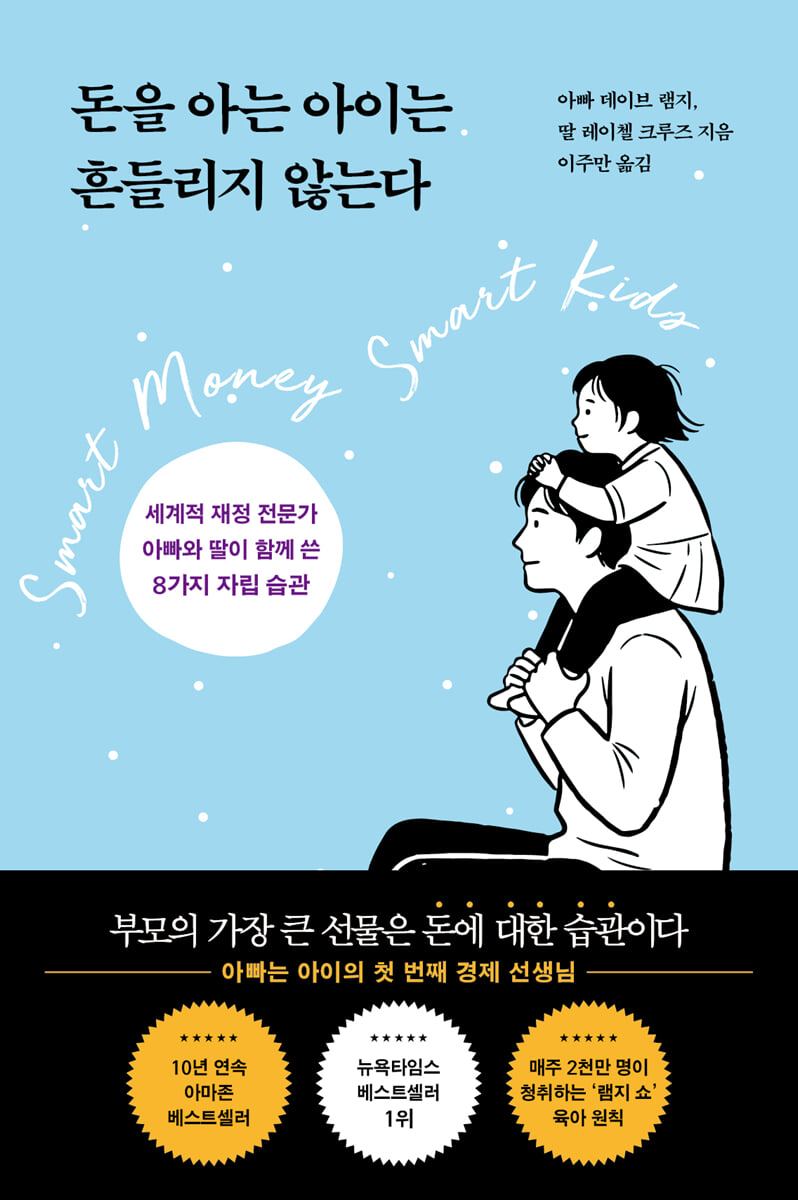

A child who knows money is unshaken.

|

Description

Book Introduction

8 Self-Reliance Habits of World-Class Financial Expert Dave Ramsey and His Daughter Rachel Cruz

The greatest gift parents can give their children is good money habits.

『Money Kids Are Unwavering』, a book co-written by world-renowned financial expert Dave Ramsey and his daughter Rachel Cruz, presents specific financial independence habits that children can develop by planning, making choices, and taking responsibility for themselves.

This book reached number one on the New York Times bestseller list immediately after its publication and has remained a bestseller in the Amazon parenting category for 10 consecutive years, winning the sympathy of countless parents.

It also contains an educational philosophy that has already been proven through the radio program "The Ramsay Show" which is listened to by 20 million people every week.

It helps children learn the value of money from a young age and trains them to take responsibility for themselves, focusing on the eight self-reliance habits of 'work, spending, saving, giving, budgeting, debt, self-sufficiency, and legacy.'

The greatest gift parents can give their children is good money habits.

『Money Kids Are Unwavering』, a book co-written by world-renowned financial expert Dave Ramsey and his daughter Rachel Cruz, presents specific financial independence habits that children can develop by planning, making choices, and taking responsibility for themselves.

This book reached number one on the New York Times bestseller list immediately after its publication and has remained a bestseller in the Amazon parenting category for 10 consecutive years, winning the sympathy of countless parents.

It also contains an educational philosophy that has already been proven through the radio program "The Ramsay Show" which is listened to by 20 million people every week.

It helps children learn the value of money from a young age and trains them to take responsibility for themselves, focusing on the eight self-reliance habits of 'work, spending, saving, giving, budgeting, debt, self-sufficiency, and legacy.'

- You can preview some of the book's contents.

Preview

index

Recommendation

As we enter, children learn from their parents' behavior.

Chapter 1: I Was That Little Girl

Chapter 2 Labor: You have to work to earn money.

Chapter 3: Consumption: Once you spend money, you never get it back.

Chapter 4: Savings: I buy the things I need with the money I save.

Chapter 5: Giving: Money is not something to own, but to manage.

Chapter 6: Budgeting: Not Planning Is Planning to Fail

Chapter 7 Debt: Debt is Poison

Chapter 8: Student Loans: Starting Your Social Life with a Mountain of Debt

Chapter 9: Self-Sufficiency: Gratitude is the Key to Happiness

Chapter 10: Family: Parenting Principles for Diverse Families

Chapter 11 Legacy: What Will We Pass On?

Chapter 12: I Was That Father

supplement

As we enter, children learn from their parents' behavior.

Chapter 1: I Was That Little Girl

Chapter 2 Labor: You have to work to earn money.

Chapter 3: Consumption: Once you spend money, you never get it back.

Chapter 4: Savings: I buy the things I need with the money I save.

Chapter 5: Giving: Money is not something to own, but to manage.

Chapter 6: Budgeting: Not Planning Is Planning to Fail

Chapter 7 Debt: Debt is Poison

Chapter 8: Student Loans: Starting Your Social Life with a Mountain of Debt

Chapter 9: Self-Sufficiency: Gratitude is the Key to Happiness

Chapter 10: Family: Parenting Principles for Diverse Families

Chapter 11 Legacy: What Will We Pass On?

Chapter 12: I Was That Father

supplement

Detailed image

Into the book

When I was born, we had already said goodbye to the days when my parents spent money lavishly.

When I went shopping with my mother, I had to wait at least 5 more minutes at the checkout counter while she took out the coupons.

People at the stores we frequented often called my mother the "Coupon Lady."

I have never seen my mother pay full price for something she buys.

My mother had a knack for finding clearance items, and no matter what she bought, she always pulled out a coupon for it.

--- From "Chapter 1: I Was That Little Girl"

I learned countless lessons from my parents, but there is one principle they have emphasized since I was young.

'Everyone in the Ramsey family must work hard.'

His father hosts a radio show and also runs a financial peace school.

And my father and I work together in our company, which offers dozens of products and services, from financial management courses for high school students to Bible study materials for children.

But if someone were to ask me what the Ramsey family's "family business" really is, I would say, based on my experience, "labor."

--- From "Chapter 2 Labor: You have to work to earn money"

The purpose of life changes when we realize that we are simply managing someone else's money.

For example, it is easier to donate money from someone else's pocket than to donate money from your own pocket.

Sharon and I taught our children about finances, and we taught them again and again that money is not theirs.

As a Christian family, we believe that God owns all things and that we are entrusted with the task of managing them on his behalf.

If we are not the owners, it is easier to give.

--- From “Chapter 5 Donation: Money is not something to own, but to manage”

If you're teaching your teenager how to manage money for the first time, budgeting can be a confusing topic.

This is because each family has different forms of support, with some parents covering all expenses for their teenage children, while others only provide financial assistance for essential items.

It is difficult to say which side is right and which side is wrong.

However, there are a few guidelines that you can follow when budgeting for your teen.

--- From “Chapter 6 Budget: Not Planning is Planning to Fail”

There are many people in our society who are confused about the concept of debt.

So, we need to define this clearly and move on.

If you owe something to someone, for any reason, it is a debt.

Credit card debt is debt, and car loans are debt too.

Home loans and student loans are also, of course, debt.

--- From Chapter 7 Debt: Debt is Poison

There are two extremes that parents should avoid when raising children.

First, it is a parenting style that applies rules inflexibly and tries to control the child in everything, as if locking the child in a cramped box.

Children growing up with these types of parents do not have the opportunity to make decisions on their own.

Children who grow up like this often become addicted to alcohol as soon as they enter college.

Because they have never enjoyed freedom, they indulge in it unrestrainedly from the first day they are freed from their mother and father.

They have never made their own judgments, so they do not know how to judge correctly.

When I went shopping with my mother, I had to wait at least 5 more minutes at the checkout counter while she took out the coupons.

People at the stores we frequented often called my mother the "Coupon Lady."

I have never seen my mother pay full price for something she buys.

My mother had a knack for finding clearance items, and no matter what she bought, she always pulled out a coupon for it.

--- From "Chapter 1: I Was That Little Girl"

I learned countless lessons from my parents, but there is one principle they have emphasized since I was young.

'Everyone in the Ramsey family must work hard.'

His father hosts a radio show and also runs a financial peace school.

And my father and I work together in our company, which offers dozens of products and services, from financial management courses for high school students to Bible study materials for children.

But if someone were to ask me what the Ramsey family's "family business" really is, I would say, based on my experience, "labor."

--- From "Chapter 2 Labor: You have to work to earn money"

The purpose of life changes when we realize that we are simply managing someone else's money.

For example, it is easier to donate money from someone else's pocket than to donate money from your own pocket.

Sharon and I taught our children about finances, and we taught them again and again that money is not theirs.

As a Christian family, we believe that God owns all things and that we are entrusted with the task of managing them on his behalf.

If we are not the owners, it is easier to give.

--- From “Chapter 5 Donation: Money is not something to own, but to manage”

If you're teaching your teenager how to manage money for the first time, budgeting can be a confusing topic.

This is because each family has different forms of support, with some parents covering all expenses for their teenage children, while others only provide financial assistance for essential items.

It is difficult to say which side is right and which side is wrong.

However, there are a few guidelines that you can follow when budgeting for your teen.

--- From “Chapter 6 Budget: Not Planning is Planning to Fail”

There are many people in our society who are confused about the concept of debt.

So, we need to define this clearly and move on.

If you owe something to someone, for any reason, it is a debt.

Credit card debt is debt, and car loans are debt too.

Home loans and student loans are also, of course, debt.

--- From Chapter 7 Debt: Debt is Poison

There are two extremes that parents should avoid when raising children.

First, it is a parenting style that applies rules inflexibly and tries to control the child in everything, as if locking the child in a cramped box.

Children growing up with these types of parents do not have the opportunity to make decisions on their own.

Children who grow up like this often become addicted to alcohol as soon as they enter college.

Because they have never enjoyed freedom, they indulge in it unrestrainedly from the first day they are freed from their mother and father.

They have never made their own judgments, so they do not know how to judge correctly.

--- From "Chapter 11 Legacy: What to Pass On"

Publisher's Review

The best gift a parent can give to a child is

Good Money Habits

★★★ Amazon Bestseller for 10 Consecutive Years ★★★

★★★ #1 New York Times Bestseller ★★★

★★★ Parenting Principles from "The Ramsay Show," Listened to by 20 Million People Each Week ★★★

Private education and college entrance exam preparation seem to be unavoidable for parents living in Korean society.

So, we read books to our children from a young age, teach them English and math, and on weekends, we make time to go to museums and do experiential learning.

But the 'money education' that children absolutely need is missing.

Children who enter society without learning financial sense will experience trial and error even as adults.

The knowledge and habits about money that a child acquires at a young age determine the rest of his or her life.

That is why, from an early age, parents should be their children's first financial teachers and help them develop sound financial and self-reliance habits.

"A child who knows money is unshaken" is a practical answer that fills that gap.

Because it addresses fundamental life issues such as education, habits, and values while also focusing on money, it will be a useful guide for parents, teachers, and youth leaders.

This book, co-written by world-renowned financial expert Dave Ramsey and his daughter Rachel Cruz, provides specific guidelines for developing financial independence habits that allow children to plan, choose, and take responsibility for their own finances.

In an age of stagnant growth, is my child ready to face the world?

This book has been an Amazon bestseller for 10 consecutive years since its publication and has also reached number one on the New York Times bestseller list, gaining the sympathy of many parents.

It also contains an educational philosophy that has already been proven through "The Ramsey Show," a representative American financial program that is listened to by 20 million people every week.

In particular, it vividly shows the process of children learning about money in real life, focusing on the eight self-reliance habits of 'work, spending, saving, giving, budgeting, debt, self-sufficiency, and legacy.'

The authors have been a unique influence in the field of financial education in the United States.

Dave Ramsey has transformed millions of lives with his practical knowledge of overcoming bankruptcy and financial education based on the principles of self-reliance.

Ramsey Solutions, which he founded, has become a leading platform for financial education for American families through lectures, online courses, and radio and podcast broadcasts that reach hundreds of thousands of attendees each year.

Rachel Cruz is also a bestselling author of several financial education books and a broadcaster who has a significant influence on millennials and young parents.

This book, co-written by father and daughter, is considered a practical manual for economic education that can be passed down through generations.

Parents' financial habits determine their children's future.

"A Child Who Knows Money Is Unshaken" presents specific methods to guide children to learn the principles of life through money.

It explains step-by-step everything from the value of labor that “you have to work to earn money” to the principle of consumption that “once you spend money, it never comes back”, to the experience of setting your own goals, saving, and achieving what you want, to the process of learning about sharing and responsibility through donation.

It also touches on budget management through a household ledger, training to recognize the dangers of debt, learning to find contentment through gratitude and self-sufficiency, and finally, the meaning of legacy, which is the transmission of family values and financial habits across generations.

Above all, the authors emphasize the role of parents.

Parents are not their children's wallets, but their children's first teachers and role models about money.

When parents show their children self-restraint and plan, and practice small habits together, children naturally learn the principles of life.

In particular, the authors emphasize that “children learn from their parents’ actions, not their words,” and that economic education should begin at home.

The key is not money-making skills, but self-reliance.

The goal is to develop children's ability to self-restrain, plan, and make right choices.

The authors say, “You must take responsibility for the choices you make.

He emphasizes that the greatest education parents can give their children is to instill in them a sense of independence and responsibility, repeatedly conveying the message that “choices always have costs.”

The author's experience and principles, which have helped countless families around the world get out of debt, will help our children live stable lives through sound financial habits.

The best legacy parents can leave their children is not wealth, but good money habits.

"A Child Who Knows Money is Unwavering" is a book that lays the foundation for life that will sustain the next generation, and it will become the starting point for the most valuable conversations that parents and children can have together.

Good Money Habits

★★★ Amazon Bestseller for 10 Consecutive Years ★★★

★★★ #1 New York Times Bestseller ★★★

★★★ Parenting Principles from "The Ramsay Show," Listened to by 20 Million People Each Week ★★★

Private education and college entrance exam preparation seem to be unavoidable for parents living in Korean society.

So, we read books to our children from a young age, teach them English and math, and on weekends, we make time to go to museums and do experiential learning.

But the 'money education' that children absolutely need is missing.

Children who enter society without learning financial sense will experience trial and error even as adults.

The knowledge and habits about money that a child acquires at a young age determine the rest of his or her life.

That is why, from an early age, parents should be their children's first financial teachers and help them develop sound financial and self-reliance habits.

"A child who knows money is unshaken" is a practical answer that fills that gap.

Because it addresses fundamental life issues such as education, habits, and values while also focusing on money, it will be a useful guide for parents, teachers, and youth leaders.

This book, co-written by world-renowned financial expert Dave Ramsey and his daughter Rachel Cruz, provides specific guidelines for developing financial independence habits that allow children to plan, choose, and take responsibility for their own finances.

In an age of stagnant growth, is my child ready to face the world?

This book has been an Amazon bestseller for 10 consecutive years since its publication and has also reached number one on the New York Times bestseller list, gaining the sympathy of many parents.

It also contains an educational philosophy that has already been proven through "The Ramsey Show," a representative American financial program that is listened to by 20 million people every week.

In particular, it vividly shows the process of children learning about money in real life, focusing on the eight self-reliance habits of 'work, spending, saving, giving, budgeting, debt, self-sufficiency, and legacy.'

The authors have been a unique influence in the field of financial education in the United States.

Dave Ramsey has transformed millions of lives with his practical knowledge of overcoming bankruptcy and financial education based on the principles of self-reliance.

Ramsey Solutions, which he founded, has become a leading platform for financial education for American families through lectures, online courses, and radio and podcast broadcasts that reach hundreds of thousands of attendees each year.

Rachel Cruz is also a bestselling author of several financial education books and a broadcaster who has a significant influence on millennials and young parents.

This book, co-written by father and daughter, is considered a practical manual for economic education that can be passed down through generations.

Parents' financial habits determine their children's future.

"A Child Who Knows Money Is Unshaken" presents specific methods to guide children to learn the principles of life through money.

It explains step-by-step everything from the value of labor that “you have to work to earn money” to the principle of consumption that “once you spend money, it never comes back”, to the experience of setting your own goals, saving, and achieving what you want, to the process of learning about sharing and responsibility through donation.

It also touches on budget management through a household ledger, training to recognize the dangers of debt, learning to find contentment through gratitude and self-sufficiency, and finally, the meaning of legacy, which is the transmission of family values and financial habits across generations.

Above all, the authors emphasize the role of parents.

Parents are not their children's wallets, but their children's first teachers and role models about money.

When parents show their children self-restraint and plan, and practice small habits together, children naturally learn the principles of life.

In particular, the authors emphasize that “children learn from their parents’ actions, not their words,” and that economic education should begin at home.

The key is not money-making skills, but self-reliance.

The goal is to develop children's ability to self-restrain, plan, and make right choices.

The authors say, “You must take responsibility for the choices you make.

He emphasizes that the greatest education parents can give their children is to instill in them a sense of independence and responsibility, repeatedly conveying the message that “choices always have costs.”

The author's experience and principles, which have helped countless families around the world get out of debt, will help our children live stable lives through sound financial habits.

The best legacy parents can leave their children is not wealth, but good money habits.

"A Child Who Knows Money is Unwavering" is a book that lays the foundation for life that will sustain the next generation, and it will become the starting point for the most valuable conversations that parents and children can have together.

GOODS SPECIFICS

- Date of issue: September 2, 2025

- Page count, weight, size: 340 pages | 480g | 150*210*20mm

- ISBN13: 9788965967422

- ISBN10: 8965967422

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)