to utilize individual real estate agents to save taxes on short-term sales.

If you're worried about what will happen to housing prices in the future or wondering which home to buy to build your wealth, you can't put off studying taxes any longer.

This book, which covers both the present and future of real estate taxes, aims to help you become a wise investor who can protect your valuable assets and increase your after-tax returns.

What are the pitfalls of tax exemption for shared rental housing that are easy to miss?

'I own two homes. Is there really no way to get both of them tax-exempt?'

Who survives in the real estate market is determined by 'taxes'!

Genesis Park's tax-saving technology turns tax regulations into opportunities for asset growth.

Real estate taxes are visible as much as you know, and you can save as much as you know.

In this volatile real estate market, how much do you know about tax savings? Most real estate investors focus on analyzing locations and predicting prices, but they don't pay much attention to calculating taxes, which determines investment returns.

In a world of increasingly stringent regulations, we must realize that differences in tax knowledge can make a difference of hundreds of millions of won in profits and losses.

The real estate market in 2026 is expected to see further polarization and concentration of "smart" properties due to various regulations and measures.

In a climate of heavy acquisition and transfer taxes, one wrong decision can wipe out assets accumulated over many years.

Not only those without homes, but also those with one or multiple homes all need new survival strategies in their respective positions.

Therefore, you need to develop a realistic tax saving strategy that is best for you.

Genesis Park, a leading expert in real estate tax, has thoroughly analyzed the latest policies and tax law amendments in "Genesis Park's Real Estate Tax Trends 2026," including tips for simultaneously seizing both "tax-saving opportunities" and "investment opportunities."

First, we predicted the direction of the new government's real estate tax policy, identified the hidden meaning behind the policy, and drew up a blueprint for the market.

Next, we summarized the techniques for ‘well’ holding assets and the methods for ‘well’ selling them in the ‘smart one-chae’ era.

We've completely explained all the possible scenarios, from how to avoid excessive acquisition tax to the "temporary second home tax exemption" that many investors miss.

In addition, as the complexity of investment increases, complex tax-free regulations that vary depending on the order and timing of acquisition, such as 'house + subscription right' and 'subscription right + house', have been organized.

In particular, we have revealed all the tax-free strategies that many people make mistakes with, including the tax-free 'mutual rental housing', 'carryover taxation', and 'low-price transfer'.

Finally, it generously includes expert-level techniques known only to those in the know, such as how to maximize profits by linking redevelopment investment with the revived '6-year short-term lease' system and how to utilize individual real estate agents to save taxes on short-term sales.

If you're worried about what will happen to housing prices in the future or wondering which home to buy to build your wealth, you can't put off studying taxes any longer.

This book, which covers both the present and future of real estate taxes, aims to help you become a wise investor who can protect your valuable assets and increase your after-tax returns.

GOODS SPECIFICS

- Date of issue: October 29, 2025

- Page count, weight, size: 352 pages | 172*235*20mm

- ISBN13: 9791194508601

- ISBN10: 119450860X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)