Psychological Investment Laws

|

Description

Book Introduction

Completely revised edition in 2020

Amazon's best-selling book in the finance and investment category

Published in 10 languages worldwide, selling over 1 million copies

The first edition of Alexander Elder Box's "Psychological Investing," which presented a new solution called "psychological investing" in the financial market, became a hot topic on Wall Street immediately after its publication and was translated into ten languages around the world.

"Psychological Investment Laws," a long-term bestseller on Amazon for over 20 years, has been published in a revised edition after 21 years.

This comprehensively revised edition offers new solutions for stock price analysis, trading plan development, and assessing your trading skills.

We've also updated all charts to the latest version, and added clear explanations of the rules and techniques.

Even amidst the uncertainty caused by the pandemic, the insights this book provides will help both novice and experienced investors approach the market calmly and systematically.

Even if you've already read the first edition, learning the newly revised edition will guide you on the path to victory in the chaotic stock market!

Amazon's best-selling book in the finance and investment category

Published in 10 languages worldwide, selling over 1 million copies

The first edition of Alexander Elder Box's "Psychological Investing," which presented a new solution called "psychological investing" in the financial market, became a hot topic on Wall Street immediately after its publication and was translated into ten languages around the world.

"Psychological Investment Laws," a long-term bestseller on Amazon for over 20 years, has been published in a revised edition after 21 years.

This comprehensively revised edition offers new solutions for stock price analysis, trading plan development, and assessing your trading skills.

We've also updated all charts to the latest version, and added clear explanations of the rules and techniques.

Even amidst the uncertainty caused by the pandemic, the insights this book provides will help both novice and experienced investors approach the market calmly and systematically.

Even if you've already read the first edition, learning the newly revised edition will guide you on the path to victory in the chaotic stock market!

- You can preview some of the book's contents.

Preview

index

┃Korean Edition Preface┃ Achieving Freedom through Trading

┃Preface to the Revised Edition┃ Skills that Increase Just by Keeping Good Records

Introduction

1.

The last frontier, the stock market

2.

The problem is psychological.

3.

A few pitfalls to know in advance

Part 1: Individual Psychology

4.

Why trade?

5.

Reality and Fantasy

6.

An act that destroys the trader himself

7.

Trading Psychology

8.

Trading Lessons Learned at Alcoholics Anonymous

9.

A gathering of losers

10.

Winners and Losers

Part 2: Group Psychology

11.

What is price?

12.

What is a market?

13.

Groups in the trading scene

14.

The crowd at the market and me

15.

The Psychology of Trends

16.

Management or prediction?

Part 3: Traditional Chart Analysis

17.

Starting point of the chart

18.

Support and resistance

19.

Trends and Boxes

20.

kangaroo tail

Part 4: Computer-Aided Technical Analysis

21.

Computer-assisted analysis

22.

moving average

23. MACD: MACD Line and MACD Histogram

24.

Directional system

25.

Oscillator

26.

Stochastic

27.

relative strength index

Part 5: Trading Volume and Time

28.

Trading volume

29.

Trading volume indicator

30.

Strength index

31.

Unpaid contracts

32.

hour

33.

Trading time units

Part 6: Indicators for analyzing the entire market

34.

New high/new low index

35.

Stocks above their 50-day moving average

36.

Other market indicators

37.

Consensus indicators and market participation indicators

Part 7 Trading System

38.

System Trading, Simulated Trading, and the Three Requirements for All Trading

39.

Triple Screen Trading System

40.

impulse system

41.

Channel Trading System

Part 8 Trading Targets

42.

stock

43. ETF

44.

Options

45. CFD

46.

gift

47.

Foreign exchange

Part 9 Risk Management

48.

Psychology and Probability

49.

The Two Laws of Risk Management

50.

2 percent rule

51.

6 percent rule

52.

Recovering after loss

Part 10: Practical Principles

53.

Setting Profit Goals: Don't Overpay

54.

Stop Loss Setting: Stop the Dream

55.

Is it A grade?

56.

Trading Candidate Detection

Part 11 Trading Journal

57.

Homework that must be done daily

58.

Developing and Scoring a Trading Plan

59.

Trading Journal

┃Conclusion┃ The Endless Journey: Never Stop Learning

┃References┃

┃Preface to the Revised Edition┃ Skills that Increase Just by Keeping Good Records

Introduction

1.

The last frontier, the stock market

2.

The problem is psychological.

3.

A few pitfalls to know in advance

Part 1: Individual Psychology

4.

Why trade?

5.

Reality and Fantasy

6.

An act that destroys the trader himself

7.

Trading Psychology

8.

Trading Lessons Learned at Alcoholics Anonymous

9.

A gathering of losers

10.

Winners and Losers

Part 2: Group Psychology

11.

What is price?

12.

What is a market?

13.

Groups in the trading scene

14.

The crowd at the market and me

15.

The Psychology of Trends

16.

Management or prediction?

Part 3: Traditional Chart Analysis

17.

Starting point of the chart

18.

Support and resistance

19.

Trends and Boxes

20.

kangaroo tail

Part 4: Computer-Aided Technical Analysis

21.

Computer-assisted analysis

22.

moving average

23. MACD: MACD Line and MACD Histogram

24.

Directional system

25.

Oscillator

26.

Stochastic

27.

relative strength index

Part 5: Trading Volume and Time

28.

Trading volume

29.

Trading volume indicator

30.

Strength index

31.

Unpaid contracts

32.

hour

33.

Trading time units

Part 6: Indicators for analyzing the entire market

34.

New high/new low index

35.

Stocks above their 50-day moving average

36.

Other market indicators

37.

Consensus indicators and market participation indicators

Part 7 Trading System

38.

System Trading, Simulated Trading, and the Three Requirements for All Trading

39.

Triple Screen Trading System

40.

impulse system

41.

Channel Trading System

Part 8 Trading Targets

42.

stock

43. ETF

44.

Options

45. CFD

46.

gift

47.

Foreign exchange

Part 9 Risk Management

48.

Psychology and Probability

49.

The Two Laws of Risk Management

50.

2 percent rule

51.

6 percent rule

52.

Recovering after loss

Part 10: Practical Principles

53.

Setting Profit Goals: Don't Overpay

54.

Stop Loss Setting: Stop the Dream

55.

Is it A grade?

56.

Trading Candidate Detection

Part 11 Trading Journal

57.

Homework that must be done daily

58.

Developing and Scoring a Trading Plan

59.

Trading Journal

┃Conclusion┃ The Endless Journey: Never Stop Learning

┃References┃

Detailed image

Into the book

Amateurs not only deny the possibility of losing money, they are also unwilling to take the risk.

Talking about capital is just an excuse to avoid the painful truth.

The problem isn't a lack of capital, but a lack of trading training and a lack of a realistic money management plan.

To survive and make money in the market, you must be thorough in your loss management.

The trick is to limit the size of any one trade to a tiny fraction of your capital (see Part 9, "Risk Management").

By operating with small amounts of capital, you should be able to learn from mistakes while minimizing losses.

--- p.50

When a trader makes a profit, he feels like a great person and is very excited.

And then, overcome with pride, they start trading recklessly to try to make a profit again, only to end up throwing up all the profits they had made.

Most traders cannot stand seeing huge losses.

If you fall into the abyss and hit rock bottom, your life as a trader is over and you are out of the market.

Only the very few who realize that the problem lies not in trading techniques but in 'thinking' survive.

These are changeable and that is what makes you successful as a trader.

--- p.78

When viewed as a group, professionals generally trade in the opposite way to amateurs.

Pros buy at low prices or short sell at high prices, then liquidate their positions at the close of the market.

Therefore, we must pay attention to the relationship between the ancestral home and the ancestral home.

If the closing price is higher than the opening price, market professionals are more likely to view the market as bullish than amateurs.

If the closing price is lower than the opening price, professionals are more likely to view the market as bearish than amateurs.

It is advantageous to trade in step with the moves of the pros and against the moves of amateurs.

--- p.158

When the first edition of "Psychological Investing Laws" was published, the only services tracking advisor opinions were Investor's Intelligence and Market Bain.

However, with the recent explosion of interest in behavioral economics, services that track advisors have become readily available.

My favorite service is SentimentRadar.com, whose motto is "Don't let your feelings hurt you, make them your ally."

The crowd market sentiment tracked by publisher Jason Goepfert is reliable.

--- p.355

I use a spreadsheet to keep track of what I need to do before opening.

I adapted an idea from Max Larson, a fund manager based in Ohio, to my own liking.

The version I'm currently using is 3.7, which changes two major elements and a few minor ones.

'3.7' is based on my perspective on the market, and contains links to various websites that have the information I want.

The homework spreadsheet I use (Figure 57-1) is still being revised by adding and removing cells.

I guarantee that once you use this spreadsheet, you will be able to modify it to your own liking.

Talking about capital is just an excuse to avoid the painful truth.

The problem isn't a lack of capital, but a lack of trading training and a lack of a realistic money management plan.

To survive and make money in the market, you must be thorough in your loss management.

The trick is to limit the size of any one trade to a tiny fraction of your capital (see Part 9, "Risk Management").

By operating with small amounts of capital, you should be able to learn from mistakes while minimizing losses.

--- p.50

When a trader makes a profit, he feels like a great person and is very excited.

And then, overcome with pride, they start trading recklessly to try to make a profit again, only to end up throwing up all the profits they had made.

Most traders cannot stand seeing huge losses.

If you fall into the abyss and hit rock bottom, your life as a trader is over and you are out of the market.

Only the very few who realize that the problem lies not in trading techniques but in 'thinking' survive.

These are changeable and that is what makes you successful as a trader.

--- p.78

When viewed as a group, professionals generally trade in the opposite way to amateurs.

Pros buy at low prices or short sell at high prices, then liquidate their positions at the close of the market.

Therefore, we must pay attention to the relationship between the ancestral home and the ancestral home.

If the closing price is higher than the opening price, market professionals are more likely to view the market as bullish than amateurs.

If the closing price is lower than the opening price, professionals are more likely to view the market as bearish than amateurs.

It is advantageous to trade in step with the moves of the pros and against the moves of amateurs.

--- p.158

When the first edition of "Psychological Investing Laws" was published, the only services tracking advisor opinions were Investor's Intelligence and Market Bain.

However, with the recent explosion of interest in behavioral economics, services that track advisors have become readily available.

My favorite service is SentimentRadar.com, whose motto is "Don't let your feelings hurt you, make them your ally."

The crowd market sentiment tracked by publisher Jason Goepfert is reliable.

--- p.355

I use a spreadsheet to keep track of what I need to do before opening.

I adapted an idea from Max Larson, a fund manager based in Ohio, to my own liking.

The version I'm currently using is 3.7, which changes two major elements and a few minor ones.

'3.7' is based on my perspective on the market, and contains links to various websites that have the information I want.

The homework spreadsheet I use (Figure 57-1) is still being revised by adding and removing cells.

I guarantee that once you use this spreadsheet, you will be able to modify it to your own liking.

--- p.554

Publisher's Review

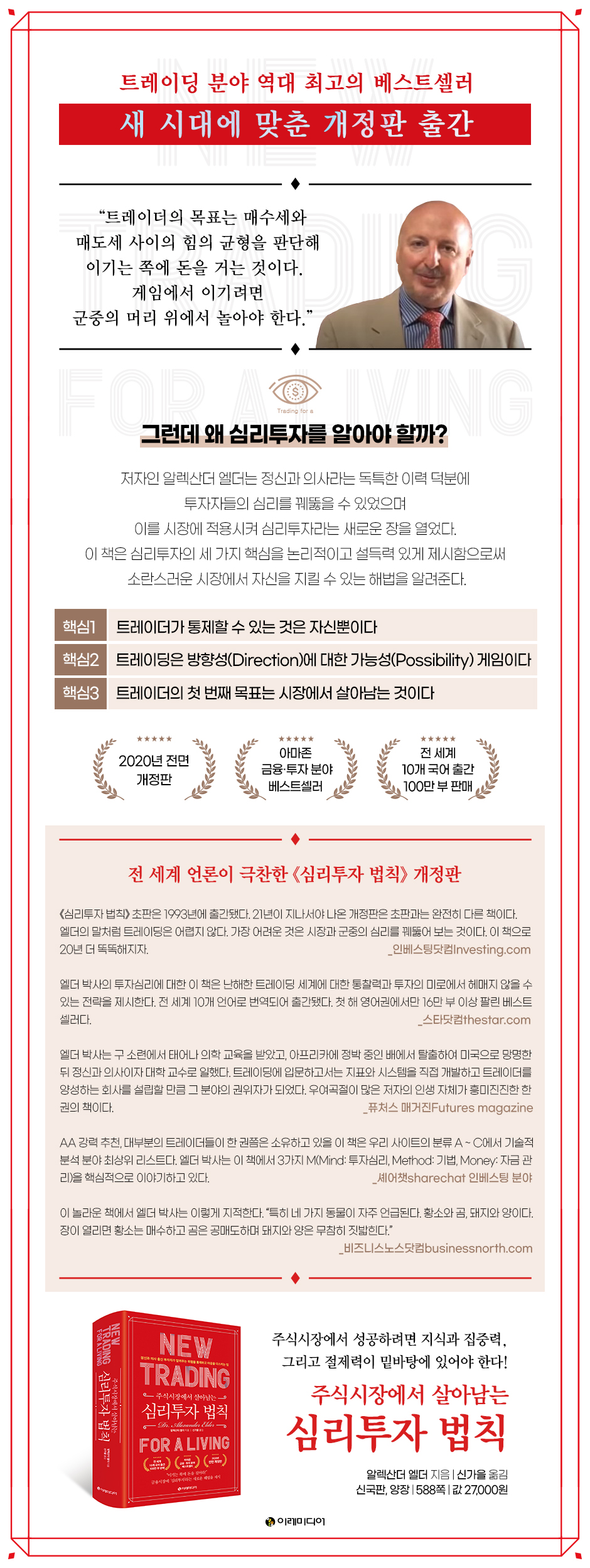

“The trader’s goal is to determine the balance of power between buying and selling forces.

It's a bet on the winning side.

“To win the game, you have to play above the crowd.”

The all-time bestseller in trading

A revised edition for the new era has been published.

The revised edition of "Psychological Investment Laws," a classic among individual and institutional traders worldwide, has been published.

This expanded and revised edition introduces time-tested concepts tailored to today's rapidly changing markets, adding new research and techniques relevant to today's traders.

This book teaches you to approach the unpredictable stock market with calm and discipline.

It emphasizes risk management, especially along with self-management, and provides clear rules for doing so.

The revised edition of "Psychological Investment Laws" offers solutions for stock price analysis, trading plan development, and evaluating your trading skills.

This book will provide you with the knowledge, perspective, and tools to develop your own effective trading system.

The charts in this book are also up-to-date and come with clear explanations of the rules and techniques.

With its clear tone, practical real-world examples, and generous presentation of core techniques, it has become an industry model, imitated by many, but nowhere else can it be found.

The insights this book provides will help both novice and experienced investors navigate the still-chaotic stock market with a calm and systematic approach.

_ Remove obstacles that stand in the way of success and develop greater self-control.

_ Identify areas where rewards are high and risks are low.

_ Be adept at managing your funds when setting entry, target, and stop-loss.

_ Become your own teacher by writing systematically.

Success in the stock market requires knowledge, focus, and discipline.

The revised edition of "Psychological Investment Laws" will elevate your trading skills by adding balanced wisdom and tools relevant to today's market.

Published in 10 languages worldwide: 1 million copies sold in English-speaking countries alone

Presenting a new solution to the financial market: "psychological investing."

It became a hot topic on Wall Street as soon as it was published, and it was translated into ten languages around the world to great acclaim, becoming a global bestseller.

The author, Dr. Alexander Elder, is a psychiatrist and renowned technician who pioneered the concept of "psychological investing" in the financial markets by combining psychology and technical analysis, and has become a leader in this field.

To date, his techniques have been cited and recommended in numerous investment books, media, and investment programs, and he continues to receive attention as a long-term bestseller on Amazon.

This is a must-read for investors of this era, with legendary traders in the domestic futures market praising it as "a book that clearly understands the psychology of the market and the crowd!"

Thanks to his unique background as a psychiatrist, he was able to penetrate the psychology of investors and apply this knowledge to the market, opening a new chapter in psychological investment.

This book presents three key principles of psychological investing in a logical and persuasive manner, offering solutions to protect yourself in turbulent markets.

“The only thing a trader can control is himself.”

The most fundamental factor that determines the success or failure of trading is psychology.

Parts 1 and 2 discuss how to uncover emotional vulnerabilities by delving into the psychology of individuals as traders and the psychology of groups as crowds.

Everyone enters the market to make money, but if you can't understand why most people fail to achieve their goals and exit, this is a topic you should read carefully.

It gives you insight into what a market is, what price is, and what the psychology behind trends is.

Trading is a game of possibility versus direction.

Based on traditional chart analysis methods such as support and resistance, trends, and chart patterns, it explains the meaning and utilization of technical indicators such as MACD, oscillators, momentum, ROC, and stochastic (Parts 3-4).

We examine volume and volume-based indicators to determine the relationship between time units and trading decisions (Part 5).

Explains indicators that analyze the entire market (Part 6) and trading systems (Part 7).

We've rewritten the Trading Targets (Part 8) section to help you decide which markets to focus on among the six types of trading targets, including stocks, ETFs, and options.

“A trader's first goal is to survive in the market.”

Once a trader enters the market, price fluctuations, whether profit or loss, make him psychologically vulnerable.

The temptation to change your financial plan becomes even stronger when you suffer a loss.

This is why strict financial management principles are necessary.

We discuss the psychology of loss and the principles of smart loss limitation, and present detailed and new strategies for setting risk levels and liquidating positions (Parts 9-10).

The author also suggests recording your trades after they are finished (Part 11), as traders who fail to learn from their past will not only fail to grow their profits steadily or become high-yield traders, but will also fail to survive in the market.

To check your understanding by reviewing the key points

Simultaneous publication of study guide

“There are only three reasons why amateurs lose money.

Because the game is difficult, because I am ignorant, and because I lack self-control.

If you're struggling with these issues, you should definitely read this book." Even if you've read the best trading book, how much of it will stick in your head a week later? The author has created a study guide to help readers fully grasp the core content of the revised edition.

The study guide contains 170 multiple-choice questions spread across 11 chapters, each with its own scoring criteria.

These questions cover trading topics ranging from psychology to system design, risk management to becoming a systematic trader.

All questions are linked to specific chapters in this book, and the answer section also serves as a mini-textbook with extensive explanations of correct and incorrect answers.

The study guide also includes 17 charts to test your ability to identify various trading signals and patterns.

The revised edition of "Psychological Investment Laws" study guide is a treasure for any trader seeking consistent market success.

It's a bet on the winning side.

“To win the game, you have to play above the crowd.”

The all-time bestseller in trading

A revised edition for the new era has been published.

The revised edition of "Psychological Investment Laws," a classic among individual and institutional traders worldwide, has been published.

This expanded and revised edition introduces time-tested concepts tailored to today's rapidly changing markets, adding new research and techniques relevant to today's traders.

This book teaches you to approach the unpredictable stock market with calm and discipline.

It emphasizes risk management, especially along with self-management, and provides clear rules for doing so.

The revised edition of "Psychological Investment Laws" offers solutions for stock price analysis, trading plan development, and evaluating your trading skills.

This book will provide you with the knowledge, perspective, and tools to develop your own effective trading system.

The charts in this book are also up-to-date and come with clear explanations of the rules and techniques.

With its clear tone, practical real-world examples, and generous presentation of core techniques, it has become an industry model, imitated by many, but nowhere else can it be found.

The insights this book provides will help both novice and experienced investors navigate the still-chaotic stock market with a calm and systematic approach.

_ Remove obstacles that stand in the way of success and develop greater self-control.

_ Identify areas where rewards are high and risks are low.

_ Be adept at managing your funds when setting entry, target, and stop-loss.

_ Become your own teacher by writing systematically.

Success in the stock market requires knowledge, focus, and discipline.

The revised edition of "Psychological Investment Laws" will elevate your trading skills by adding balanced wisdom and tools relevant to today's market.

Published in 10 languages worldwide: 1 million copies sold in English-speaking countries alone

Presenting a new solution to the financial market: "psychological investing."

It became a hot topic on Wall Street as soon as it was published, and it was translated into ten languages around the world to great acclaim, becoming a global bestseller.

The author, Dr. Alexander Elder, is a psychiatrist and renowned technician who pioneered the concept of "psychological investing" in the financial markets by combining psychology and technical analysis, and has become a leader in this field.

To date, his techniques have been cited and recommended in numerous investment books, media, and investment programs, and he continues to receive attention as a long-term bestseller on Amazon.

This is a must-read for investors of this era, with legendary traders in the domestic futures market praising it as "a book that clearly understands the psychology of the market and the crowd!"

Thanks to his unique background as a psychiatrist, he was able to penetrate the psychology of investors and apply this knowledge to the market, opening a new chapter in psychological investment.

This book presents three key principles of psychological investing in a logical and persuasive manner, offering solutions to protect yourself in turbulent markets.

“The only thing a trader can control is himself.”

The most fundamental factor that determines the success or failure of trading is psychology.

Parts 1 and 2 discuss how to uncover emotional vulnerabilities by delving into the psychology of individuals as traders and the psychology of groups as crowds.

Everyone enters the market to make money, but if you can't understand why most people fail to achieve their goals and exit, this is a topic you should read carefully.

It gives you insight into what a market is, what price is, and what the psychology behind trends is.

Trading is a game of possibility versus direction.

Based on traditional chart analysis methods such as support and resistance, trends, and chart patterns, it explains the meaning and utilization of technical indicators such as MACD, oscillators, momentum, ROC, and stochastic (Parts 3-4).

We examine volume and volume-based indicators to determine the relationship between time units and trading decisions (Part 5).

Explains indicators that analyze the entire market (Part 6) and trading systems (Part 7).

We've rewritten the Trading Targets (Part 8) section to help you decide which markets to focus on among the six types of trading targets, including stocks, ETFs, and options.

“A trader's first goal is to survive in the market.”

Once a trader enters the market, price fluctuations, whether profit or loss, make him psychologically vulnerable.

The temptation to change your financial plan becomes even stronger when you suffer a loss.

This is why strict financial management principles are necessary.

We discuss the psychology of loss and the principles of smart loss limitation, and present detailed and new strategies for setting risk levels and liquidating positions (Parts 9-10).

The author also suggests recording your trades after they are finished (Part 11), as traders who fail to learn from their past will not only fail to grow their profits steadily or become high-yield traders, but will also fail to survive in the market.

To check your understanding by reviewing the key points

Simultaneous publication of study guide

“There are only three reasons why amateurs lose money.

Because the game is difficult, because I am ignorant, and because I lack self-control.

If you're struggling with these issues, you should definitely read this book." Even if you've read the best trading book, how much of it will stick in your head a week later? The author has created a study guide to help readers fully grasp the core content of the revised edition.

The study guide contains 170 multiple-choice questions spread across 11 chapters, each with its own scoring criteria.

These questions cover trading topics ranging from psychology to system design, risk management to becoming a systematic trader.

All questions are linked to specific chapters in this book, and the answer section also serves as a mini-textbook with extensive explanations of correct and incorrect answers.

The study guide also includes 17 charts to test your ability to identify various trading signals and patterns.

The revised edition of "Psychological Investment Laws" study guide is a treasure for any trader seeking consistent market success.

GOODS SPECIFICS

- Publication date: December 15, 2020

- Format: Hardcover book binding method guide

- Page count, weight, size: 588 pages | 1,108g | 153*224*35mm

- ISBN13: 9791188279951

- ISBN10: 1188279955

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)