300 Questions and Answers on Economic News

|

Description

Book Introduction

The choice of 900,000 readers! The longest-running bestseller for 27 years!

The only "real economics textbook" chosen by universities, businesses, and economic journalists.

Perfectly reflecting new economic trends and the latest economic information

[300 Questions and Answers on Economic News] Revised and Expanded Edition to be Published in 2025

In an age of uncertainty, the answers lie in economic news.

Economic common sense is no longer knowledge, but a necessity for survival.

So, where and how should we begin to easily approach this difficult field of economics? The answer lies in economic news. Every day, we're bombarded with economic news and articles, whether on TV, in the newspaper, or even on our phones.

Only by properly grasping the context hidden within economic articles can you develop the ability to accurately discern which elements are "opportunities" and which elements are "risks" for you.

If you still find economic knowledge difficult, and if you can't even distinguish which economic information is useful among the numerous economic information,

Now, we must begin studying the 'real economy' with 『300 Questions and Answers on Economic News』.

"300 Questions and Answers on Economic News" is an introductory book to practical economics that explains "economic principles and the real economy" in an easy-to-understand manner so that even readers who do not major in economics can understand economic trends in a short period of time.

By selecting only the latest economic articles and providing easy-to-understand explanations of economic principles along with 'article comprehension,' it will be even more useful for those seeking to avoid economic risks and seize upcoming opportunities.

The only "real economics textbook" chosen by universities, businesses, and economic journalists.

Perfectly reflecting new economic trends and the latest economic information

[300 Questions and Answers on Economic News] Revised and Expanded Edition to be Published in 2025

In an age of uncertainty, the answers lie in economic news.

Economic common sense is no longer knowledge, but a necessity for survival.

So, where and how should we begin to easily approach this difficult field of economics? The answer lies in economic news. Every day, we're bombarded with economic news and articles, whether on TV, in the newspaper, or even on our phones.

Only by properly grasping the context hidden within economic articles can you develop the ability to accurately discern which elements are "opportunities" and which elements are "risks" for you.

If you still find economic knowledge difficult, and if you can't even distinguish which economic information is useful among the numerous economic information,

Now, we must begin studying the 'real economy' with 『300 Questions and Answers on Economic News』.

"300 Questions and Answers on Economic News" is an introductory book to practical economics that explains "economic principles and the real economy" in an easy-to-understand manner so that even readers who do not major in economics can understand economic trends in a short period of time.

By selecting only the latest economic articles and providing easy-to-understand explanations of economic principles along with 'article comprehension,' it will be even more useful for those seeking to avoid economic risks and seize upcoming opportunities.

- You can preview some of the book's contents.

Preview

index

004 Introduction: Knowing the economy gives you a perspective that sees through the world!

Chapter 1 | How the Economy Works

021 What is the Economy?

022 What does it mean when the economy grows?

023 How do you know the state of the economy?

024 Microeconomics and Macroeconomics: What's the Difference?

026 What's the Difference Between the Real Economy and the Financial Economy?

028 How Finance Affects the Real Economy

030 Capitalism and Socialism: What's the Difference?

031 How the Market Drives the Economy

034 How Capitalism Arose and How Socialism Fell

039 How does European social democracy differ from capitalism?

043 Can the Far Right Solve Europe's Economic Crisis?

Chapter 2 | Match

049 When is a good time for the game?

051 A game that was going well, how did it suddenly fall apart?

055 How to understand the flow of the game

059 How do production, shipments, and inventory move when the economy worsens?

060 It's a recession, but inventory is decreasing?

062 Why do interest rates rise when the economy improves?

064 When will interest rates rise even though the economy is bad?

067 Why is economic policy necessary?

070 How can fiscal policy revive the economy?

076 How can monetary policy revive the economy?

A History of the Modern Korean Economy Through Economic Trends:

080 ① The recession caused by the oil shock in the 1970s

083 ② 1980s~early 1990s, 3 low boom

087 ③ Late 1990s, low yen, recession, and collapse of conglomerates

093 ④ 1997-1998, recession caused by the foreign exchange crisis

098 ⑤ 1999~2003, a short economic recovery and a domestic recession following an overseas recession

100 ⑥ 2004~2007, deepening domestic recession due to failure to respond to real estate speculation

102 ⑦ 2008~2012, domestic economic recession aggravated by large corporation-biased policies and overseas economic crises

106 ⑧ 2013~2016, Chronic recession due to neglect of economic issues

108 ⑨ 2017-2021, polarization deepens due to failures in growth and real estate policies.

Chapter 3 | Prices

115 How is the price of watermelon determined?

118 How much should I sell it for to sell more?

119 You're saying that the candy seller can't set the price of candy as he pleases?

Why do prices rise when the economy improves?

122 How Household Consumption Drives Prices

124 Why do prices rise when oil prices rise?

Article Reading: Producer Price Index Increases Due to Rising International Oil Prices

126 What moves the price?

Political Economy of Oil:

128 ① Why are Middle Eastern oil prices always a problem?

130 ② Why is the United States intervening in the Middle East?

Article: Is a fifth Middle East war on the horizon? "The US is out," Iran warns, imminently attacking Israel.

Why is it a problem if oil prices fall?

134 ① Why the oil price plunge is a blow to both oil-producing and oil-importing countries

137 ② Why did oil prices plummet in 2014?

139 ③ Why did oil prices plummet in 2020?

141 How do you know the price fluctuations?

The Bank of Korea stated that the slowdown in inflation in April was in line with expectations, but added that uncertainty in agricultural and oil prices remains high.

144 How to find out consumer and producer prices

146 Core Inflation and Headline Inflation: What's the Difference?

149 How is inflation expectations measured?

February expected inflation remains at 3.0%... "Perceived inflation still high"

150 You're not just looking at prices with the consumer price index?

152 Why Are Official Prices and Perceived Prices Different?

The article claims that inflation is slowing, but perceived inflation remains high.

154 How Inflation Crashes the Economy

159 Why Inflation Is the Enemy of the Common People and an Opportunity for the Rich

162 Why You Should Be Careful About Inflation When Investing in Real Estate and Stocks

163 Why Does Inflation Lead to Consumption Polarization?

165 When will inflation occur?

167 How to Prevent Demand-Driven Inflation

170 How to Respond to Cost Inflation and Stagflation

175 What's the problem with deflation?

How did the Japanese economy fall into deflation?

179 ① Inflation in the United States in the late 1970s and Volcker's high interest rate policy

186 ② The Plaza Accord and the High Yen Recession

189 ③ Low interest rates and fiscal expansion, creating a bubble economy

194 Why did Japan's economy continue to experience deflation?

When will stagflation come?

Article: "Rising prices and slowing growth" raises concerns about 1970s-style stagflation in the US.

205 Who sees the raw material prices?

Article: "The fight against inflation isn't over"... Raw materials prices continue to soar.

International oil prices fall... WTI down 1.39%

210 How to Trade Commodity Futures

Global grain prices are falling… Government: "Domestic supply and demand are stable."

213 How are crude oil prices determined?

[International Oil Prices] Rise on Decreasing US Crude Oil Inventories

215 Why do crude oil prices always fluctuate?

218 Who controls non-ferrous metal prices?

Article Reading [Non-Ferrous Metal Focus] Nickel Price at $18,000... Indonesia to Mine Battery Nickel Until 2069

Are you predicting the global economy based on the price of 220 copper?

Pungsan shares hit a new 52-week high on strong copper prices.

222 How does the price of gold move?

Article Comprehension [Today's Gold Price] International gold prices fall more than 2%... What is the domestic gold price?

226 How to invest in gold

229 How do grain prices move?

Grain prices surge following Russian bombing of the Danube River, reaching a five-month high.

233 What indicators can be used to read grain market trends?

Chapter 4 | Finance

237 What is Finance?

239 Why can't I just print and spend money?

242 Why is monetary policy important?

244 How Interest Rate Policy Changes Financial Flows

248 How does the Bank of Korea determine its base interest rate?

251 How is the US benchmark interest rate determined?

254 How are European interest rates determined?

256 How Monetary Policy Works: Open Market Operations/Lending and Depositing Systems/Reserve Ratio Adjustments

The Bank of Korea fined Hana Bank 15.7 billion won for failing to meet its reserve requirements.

271 Where will the economy go when finance tightens?

275 Where will the economy go when monetary policy is eased?

278 What's the Difference Between Monetary Easing and Quantitative Easing?

Federal Reserve Chairman Powell: "If we taper quantitative easing, it will be like 2013."

The Federal Reserve is also implementing quantitative tightening at full speed... Fed governor: "I'm pleased" with market panic

285 What kind of financial institutions are there?

291 How do short-term financial markets work?

298 What is the relationship between long-term financial markets and capital markets?

298 What's the Difference Between Direct and Indirect Financial Markets?

301 How the International Financial Market Works

KB Kookmin Bank Issues $600 Million in Senior Global Bonds

305 What's the difference between the public interest rate and the real interest rate?

307 Real Interest Rate Movements: What Can We See?

Article Comprehension [Stock Market Data] Bond Yields (May 28)

Why do corporate bonds with lower credit ratings have higher interest rates?

310 Credit Rating: Who Does It and How?

312 Credit Ratings: How They Determine a Company's Life or Death

Kwangdong Pharmaceutical issues 15 billion won in corporate bonds, plans to repay debt

Hanon Systems Preemptively Refinances to Prepare for Credit Rating Downgrade

316 Credit Ratings: How They Shaken the National Economy

WSJ article: "Italian bonds surge as downgrade risk averted."

Why do bonds become riskier when the interest rate gap between corporate and government bonds widens?

April corporate bond market volatile, with 6.5 trillion won maturing... authorities grappling with anxiety

324 Are corporate bonds risky?

Growing preference for risky assets… Corporate bond spreads narrow to pre-COVID levels

327 Market Interest Rates: What Raises and Lowers Them?

328 Is it cheaper if you can move freely?

How Interest Rates Regulate the Economy

333 Why doesn't investment increase even when interest rates are low?

335 Real Estate or Stocks: Which is Better in a Time of Low Interest Rates?

338 What is leveraged investing?

Why do I lose money when I deposit 340?

Why is the interest higher when calculated using 344 compound interest?

345 How the Private Debt Market Works

Unscrupulous loan sharks charge 400,000 won in advance interest on a 1 million won loan.

349 Why the Underground Economy is Bad

Will the Bank of Korea accelerate its CBDC efforts, ushering in the era of digital currency?

Chapter 5 | Securities

What are 355 securities?

What is 356 stock?

How issuing 358 shares can help grow a company.

How is the share issuance price determined?

Who benefits when 360 shares rise?

363 Stock Trading: Where and How to Do It

What kind of market is the 365 over-the-counter market?

How to place a 367 buy/sell order

How to Read the 369 Stock Price Chart

371 Why are there upper and lower price limits?

What can we learn from looking at the KOSPI 372?

Article Reading: KOSPI closes flat

Why is the KOSDAQ index benchmark set at 1000?

[KOSDAQ Closing] Ants' "Fate"... 830 Level Just Hanging in

Why Look at the Dow, Nasdaq, and S&P 500?

[Comprehensive] The Dow Jones Industrial Average surged by the largest margin of the year, but the New York Stock Exchange remained mixed.

379 When is the stock price going up when the game is bad?

380 How Interest Rates and Stock Prices Move

Why do our stock prices fall when interest rates rise?

Why do our stock prices rise when interest rates fall?

Why Stock Investors Should Be Wary of Hot Money

Will the global "hot money" that underpinned China's economy boom backfire?

390 How Hedge Funds Sway Stock Prices

Samsung Electronics and Kakao's "National Stocks" Fall... Behind the Scenes: Foreigners Who Made 10 Trillion Won Short-Term Trading

394 Where do stock prices go when prices rise?

How the 397th election moves stock prices

Stocks related to Han Dong-hoon, Cho Kuk, and Lee Jae-myung plummet after the general election.

399 Value Stocks vs. Growth Stocks: Which Should You Buy?

The battle between value stocks and growth stocks continues... KOSPI rebounds after three trading days.

What is a 401 dividend?

Why Operation 404 is Dangerous

The second trial verdict also stated, "Kim Gun-hee's account was operated under the direction of Kwon Oh-soo."

406 Illegal Insider Trading: Why Does It Continue?

408 Public Notice, Don't Trust It Too Much?

The Korea Exchange and Alpha Holdings were designated as unfaithful disclosure companies for their "public disclosure changes."

What is a 411 bond?

412 What are coupon bonds, compound bonds, and discount bonds?

When to Buy and When to Sell 414 Bonds

416 Why do bond prices fall during inflation?

How do bond yields, bond prices, and market interest rates move?

Why are bond yields and market interest rates the same?

424 What are the differences between government bonds, financial bonds, and special bonds?

What's special about 426 special bonds?

First-quarter bond-related rights exercise reached KRW 951.4 billion, a 37% decrease from the previous quarter.

Where to buy 430 bonds

Why do yields on long- and short-term bonds reverse when the economy worsens?

How can the difference between short-term and long-term interest rates determine the direction of the economy?

The gap between short-term and long-term interest rates is narrowing rapidly... Is this a sign of an economic slowdown?

435 If the short-term and long-term interest rates invert, will the economy really get worse?

Article Reading: Inversion of short-term and long-term interest rates… A signal of economic recession?

Is this a sign of a recession? The spread between US short-term and long-term Treasury yields inverted for the first time in two and a half years.

Amidst fears of austerity, interest rate shocks hit... 3-year yields soar, leading to the first-ever 30-year yield inversion.

Why do short-term bond yields rise when prices rise?

442 How Does the US Federal Reserve's Interest Rate Sway Bond Yields and the Economy?

Why Does an Inverted Bond Yield Curve Lead to a Worsening Economy?

"Bond King" Gundlak: "This time, don't believe anyone who says the bond yield curve doesn't matter."

447 How Does Yield Curve Control Work?

449 How Finance Destroys the Economy: The Full Story of the 2008 US-Emerging Global Financial Crisis

Chapter 6 | Foreign Exchange

When we talk about the 457 exchange rate, why do we talk about the dollar exchange rate?

How to display the 459 exchange rate

461 What happens to the won price when the exchange rate changes?

462 Exchange Rate: Where and How is it Determined?

464 China has two exchange rate systems?

Yuan depreciates 0.02% to 7.1097 yuan

Why do currency exchange rates increase in proportion to a country's strength?

How the $468 Became a Reserve Currency

How to Read the 474 Forex Rate Table

Why do exports go well when the won is 479?

Why do prices rise when the dollar-won exchange rate rises to 480?

484 Why do exchange rates follow inflation?

The Bank of Korea said, "The surge in international raw material prices has exacerbated the won's weakness."

Why can't exports be made when the 487 won is low?

Why did stock prices fall when the price hit 490 won?

Where will the stock price go when the 492 'original text' is published?

Why do currency prices rise when the economy improves?

495 Is there a way to beat the 'original' recession?

Why is the 496 yen low a red light for our exports?

Super Yen hits for the first time in 37 years... Warning signs for Korean car and oil exports

How the 'Super N-G' of 2024 Appeared

Japanese people, impoverished by the super-engine, say they have become a "cheap country."

502 Why a Strong Yen Is a Trap for the Korean Economy

503 Why does the government intervene in the foreign exchange market?

Authorities verbally intervene as the exchange rate breaks 1,400 won... "Watch closely for oversupply."

508 How much foreign exchange reserves are needed?

We need to defend the exchange rate, but foreign exchange reserves are a concern.

Why is Hong Kong's exchange rate system shaking as US interest rates rise?

Hong Kong spent 28 trillion won in three months defending its currency peg, raising concerns about its currency peg.

Where do currency prices go when interest rates move?

Where will the dollar-won exchange rate go when the US interest rate fluctuates?

Where will the Korean-Japanese exchange rate and stock prices go when the US interest rate fluctuates?

Why does the yen price fall when a 520 yen carry trade occurs?

The yen is nearing 152 yen per dollar... Yen carry trade accelerates yen depreciation.

526 Yen Carry Liquidation: Why Is It Causing a Stock Price Crash?

KOSPI closes with 8% plunge, biggest drop ever, on 'worst day ever'

The liquidation of yen carry, which led to the global stock market crash, is underway. "There's still a long way to go."

Chapter 7 | Balance of Payments and Trade

531 Why Look at the Balance of Payments?

532 How is the Balance of Payments Calculated?

Read the 539 Balance of Payments News

The semiconductor industry's boom led to a 10th consecutive month of current account surplus in February, reaching $6.86 billion.

When you calculate the balance of payments, it always comes out as '0'?

Article Reading: Balance of Payments Expected to Maintain Surplus for 5th Month

Prime Minister Han: "The balance of payments will decrease compared to last year, but a surplus of $40-50 billion is possible."

543 What's the Difference Between the Balance of Goods and the Balance of Trade?

Article Reading ① March Current Account Balance of $6.93 Billion... 11th Consecutive Month of Surplus on Semiconductor Exports

Article Reading ② [Breaking News] March exports hit $56.6 billion, up 3.1% year-on-year… 10th consecutive month of trade surplus

546 Where does the exchange rate go when the current account is in surplus or deficit?

The US dollar is weak, but the won-dollar exchange rate is approaching 1,330 won, a record high. Why?

Where will the current account balance go when the dollar-won exchange rate moves to 549?

551 Current Account Surplus I'm Not Happy About It What is a Recession-Type Surplus?

Article: "The current account surplus will widen further this year." Is a $50 billion surplus possible?

553 When is a current account surplus burdensome even when there is no recession?

555 Current Account Deficit: How It Causes a Foreign Exchange Crisis

558 Foreign Debt At least we are facing a foreign debt crisis?

Where are currency swaps between 560 countries used?

Korea and Malaysia to Renew 5 Trillion Won Currency Swap Agreement by Year-End

Why is the service balance in perpetual deficit?

564 Where is our trade?

566 Can we give up on the Chinese market?

570 Why is exporting so much to the US and China a problem?

573 Why Capital Goods Imports Are Important

574 Why Korea's Trade Should Surpass Japan's

Article Reading: "57 Years of Deficit"... Cumulative Trade Deficit with Japan Hits 926 Trillion Won

580 How to Foster Triangular Trade Between Korea, China, and Japan

585 You shouldn't rely too much on trade?

Korea's high dependence on trade... Busy seeking new opportunities through visits and legislation

590 Why does the US "monitor" other countries' currency exchange rates?

US includes South Korea on currency monitoring list, redesignating after a year

592 Where is the global market headed?

598 Why the US-China Trade War Continues

Article: US-China trade conflict intensifies… Electric vehicle subsidies on the rise

Chapter 8 | Economic Indicators

How to Create 607 Economic Indicators

609 Why Should Economic Statistics Be Based on a "Standard"?

OECD forecasts 2.6% growth for Korea this year, significantly raising its forecast

610 Why Clear Statistics Are Actually Blurry: Base Effects

Household spending rose 3.9% last year, reaching a 10-year high due to the base effect.

613% vs. %points, what's the difference?

The number of employed people increased by 173,000 in March, reaching a record high of 62.4% in the employment rate for March.

615 How is the size of an economy measured: GDP

Korea's economic size plummets to 14th place for the first time in 11 years, necessitating a strong drive for structural reform.

OECD Q2 GDP rises 0.4%, bringing cumulative growth since the pandemic to 5.1%

Korea's household debt ratio stands at 100.1%... "We expect it to fall below 100% this year."

Why doesn't the economy grow as much as GDP?: Nominal and Real GDP

China's share of the global economy has declined for the first time in 30 years.

623 How is economic growth measured? Real GDP growth rate

626 Why does our potential growth rate continue to fall?

Korea's potential growth rate continues to plummet since 2011.

What can we learn from the 630 GDP gap?

The Bank of Korea: "The GDP gap is likely to remain positive... Inflationary pressure is exerting."

633 Why is national income measured by GNI?

National income shrank by the largest margin in a year.

How is GNI calculated?

637 What is the difference between GNI, GNP, and GDP?

638 Why do trade terms change?

Soaring exchange rates and worsening terms of trade are dragging down national income.

639 How are the terms of trade measured?

Why does national income differ from purchasing power?

How does the 644 Big Mac exchange rate differ from the market rate?

What's the problem if the GDP deflator is negative?

China's producer prices remain negative for 18 consecutive months... "Similar to Japan's bubble burst in 1995."

How can you gauge economic trends by looking at the 649 Composite Economic Index?

Why we can't smile despite the triple increase in production, consumption, and investment... Leading indicators have already fallen.

How to read the game with 658 BSI

Business Survey Index (BSI) Trends

661 What's the Difference Between the Real Unemployment Rate and the Real Unemployment Rate?

The number of employed people increased by 173,000 in March, but it was the lowest in 37 months.

665 How to Increase Added Value

The petrochemical industry is grappling with China's oversupply... "High value-added products are the only way to survive."

Appendix 669 | Economics Article Reading Techniques

684 Economic Terms to Look Up

Chapter 1 | How the Economy Works

021 What is the Economy?

022 What does it mean when the economy grows?

023 How do you know the state of the economy?

024 Microeconomics and Macroeconomics: What's the Difference?

026 What's the Difference Between the Real Economy and the Financial Economy?

028 How Finance Affects the Real Economy

030 Capitalism and Socialism: What's the Difference?

031 How the Market Drives the Economy

034 How Capitalism Arose and How Socialism Fell

039 How does European social democracy differ from capitalism?

043 Can the Far Right Solve Europe's Economic Crisis?

Chapter 2 | Match

049 When is a good time for the game?

051 A game that was going well, how did it suddenly fall apart?

055 How to understand the flow of the game

059 How do production, shipments, and inventory move when the economy worsens?

060 It's a recession, but inventory is decreasing?

062 Why do interest rates rise when the economy improves?

064 When will interest rates rise even though the economy is bad?

067 Why is economic policy necessary?

070 How can fiscal policy revive the economy?

076 How can monetary policy revive the economy?

A History of the Modern Korean Economy Through Economic Trends:

080 ① The recession caused by the oil shock in the 1970s

083 ② 1980s~early 1990s, 3 low boom

087 ③ Late 1990s, low yen, recession, and collapse of conglomerates

093 ④ 1997-1998, recession caused by the foreign exchange crisis

098 ⑤ 1999~2003, a short economic recovery and a domestic recession following an overseas recession

100 ⑥ 2004~2007, deepening domestic recession due to failure to respond to real estate speculation

102 ⑦ 2008~2012, domestic economic recession aggravated by large corporation-biased policies and overseas economic crises

106 ⑧ 2013~2016, Chronic recession due to neglect of economic issues

108 ⑨ 2017-2021, polarization deepens due to failures in growth and real estate policies.

Chapter 3 | Prices

115 How is the price of watermelon determined?

118 How much should I sell it for to sell more?

119 You're saying that the candy seller can't set the price of candy as he pleases?

Why do prices rise when the economy improves?

122 How Household Consumption Drives Prices

124 Why do prices rise when oil prices rise?

Article Reading: Producer Price Index Increases Due to Rising International Oil Prices

126 What moves the price?

Political Economy of Oil:

128 ① Why are Middle Eastern oil prices always a problem?

130 ② Why is the United States intervening in the Middle East?

Article: Is a fifth Middle East war on the horizon? "The US is out," Iran warns, imminently attacking Israel.

Why is it a problem if oil prices fall?

134 ① Why the oil price plunge is a blow to both oil-producing and oil-importing countries

137 ② Why did oil prices plummet in 2014?

139 ③ Why did oil prices plummet in 2020?

141 How do you know the price fluctuations?

The Bank of Korea stated that the slowdown in inflation in April was in line with expectations, but added that uncertainty in agricultural and oil prices remains high.

144 How to find out consumer and producer prices

146 Core Inflation and Headline Inflation: What's the Difference?

149 How is inflation expectations measured?

February expected inflation remains at 3.0%... "Perceived inflation still high"

150 You're not just looking at prices with the consumer price index?

152 Why Are Official Prices and Perceived Prices Different?

The article claims that inflation is slowing, but perceived inflation remains high.

154 How Inflation Crashes the Economy

159 Why Inflation Is the Enemy of the Common People and an Opportunity for the Rich

162 Why You Should Be Careful About Inflation When Investing in Real Estate and Stocks

163 Why Does Inflation Lead to Consumption Polarization?

165 When will inflation occur?

167 How to Prevent Demand-Driven Inflation

170 How to Respond to Cost Inflation and Stagflation

175 What's the problem with deflation?

How did the Japanese economy fall into deflation?

179 ① Inflation in the United States in the late 1970s and Volcker's high interest rate policy

186 ② The Plaza Accord and the High Yen Recession

189 ③ Low interest rates and fiscal expansion, creating a bubble economy

194 Why did Japan's economy continue to experience deflation?

When will stagflation come?

Article: "Rising prices and slowing growth" raises concerns about 1970s-style stagflation in the US.

205 Who sees the raw material prices?

Article: "The fight against inflation isn't over"... Raw materials prices continue to soar.

International oil prices fall... WTI down 1.39%

210 How to Trade Commodity Futures

Global grain prices are falling… Government: "Domestic supply and demand are stable."

213 How are crude oil prices determined?

[International Oil Prices] Rise on Decreasing US Crude Oil Inventories

215 Why do crude oil prices always fluctuate?

218 Who controls non-ferrous metal prices?

Article Reading [Non-Ferrous Metal Focus] Nickel Price at $18,000... Indonesia to Mine Battery Nickel Until 2069

Are you predicting the global economy based on the price of 220 copper?

Pungsan shares hit a new 52-week high on strong copper prices.

222 How does the price of gold move?

Article Comprehension [Today's Gold Price] International gold prices fall more than 2%... What is the domestic gold price?

226 How to invest in gold

229 How do grain prices move?

Grain prices surge following Russian bombing of the Danube River, reaching a five-month high.

233 What indicators can be used to read grain market trends?

Chapter 4 | Finance

237 What is Finance?

239 Why can't I just print and spend money?

242 Why is monetary policy important?

244 How Interest Rate Policy Changes Financial Flows

248 How does the Bank of Korea determine its base interest rate?

251 How is the US benchmark interest rate determined?

254 How are European interest rates determined?

256 How Monetary Policy Works: Open Market Operations/Lending and Depositing Systems/Reserve Ratio Adjustments

The Bank of Korea fined Hana Bank 15.7 billion won for failing to meet its reserve requirements.

271 Where will the economy go when finance tightens?

275 Where will the economy go when monetary policy is eased?

278 What's the Difference Between Monetary Easing and Quantitative Easing?

Federal Reserve Chairman Powell: "If we taper quantitative easing, it will be like 2013."

The Federal Reserve is also implementing quantitative tightening at full speed... Fed governor: "I'm pleased" with market panic

285 What kind of financial institutions are there?

291 How do short-term financial markets work?

298 What is the relationship between long-term financial markets and capital markets?

298 What's the Difference Between Direct and Indirect Financial Markets?

301 How the International Financial Market Works

KB Kookmin Bank Issues $600 Million in Senior Global Bonds

305 What's the difference between the public interest rate and the real interest rate?

307 Real Interest Rate Movements: What Can We See?

Article Comprehension [Stock Market Data] Bond Yields (May 28)

Why do corporate bonds with lower credit ratings have higher interest rates?

310 Credit Rating: Who Does It and How?

312 Credit Ratings: How They Determine a Company's Life or Death

Kwangdong Pharmaceutical issues 15 billion won in corporate bonds, plans to repay debt

Hanon Systems Preemptively Refinances to Prepare for Credit Rating Downgrade

316 Credit Ratings: How They Shaken the National Economy

WSJ article: "Italian bonds surge as downgrade risk averted."

Why do bonds become riskier when the interest rate gap between corporate and government bonds widens?

April corporate bond market volatile, with 6.5 trillion won maturing... authorities grappling with anxiety

324 Are corporate bonds risky?

Growing preference for risky assets… Corporate bond spreads narrow to pre-COVID levels

327 Market Interest Rates: What Raises and Lowers Them?

328 Is it cheaper if you can move freely?

How Interest Rates Regulate the Economy

333 Why doesn't investment increase even when interest rates are low?

335 Real Estate or Stocks: Which is Better in a Time of Low Interest Rates?

338 What is leveraged investing?

Why do I lose money when I deposit 340?

Why is the interest higher when calculated using 344 compound interest?

345 How the Private Debt Market Works

Unscrupulous loan sharks charge 400,000 won in advance interest on a 1 million won loan.

349 Why the Underground Economy is Bad

Will the Bank of Korea accelerate its CBDC efforts, ushering in the era of digital currency?

Chapter 5 | Securities

What are 355 securities?

What is 356 stock?

How issuing 358 shares can help grow a company.

How is the share issuance price determined?

Who benefits when 360 shares rise?

363 Stock Trading: Where and How to Do It

What kind of market is the 365 over-the-counter market?

How to place a 367 buy/sell order

How to Read the 369 Stock Price Chart

371 Why are there upper and lower price limits?

What can we learn from looking at the KOSPI 372?

Article Reading: KOSPI closes flat

Why is the KOSDAQ index benchmark set at 1000?

[KOSDAQ Closing] Ants' "Fate"... 830 Level Just Hanging in

Why Look at the Dow, Nasdaq, and S&P 500?

[Comprehensive] The Dow Jones Industrial Average surged by the largest margin of the year, but the New York Stock Exchange remained mixed.

379 When is the stock price going up when the game is bad?

380 How Interest Rates and Stock Prices Move

Why do our stock prices fall when interest rates rise?

Why do our stock prices rise when interest rates fall?

Why Stock Investors Should Be Wary of Hot Money

Will the global "hot money" that underpinned China's economy boom backfire?

390 How Hedge Funds Sway Stock Prices

Samsung Electronics and Kakao's "National Stocks" Fall... Behind the Scenes: Foreigners Who Made 10 Trillion Won Short-Term Trading

394 Where do stock prices go when prices rise?

How the 397th election moves stock prices

Stocks related to Han Dong-hoon, Cho Kuk, and Lee Jae-myung plummet after the general election.

399 Value Stocks vs. Growth Stocks: Which Should You Buy?

The battle between value stocks and growth stocks continues... KOSPI rebounds after three trading days.

What is a 401 dividend?

Why Operation 404 is Dangerous

The second trial verdict also stated, "Kim Gun-hee's account was operated under the direction of Kwon Oh-soo."

406 Illegal Insider Trading: Why Does It Continue?

408 Public Notice, Don't Trust It Too Much?

The Korea Exchange and Alpha Holdings were designated as unfaithful disclosure companies for their "public disclosure changes."

What is a 411 bond?

412 What are coupon bonds, compound bonds, and discount bonds?

When to Buy and When to Sell 414 Bonds

416 Why do bond prices fall during inflation?

How do bond yields, bond prices, and market interest rates move?

Why are bond yields and market interest rates the same?

424 What are the differences between government bonds, financial bonds, and special bonds?

What's special about 426 special bonds?

First-quarter bond-related rights exercise reached KRW 951.4 billion, a 37% decrease from the previous quarter.

Where to buy 430 bonds

Why do yields on long- and short-term bonds reverse when the economy worsens?

How can the difference between short-term and long-term interest rates determine the direction of the economy?

The gap between short-term and long-term interest rates is narrowing rapidly... Is this a sign of an economic slowdown?

435 If the short-term and long-term interest rates invert, will the economy really get worse?

Article Reading: Inversion of short-term and long-term interest rates… A signal of economic recession?

Is this a sign of a recession? The spread between US short-term and long-term Treasury yields inverted for the first time in two and a half years.

Amidst fears of austerity, interest rate shocks hit... 3-year yields soar, leading to the first-ever 30-year yield inversion.

Why do short-term bond yields rise when prices rise?

442 How Does the US Federal Reserve's Interest Rate Sway Bond Yields and the Economy?

Why Does an Inverted Bond Yield Curve Lead to a Worsening Economy?

"Bond King" Gundlak: "This time, don't believe anyone who says the bond yield curve doesn't matter."

447 How Does Yield Curve Control Work?

449 How Finance Destroys the Economy: The Full Story of the 2008 US-Emerging Global Financial Crisis

Chapter 6 | Foreign Exchange

When we talk about the 457 exchange rate, why do we talk about the dollar exchange rate?

How to display the 459 exchange rate

461 What happens to the won price when the exchange rate changes?

462 Exchange Rate: Where and How is it Determined?

464 China has two exchange rate systems?

Yuan depreciates 0.02% to 7.1097 yuan

Why do currency exchange rates increase in proportion to a country's strength?

How the $468 Became a Reserve Currency

How to Read the 474 Forex Rate Table

Why do exports go well when the won is 479?

Why do prices rise when the dollar-won exchange rate rises to 480?

484 Why do exchange rates follow inflation?

The Bank of Korea said, "The surge in international raw material prices has exacerbated the won's weakness."

Why can't exports be made when the 487 won is low?

Why did stock prices fall when the price hit 490 won?

Where will the stock price go when the 492 'original text' is published?

Why do currency prices rise when the economy improves?

495 Is there a way to beat the 'original' recession?

Why is the 496 yen low a red light for our exports?

Super Yen hits for the first time in 37 years... Warning signs for Korean car and oil exports

How the 'Super N-G' of 2024 Appeared

Japanese people, impoverished by the super-engine, say they have become a "cheap country."

502 Why a Strong Yen Is a Trap for the Korean Economy

503 Why does the government intervene in the foreign exchange market?

Authorities verbally intervene as the exchange rate breaks 1,400 won... "Watch closely for oversupply."

508 How much foreign exchange reserves are needed?

We need to defend the exchange rate, but foreign exchange reserves are a concern.

Why is Hong Kong's exchange rate system shaking as US interest rates rise?

Hong Kong spent 28 trillion won in three months defending its currency peg, raising concerns about its currency peg.

Where do currency prices go when interest rates move?

Where will the dollar-won exchange rate go when the US interest rate fluctuates?

Where will the Korean-Japanese exchange rate and stock prices go when the US interest rate fluctuates?

Why does the yen price fall when a 520 yen carry trade occurs?

The yen is nearing 152 yen per dollar... Yen carry trade accelerates yen depreciation.

526 Yen Carry Liquidation: Why Is It Causing a Stock Price Crash?

KOSPI closes with 8% plunge, biggest drop ever, on 'worst day ever'

The liquidation of yen carry, which led to the global stock market crash, is underway. "There's still a long way to go."

Chapter 7 | Balance of Payments and Trade

531 Why Look at the Balance of Payments?

532 How is the Balance of Payments Calculated?

Read the 539 Balance of Payments News

The semiconductor industry's boom led to a 10th consecutive month of current account surplus in February, reaching $6.86 billion.

When you calculate the balance of payments, it always comes out as '0'?

Article Reading: Balance of Payments Expected to Maintain Surplus for 5th Month

Prime Minister Han: "The balance of payments will decrease compared to last year, but a surplus of $40-50 billion is possible."

543 What's the Difference Between the Balance of Goods and the Balance of Trade?

Article Reading ① March Current Account Balance of $6.93 Billion... 11th Consecutive Month of Surplus on Semiconductor Exports

Article Reading ② [Breaking News] March exports hit $56.6 billion, up 3.1% year-on-year… 10th consecutive month of trade surplus

546 Where does the exchange rate go when the current account is in surplus or deficit?

The US dollar is weak, but the won-dollar exchange rate is approaching 1,330 won, a record high. Why?

Where will the current account balance go when the dollar-won exchange rate moves to 549?

551 Current Account Surplus I'm Not Happy About It What is a Recession-Type Surplus?

Article: "The current account surplus will widen further this year." Is a $50 billion surplus possible?

553 When is a current account surplus burdensome even when there is no recession?

555 Current Account Deficit: How It Causes a Foreign Exchange Crisis

558 Foreign Debt At least we are facing a foreign debt crisis?

Where are currency swaps between 560 countries used?

Korea and Malaysia to Renew 5 Trillion Won Currency Swap Agreement by Year-End

Why is the service balance in perpetual deficit?

564 Where is our trade?

566 Can we give up on the Chinese market?

570 Why is exporting so much to the US and China a problem?

573 Why Capital Goods Imports Are Important

574 Why Korea's Trade Should Surpass Japan's

Article Reading: "57 Years of Deficit"... Cumulative Trade Deficit with Japan Hits 926 Trillion Won

580 How to Foster Triangular Trade Between Korea, China, and Japan

585 You shouldn't rely too much on trade?

Korea's high dependence on trade... Busy seeking new opportunities through visits and legislation

590 Why does the US "monitor" other countries' currency exchange rates?

US includes South Korea on currency monitoring list, redesignating after a year

592 Where is the global market headed?

598 Why the US-China Trade War Continues

Article: US-China trade conflict intensifies… Electric vehicle subsidies on the rise

Chapter 8 | Economic Indicators

How to Create 607 Economic Indicators

609 Why Should Economic Statistics Be Based on a "Standard"?

OECD forecasts 2.6% growth for Korea this year, significantly raising its forecast

610 Why Clear Statistics Are Actually Blurry: Base Effects

Household spending rose 3.9% last year, reaching a 10-year high due to the base effect.

613% vs. %points, what's the difference?

The number of employed people increased by 173,000 in March, reaching a record high of 62.4% in the employment rate for March.

615 How is the size of an economy measured: GDP

Korea's economic size plummets to 14th place for the first time in 11 years, necessitating a strong drive for structural reform.

OECD Q2 GDP rises 0.4%, bringing cumulative growth since the pandemic to 5.1%

Korea's household debt ratio stands at 100.1%... "We expect it to fall below 100% this year."

Why doesn't the economy grow as much as GDP?: Nominal and Real GDP

China's share of the global economy has declined for the first time in 30 years.

623 How is economic growth measured? Real GDP growth rate

626 Why does our potential growth rate continue to fall?

Korea's potential growth rate continues to plummet since 2011.

What can we learn from the 630 GDP gap?

The Bank of Korea: "The GDP gap is likely to remain positive... Inflationary pressure is exerting."

633 Why is national income measured by GNI?

National income shrank by the largest margin in a year.

How is GNI calculated?

637 What is the difference between GNI, GNP, and GDP?

638 Why do trade terms change?

Soaring exchange rates and worsening terms of trade are dragging down national income.

639 How are the terms of trade measured?

Why does national income differ from purchasing power?

How does the 644 Big Mac exchange rate differ from the market rate?

What's the problem if the GDP deflator is negative?

China's producer prices remain negative for 18 consecutive months... "Similar to Japan's bubble burst in 1995."

How can you gauge economic trends by looking at the 649 Composite Economic Index?

Why we can't smile despite the triple increase in production, consumption, and investment... Leading indicators have already fallen.

How to read the game with 658 BSI

Business Survey Index (BSI) Trends

661 What's the Difference Between the Real Unemployment Rate and the Real Unemployment Rate?

The number of employed people increased by 173,000 in March, but it was the lowest in 37 months.

665 How to Increase Added Value

The petrochemical industry is grappling with China's oversupply... "High value-added products are the only way to survive."

Appendix 669 | Economics Article Reading Techniques

684 Economic Terms to Look Up

Detailed image

Into the book

People often say, "How is the economy?", but it is not easy to know exactly what state the economy is in at the moment.

Even if you know, it is difficult to predict when the game will move to the next stage.

However, the actual impact of economic changes on economic activity is very large.

Anyone can suffer a great loss if they misread the flow of the game.

--- From "Game"

When the economy improves, demand for goods increases and prices rise.

Conversely, when the economy worsens, demand decreases and prices fall.

Prices reflect the economy.

Ultimately, you can get a rough idea of how the economy is doing by looking at whether the price index is increasing or decreasing.

--- From "Prices"

Economic transactions can be broadly divided into real transactions and financial transactions, and in the modern economy, the proportion of financial transactions is increasing.

There are increasing cases where the smooth operation of finance determines the vitality of the real economy.

Even on a global scale, this is true.

--- From "Finance"

Stocks and bonds are useful financial instruments for issuers to raise capital.

Investors primarily perceive it as an investment vehicle.

Stocks and bonds can be freely traded after issuance, and their trading prices are constantly changing.

If you choose well and trade at the right time, you can make a lot of money in a short period of time.

--- From "Securities"

A country that possesses goods with high import demand will have a higher demand for its currency, which will lead to a rise in its currency value, increased exports, and increased economic power.

In this way, currency prices and economic power move together.

In this way, global demand flows to currencies issued by powerful countries, and currency exchange rates rise in proportion to the country's strength.

--- From "Foreign Exchange"

The current account balance is often used as a measure of a national economy's external competitiveness, that is, its ability to produce goods and services and sell them abroad.

This is because countries that earn a lot of foreign currency through foreign trade often have a surplus in their current account, while countries that lose foreign currency often have a deficit.

--- From "Balance of Payments and Trade"

In articles using economic statistics, you should pay close attention to what criteria they use to make their statements.

To accurately understand the economic phenomena that statistics indicate, you need to know what the standard value is and when the standard point in time is set.

Even if you know, it is difficult to predict when the game will move to the next stage.

However, the actual impact of economic changes on economic activity is very large.

Anyone can suffer a great loss if they misread the flow of the game.

--- From "Game"

When the economy improves, demand for goods increases and prices rise.

Conversely, when the economy worsens, demand decreases and prices fall.

Prices reflect the economy.

Ultimately, you can get a rough idea of how the economy is doing by looking at whether the price index is increasing or decreasing.

--- From "Prices"

Economic transactions can be broadly divided into real transactions and financial transactions, and in the modern economy, the proportion of financial transactions is increasing.

There are increasing cases where the smooth operation of finance determines the vitality of the real economy.

Even on a global scale, this is true.

--- From "Finance"

Stocks and bonds are useful financial instruments for issuers to raise capital.

Investors primarily perceive it as an investment vehicle.

Stocks and bonds can be freely traded after issuance, and their trading prices are constantly changing.

If you choose well and trade at the right time, you can make a lot of money in a short period of time.

--- From "Securities"

A country that possesses goods with high import demand will have a higher demand for its currency, which will lead to a rise in its currency value, increased exports, and increased economic power.

In this way, currency prices and economic power move together.

In this way, global demand flows to currencies issued by powerful countries, and currency exchange rates rise in proportion to the country's strength.

--- From "Foreign Exchange"

The current account balance is often used as a measure of a national economy's external competitiveness, that is, its ability to produce goods and services and sell them abroad.

This is because countries that earn a lot of foreign currency through foreign trade often have a surplus in their current account, while countries that lose foreign currency often have a deficit.

--- From "Balance of Payments and Trade"

In articles using economic statistics, you should pay close attention to what criteria they use to make their statements.

To accurately understand the economic phenomena that statistics indicate, you need to know what the standard value is and when the standard point in time is set.

--- From "Economic Indicators"

Publisher's Review

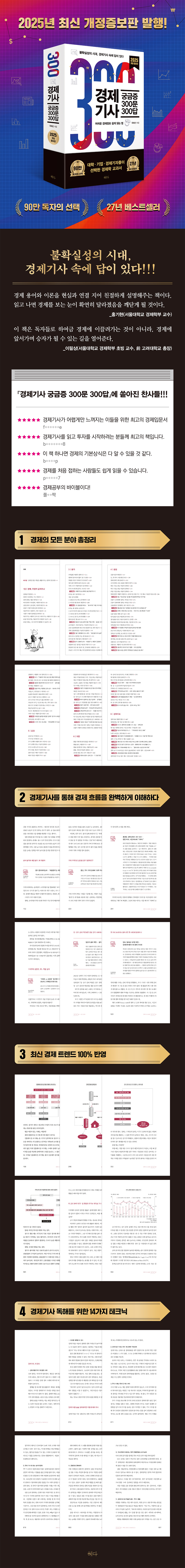

A 27-year bestseller, a classic in practical economics

"300 Questions and Answers on Economic News" is a classic in the field of practical economics that has been reprinted over 26 years since its first publication in 1998, becoming both a bestseller and a steady seller.

In an economy where the pace of change is rapid, the validity period of information is also very short.

This book reflects the latest economic trends by analyzing the numerous changes that occur in economic trends every year and adding new information and knowledge, making significant revisions.

This 18th edition also went through the same process.

In addition to the comprehensive knowledge of each economic sector covered in the existing edition, including economic conditions, prices, finance, securities, foreign exchange, balance of payments and trade, and economic indicators, we have added commentary on the latest economic news, including Korea's real economy, financial policy, and international oil prices.

By organically linking the overview and specific theories of the economy, readers will gain the insight to simultaneously view both the overall forest of the economy and the individual trees of the real economy.

14 Economic Reading Techniques to Predict Economic Trends

Reading economic articles helps you develop an eye for economics.

That's a given.

But when I actually try to read it, I don't know where or how to start.

Articles filled with technical terms, graphs, and various numbers can sometimes feel like codes.

The beginning is simple.

Just learning a few economic concepts and terms will make reading articles much easier.

Moreover, since economic events are cyclical and similar throughout the year, the more experience you gain in examining the events before and after, the more sophisticated your economic forecasts become.

For example, it gives you the power to predict economic trends, such as, "Interest rates are rising, so stock prices will fall in the future," or, "The yen has depreciated, so export-related stock prices will be affected."

"300 Questions and Answers on Economic News" includes 14 practical techniques to cultivate this kind of strength as an appendix.

"300 Questions and Answers on Economic News" is a classic in the field of practical economics that has been reprinted over 26 years since its first publication in 1998, becoming both a bestseller and a steady seller.

In an economy where the pace of change is rapid, the validity period of information is also very short.

This book reflects the latest economic trends by analyzing the numerous changes that occur in economic trends every year and adding new information and knowledge, making significant revisions.

This 18th edition also went through the same process.

In addition to the comprehensive knowledge of each economic sector covered in the existing edition, including economic conditions, prices, finance, securities, foreign exchange, balance of payments and trade, and economic indicators, we have added commentary on the latest economic news, including Korea's real economy, financial policy, and international oil prices.

By organically linking the overview and specific theories of the economy, readers will gain the insight to simultaneously view both the overall forest of the economy and the individual trees of the real economy.

14 Economic Reading Techniques to Predict Economic Trends

Reading economic articles helps you develop an eye for economics.

That's a given.

But when I actually try to read it, I don't know where or how to start.

Articles filled with technical terms, graphs, and various numbers can sometimes feel like codes.

The beginning is simple.

Just learning a few economic concepts and terms will make reading articles much easier.

Moreover, since economic events are cyclical and similar throughout the year, the more experience you gain in examining the events before and after, the more sophisticated your economic forecasts become.

For example, it gives you the power to predict economic trends, such as, "Interest rates are rising, so stock prices will fall in the future," or, "The yen has depreciated, so export-related stock prices will be affected."

"300 Questions and Answers on Economic News" includes 14 practical techniques to cultivate this kind of strength as an appendix.

This is an introductory practical economics book that explains economic principles and realities in an easy-to-understand manner, allowing even readers who have not majored in economics to develop a keen understanding of the economy in a short period of time.

In addition to comprehensive knowledge of each economic sector, including economic conditions, prices, finance, securities, foreign exchange, the balance of payments and trade, and economic indicators, we also provide commentary on the latest economic news, including Korea's real economy, financial policy, and international oil prices.

By organically linking the overview and specifics of the economy, it helps readers develop the ability to see both the forest and the trees.

This will be a special lecture that will provide solid practical economic knowledge to readers who need to start studying economics but don't know where or how to start.

This is an introductory practical economics book that explains economic principles and realities in an easy-to-understand manner, allowing even readers who have not majored in economics to develop a keen understanding of the economy in a short period of time.

In addition to comprehensive knowledge of each economic sector, including economic conditions, prices, finance, securities, foreign exchange, the balance of payments and trade, and economic indicators, we also provide commentary on the latest economic news, including Korea's real economy, financial policy, and international oil prices.

By organically linking the overview and specifics of the economy, it helps readers develop the ability to see both the forest and the trees.

This will be a special lecture that will provide solid practical economic knowledge to readers who need to start studying economics but don't know where or how to start.

In addition to comprehensive knowledge of each economic sector, including economic conditions, prices, finance, securities, foreign exchange, the balance of payments and trade, and economic indicators, we also provide commentary on the latest economic news, including Korea's real economy, financial policy, and international oil prices.

By organically linking the overview and specifics of the economy, it helps readers develop the ability to see both the forest and the trees.

This will be a special lecture that will provide solid practical economic knowledge to readers who need to start studying economics but don't know where or how to start.

This is an introductory practical economics book that explains economic principles and realities in an easy-to-understand manner, allowing even readers who have not majored in economics to develop a keen understanding of the economy in a short period of time.

In addition to comprehensive knowledge of each economic sector, including economic conditions, prices, finance, securities, foreign exchange, the balance of payments and trade, and economic indicators, we also provide commentary on the latest economic news, including Korea's real economy, financial policy, and international oil prices.

By organically linking the overview and specifics of the economy, it helps readers develop the ability to see both the forest and the trees.

This will be a special lecture that will provide solid practical economic knowledge to readers who need to start studying economics but don't know where or how to start.

GOODS SPECIFICS

- Date of issue: December 20, 2024

- Page count, weight, size: 708 pages | 1,122g | 152*224*40mm

- ISBN13: 9791191183337

- ISBN10: 1191183335

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)