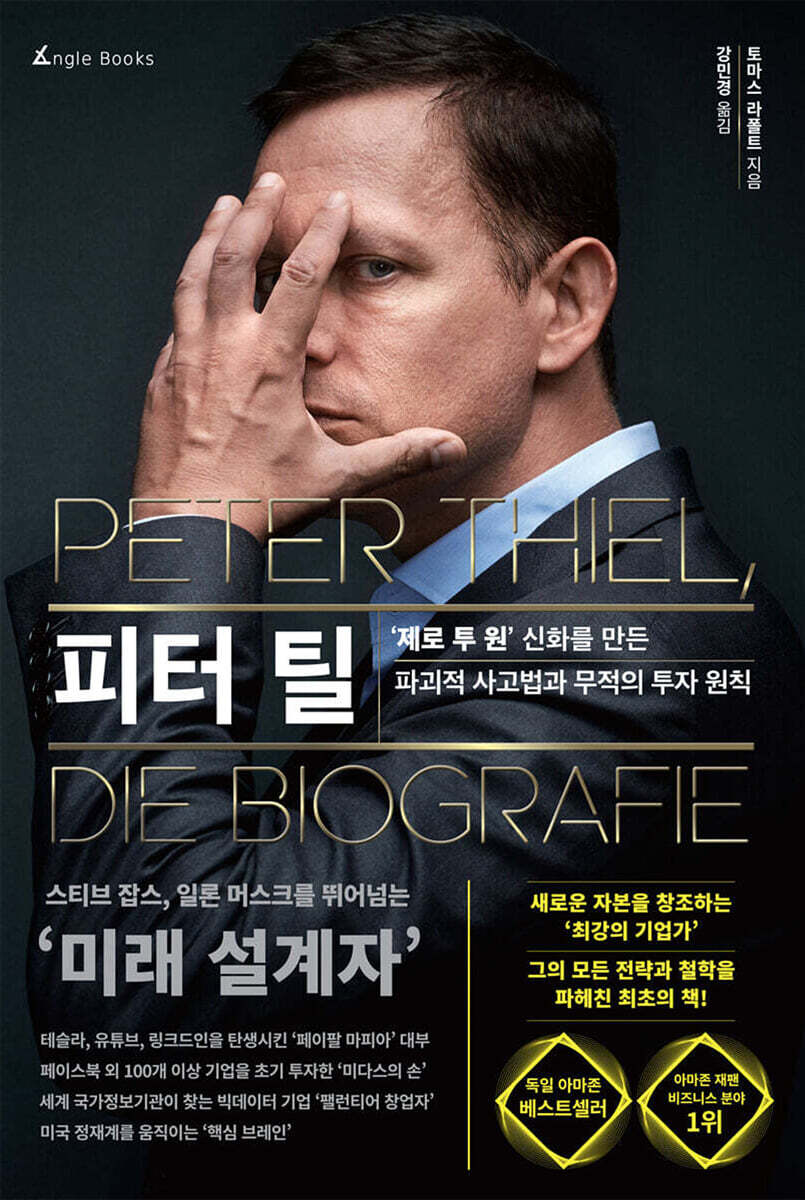

Peter Thiel

|

Description

Book Introduction

- A word from MD

-

The creator of the 'Zero to One' mythCo-founder of PayPal and godfather of the 'PayPal Mafia', a group of entrepreneurs representing Silicon Valley.

The first outside investor to back Facebook. Founder of a big data company sought after by the CIA and FBI.

It is time to pay attention to his insight and principles of monopolizing without competing and only making winning investments.

March 19, 2019. Park Jeong-yoon, Economics and Management PD

“Why are world leaders paying attention to Peter Thiel?”

The 'Invincible Man' who turns everything he touches into future capital

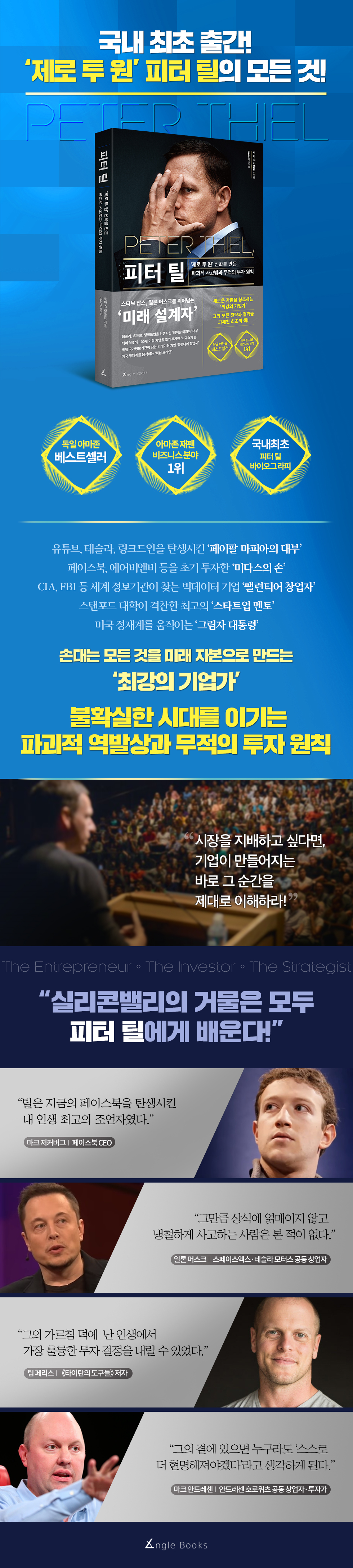

Peter Thiel's biography finally arrives in Korea!

Peter Thiel is the co-founder of PayPal, the world's first electronic payment company that successfully pioneered the fintech era, and is known as the 'godfather' of the 'PayPal Mafia', which leads those who move Silicon Valley, including Elon Musk, founder of SpaceX, Chad Hurley and Steve Chan, co-founders of YouTube, and Reid Hoffman, founder of LinkedIn.

He is also a prominent venture capital investor who became a billionaire through early investments in famous startups such as Airbnb and Spotify, and is also an 'investment genius' who was the first outside investor to see the value of Facebook and achieved a return on investment of 3,400 times.

In addition, he founded Palantir Technologies, a big data analytics company that predicts terrorism and crime, and grew it into a company with an estimated corporate value of $20 billion and ranked among the top three private companies in Silicon Valley.

Not only that.

Thiel is also a strategist who has never known failure, having bet on Donald Trump and won, the only one in Silicon Valley, when Hillary Clinton was expected to win the last US presidential election.

This book is the first in Korea to cover his life, from his days at Stanford, which laid the foundation for the birth of the 'PayPal Mafia', to his founding of PayPal, his meeting with Facebook's Zuckerberg, the background of the founding of Palantir, and his rise to become the shadow president of the United States. Through this book, it reveals the secrets of Peter Tillman's 'vision to win the times' and 'hidden investment strategy' that were not revealed in 'Zero to One'.

This book delves into the history of Peter Thiel, one of the most revolutionary entrepreneurs in history. It will teach readers struggling to survive in uncertain times the investment eye that can uncover new wealth opportunities and the essence of exceptional entrepreneurs and investors.

The 'Invincible Man' who turns everything he touches into future capital

Peter Thiel's biography finally arrives in Korea!

Peter Thiel is the co-founder of PayPal, the world's first electronic payment company that successfully pioneered the fintech era, and is known as the 'godfather' of the 'PayPal Mafia', which leads those who move Silicon Valley, including Elon Musk, founder of SpaceX, Chad Hurley and Steve Chan, co-founders of YouTube, and Reid Hoffman, founder of LinkedIn.

He is also a prominent venture capital investor who became a billionaire through early investments in famous startups such as Airbnb and Spotify, and is also an 'investment genius' who was the first outside investor to see the value of Facebook and achieved a return on investment of 3,400 times.

In addition, he founded Palantir Technologies, a big data analytics company that predicts terrorism and crime, and grew it into a company with an estimated corporate value of $20 billion and ranked among the top three private companies in Silicon Valley.

Not only that.

Thiel is also a strategist who has never known failure, having bet on Donald Trump and won, the only one in Silicon Valley, when Hillary Clinton was expected to win the last US presidential election.

This book is the first in Korea to cover his life, from his days at Stanford, which laid the foundation for the birth of the 'PayPal Mafia', to his founding of PayPal, his meeting with Facebook's Zuckerberg, the background of the founding of Palantir, and his rise to become the shadow president of the United States. Through this book, it reveals the secrets of Peter Tillman's 'vision to win the times' and 'hidden investment strategy' that were not revealed in 'Zero to One'.

This book delves into the history of Peter Thiel, one of the most revolutionary entrepreneurs in history. It will teach readers struggling to survive in uncertain times the investment eye that can uncover new wealth opportunities and the essence of exceptional entrepreneurs and investors.

- You can preview some of the book's contents.

Preview

index

To begin with - Why is the world paying attention to 'this man'?

Part 1: The Birth of the "Zero to One" Myth: The Moment a Creative Company Is Created

Chapter 1: Stanford, the Land of Beginnings: Immersed in Competition and Victory

The Beginning of Creative Duality

All possibilities are open

Learn the essentials of being an entrepreneur and investor

Comrades of [Stanford Review]

Chapter 2: Don't Be a "Competitive Loser": Starting PayPal from Frustration

zero-sum game

Silicon Valley's next-generation innovation

The founding of PayPal, the world's first fintech company.

Elon Musk: From Worst Enemy to Colleague

Musk's dismissal

Standing on the shoulders of giants, eBay

The dream of listing achieved immediately after the 9/11 terrorist attacks

PayPal's sale

The Birth of the 'PayPal Mafia'

Men with strong bonds

Chapter 3: The Secrets of PayPal and Palantir's Success: Thiel's Unconventional Management Strategy

How to overcome challenges

Liberation of currency from government

Choosing a business partner is like getting married.

Focus all your strategies on one thing

Build a team that will last

Agile business management

An organization that attracts outstanding people

The innovative mechanism created by PayPal

The Power of Big Data to Predict Terrorism: The Beginning of Palantir

Why We Put a Philosopher in the CEO Chair

Collaboration between AI and humans

Safety and Privacy: Which Comes First?

The most powerful engineers who 'converse' with data.

The secret to technological innovation is a small team with boundless imagination.

The Shadow of Palantir

Peter Thiel and Mark Zuckerberg

Chapter 4: "Reverse Thinking" is the Answer: The Conditions for a Successful Startup

The Birth of Zero to One

Seize opportunities with disruptive thinking

Ten Rules for Startups That Never Fail

Part 2: Designing Future Capital: The "Hand of Midas" - Peter Thiel's Golden Rules for Investment

Chapter 5: Where to Invest: Thiel's Approach to Investment Decisions

Thiel's corporate valuation method

Study the last number

Google and Apple Create Economic Moats

Market share and market creation

Four Elements of a Market-Dominating Company

Chapter 6: Preempting the Future Market: Thiel's Unique and Ambitious Investment Firms

Clarium Capital: Delving into the Global Economy with a Converse Mindset

Mithril Capital: A Modern-Day Berkshire Hathaway

Founders Fund: Creating a Whole New Market

Bala Ventures, which monitors startups around the world.

Y Combinator: Connecting with Investment Candidates

Chapter 7 Warren Buffett vs.

Peter Thiel: The Similarities and Differences Between Two Investment Guru

Be selective and select again

Strengthen your defensive range

Take a long-term perspective

Enter through the hidden door

Avoid buzzwords

Stand on your own two feet

Build strong friendships

Making something from zero to one is progress.

* Case Study_Analysis of Peter Thiel's Investment Case

Case Study 1: Facebook

Case Study 2: Palantir

Part 3: What Drives Him_Peter Thiel's Brave New World

Chapter 8: Liberating Technology from Power: Thiel's Libertarian Thought

A space free from power

We fail to recognize the stagnant reality

What will happen in the future?

Find innovative technologies that will change the world.

Bookworm Till's Favorite Books

Chapter 9: America's "Shadow President" - The Key Brain Behind the Trump Administration

The outsider who will become the winner

Political Intervention by 'Political Atheists'

Globalization is 'copy and paste'

The United States is no longer a "high-tech nation."

Why I Donated $1.25 Million to Trump

Trump's Meeting with Tech Leaders

The Shadow President's inner circle

The ultimate counter-intuitive move that gave Trump a leg up

Areas requiring progressive innovation

Cambridge Analytica

Chapter 10: Betting on Education, Space, and Life Extension: Thiel's Future Strategy Pushing the Boundaries

The Thiel Foundation: Focusing on Challenges That Transform the Future

The Thiel Scholarship: Supporting Talented Young People

Breakout Lab: Aiming for a "Next Level" Society

Conclusion_ What will the future hold?

Americas

Part 1: The Birth of the "Zero to One" Myth: The Moment a Creative Company Is Created

Chapter 1: Stanford, the Land of Beginnings: Immersed in Competition and Victory

The Beginning of Creative Duality

All possibilities are open

Learn the essentials of being an entrepreneur and investor

Comrades of [Stanford Review]

Chapter 2: Don't Be a "Competitive Loser": Starting PayPal from Frustration

zero-sum game

Silicon Valley's next-generation innovation

The founding of PayPal, the world's first fintech company.

Elon Musk: From Worst Enemy to Colleague

Musk's dismissal

Standing on the shoulders of giants, eBay

The dream of listing achieved immediately after the 9/11 terrorist attacks

PayPal's sale

The Birth of the 'PayPal Mafia'

Men with strong bonds

Chapter 3: The Secrets of PayPal and Palantir's Success: Thiel's Unconventional Management Strategy

How to overcome challenges

Liberation of currency from government

Choosing a business partner is like getting married.

Focus all your strategies on one thing

Build a team that will last

Agile business management

An organization that attracts outstanding people

The innovative mechanism created by PayPal

The Power of Big Data to Predict Terrorism: The Beginning of Palantir

Why We Put a Philosopher in the CEO Chair

Collaboration between AI and humans

Safety and Privacy: Which Comes First?

The most powerful engineers who 'converse' with data.

The secret to technological innovation is a small team with boundless imagination.

The Shadow of Palantir

Peter Thiel and Mark Zuckerberg

Chapter 4: "Reverse Thinking" is the Answer: The Conditions for a Successful Startup

The Birth of Zero to One

Seize opportunities with disruptive thinking

Ten Rules for Startups That Never Fail

Part 2: Designing Future Capital: The "Hand of Midas" - Peter Thiel's Golden Rules for Investment

Chapter 5: Where to Invest: Thiel's Approach to Investment Decisions

Thiel's corporate valuation method

Study the last number

Google and Apple Create Economic Moats

Market share and market creation

Four Elements of a Market-Dominating Company

Chapter 6: Preempting the Future Market: Thiel's Unique and Ambitious Investment Firms

Clarium Capital: Delving into the Global Economy with a Converse Mindset

Mithril Capital: A Modern-Day Berkshire Hathaway

Founders Fund: Creating a Whole New Market

Bala Ventures, which monitors startups around the world.

Y Combinator: Connecting with Investment Candidates

Chapter 7 Warren Buffett vs.

Peter Thiel: The Similarities and Differences Between Two Investment Guru

Be selective and select again

Strengthen your defensive range

Take a long-term perspective

Enter through the hidden door

Avoid buzzwords

Stand on your own two feet

Build strong friendships

Making something from zero to one is progress.

* Case Study_Analysis of Peter Thiel's Investment Case

Case Study 1: Facebook

Case Study 2: Palantir

Part 3: What Drives Him_Peter Thiel's Brave New World

Chapter 8: Liberating Technology from Power: Thiel's Libertarian Thought

A space free from power

We fail to recognize the stagnant reality

What will happen in the future?

Find innovative technologies that will change the world.

Bookworm Till's Favorite Books

Chapter 9: America's "Shadow President" - The Key Brain Behind the Trump Administration

The outsider who will become the winner

Political Intervention by 'Political Atheists'

Globalization is 'copy and paste'

The United States is no longer a "high-tech nation."

Why I Donated $1.25 Million to Trump

Trump's Meeting with Tech Leaders

The Shadow President's inner circle

The ultimate counter-intuitive move that gave Trump a leg up

Areas requiring progressive innovation

Cambridge Analytica

Chapter 10: Betting on Education, Space, and Life Extension: Thiel's Future Strategy Pushing the Boundaries

The Thiel Foundation: Focusing on Challenges That Transform the Future

The Thiel Scholarship: Supporting Talented Young People

Breakout Lab: Aiming for a "Next Level" Society

Conclusion_ What will the future hold?

Americas

Detailed image

Into the book

The subsequent actions of PayPal's founders have become legendary in the startup world.

After selling the company to eBay, the 220 people who left PayPal went on to found seven so-called "unicorn companies."

The term 'unicorn company', which refers to a company as rare as the legendary animal unicorn, is used to refer to a startup with a corporate value of over $1 billion.

The seven unicorn companies and their respective valuations are as follows.

--- p.61

“I believe our company has the opportunity to become the Microsoft of payments platforms—the financial operating system for the world.”

In addition, there is one thing we must not forget.

PayPal's vision is to liberate the world from the shackles of government-mandated currencies and create a new internet currency that is independent of state influence.

In other words, this was Thiel's libertarian worldview itself, which sought to break free from the shackles of power, and as a result, the world's first global financial internet company was born.

The concept of "fintech" didn't really take hold until about 15 years later, and since then, banks, insurance companies, and venture capitalists have been investing in the digitalization of finance.

--- p.70

“Peter closed the investment round without consulting anyone.

But just a few days later, the stock market crashed.

“If Peter had hesitated for just one more week, our company would have gone under.”

There are not many people who possess not only foresight but also the ability to take immediate, concrete action.

In addition to being a brilliant thinker, Thiel also had a strong vision for the world.

Whenever PayPal faced a challenge, he quickly found a solution with his tight-knit team.

--- p.71

The success of a company's vision or strategy depends on how well its employees put it into practice.

For this reason, Thiel places a high value on camaraderie and teamwork, a tradition that began when he founded PayPal and has continued ever since.

"Motivation is always important," Thiel emphasizes.

“A good company has a special mission that only that person can do.

“Only you can make it happen.” That was PayPal’s vision.”

It's no surprise to Thiel that founders from tech companies like Google and Microsoft can't build startups that are as good as the PayPal Mafia in both quality and quantity.

Because it's easy for someone who's been part of a perfectly established company to underestimate the challenge of building a company from scratch.

--- p79

The war on terror, a new war that no one had ever experienced before, required a different approach than before.

Thiel's solution was to use the power of technology to prevent terrorism while also protecting civil liberties.

After earning about $55 million from the PayPal sale, Thiel entered a new "battle" and founded Palantir in 2004.

Palantir is a company that develops and sells data mining software and provides security solutions.

Palantir's origins are also PayPal.

PayPal has developed a unique and highly sophisticated algorithm to prevent fraud and detect suspicious money flows during payments.

This algorithm's high precision has even caught the attention of law enforcement authorities, and Palantir aims to develop this technology to meet broader needs, such as countering terrorism and crime.

--- p.92

Palantir's core is not a department like sales or marketing, but rather an engineer-centric, startup culture.

In a typical company, software developers are confined to their offices and never meet customers face-to-face, but that's not the case at Palantir.

Once a contract is concluded, software developers communicate directly with customers and develop products according to their needs.

Kap believes that developers can build strong, trusting relationships with customers because they can honestly explain the product's strengths and weaknesses and understand how to solve the challenges at hand.

“The developers may seem like people with Asperger’s syndrome, but they always exceed expectations in their work, so they are completely trusted by customers.

Palantir is that kind of company.”

“Palantir’s development team is truly first-class.

“It was truly jaw-dropping to see him dig deep into the problem and ‘converse’ with the data.”

Hershey Patel, who was the head of In-Q-Tel, said this and stuck out his tongue.

--- p.101

Thiel is both an economist and a philosopher.

Till's goal is to find a different path than most people.

In short, Thiel is a contrarian investor who is willing to take a risky bet on another bubble and a dysfunctional global economy, no matter which way it goes.

Thiel's investment team took a contrarian approach, buying Japanese corporations when other investors were selling them and betting on soaring oil prices when supplies were tight.

By the summer of 2008, when the real estate bubble was at its peak, Thiel's initial $10 million investment in Clarium had ballooned to more than $7 billion as fund returns rose.

In just 6 years, he made a 700-fold profit.

At this time, Thiel gained a reputation as an 'investment genius'.

--- p.148

Mithril Capital is a slim company, a bit like a modern-day Berkshire Hathaway.

Royan is the CEO, Thiel is the chairman of the investment committee, and the rest of the staff consists of ten people who were recruited from the company Thiel ran.

The final decision on which companies to fund and to whom will be made is made by Royan and Thiel.

According to Royan, the original plan was to take the form of a perpetual bond and list the shares after 15 years.

Till and Royan were prepared to have their invested money tied up during that period.

However, investors considered this approach too radical, so the pair eventually opted for a more conventional fund structure.

Even so, it was a long-term fund with a maturity of 12 years.

Mithril Capital's portfolio is concentrated in companies that no one in Silicon Valley has ever heard of.

Among them are C2FO, a Kansas City-based fintech company that provides cash flow optimization services, a Toulouse-based company developing sewer inspection robots, and a Boston-based tech company that provides a rail ticket reservation service.

--- p.151

Founders Fund is a fund company that Thiel founded in 2005 with PayPal co-founders Ken Howery and Luke Nosek.

The line from the Founders Fund manifesto, “We wanted flying cars, but all we got were 140 characters,” became widely known around the world.

It was a biting satire aimed at Twitter and venture capitalists who are reluctant to invest in risky but world-changing technologies.

“What happened in the future?”

Founders Fund's investment targets are individuals who take this question as their starting point, are committed to solving difficult, global problems, and are driven by an entrepreneurial spirit.

Their focus is largely on challenging problems in science and technology, and the Thiel team hopes to use this fund to create interesting, mutually beneficial relationships.

The goal is to support the development of technologies that will further develop advanced countries while also providing large returns to investors.

--- p.153

Thiel has achieved the same success in investing as Jobs and Apple achieved in their products three times over.

As the founder of PayPal and Palantir, and as the first outside investor in Facebook, he has created a multi-billion dollar success story.

In the spring of 2017, PayPal was valued at $52 billion. Combined with Palantir's $20 billion and Facebook's $410 billion, the combined value of Thiel's investments reached a staggering $482 billion.

For reference, the corporate value of Berkshire Hathaway, run by Buffett, is $410 billion.

Buffett took over Berkshire Hathaway in 1965, over 50 years ago, and PayPal was founded in 1998, so Thiel has matched Buffett's performance in just 20 years.

--- p.161

Thiel has twice overturned conventional venture capital wisdom, demonstrating that massive profits can be made by investing against trends, recognizing breakthrough innovations, and timing them appropriately.

He tells them to go through the hidden door, the one in the corner where no one wants to go.

It means to avoid doors that are crowded with people.

--- p.165

Thiel, a technology entrepreneur and investor, is better at spotting the emergence of new disruptive startups than anyone else.

For Thiel, a man like Donald Trump is a "disruptive change agent," and the Trump administration is a "startup that will shatter old business models."

In Thiel's view, endorsing Trump was not a gamble on a dangerous outsider.

Because 'in the end, more than half of Americans supported Trump.'

--- p.236

According to Thiel, the influence of opinion polls is so unbelievably powerful these days that politicians are obsessed with currying favor with the majority.

But politicians who are obsessed with current trends and public opinion are reluctant to take risks.

Extreme bureaucracy and increased regulation of critical sectors such as banking, insurance, energy, transportation, health, and pharmaceuticals have a serious impact on the progress of innovation.

The reason the tech industry has made such great strides since the 1960s is because Bill Gates, Larry Page, and Sergey Brin were unsupervised when they started their startups in garages.

For politicians, it was often far more effective to target the big corporations of the old world that clashed with the Internet industry. --- p.239

When Thiel announced his support and funding for Trump, Silicon Valley erupted in outrage.

Some people strongly urged Thiel to step down from his Facebook board and his role as a non-executive partner at Y Combinator.

Thiel's position as chairman and largest shareholder of Palantir, which counts government and military clients, also contributed to the fierce criticism.

Sam Altman, the CEO of Y Combinator and a friend of Thiel's, was a staunch Trump critic and was outspoken about his disappointment with Thiel.

Many Internet companies hoard billions of dollars every quarter and live comfortably within the political bubble, much like Washington politicians.

As if he had no idea what the situation was like in other parts of the United States.

Till considers himself an "atheist" when it comes to politics.

While Thiel has challenged new boundaries with each startup he has founded, he believes that "we always operate within a political system, and that system has legitimacy."

That is why he finds it meaningful to 'intervene' in it.

Till said:

“Politics is not God, nor is it all.” --- p.241

Politico, an American online political daily, called Thiel the “shadow president.”

Thiel's close associates have been calling him that lately, and indeed, Thiel has been a significant presence in the Trump administration, attending numerous meetings.

A chess master and experienced startup leader, Thiel is adept at placing the right people in the right positions.

If so, perhaps we can clean up the swamp in Washington, install experts Thiel trusts in key positions, and deregulate and foster innovation.

--- p.256

In late 2015, Thiel co-founded OpenAI, a non-profit artificial intelligence research organization, with Tesla's Elon Musk, LinkedIn's Reid Hoffman, and Y Combinator's Sam Altman and Jessica Livingston.

The company, which aims to "advance digital intelligence for the benefit of all humanity, not just for profit," has received a total of $1 billion in funding from backers including Amazon Web Services (AWS) and Indian IT company Infosys.

In this way, Musk and Thiel are poised to take on tech giants like Alphabet, Apple, Facebook, and Microsoft.

These companies have been absorbing a large number of prominent scholars and startups in the field of artificial intelligence, which has raised concerns that a small number of IT companies will monopolize artificial intelligence.

In 2014, Musk sounded the alarm in an interview with CNBC:

“There needs to be regulatory oversight at the national and international levels to ensure we don’t do anything foolish.”

After selling the company to eBay, the 220 people who left PayPal went on to found seven so-called "unicorn companies."

The term 'unicorn company', which refers to a company as rare as the legendary animal unicorn, is used to refer to a startup with a corporate value of over $1 billion.

The seven unicorn companies and their respective valuations are as follows.

--- p.61

“I believe our company has the opportunity to become the Microsoft of payments platforms—the financial operating system for the world.”

In addition, there is one thing we must not forget.

PayPal's vision is to liberate the world from the shackles of government-mandated currencies and create a new internet currency that is independent of state influence.

In other words, this was Thiel's libertarian worldview itself, which sought to break free from the shackles of power, and as a result, the world's first global financial internet company was born.

The concept of "fintech" didn't really take hold until about 15 years later, and since then, banks, insurance companies, and venture capitalists have been investing in the digitalization of finance.

--- p.70

“Peter closed the investment round without consulting anyone.

But just a few days later, the stock market crashed.

“If Peter had hesitated for just one more week, our company would have gone under.”

There are not many people who possess not only foresight but also the ability to take immediate, concrete action.

In addition to being a brilliant thinker, Thiel also had a strong vision for the world.

Whenever PayPal faced a challenge, he quickly found a solution with his tight-knit team.

--- p.71

The success of a company's vision or strategy depends on how well its employees put it into practice.

For this reason, Thiel places a high value on camaraderie and teamwork, a tradition that began when he founded PayPal and has continued ever since.

"Motivation is always important," Thiel emphasizes.

“A good company has a special mission that only that person can do.

“Only you can make it happen.” That was PayPal’s vision.”

It's no surprise to Thiel that founders from tech companies like Google and Microsoft can't build startups that are as good as the PayPal Mafia in both quality and quantity.

Because it's easy for someone who's been part of a perfectly established company to underestimate the challenge of building a company from scratch.

--- p79

The war on terror, a new war that no one had ever experienced before, required a different approach than before.

Thiel's solution was to use the power of technology to prevent terrorism while also protecting civil liberties.

After earning about $55 million from the PayPal sale, Thiel entered a new "battle" and founded Palantir in 2004.

Palantir is a company that develops and sells data mining software and provides security solutions.

Palantir's origins are also PayPal.

PayPal has developed a unique and highly sophisticated algorithm to prevent fraud and detect suspicious money flows during payments.

This algorithm's high precision has even caught the attention of law enforcement authorities, and Palantir aims to develop this technology to meet broader needs, such as countering terrorism and crime.

--- p.92

Palantir's core is not a department like sales or marketing, but rather an engineer-centric, startup culture.

In a typical company, software developers are confined to their offices and never meet customers face-to-face, but that's not the case at Palantir.

Once a contract is concluded, software developers communicate directly with customers and develop products according to their needs.

Kap believes that developers can build strong, trusting relationships with customers because they can honestly explain the product's strengths and weaknesses and understand how to solve the challenges at hand.

“The developers may seem like people with Asperger’s syndrome, but they always exceed expectations in their work, so they are completely trusted by customers.

Palantir is that kind of company.”

“Palantir’s development team is truly first-class.

“It was truly jaw-dropping to see him dig deep into the problem and ‘converse’ with the data.”

Hershey Patel, who was the head of In-Q-Tel, said this and stuck out his tongue.

--- p.101

Thiel is both an economist and a philosopher.

Till's goal is to find a different path than most people.

In short, Thiel is a contrarian investor who is willing to take a risky bet on another bubble and a dysfunctional global economy, no matter which way it goes.

Thiel's investment team took a contrarian approach, buying Japanese corporations when other investors were selling them and betting on soaring oil prices when supplies were tight.

By the summer of 2008, when the real estate bubble was at its peak, Thiel's initial $10 million investment in Clarium had ballooned to more than $7 billion as fund returns rose.

In just 6 years, he made a 700-fold profit.

At this time, Thiel gained a reputation as an 'investment genius'.

--- p.148

Mithril Capital is a slim company, a bit like a modern-day Berkshire Hathaway.

Royan is the CEO, Thiel is the chairman of the investment committee, and the rest of the staff consists of ten people who were recruited from the company Thiel ran.

The final decision on which companies to fund and to whom will be made is made by Royan and Thiel.

According to Royan, the original plan was to take the form of a perpetual bond and list the shares after 15 years.

Till and Royan were prepared to have their invested money tied up during that period.

However, investors considered this approach too radical, so the pair eventually opted for a more conventional fund structure.

Even so, it was a long-term fund with a maturity of 12 years.

Mithril Capital's portfolio is concentrated in companies that no one in Silicon Valley has ever heard of.

Among them are C2FO, a Kansas City-based fintech company that provides cash flow optimization services, a Toulouse-based company developing sewer inspection robots, and a Boston-based tech company that provides a rail ticket reservation service.

--- p.151

Founders Fund is a fund company that Thiel founded in 2005 with PayPal co-founders Ken Howery and Luke Nosek.

The line from the Founders Fund manifesto, “We wanted flying cars, but all we got were 140 characters,” became widely known around the world.

It was a biting satire aimed at Twitter and venture capitalists who are reluctant to invest in risky but world-changing technologies.

“What happened in the future?”

Founders Fund's investment targets are individuals who take this question as their starting point, are committed to solving difficult, global problems, and are driven by an entrepreneurial spirit.

Their focus is largely on challenging problems in science and technology, and the Thiel team hopes to use this fund to create interesting, mutually beneficial relationships.

The goal is to support the development of technologies that will further develop advanced countries while also providing large returns to investors.

--- p.153

Thiel has achieved the same success in investing as Jobs and Apple achieved in their products three times over.

As the founder of PayPal and Palantir, and as the first outside investor in Facebook, he has created a multi-billion dollar success story.

In the spring of 2017, PayPal was valued at $52 billion. Combined with Palantir's $20 billion and Facebook's $410 billion, the combined value of Thiel's investments reached a staggering $482 billion.

For reference, the corporate value of Berkshire Hathaway, run by Buffett, is $410 billion.

Buffett took over Berkshire Hathaway in 1965, over 50 years ago, and PayPal was founded in 1998, so Thiel has matched Buffett's performance in just 20 years.

--- p.161

Thiel has twice overturned conventional venture capital wisdom, demonstrating that massive profits can be made by investing against trends, recognizing breakthrough innovations, and timing them appropriately.

He tells them to go through the hidden door, the one in the corner where no one wants to go.

It means to avoid doors that are crowded with people.

--- p.165

Thiel, a technology entrepreneur and investor, is better at spotting the emergence of new disruptive startups than anyone else.

For Thiel, a man like Donald Trump is a "disruptive change agent," and the Trump administration is a "startup that will shatter old business models."

In Thiel's view, endorsing Trump was not a gamble on a dangerous outsider.

Because 'in the end, more than half of Americans supported Trump.'

--- p.236

According to Thiel, the influence of opinion polls is so unbelievably powerful these days that politicians are obsessed with currying favor with the majority.

But politicians who are obsessed with current trends and public opinion are reluctant to take risks.

Extreme bureaucracy and increased regulation of critical sectors such as banking, insurance, energy, transportation, health, and pharmaceuticals have a serious impact on the progress of innovation.

The reason the tech industry has made such great strides since the 1960s is because Bill Gates, Larry Page, and Sergey Brin were unsupervised when they started their startups in garages.

For politicians, it was often far more effective to target the big corporations of the old world that clashed with the Internet industry. --- p.239

When Thiel announced his support and funding for Trump, Silicon Valley erupted in outrage.

Some people strongly urged Thiel to step down from his Facebook board and his role as a non-executive partner at Y Combinator.

Thiel's position as chairman and largest shareholder of Palantir, which counts government and military clients, also contributed to the fierce criticism.

Sam Altman, the CEO of Y Combinator and a friend of Thiel's, was a staunch Trump critic and was outspoken about his disappointment with Thiel.

Many Internet companies hoard billions of dollars every quarter and live comfortably within the political bubble, much like Washington politicians.

As if he had no idea what the situation was like in other parts of the United States.

Till considers himself an "atheist" when it comes to politics.

While Thiel has challenged new boundaries with each startup he has founded, he believes that "we always operate within a political system, and that system has legitimacy."

That is why he finds it meaningful to 'intervene' in it.

Till said:

“Politics is not God, nor is it all.” --- p.241

Politico, an American online political daily, called Thiel the “shadow president.”

Thiel's close associates have been calling him that lately, and indeed, Thiel has been a significant presence in the Trump administration, attending numerous meetings.

A chess master and experienced startup leader, Thiel is adept at placing the right people in the right positions.

If so, perhaps we can clean up the swamp in Washington, install experts Thiel trusts in key positions, and deregulate and foster innovation.

--- p.256

In late 2015, Thiel co-founded OpenAI, a non-profit artificial intelligence research organization, with Tesla's Elon Musk, LinkedIn's Reid Hoffman, and Y Combinator's Sam Altman and Jessica Livingston.

The company, which aims to "advance digital intelligence for the benefit of all humanity, not just for profit," has received a total of $1 billion in funding from backers including Amazon Web Services (AWS) and Indian IT company Infosys.

In this way, Musk and Thiel are poised to take on tech giants like Alphabet, Apple, Facebook, and Microsoft.

These companies have been absorbing a large number of prominent scholars and startups in the field of artificial intelligence, which has raised concerns that a small number of IT companies will monopolize artificial intelligence.

In 2014, Musk sounded the alarm in an interview with CNBC:

“There needs to be regulatory oversight at the national and international levels to ensure we don’t do anything foolish.”

--- p.279

Publisher's Review

Learn Peter Thiel's New 'Sense of Wealth'

Turning a crisis into a new wealth opportunity

Disruptive Contrarian Thinking and Unbeatable Investment Principles

Thiel's success story of creating new businesses and wealth that never existed before always began in crisis.

Moments of crisis and difficulty, moments when everyone is trembling with anxiety, were, in the eyes of Thiel, a brilliant contrarian, an opportunity to create new markets and wealth.

In the early days of PayPal's growth as a startup, when Elon Musk's X.com emerged as a powerful rival threatening PayPal, Thiel turned the crisis into an opportunity for growth by merging with X.com instead of unnecessary competition, thereby establishing a foothold to rise to the top of the e-commerce market.

Even after the dot-com bubble burst, when most venture capital funds were reluctant to make an early investment in Facebook, Thiel was the first to recognize the growth potential of social media and became Facebook's first outside investor.

Since then, Facebook has become a global company with a corporate value of $432 billion (as of June 2017), and Thiel recorded a return on his investment of 3,400 times over eight years of investment in Facebook.

Also, at a time when the world was in shock due to the 9/11 terrorist attacks, Thiel founded Palantir after judging that there was a demand for big data analysis due to the increase in cybercrime and terrorist threats.

Since then, Palantir's crime detection technology software has achieved great success, playing a crucial, hidden role in tracking down Osama bin Laden and arresting Bernard Madoff, the perpetrator of a massive financial fraud case.

Thiel once again proved his invincibility by generating 36-60x returns over 14 years through Palantir.

Thiel recently declared that "Silicon Valley's golden age is over," and moved his residence and office from Silicon Valley to LA, causing a stir in the tech industry and heralding another revolution.

Peter Thiel, who seized new markets and wealth opportunities in every moment of crisis, possessed his own exceptional foresight, the ability to immediately take concrete action, and a firm vision for the world.

This book delves deeply into how he consistently makes successful startup and investment decisions, and opens up a whole new world of business and investing through Thiel's previously unknown thinking and approach.

· How did PayPal, the world's first fintech company, become successful?

· Why were we able to produce founders of unicorn companies like YouTube, Tesla, and LinkedIn?

· How did Thiel see Facebook's potential faster than anyone else?

· Why did you found Palantir, the mysterious big data analytics company that predicts terrorism and crime?

· What was Thiel's investment strategy that allowed him to match Buffett's investment in just 20 years?

· What was your real reason for supporting Trump and joining his transition team?

· Why does he find Silicon Valley stifling, even though he reigns supreme there?

· What kind of future companies does he want to invest in?

· What is Thiel's vision for reading the times and drawing a bigger picture?

Turning a crisis into a new wealth opportunity

Disruptive Contrarian Thinking and Unbeatable Investment Principles

Thiel's success story of creating new businesses and wealth that never existed before always began in crisis.

Moments of crisis and difficulty, moments when everyone is trembling with anxiety, were, in the eyes of Thiel, a brilliant contrarian, an opportunity to create new markets and wealth.

In the early days of PayPal's growth as a startup, when Elon Musk's X.com emerged as a powerful rival threatening PayPal, Thiel turned the crisis into an opportunity for growth by merging with X.com instead of unnecessary competition, thereby establishing a foothold to rise to the top of the e-commerce market.

Even after the dot-com bubble burst, when most venture capital funds were reluctant to make an early investment in Facebook, Thiel was the first to recognize the growth potential of social media and became Facebook's first outside investor.

Since then, Facebook has become a global company with a corporate value of $432 billion (as of June 2017), and Thiel recorded a return on his investment of 3,400 times over eight years of investment in Facebook.

Also, at a time when the world was in shock due to the 9/11 terrorist attacks, Thiel founded Palantir after judging that there was a demand for big data analysis due to the increase in cybercrime and terrorist threats.

Since then, Palantir's crime detection technology software has achieved great success, playing a crucial, hidden role in tracking down Osama bin Laden and arresting Bernard Madoff, the perpetrator of a massive financial fraud case.

Thiel once again proved his invincibility by generating 36-60x returns over 14 years through Palantir.

Thiel recently declared that "Silicon Valley's golden age is over," and moved his residence and office from Silicon Valley to LA, causing a stir in the tech industry and heralding another revolution.

Peter Thiel, who seized new markets and wealth opportunities in every moment of crisis, possessed his own exceptional foresight, the ability to immediately take concrete action, and a firm vision for the world.

This book delves deeply into how he consistently makes successful startup and investment decisions, and opens up a whole new world of business and investing through Thiel's previously unknown thinking and approach.

· How did PayPal, the world's first fintech company, become successful?

· Why were we able to produce founders of unicorn companies like YouTube, Tesla, and LinkedIn?

· How did Thiel see Facebook's potential faster than anyone else?

· Why did you found Palantir, the mysterious big data analytics company that predicts terrorism and crime?

· What was Thiel's investment strategy that allowed him to match Buffett's investment in just 20 years?

· What was your real reason for supporting Trump and joining his transition team?

· Why does he find Silicon Valley stifling, even though he reigns supreme there?

· What kind of future companies does he want to invest in?

· What is Thiel's vision for reading the times and drawing a bigger picture?

GOODS SPECIFICS

- Date of publication: March 28, 2019

- Page count, weight, size: 326 pages | 487g | 152*225*18mm

- ISBN13: 9791187512417

- ISBN10: 1187512419

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)