My investment skills

|

Description

Book Introduction

Sold over 240,000 copies in Japan!

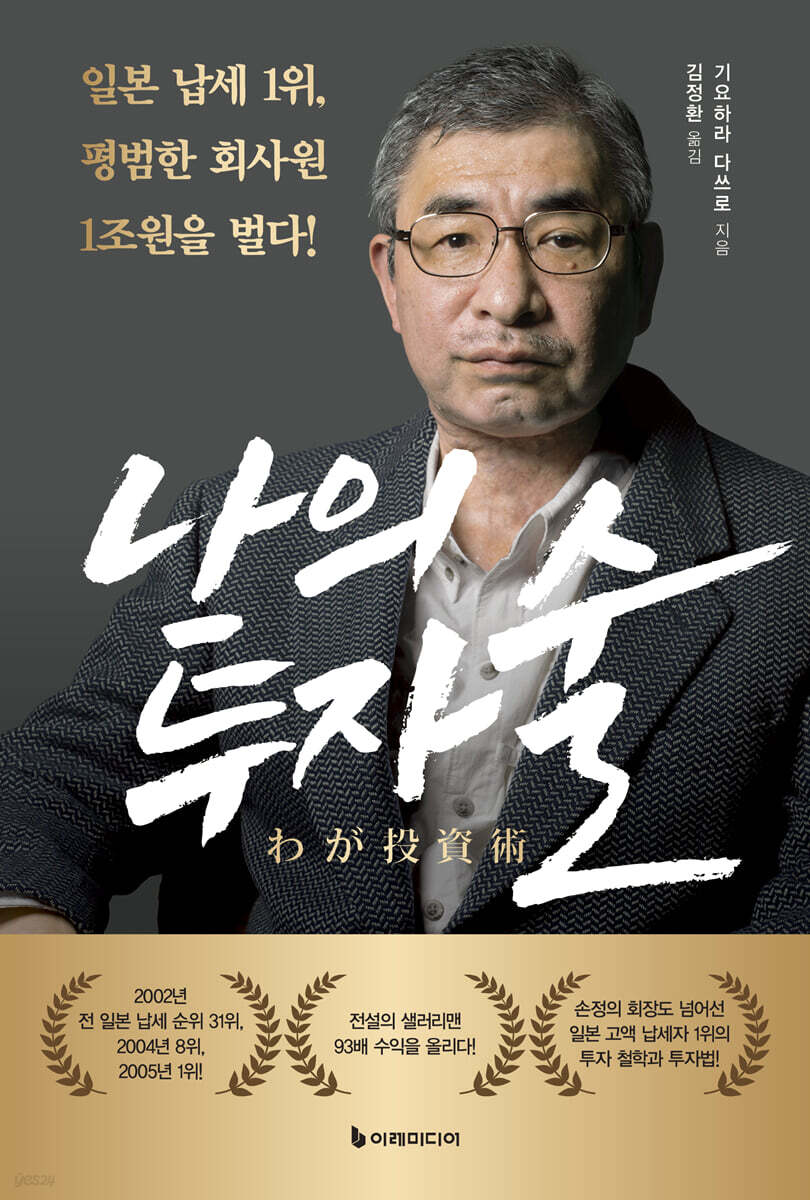

The legendary salaried investor who became Japan's top taxpayer! The first book to share the investment know-how of Tatsuro Kiyohara!

In 2005, the name of a simple office worker was ranked first in the list of Japan's richest people (highest taxpayers in Japan), causing a stir throughout Japan.

The main character is the author of this book, Tatsuro Kiyohara, who has managed hedge funds for 25 years as a fund manager and achieved a 93-fold return.

He became a legend among office workers, ranking 31st in the Japanese taxpayer rankings in 2002, 8th in 2004, and 1st in 2005.

The author, who decided to retire for health reasons, has compiled his investment know-how into a book for those who want to try their hand at managing hedge funds and those who have decided to enter the stock market as an individual investor.

The investment genius reveals his philosophy behind failure, success, and beyond.

This investment journey, which unfolds humbly yet honestly, coolly yet cheerfully, provides clear direction not only to novice investors but also to those who have lost their way in the market.

This book is not just a success story.

Having experienced numerous failures, he has been able to survive in the market for 25 years, and he persistently pursues 'why he failed' rather than 'why he was able to make a profit'.

This intimate confession from a man at the forefront of stock trading in Tokyo's financial district will serve as a highly practical investment textbook for practicing investors.

The legendary salaried investor who became Japan's top taxpayer! The first book to share the investment know-how of Tatsuro Kiyohara!

In 2005, the name of a simple office worker was ranked first in the list of Japan's richest people (highest taxpayers in Japan), causing a stir throughout Japan.

The main character is the author of this book, Tatsuro Kiyohara, who has managed hedge funds for 25 years as a fund manager and achieved a 93-fold return.

He became a legend among office workers, ranking 31st in the Japanese taxpayer rankings in 2002, 8th in 2004, and 1st in 2005.

The author, who decided to retire for health reasons, has compiled his investment know-how into a book for those who want to try their hand at managing hedge funds and those who have decided to enter the stock market as an individual investor.

The investment genius reveals his philosophy behind failure, success, and beyond.

This investment journey, which unfolds humbly yet honestly, coolly yet cheerfully, provides clear direction not only to novice investors but also to those who have lost their way in the market.

This book is not just a success story.

Having experienced numerous failures, he has been able to survive in the market for 25 years, and he persistently pursues 'why he failed' rather than 'why he was able to make a profit'.

This intimate confession from a man at the forefront of stock trading in Tokyo's financial district will serve as a highly practical investment textbook for practicing investors.

- You can preview some of the book's contents.

Preview

index

Introduction

Recommendation

Chapter 1: The Market Doesn't Ignore You

Being wrong doesn't necessarily mean you'll lose money, and being right doesn't necessarily mean you'll profit.

Investment idea = idea not reflected in stock price

The first step in investing is to question common sense.

Not everything written in textbooks is correct.

All information is biased

Bias on my side

There's no need to spend money on information gathering.

'Investment Club' for information gathering

Can Investors Beat the Market? - The Efficient Market Hypothesis

Passive vs. Active Management

Chapter 2: The Long Journey to Hedge Funds

The Journey to Starting a Hedge Fund

Joining Nomura Securities - The Intense Discomfort I Felt

Patterns of individual investors who suffer losses

Overseas Investment Advisory Office - Receiving Help from Yoshitaka Kitao

A sergeant who gave me a lot of insight

Nomura Securities New York Branch - The Whereabouts of the 'Rotten Egg'

Convertible bonds? Purchase of bonds with warrants, arbitrage from short selling stocks

Meeting with Tiger Management

Joining GS Tokyo Branch - The Dawn of "Long/Short Management"

Starting a hedge fund

What is a hedge fund?

Meeting with George Soros

Nomura Securities today

Chapter 3: The Destructive Power of Undervalued Small-Cap Growth Stocks

What on earth does 'underrated' mean?

What is a 'fair PER'?

PBR is actually not helpful

Net cash ratio

Cash-neutral PER

Problems with Cash-Neutral PER

Deriving an appropriate PER through growth rates and interest rates

The Stage 1 model is effective for stocks with low PERs.

Are stocks with high PERs disadvantaged when interest rates rise?

Will buying undervalued stocks make a profit?

The Destructive Power of Investing in Undervalued Small-Cap Growth Stocks

Why Small Caps Are Undervalued

The worse an industry's image, the more opportunities it holds.

90% of small-cap growth depends on management

Positive and negative feedback

Climbing the valuation ladder

Invest 1 million yen in undervalued small-cap growth stocks now.

There's no such thing as "talent" in stock investing.

The Difference Between Growth and Value Investing

Mothers (Gross) is the worst market

What is the ideal role of a value investor?

Trend-following and counter-trend investing

Bottom-up and top-down approaches

Bottom-up approach believer

Stock Investment and Probability Theory

Bayesian thinking

Chapter 4: You Can Survive Hell by Holding Stocks - A Path Walked for 25 Years

The evolution of K1 Fund's management style

Fund performance by period

July 1998 - September 1999 "The party has begun, so let's go home."

Investing in small-cap stocks is advantageous when operating with less capital.

September 1999 - February 2000: The IT bubble and shorting of technology stocks resulted in significant losses.

From February 2000 to October 2005, he made significant progress by investing in REITs and real estate investment advisory firms.

From October 2005 to December 2007, the stock market crashed and foreign buying led to a collapse of short positions, resulting in significant losses.

The hellish Lehman Brothers crisis from December 2007 to February 2009

The Abenomics boom from February 2009 to February 2018 yielded significant profits thanks to the Bank of Japan's ETF purchases.

From February 2018 to March 2020, the stock market plummeted due to the COVID-19 pandemic, leading to massive purchases of major bank stocks.

Large bank stocks surged between March 2020 and June 2023, with stock prices rising across the board.

Regarding the arbitrage balance of stock index futures

Chapter 5 REITs - Catch a Falling Knife Twice

Unexpected IPO winnings worth 2 billion yen

The Lehman Brothers crisis and the REIT crash

Chapter 6: Highlights of Practice - Long

HS Holdings

Olympus

UT Group

Presans Corporation

Chapter 7: Highlights of Practice - Short? Pairs Trading

We do not recommend shorting individual stocks for individual investors.

Short diversification is foolish.

Uniqlo investment ended in failure

Darkness over the Nikkei 225 Index

How to Profit from Short Trading, Finally Realized

Short's success story

pair trading

Chapter 8: Investments You Should Never Make

ESG investing is nonsense

Corporate governance of Japanese companies

AIJ Investment Advisory Fraud Case

Why You Should Never Buy Private Stock

Financial product fees that require caution

Chapter 9: The Future of the Japanese Stock Market

Catastrophic risks likely to occur within 10 years

Eight Predictions About the Environment Surrounding Japanese Stocks

Domestic demand will continue to shrink.

Japanese people's English skills are at a crisis level

The keyword is management integration

The era of Japanese stock shortages is upon us.

The text that appears

Recommendation

Chapter 1: The Market Doesn't Ignore You

Being wrong doesn't necessarily mean you'll lose money, and being right doesn't necessarily mean you'll profit.

Investment idea = idea not reflected in stock price

The first step in investing is to question common sense.

Not everything written in textbooks is correct.

All information is biased

Bias on my side

There's no need to spend money on information gathering.

'Investment Club' for information gathering

Can Investors Beat the Market? - The Efficient Market Hypothesis

Passive vs. Active Management

Chapter 2: The Long Journey to Hedge Funds

The Journey to Starting a Hedge Fund

Joining Nomura Securities - The Intense Discomfort I Felt

Patterns of individual investors who suffer losses

Overseas Investment Advisory Office - Receiving Help from Yoshitaka Kitao

A sergeant who gave me a lot of insight

Nomura Securities New York Branch - The Whereabouts of the 'Rotten Egg'

Convertible bonds? Purchase of bonds with warrants, arbitrage from short selling stocks

Meeting with Tiger Management

Joining GS Tokyo Branch - The Dawn of "Long/Short Management"

Starting a hedge fund

What is a hedge fund?

Meeting with George Soros

Nomura Securities today

Chapter 3: The Destructive Power of Undervalued Small-Cap Growth Stocks

What on earth does 'underrated' mean?

What is a 'fair PER'?

PBR is actually not helpful

Net cash ratio

Cash-neutral PER

Problems with Cash-Neutral PER

Deriving an appropriate PER through growth rates and interest rates

The Stage 1 model is effective for stocks with low PERs.

Are stocks with high PERs disadvantaged when interest rates rise?

Will buying undervalued stocks make a profit?

The Destructive Power of Investing in Undervalued Small-Cap Growth Stocks

Why Small Caps Are Undervalued

The worse an industry's image, the more opportunities it holds.

90% of small-cap growth depends on management

Positive and negative feedback

Climbing the valuation ladder

Invest 1 million yen in undervalued small-cap growth stocks now.

There's no such thing as "talent" in stock investing.

The Difference Between Growth and Value Investing

Mothers (Gross) is the worst market

What is the ideal role of a value investor?

Trend-following and counter-trend investing

Bottom-up and top-down approaches

Bottom-up approach believer

Stock Investment and Probability Theory

Bayesian thinking

Chapter 4: You Can Survive Hell by Holding Stocks - A Path Walked for 25 Years

The evolution of K1 Fund's management style

Fund performance by period

July 1998 - September 1999 "The party has begun, so let's go home."

Investing in small-cap stocks is advantageous when operating with less capital.

September 1999 - February 2000: The IT bubble and shorting of technology stocks resulted in significant losses.

From February 2000 to October 2005, he made significant progress by investing in REITs and real estate investment advisory firms.

From October 2005 to December 2007, the stock market crashed and foreign buying led to a collapse of short positions, resulting in significant losses.

The hellish Lehman Brothers crisis from December 2007 to February 2009

The Abenomics boom from February 2009 to February 2018 yielded significant profits thanks to the Bank of Japan's ETF purchases.

From February 2018 to March 2020, the stock market plummeted due to the COVID-19 pandemic, leading to massive purchases of major bank stocks.

Large bank stocks surged between March 2020 and June 2023, with stock prices rising across the board.

Regarding the arbitrage balance of stock index futures

Chapter 5 REITs - Catch a Falling Knife Twice

Unexpected IPO winnings worth 2 billion yen

The Lehman Brothers crisis and the REIT crash

Chapter 6: Highlights of Practice - Long

HS Holdings

Olympus

UT Group

Presans Corporation

Chapter 7: Highlights of Practice - Short? Pairs Trading

We do not recommend shorting individual stocks for individual investors.

Short diversification is foolish.

Uniqlo investment ended in failure

Darkness over the Nikkei 225 Index

How to Profit from Short Trading, Finally Realized

Short's success story

pair trading

Chapter 8: Investments You Should Never Make

ESG investing is nonsense

Corporate governance of Japanese companies

AIJ Investment Advisory Fraud Case

Why You Should Never Buy Private Stock

Financial product fees that require caution

Chapter 9: The Future of the Japanese Stock Market

Catastrophic risks likely to occur within 10 years

Eight Predictions About the Environment Surrounding Japanese Stocks

Domestic demand will continue to shrink.

Japanese people's English skills are at a crisis level

The keyword is management integration

The era of Japanese stock shortages is upon us.

The text that appears

Detailed image

Publisher's Review

Recommended by Park Du-hwan, Kkangto, and Lee Jeong-yoon!

The investment philosophy and investment methods of Japan's top taxpayer, surpassing even Chairman Son!

“My Investment Techniques” is different from the many introductory books on stock investment available on the market.

This book is a memoir, a raw account of the author's journey from managing a hedge fund to surviving, growing, and ultimately retiring from the stock market.

He is a legendary figure who once rose to the top of the list of Japan's richest people (highest taxpayers in Japan) while still a salaried worker.

He paid a whopping 3.69 billion yen, or about 36 billion won in Korean currency, in taxes.

This record far exceeded the tax paid by SoftBank Chairman Son Jeong-ui, Japan's largest conglomerate.

He published this book with the thought that, "If I can't pass on the hedge fund management know-how I've accumulated to my successor, I'll reveal it all to the world."

He summarized the three essential questions that investors must ponder and consider, and presented them as new standards that will change the lives of investors.

A management strategy that turns failure into opportunity. Lessons learned from failure created a '1 trillion won profit.'

Most investment books are obsessed with boasting about successful strategies and returns.

But this book is different.

The author's main content focuses on numerous failures he experienced in the Japanese stock market over many years, such as the bursting of the IT bubble, failed REIT investments, poor timing of short positions, and the Lehman Brothers crisis.

He vividly demonstrates the losses that overconfidence in market sentiment and misinterpretation of information can cause through his failed short position in Uniqlo stock.

And rather than simply regretting it, it logically delves into the causes of failure and provides a framework to avoid repeating the same mistakes.

This can be an important criterion for individual investors to self-examine.

So, “success is not something that is repeated in the same form several times.

As he said, “I think stories of failure will be more helpful,” this book will be much more helpful to those who want to learn “how not to fail” rather than “how to make a profit.”

Understanding the reality of "undervalued small-cap growth stocks" and the strategy that enabled an ordinary office worker to achieve a 93x return.

One of the central themes of this book is a long strategy centered on "undervalued small-cap growth stocks."

While many investors blindly trust large-cap stocks, well-known names, and analyst recommendations, the author seeks out companies overlooked by others, industries with negative image, and areas not covered by the media.

As a result, it recorded an incredible return of 93 times.

He emphasized, “Investment ideas come from finding ideas that are not reflected in stocks.”

For example, the case of Japan Airlines (JAL) and large banks making large investments by taking advantage of the market's negative bias clearly shows that 'interpretation, not information' determines profits.

Moreover, beyond simply recommending investing in undervalued stocks, it analyzes, through specific examples, why the market undervalues small-cap stocks, why profit opportunities exist at that point, and what criteria should be used to minimize risk.

In particular, the net cash ratio, cash-neutral PER, and PER settings based on growth rates and interest rates are useful practical indicators for evaluating the intrinsic value of stocks.

An investment guru explains it himself.

How to Use Information for Individual Investors

These days, investors suffer from information overload rather than information deficiency.

For those feeling confused by the countless news reports, analyst reviews, and stock recommendations on YouTube and social media, this book consistently delivers the message that individual investors can beat the market.

He proves that paid information is not essential for performance, drawing on his experience canceling all expensive information services, such as Quick, operated by subsidiaries of Bloomberg and Nikkei.

The information sources he recommends are practical media such as the Company's Genealogy.

He recommends saving money on newspaper and magazine subscriptions and buying stocks.

He also emphasizes that the most important thing in gathering investment information is the ability to determine "who sent it," and advises that you train yourself to critically examine analyst and media bias and to penetrate the source and intent of information.

This book is not simply a 'book to read', but a 'book to use'.

It's filled with candid yet sharp insights, as if a senior were imparting advice to a junior, on everything from the attitude investors should have to the ability to interpret information to their attitude toward failure.

If you are wandering around, unable to decide on an investment direction, I recommend reading this book.

It will surely illuminate the path you must take.

The investment philosophy and investment methods of Japan's top taxpayer, surpassing even Chairman Son!

“My Investment Techniques” is different from the many introductory books on stock investment available on the market.

This book is a memoir, a raw account of the author's journey from managing a hedge fund to surviving, growing, and ultimately retiring from the stock market.

He is a legendary figure who once rose to the top of the list of Japan's richest people (highest taxpayers in Japan) while still a salaried worker.

He paid a whopping 3.69 billion yen, or about 36 billion won in Korean currency, in taxes.

This record far exceeded the tax paid by SoftBank Chairman Son Jeong-ui, Japan's largest conglomerate.

He published this book with the thought that, "If I can't pass on the hedge fund management know-how I've accumulated to my successor, I'll reveal it all to the world."

He summarized the three essential questions that investors must ponder and consider, and presented them as new standards that will change the lives of investors.

A management strategy that turns failure into opportunity. Lessons learned from failure created a '1 trillion won profit.'

Most investment books are obsessed with boasting about successful strategies and returns.

But this book is different.

The author's main content focuses on numerous failures he experienced in the Japanese stock market over many years, such as the bursting of the IT bubble, failed REIT investments, poor timing of short positions, and the Lehman Brothers crisis.

He vividly demonstrates the losses that overconfidence in market sentiment and misinterpretation of information can cause through his failed short position in Uniqlo stock.

And rather than simply regretting it, it logically delves into the causes of failure and provides a framework to avoid repeating the same mistakes.

This can be an important criterion for individual investors to self-examine.

So, “success is not something that is repeated in the same form several times.

As he said, “I think stories of failure will be more helpful,” this book will be much more helpful to those who want to learn “how not to fail” rather than “how to make a profit.”

Understanding the reality of "undervalued small-cap growth stocks" and the strategy that enabled an ordinary office worker to achieve a 93x return.

One of the central themes of this book is a long strategy centered on "undervalued small-cap growth stocks."

While many investors blindly trust large-cap stocks, well-known names, and analyst recommendations, the author seeks out companies overlooked by others, industries with negative image, and areas not covered by the media.

As a result, it recorded an incredible return of 93 times.

He emphasized, “Investment ideas come from finding ideas that are not reflected in stocks.”

For example, the case of Japan Airlines (JAL) and large banks making large investments by taking advantage of the market's negative bias clearly shows that 'interpretation, not information' determines profits.

Moreover, beyond simply recommending investing in undervalued stocks, it analyzes, through specific examples, why the market undervalues small-cap stocks, why profit opportunities exist at that point, and what criteria should be used to minimize risk.

In particular, the net cash ratio, cash-neutral PER, and PER settings based on growth rates and interest rates are useful practical indicators for evaluating the intrinsic value of stocks.

An investment guru explains it himself.

How to Use Information for Individual Investors

These days, investors suffer from information overload rather than information deficiency.

For those feeling confused by the countless news reports, analyst reviews, and stock recommendations on YouTube and social media, this book consistently delivers the message that individual investors can beat the market.

He proves that paid information is not essential for performance, drawing on his experience canceling all expensive information services, such as Quick, operated by subsidiaries of Bloomberg and Nikkei.

The information sources he recommends are practical media such as the Company's Genealogy.

He recommends saving money on newspaper and magazine subscriptions and buying stocks.

He also emphasizes that the most important thing in gathering investment information is the ability to determine "who sent it," and advises that you train yourself to critically examine analyst and media bias and to penetrate the source and intent of information.

This book is not simply a 'book to read', but a 'book to use'.

It's filled with candid yet sharp insights, as if a senior were imparting advice to a junior, on everything from the attitude investors should have to the ability to interpret information to their attitude toward failure.

If you are wandering around, unable to decide on an investment direction, I recommend reading this book.

It will surely illuminate the path you must take.

GOODS SPECIFICS

- Date of issue: September 10, 2025

- Page count, weight, size: 352 pages | 660g | 152*225*23mm

- ISBN13: 9791193394748

- ISBN10: 1193394740

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)