Bitcoin Super Cycle 2026

|

Description

Book Introduction

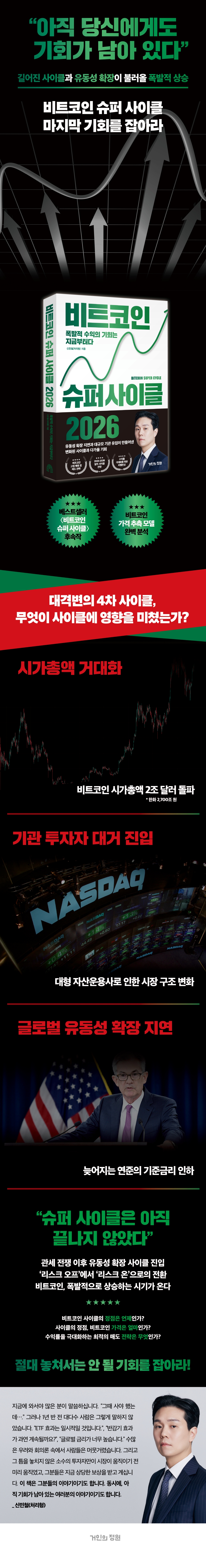

“You still have a chance.”

Bitcoin Super Cycle: Seize the Last Chance!

Explosive rise brought about by longer cycles and increased liquidity

* Sequel to the best-selling [Bitcoin Super Cycle] *

* Complete Analysis of the Bitcoin Price Estimation Model *

When is the peak of the Bitcoin cycle?

At the peak of the cycle, what is the price of Bitcoin?

What is the optimal selling strategy to maximize returns?

Bitcoin price moves in cycles centered around halving events.

However, this fourth cycle is moving in a 'stepwise' pattern, repeating sideways movement and upward movement within a box, rather than a 'sudden rise followed by a sharp fall' pattern like in the past.

This is because the approval of spot ETFs and the entry of institutions have increased market capitalization and changed the market structure, reducing volatility, and the cycle has progressed much more slowly than expected due to the delayed expansion of liquidity than expected due to Trump's tariff war.

However, if psychological resistance is broken by a breakout from the previous high, current uncertainty is resolved, and liquidity expansion begins, there is a very high probability that an explosive parabolic rise will occur.

In other words, the peak of the 'Bitcoin super cycle' of the 4th halving has not yet arrived.

So when will this cycle peak? How high will Bitcoin's price rise? Based on various on-chain data and macroeconomic analysis, this book reasonably infers Bitcoin's peak in this cycle and suggests optimal selling strategies.

Bitcoin Super Cycle: Seize the Last Chance!

Explosive rise brought about by longer cycles and increased liquidity

* Sequel to the best-selling [Bitcoin Super Cycle] *

* Complete Analysis of the Bitcoin Price Estimation Model *

When is the peak of the Bitcoin cycle?

At the peak of the cycle, what is the price of Bitcoin?

What is the optimal selling strategy to maximize returns?

Bitcoin price moves in cycles centered around halving events.

However, this fourth cycle is moving in a 'stepwise' pattern, repeating sideways movement and upward movement within a box, rather than a 'sudden rise followed by a sharp fall' pattern like in the past.

This is because the approval of spot ETFs and the entry of institutions have increased market capitalization and changed the market structure, reducing volatility, and the cycle has progressed much more slowly than expected due to the delayed expansion of liquidity than expected due to Trump's tariff war.

However, if psychological resistance is broken by a breakout from the previous high, current uncertainty is resolved, and liquidity expansion begins, there is a very high probability that an explosive parabolic rise will occur.

In other words, the peak of the 'Bitcoin super cycle' of the 4th halving has not yet arrived.

So when will this cycle peak? How high will Bitcoin's price rise? Based on various on-chain data and macroeconomic analysis, this book reasonably infers Bitcoin's peak in this cycle and suggests optimal selling strategies.

- You can preview some of the book's contents.

Preview

index

West Gate again, before the peak of the cycle

Part 1: Diagnosing the Bitcoin Cycle So Far

1 Why do we need to talk about cycles again now?

2 The first cycle of 2013: Primal market enthusiasm and extreme volatility

3. The Second Cycle of 2017: Bitcoin Popularization and the Peak of Madness

4 The Third Cycle of 2021: At the Threshold of Institutions, the Intersection of Trust and Collapse

5 The Fourth Cycle 2023–2025: Recovery, Beginning, and Back to the Peak

4th cycle showing a stepwise rise

Part 2: What Determines Bitcoin's Price?

1 Bitcoin's price mechanism is different from that of traditional assets.

2. Price dynamics where digital scarcity and liquidity interact.

3 Hybrid assets combining commodity assets and risky assets

4 The decisive reason for the change in the pace of the 4th cycle

Liquidity reflected in Bitcoin prices with a 5-hour lag

Bitcoin's Explosive Rise: Part 3

1. Predictions for the Bitcoin Super Cycle

2 Bitcoin is ready for an explosive rise

3 When will Bitcoin surge?

4 The Lengthening Bitcoin Super Cycle

What will the Bitcoin price be at its peak in the fifth cycle?

Part 4: Altcoin Cycle Forecast 2025-2026

1 Cycle Predicts an Altcoin Bull Run

2 AI Tokens That Will Change the Cryptocurrency Market Paradigm

3 RWAs that generate profits through real asset linkage

4 Memecoins where collective emotions determine price

5 Best Times to Invest in Altcoins

A four-step fund allocation strategy based on six cycles

7 When Will Altcoin Season End?

Part 5: Bitcoin Peak Signals and Selling Strategies

7 Signs That Your Cycle Is Ending

2 Cycle peaks as indicated by on-chain data

3. Signal strength selling method proven through three cycles

4 Must-Follow Bitcoin Selling Principles

5 Bitcoin Price Estimation Models ①: Market Capitalization Approach

6 Bitcoin Price Prediction Models ②: Expert Opinions and Market Expectations

7 Bitcoin Price Prediction Model ③: Data-Based Structural Prediction

8 Split Selling Strategies for Real Investors

Part 6: Real Investment Begins After the Super Cycle

1 Be sure to prepare for the next cycle.

Rebalance your earnings across 2 or 3 assets.

3. Take a mental reset and investment break.

4 Where is Bitcoin's ultimate destination?

Conclusion: Time to grow a vessel

Part 1: Diagnosing the Bitcoin Cycle So Far

1 Why do we need to talk about cycles again now?

2 The first cycle of 2013: Primal market enthusiasm and extreme volatility

3. The Second Cycle of 2017: Bitcoin Popularization and the Peak of Madness

4 The Third Cycle of 2021: At the Threshold of Institutions, the Intersection of Trust and Collapse

5 The Fourth Cycle 2023–2025: Recovery, Beginning, and Back to the Peak

4th cycle showing a stepwise rise

Part 2: What Determines Bitcoin's Price?

1 Bitcoin's price mechanism is different from that of traditional assets.

2. Price dynamics where digital scarcity and liquidity interact.

3 Hybrid assets combining commodity assets and risky assets

4 The decisive reason for the change in the pace of the 4th cycle

Liquidity reflected in Bitcoin prices with a 5-hour lag

Bitcoin's Explosive Rise: Part 3

1. Predictions for the Bitcoin Super Cycle

2 Bitcoin is ready for an explosive rise

3 When will Bitcoin surge?

4 The Lengthening Bitcoin Super Cycle

What will the Bitcoin price be at its peak in the fifth cycle?

Part 4: Altcoin Cycle Forecast 2025-2026

1 Cycle Predicts an Altcoin Bull Run

2 AI Tokens That Will Change the Cryptocurrency Market Paradigm

3 RWAs that generate profits through real asset linkage

4 Memecoins where collective emotions determine price

5 Best Times to Invest in Altcoins

A four-step fund allocation strategy based on six cycles

7 When Will Altcoin Season End?

Part 5: Bitcoin Peak Signals and Selling Strategies

7 Signs That Your Cycle Is Ending

2 Cycle peaks as indicated by on-chain data

3. Signal strength selling method proven through three cycles

4 Must-Follow Bitcoin Selling Principles

5 Bitcoin Price Estimation Models ①: Market Capitalization Approach

6 Bitcoin Price Prediction Models ②: Expert Opinions and Market Expectations

7 Bitcoin Price Prediction Model ③: Data-Based Structural Prediction

8 Split Selling Strategies for Real Investors

Part 6: Real Investment Begins After the Super Cycle

1 Be sure to prepare for the next cycle.

Rebalance your earnings across 2 or 3 assets.

3. Take a mental reset and investment break.

4 Where is Bitcoin's ultimate destination?

Conclusion: Time to grow a vessel

Detailed image

Into the book

The early Bitcoin market was characterized by extreme volatility.

In 2013 and 2017, Bitcoin's market capitalization was only in the hundreds of billions to trillions of dollars.

During this period, Bitcoin sometimes rose 20-30% in a day and sometimes fell over 40% in a week.

At the time, the market was thin, liquidity was scarce, and prices could move significantly with relatively small amounts of money.

This resulted in a roller coaster-like pattern of 'sudden rises and sudden falls'.

But Bitcoin, with its current market cap of $2 trillion, is behaving quite differently.

---From "The 4th Cycle Showing a Step-by-Step Rise"

Bitcoin's duality, possessing characteristics of both a commodity asset and a risky asset, represents a new asset class unprecedented in financial history.

This is not simply a classification ambiguity, but an essential characteristic of the innovative asset class that has emerged in the digital age.

These unique characteristics also have a significant impact on determining Bitcoin's price.

By understanding this and moving beyond the lens of viewing Bitcoin solely as a traditional commodity or risk asset, we can truly assess its true value and potential.

---Among "hybrid assets combining commodity assets and risky assets"

But as we enter the second quarter of 2025, the situation has changed markedly.

Global M2 finally broke through its 2022 peak, and the US Federal Reserve has formalized at least two more interest rate cuts this year.

Real interest rates have turned downward, and U.S. retail sales and industrial production indicators are also showing signs of slowing, strengthening the case for a "policy pivot."

Liquidity is now ready to really push the market higher.

However, as the starting point was later than expected, the Bitcoin bull market's wave also took on a temporally later form than previously predicted.

---From "Predictions on the Bitcoin Super Cycle"

As the cryptocurrency market matures and institutional investment in Bitcoin grows, claims that there will be no altcoin season this cycle have grown significantly.

This is because the approval of Bitcoin ETFs, the participation of large financial institutions, and the development of the regulatory environment have fundamentally changed the market.

At first glance, this argument seems persuasive.

However, we must remember that the essence of the market is ultimately based on 'human psychology', and basic investment psychology and behavioral patterns do not change easily.

---From "When Will the Altcoin Season End?"

Beyond simple return comparisons, the true value of this system lies in the psychological comfort it provides.

The simple holding strategy had to endure Bitcoin's price declines from $1,200 to $200 in 2013, from $19,783 to $3,200 in 2017, and from $68,789 to $15,500 in 2021.

This massive decline is emotionally unbearable for most investors.

In contrast, investors who utilized a signal strength assessment system were able to liquidate most of their positions near the high of each cycle, hold cash during bear markets, and wait for the next opportunity.

This provides a psychological advantage that cannot be measured by simple returns, as well as a positive impact on quality of life.

---From "Signal Strength Selling Method Verified Through Three Cycles"

The market capitalization approach has several advantages when predicting Bitcoin price.

Its greatest strength is that it provides a clear and logical justification for why that price is possible, rather than simply a numerical prediction.

Comparisons with other asset classes allow for an objective assessment of Bitcoin's relative value, providing a valuable benchmark for assessing the realisticity of specific target prices.

A market capitalization-based approach also has the practical advantage of being easy to integrate into investment strategies, particularly selling strategies, because it provides clear landmarks.

In 2013 and 2017, Bitcoin's market capitalization was only in the hundreds of billions to trillions of dollars.

During this period, Bitcoin sometimes rose 20-30% in a day and sometimes fell over 40% in a week.

At the time, the market was thin, liquidity was scarce, and prices could move significantly with relatively small amounts of money.

This resulted in a roller coaster-like pattern of 'sudden rises and sudden falls'.

But Bitcoin, with its current market cap of $2 trillion, is behaving quite differently.

---From "The 4th Cycle Showing a Step-by-Step Rise"

Bitcoin's duality, possessing characteristics of both a commodity asset and a risky asset, represents a new asset class unprecedented in financial history.

This is not simply a classification ambiguity, but an essential characteristic of the innovative asset class that has emerged in the digital age.

These unique characteristics also have a significant impact on determining Bitcoin's price.

By understanding this and moving beyond the lens of viewing Bitcoin solely as a traditional commodity or risk asset, we can truly assess its true value and potential.

---Among "hybrid assets combining commodity assets and risky assets"

But as we enter the second quarter of 2025, the situation has changed markedly.

Global M2 finally broke through its 2022 peak, and the US Federal Reserve has formalized at least two more interest rate cuts this year.

Real interest rates have turned downward, and U.S. retail sales and industrial production indicators are also showing signs of slowing, strengthening the case for a "policy pivot."

Liquidity is now ready to really push the market higher.

However, as the starting point was later than expected, the Bitcoin bull market's wave also took on a temporally later form than previously predicted.

---From "Predictions on the Bitcoin Super Cycle"

As the cryptocurrency market matures and institutional investment in Bitcoin grows, claims that there will be no altcoin season this cycle have grown significantly.

This is because the approval of Bitcoin ETFs, the participation of large financial institutions, and the development of the regulatory environment have fundamentally changed the market.

At first glance, this argument seems persuasive.

However, we must remember that the essence of the market is ultimately based on 'human psychology', and basic investment psychology and behavioral patterns do not change easily.

---From "When Will the Altcoin Season End?"

Beyond simple return comparisons, the true value of this system lies in the psychological comfort it provides.

The simple holding strategy had to endure Bitcoin's price declines from $1,200 to $200 in 2013, from $19,783 to $3,200 in 2017, and from $68,789 to $15,500 in 2021.

This massive decline is emotionally unbearable for most investors.

In contrast, investors who utilized a signal strength assessment system were able to liquidate most of their positions near the high of each cycle, hold cash during bear markets, and wait for the next opportunity.

This provides a psychological advantage that cannot be measured by simple returns, as well as a positive impact on quality of life.

---From "Signal Strength Selling Method Verified Through Three Cycles"

The market capitalization approach has several advantages when predicting Bitcoin price.

Its greatest strength is that it provides a clear and logical justification for why that price is possible, rather than simply a numerical prediction.

Comparisons with other asset classes allow for an objective assessment of Bitcoin's relative value, providing a valuable benchmark for assessing the realisticity of specific target prices.

A market capitalization-based approach also has the practical advantage of being easy to integrate into investment strategies, particularly selling strategies, because it provides clear landmarks.

---From "Bitcoin Price Estimation Model ①: Market Capitalization Approach"

Publisher's Review

The Fourth Cycle of Cataclysm: What's Changed?

A complete analysis of the variables that determine the cycle's peak.

Bitcoin, the time for explosive growth is coming!

Seize this opportunity you can't miss!

★ Bitcoin Peak Prediction and Sell Strategy ★

★ 2025-2026 Alt Cycle Outlook ★

★ Rebalancing to maximize returns ★

Now, many people say, “I should have bought Bitcoin back then…”

But before the fourth halving, most people didn't say that.

They were skeptical, saying that the impact of the halving or spot ETFs would be minimal, and that global interest rates were high, leaving Bitcoin with no room for growth.

In "The Bitcoin Super Cycle," the author predicted, using various arguments, that Bitcoin would experience an explosive rise after the halving, and as a result, Bitcoin once again broke through its historic high.

The few investors who moved ahead of the market reaped sweet rewards in return.

So, does this mean there's no more opportunity in mid-2025, a year and a half after the fourth halving? In his book, "Bitcoin Super Cycle 2026," the author asserts that there still is.

The Bitcoin Cycle Has Changed, Opportunities Still Remain

The most notable feature of this cycle is the step-by-step rise.

The most notable features of the three major cycles centered around past halvings were sharp rises and falls.

It was common for prices to skyrocket from a low point by tens to hundreds of times, and then fall by about 80% after the cycle ended.

However, in this cycle, the Bitcoin price is moving in a stepwise manner, repeating upward and sideways movements.

With its market capitalization surpassing $2 trillion, it has grown to a size similar to that of giants like Apple and Microsoft, and the launch of ETFs has led to an influx of institutional capital, which has reduced volatility. However, this is largely due to the delay in liquidity expansion caused by the Trump tariff war and the Federal Reserve's slower-than-expected interest rate cuts.

As a result, the cycle progresses slower and the cycle length becomes longer.

In other words, there is a very high probability that there will be an explosive rise once the factors that caused the step pattern are resolved.

Bitcoin is poised for explosive growth.

From the second quarter of 2025, global liquidity shifted into a clear upward trend.

Not only did central banks in major advanced economies ease their policies, but global M2 totals also surpassed their all-time highs for the first time since the pandemic.

The prevailing prediction is that the US Federal Reserve will also cut interest rates in the second half of 2025.

The direction of liquidity is clear.

Now is a time of expansion, not contraction.

In a time of lingering uncertainty and anticipated liquidity expansion, Bitcoin, which possesses both safe-haven characteristics like gold and riskier assets, is highly likely to benefit.

In addition, as the external environment changes, if the market sentiment that has been suppressed by the step-wise rise so far explodes, there is a very high probability that an explosive parabolic rise, as has been seen several times in the past, will occur.

Bitcoin Peak Signals and Optimal Selling Strategies

So, with Bitcoin's price now surpassing $100,000 and hitting a historic high of $120,000, where in the cycle are we currently? If the peak hasn't yet arrived, when will it occur, and what will the Bitcoin price be at that moment? This book predicts when Bitcoin will peak based on various macroeconomic factors and on-chain data analysis, including the LTH-SOPR, MVRV-Z Score, RCHW, and aSOPR, and provides a reasonable estimate of its price range at that time.

And based on this scenario, we provide a selling strategy that maximizes profits while minimizing risk.

Real investing starts after the super cycle.

So far, Bitcoin has shown tremendous growth.

However, there are fewer people who have 'turned their lives around' with Bitcoin than you might think.

Because I invested emotionally without a solid plan.

Because of greed, I couldn't sell at the high point, because of fear, I couldn't buy at the low point, and because I just kept repeating the thought, "Is it okay to buy now?", "I should have bought it then."

The problem is that as humans, we cannot help but be swayed by emotions.

People overestimate themselves and believe they are rational, but it is not easy to avoid being FOMO in a bull market or fear in a bear market.

Therefore, to succeed in long-term Bitcoin investing, it is necessary to thoroughly plan your sales and rebalance to prepare for the next cycle.

This book closely presents effective selling and rebalancing strategies based on scenarios for the peak of this cycle.

This will help investors set themselves up for success not only in this cycle but also in the next.

A complete analysis of the variables that determine the cycle's peak.

Bitcoin, the time for explosive growth is coming!

Seize this opportunity you can't miss!

★ Bitcoin Peak Prediction and Sell Strategy ★

★ 2025-2026 Alt Cycle Outlook ★

★ Rebalancing to maximize returns ★

Now, many people say, “I should have bought Bitcoin back then…”

But before the fourth halving, most people didn't say that.

They were skeptical, saying that the impact of the halving or spot ETFs would be minimal, and that global interest rates were high, leaving Bitcoin with no room for growth.

In "The Bitcoin Super Cycle," the author predicted, using various arguments, that Bitcoin would experience an explosive rise after the halving, and as a result, Bitcoin once again broke through its historic high.

The few investors who moved ahead of the market reaped sweet rewards in return.

So, does this mean there's no more opportunity in mid-2025, a year and a half after the fourth halving? In his book, "Bitcoin Super Cycle 2026," the author asserts that there still is.

The Bitcoin Cycle Has Changed, Opportunities Still Remain

The most notable feature of this cycle is the step-by-step rise.

The most notable features of the three major cycles centered around past halvings were sharp rises and falls.

It was common for prices to skyrocket from a low point by tens to hundreds of times, and then fall by about 80% after the cycle ended.

However, in this cycle, the Bitcoin price is moving in a stepwise manner, repeating upward and sideways movements.

With its market capitalization surpassing $2 trillion, it has grown to a size similar to that of giants like Apple and Microsoft, and the launch of ETFs has led to an influx of institutional capital, which has reduced volatility. However, this is largely due to the delay in liquidity expansion caused by the Trump tariff war and the Federal Reserve's slower-than-expected interest rate cuts.

As a result, the cycle progresses slower and the cycle length becomes longer.

In other words, there is a very high probability that there will be an explosive rise once the factors that caused the step pattern are resolved.

Bitcoin is poised for explosive growth.

From the second quarter of 2025, global liquidity shifted into a clear upward trend.

Not only did central banks in major advanced economies ease their policies, but global M2 totals also surpassed their all-time highs for the first time since the pandemic.

The prevailing prediction is that the US Federal Reserve will also cut interest rates in the second half of 2025.

The direction of liquidity is clear.

Now is a time of expansion, not contraction.

In a time of lingering uncertainty and anticipated liquidity expansion, Bitcoin, which possesses both safe-haven characteristics like gold and riskier assets, is highly likely to benefit.

In addition, as the external environment changes, if the market sentiment that has been suppressed by the step-wise rise so far explodes, there is a very high probability that an explosive parabolic rise, as has been seen several times in the past, will occur.

Bitcoin Peak Signals and Optimal Selling Strategies

So, with Bitcoin's price now surpassing $100,000 and hitting a historic high of $120,000, where in the cycle are we currently? If the peak hasn't yet arrived, when will it occur, and what will the Bitcoin price be at that moment? This book predicts when Bitcoin will peak based on various macroeconomic factors and on-chain data analysis, including the LTH-SOPR, MVRV-Z Score, RCHW, and aSOPR, and provides a reasonable estimate of its price range at that time.

And based on this scenario, we provide a selling strategy that maximizes profits while minimizing risk.

Real investing starts after the super cycle.

So far, Bitcoin has shown tremendous growth.

However, there are fewer people who have 'turned their lives around' with Bitcoin than you might think.

Because I invested emotionally without a solid plan.

Because of greed, I couldn't sell at the high point, because of fear, I couldn't buy at the low point, and because I just kept repeating the thought, "Is it okay to buy now?", "I should have bought it then."

The problem is that as humans, we cannot help but be swayed by emotions.

People overestimate themselves and believe they are rational, but it is not easy to avoid being FOMO in a bull market or fear in a bear market.

Therefore, to succeed in long-term Bitcoin investing, it is necessary to thoroughly plan your sales and rebalance to prepare for the next cycle.

This book closely presents effective selling and rebalancing strategies based on scenarios for the peak of this cycle.

This will help investors set themselves up for success not only in this cycle but also in the next.

GOODS SPECIFICS

- Date of issue: August 13, 2025

- Page count, weight, size: 328 pages | 602g | 152*225*20mm

- ISBN13: 9791193869314

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)