Pension Story

|

Description

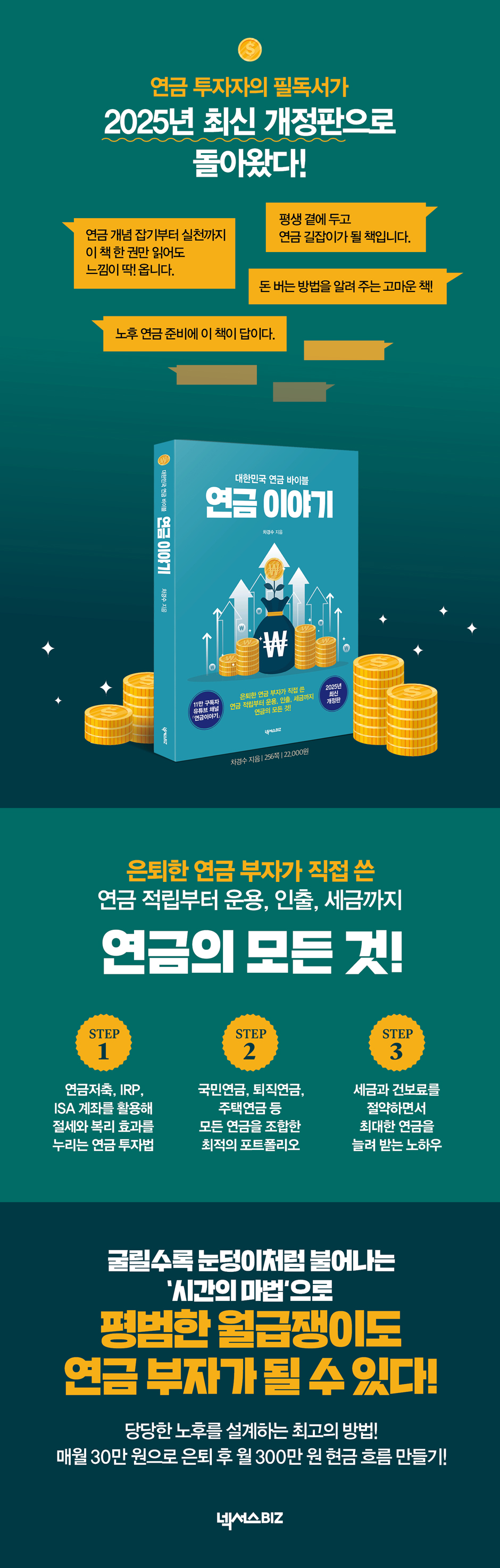

Book Introduction

Written by a retired pensioner himself

From pension savings to management, withdrawals, and taxes

All about pensions!

YouTube channel "Pension Story" with 110,000 subscribers

The latest revised edition reflecting changes in tax laws and the investment environment in 2025.

The more you roll it, the more it grows like a snowball, the more it becomes a 'magic of time'.

Even an ordinary salaried worker can become a pensioner!

The best way to plan for a dignified retirement!

Create a monthly cash flow of 3 million won after retirement with 300,000 won per month!

Author Cha Kyung-soo's "Pension Story," which has been introducing pension investment through annual revisions, has returned with the latest revised edition for 2025.

As South Korea enters a super-aged society, interest in pensions, which will ensure economic stability in old age, is growing.

This book goes beyond the basic purpose of pensions—simply preparing retirement funds—and provides detailed guidance on how to utilize tax-saving accounts like pension savings funds, IRPs, and ISAs, which are gaining popularity among young people as effective financial tools.

It also introduces practical tips and various examples for effectively utilizing various pension systems, such as the National Pension, Housing Pension, Retirement Pension, and Basic Pension, to create a portfolio for a comfortable retirement. It also thoroughly organizes issues related to pensions, such as taxes and health insurance premiums, to provide a comprehensive solution for pension investment.

From pension savings to management, withdrawals, and taxes

All about pensions!

YouTube channel "Pension Story" with 110,000 subscribers

The latest revised edition reflecting changes in tax laws and the investment environment in 2025.

The more you roll it, the more it grows like a snowball, the more it becomes a 'magic of time'.

Even an ordinary salaried worker can become a pensioner!

The best way to plan for a dignified retirement!

Create a monthly cash flow of 3 million won after retirement with 300,000 won per month!

Author Cha Kyung-soo's "Pension Story," which has been introducing pension investment through annual revisions, has returned with the latest revised edition for 2025.

As South Korea enters a super-aged society, interest in pensions, which will ensure economic stability in old age, is growing.

This book goes beyond the basic purpose of pensions—simply preparing retirement funds—and provides detailed guidance on how to utilize tax-saving accounts like pension savings funds, IRPs, and ISAs, which are gaining popularity among young people as effective financial tools.

It also introduces practical tips and various examples for effectively utilizing various pension systems, such as the National Pension, Housing Pension, Retirement Pension, and Basic Pension, to create a portfolio for a comfortable retirement. It also thoroughly organizes issues related to pensions, such as taxes and health insurance premiums, to provide a comprehensive solution for pension investment.

- You can preview some of the book's contents.

Preview

index

Introduction

PART 1.

private pension

1.

Pension savings

History of Pension Savings | Overview of Pension Savings | Benefits of Pension Savings | Frequently Asked Questions About Pension Savings

2. IRP

An Overview of IRPs | The Difference Between Pension Savings and IRPs | Should I Save for Pension or Use an IRP? | Frequently Asked Questions About IRPs

3. ISA

ISA Overview | ISA Account Benefits | How to Calculate Profits and Losses | Additional Tax Benefits from Maturity Fund Transfers | Creating a 300 Million Won Pension Using an ISA Account | Frequently Asked Questions About ISAs

Plus+.

Pension Accounts vs. Yellow Umbrella

Comparing the Pros and Cons | Planning for Your Purpose

4.

retirement pension

Overview of Severance Pay & Pensions | DB and DC Pensions | Calculating Severance Pay & Income Tax | Special Provisions for Interim Severance Pay Settlement | In-Kind Transfer System for Severance Pensions (IRPs and DCs)

PART 2.

public pension

1.

National Pension

National Pension Overview | Voluntary Enrollment and Using Backdated, Returned, and Prepaid Contributions | National Pension Issues

2.

Public pension related systems

How Civil Servants, Teachers, and Military Personnel Receive National Pension | Public Pension Linkage System | Public Pension Reduction System | Survivors' Pension | What Civil Servants, Teachers, and Military Personnel Should Know Before Retirement

PART 3.

Pension management

1.

Pension Management: ETFs Are the Answer!

Operating Income Effect | ETF Key Information | Taxes on ETF Trading Gains and Distributions

Plus+.

What should I do with various pension insurance policies?

Judging Criteria | How to Organize

2.

Managing your pension account

kite

■ Press Release

Canceling your savings or IRP will expose you to a tax blunder | Pension account transfer system | Preparing for child pensions

PART 4.

Pension withdrawal strategy

1.

Withdrawal methods by account

Four Ways to Receive Pension Savings and IRP Pensions | How to Receive Pension Benefits Based on the Number of Pension Accounts You Have | Comparing Insurance vs. Pension Savings and IRP Pension Benefits | How to Designate Tax-Deductible Accounts vs. Non-Deductible Accounts | Pension Benefit Limits and Annual Pension Receiving Periods

2.

Pension withdrawal consultation case

Retirement and retirement accounts before age 55 | Things to keep in mind when transferring DB/DC accounts | Do I need to sell all my products to start a pension? | Why it's good to have three pension accounts | Real-life counseling cases for those aged 55 | What taxes are levied on pensions? | If you need 5 million won per month after retirement

Plus+.

Health insurance premiums you must consider

Dependent eligibility requirements for health insurance | How is a combined income of 20 million won calculated? | A complete guide to calculating and assessing health insurance premiums | Housing rental income and health insurance premiums | Financial income! Health insurance premiums are more dangerous than taxes | How to reduce health insurance premiums

PART 5.

Housing and basic pension

1.

Housing pension

Housing Pension Subscription Requirements | Housing Pension Payment Methods | Housing Pension Loan Interest Rates Are Scary

2.

Basic pension

Basic Pension Recipients Surpass 7.36 Million | Basic Pension Eligibility | How to Calculate Recognized Income

PART 1.

private pension

1.

Pension savings

History of Pension Savings | Overview of Pension Savings | Benefits of Pension Savings | Frequently Asked Questions About Pension Savings

2. IRP

An Overview of IRPs | The Difference Between Pension Savings and IRPs | Should I Save for Pension or Use an IRP? | Frequently Asked Questions About IRPs

3. ISA

ISA Overview | ISA Account Benefits | How to Calculate Profits and Losses | Additional Tax Benefits from Maturity Fund Transfers | Creating a 300 Million Won Pension Using an ISA Account | Frequently Asked Questions About ISAs

Plus+.

Pension Accounts vs. Yellow Umbrella

Comparing the Pros and Cons | Planning for Your Purpose

4.

retirement pension

Overview of Severance Pay & Pensions | DB and DC Pensions | Calculating Severance Pay & Income Tax | Special Provisions for Interim Severance Pay Settlement | In-Kind Transfer System for Severance Pensions (IRPs and DCs)

PART 2.

public pension

1.

National Pension

National Pension Overview | Voluntary Enrollment and Using Backdated, Returned, and Prepaid Contributions | National Pension Issues

2.

Public pension related systems

How Civil Servants, Teachers, and Military Personnel Receive National Pension | Public Pension Linkage System | Public Pension Reduction System | Survivors' Pension | What Civil Servants, Teachers, and Military Personnel Should Know Before Retirement

PART 3.

Pension management

1.

Pension Management: ETFs Are the Answer!

Operating Income Effect | ETF Key Information | Taxes on ETF Trading Gains and Distributions

Plus+.

What should I do with various pension insurance policies?

Judging Criteria | How to Organize

2.

Managing your pension account

kite

■ Press Release

Canceling your savings or IRP will expose you to a tax blunder | Pension account transfer system | Preparing for child pensions

PART 4.

Pension withdrawal strategy

1.

Withdrawal methods by account

Four Ways to Receive Pension Savings and IRP Pensions | How to Receive Pension Benefits Based on the Number of Pension Accounts You Have | Comparing Insurance vs. Pension Savings and IRP Pension Benefits | How to Designate Tax-Deductible Accounts vs. Non-Deductible Accounts | Pension Benefit Limits and Annual Pension Receiving Periods

2.

Pension withdrawal consultation case

Retirement and retirement accounts before age 55 | Things to keep in mind when transferring DB/DC accounts | Do I need to sell all my products to start a pension? | Why it's good to have three pension accounts | Real-life counseling cases for those aged 55 | What taxes are levied on pensions? | If you need 5 million won per month after retirement

Plus+.

Health insurance premiums you must consider

Dependent eligibility requirements for health insurance | How is a combined income of 20 million won calculated? | A complete guide to calculating and assessing health insurance premiums | Housing rental income and health insurance premiums | Financial income! Health insurance premiums are more dangerous than taxes | How to reduce health insurance premiums

PART 5.

Housing and basic pension

1.

Housing pension

Housing Pension Subscription Requirements | Housing Pension Payment Methods | Housing Pension Loan Interest Rates Are Scary

2.

Basic pension

Basic Pension Recipients Surpass 7.36 Million | Basic Pension Eligibility | How to Calculate Recognized Income

Detailed image

Into the book

One in five people in South Korea is over 65 years old.

We have already entered a super-aged society.

Life after retirement has become so long and will only get longer in the future, yet we are not well prepared for it.

In this situation, the cost-effectiveness of public pensions is also declining.

Therefore, everyone, regardless of whether they are a civil servant, a teacher, or an employee of a large corporation, should prepare for a personal pension early.

However, most workers retire without ever receiving pension education in their lifetime.

Not only do they not know how to invest their retirement funds properly, they also do not know where to put their retirement funds and how to withdraw them, which can lead to tax losses.

Even if you know and prepare, your pension is insufficient, but there are too many people who don't even know what pension savings are, what an IRP is, or what an ISA is.

The more you know and the more you care, the more your pension will grow.

Living long without a pension is a disaster.

The extended post-retirement life can be a disaster for some and a blessing for others. I hope this book will serve as a guide to lead readers on the path to blessing.

We have already entered a super-aged society.

Life after retirement has become so long and will only get longer in the future, yet we are not well prepared for it.

In this situation, the cost-effectiveness of public pensions is also declining.

Therefore, everyone, regardless of whether they are a civil servant, a teacher, or an employee of a large corporation, should prepare for a personal pension early.

However, most workers retire without ever receiving pension education in their lifetime.

Not only do they not know how to invest their retirement funds properly, they also do not know where to put their retirement funds and how to withdraw them, which can lead to tax losses.

Even if you know and prepare, your pension is insufficient, but there are too many people who don't even know what pension savings are, what an IRP is, or what an ISA is.

The more you know and the more you care, the more your pension will grow.

Living long without a pension is a disaster.

The extended post-retirement life can be a disaster for some and a blessing for others. I hope this book will serve as a guide to lead readers on the path to blessing.

--- From the opening remarks

Publisher's Review

Pension Investment: The Best Investment Strategy for Your Future

The phrase 'the 100-year era' has finally become a reality.

As life expectancy increases, concerns about poverty in old age are growing, and the number of savvy investors preparing early for a happy retirement is also increasing.

There are many ways to build a financial foundation for retirement, but for the average individual, the most effective and powerful weapon is a pension.

Despite various controversies, including the depletion of the national pension fund, pensions remain the most important means of preparing for retirement and an excellent means of financial investment.

In particular, the government is providing many policy benefits for private pensions such as pension savings and IRP to make up for the insufficient public pension, so the importance of financial management using these is receiving increasing attention.

This book, "The Pension Bible of the Republic of Korea: Pension Stories," is the latest revised edition for 2025 of the best-selling "Pension Stories." It is the definitive edition, having been revised repeatedly over time to supplement and update many contents with the latest information.

Author Cha Kyung-soo, a retired pensioner himself, has been receiving great responses by generously sharing his vivid knowledge, which he has personally experienced and studied, through his YouTube channel 'Pension Story TV' and Naver blog 'Pension Story'.

This book is filled with author Cha Kyung-soo's professional knowledge accumulated over the years, as well as a variety of case studies and practical tips gleaned from his many years of lectures and consultations.

This book provides step-by-step explanations of the basics of pensions, which are so important but most people do not know precisely, including private pensions, public pensions, pension management and receipt strategies, housing pensions and basic pensions, pension-related taxes, and health insurance premiums.

It is also filled with essential information that readers need to know, such as how to utilize and invest in accordance with the characteristics of each pension, how to create a pension portfolio that suits their age and circumstances, and how to strategically receive pension while minimizing tax and health insurance burden, and will quickly resolve readers' questions.

In particular, it has been updated to the latest content to quickly reflect the significant changes in tax laws and investment environment in 2025.

The newly revised "Korea Pension Bible: Pension Stories" will be a great help to readers who dream of achieving financial freedom and a happy retirement through pension investment.

The phrase 'the 100-year era' has finally become a reality.

As life expectancy increases, concerns about poverty in old age are growing, and the number of savvy investors preparing early for a happy retirement is also increasing.

There are many ways to build a financial foundation for retirement, but for the average individual, the most effective and powerful weapon is a pension.

Despite various controversies, including the depletion of the national pension fund, pensions remain the most important means of preparing for retirement and an excellent means of financial investment.

In particular, the government is providing many policy benefits for private pensions such as pension savings and IRP to make up for the insufficient public pension, so the importance of financial management using these is receiving increasing attention.

This book, "The Pension Bible of the Republic of Korea: Pension Stories," is the latest revised edition for 2025 of the best-selling "Pension Stories." It is the definitive edition, having been revised repeatedly over time to supplement and update many contents with the latest information.

Author Cha Kyung-soo, a retired pensioner himself, has been receiving great responses by generously sharing his vivid knowledge, which he has personally experienced and studied, through his YouTube channel 'Pension Story TV' and Naver blog 'Pension Story'.

This book is filled with author Cha Kyung-soo's professional knowledge accumulated over the years, as well as a variety of case studies and practical tips gleaned from his many years of lectures and consultations.

This book provides step-by-step explanations of the basics of pensions, which are so important but most people do not know precisely, including private pensions, public pensions, pension management and receipt strategies, housing pensions and basic pensions, pension-related taxes, and health insurance premiums.

It is also filled with essential information that readers need to know, such as how to utilize and invest in accordance with the characteristics of each pension, how to create a pension portfolio that suits their age and circumstances, and how to strategically receive pension while minimizing tax and health insurance burden, and will quickly resolve readers' questions.

In particular, it has been updated to the latest content to quickly reflect the significant changes in tax laws and investment environment in 2025.

The newly revised "Korea Pension Bible: Pension Stories" will be a great help to readers who dream of achieving financial freedom and a happy retirement through pension investment.

GOODS SPECIFICS

- Date of issue: March 5, 2025

- Page count, weight, size: 256 pages | 596g | 174*246*17mm

- ISBN13: 9791166839993

- ISBN10: 1166839990

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)