K-beauty trends

|

Description

Book Introduction

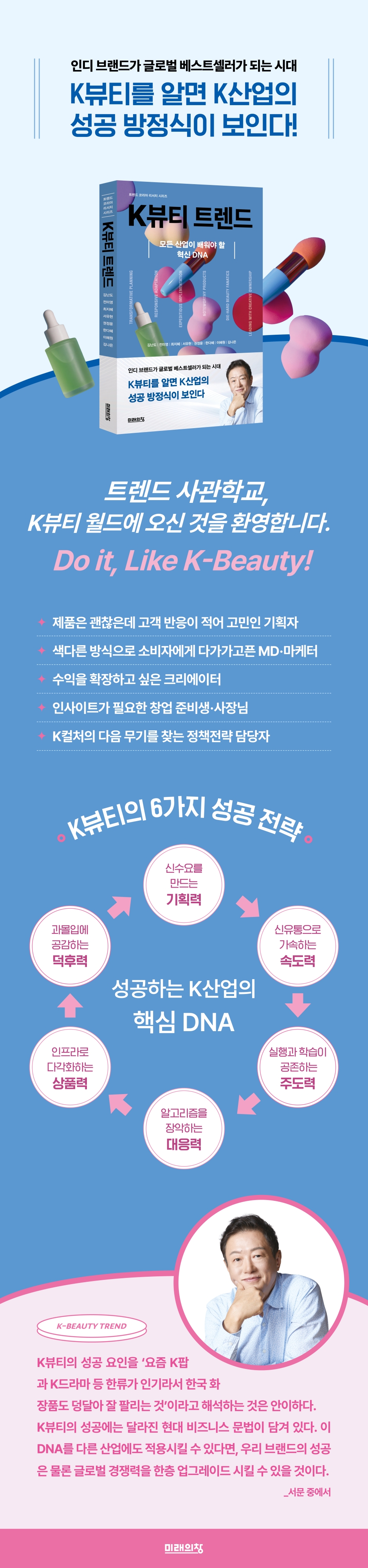

The era in which indie brands become global bestsellers

Adopt the strategy of K-beauty, the most successful industry right now!

K-beauty is not simply an extension of Korean Wave content.

This is the first site to experiment with and implement strategies that work in today's global market, including rapid market response, agile execution, sensible branding, and data-driven planning.

This book analyzes how the K-beauty industry transitioned from a "following industry" to a "leading industry," dissecting the strategic thinking and execution capabilities embedded within it.

If these strategies and structures can be applied beyond K-beauty to other industries, they could create new growth engines.

Now is the time to understand the success of the K-industry not as a one-time phenomenon, but as a sustainable strategy.

This book will be the starting point.

Adopt the strategy of K-beauty, the most successful industry right now!

K-beauty is not simply an extension of Korean Wave content.

This is the first site to experiment with and implement strategies that work in today's global market, including rapid market response, agile execution, sensible branding, and data-driven planning.

This book analyzes how the K-beauty industry transitioned from a "following industry" to a "leading industry," dissecting the strategic thinking and execution capabilities embedded within it.

If these strategies and structures can be applied beyond K-beauty to other industries, they could create new growth engines.

Now is the time to understand the success of the K-industry not as a one-time phenomenon, but as a sustainable strategy.

This book will be the starting point.

- You can preview some of the book's contents.

Preview

index

Introduction_Trends in the end

Prologue: The Warp and Weft of Crisis and Opportunity

1.

Planning: Supported by the brand and nurtured by Olive Young

2.

Speed: K-beauty Accelerating Through New Distribution

3.

Leadership: New K-beauty trends emerging from MDs in their 20s

4.

Responsiveness: From Sanrio to TikTok, Respond to Content

5.

Product Power: Global No. 1 Created through Infrastructure, Investment, and Effort

6.

Geek Power: The Hidden Designer of K-Beauty is the Customer

Epilogue_K-Beauty is the Teacher

Prologue: The Warp and Weft of Crisis and Opportunity

1.

Planning: Supported by the brand and nurtured by Olive Young

2.

Speed: K-beauty Accelerating Through New Distribution

3.

Leadership: New K-beauty trends emerging from MDs in their 20s

4.

Responsiveness: From Sanrio to TikTok, Respond to Content

5.

Product Power: Global No. 1 Created through Infrastructure, Investment, and Effort

6.

Geek Power: The Hidden Designer of K-Beauty is the Customer

Epilogue_K-Beauty is the Teacher

Detailed image

Into the book

It would be naive to interpret the success of K-beauty as “Korean cosmetics are selling well these days because Korean Wave, including K-pop and K-dramas, is popular.”

This is because the countries where K-content is popular and the countries where K-beauty is doing well do not exactly match.

The popularity of K-content may be a positive factor, but it is not the fundamental cause.

Industrial success is only possible when the entire value chain of planning, manufacturing, production, marketing, and distribution encompassing a product are aligned and functioning together.

This book aims to comprehensively illuminate the 'coevolution' of the entire cosmetics industry ecosystem.

In other words, we want to comprehensively consider the process by which indie brands, ODM manufacturers that quickly produce high-quality products, and distributors such as Olive Young have evolved together through 'symbiosis' in the Korean cosmetics market, which is full of discerning and savvy consumers.

--- p.7

In 2020, the world that was once peaceful was suddenly shut down.

The unexpected COVID-19 pandemic has dealt a severe blow to offline stores.

But the shock also presented a tremendous opportunity.

American and Japanese consumers, who were previously reluctant to make online purchases, are starting to become accustomed to new shopping channels such as Amazon and Qoo10.

With the opening of a new platform, the K-beauty industry had no reason to hesitate as it seized the opportunity.

Duty-free shops and offline stores were emptying out, but online shopping soon emerged as a new breakthrough.

The trade surplus continued to expand, fueled by the growth of digital and non-face-to-face channels.

Since 2020, Korea's cosmetics exports have surpassed $6.1 billion, and by 2024, they are projected to reach a record high of $10.2 billion (approximately KRW 10.5099 trillion), solidifying their position as the world's third-largest exporter.

In particular, the basic cosmetics sector is driving both production and exports, and the K-beauty routine centered on skincare products such as cleansers, essences, and mask packs has spread as a global trend.

--- p.46

K-beauty uses this disruption of order as a source of planning power.

It is also called reverse engineering because it flows in the opposite direction from the consumer to the product.

Reverse planning can be divided into two types: reverse engineering and reverse thinking.

First, reverse engineering planning goes against the traditional order of product → distribution → consumer.

Rather than creating a good product and then appealing to consumers, we begin planning with consumer-oriented questions like, “What ingredients can solve this consumer concern?” and “What characteristics should the product have to sell on this distribution platform?”

First, understand the situations and context in which consumers use beauty products, and then discover the product's core attributes.

CLIO's cushion product, 'Kill Cover', was successful by planning product differentiation elements tailored to the distributor and target audience.

Before the advent of the Kill Cover Cushion, cushion products were mainly sold only in department stores or single-brand shops.

In contrast, Clio, which decided to sell color base products at Olive Young, began to think about the properties that the store's main target audience, women in their 20s and 30s, would expect from a cushion.

The keyword found that way was ‘coverage’, as revealed in the product name.

At the time, most high-end brand cushions were natural colors, but Clio, on the other hand, maximized the coverage.

The concept was proposed so that women in their 20s and 30s who have many skin concerns such as acne can easily cover up blemishes without foundation.

--- p.61

Behind TikTok's rapid rise as a global K-beauty platform is TikTok Shop, a sales platform that integrates content and commerce.

Since TikTok Shop is structured so that consumers can purchase content immediately after watching it, the importance of immediate sales and delivery is emphasized.

To this end, TikTok introduced its own logistics warehouse system, FBT (Fullfilled By TikTok), to directly control logistics and increase the speed, reliability, and conversion rate of logistics.

The FBT system is currently being operated in eight countries, including the US, UK, and Southeast Asia, and there are plans to expand to Europe and South America in the future.

Meanwhile, as competition for daily and weekly category rankings on platforms like Quten and Amazon intensifies, real-time competition in the global distribution environment is intensifying.

In line with this trend, Olive Young has established a dedicated organization called GTM (Go-To-Market) to effectively introduce K-beauty products into the global market, and is developing a local optimization strategy by strengthening collaboration with TikTokers, Wang Hongs, and short-form creators in each region, including the U.S., Japan, and Southeast Asia.

--- p.97

At this point, the concept of 'seeding' appears.

Seeding literally means 'sowing seeds'.

It is a marketing strategy that allows a product or service to spread naturally in the market.

In the initial stages, it is a series of processes that provide products for free to influencers, experts, media, and general consumers to encourage usage experiences and thereby spread positive word of mouth and content.

Micro-influencer seeding → increased TikTok mentions → higher Amazon rankings is the trajectory that most K-beauty brands that have established themselves in the North American market have followed.

MEDIHEAL's toner pad is a representative example.

Toner pads were not a popular item in the United States.

However, in August 2023, after a micro-level TikTok influencer with 50,000 to 70,000 followers introduced Mediheal's toner pad product, sales increased, and Mediheal's toner pad eventually ranked first in the toner category on Amazon US.

And interest in this product spread to other products, such as Mediheal's 'Tea Tree Calming Moisture Ampoule'.

Yoon Su-jeong, manager of Amazon Korea's consumer goods business development team, explained the success of K-beauty as a "social media-sales-directed relationship phenomenon."

--- p.156

The core strength of the Korean ODM system lies in its "one-stop system," where R&D and manufacturing are organically integrated.

This is the structural foundation upon which the aforementioned advanced technologies and rapid execution capabilities can be effectively implemented.

Overseas ODMs are typically separated into separate stages. When producing a single product, planning and marketing, as well as R&D, ingredient development, and packaging, are all carried out by different companies or departments.

This is time-consuming and expensive to coordinate and implement.

On the other hand, Korean ODM companies comprehensively manage the entire process from A to Z.

This integrated, one-stop system boasts an agile operational ecosystem that enables rapid feedback and iterative testing.

While global brands often have a complex three-tiered process involving headquarters, regional corporations, and outsourced manufacturers, delaying decision-making, Korean ODM companies can shorten sample revision cycles to as little as a day, based on real-time communication with the brand team.

This is thanks to the establishment of an 'integrated design and manufacturing platform' that can quickly perform the entire process from trend analysis, raw material research, formulation development, testing, production, and packaging within a single system, based on the principle that information and networks should be in one place.

--- p.177

The country's halo effect is clearly a positive factor.

K-beauty has recently been enjoying the 'K' country of origin effect.

Interest in and trust in Korean products has grown to the point where overseas distribution channels have established separate "K-beauty zones" for marketing purposes.

This is a significant change from the old days when 'Made in Korea' was associated with cheap prices and some brands tried to hide their Korean origins.

The country of origin effect increases the overall credibility of the product.

Just like the perception that “if it’s a Swiss watch, it must be of excellent quality,” the country of origin serves as a guarantee of quality.

But there are limitations.

If we rely solely on the Korean Wave or the halo effect of Korea, we will not only be vulnerable to unexpected events like THAAD, but also our leap forward as a global brand will become more distant.

So, paradoxically, the future of K-beauty starts with removing the 'K'.

K-beauty becoming independent from 'K' has two meanings.

The first, as mentioned earlier, is to achieve complete localization, that is, to be naturally accepted by local consumers and not to evoke the perception of being “made in Korea.”

The second is, as we saw in the case of global brands above, when the brand power of an individual brand grows sufficiently that the adjective 'K' is no longer necessary.

If this happens, the previously emphasized product power and brand power will be naturally harmonized, allowing the company to establish itself as a proud and sustainable global brand.

This is not just a story limited to the beauty industry.

This is a task that all Korean industries that are targeting the global market with the prefix 'K' must keep in mind.

This is because the countries where K-content is popular and the countries where K-beauty is doing well do not exactly match.

The popularity of K-content may be a positive factor, but it is not the fundamental cause.

Industrial success is only possible when the entire value chain of planning, manufacturing, production, marketing, and distribution encompassing a product are aligned and functioning together.

This book aims to comprehensively illuminate the 'coevolution' of the entire cosmetics industry ecosystem.

In other words, we want to comprehensively consider the process by which indie brands, ODM manufacturers that quickly produce high-quality products, and distributors such as Olive Young have evolved together through 'symbiosis' in the Korean cosmetics market, which is full of discerning and savvy consumers.

--- p.7

In 2020, the world that was once peaceful was suddenly shut down.

The unexpected COVID-19 pandemic has dealt a severe blow to offline stores.

But the shock also presented a tremendous opportunity.

American and Japanese consumers, who were previously reluctant to make online purchases, are starting to become accustomed to new shopping channels such as Amazon and Qoo10.

With the opening of a new platform, the K-beauty industry had no reason to hesitate as it seized the opportunity.

Duty-free shops and offline stores were emptying out, but online shopping soon emerged as a new breakthrough.

The trade surplus continued to expand, fueled by the growth of digital and non-face-to-face channels.

Since 2020, Korea's cosmetics exports have surpassed $6.1 billion, and by 2024, they are projected to reach a record high of $10.2 billion (approximately KRW 10.5099 trillion), solidifying their position as the world's third-largest exporter.

In particular, the basic cosmetics sector is driving both production and exports, and the K-beauty routine centered on skincare products such as cleansers, essences, and mask packs has spread as a global trend.

--- p.46

K-beauty uses this disruption of order as a source of planning power.

It is also called reverse engineering because it flows in the opposite direction from the consumer to the product.

Reverse planning can be divided into two types: reverse engineering and reverse thinking.

First, reverse engineering planning goes against the traditional order of product → distribution → consumer.

Rather than creating a good product and then appealing to consumers, we begin planning with consumer-oriented questions like, “What ingredients can solve this consumer concern?” and “What characteristics should the product have to sell on this distribution platform?”

First, understand the situations and context in which consumers use beauty products, and then discover the product's core attributes.

CLIO's cushion product, 'Kill Cover', was successful by planning product differentiation elements tailored to the distributor and target audience.

Before the advent of the Kill Cover Cushion, cushion products were mainly sold only in department stores or single-brand shops.

In contrast, Clio, which decided to sell color base products at Olive Young, began to think about the properties that the store's main target audience, women in their 20s and 30s, would expect from a cushion.

The keyword found that way was ‘coverage’, as revealed in the product name.

At the time, most high-end brand cushions were natural colors, but Clio, on the other hand, maximized the coverage.

The concept was proposed so that women in their 20s and 30s who have many skin concerns such as acne can easily cover up blemishes without foundation.

--- p.61

Behind TikTok's rapid rise as a global K-beauty platform is TikTok Shop, a sales platform that integrates content and commerce.

Since TikTok Shop is structured so that consumers can purchase content immediately after watching it, the importance of immediate sales and delivery is emphasized.

To this end, TikTok introduced its own logistics warehouse system, FBT (Fullfilled By TikTok), to directly control logistics and increase the speed, reliability, and conversion rate of logistics.

The FBT system is currently being operated in eight countries, including the US, UK, and Southeast Asia, and there are plans to expand to Europe and South America in the future.

Meanwhile, as competition for daily and weekly category rankings on platforms like Quten and Amazon intensifies, real-time competition in the global distribution environment is intensifying.

In line with this trend, Olive Young has established a dedicated organization called GTM (Go-To-Market) to effectively introduce K-beauty products into the global market, and is developing a local optimization strategy by strengthening collaboration with TikTokers, Wang Hongs, and short-form creators in each region, including the U.S., Japan, and Southeast Asia.

--- p.97

At this point, the concept of 'seeding' appears.

Seeding literally means 'sowing seeds'.

It is a marketing strategy that allows a product or service to spread naturally in the market.

In the initial stages, it is a series of processes that provide products for free to influencers, experts, media, and general consumers to encourage usage experiences and thereby spread positive word of mouth and content.

Micro-influencer seeding → increased TikTok mentions → higher Amazon rankings is the trajectory that most K-beauty brands that have established themselves in the North American market have followed.

MEDIHEAL's toner pad is a representative example.

Toner pads were not a popular item in the United States.

However, in August 2023, after a micro-level TikTok influencer with 50,000 to 70,000 followers introduced Mediheal's toner pad product, sales increased, and Mediheal's toner pad eventually ranked first in the toner category on Amazon US.

And interest in this product spread to other products, such as Mediheal's 'Tea Tree Calming Moisture Ampoule'.

Yoon Su-jeong, manager of Amazon Korea's consumer goods business development team, explained the success of K-beauty as a "social media-sales-directed relationship phenomenon."

--- p.156

The core strength of the Korean ODM system lies in its "one-stop system," where R&D and manufacturing are organically integrated.

This is the structural foundation upon which the aforementioned advanced technologies and rapid execution capabilities can be effectively implemented.

Overseas ODMs are typically separated into separate stages. When producing a single product, planning and marketing, as well as R&D, ingredient development, and packaging, are all carried out by different companies or departments.

This is time-consuming and expensive to coordinate and implement.

On the other hand, Korean ODM companies comprehensively manage the entire process from A to Z.

This integrated, one-stop system boasts an agile operational ecosystem that enables rapid feedback and iterative testing.

While global brands often have a complex three-tiered process involving headquarters, regional corporations, and outsourced manufacturers, delaying decision-making, Korean ODM companies can shorten sample revision cycles to as little as a day, based on real-time communication with the brand team.

This is thanks to the establishment of an 'integrated design and manufacturing platform' that can quickly perform the entire process from trend analysis, raw material research, formulation development, testing, production, and packaging within a single system, based on the principle that information and networks should be in one place.

--- p.177

The country's halo effect is clearly a positive factor.

K-beauty has recently been enjoying the 'K' country of origin effect.

Interest in and trust in Korean products has grown to the point where overseas distribution channels have established separate "K-beauty zones" for marketing purposes.

This is a significant change from the old days when 'Made in Korea' was associated with cheap prices and some brands tried to hide their Korean origins.

The country of origin effect increases the overall credibility of the product.

Just like the perception that “if it’s a Swiss watch, it must be of excellent quality,” the country of origin serves as a guarantee of quality.

But there are limitations.

If we rely solely on the Korean Wave or the halo effect of Korea, we will not only be vulnerable to unexpected events like THAAD, but also our leap forward as a global brand will become more distant.

So, paradoxically, the future of K-beauty starts with removing the 'K'.

K-beauty becoming independent from 'K' has two meanings.

The first, as mentioned earlier, is to achieve complete localization, that is, to be naturally accepted by local consumers and not to evoke the perception of being “made in Korea.”

The second is, as we saw in the case of global brands above, when the brand power of an individual brand grows sufficiently that the adjective 'K' is no longer necessary.

If this happens, the previously emphasized product power and brand power will be naturally harmonized, allowing the company to establish itself as a proud and sustainable global brand.

This is not just a story limited to the beauty industry.

This is a task that all Korean industries that are targeting the global market with the prefix 'K' must keep in mind.

--- p.248

Publisher's Review

How K-Beauty's Amazing Success Was Possible

"K-Beauty surpasses France"... Korea rises to No. 1 in cosmetics exports in the US - Chosun Ilbo, April 1, 2025.

APL emerges as a leading K-beauty stock, surpassing Amore Pacific to become No. 1 in market cap - Korea Economic Daily, August 7, 2025.

Korean beauty brands set new global sales records on Amazon Prime Day - Digital Times, July 25, 2025.

K-Beauty Takes the World by storm... Skincare-focused startups take the lead - Seoul Economic Daily TV 2025.07.19.

Medicube maintains its top spot on Amazon Prime Day, and is expected to become a "1 trillion won brand" next year - July 14, 2025.

8 out of 10 foreigners visit Olive Young... "Foreign sales exceed 26%" - SNS News 2025.07.22.

ODM giants Korea Kolmar and Cosmax join the 2 trillion club - Pharmaceutical Newspaper, March 4, 2025

Tirtir, Joseon Beauty, Anua, Isoi, Medicube, Cosrx, Estura, Round Lab, Dalba, Manyo Factory, Skin1004, Rom&nd,.........

The list of K-beauty indie brands that were recognized by the world before Korea goes on and on.

When you come across news from the cosmetics industry, it's almost like 'believe it or not'.

People ask:

"Really?" "How did they manage to become number one on Amazon?" "How do foreigners know about and buy a small cosmetics brand we don't even know the name of?" "Olive Young has become a beauty mecca for foreigners visiting Korea?" "Aren't Amore Pacific and LG Household & Health Care the leading cosmetics companies? Who's the current number one beauty company by market cap?"

This is perhaps a miracle story.

The world has just opened its eyes to K-beauty.

So what I'm saying is that it's just beginning.

It is difficult to estimate how large this market will become and the potential of Korean cosmetics.

Market money is flowing into the beauty industry, and cosmetics is emerging as a leading industry in Korea, following automobiles, semiconductors, and shipbuilding.

At this point, I can't help but ask.

“How was it possible?”

Just as the success of K-pop and K-dramas didn't happen overnight, the success of K-beauty is also the result of a long period of challenges, failures, and re-challenges.

It is true that the flood of Korean Wave content and the interest of overseas consumers who admire the "glass skin" of Korean celebrities have led to K-beauty.

But in an era where the Internet and social media have transformed the world into one massive network, unlocking the potential of an industry requires a different strategy than in the past.

In this respect, K-beauty's 'speed' and 'responsiveness' are truly impressive.

It is essential to listen to consumers' needs and quickly produce what they want.

The dazzling performance of TikTok influencers, who are dominating the American beauty industry, is ultimately due to the speed and responsiveness of K-beauty brands.

Korea's unrivaled ability to produce something quickly shines in manufacturing and distribution as well.

A representative example is TirTir, which resolved a complaint from a black influencer who said there was no color cushion that matched her skin tone in just one month.

This would have been impossible without the manufacturing infrastructure to support it.

The planning and manufacturing capabilities of Korea's two ODM companies, Kolmar and Cosmax, which already have global beauty brands as customers, have helped fuel the growth of K-beauty indie brands, which in turn has become the foundation for both companies to achieve new sales records.

Olive Young's presence in K-beauty is strong, with large stores in Myeongdong and Seongsu emerging as beauty meccas for foreigners visiting Korea, and brands that have grown alongside Olive Young also active in the global beauty market.

Beyond being a simple beauty shop, Olive Young provides one-stop service from planning to sales, distribution, and overseas expansion, establishing itself as a leading figure in the K-beauty industry.

The growth of indie brands, record sales for ODM companies, and the dazzling success of Olive Young are textbook examples of win-win and exemplary ecosystems for successful industries.

So how does K-beauty's organizational culture differentiate itself from other industries?

The authors cite the flexibility and leadership of organizations created by the younger generation, particularly those in their 20s and 30s, as competitive advantages.

A horizontal organizational culture, bold delegation of authority, the discretion essential for organizations that require quick decision-making and progress, and democratic communication are common traits found in successful K-beauty indie brands.

For large, legacy companies, this kind of fast, agile organizational flexibility can be difficult.

However, K-beauty's success was possible because of this organizational culture.

The Trend Korea team's analysis of K-beauty's success factors boils down to the following:

“K-beauty is ultimately a trend.”

The ability to adapt to trends is the DNA of innovation that every industry desperately needs today.

That's why K-beauty is called the teacher of all industries and a trend academy.

"K-Beauty surpasses France"... Korea rises to No. 1 in cosmetics exports in the US - Chosun Ilbo, April 1, 2025.

APL emerges as a leading K-beauty stock, surpassing Amore Pacific to become No. 1 in market cap - Korea Economic Daily, August 7, 2025.

Korean beauty brands set new global sales records on Amazon Prime Day - Digital Times, July 25, 2025.

K-Beauty Takes the World by storm... Skincare-focused startups take the lead - Seoul Economic Daily TV 2025.07.19.

Medicube maintains its top spot on Amazon Prime Day, and is expected to become a "1 trillion won brand" next year - July 14, 2025.

8 out of 10 foreigners visit Olive Young... "Foreign sales exceed 26%" - SNS News 2025.07.22.

ODM giants Korea Kolmar and Cosmax join the 2 trillion club - Pharmaceutical Newspaper, March 4, 2025

Tirtir, Joseon Beauty, Anua, Isoi, Medicube, Cosrx, Estura, Round Lab, Dalba, Manyo Factory, Skin1004, Rom&nd,.........

The list of K-beauty indie brands that were recognized by the world before Korea goes on and on.

When you come across news from the cosmetics industry, it's almost like 'believe it or not'.

People ask:

"Really?" "How did they manage to become number one on Amazon?" "How do foreigners know about and buy a small cosmetics brand we don't even know the name of?" "Olive Young has become a beauty mecca for foreigners visiting Korea?" "Aren't Amore Pacific and LG Household & Health Care the leading cosmetics companies? Who's the current number one beauty company by market cap?"

This is perhaps a miracle story.

The world has just opened its eyes to K-beauty.

So what I'm saying is that it's just beginning.

It is difficult to estimate how large this market will become and the potential of Korean cosmetics.

Market money is flowing into the beauty industry, and cosmetics is emerging as a leading industry in Korea, following automobiles, semiconductors, and shipbuilding.

At this point, I can't help but ask.

“How was it possible?”

Just as the success of K-pop and K-dramas didn't happen overnight, the success of K-beauty is also the result of a long period of challenges, failures, and re-challenges.

It is true that the flood of Korean Wave content and the interest of overseas consumers who admire the "glass skin" of Korean celebrities have led to K-beauty.

But in an era where the Internet and social media have transformed the world into one massive network, unlocking the potential of an industry requires a different strategy than in the past.

In this respect, K-beauty's 'speed' and 'responsiveness' are truly impressive.

It is essential to listen to consumers' needs and quickly produce what they want.

The dazzling performance of TikTok influencers, who are dominating the American beauty industry, is ultimately due to the speed and responsiveness of K-beauty brands.

Korea's unrivaled ability to produce something quickly shines in manufacturing and distribution as well.

A representative example is TirTir, which resolved a complaint from a black influencer who said there was no color cushion that matched her skin tone in just one month.

This would have been impossible without the manufacturing infrastructure to support it.

The planning and manufacturing capabilities of Korea's two ODM companies, Kolmar and Cosmax, which already have global beauty brands as customers, have helped fuel the growth of K-beauty indie brands, which in turn has become the foundation for both companies to achieve new sales records.

Olive Young's presence in K-beauty is strong, with large stores in Myeongdong and Seongsu emerging as beauty meccas for foreigners visiting Korea, and brands that have grown alongside Olive Young also active in the global beauty market.

Beyond being a simple beauty shop, Olive Young provides one-stop service from planning to sales, distribution, and overseas expansion, establishing itself as a leading figure in the K-beauty industry.

The growth of indie brands, record sales for ODM companies, and the dazzling success of Olive Young are textbook examples of win-win and exemplary ecosystems for successful industries.

So how does K-beauty's organizational culture differentiate itself from other industries?

The authors cite the flexibility and leadership of organizations created by the younger generation, particularly those in their 20s and 30s, as competitive advantages.

A horizontal organizational culture, bold delegation of authority, the discretion essential for organizations that require quick decision-making and progress, and democratic communication are common traits found in successful K-beauty indie brands.

For large, legacy companies, this kind of fast, agile organizational flexibility can be difficult.

However, K-beauty's success was possible because of this organizational culture.

The Trend Korea team's analysis of K-beauty's success factors boils down to the following:

“K-beauty is ultimately a trend.”

The ability to adapt to trends is the DNA of innovation that every industry desperately needs today.

That's why K-beauty is called the teacher of all industries and a trend academy.

GOODS SPECIFICS

- Date of issue: August 27, 2025

- Page count, weight, size: 264 pages | 402g | 135*210*17mm

- ISBN13: 9791193638781

- ISBN10: 119363878X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)