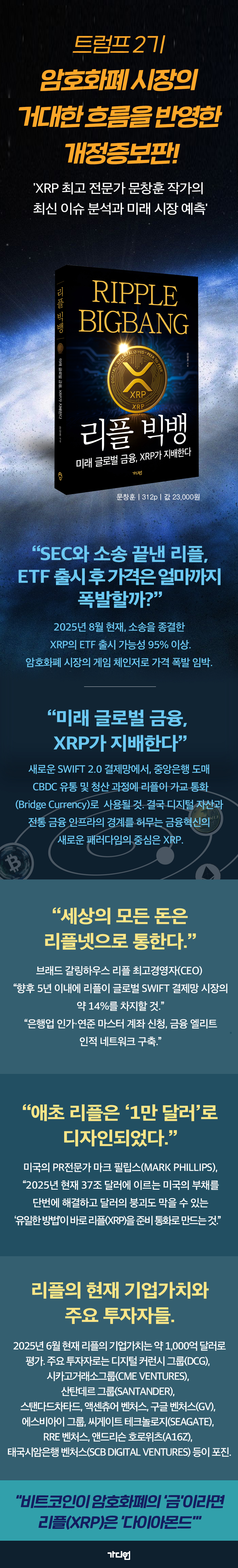

Ripple Big Bang

|

Description

Book Introduction

Trump's second term marks the beginning of a major upheaval in the cryptocurrency market!

Ripple (XRP), which has concluded its SEC lawsuit, is challenging global financial hegemony with ETF approval.

As Vitalik Buterin predicted, “XRP will not only challenge Bitcoin’s dominance, but also become a more powerful alternative.” XRP has emerged as a central axis of future financial innovation beyond a simple alternative.

As of September 2025, the SEC has withdrawn its case, resulting in a historic ruling that has resulted in a landslide victory for XRP and cleared regulatory uncertainty for the entire cryptocurrency market.

As a result, the price of XRP, which had been suppressed for years, rose by more than 300%, causing cheers, and even Bloomberg, JP Morgan, and Wall Street analysts officially mentioned the potential of XRP, making it a foregone conclusion that it will rise at least 10 times in the future, and even explosively (Big Bang).

Accordingly, about 10 ETF products, including Grayscale and Franklin Templeton, have been launched, and the probability of approval is expected to be over 95%.

With the approval, global institutional funds will begin to flow in, meaning that the price of XRP is not just rising, but is on the verge of a 'Big Bang-level explosion'.

The revised and expanded edition of "Ripple Big Bang" is not a simple update of the existing book.

This book analyzes in detail the pro-cryptocurrency policies of Trump's second term, ETF approval, the global financial sector's integration of XRP, and the latest moves of XRP (Ripple) and financial market movements within the CBDC and SWIFT 2.0 systems, persuasively presenting why XRP will be the biggest beneficiary of this cycle.

Author Moon Chang-hoon (operator of YouTube channel 'Time Leverage'), who has established himself as Korea's top XRP expert, strictly excludes baseless price predictions and short-term trading.

Instead, it logically demonstrates XRP's intrinsic value within the global financial infrastructure, how global vested interests have chosen XRP, and how Ripple will rise to become the world's single currency as a 'digital diamond' over the next five years.

The revised and expanded edition of "Ripple Big Bang" provides existing readers with completely new, up-to-date information and powerful persuasive power, while new readers have a life-changing opportunity.

This is the last chance before the XRP Big Bang.

Ripple (XRP), which has concluded its SEC lawsuit, is challenging global financial hegemony with ETF approval.

As Vitalik Buterin predicted, “XRP will not only challenge Bitcoin’s dominance, but also become a more powerful alternative.” XRP has emerged as a central axis of future financial innovation beyond a simple alternative.

As of September 2025, the SEC has withdrawn its case, resulting in a historic ruling that has resulted in a landslide victory for XRP and cleared regulatory uncertainty for the entire cryptocurrency market.

As a result, the price of XRP, which had been suppressed for years, rose by more than 300%, causing cheers, and even Bloomberg, JP Morgan, and Wall Street analysts officially mentioned the potential of XRP, making it a foregone conclusion that it will rise at least 10 times in the future, and even explosively (Big Bang).

Accordingly, about 10 ETF products, including Grayscale and Franklin Templeton, have been launched, and the probability of approval is expected to be over 95%.

With the approval, global institutional funds will begin to flow in, meaning that the price of XRP is not just rising, but is on the verge of a 'Big Bang-level explosion'.

The revised and expanded edition of "Ripple Big Bang" is not a simple update of the existing book.

This book analyzes in detail the pro-cryptocurrency policies of Trump's second term, ETF approval, the global financial sector's integration of XRP, and the latest moves of XRP (Ripple) and financial market movements within the CBDC and SWIFT 2.0 systems, persuasively presenting why XRP will be the biggest beneficiary of this cycle.

Author Moon Chang-hoon (operator of YouTube channel 'Time Leverage'), who has established himself as Korea's top XRP expert, strictly excludes baseless price predictions and short-term trading.

Instead, it logically demonstrates XRP's intrinsic value within the global financial infrastructure, how global vested interests have chosen XRP, and how Ripple will rise to become the world's single currency as a 'digital diamond' over the next five years.

The revised and expanded edition of "Ripple Big Bang" provides existing readers with completely new, up-to-date information and powerful persuasive power, while new readers have a life-changing opportunity.

This is the last chance before the XRP Big Bang.

- You can preview some of the book's contents.

Preview

index

Ripple changes the market landscape with a revised edition

Prologue: The Prelude to a Currency Transformation

PART 1

The Birth of Bitcoin and the History of the Dollar's Hegemony

01 The First Blockchain and the Beginning and End of the Dollar

02 The Secret Thoughts of Bitcoin Saint Roger Ver

03 Layer 2 supporting the Ethereum ecosystem

04 The Role of the Lightning Network

05 The Emergence of the BRICS Common Currency and the Abor Project

PART 2

Central Banks Around the World and the Coming World of CBDCs

01 The Revolution Coming to Us: Blockchain & AI

02 Status of CBDC preparations in each country

03 Countdown to China's CBDC Issuance

04 How far will Korea's CBDC go?

05 The Future Created by CBDC

06 SWIFT & International Standard for Financial Communications Messages

07 Ripple as described by Ethereum founder Vitalik Buterin

08 Tokens and Companies Associated with ISO 20022

09 PadNow, Companies with Technology to Support ISO 20022

PART 3

Vested interests, international organizations, and Ripple

01 International Financial Institutions

02 The Relationship Between the Interledger Protocol and the Bill & Melinda Gates Foundation

03 List of Coins Recognized by the World Economic Forum

04 Future Financial Technologies and Partner Forces

05 Payment Commissions in the United States and Europe

PART 4

A new world that Ripple will change

01 The global remittance network is integrated into one.

02 Ripple's History: A Unique Early Investor

03 Differences Between Bitcoin, Ethereum, and Ripple

04 Subunit, Drop

05 Current Swift Limitations

06 Integrating Blockchain into Finance: R3

07 Finance Blockchain: Ripple Payments

08 Evolution of Ripple Escrow and its Structural Virtuous Cycle

09 The Center of Payment Innovation that Financial Elite Are Paying Attention to

PART 5

Secrets of the U.S. Securities and Exchange Commission vs. Ripple Labs Legal Battle

01 Ripple's Lawsuit: A Ridiculous Development

02 Ripple's Litigation Settlement: Uncertainty Resolved

03 Ripple Price Predictions by Experts After the Lawsuit

04 Ripple Labs' Acquisition of Custody Firms

PART 6

Ripple's initial design

01 Coin Investment Guide

02 Don't be fooled by the media

03 The cryptocurrency ecosystem is expanding to East Asia.

04 Ripple was designed with ten thousand dollars

05 Ripple's Annual Event Swell

06 Ripple Labs' Unusual High-Level Advisory Group

PART 7

Ripple Big Bang! Why?

01 Interoperability between Traditional Finance and the Ripple Ledger Ecosystem

02 RippleNet Hidden Behind Bricks Pay

03 Stablecoin

04 FTX Exchange Bankruptcy

05 Ripple's mid- to long-term vision

06 Additional Information on Ripple Ledger

07 Three Crypto Bills Passed in the US House of Representatives

08 Ripple's Patents

PART 8

Ripple: How to invest?

$0.01 Cost Averaging

02 Staking

03 Mother's Ripple Savings

04 Frequently Asked Questions from Subscribers

Epilogue: A Revolution in Life: Cryptocurrency Value Investing

Prologue: The Prelude to a Currency Transformation

PART 1

The Birth of Bitcoin and the History of the Dollar's Hegemony

01 The First Blockchain and the Beginning and End of the Dollar

02 The Secret Thoughts of Bitcoin Saint Roger Ver

03 Layer 2 supporting the Ethereum ecosystem

04 The Role of the Lightning Network

05 The Emergence of the BRICS Common Currency and the Abor Project

PART 2

Central Banks Around the World and the Coming World of CBDCs

01 The Revolution Coming to Us: Blockchain & AI

02 Status of CBDC preparations in each country

03 Countdown to China's CBDC Issuance

04 How far will Korea's CBDC go?

05 The Future Created by CBDC

06 SWIFT & International Standard for Financial Communications Messages

07 Ripple as described by Ethereum founder Vitalik Buterin

08 Tokens and Companies Associated with ISO 20022

09 PadNow, Companies with Technology to Support ISO 20022

PART 3

Vested interests, international organizations, and Ripple

01 International Financial Institutions

02 The Relationship Between the Interledger Protocol and the Bill & Melinda Gates Foundation

03 List of Coins Recognized by the World Economic Forum

04 Future Financial Technologies and Partner Forces

05 Payment Commissions in the United States and Europe

PART 4

A new world that Ripple will change

01 The global remittance network is integrated into one.

02 Ripple's History: A Unique Early Investor

03 Differences Between Bitcoin, Ethereum, and Ripple

04 Subunit, Drop

05 Current Swift Limitations

06 Integrating Blockchain into Finance: R3

07 Finance Blockchain: Ripple Payments

08 Evolution of Ripple Escrow and its Structural Virtuous Cycle

09 The Center of Payment Innovation that Financial Elite Are Paying Attention to

PART 5

Secrets of the U.S. Securities and Exchange Commission vs. Ripple Labs Legal Battle

01 Ripple's Lawsuit: A Ridiculous Development

02 Ripple's Litigation Settlement: Uncertainty Resolved

03 Ripple Price Predictions by Experts After the Lawsuit

04 Ripple Labs' Acquisition of Custody Firms

PART 6

Ripple's initial design

01 Coin Investment Guide

02 Don't be fooled by the media

03 The cryptocurrency ecosystem is expanding to East Asia.

04 Ripple was designed with ten thousand dollars

05 Ripple's Annual Event Swell

06 Ripple Labs' Unusual High-Level Advisory Group

PART 7

Ripple Big Bang! Why?

01 Interoperability between Traditional Finance and the Ripple Ledger Ecosystem

02 RippleNet Hidden Behind Bricks Pay

03 Stablecoin

04 FTX Exchange Bankruptcy

05 Ripple's mid- to long-term vision

06 Additional Information on Ripple Ledger

07 Three Crypto Bills Passed in the US House of Representatives

08 Ripple's Patents

PART 8

Ripple: How to invest?

$0.01 Cost Averaging

02 Staking

03 Mother's Ripple Savings

04 Frequently Asked Questions from Subscribers

Epilogue: A Revolution in Life: Cryptocurrency Value Investing

Detailed image

Into the book

There is a global payments pipeline with shareholders from over 200 countries, 11,000 institutions, and 3,000 financial institutions.

That's SWIFT.

Swift is a financial pyramid

We are working with the Bank for International Settlements (BIS), the International Monetary Fund (IMF), and the World Bank (WB) at the top to continuously innovate the financial network.

Just as there are different types of mobile phone chargers, there is a single international standard (ISO) for financial communication messages in the financial market.

Currently, ISO 7775 has been replaced by ISO 15022, and is gradually evolving into an international standard called ISO 20022.

The official Swift website provides a timeline for all relevant international standards to coexist until November 2025.

The most important thing to note is that RippleNet is included in the registration management group of the ISO 20022 international standard, which is being implemented by financial institutions around the world.

--- p.146-147, from “The Global Remittance Network is Unified”

Central banks, major commercial banks, and fintech and payment infrastructure companies have evaluated Ripple's Interledger Protocol as a core technology for 'liquidity optimization and network scalability' in global DLT payment network pilot projects such as Fnality and FNA.

Digital payment innovations like the Ripple Network, Ripple, and RLUSD are becoming key topics in official international financial policy reports, WEF partner documents, and actual central bank conferences.

The US Federal Reserve broadly accepts private proposals through official channels such as the Faster Payments Task Force and the CBDC white paper comment process. In fact, Ripple's CEO participated as an advisory committee member for the Fed's payment system design, and many technical proposals were officially reviewed.

--- p.179-180, from “The Center of Payment Innovation Paying Attention to the Financial Elite”

Renowned cryptocurrency analyst Captain Toblerone has previously predicted that Ripple could rally as much as 1,500% before Bitcoin enters its traditional halving cycle in 2025.

Jake Gagain also presented a positive outlook for the cryptocurrency market entering a bull market in 2025, setting a short-term price target of $5 for Ripple.

He selected Bitcoin, Ethereum, Ripple, Solana, and Ada as representative stocks with bright futures.

Nick, the founder of a cryptocurrency company, also set a target price of $10 for Ripple by the end of this cycle, and major media outlets and analysts are also predicting various peaks, such as Ripple challenging $10 or breaking through $20 in the second half of 2025.

Additionally, according to The Crypto Basic, Sean McBride, Ripple's former global talent acquisition executive, predicted that a Ripple spot exchange-traded fund (ETF) could be approved within 2025, and that Ripple could even have an IPO outside the U.S.

In fact, as of August 2025, the U.S. Securities and Exchange Commission (SEC) has begun revising regulations and reorganizing the review process for major cryptocurrency ETFs, including Ripple, and the market is focusing on the possibility of multiple ETFs being reviewed and approved.

--- p.191-192, from “Experts Predict Ripple Price After the Lawsuit”

In conclusion, the essence of the 2025 White House Crypto Week and Crypto Policy Report is that the United States has expressed its intention to move beyond a policy limited to Bitcoin and Ethereum and incorporate major coins such as Ripple, Solana, and Ada into the institutional strategic asset class.

This is a clear signal of the U.S. government's official acceptance of innovation, and a historic policy turning point that could allow global digital infrastructure companies like Ripple to emerge as key players in the new institutional market, similar to the bank charter and Federal Reserve account approval for cryptocurrency companies. It also clearly indicates that this is a significant "big bang" that heralds a shift in the financial order over the next decade.

--- p.273-274, from “Three Crypto Bills Passed by the US House of Representatives”

With Ripple still recording a participation rate of less than 0.02% of the global population, this represents a final opportunity for early market entry and a potential crossroads for Ripple to become a leading force in global digital asset hegemony within the next decade.

If investors focus on Ripple's fundamental value and structural utility, such as blockchain infrastructure adoption, global payment market share, and large institutional inflows, rather than focusing solely on short-term price fluctuations, it would be wise to approach investments with a mid- to long-term vision.

That's SWIFT.

Swift is a financial pyramid

We are working with the Bank for International Settlements (BIS), the International Monetary Fund (IMF), and the World Bank (WB) at the top to continuously innovate the financial network.

Just as there are different types of mobile phone chargers, there is a single international standard (ISO) for financial communication messages in the financial market.

Currently, ISO 7775 has been replaced by ISO 15022, and is gradually evolving into an international standard called ISO 20022.

The official Swift website provides a timeline for all relevant international standards to coexist until November 2025.

The most important thing to note is that RippleNet is included in the registration management group of the ISO 20022 international standard, which is being implemented by financial institutions around the world.

--- p.146-147, from “The Global Remittance Network is Unified”

Central banks, major commercial banks, and fintech and payment infrastructure companies have evaluated Ripple's Interledger Protocol as a core technology for 'liquidity optimization and network scalability' in global DLT payment network pilot projects such as Fnality and FNA.

Digital payment innovations like the Ripple Network, Ripple, and RLUSD are becoming key topics in official international financial policy reports, WEF partner documents, and actual central bank conferences.

The US Federal Reserve broadly accepts private proposals through official channels such as the Faster Payments Task Force and the CBDC white paper comment process. In fact, Ripple's CEO participated as an advisory committee member for the Fed's payment system design, and many technical proposals were officially reviewed.

--- p.179-180, from “The Center of Payment Innovation Paying Attention to the Financial Elite”

Renowned cryptocurrency analyst Captain Toblerone has previously predicted that Ripple could rally as much as 1,500% before Bitcoin enters its traditional halving cycle in 2025.

Jake Gagain also presented a positive outlook for the cryptocurrency market entering a bull market in 2025, setting a short-term price target of $5 for Ripple.

He selected Bitcoin, Ethereum, Ripple, Solana, and Ada as representative stocks with bright futures.

Nick, the founder of a cryptocurrency company, also set a target price of $10 for Ripple by the end of this cycle, and major media outlets and analysts are also predicting various peaks, such as Ripple challenging $10 or breaking through $20 in the second half of 2025.

Additionally, according to The Crypto Basic, Sean McBride, Ripple's former global talent acquisition executive, predicted that a Ripple spot exchange-traded fund (ETF) could be approved within 2025, and that Ripple could even have an IPO outside the U.S.

In fact, as of August 2025, the U.S. Securities and Exchange Commission (SEC) has begun revising regulations and reorganizing the review process for major cryptocurrency ETFs, including Ripple, and the market is focusing on the possibility of multiple ETFs being reviewed and approved.

--- p.191-192, from “Experts Predict Ripple Price After the Lawsuit”

In conclusion, the essence of the 2025 White House Crypto Week and Crypto Policy Report is that the United States has expressed its intention to move beyond a policy limited to Bitcoin and Ethereum and incorporate major coins such as Ripple, Solana, and Ada into the institutional strategic asset class.

This is a clear signal of the U.S. government's official acceptance of innovation, and a historic policy turning point that could allow global digital infrastructure companies like Ripple to emerge as key players in the new institutional market, similar to the bank charter and Federal Reserve account approval for cryptocurrency companies. It also clearly indicates that this is a significant "big bang" that heralds a shift in the financial order over the next decade.

--- p.273-274, from “Three Crypto Bills Passed by the US House of Representatives”

With Ripple still recording a participation rate of less than 0.02% of the global population, this represents a final opportunity for early market entry and a potential crossroads for Ripple to become a leading force in global digital asset hegemony within the next decade.

If investors focus on Ripple's fundamental value and structural utility, such as blockchain infrastructure adoption, global payment market share, and large institutional inflows, rather than focusing solely on short-term price fluctuations, it would be wise to approach investments with a mid- to long-term vision.

--- p.305, from "Epilogue"

Publisher's Review

“All the money in the world flows through RippleNet.”

If Bitcoin is the 'gold' of cryptocurrencies, Ripple (XRP) is the 'diamond.'

The revised and expanded edition of "Ripple Big Bang" is a strategy book of a completely different level that proves with real names, figures, and examples how XRP will dominate the future global finance.

Now that the nightmarish lawsuit with the SEC has been resolved, the market has completely flipped. The odds of ETF approval are over 95%, and Trump's second term's pro-crypto policies are a tailwind that's pushing XRP forward.

From the moment regulatory uncertainty cleared, global funds have been flocking to XRP as if they had been waiting for it, and a 'price big bang' with the launch of the ETF has become a matter of time.

Ripple's specific actions are a reality that can no longer be hidden.

RippleNet, which connects with over 9,000 financial institutions in over 130 countries, has partnered with global banks such as Bank of America, Santander, Standard Chartered, and SBI, and has even been named as an official partner in digital payment discussions with the IMF and World Bank.

The picture of Ripple replacing SWIFT as the international payment network is no longer a hypothesis, but a roadmap.

The experts' outlook is surprising.

Bloomberg Intelligence said, “Ripple will account for 14% of the global wholesale payment market within the next five years,” and Wall Street analysts analyzed that “XRP could soar to at least $6 in the short term, $50 immediately after ETF approval, and even $500 within five years.”

Brad Garlinghouse, CEO of Ripple, also declared that “within five years, Ripple will be established as a bridge currency for all central bank digital currencies (CBDC).”

As of 2025, Ripple's corporate value is approximately $100 billion.

Global financial capitals such as Digital Currency Group, CME Ventures, Google Ventures, Andreessen Horowitz (a16z), SBI Group, Santander, and Seagate are competing to secure XRP.

This means that this is not simply a case of 'cryptocurrency investment', but a battle for hegemony over future financial infrastructure.

The revised and expanded edition of "Ripple Big Bang" keenly traces how XRP will emerge as a digital diamond and take its place as the world's single currency amidst this massive change.

Readers who have read the previous edition will find this revised edition to be even more specific and bold in its numerical outlook, the latest global financial trends, and the grand narrative of “a world ruled by XRP.”

If Bitcoin is ‘digital gold,’ XRP will finally dominate the global financial order as a ‘digital diamond.’

For the generation that missed out on real estate in the 1980s and IT investments in the 2000s, this is their last chance. For the younger generation living in this era of fierce competition, this is the stage for a life-changing turnaround.

If Bitcoin is the 'gold' of cryptocurrencies, Ripple (XRP) is the 'diamond.'

The revised and expanded edition of "Ripple Big Bang" is a strategy book of a completely different level that proves with real names, figures, and examples how XRP will dominate the future global finance.

Now that the nightmarish lawsuit with the SEC has been resolved, the market has completely flipped. The odds of ETF approval are over 95%, and Trump's second term's pro-crypto policies are a tailwind that's pushing XRP forward.

From the moment regulatory uncertainty cleared, global funds have been flocking to XRP as if they had been waiting for it, and a 'price big bang' with the launch of the ETF has become a matter of time.

Ripple's specific actions are a reality that can no longer be hidden.

RippleNet, which connects with over 9,000 financial institutions in over 130 countries, has partnered with global banks such as Bank of America, Santander, Standard Chartered, and SBI, and has even been named as an official partner in digital payment discussions with the IMF and World Bank.

The picture of Ripple replacing SWIFT as the international payment network is no longer a hypothesis, but a roadmap.

The experts' outlook is surprising.

Bloomberg Intelligence said, “Ripple will account for 14% of the global wholesale payment market within the next five years,” and Wall Street analysts analyzed that “XRP could soar to at least $6 in the short term, $50 immediately after ETF approval, and even $500 within five years.”

Brad Garlinghouse, CEO of Ripple, also declared that “within five years, Ripple will be established as a bridge currency for all central bank digital currencies (CBDC).”

As of 2025, Ripple's corporate value is approximately $100 billion.

Global financial capitals such as Digital Currency Group, CME Ventures, Google Ventures, Andreessen Horowitz (a16z), SBI Group, Santander, and Seagate are competing to secure XRP.

This means that this is not simply a case of 'cryptocurrency investment', but a battle for hegemony over future financial infrastructure.

The revised and expanded edition of "Ripple Big Bang" keenly traces how XRP will emerge as a digital diamond and take its place as the world's single currency amidst this massive change.

Readers who have read the previous edition will find this revised edition to be even more specific and bold in its numerical outlook, the latest global financial trends, and the grand narrative of “a world ruled by XRP.”

If Bitcoin is ‘digital gold,’ XRP will finally dominate the global financial order as a ‘digital diamond.’

For the generation that missed out on real estate in the 1980s and IT investments in the 2000s, this is their last chance. For the younger generation living in this era of fierce competition, this is the stage for a life-changing turnaround.

GOODS SPECIFICS

- Date of issue: September 25, 2025

- Page count, weight, size: 312 pages | 430g | 145*210*20mm

- ISBN13: 9791167781680

- ISBN10: 1167781686

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)