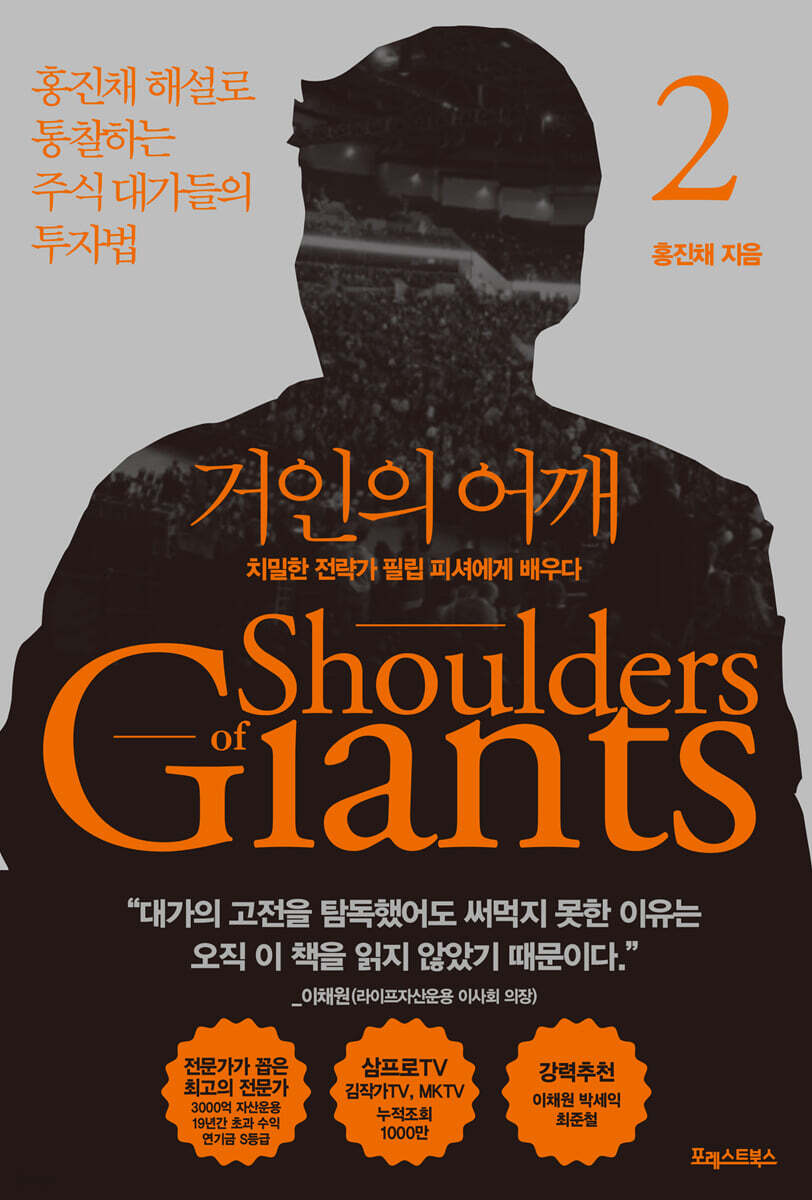

Shoulders of Giants 2

|

Description

Book Introduction

300 billion won in assets under management, 19 years of over-the-top returns, pension fund S rating, and experts selected by experts

Insights through Hong Jin-chae's commentary

The investment methods of stock experts

"Warren Buffett was able to surpass his mentor Benjamin Graham thanks to Philip Fisher."

Learn the essentials of stock investing and the culmination of investment know-how from meticulous strategist Philip Fisher!

An exploration of the investment philosophies and methods of stock market gurus of the era, as explained by author Hong Jin-chae.

"Shoulders of Giants" is planned to consist of three volumes, with volumes 1 and 2 being published simultaneously, and volume 3 scheduled for release in 2023.

In Volume 2, we examine the investment methods of meticulous strategist Philip Fisher from the very beginning and explore how to implement his investment methods in practice.

By dismantling and reassembling Fisher's thought system, we examine what exactly a stock is, what value a stock has, what is the relationship between value and price, and which elements of a company each investor should focus on and which elements should be ignored to make money through this relationship, helping them establish their own investment thought system.

Insights through Hong Jin-chae's commentary

The investment methods of stock experts

"Warren Buffett was able to surpass his mentor Benjamin Graham thanks to Philip Fisher."

Learn the essentials of stock investing and the culmination of investment know-how from meticulous strategist Philip Fisher!

An exploration of the investment philosophies and methods of stock market gurus of the era, as explained by author Hong Jin-chae.

"Shoulders of Giants" is planned to consist of three volumes, with volumes 1 and 2 being published simultaneously, and volume 3 scheduled for release in 2023.

In Volume 2, we examine the investment methods of meticulous strategist Philip Fisher from the very beginning and explore how to implement his investment methods in practice.

By dismantling and reassembling Fisher's thought system, we examine what exactly a stock is, what value a stock has, what is the relationship between value and price, and which elements of a company each investor should focus on and which elements should be ignored to make money through this relationship, helping them establish their own investment thought system.

- You can preview some of the book's contents.

Preview

index

Recommendation

Introduction: In Search of Foundation, Part 2

Part 3.

Kick ten thousand times

9.

Basic physical fitness test

Business Model Analysis

Financial statement analysis

Industry Analysis

Competitive Analysis

Check your ability range

10.

The illusion of valuation

Evaluation criteria and evaluation techniques

What on earth is value?

What on earth is the discount rate?

Expected return is a two-dimensional value

Premium Conditions

11.

Fishmonger Cat

bad people

If you open it, you'll find everything.

Depth of management

About shareholder returns

12.

Fisher, one kick

Focus on growth stocks

Lesson 1.

Corporate growth is limitless

Lesson 2.

The magic of great companies becoming great stocks

Lesson 3.

When to buy, when not to sell

About fact gathering

Again, you can stop here

Investor's Study

The rest of the story

annotation

Introduction: In Search of Foundation, Part 2

Part 3.

Kick ten thousand times

9.

Basic physical fitness test

Business Model Analysis

Financial statement analysis

Industry Analysis

Competitive Analysis

Check your ability range

10.

The illusion of valuation

Evaluation criteria and evaluation techniques

What on earth is value?

What on earth is the discount rate?

Expected return is a two-dimensional value

Premium Conditions

11.

Fishmonger Cat

bad people

If you open it, you'll find everything.

Depth of management

About shareholder returns

12.

Fisher, one kick

Focus on growth stocks

Lesson 1.

Corporate growth is limitless

Lesson 2.

The magic of great companies becoming great stocks

Lesson 3.

When to buy, when not to sell

About fact gathering

Again, you can stop here

Investor's Study

The rest of the story

annotation

Detailed image

.jpg)

Into the book

"Is corporate analysis helpful for stock investing?" Corporate analysis is like looking at a hand in poker when it comes to stock investing.

You can win some hands by betting randomly without looking at the cards.

Alternatively, you can consistently win by reading your opponent's psychology through facial expressions, body language, and betting style.

The same goes for stocks.

You can make money sometimes by buying and selling stocks however you like.

Decisions may be made based more on macroeconomic factors or overall investor sentiment than on corporate analysis.

There may be investors who make a lot of money that way.

In any case, isn't the most important thing in investing 'whether you can make money sustainably?'"

---"introduction.

From "In Search of the Foundation, Part 2"

Technological prowess is difficult to grasp, and even if it is, it is difficult to predict future changes. Even if a company has a technological advantage, making money is another story.

Ultimately, what matters is how much money a company spends and how much money it gets back.

Whether it's technology or something else, the real, important know-how that makes a company money is hidden behind it.

From an investor's perspective, it's more important to understand how truthfully a company conducts its business than to evaluate the technology itself in detail.

If investors have a thorough understanding of overall technology trends, they will be better able to assess the veracity of the information presented by a company.

If we can just filter out the cases where people dress up their skills as incredible when they have really ridiculous skills, then all the studying we've done will be worth it.

---「9.

From the “Basic Physical Fitness Test”

If Samsung Electronics' market capitalization is 40,000 won, is it cheap? It's the market capitalization, not the price per share.

The question is, would you agree to acquire the entire company called Samsung Electronics for 40,000 won?

Anyone can answer 'yes'.

But why can you answer so confidently? The answer that Samsung Electronics' market capitalization was 400 trillion won as of yesterday isn't a very satisfying one.

Even a stone on the side of the road can be traded for 100 million won by someone.

It's a whole different story if I pay that price and buy the stone.

Warren Buffett said at the 2022 annual shareholder meeting that he would not buy all of Bitcoin even if they offered him $35.

The total market capitalization of Bitcoin has exceeded 400 trillion won.

From what perspective can we understand the statement that he wouldn't buy all of Bitcoin, which was worth 400 trillion won yesterday, even for 40,000 won?

---「10.

From “The Illusion of Valuation”

When talking about management, questions like, "How can I trust people?" and "How can I verify the trustworthiness of management?" come up.

Trust is not something that is confirmed by one or two specific signals, but rather something that is 'built' over time through repeated patterns and behaviors observed.

The examples I've given above are a collection of patterns I've observed over a long period of time in my investments: the "companies that ultimately backstab" and the numerical aspects of "companies that do business reliably."

Please do not conclude that a company is 'untrustworthy' or 'trustworthy' just because one or two things are right or one or two things are lacking.

“Trust is something each individual gives, and through constant bumps and breaks, each individual must build their own standards for what constitutes a ‘trustworthy company.’”

---「11.

From "The Fish Shop Cat"

Philip Fisher is the spiritual mentor who has had the greatest influence on me.

As a professional investor, I've studied and applied various investment methods in my own practice, but the method I learned from Fisher is the most fundamental and best-performing of all the styles I can always rely on.

Fisher's investment method is often referred to as "growth investing."

Of course, that's right.

But who doesn't know that if you invest in a company that has grown significantly over a long period of time, you can make money?

Fisher's investment approach isn't simply about holding onto high-growth companies for a long time.

High-growth companies always attract market attention and trade at a high premium.

Any sign of growth will cause the stock price to plummet.

I, too, once had a hard time misunderstanding Fisher's method.

Fisher's investment method requires a thorough investigation into what evidence there is currently to believe a company will grow over the long term, what the key drivers of a company's long-term growth are, and what the underlying forces are that will sustain those drivers.

You can win some hands by betting randomly without looking at the cards.

Alternatively, you can consistently win by reading your opponent's psychology through facial expressions, body language, and betting style.

The same goes for stocks.

You can make money sometimes by buying and selling stocks however you like.

Decisions may be made based more on macroeconomic factors or overall investor sentiment than on corporate analysis.

There may be investors who make a lot of money that way.

In any case, isn't the most important thing in investing 'whether you can make money sustainably?'"

---"introduction.

From "In Search of the Foundation, Part 2"

Technological prowess is difficult to grasp, and even if it is, it is difficult to predict future changes. Even if a company has a technological advantage, making money is another story.

Ultimately, what matters is how much money a company spends and how much money it gets back.

Whether it's technology or something else, the real, important know-how that makes a company money is hidden behind it.

From an investor's perspective, it's more important to understand how truthfully a company conducts its business than to evaluate the technology itself in detail.

If investors have a thorough understanding of overall technology trends, they will be better able to assess the veracity of the information presented by a company.

If we can just filter out the cases where people dress up their skills as incredible when they have really ridiculous skills, then all the studying we've done will be worth it.

---「9.

From the “Basic Physical Fitness Test”

If Samsung Electronics' market capitalization is 40,000 won, is it cheap? It's the market capitalization, not the price per share.

The question is, would you agree to acquire the entire company called Samsung Electronics for 40,000 won?

Anyone can answer 'yes'.

But why can you answer so confidently? The answer that Samsung Electronics' market capitalization was 400 trillion won as of yesterday isn't a very satisfying one.

Even a stone on the side of the road can be traded for 100 million won by someone.

It's a whole different story if I pay that price and buy the stone.

Warren Buffett said at the 2022 annual shareholder meeting that he would not buy all of Bitcoin even if they offered him $35.

The total market capitalization of Bitcoin has exceeded 400 trillion won.

From what perspective can we understand the statement that he wouldn't buy all of Bitcoin, which was worth 400 trillion won yesterday, even for 40,000 won?

---「10.

From “The Illusion of Valuation”

When talking about management, questions like, "How can I trust people?" and "How can I verify the trustworthiness of management?" come up.

Trust is not something that is confirmed by one or two specific signals, but rather something that is 'built' over time through repeated patterns and behaviors observed.

The examples I've given above are a collection of patterns I've observed over a long period of time in my investments: the "companies that ultimately backstab" and the numerical aspects of "companies that do business reliably."

Please do not conclude that a company is 'untrustworthy' or 'trustworthy' just because one or two things are right or one or two things are lacking.

“Trust is something each individual gives, and through constant bumps and breaks, each individual must build their own standards for what constitutes a ‘trustworthy company.’”

---「11.

From "The Fish Shop Cat"

Philip Fisher is the spiritual mentor who has had the greatest influence on me.

As a professional investor, I've studied and applied various investment methods in my own practice, but the method I learned from Fisher is the most fundamental and best-performing of all the styles I can always rely on.

Fisher's investment method is often referred to as "growth investing."

Of course, that's right.

But who doesn't know that if you invest in a company that has grown significantly over a long period of time, you can make money?

Fisher's investment approach isn't simply about holding onto high-growth companies for a long time.

High-growth companies always attract market attention and trade at a high premium.

Any sign of growth will cause the stock price to plummet.

I, too, once had a hard time misunderstanding Fisher's method.

Fisher's investment method requires a thorough investigation into what evidence there is currently to believe a company will grow over the long term, what the key drivers of a company's long-term growth are, and what the underlying forces are that will sustain those drivers.

---「12.

Fisher, from "One Kick"

Fisher, from "One Kick"

Publisher's Review

“I didn’t know much, but I thought I knew much

“Insight into Philip Fisher’s investment philosophy and know-how!”

The Meaning of Stock Investing: A Look Over Philip Fisher's Shoulder

The author has always emphasized that explaining Philip Fisher's investment method would require a whole book.

The reason is that to understand Fisher's investment method, you need to establish a new perspective on stocks, companies, value, returns, and management. Only after going through this process can you finally understand why Philip Fisher was so obsessed with qualitative factors including management, why he was able to generate excellent returns with just that, and why macroeconomics, financial statements, industry competition, and even shareholder returns are secondary factors.

This book is composed of three parts, one part and four chapters, "Part 3: Ten Thousand Kicks." The first half (Chapters 9, 10, and 11) covers corporate analysis and valuation methodology.

It's a comprehensive compilation of value and price, the principles of making money, and the relationship between corporate analysis and returns, while also serving as a long "build-up" to understanding Fisher.

“Fisher’s investment method that transcends the times

“Let’s string it all together and compile it!”

In stock investing, analyzing a company is like looking at your opponent's cards in poker.

In Volume 1 of "Shoulders of Giants," we looked at the special properties of stocks as an asset class, as well as the investment principles and thought processes of three investment giants who made great profits with stocks: Benjamin Graham, Warren Buffett, and Peter Lynch. In Volume 2, "Part 3: Ten Thousand Kicks," we will discuss in four chapters how to build up your "basic stamina" for investing.

Chapter 9, "Basic Physical Fitness Test," explains the corporate analysis methods that all stock investors are curious about, broadly categorized into business models, financial statements, industry, and competitiveness, and explains how to analyze each.

Through the author's own experiences investing, he addresses common pitfalls in corporate analysis and offers ideas that break the mold.

Chapter 10, "The Illusion of Valuation," provides a detailed explanation of what a company's value is and what the "return" that investors can ultimately expect, based on the corporate analysis explained above.

The author, who says that buying stocks is like "putting a cat in charge of a fish shop," discusses management in "Chapter 11: The Cat in a Fish Shop."

Ultimately, it emphasizes that the management's attitude toward the business and shareholders is a key factor in investors' ability to make money. It also provides insights into how management can profit in various ways and how investors can weed out managers with such tendencies.

In Chapter 12, Fisher: One Kick, we look at another investment giant, Philip Fisher.

This book details why Philip Fisher was so obsessed with qualitative factors, including management, and why he was able to achieve outstanding returns using these factors alone. It also dissects Philip Fisher's investment thinking, which is often overly fragmented and understood as "long-term investment in growth stocks."

Through Philip Fisher's investment principles, a comprehensive compilation of value and price, money-making principles, and the relationship between corporate analysis and returns, it details why typical "growth investing" is theoretically flawed and how Philip Fisher's investing is fundamentally different from simple "growth investing."

“The reason I couldn’t use it even though I read the classics of the great masters is

“Only because I haven’t read this book.”

The best investment strategy for preparing for the future is understanding the investment methods of giants.

“Can you make money investing in stocks?” The author says he wrote this book to answer this question.

To answer this question, he devoured classic investment books, as well as books on management, economics, and psychology, and pondered deeply about the 'efficient market hypothesis'. However, after reading Benjamin Graham's famous quote, he thought, 'This must be the conclusion.'

“Achieving satisfactory investment performance isn't as difficult as you might think, but achieving excellent performance is harder than you might think.”

"Shoulders of Giants" is a book filled with the author's intense struggle to properly answer the above question.

This is the fruit and culmination of research into the essence of stock investment and all the elements necessary to establish investment principles, while tracing the origins of stocks and studying the investment methods of masters.

As CEO Choi Jun-cheol mentioned in his recommendation, there is no doubt that this book could have been written by author Hong Jin-chae, who possesses the aspects of both a scientist and a philosopher.

And I think it's a book worth writing because he's achieved excess returns for 19 years.

Anyone entering the world of investing starts out learning from others, but eventually finds their own path.

We must all develop our own principles so that we can continue to invest without wavering, based on our own principles, even in real-world investment situations.

If deep reflection on what investing is and building our own experiences and decision-making systems are the path we should take, the footsteps of the masters will undoubtedly serve as a very bright beacon.

I hope and pray that this book will become the wick of that light.

“Insight into Philip Fisher’s investment philosophy and know-how!”

The Meaning of Stock Investing: A Look Over Philip Fisher's Shoulder

The author has always emphasized that explaining Philip Fisher's investment method would require a whole book.

The reason is that to understand Fisher's investment method, you need to establish a new perspective on stocks, companies, value, returns, and management. Only after going through this process can you finally understand why Philip Fisher was so obsessed with qualitative factors including management, why he was able to generate excellent returns with just that, and why macroeconomics, financial statements, industry competition, and even shareholder returns are secondary factors.

This book is composed of three parts, one part and four chapters, "Part 3: Ten Thousand Kicks." The first half (Chapters 9, 10, and 11) covers corporate analysis and valuation methodology.

It's a comprehensive compilation of value and price, the principles of making money, and the relationship between corporate analysis and returns, while also serving as a long "build-up" to understanding Fisher.

“Fisher’s investment method that transcends the times

“Let’s string it all together and compile it!”

In stock investing, analyzing a company is like looking at your opponent's cards in poker.

In Volume 1 of "Shoulders of Giants," we looked at the special properties of stocks as an asset class, as well as the investment principles and thought processes of three investment giants who made great profits with stocks: Benjamin Graham, Warren Buffett, and Peter Lynch. In Volume 2, "Part 3: Ten Thousand Kicks," we will discuss in four chapters how to build up your "basic stamina" for investing.

Chapter 9, "Basic Physical Fitness Test," explains the corporate analysis methods that all stock investors are curious about, broadly categorized into business models, financial statements, industry, and competitiveness, and explains how to analyze each.

Through the author's own experiences investing, he addresses common pitfalls in corporate analysis and offers ideas that break the mold.

Chapter 10, "The Illusion of Valuation," provides a detailed explanation of what a company's value is and what the "return" that investors can ultimately expect, based on the corporate analysis explained above.

The author, who says that buying stocks is like "putting a cat in charge of a fish shop," discusses management in "Chapter 11: The Cat in a Fish Shop."

Ultimately, it emphasizes that the management's attitude toward the business and shareholders is a key factor in investors' ability to make money. It also provides insights into how management can profit in various ways and how investors can weed out managers with such tendencies.

In Chapter 12, Fisher: One Kick, we look at another investment giant, Philip Fisher.

This book details why Philip Fisher was so obsessed with qualitative factors, including management, and why he was able to achieve outstanding returns using these factors alone. It also dissects Philip Fisher's investment thinking, which is often overly fragmented and understood as "long-term investment in growth stocks."

Through Philip Fisher's investment principles, a comprehensive compilation of value and price, money-making principles, and the relationship between corporate analysis and returns, it details why typical "growth investing" is theoretically flawed and how Philip Fisher's investing is fundamentally different from simple "growth investing."

“The reason I couldn’t use it even though I read the classics of the great masters is

“Only because I haven’t read this book.”

The best investment strategy for preparing for the future is understanding the investment methods of giants.

“Can you make money investing in stocks?” The author says he wrote this book to answer this question.

To answer this question, he devoured classic investment books, as well as books on management, economics, and psychology, and pondered deeply about the 'efficient market hypothesis'. However, after reading Benjamin Graham's famous quote, he thought, 'This must be the conclusion.'

“Achieving satisfactory investment performance isn't as difficult as you might think, but achieving excellent performance is harder than you might think.”

"Shoulders of Giants" is a book filled with the author's intense struggle to properly answer the above question.

This is the fruit and culmination of research into the essence of stock investment and all the elements necessary to establish investment principles, while tracing the origins of stocks and studying the investment methods of masters.

As CEO Choi Jun-cheol mentioned in his recommendation, there is no doubt that this book could have been written by author Hong Jin-chae, who possesses the aspects of both a scientist and a philosopher.

And I think it's a book worth writing because he's achieved excess returns for 19 years.

Anyone entering the world of investing starts out learning from others, but eventually finds their own path.

We must all develop our own principles so that we can continue to invest without wavering, based on our own principles, even in real-world investment situations.

If deep reflection on what investing is and building our own experiences and decision-making systems are the path we should take, the footsteps of the masters will undoubtedly serve as a very bright beacon.

I hope and pray that this book will become the wick of that light.

GOODS SPECIFICS

- Publication date: December 12, 2022

- Page count, weight, size: 372 pages | 656g | 152*225*22mm

- ISBN13: 9791192625140

- ISBN10: 1192625145

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)