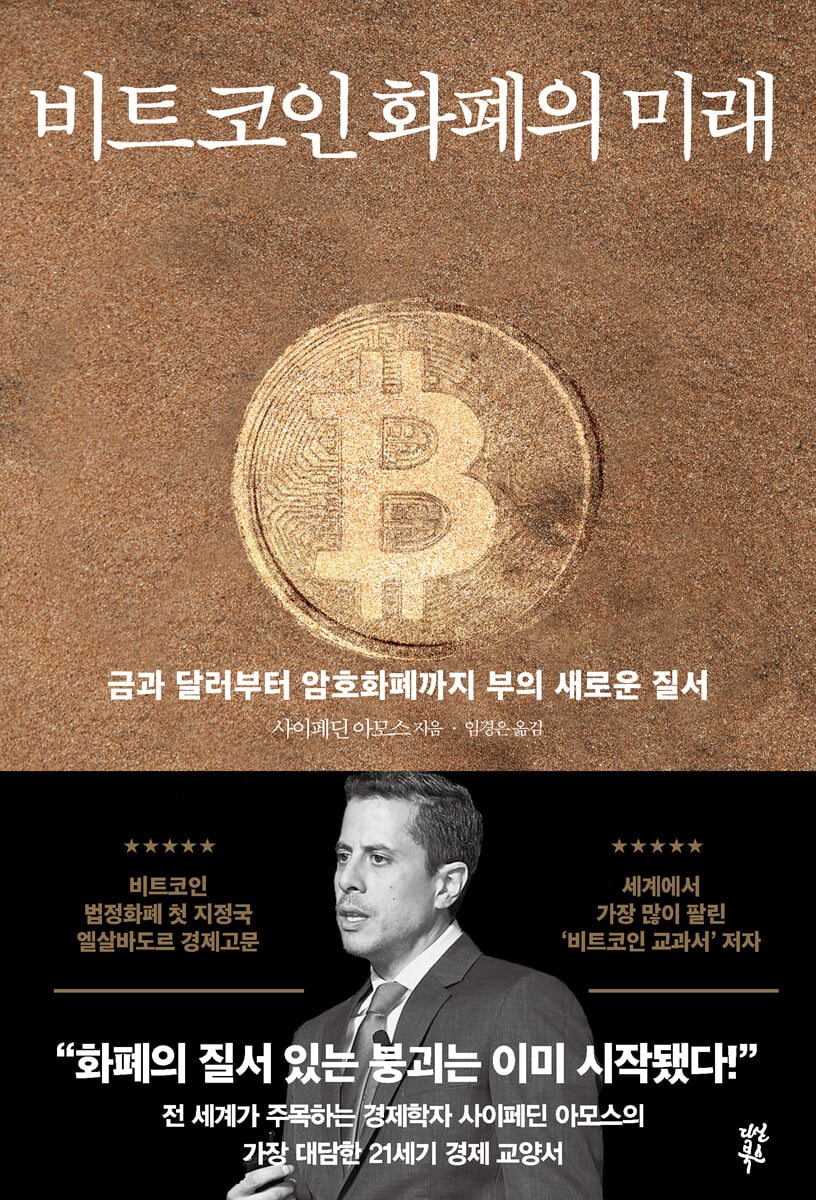

The Future of Bitcoin Currency

|

Description

Book Introduction

“Who will be the new owner of money?

“The ‘orderly collapse’ of currency has already begun!”

The most daring 21st-century economics textbook from globally acclaimed economist Saifeddine Amos.

“I read his book and lost all my money.

“I bought $425 million worth of Bitcoin!”

Michael Saylor (Chairman, MicroStrategy)

“Bitcoin is more than just an investment asset,

“A book that proves that there can be unchanging fairness, justice, and truth!”

Ross Stevens (founder of New York Digital Investment Group)

Saifedine Amos, an economic advisor to El Salvador, which adopted Bitcoin as its legal tender, and one of the world's leading Bitcoin experts, delves into the past, present, and future of money, from gold and the dollar to cryptocurrencies.

While there have been many books on Bitcoin's technical analysis, simple history, or specific investment strategies, none have yet described the full picture of the massive "phenomenon" unfolding today from the expert perspective of a world-renowned authority.

This book analyzes the historical and technological reasons why the current monetary system will collapse in the near future and be replaced by Bitcoin. This book will help dispel any lasting doubts about Bitcoin.

“The ‘orderly collapse’ of currency has already begun!”

The most daring 21st-century economics textbook from globally acclaimed economist Saifeddine Amos.

“I read his book and lost all my money.

“I bought $425 million worth of Bitcoin!”

Michael Saylor (Chairman, MicroStrategy)

“Bitcoin is more than just an investment asset,

“A book that proves that there can be unchanging fairness, justice, and truth!”

Ross Stevens (founder of New York Digital Investment Group)

Saifedine Amos, an economic advisor to El Salvador, which adopted Bitcoin as its legal tender, and one of the world's leading Bitcoin experts, delves into the past, present, and future of money, from gold and the dollar to cryptocurrencies.

While there have been many books on Bitcoin's technical analysis, simple history, or specific investment strategies, none have yet described the full picture of the massive "phenomenon" unfolding today from the expert perspective of a world-renowned authority.

This book analyzes the historical and technological reasons why the current monetary system will collapse in the near future and be replaced by Bitcoin. This book will help dispel any lasting doubts about Bitcoin.

index

Recommended Reading (Ross Stevens) - Bitcoin Will Rise on Its Own

Introduction: The orderly collapse has already begun.

Part 1: Premature Birth

“Why has such a dangerous system been considered the right solution until now?”

Chapter 1 | A Century-Old Judgment | An Inevitable Geopolitical Choice

Chapter 2 | The Debt of the Future | Killing Tomorrow to Live Today

Chapter 3 | Credit Expansion | Inflation is Now a Part of Our Lives

Chapter 4 | The Eternal Discord | How Savings Collapse and How Debt Spreads

Chapter 5 | Fiat Standard | The Undeniable Basis of Existence

Part 2: Patterns of Collapse

“How has corrupt money robbed people of their prosperity?”

Chapter 6: The Lies the Lotus Sutra Told Us

Chapter 7: How Money Pollutes Humanity's Table

Chapter 8: How Money Subordinates Science and Education

Chapter 9: How Money Creates Nonexistent Fear

Chapter 10: How Money Destroys Nations and Creates Colonies

Part 3: The Final Order

“What will the future of wealth look like after the collapse?”

Chapter 11: Cost-Benefit Analysis of Legalization

Chapter 12: A World Where No One Is in Debt

Chapter 13: The Lotus Can Never Overcome the Hardened

Chapter 14: The Most Reliable Store of Value

Chapter 15: If Cryptocurrency Could Solve the Energy Problem

Chapter 16: Bitcoin is just another electrical device invented by humans.

Conclusion: The Only Shelter from Hyperinflation

Acknowledgements

main

Introduction: The orderly collapse has already begun.

Part 1: Premature Birth

“Why has such a dangerous system been considered the right solution until now?”

Chapter 1 | A Century-Old Judgment | An Inevitable Geopolitical Choice

Chapter 2 | The Debt of the Future | Killing Tomorrow to Live Today

Chapter 3 | Credit Expansion | Inflation is Now a Part of Our Lives

Chapter 4 | The Eternal Discord | How Savings Collapse and How Debt Spreads

Chapter 5 | Fiat Standard | The Undeniable Basis of Existence

Part 2: Patterns of Collapse

“How has corrupt money robbed people of their prosperity?”

Chapter 6: The Lies the Lotus Sutra Told Us

Chapter 7: How Money Pollutes Humanity's Table

Chapter 8: How Money Subordinates Science and Education

Chapter 9: How Money Creates Nonexistent Fear

Chapter 10: How Money Destroys Nations and Creates Colonies

Part 3: The Final Order

“What will the future of wealth look like after the collapse?”

Chapter 11: Cost-Benefit Analysis of Legalization

Chapter 12: A World Where No One Is in Debt

Chapter 13: The Lotus Can Never Overcome the Hardened

Chapter 14: The Most Reliable Store of Value

Chapter 15: If Cryptocurrency Could Solve the Energy Problem

Chapter 16: Bitcoin is just another electrical device invented by humans.

Conclusion: The Only Shelter from Hyperinflation

Acknowledgements

main

Detailed image

.jpg)

Into the book

It is easier to explain an abacus to someone who uses a computer than to explain a computer to someone who uses an abacus.

--- p.19

The Lotus Sutra system is not the result of a single engineer's design.

Rather, it was a desperate measure by central banks facing the threat of bankruptcy, an inevitable geopolitical consequence of 60 years of politics and money intertwined.

--- p.56

The fiat-based system first eliminated individuals' ability to save, then forced people to treat their homes like savings accounts.

--- p.93

Most fiat currency balances are held on the balance sheets of licensed banks, so the Federal Reserve, which is the fiat currency node in the United States and a full node for the world, can cancel them at any time.

If we define 'ownership' as the ability to dominate and control something, then legal tender, in terms of completely autonomous control, can never be an object of ownership.

Ordinary citizens can only hold fiat money temporarily thanks to the government's favor, which virtually owns all liquid assets.

--- p.102

Just as issuing more tickets to a soccer match does not increase the stadium's capacity, increasing the money supply or credit supply does not increase the assets used in production.

Just as a ticket is merely a substitute for the right to sit in a stadium seat, money and credit are merely rights to use capital goods or final goods used in production.

If a club wants to maximize ticket sales, it should not simply increase the number of tickets issued, but rather hire more civil engineers and construction workers, and expand the size of the stadium by mobilizing more heavy equipment.

If tickets are issued in excess of the stadium's capacity, there will be more spectators than seats available, which will lead to fierce competition for seats.

But once this situation has already occurred, no matter how much you think about it, there is no way to increase the number of seats.

--- p.142

In a hyperinflationary economy, trees are cut down for winter firewood before they even bear fruit, promising businesses are sold off to finance expenses, and future revenue streams are consumed in advance.

--- p.165

Yet, since the pharmaceutical industry's profitability would suffer if people adopted disease-prevention habits, the government-backed medical establishment has no reason to warn about the obvious dangers of modern eating habits.

Why promote diabetes prevention when we need to sell as many insulin doses as possible during the remaining days of people's shortened lives?

--- p.199

The lack of financial constraints on public education is a curse, not a blessing.

(Omitted) A century later, the Lotus Sutra has truly destroyed the modern ivory tower, the center of learning and research.

As a result, universities, once symbols of class and sophistication, have become job creation programs for the uneducated, expensive certification mills, inescapable debt traps, rehearsals for social activities, concentration camps for political indoctrination, and corporate PR agencies.

--- p.228

Realistically, it's difficult to convince a child who refuses to take a car when the only options for getting to Disneyland are a car or walking for days.

--- p.276

Now (European) currencies will be divided into two classes.

Tier 1 currencies are the dollar and pound sterling, which are backed by gold, and Tier 2 currencies are the currencies of other countries backed by the pound and dollar.

A portion of the gold reserves is held by the Bank of England and the Federal Reserve Bank of New York.

Second-tier currencies will lose their sovereignty.

--- p.292

The legal system turns all domestic and international politics into a do-or-die contest, and the winner is given the power to virtually control all economic value within the country or around the world.

--- p.338

Bitcoin can be seen as the liberation of the world's debt.

As Bitcoin continues to grow, demand for loans will weaken.

If so, it would be possible to reverse the massive increase in debt that fiat money has caused over the past several decades.

--- p.353

Bitcoin and non-cash transactions may seem similar because they are both digital, but in reality, they are not comparable.

The essence of Bitcoin is not its digital form, but the absence of counterparty risk.

--- p.364

Just as a spoon cannot replace a knife, cash cannot satisfactorily perform the role of money, so legal tender humans must necessarily have non-monetary assets as an alternative.

--- p.394

Bitcoin makes it possible to monetize, transfer, and consume all the energy that is easily wasted: methane that could have been burned, rivers that could have flooded, oil fields that could have been abandoned, volcanic energy that could have been lost after an eruption.

Difficulty adjustments ensure that Bitcoin is mined only on the power with the lowest opportunity cost, encouraging more miners to seek out and use cheaper energy.

--- p.429

If we convert Bitcoin's market rewards into dollar value each day and add them up, the market capitalization over the past 12 and a half years would be $620 billion, and the total expenses incurred would be $27.33 billion.

The average investment return is about 2200 percent.

In fact, the Bitcoin network's native token has risen an average of 23 times its original value since its creation.

As such, Bitcoin's effectiveness as a mechanism for saving future wealth has far exceeded expectations.

With Bitcoin increasingly recognized as a superior savings technology, more and more wealth is being invested in it, and its inherent scarcity is driving up the value of Bitcoin for existing holders.

--- p.443

Rather than threatening to destroy fiat money, Bitcoin will likely prove to be a neat technological solution that allows fiat money to rest in peace.

Bitcoin simultaneously reduces the demand for fiat currencies and the incentive to create more fiat supply.

It's like someone skillfully and cleverly removes the cards one by one from a house built by stacking up the demand and supply cards of the Lotus Sutra, and then slowly destroys it.

--- p.19

The Lotus Sutra system is not the result of a single engineer's design.

Rather, it was a desperate measure by central banks facing the threat of bankruptcy, an inevitable geopolitical consequence of 60 years of politics and money intertwined.

--- p.56

The fiat-based system first eliminated individuals' ability to save, then forced people to treat their homes like savings accounts.

--- p.93

Most fiat currency balances are held on the balance sheets of licensed banks, so the Federal Reserve, which is the fiat currency node in the United States and a full node for the world, can cancel them at any time.

If we define 'ownership' as the ability to dominate and control something, then legal tender, in terms of completely autonomous control, can never be an object of ownership.

Ordinary citizens can only hold fiat money temporarily thanks to the government's favor, which virtually owns all liquid assets.

--- p.102

Just as issuing more tickets to a soccer match does not increase the stadium's capacity, increasing the money supply or credit supply does not increase the assets used in production.

Just as a ticket is merely a substitute for the right to sit in a stadium seat, money and credit are merely rights to use capital goods or final goods used in production.

If a club wants to maximize ticket sales, it should not simply increase the number of tickets issued, but rather hire more civil engineers and construction workers, and expand the size of the stadium by mobilizing more heavy equipment.

If tickets are issued in excess of the stadium's capacity, there will be more spectators than seats available, which will lead to fierce competition for seats.

But once this situation has already occurred, no matter how much you think about it, there is no way to increase the number of seats.

--- p.142

In a hyperinflationary economy, trees are cut down for winter firewood before they even bear fruit, promising businesses are sold off to finance expenses, and future revenue streams are consumed in advance.

--- p.165

Yet, since the pharmaceutical industry's profitability would suffer if people adopted disease-prevention habits, the government-backed medical establishment has no reason to warn about the obvious dangers of modern eating habits.

Why promote diabetes prevention when we need to sell as many insulin doses as possible during the remaining days of people's shortened lives?

--- p.199

The lack of financial constraints on public education is a curse, not a blessing.

(Omitted) A century later, the Lotus Sutra has truly destroyed the modern ivory tower, the center of learning and research.

As a result, universities, once symbols of class and sophistication, have become job creation programs for the uneducated, expensive certification mills, inescapable debt traps, rehearsals for social activities, concentration camps for political indoctrination, and corporate PR agencies.

--- p.228

Realistically, it's difficult to convince a child who refuses to take a car when the only options for getting to Disneyland are a car or walking for days.

--- p.276

Now (European) currencies will be divided into two classes.

Tier 1 currencies are the dollar and pound sterling, which are backed by gold, and Tier 2 currencies are the currencies of other countries backed by the pound and dollar.

A portion of the gold reserves is held by the Bank of England and the Federal Reserve Bank of New York.

Second-tier currencies will lose their sovereignty.

--- p.292

The legal system turns all domestic and international politics into a do-or-die contest, and the winner is given the power to virtually control all economic value within the country or around the world.

--- p.338

Bitcoin can be seen as the liberation of the world's debt.

As Bitcoin continues to grow, demand for loans will weaken.

If so, it would be possible to reverse the massive increase in debt that fiat money has caused over the past several decades.

--- p.353

Bitcoin and non-cash transactions may seem similar because they are both digital, but in reality, they are not comparable.

The essence of Bitcoin is not its digital form, but the absence of counterparty risk.

--- p.364

Just as a spoon cannot replace a knife, cash cannot satisfactorily perform the role of money, so legal tender humans must necessarily have non-monetary assets as an alternative.

--- p.394

Bitcoin makes it possible to monetize, transfer, and consume all the energy that is easily wasted: methane that could have been burned, rivers that could have flooded, oil fields that could have been abandoned, volcanic energy that could have been lost after an eruption.

Difficulty adjustments ensure that Bitcoin is mined only on the power with the lowest opportunity cost, encouraging more miners to seek out and use cheaper energy.

--- p.429

If we convert Bitcoin's market rewards into dollar value each day and add them up, the market capitalization over the past 12 and a half years would be $620 billion, and the total expenses incurred would be $27.33 billion.

The average investment return is about 2200 percent.

In fact, the Bitcoin network's native token has risen an average of 23 times its original value since its creation.

As such, Bitcoin's effectiveness as a mechanism for saving future wealth has far exceeded expectations.

With Bitcoin increasingly recognized as a superior savings technology, more and more wealth is being invested in it, and its inherent scarcity is driving up the value of Bitcoin for existing holders.

--- p.443

Rather than threatening to destroy fiat money, Bitcoin will likely prove to be a neat technological solution that allows fiat money to rest in peace.

Bitcoin simultaneously reduces the demand for fiat currencies and the incentive to create more fiat supply.

It's like someone skillfully and cleverly removes the cards one by one from a house built by stacking up the demand and supply cards of the Lotus Sutra, and then slowly destroys it.

--- p.485

Publisher's Review

“Jordan Peterson, Nassim Taleb, El Salvadoran President Nayib Bukele…

“Why do the world’s greatest scholars ask him about the new face of money?”

A book that will give those who still believe Bitcoin is gambling a "last chance of faith."

Economist Saifeddine Amos, who witnessed the economic collapse caused by soaring prices, began to explore the 'future of wealth' that would come.

He's neither a Bitcoin investor nor the CEO of a cryptocurrency company, but the world's leading scholars are still asking him about the new face of money.

Saifeddine Amos, who presented a new monetary paradigm for the 21st century to Nassim Taleb and taught Jordan Peterson the principles of Bitcoin, says in this book that the capitalist model will be more completely upgraded as the 'Fiat Standard', which has been precariously maintained for the past 100 years, eventually gives way to Bitcoin as the reserve currency after an orderly collapse.

“The Fiat Standard, or the Fiat-based standard, is not the result of a single engineer’s design.

Rather, it was a desperate measure by central banks facing bankruptcy, an inevitable geopolitical consequence of 60 years of politics and currency intertwined.”

The author, who has been tracking the evolution of currency for a long time, accuses that the current fiat currency system that we accept as common sense was introduced to humanity without any agreement and based on hasty judgment, and as a result, humanity has fallen into debt slavery, experiencing hyperinflation every 1.64 years on a scale that could collapse a society over the past century.

And it is said that a 'currency swap' is already quietly underway all over the world to escape this chronic financial disaster.

What exactly does the collapse of the fiat currency system he speaks of, the "fiat standard," look like? And what does the future hold for us after that collapse?

“The number of assets is increasing endlessly.

“Why do asset values continue to fall?”

Why an imperfect and dangerous monetary system defies the principles of nature

Just because we used it without issue yesterday and today, can we be confident that "today's money" will be problem-free tomorrow? Looking at the grand history of humanity, the fiat system is a far more peculiar and abnormal phenomenon than Bitcoin.

The financial system is a system that operates by finding exquisite harmony within finite materials and resources.

This is the same as the law of nature.

But the 'money' we are experiencing now is completely different.

Does a legal system in which a specific entity holds full power and can print money without limit truly correspond to human history and natural phenomena?

Even the problems with fiat currency are not limited to the economic and financial sectors.

In the book, the author exposes how industrial capital, in collusion with corrupt legal powers, is polluting humanity's food supply, and how conspiracy theorists are propagating and reproducing fears about the climate crisis in civil society to maintain the legal system.

It is even argued that the birth and survival of imperialist colonial powers are fundamentally tied to this dollar-centered fiat standard.

By following his provocative and lucid arguments, we will clearly see how hypocritical and precarious the fiat-centric economic system we have long believed to be mainstream economics is.

“Bitcoin won’t destroy the world,

“It only restores the order of the collapsed currency!”

Money and currency, capitalism, and the 21st-century financial order... A book that will expand our imagination about wealth!

Despite this catastrophic diagnosis, Saifeddin Amos is optimistic about the future of the civilized economy.

The author says, “With a very high probability, Bitcoin will change the entire economic system in an orderly and calm manner without causing a catastrophic collapse of fiat currencies.”

And I foresee that the rise of Bitcoin is not a one-time radical storm, nor a destroyer that will bring down the world we live in now, but simply the result of a huge 'Debt Jubilee' in which the bomb of debt that has endlessly ballooned over the past century due to incompetent governments, greedy central banks, and the ignorance and negligence of humanity that lived through previous eras is finally completely forgiven.

“Bitcoin has proven to ‘settle payments’ 500,000 times per day in a transparent, predictable, and public manner.

(…) Bitcoin doesn’t need to convince government authorities to prove its value.

“All you have to do is provide value to users and continue to survive in the free market.” Even at this very moment, someone is exploiting the ignorance and prejudice of the 99 percent of the public who blindly criticize cryptocurrencies to make huge profits from the absurdity of the fiat system.

And some people are starting to gradually shift their fiat assets to the Bitcoin revolution that will unfold after this planned collapse.

Saifeddin Amos asks you:

"Where do you belong now? Where will your assets be and what will they be doing when the revolution begins?"

This book isn't about telling you to open an investment app right now and buy cryptocurrencies like Bitcoin.

Trading cryptocurrencies is just the tip of the iceberg in the ongoing currency revolution.

Bitcoin has grown at an average annual rate of 215 percent over the past decade, without any corruption or leadership, solely through market forces.

If we apply this average, it appears that Bitcoin will surpass the total nominal value of the dollar by 2026, and when Bitcoin surpasses the dollar, we may be living in a very different world than we do now.

In the near future, Bitcoin will likely prove to be not a threat to destroy fiat money, but rather an escape hatch that will liberate it.

Anyone who wants to stay on track in the rapidly changing economic landscape and stay ahead of the curve will find this book dispelling misconceptions, prejudices, and ignorance about Bitcoin, and establishing their own, well-founded standards.

“Why do the world’s greatest scholars ask him about the new face of money?”

A book that will give those who still believe Bitcoin is gambling a "last chance of faith."

Economist Saifeddine Amos, who witnessed the economic collapse caused by soaring prices, began to explore the 'future of wealth' that would come.

He's neither a Bitcoin investor nor the CEO of a cryptocurrency company, but the world's leading scholars are still asking him about the new face of money.

Saifeddine Amos, who presented a new monetary paradigm for the 21st century to Nassim Taleb and taught Jordan Peterson the principles of Bitcoin, says in this book that the capitalist model will be more completely upgraded as the 'Fiat Standard', which has been precariously maintained for the past 100 years, eventually gives way to Bitcoin as the reserve currency after an orderly collapse.

“The Fiat Standard, or the Fiat-based standard, is not the result of a single engineer’s design.

Rather, it was a desperate measure by central banks facing bankruptcy, an inevitable geopolitical consequence of 60 years of politics and currency intertwined.”

The author, who has been tracking the evolution of currency for a long time, accuses that the current fiat currency system that we accept as common sense was introduced to humanity without any agreement and based on hasty judgment, and as a result, humanity has fallen into debt slavery, experiencing hyperinflation every 1.64 years on a scale that could collapse a society over the past century.

And it is said that a 'currency swap' is already quietly underway all over the world to escape this chronic financial disaster.

What exactly does the collapse of the fiat currency system he speaks of, the "fiat standard," look like? And what does the future hold for us after that collapse?

“The number of assets is increasing endlessly.

“Why do asset values continue to fall?”

Why an imperfect and dangerous monetary system defies the principles of nature

Just because we used it without issue yesterday and today, can we be confident that "today's money" will be problem-free tomorrow? Looking at the grand history of humanity, the fiat system is a far more peculiar and abnormal phenomenon than Bitcoin.

The financial system is a system that operates by finding exquisite harmony within finite materials and resources.

This is the same as the law of nature.

But the 'money' we are experiencing now is completely different.

Does a legal system in which a specific entity holds full power and can print money without limit truly correspond to human history and natural phenomena?

Even the problems with fiat currency are not limited to the economic and financial sectors.

In the book, the author exposes how industrial capital, in collusion with corrupt legal powers, is polluting humanity's food supply, and how conspiracy theorists are propagating and reproducing fears about the climate crisis in civil society to maintain the legal system.

It is even argued that the birth and survival of imperialist colonial powers are fundamentally tied to this dollar-centered fiat standard.

By following his provocative and lucid arguments, we will clearly see how hypocritical and precarious the fiat-centric economic system we have long believed to be mainstream economics is.

“Bitcoin won’t destroy the world,

“It only restores the order of the collapsed currency!”

Money and currency, capitalism, and the 21st-century financial order... A book that will expand our imagination about wealth!

Despite this catastrophic diagnosis, Saifeddin Amos is optimistic about the future of the civilized economy.

The author says, “With a very high probability, Bitcoin will change the entire economic system in an orderly and calm manner without causing a catastrophic collapse of fiat currencies.”

And I foresee that the rise of Bitcoin is not a one-time radical storm, nor a destroyer that will bring down the world we live in now, but simply the result of a huge 'Debt Jubilee' in which the bomb of debt that has endlessly ballooned over the past century due to incompetent governments, greedy central banks, and the ignorance and negligence of humanity that lived through previous eras is finally completely forgiven.

“Bitcoin has proven to ‘settle payments’ 500,000 times per day in a transparent, predictable, and public manner.

(…) Bitcoin doesn’t need to convince government authorities to prove its value.

“All you have to do is provide value to users and continue to survive in the free market.” Even at this very moment, someone is exploiting the ignorance and prejudice of the 99 percent of the public who blindly criticize cryptocurrencies to make huge profits from the absurdity of the fiat system.

And some people are starting to gradually shift their fiat assets to the Bitcoin revolution that will unfold after this planned collapse.

Saifeddin Amos asks you:

"Where do you belong now? Where will your assets be and what will they be doing when the revolution begins?"

This book isn't about telling you to open an investment app right now and buy cryptocurrencies like Bitcoin.

Trading cryptocurrencies is just the tip of the iceberg in the ongoing currency revolution.

Bitcoin has grown at an average annual rate of 215 percent over the past decade, without any corruption or leadership, solely through market forces.

If we apply this average, it appears that Bitcoin will surpass the total nominal value of the dollar by 2026, and when Bitcoin surpasses the dollar, we may be living in a very different world than we do now.

In the near future, Bitcoin will likely prove to be not a threat to destroy fiat money, but rather an escape hatch that will liberate it.

Anyone who wants to stay on track in the rapidly changing economic landscape and stay ahead of the curve will find this book dispelling misconceptions, prejudices, and ignorance about Bitcoin, and establishing their own, well-founded standards.

GOODS SPECIFICS

- Date of issue: April 24, 2025

- Page count, weight, size: 512 pages | 152*224*35mm

- ISBN13: 9791130665085

- ISBN10: 1130665089

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)