Just. Keep. Buying.

|

Description

Book Introduction

Just Keep Buying, which has sold hundreds of thousands of copies in the United States alone and has become a steady seller in Korea, where many financiers and investors have cited it as the "best book of their lives," has been republished in a special expanded edition.

This special edition includes the real-life "Just Keep Buying" story of Lee Sang-geon, CEO of Mirae Asset Pension & Investment Center, who has been practicing lump-sum investing without missing a single month for the past 22 years, with the permission of author Nick Maguly.

The title is “Just Keep Buying in Korea: A 22-Year Accumulation Investor’s Praise for Accumulation.”

This book contains the long-term experience and philosophy of CEO Lee Sang-geon, who has made a fortune through installment savings, secured funds for a home purchase, and prepared for retirement through installment savings since a time when the term "installment savings" was unfamiliar.

We offer pioneering wisdom to those who struggle with 'just keep buying' in Korea.

It's full of meaningful advice on how Korean investors, who are often faced with the dilemma of whether to buy a stock or a director, a fund or an ETF, can wisely "just keep buying."

Nick Magiuly's book emphasizes that the most certain and safest way for ordinary people to achieve financial freedom is through 'Just, Keep, Buy', and presents 21 practical measures.

It immediately rose to number one on Amazon and received rave reviews from domestic and international financial experts, including James Clear of "The Power of Tiny Habits" and Morgan Housel of "The Immutable Laws" and "The Psychology of Money," as well as Park Se-ik, Oh Geon-yeong, Kang Hwan-guk, Park Sung-jin, and Mok Dae-gyun.

This special edition includes the real-life "Just Keep Buying" story of Lee Sang-geon, CEO of Mirae Asset Pension & Investment Center, who has been practicing lump-sum investing without missing a single month for the past 22 years, with the permission of author Nick Maguly.

The title is “Just Keep Buying in Korea: A 22-Year Accumulation Investor’s Praise for Accumulation.”

This book contains the long-term experience and philosophy of CEO Lee Sang-geon, who has made a fortune through installment savings, secured funds for a home purchase, and prepared for retirement through installment savings since a time when the term "installment savings" was unfamiliar.

We offer pioneering wisdom to those who struggle with 'just keep buying' in Korea.

It's full of meaningful advice on how Korean investors, who are often faced with the dilemma of whether to buy a stock or a director, a fund or an ETF, can wisely "just keep buying."

Nick Magiuly's book emphasizes that the most certain and safest way for ordinary people to achieve financial freedom is through 'Just, Keep, Buy', and presents 21 practical measures.

It immediately rose to number one on Amazon and received rave reviews from domestic and international financial experts, including James Clear of "The Power of Tiny Habits" and Morgan Housel of "The Immutable Laws" and "The Psychology of Money," as well as Park Se-ik, Oh Geon-yeong, Kang Hwan-guk, Park Sung-jin, and Mok Dae-gyun.

- You can preview some of the book's contents.

Preview

index

What it means to 'just keep buying' in Korea

Reviewer's note

Before reading this book

Prologue_ The Magic Spell That Will Make You Rich

Part 1 Savings

Chapter 1: Where to Start

: Poor people save, rich people invest.

Chapter 2: How Much Should I Save?

: It will be less than you think

Chapter 3 If you want to save more money

: The Biggest Lie About Investment

Chapter 4: How to Spend Money Without Guilt

: Double the Rule and Maximize Achievement

Chapter 5: How Long Is Lifestyle Creep Okay?

: Why it's okay to have more than you think

Chapter 6: Is it okay to go into debt?

: Credit cards aren't always a bad choice.

Chapter 7: Should I Rent or Buy?

: How to Make the Biggest Financial Decision of Your Life

Chapter 8: Some Ways to Raise Money

: Why time horizon is more important than anything else

Chapter 9: When Can I Retire?

: Surprisingly, money is not the most important factor.

Part 2 Investment

Chapter 10: Why Invest?

: Three reasons why making money is more important than ever

Chapter 11

What should I invest in?

: There is not just one way to become wealthy.

Chapter 12: Why You Shouldn't Invest in Individual Stocks

: The returns from stock picking are bound to be low.

Chapter 13: How Soon Should You Start Investing?

: Why Fast is Better Than Slow

Chapter 14: Why You Don't Need to Wait for a Buy-By-Buy Timing

: It does not produce higher returns than the average unit price installment purchase method.

Chapter 15: Why Luck Matters in Investing

: Also, why isn't luck important in investing?

Chapter 16: Investors Don't Need to Fear Volatility

: The price paid for successful investing

Chapter 17: How to Keep Buying Even in a Crisis

: When there is blood on the streets, it is time to buy.

Chapter 18: So, when is the best time to sell?

: Three Cases When You Should Sell an Asset

Chapter 19: Where is your money?

: How to Choose the Best Investment Account for You

Chapter 20: Why Rich People Don't Feel Rich

: Maybe you are already rich

Chapter 21: The Most Important Asset is Time

: How to utilize the asset called time

Epilogue_ How to Win the Time Traveler's Game

Acknowledgements

References

Reviewer's note

Before reading this book

Prologue_ The Magic Spell That Will Make You Rich

Part 1 Savings

Chapter 1: Where to Start

: Poor people save, rich people invest.

Chapter 2: How Much Should I Save?

: It will be less than you think

Chapter 3 If you want to save more money

: The Biggest Lie About Investment

Chapter 4: How to Spend Money Without Guilt

: Double the Rule and Maximize Achievement

Chapter 5: How Long Is Lifestyle Creep Okay?

: Why it's okay to have more than you think

Chapter 6: Is it okay to go into debt?

: Credit cards aren't always a bad choice.

Chapter 7: Should I Rent or Buy?

: How to Make the Biggest Financial Decision of Your Life

Chapter 8: Some Ways to Raise Money

: Why time horizon is more important than anything else

Chapter 9: When Can I Retire?

: Surprisingly, money is not the most important factor.

Part 2 Investment

Chapter 10: Why Invest?

: Three reasons why making money is more important than ever

Chapter 11

What should I invest in?

: There is not just one way to become wealthy.

Chapter 12: Why You Shouldn't Invest in Individual Stocks

: The returns from stock picking are bound to be low.

Chapter 13: How Soon Should You Start Investing?

: Why Fast is Better Than Slow

Chapter 14: Why You Don't Need to Wait for a Buy-By-Buy Timing

: It does not produce higher returns than the average unit price installment purchase method.

Chapter 15: Why Luck Matters in Investing

: Also, why isn't luck important in investing?

Chapter 16: Investors Don't Need to Fear Volatility

: The price paid for successful investing

Chapter 17: How to Keep Buying Even in a Crisis

: When there is blood on the streets, it is time to buy.

Chapter 18: So, when is the best time to sell?

: Three Cases When You Should Sell an Asset

Chapter 19: Where is your money?

: How to Choose the Best Investment Account for You

Chapter 20: Why Rich People Don't Feel Rich

: Maybe you are already rich

Chapter 21: The Most Important Asset is Time

: How to utilize the asset called time

Epilogue_ How to Win the Time Traveler's Game

Acknowledgements

References

Detailed image

Into the book

And I am a believer in the power of diversification.

I don't think that because the director is good, we should abandon the director, and because the director is undervalued, we shouldn't leave the overvalued director.

Since it is impossible to accurately predict which one is better, we divide it appropriately and invest in the beauty salon and the national hospital.

Just adjust the specific gravity.

There is no strict distinction between index funds and active funds.

Research showing that 90 percent of active funds underperform the index, particularly the S&P 500, is now accepted as established fact.

However, once you have accumulated a certain level of investment knowledge and the ability to select good funds, there is no reason to stick to index funds.

With this mindset, my portfolio includes index funds, active funds, and individual stocks.

--- p.13, from “Just Keep Buying in Korea”

Nick Maguly, the author of this book, says to ignore these things and just "keep buying," but I think a little differently.

Since we live in Korea, we don't think we can put all our assets into the S&P 500.

So as the amount grew, I started to practice asset allocation and savings in parallel.

This is not a question of which is 'right' or 'wrong'.

It's a matter of personal taste and preference.

Continuing to invest in the S&P 500, like Morgan Housel, author of "The Immutable Laws" and "The Psychology of Money," and Nick Magieuly, author of this book, suggest, is a good approach, but I didn't feel comfortable with that.

Since I prefer to diversify my investments across regions and targets, I manage my assets in a way that combines asset allocation and savings.

--- pp.23-24, from “Just Keep Buying in Korea”

The biggest lie about investing is that “you can get rich just by cutting back on your spending.”

The reason this has to be a lie is because of the 'poverty trap'.

The financial media still spreads the lie that you can become a millionaire if you just cut out $5 a day on coffee.

Financial experts who spread such lies fail to mention that this is only possible if you earn 12 percent annual returns (the average market return is 8-10 percent).

--- p.74, from “Chapter 2 How Much Should I Save?”

Let's say your income increases tenfold.

Even so, it is very unlikely that you will spend 10 times more on basic living expenses such as food, rent, medical expenses, and transportation.

The quality of food and housing will improve, but no matter how much it improves, it won't cost ten times as much.

This is why saving is much easier for high-income households.

This is because they do not spend their basic living expenses at the same rate as low-income households.

However, many mainstream financial media outlets are reluctant to acknowledge this.

They keep repeating the same lies, saying that you have to save more to become rich.

--- p.93, from “Chapter 3 If You Want to Save More Money”

Let's say the time horizon is over two years.

In these cases, a cash savings strategy can be much riskier than you might think.

If you save $1,000 a month and accumulate $60,000, it would take 60 months (5 years) in a world without inflation.

…it took an average of 67 months to reach the goal of $60,000 in cash savings, a delay of 7 months.

Why is there such a long delay? The reason is that the longer the time horizon, the greater the impact of inflation on purchasing power.

--- pp.186-187, from “Chapter 8: Some Ways to Make Money”

The 4 percent rule states that you need 25 times your annual expenses to retire, so according to this rule, you need to save $1.2 million ($48,000 x 25).

That's slightly less than the $1.6 million suggested by the intersection rules.

However, this is because the intersection rule is applied and the annual investment return is assumed to be 3 percent.

Assuming a 4 percent annual investment return, the two rules recommend the same retirement assets of $1.2 million.

--- p.207, from “Chapter 9: When Can I Retire?”

Adam Ferguson said this in his book, The Money Crash:

“There is a story that the price of food is different when you order and when you pay.

“He ordered a 5,000-mark coffee, and when he went to pay, he found that the price had gone up to 8,000 marks.” This situation is not common, but it shows how devastating the effects of extreme inflation can be.

Fortunately, we have effective tools to protect asset values against inflation.

It's an investment.

You can successfully counter the effects of inflation by holding assets that maintain or increase in value (purchasing power) over time.

--- p.225, from Chapter 10, “Why Should We Invest?”

Although we've discussed the many advantages of stocks, they are also income-generating assets that we wouldn't recommend to the faint-hearted.

This is because we have to endure a decline of more than 50 percent two or three times a century, a decline of around 30 percent every four or five years, and a decline of at least 10 percent every other year.

Watching a decade of steady growth evaporate in a matter of days is a terribly painful experience, even for the most seasoned investor.

The best way to deal with these emotional upheavals is to take a long-term, 'long-term' approach.

While this attitude doesn't necessarily guarantee profits, historically, stocks have always recovered losses over time.

Time is a stock investor's best friend.

--- pp.239-240, from “Chapter 11 What is a good thing to invest in?”

Even the most accomplished professional investor will find it difficult to beat the returns of a broad basket of stocks (indexes).

Moreover, the chances of you finding highly profitable stocks are very low.

Even stocks that earn the top 4 percent of returns are not guaranteed to last forever.

So, it's much better to own a lot of stocks by investing in index funds or ETFs than to try to pick individual stocks.

Because you can earn higher profits and it will be much less stressful.

--- p.278, from Chapter 12, “Why You Should Not Invest in Individual Stocks”

“Most stock markets go up most of the time.” No matter how turbulent and sometimes destructive human history has been, this fact remains.

Let's listen to Warren Buffett.

In the 20th century, the United States fought two world wars, as well as numerous military conflicts, which inflicted great harm and great cost.

We've been through the Great Depression, about ten recessions, financial market panics, and oil shocks.

We've suffered through a devastating flu pandemic and seen an impeached president resign.

Yet the Dow Jones Industrial Average rose from 66 to 11,497.

…this empirical evidence tells us that you should invest your money as soon as possible.

Why is this? The fact that most stock markets rise most of the time means that every day you hesitate and let your investments slip away is, from a future perspective, a day of accumulating losses.

So don't wait for the right time to invest, just jump in.

Invest the money you have right now.

--- p.292, from Chapter 13, “How soon should I start investing?”

Let me explain with an example of a simple thought experiment.

You suddenly have a million dollars.

I want to make this money grow significantly over the next 100 years.

However, investment strategies are limited to one of two.

Which would you choose? Invest all $1 million right now.

Invest $10,000 annually for 100 years.

Which option would you choose? If you assume your investments will appreciate in value over time (and who would invest otherwise?), investing now is a far better option than investing incrementally over a century.

--- p.293, from Chapter 13, “How soon should I start investing?”

Even a god with all the knowledge couldn't beat the average-price split-purchase method! Why? Because buy-the-dip is a strategy that only works when you know a serious bear market is imminent and can perfectly time it.

The problem is that serious bear markets don't happen very often.

In the history of the U.S. stock market, there have only been three near-collapses: the 1930s, the 1970s, and the 2000s.

It's very rare.

In other words, it is highly unlikely that BuyerDip will beat the average unit price split purchase method.

--- p.319, from “Chapter 14: Why There is No Need to Wait for a Low-Price Buying Timing”

Another reason the buy-the-dip strategy is problematic is that we don't know when the optimal low is to buy in the first place.

Although we have analyzed so far under the assumption that we know when the optimal low is and enter the buy-the-dip phase, that was literally just an assumption for analysis.

Capturing perfect buy-the-dip timing is virtually impossible.

--- p.330, from Chapter 14, “Why There is No Need to Wait for a Low-Price Purchase Timing”

If you had invested in stocks worldwide in the same way since 1970, you would have an 85 percent chance of earning more than cash in 10 years, and you would have earned 8 percent of your investment.

In both cases, the method of accumulating wealth is the same.

Just keep buying! Even if God comes, you can't achieve higher returns than the average unit price installment method, so what can you do?

--- p.331, from “Chapter 14: Why There is No Need to Wait for a Low-Price Buying Timing”

Why are profits lower when loss avoidance is used rather than when holding a buy candidate?

Simply put, it is because the period of time spent out of the stock market is too long.

If you had used a loss aversion strategy, you would have invested about 90 percent of your money in bonds every year except for seven years since 1950.

This can also be confirmed through [Table 16-3], which shows the results of investing in bonds as a loss aversion strategy.

--- p.360, from “Chapter 16: Investors Don’t Need to Fear Volatility”

Researchers at Vanguard, a professional asset management firm, reached a similar conclusion.

“Regardless of how frequently the portfolio was rebalanced—monthly, quarterly, or annually—there was no significant difference in returns.

But the more frequent the readjustments, the more the costs increase." Is there a better way to readjust? Just keep buying.

Yes, that's right.

You can continue buying and bring your portfolio back to its original state.

I call this 'purchase readjustment'.

--- p.400, from “Chapter 18: When is it best to sell?”

What really matters is not what you own, but where you own it.

From now on, we will look at asset location.

Asset location refers to the method of dividing assets into various types of accounts, such as taxable accounts and tax-exempt accounts.

For example, are your bonds held in a taxable account, a tax-exempt account, or both? What about stocks?

--- pp.438-439, from “Chapter 19: Where is Your Money?”

Former Goldman Sachs CEO and billionaire Lloyd Blankfein, despite his vast wealth, claimed in a 2020 interview that he was "just fine" but not rich.

Blankfine's story is truly amazing, but at the same time, it's not that incomprehensible.

If you hang out with people like Jeff Bezos and David Geffen, and have Ray Dalio and Ken Griffin as friends, a billion dollars might not seem like a lot of money.

But objectively speaking, Blankfein is in the top 0.01 percent of income earners in the United States.

In other words, it is 1 percent of 1 percent.

I don't think that because the director is good, we should abandon the director, and because the director is undervalued, we shouldn't leave the overvalued director.

Since it is impossible to accurately predict which one is better, we divide it appropriately and invest in the beauty salon and the national hospital.

Just adjust the specific gravity.

There is no strict distinction between index funds and active funds.

Research showing that 90 percent of active funds underperform the index, particularly the S&P 500, is now accepted as established fact.

However, once you have accumulated a certain level of investment knowledge and the ability to select good funds, there is no reason to stick to index funds.

With this mindset, my portfolio includes index funds, active funds, and individual stocks.

--- p.13, from “Just Keep Buying in Korea”

Nick Maguly, the author of this book, says to ignore these things and just "keep buying," but I think a little differently.

Since we live in Korea, we don't think we can put all our assets into the S&P 500.

So as the amount grew, I started to practice asset allocation and savings in parallel.

This is not a question of which is 'right' or 'wrong'.

It's a matter of personal taste and preference.

Continuing to invest in the S&P 500, like Morgan Housel, author of "The Immutable Laws" and "The Psychology of Money," and Nick Magieuly, author of this book, suggest, is a good approach, but I didn't feel comfortable with that.

Since I prefer to diversify my investments across regions and targets, I manage my assets in a way that combines asset allocation and savings.

--- pp.23-24, from “Just Keep Buying in Korea”

The biggest lie about investing is that “you can get rich just by cutting back on your spending.”

The reason this has to be a lie is because of the 'poverty trap'.

The financial media still spreads the lie that you can become a millionaire if you just cut out $5 a day on coffee.

Financial experts who spread such lies fail to mention that this is only possible if you earn 12 percent annual returns (the average market return is 8-10 percent).

--- p.74, from “Chapter 2 How Much Should I Save?”

Let's say your income increases tenfold.

Even so, it is very unlikely that you will spend 10 times more on basic living expenses such as food, rent, medical expenses, and transportation.

The quality of food and housing will improve, but no matter how much it improves, it won't cost ten times as much.

This is why saving is much easier for high-income households.

This is because they do not spend their basic living expenses at the same rate as low-income households.

However, many mainstream financial media outlets are reluctant to acknowledge this.

They keep repeating the same lies, saying that you have to save more to become rich.

--- p.93, from “Chapter 3 If You Want to Save More Money”

Let's say the time horizon is over two years.

In these cases, a cash savings strategy can be much riskier than you might think.

If you save $1,000 a month and accumulate $60,000, it would take 60 months (5 years) in a world without inflation.

…it took an average of 67 months to reach the goal of $60,000 in cash savings, a delay of 7 months.

Why is there such a long delay? The reason is that the longer the time horizon, the greater the impact of inflation on purchasing power.

--- pp.186-187, from “Chapter 8: Some Ways to Make Money”

The 4 percent rule states that you need 25 times your annual expenses to retire, so according to this rule, you need to save $1.2 million ($48,000 x 25).

That's slightly less than the $1.6 million suggested by the intersection rules.

However, this is because the intersection rule is applied and the annual investment return is assumed to be 3 percent.

Assuming a 4 percent annual investment return, the two rules recommend the same retirement assets of $1.2 million.

--- p.207, from “Chapter 9: When Can I Retire?”

Adam Ferguson said this in his book, The Money Crash:

“There is a story that the price of food is different when you order and when you pay.

“He ordered a 5,000-mark coffee, and when he went to pay, he found that the price had gone up to 8,000 marks.” This situation is not common, but it shows how devastating the effects of extreme inflation can be.

Fortunately, we have effective tools to protect asset values against inflation.

It's an investment.

You can successfully counter the effects of inflation by holding assets that maintain or increase in value (purchasing power) over time.

--- p.225, from Chapter 10, “Why Should We Invest?”

Although we've discussed the many advantages of stocks, they are also income-generating assets that we wouldn't recommend to the faint-hearted.

This is because we have to endure a decline of more than 50 percent two or three times a century, a decline of around 30 percent every four or five years, and a decline of at least 10 percent every other year.

Watching a decade of steady growth evaporate in a matter of days is a terribly painful experience, even for the most seasoned investor.

The best way to deal with these emotional upheavals is to take a long-term, 'long-term' approach.

While this attitude doesn't necessarily guarantee profits, historically, stocks have always recovered losses over time.

Time is a stock investor's best friend.

--- pp.239-240, from “Chapter 11 What is a good thing to invest in?”

Even the most accomplished professional investor will find it difficult to beat the returns of a broad basket of stocks (indexes).

Moreover, the chances of you finding highly profitable stocks are very low.

Even stocks that earn the top 4 percent of returns are not guaranteed to last forever.

So, it's much better to own a lot of stocks by investing in index funds or ETFs than to try to pick individual stocks.

Because you can earn higher profits and it will be much less stressful.

--- p.278, from Chapter 12, “Why You Should Not Invest in Individual Stocks”

“Most stock markets go up most of the time.” No matter how turbulent and sometimes destructive human history has been, this fact remains.

Let's listen to Warren Buffett.

In the 20th century, the United States fought two world wars, as well as numerous military conflicts, which inflicted great harm and great cost.

We've been through the Great Depression, about ten recessions, financial market panics, and oil shocks.

We've suffered through a devastating flu pandemic and seen an impeached president resign.

Yet the Dow Jones Industrial Average rose from 66 to 11,497.

…this empirical evidence tells us that you should invest your money as soon as possible.

Why is this? The fact that most stock markets rise most of the time means that every day you hesitate and let your investments slip away is, from a future perspective, a day of accumulating losses.

So don't wait for the right time to invest, just jump in.

Invest the money you have right now.

--- p.292, from Chapter 13, “How soon should I start investing?”

Let me explain with an example of a simple thought experiment.

You suddenly have a million dollars.

I want to make this money grow significantly over the next 100 years.

However, investment strategies are limited to one of two.

Which would you choose? Invest all $1 million right now.

Invest $10,000 annually for 100 years.

Which option would you choose? If you assume your investments will appreciate in value over time (and who would invest otherwise?), investing now is a far better option than investing incrementally over a century.

--- p.293, from Chapter 13, “How soon should I start investing?”

Even a god with all the knowledge couldn't beat the average-price split-purchase method! Why? Because buy-the-dip is a strategy that only works when you know a serious bear market is imminent and can perfectly time it.

The problem is that serious bear markets don't happen very often.

In the history of the U.S. stock market, there have only been three near-collapses: the 1930s, the 1970s, and the 2000s.

It's very rare.

In other words, it is highly unlikely that BuyerDip will beat the average unit price split purchase method.

--- p.319, from “Chapter 14: Why There is No Need to Wait for a Low-Price Buying Timing”

Another reason the buy-the-dip strategy is problematic is that we don't know when the optimal low is to buy in the first place.

Although we have analyzed so far under the assumption that we know when the optimal low is and enter the buy-the-dip phase, that was literally just an assumption for analysis.

Capturing perfect buy-the-dip timing is virtually impossible.

--- p.330, from Chapter 14, “Why There is No Need to Wait for a Low-Price Purchase Timing”

If you had invested in stocks worldwide in the same way since 1970, you would have an 85 percent chance of earning more than cash in 10 years, and you would have earned 8 percent of your investment.

In both cases, the method of accumulating wealth is the same.

Just keep buying! Even if God comes, you can't achieve higher returns than the average unit price installment method, so what can you do?

--- p.331, from “Chapter 14: Why There is No Need to Wait for a Low-Price Buying Timing”

Why are profits lower when loss avoidance is used rather than when holding a buy candidate?

Simply put, it is because the period of time spent out of the stock market is too long.

If you had used a loss aversion strategy, you would have invested about 90 percent of your money in bonds every year except for seven years since 1950.

This can also be confirmed through [Table 16-3], which shows the results of investing in bonds as a loss aversion strategy.

--- p.360, from “Chapter 16: Investors Don’t Need to Fear Volatility”

Researchers at Vanguard, a professional asset management firm, reached a similar conclusion.

“Regardless of how frequently the portfolio was rebalanced—monthly, quarterly, or annually—there was no significant difference in returns.

But the more frequent the readjustments, the more the costs increase." Is there a better way to readjust? Just keep buying.

Yes, that's right.

You can continue buying and bring your portfolio back to its original state.

I call this 'purchase readjustment'.

--- p.400, from “Chapter 18: When is it best to sell?”

What really matters is not what you own, but where you own it.

From now on, we will look at asset location.

Asset location refers to the method of dividing assets into various types of accounts, such as taxable accounts and tax-exempt accounts.

For example, are your bonds held in a taxable account, a tax-exempt account, or both? What about stocks?

--- pp.438-439, from “Chapter 19: Where is Your Money?”

Former Goldman Sachs CEO and billionaire Lloyd Blankfein, despite his vast wealth, claimed in a 2020 interview that he was "just fine" but not rich.

Blankfine's story is truly amazing, but at the same time, it's not that incomprehensible.

If you hang out with people like Jeff Bezos and David Geffen, and have Ray Dalio and Ken Griffin as friends, a billion dollars might not seem like a lot of money.

But objectively speaking, Blankfein is in the top 0.01 percent of income earners in the United States.

In other words, it is 1 percent of 1 percent.

--- pp.459-460, from “Chapter 20: Why Rich People Don’t Feel Rich”

Publisher's Review

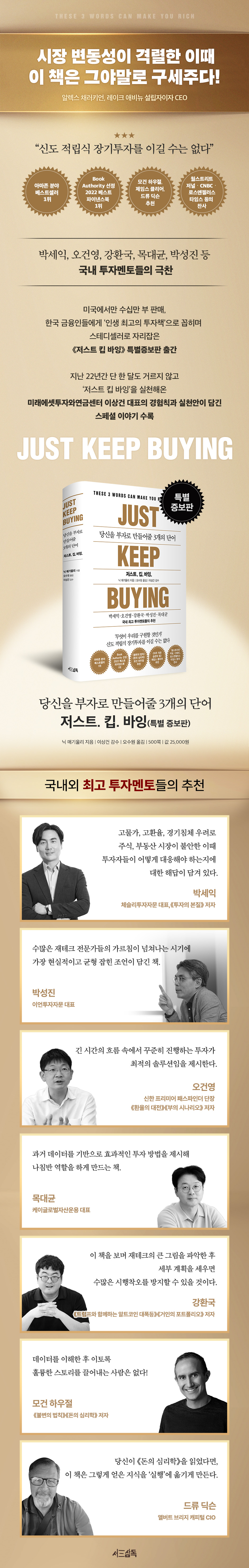

At a time of intense market volatility,

This book is a true savior!

-Alex Charakian, Founder and CEO of Lake Avenue-

★★★★★

Park Se-ik, Oh Geon-yeong, Kang Hwan-guk, Park Seong-jin, and Mok Dae-gyun

Recommendations from Korea's top investment mentors

#1 Amazon Bestseller

BookAuthority's #1 Best Finance Book of 2022

High praise from James Clear and Morgan Housel

Praise from the Wall Street Journal, CNBC, and the Los Angeles Times

■ “I am a person who believes in the power of diversification.”

The experience and philosophy of an investor who has been practicing "Just Keep Buying" in Korea for 22 years, as featured in this special edition.

Just Keep Buying, which has sold hundreds of thousands of copies in the United States alone and has become a steady seller in Korea, where many financiers and investors have cited it as the "best book of their lives," has been republished in a special expanded edition.

This special edition includes the real-life "Just Keep Buying" story of Lee Sang-geon, CEO of Mirae Asset Pension & Investment Center, who has been practicing lump-sum investing without missing a single month for the past 22 years, with the permission of author Nick Maguly.

The title is “Just Keep Buying in Korea: A 22-Year Accumulation Investor’s Praise for Accumulation.”

This book contains the long-term experience and philosophy of CEO Lee Sang-geon, who has made a fortune through installment savings, secured funds for a home purchase, and prepared for retirement through installment savings since a time when the term "installment savings" was unfamiliar.

CEO Lee Sang-geon said, “I don’t think we should abandon the director because the manager is good, and I don’t think we should abandon the highly rated director because the manager is undervalued.

Since we cannot make an accurate prediction, we divide it appropriately and invest in the beauty salon and the national hospital.

Just adjust the specific gravity.

There is no strict distinction between index funds and active funds.

Research showing that 90 percent of active funds underperform the index, particularly the S&P 500, is now accepted as established fact.

But if you have the ability to choose good funds, there's no reason to stick to index funds.

“So, my portfolio includes index funds, active funds, and individual stocks,” he says.

And he tells them to keep numbers like 10, 20, 30, and 50 in their heads.

“Based on the U.S. market, the stock market historically records -10% once every two years, -20-30% every four to five years, and -50% once every 50 years.

If the stock market falls by 10 percent, the newspaper headlines the stock market crash.

If 20-30 is missed, the stock market will be covered as the front story on the 9 o'clock news.

If it drops 50 percent, that's panic itself.

This will be a time of tremendous opportunity for some, and a time of great suffering for others.

A 10 percent drop is common in the stock market, so just sit tight.

A 20-30 percent decline is a golden opportunity for investors who invest in stocks at low prices.

“If it drops 50 percent, if you're a prepared investor, you have a chance to make a lot of money, and if you're a savvy investor, you can literally buy the dip, or buy at the bottom.”

Furthermore, based on my 22 years of investing, I believe the most important thing is patience, and I emphasize that you should not leave the market under any circumstances and continue to invest.

In this way, CEO Lee Sang-geon generously shares his extensive experience and philosophy, imparting the wisdom of a pioneer to those struggling to "just keep buying" in Korea.

It's full of meaningful advice on how Korean investors, who are often faced with the dilemma of whether to buy a stock or a director, a fund or an ETF, can wisely "just keep buying."

■ “No matter what books I read, my anxiety about money never went away.”

Why Data Scientist Nick Magiuly Wrote This Book

“Wait for the right time to buy at a low price.” “Don’t put all your eggs in one basket.” “Buy on your knees and sell on your shoulders.” And so on.

The world of investing is full of colorful words and wise sayings.

But Nick Magiuly, a data scientist and wealth management expert, says this long-held message isn't always true, nor does it apply to everyone or in every situation.

Nick Maguly admits that he once faithfully followed this maxim, reading many books and reports.

His parents were not rich, and he didn't even know what stocks were until he entered college. He was anxious every day, worried about how to make a living.

Nick suffered from a neurosis about money, reading everything he could about money and investing and trying to put it into practice, but his fear of the future never went away.

Then, while analyzing the stock market as a data scientist, he had a surprising realization.

And I compiled that realization into a book.

“The reason I wrote Just Keep Buying is simple.

After analyzing nearly 100 years of stock market data, we concluded that the safest and most certain way to make money is through 'Just Keep Buying.'

“It was all about continuing to buy income-generating assets.”

■ “Just, keep, buy!”

The path to financial freedom lies in these three words.

So, which income-generating assets should you continue to buy? In "Wealth, War, and Wisdom," Barton Biggs analyzed which income-generating assets have been most effective at preserving asset value over hundreds of years and concluded, "Considering liquidity, stocks are the optimal place to hold your assets."

Nick Magiuly said, “There’s no guarantee that the global stock market bull market of the 20th century will continue in the future, but I’d bet on it continuing,” adding, “If I had to pick just one income-generating asset, it would be stocks without hesitation.”

It didn't matter which stocks I bought or when.

The important thing was to just keep buying, buying, and living.

There was no need to analyze corporate value or determine whether it was a bull or bear market.

As if it were a habit, the only thing that mattered was to ‘keep living’ frequently.

This is also known as Dollar Cost Averaging (DCA).

Comparing returns over 40 years, starting in 1975, the average-price installment method outperformed buy-the-dip from start to finish! When considering returns, it was clear that the path to wealth lay in these three words: "Just Keep Buying."

■ Data says, “Returns are highest after a market crash!”

A new perspective and attitude toward stocks and investing

Nick Magiuly's proposals are based on rigorous data and evidence rather than personal beliefs or speculation.

As a result, there are some guidelines that run counter to the advice we often hear, such as the following:

Why you should save less than you think

· Why you shouldn't buy individual stocks

Why a large correction is a good buying opportunity

· Reasons why it is not advisable to hold cash to catch the timing of low-price purchases, etc.

Nick uses data to convince readers of these "unexpected tips."

For example, they present 100 years of data analysis on why 'large-scale corrections are good buying opportunities.'

The future annual return on investment during the period of declines of more than 50 percent between 1920 and 2020 was a whopping 25 percent!

So why shouldn't you buy individual stocks? A study of the U.S. stock market from 1926 to 2016 found that only 4 percent of stocks outperformed Treasury bonds.

Five companies created 10 percent of the total wealth.

The five companies were ExxonMobil, Apple, Microsoft, General Electric, and IBM.

Nick asks his readers:

“Are you confident that you can pick one of the 4 percent of stocks and not pick one of the 96 percent?”

Nick recommends that if you don't have the confidence to do so, don't buy individual stocks, and instead actively use index funds.

■ “Even God cannot beat the returns of long-term, lump-sum investment!”

Here's why we just have to keep buying.

Lee Sang-geon, CEO of Mirae Asset Investment & Pension Center, who reviewed this book, said, “I regret realizing too late that income-generating assets like stocks are not meant to be bought and sold, but rather ‘buyed and accumulated.’”

The point is that if Nick Magiuly's argument had been put into practice 20 years ago, things would be very different now.

Over the past 20 years, there have been countless events, including the foreign exchange crisis, the credit card liquidity crisis, the internet bubble, the Iraq War, the 9/11 terrorist attacks, the financial crisis, and the COVID-19 pandemic. Yet, stocks have continued to rise over the long term.

If a person had quietly worked hard and accumulated S&P 500 index funds or ETFs (exchange-traded funds), or had consistently invested a fixed amount every month, he or she would probably have significant assets now.

Perhaps the path for ordinary people like us to become rich was this simple and straightforward.

'Just keep buying' is the easiest and most active way to accumulate wealth.

All you have to do is watch the little snowball roll down the hill and turn into a big snowball all by itself.

All you need is a long-term perspective, a disciplined approach, and the habit of consistently investing your money.

Just Keep Buying.

I believe that if we simply put these three simple words into practice, anyone can enter the path to becoming a happy and wealthy person.

******The Just Keep Buying's rules

- 21 Principles to Guide You to Financial Freedom -

1.

Poor people save, rich people invest.

Is now the time to save or invest? If your expected savings exceed your expected investment returns, focus on saving. If not, focus on investing.

If both are similar, it is better to focus on both.

2.

Saving is just doing as much as you can.

Unless you inherited wealth, for any rich person, everything starts with saving money to make a lump sum.

But could it be that excessive anxiety about the future is driving you to increase your savings rate, preventing you from making wise decisions about savings and investments? To address this, the advice is to save only as much as you can.

Not overdoing it is the key to surviving the long and arduous journey of investing.

3.

Focus on increasing your income, not reducing your spending.

The debate over whether to cut spending or increase income to make money is never-ending.

Let me be clear.

Focus on increasing your income.

There are limits to reducing spending, but there are no limits to increasing income.

Remember that Jerry Richardson, an American football player, became the richest football player in American history through business ownership, not through his labor (football).

4.

To eliminate consumer guilt, it's a good idea to use the "2x rule."

If you feel guilty about spending even though you have enough money in your account, it's time to use the "2x rule."

It is not always best to save money unconditionally.

Ultimately, money should be used as a 'tool' to live the life you want.

The double rule is a consumption technique that can be used meaningfully in that context.

5.

If you have an 'increase' in your income, save at least 50 percent of it.

Lifestyle creep isn't necessarily a bad thing.

'To some extent' is okay.

If you can't enjoy the fruits of your labor, there's no reason to keep working hard.

So how much of your increased income should you save? Save at least 50 percent of your increase.

This is advice that applies to almost everyone in almost any situation.

6.

Debt isn't a good or bad thing, it just depends on how you use it.

There is no right or wrong in debt itself.

Depending on your investment scenario, debt can be either harmful or beneficial.

The key is to use it wisely and only when it helps your personal finances.

7.

When the time comes, you have to buy a house.

Many people ask:

"Should I buy a home, or should I invest the money?" Buying a home is a difficult decision that significantly impacts our lives.

Still, for whatever reason, you need to buy a house.

It's just a matter of timing.

8.

If your time horizon is less than two years, use cash savings. If it is more than two years, use stock and bond investments.

If you need a large sum of money for a wedding or home purchase within the next two years, setting a short-term goal and saving cash is the best way to accumulate a large sum of money.

On the other hand, if the time horizon is longer, the choices are different.

It is better to consider options such as bonds or stocks that can offset the loss of purchasing power due to inflation.

9.

The most important thing in retirement isn't money.

Many people have vague fears about retirement.

The first reason most people cite for fear is 'money'.

But what actually drives them into a corner is not money, but 'identity'.

Before deciding to retire, you should have a clear idea of what kind of life you want to lead and a clear plan for it.

10.

Invest in converting human capital into financial assets.

It is not possible to receive labor income until death.

Replace human capital with financial assets before it's too late.

Build financial assets that will add money to your bank account even when you are not working.

There is probably no stronger motivation to invest than this.

11.

Prepare income-generating assets with the concept of ownership where you become the owner yourself.

Find an investment method that suits you.

Few people truly understand the significance of this seemingly simple and obvious statement.

Finding the right income-generating asset for you.

To do so, I hope you will first consider all the methods offered in the world of investment.

Among these, income-generating assets that can have a concept of ownership can be expected to yield the greatest returns when successful.

12.

Do not buy individual stocks.

From 1926 to 2016, stocks outperformed Treasury bonds in the United States thanks to the returns of just 4 percent of stocks.

So, are you confident you'll pick one of the top 4% of stocks and not pick one of the top 96%? There's so much luck involved in individual stock investing.

Why bother jumping into this game and getting impatient? Buying individual stocks and hoping for good results is perhaps like playing a coin-flipping game.

13.

Buy fast, sell slow.

Most markets tend to rise over the long term.

Therefore, buying fast and selling slow is the optimal way to maximize wealth.

14.

Invest as soon as possible, and invest often.

Are you still thinking about saving cash and waiting for the right time to enter the market? If so, I urge you to reconsider your thinking.

Even God cannot make a better profit than the average unit price split purchase method.

15.

Investing is not about what cards you have in your hand, but what game you play with them.

It's true that luck is important in investing.

But 'nevertheless' we can control our future.

Of course, to some extent.

Anyway, these conditions are the same for everyone.

We have a variety of cards to choose from and play when it comes to how much to save and where to invest, and how to adjust our portfolios to respond to crises.

Ultimately, the outcome comes down to how you play the game with those cards.

16.

Volatility is inevitable, don't be afraid.

The twists and turns are bound to come.

It's just a question of 'when'.

Accept it.

No one can avoid volatility.

Charles Munger once said:

“About two or three times a century, the market falls by more than 50 percent.

“Anyone who loses their composure in times like these is not suitable for stock investment, and even if they receive poor results, they will have nothing to say.”

17.

A market crash is a buying opportunity.

The highest returns are obtained after a severe market crash.

When these crashes occur periodically, don't be afraid and take advantage of the opportunity.

The data tells us that if you have the funds, you should make the most of these buying opportunities.

18.

There are only three cases in which you may sell an asset:

I've said it over and over again.

Just keep going.

But there are times when you have to sell.

However, selling assets is justified only in three cases:

For portfolio rebalancing.

To get out of a losing position.

And to live the life you want.

Let's not forget one important fact here.

The purpose of making money is not to become rich.

To live the life you want.

Nothing can precede this proposition.

19.

What you buy is important, but where you put it is also important.

People who have recently invested often judge their investment performance by looking at numbers or return graphs in Excel files.

But anyone with long-term investment experience will know that's not all.

What matters is the actual after-tax profit you get.

This is why it is important to know which account you keep your money in.

20.

You may already be rich.

Billionaire Lloyd Blankfein once said:

“I am not rich.

“I’m just living well.” It’s a shocking story, but I’m sure he’s being sincere.

This is because the concept of wealth is relative.

There is no such thing as absolute rich or absolute poor.

Remember that it is far more important to stick to your life purpose, investment philosophy, and investment principles.

21.

Time is your most important asset.

Time is our most important asset.

It has been so until now and will be so in the future.

How you spend your time in your 20s, 30s, and 40s will make a big difference in your 50s, 60s, and 70s.

Unfortunately, it takes a considerable amount of time to learn this lesson.

This book is a true savior!

-Alex Charakian, Founder and CEO of Lake Avenue-

★★★★★

Park Se-ik, Oh Geon-yeong, Kang Hwan-guk, Park Seong-jin, and Mok Dae-gyun

Recommendations from Korea's top investment mentors

#1 Amazon Bestseller

BookAuthority's #1 Best Finance Book of 2022

High praise from James Clear and Morgan Housel

Praise from the Wall Street Journal, CNBC, and the Los Angeles Times

■ “I am a person who believes in the power of diversification.”

The experience and philosophy of an investor who has been practicing "Just Keep Buying" in Korea for 22 years, as featured in this special edition.

Just Keep Buying, which has sold hundreds of thousands of copies in the United States alone and has become a steady seller in Korea, where many financiers and investors have cited it as the "best book of their lives," has been republished in a special expanded edition.

This special edition includes the real-life "Just Keep Buying" story of Lee Sang-geon, CEO of Mirae Asset Pension & Investment Center, who has been practicing lump-sum investing without missing a single month for the past 22 years, with the permission of author Nick Maguly.

The title is “Just Keep Buying in Korea: A 22-Year Accumulation Investor’s Praise for Accumulation.”

This book contains the long-term experience and philosophy of CEO Lee Sang-geon, who has made a fortune through installment savings, secured funds for a home purchase, and prepared for retirement through installment savings since a time when the term "installment savings" was unfamiliar.

CEO Lee Sang-geon said, “I don’t think we should abandon the director because the manager is good, and I don’t think we should abandon the highly rated director because the manager is undervalued.

Since we cannot make an accurate prediction, we divide it appropriately and invest in the beauty salon and the national hospital.

Just adjust the specific gravity.

There is no strict distinction between index funds and active funds.

Research showing that 90 percent of active funds underperform the index, particularly the S&P 500, is now accepted as established fact.

But if you have the ability to choose good funds, there's no reason to stick to index funds.

“So, my portfolio includes index funds, active funds, and individual stocks,” he says.

And he tells them to keep numbers like 10, 20, 30, and 50 in their heads.

“Based on the U.S. market, the stock market historically records -10% once every two years, -20-30% every four to five years, and -50% once every 50 years.

If the stock market falls by 10 percent, the newspaper headlines the stock market crash.

If 20-30 is missed, the stock market will be covered as the front story on the 9 o'clock news.

If it drops 50 percent, that's panic itself.

This will be a time of tremendous opportunity for some, and a time of great suffering for others.

A 10 percent drop is common in the stock market, so just sit tight.

A 20-30 percent decline is a golden opportunity for investors who invest in stocks at low prices.

“If it drops 50 percent, if you're a prepared investor, you have a chance to make a lot of money, and if you're a savvy investor, you can literally buy the dip, or buy at the bottom.”

Furthermore, based on my 22 years of investing, I believe the most important thing is patience, and I emphasize that you should not leave the market under any circumstances and continue to invest.

In this way, CEO Lee Sang-geon generously shares his extensive experience and philosophy, imparting the wisdom of a pioneer to those struggling to "just keep buying" in Korea.

It's full of meaningful advice on how Korean investors, who are often faced with the dilemma of whether to buy a stock or a director, a fund or an ETF, can wisely "just keep buying."

■ “No matter what books I read, my anxiety about money never went away.”

Why Data Scientist Nick Magiuly Wrote This Book

“Wait for the right time to buy at a low price.” “Don’t put all your eggs in one basket.” “Buy on your knees and sell on your shoulders.” And so on.

The world of investing is full of colorful words and wise sayings.

But Nick Magiuly, a data scientist and wealth management expert, says this long-held message isn't always true, nor does it apply to everyone or in every situation.

Nick Maguly admits that he once faithfully followed this maxim, reading many books and reports.

His parents were not rich, and he didn't even know what stocks were until he entered college. He was anxious every day, worried about how to make a living.

Nick suffered from a neurosis about money, reading everything he could about money and investing and trying to put it into practice, but his fear of the future never went away.

Then, while analyzing the stock market as a data scientist, he had a surprising realization.

And I compiled that realization into a book.

“The reason I wrote Just Keep Buying is simple.

After analyzing nearly 100 years of stock market data, we concluded that the safest and most certain way to make money is through 'Just Keep Buying.'

“It was all about continuing to buy income-generating assets.”

■ “Just, keep, buy!”

The path to financial freedom lies in these three words.

So, which income-generating assets should you continue to buy? In "Wealth, War, and Wisdom," Barton Biggs analyzed which income-generating assets have been most effective at preserving asset value over hundreds of years and concluded, "Considering liquidity, stocks are the optimal place to hold your assets."

Nick Magiuly said, “There’s no guarantee that the global stock market bull market of the 20th century will continue in the future, but I’d bet on it continuing,” adding, “If I had to pick just one income-generating asset, it would be stocks without hesitation.”

It didn't matter which stocks I bought or when.

The important thing was to just keep buying, buying, and living.

There was no need to analyze corporate value or determine whether it was a bull or bear market.

As if it were a habit, the only thing that mattered was to ‘keep living’ frequently.

This is also known as Dollar Cost Averaging (DCA).

Comparing returns over 40 years, starting in 1975, the average-price installment method outperformed buy-the-dip from start to finish! When considering returns, it was clear that the path to wealth lay in these three words: "Just Keep Buying."

■ Data says, “Returns are highest after a market crash!”

A new perspective and attitude toward stocks and investing

Nick Magiuly's proposals are based on rigorous data and evidence rather than personal beliefs or speculation.

As a result, there are some guidelines that run counter to the advice we often hear, such as the following:

Why you should save less than you think

· Why you shouldn't buy individual stocks

Why a large correction is a good buying opportunity

· Reasons why it is not advisable to hold cash to catch the timing of low-price purchases, etc.

Nick uses data to convince readers of these "unexpected tips."

For example, they present 100 years of data analysis on why 'large-scale corrections are good buying opportunities.'

The future annual return on investment during the period of declines of more than 50 percent between 1920 and 2020 was a whopping 25 percent!

So why shouldn't you buy individual stocks? A study of the U.S. stock market from 1926 to 2016 found that only 4 percent of stocks outperformed Treasury bonds.

Five companies created 10 percent of the total wealth.

The five companies were ExxonMobil, Apple, Microsoft, General Electric, and IBM.

Nick asks his readers:

“Are you confident that you can pick one of the 4 percent of stocks and not pick one of the 96 percent?”

Nick recommends that if you don't have the confidence to do so, don't buy individual stocks, and instead actively use index funds.

■ “Even God cannot beat the returns of long-term, lump-sum investment!”

Here's why we just have to keep buying.

Lee Sang-geon, CEO of Mirae Asset Investment & Pension Center, who reviewed this book, said, “I regret realizing too late that income-generating assets like stocks are not meant to be bought and sold, but rather ‘buyed and accumulated.’”

The point is that if Nick Magiuly's argument had been put into practice 20 years ago, things would be very different now.

Over the past 20 years, there have been countless events, including the foreign exchange crisis, the credit card liquidity crisis, the internet bubble, the Iraq War, the 9/11 terrorist attacks, the financial crisis, and the COVID-19 pandemic. Yet, stocks have continued to rise over the long term.

If a person had quietly worked hard and accumulated S&P 500 index funds or ETFs (exchange-traded funds), or had consistently invested a fixed amount every month, he or she would probably have significant assets now.

Perhaps the path for ordinary people like us to become rich was this simple and straightforward.

'Just keep buying' is the easiest and most active way to accumulate wealth.

All you have to do is watch the little snowball roll down the hill and turn into a big snowball all by itself.

All you need is a long-term perspective, a disciplined approach, and the habit of consistently investing your money.

Just Keep Buying.

I believe that if we simply put these three simple words into practice, anyone can enter the path to becoming a happy and wealthy person.

******The Just Keep Buying's rules

- 21 Principles to Guide You to Financial Freedom -

1.

Poor people save, rich people invest.

Is now the time to save or invest? If your expected savings exceed your expected investment returns, focus on saving. If not, focus on investing.

If both are similar, it is better to focus on both.

2.

Saving is just doing as much as you can.

Unless you inherited wealth, for any rich person, everything starts with saving money to make a lump sum.

But could it be that excessive anxiety about the future is driving you to increase your savings rate, preventing you from making wise decisions about savings and investments? To address this, the advice is to save only as much as you can.

Not overdoing it is the key to surviving the long and arduous journey of investing.

3.

Focus on increasing your income, not reducing your spending.

The debate over whether to cut spending or increase income to make money is never-ending.

Let me be clear.

Focus on increasing your income.

There are limits to reducing spending, but there are no limits to increasing income.

Remember that Jerry Richardson, an American football player, became the richest football player in American history through business ownership, not through his labor (football).

4.

To eliminate consumer guilt, it's a good idea to use the "2x rule."

If you feel guilty about spending even though you have enough money in your account, it's time to use the "2x rule."

It is not always best to save money unconditionally.

Ultimately, money should be used as a 'tool' to live the life you want.

The double rule is a consumption technique that can be used meaningfully in that context.

5.

If you have an 'increase' in your income, save at least 50 percent of it.

Lifestyle creep isn't necessarily a bad thing.

'To some extent' is okay.

If you can't enjoy the fruits of your labor, there's no reason to keep working hard.

So how much of your increased income should you save? Save at least 50 percent of your increase.

This is advice that applies to almost everyone in almost any situation.

6.

Debt isn't a good or bad thing, it just depends on how you use it.

There is no right or wrong in debt itself.

Depending on your investment scenario, debt can be either harmful or beneficial.

The key is to use it wisely and only when it helps your personal finances.

7.

When the time comes, you have to buy a house.

Many people ask:

"Should I buy a home, or should I invest the money?" Buying a home is a difficult decision that significantly impacts our lives.

Still, for whatever reason, you need to buy a house.

It's just a matter of timing.

8.

If your time horizon is less than two years, use cash savings. If it is more than two years, use stock and bond investments.

If you need a large sum of money for a wedding or home purchase within the next two years, setting a short-term goal and saving cash is the best way to accumulate a large sum of money.

On the other hand, if the time horizon is longer, the choices are different.

It is better to consider options such as bonds or stocks that can offset the loss of purchasing power due to inflation.

9.

The most important thing in retirement isn't money.

Many people have vague fears about retirement.

The first reason most people cite for fear is 'money'.

But what actually drives them into a corner is not money, but 'identity'.

Before deciding to retire, you should have a clear idea of what kind of life you want to lead and a clear plan for it.

10.

Invest in converting human capital into financial assets.

It is not possible to receive labor income until death.

Replace human capital with financial assets before it's too late.

Build financial assets that will add money to your bank account even when you are not working.

There is probably no stronger motivation to invest than this.

11.

Prepare income-generating assets with the concept of ownership where you become the owner yourself.

Find an investment method that suits you.

Few people truly understand the significance of this seemingly simple and obvious statement.

Finding the right income-generating asset for you.

To do so, I hope you will first consider all the methods offered in the world of investment.

Among these, income-generating assets that can have a concept of ownership can be expected to yield the greatest returns when successful.

12.

Do not buy individual stocks.

From 1926 to 2016, stocks outperformed Treasury bonds in the United States thanks to the returns of just 4 percent of stocks.

So, are you confident you'll pick one of the top 4% of stocks and not pick one of the top 96%? There's so much luck involved in individual stock investing.

Why bother jumping into this game and getting impatient? Buying individual stocks and hoping for good results is perhaps like playing a coin-flipping game.

13.

Buy fast, sell slow.

Most markets tend to rise over the long term.

Therefore, buying fast and selling slow is the optimal way to maximize wealth.

14.

Invest as soon as possible, and invest often.

Are you still thinking about saving cash and waiting for the right time to enter the market? If so, I urge you to reconsider your thinking.

Even God cannot make a better profit than the average unit price split purchase method.

15.

Investing is not about what cards you have in your hand, but what game you play with them.

It's true that luck is important in investing.

But 'nevertheless' we can control our future.

Of course, to some extent.

Anyway, these conditions are the same for everyone.

We have a variety of cards to choose from and play when it comes to how much to save and where to invest, and how to adjust our portfolios to respond to crises.

Ultimately, the outcome comes down to how you play the game with those cards.

16.

Volatility is inevitable, don't be afraid.

The twists and turns are bound to come.

It's just a question of 'when'.

Accept it.

No one can avoid volatility.

Charles Munger once said:

“About two or three times a century, the market falls by more than 50 percent.

“Anyone who loses their composure in times like these is not suitable for stock investment, and even if they receive poor results, they will have nothing to say.”

17.

A market crash is a buying opportunity.

The highest returns are obtained after a severe market crash.

When these crashes occur periodically, don't be afraid and take advantage of the opportunity.

The data tells us that if you have the funds, you should make the most of these buying opportunities.

18.

There are only three cases in which you may sell an asset:

I've said it over and over again.

Just keep going.

But there are times when you have to sell.

However, selling assets is justified only in three cases:

For portfolio rebalancing.

To get out of a losing position.

And to live the life you want.

Let's not forget one important fact here.

The purpose of making money is not to become rich.

To live the life you want.

Nothing can precede this proposition.

19.

What you buy is important, but where you put it is also important.

People who have recently invested often judge their investment performance by looking at numbers or return graphs in Excel files.

But anyone with long-term investment experience will know that's not all.

What matters is the actual after-tax profit you get.

This is why it is important to know which account you keep your money in.

20.

You may already be rich.

Billionaire Lloyd Blankfein once said:

“I am not rich.

“I’m just living well.” It’s a shocking story, but I’m sure he’s being sincere.

This is because the concept of wealth is relative.

There is no such thing as absolute rich or absolute poor.

Remember that it is far more important to stick to your life purpose, investment philosophy, and investment principles.

21.

Time is your most important asset.

Time is our most important asset.

It has been so until now and will be so in the future.

How you spend your time in your 20s, 30s, and 40s will make a big difference in your 50s, 60s, and 70s.

Unfortunately, it takes a considerable amount of time to learn this lesson.

GOODS SPECIFICS

- Date of issue: March 28, 2025

- Format: Hardcover book binding method guide

- Page count, weight, size: 500 pages | 758g | 145*217*35mm

- ISBN13: 9791193904312

- ISBN10: 1193904315

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)