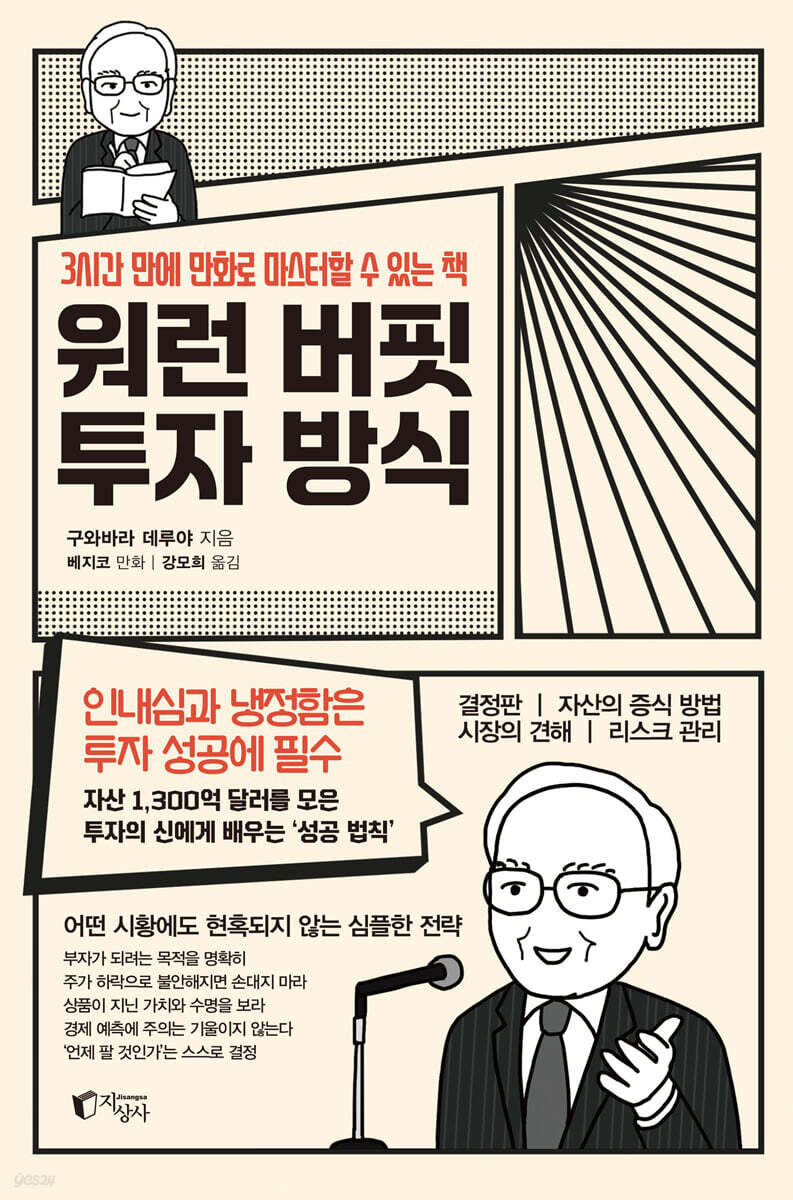

Warren Buffett's investment style

|

Description

Book Introduction

Don't rely too much on experts; think for yourself and be convinced.

Patience and composure are essential for successful investing.

You can't succeed in investing by doing the same things as everyone else.

The cause of failure is the investor's own problem.

Starting as soon as possible is the key to success.

When talking about Warren Buffett, the first thing that comes to mind is the money he has made and his massive fortune, estimated at $100 billion.

The fact that he was able to earn that much money through investment alone is impressive, but the author, who has studied Warren Buffett for many years, personally feels that it has made us realize that we should prioritize 'value' over 'price'.

If you are interested in stock investment but have little experience, it would be good to learn about Warren Buffett, who is introduced in this book.

Warren Buffett is known in the investment industry as "the world's greatest investor" and "the Oracle of Omaha." This is because he has never suffered a major loss while investing throughout his life since buying his first stock in 1941, when he was 11 years old, and his reputation has only grown higher as he has gotten older.

There are many famous investors in the investment industry, but none have been called a "wise man" other than Warren Buffett.

Of course, Warren Buffett wasn't a 'wise man' from the beginning.

At first, Omaha, Nebraska, a rural investor in the American Midwest, was just a successful investor, but he gradually began to make his mark in the financial world.

He rose to fame in the 2000s by serving as a major shareholder of the Washington Post, as interim chairman of Goldman Sachs, and as a financial advisor to Hollywood actor Arnold Schwarzenegger, who ran for governor of California in 2003, and by making large donations to the Bill & Melinda Gates Foundation.

As his fame grew, interest in Warren Buffett also began to increase.

Berkshire Hathaway's annual shareholders' meeting in Omaha attracts shareholders from around the world to hear from Warren Buffett.

Also, when Warren Buffett writes or says something, not only investors and financial professionals, but also the general public takes notice.

Why are so many people interested in Warren Buffett?

Most of Warren Buffett's words and actions were learned through his long-term investment activities.

However, this does not mean that the saying applies only to those engaged in investment activities.

Warren Buffett's words not only contain helpful lessons for investors, but also served as a great support for the founders of Amazon and Google as they navigated crises and led their businesses.

And it also serves as a guide for young students on how to live their future lives.

That's why so many people around the world listen to Warren Buffett.

Warren Buffett's words teach us about investment values and sound financial thinking, and his actions serve as a guide for how we should live.

As a result, you will be able to live a more enriched life not only financially and socially, but also mentally.

Warren Buffett's famous quote

?Investing is postponing consumption.

If you pay now, you will get a lot more money back later.

There are only two really important issues.

One is how much it will return, and the other is when it will return.

Do what you love and work alongside the people you most respect.

Then you can get the best opportunity in life.

Warren Buffett started rolling small snowballs when he was young.

If I had started ten years later, I would be somewhere along the mountain ridge now.

That's why Warren Buffett always advises his students to take the lead.

Patience and composure are essential for successful investing.

You can't succeed in investing by doing the same things as everyone else.

The cause of failure is the investor's own problem.

Starting as soon as possible is the key to success.

When talking about Warren Buffett, the first thing that comes to mind is the money he has made and his massive fortune, estimated at $100 billion.

The fact that he was able to earn that much money through investment alone is impressive, but the author, who has studied Warren Buffett for many years, personally feels that it has made us realize that we should prioritize 'value' over 'price'.

If you are interested in stock investment but have little experience, it would be good to learn about Warren Buffett, who is introduced in this book.

Warren Buffett is known in the investment industry as "the world's greatest investor" and "the Oracle of Omaha." This is because he has never suffered a major loss while investing throughout his life since buying his first stock in 1941, when he was 11 years old, and his reputation has only grown higher as he has gotten older.

There are many famous investors in the investment industry, but none have been called a "wise man" other than Warren Buffett.

Of course, Warren Buffett wasn't a 'wise man' from the beginning.

At first, Omaha, Nebraska, a rural investor in the American Midwest, was just a successful investor, but he gradually began to make his mark in the financial world.

He rose to fame in the 2000s by serving as a major shareholder of the Washington Post, as interim chairman of Goldman Sachs, and as a financial advisor to Hollywood actor Arnold Schwarzenegger, who ran for governor of California in 2003, and by making large donations to the Bill & Melinda Gates Foundation.

As his fame grew, interest in Warren Buffett also began to increase.

Berkshire Hathaway's annual shareholders' meeting in Omaha attracts shareholders from around the world to hear from Warren Buffett.

Also, when Warren Buffett writes or says something, not only investors and financial professionals, but also the general public takes notice.

Why are so many people interested in Warren Buffett?

Most of Warren Buffett's words and actions were learned through his long-term investment activities.

However, this does not mean that the saying applies only to those engaged in investment activities.

Warren Buffett's words not only contain helpful lessons for investors, but also served as a great support for the founders of Amazon and Google as they navigated crises and led their businesses.

And it also serves as a guide for young students on how to live their future lives.

That's why so many people around the world listen to Warren Buffett.

Warren Buffett's words teach us about investment values and sound financial thinking, and his actions serve as a guide for how we should live.

As a result, you will be able to live a more enriched life not only financially and socially, but also mentally.

Warren Buffett's famous quote

?Investing is postponing consumption.

If you pay now, you will get a lot more money back later.

There are only two really important issues.

One is how much it will return, and the other is when it will return.

Do what you love and work alongside the people you most respect.

Then you can get the best opportunity in life.

Warren Buffett started rolling small snowballs when he was young.

If I had started ten years later, I would be somewhere along the mountain ridge now.

That's why Warren Buffett always advises his students to take the lead.

- You can preview some of the book's contents.

Preview

index

preface

- To live a rich and happy life

Introduction | The Life of Warren Buffett, the "Sage of Omaha"

01 To succeed, you must 'take the lead'

02 The amount of money you spend is less than the amount of money you receive.

03 Clarify your purpose of becoming 'rich'

04 Take advantage of 'compound interest', where money makes money.

05 Don't be swayed by emotions; stick to your principles.

06 Believe in the 'chart within me'

Warren Buffett's Famous Quote ①

Chapter 1 | How to Develop a Long-Term Perspective

07 Invest in the company itself from a long-term perspective

08 Stocks do not always show their exact value.

There are only three reasons to sell stocks.

10. Don't be swayed by daily stock prices.

11. Don't be overconfident in the way securities firms work.

12 Investing is about owning value

13 Let's also look at brand power and competitiveness.

14 Look at future growth potential rather than past

I wonder if this product will survive 15 to 10 years from now.

16 Choose a company that can grow no matter what manager comes in.

17 Companies that create beloved products are strong.

18 Hold stocks of excellent companies permanently

Warren Buffett's Famous Quotes②

Chapter 2 | How to Choose to Avoid Losses

19 Research the company thoroughly until you are convinced.

20 When the gap between stock price and value is large, it is the right time to buy.

21 Select investment items carefully

22 Debt is limited to one-fourth of net worth.

23 The numbers companies provide aren't always right.

24 'Excellent Business Performance' Reduces Risk

25. Check the changing corporate information.

26 Ignorance and Debt Lead to Risk

27. Don't invest if it's outside your "range of ability"

Missing an investment opportunity doesn't mean you've failed.

29 Countries and cultures can also be knowledge for investment.

30 Buy excellent companies at reasonable prices

Invest in companies that will remain competitive in 31 years.

32 Invest in products created by outstanding managers.

33 Reduce risk and secure profits

34 You must be able to explain the reasons for failure.

Warren Buffett's Famous Quotes ③

Chapter 3 | Developing the Habit of Thinking for Yourself

35 When investing, you must think for yourself and be confident.

36 No one takes responsibility for your investments.

37 Don't make hasty decisions like those around you.

38 Don't rely too much on expert opinions.

39 Don't 'predict'; understand the 'long-term value of the company'

40. If you only believe in information, your judgment will be wrong.

41 Don't take the reputation of others at face value.

42 Opportunities to make money come from the brain.

43 The "Supari" mentality applies to investing as well.

44 Finding a 'good company' for yourself

45 Be confident in your own conclusions.

Warren Buffett's Famous Quotes④

Chapter 4 | Timing is Key

46 Wait patiently for the opportunity to come.

47 Let's make a solid decision

48 Act only when you have an idea.

49 Think for yourself when to sell

50 I study industry knowledge on a regular basis.

51 Investing at the Perfect 'Timing'

If you faithfully follow the 52 principles, your performance will improve.

53 Opportunities Come Even in the Face of Economic Crisis

54 If you have the ability to invest, you can seize the opportunity.

55 Keep an eye on companies you're interested in.

56 The market's judgment has nothing to do with me.

Warren Buffett's famous quotes⑤

Chapter 5 | Market Perspectives

57 A downtrend with the surroundings shrinking is an opportunity

58 Pay attention to what happened

59 There is no such thing as a rumor that leads directly to a quick fortune.

60 Market is a place to check out ridiculous prices

61 Prepare for a crisis without warning

62 Human psychology influences investment.

63 Don't be overconfident in your abilities.

64 Maintain your composure in the market under any circumstances.

65. Understand the Internet and AI well.

66. When you actually invest, you face the market head-on.

Warren Buffett's Famous Quotes⑥

Chapter 6 | Developing Humane and Desirable Habits

67 Good habits are a great force for success.

68 Cherish your brain and body

69 Spend one hour a day on yourself

70. Adhere to the 'range of ability' in everyday life.

71 Say 'No' to things that are not important.

72 Be honest with yourself

73 Communication is the strongest weapon

74 'Greed' causes loss

75 Patience and cool-headedness are more important than knowledge.

Warren Buffett's Famous Quotes⑦

Chapter 7 | How to Get Along with Others

76 Let's have our own idol

77 Be close to people who are better than you.

78 It's fun to work with respectable people.

79 Hire excellent people and delegate work to them.

80 Work with great people regardless of age

81. Value connections with people.

82 Don't fight for the sake of fighting

83 Success in life can be measured by love.

Warren Buffett's Famous Quotes⑧

Chapter 8 | Philosophy for a Happier Life

84 How to Live Rich for a Long Time

85 Become a person worthy of success

86 Be grateful for your surroundings

87. Value the spirit of saving

88 Money is something that is temporarily held by society.

Living as one of the 89 1% lucky ones

90 Trust is more valuable than money.

Conclusion

-Efforts to increase one's own value

Let's live a rich life again and again

Appendix? Warren Buffett's Life

References

- To live a rich and happy life

Introduction | The Life of Warren Buffett, the "Sage of Omaha"

01 To succeed, you must 'take the lead'

02 The amount of money you spend is less than the amount of money you receive.

03 Clarify your purpose of becoming 'rich'

04 Take advantage of 'compound interest', where money makes money.

05 Don't be swayed by emotions; stick to your principles.

06 Believe in the 'chart within me'

Warren Buffett's Famous Quote ①

Chapter 1 | How to Develop a Long-Term Perspective

07 Invest in the company itself from a long-term perspective

08 Stocks do not always show their exact value.

There are only three reasons to sell stocks.

10. Don't be swayed by daily stock prices.

11. Don't be overconfident in the way securities firms work.

12 Investing is about owning value

13 Let's also look at brand power and competitiveness.

14 Look at future growth potential rather than past

I wonder if this product will survive 15 to 10 years from now.

16 Choose a company that can grow no matter what manager comes in.

17 Companies that create beloved products are strong.

18 Hold stocks of excellent companies permanently

Warren Buffett's Famous Quotes②

Chapter 2 | How to Choose to Avoid Losses

19 Research the company thoroughly until you are convinced.

20 When the gap between stock price and value is large, it is the right time to buy.

21 Select investment items carefully

22 Debt is limited to one-fourth of net worth.

23 The numbers companies provide aren't always right.

24 'Excellent Business Performance' Reduces Risk

25. Check the changing corporate information.

26 Ignorance and Debt Lead to Risk

27. Don't invest if it's outside your "range of ability"

Missing an investment opportunity doesn't mean you've failed.

29 Countries and cultures can also be knowledge for investment.

30 Buy excellent companies at reasonable prices

Invest in companies that will remain competitive in 31 years.

32 Invest in products created by outstanding managers.

33 Reduce risk and secure profits

34 You must be able to explain the reasons for failure.

Warren Buffett's Famous Quotes ③

Chapter 3 | Developing the Habit of Thinking for Yourself

35 When investing, you must think for yourself and be confident.

36 No one takes responsibility for your investments.

37 Don't make hasty decisions like those around you.

38 Don't rely too much on expert opinions.

39 Don't 'predict'; understand the 'long-term value of the company'

40. If you only believe in information, your judgment will be wrong.

41 Don't take the reputation of others at face value.

42 Opportunities to make money come from the brain.

43 The "Supari" mentality applies to investing as well.

44 Finding a 'good company' for yourself

45 Be confident in your own conclusions.

Warren Buffett's Famous Quotes④

Chapter 4 | Timing is Key

46 Wait patiently for the opportunity to come.

47 Let's make a solid decision

48 Act only when you have an idea.

49 Think for yourself when to sell

50 I study industry knowledge on a regular basis.

51 Investing at the Perfect 'Timing'

If you faithfully follow the 52 principles, your performance will improve.

53 Opportunities Come Even in the Face of Economic Crisis

54 If you have the ability to invest, you can seize the opportunity.

55 Keep an eye on companies you're interested in.

56 The market's judgment has nothing to do with me.

Warren Buffett's famous quotes⑤

Chapter 5 | Market Perspectives

57 A downtrend with the surroundings shrinking is an opportunity

58 Pay attention to what happened

59 There is no such thing as a rumor that leads directly to a quick fortune.

60 Market is a place to check out ridiculous prices

61 Prepare for a crisis without warning

62 Human psychology influences investment.

63 Don't be overconfident in your abilities.

64 Maintain your composure in the market under any circumstances.

65. Understand the Internet and AI well.

66. When you actually invest, you face the market head-on.

Warren Buffett's Famous Quotes⑥

Chapter 6 | Developing Humane and Desirable Habits

67 Good habits are a great force for success.

68 Cherish your brain and body

69 Spend one hour a day on yourself

70. Adhere to the 'range of ability' in everyday life.

71 Say 'No' to things that are not important.

72 Be honest with yourself

73 Communication is the strongest weapon

74 'Greed' causes loss

75 Patience and cool-headedness are more important than knowledge.

Warren Buffett's Famous Quotes⑦

Chapter 7 | How to Get Along with Others

76 Let's have our own idol

77 Be close to people who are better than you.

78 It's fun to work with respectable people.

79 Hire excellent people and delegate work to them.

80 Work with great people regardless of age

81. Value connections with people.

82 Don't fight for the sake of fighting

83 Success in life can be measured by love.

Warren Buffett's Famous Quotes⑧

Chapter 8 | Philosophy for a Happier Life

84 How to Live Rich for a Long Time

85 Become a person worthy of success

86 Be grateful for your surroundings

87. Value the spirit of saving

88 Money is something that is temporarily held by society.

Living as one of the 89 1% lucky ones

90 Trust is more valuable than money.

Conclusion

-Efforts to increase one's own value

Let's live a rich life again and again

Appendix? Warren Buffett's Life

References

Detailed image

Into the book

While some aim for financial independence and early retirement, some also enjoy the "rich lifestyle."

Elon Musk, who founded SpaceX and other companies with a huge amount of his own money to 'save the world', said that in order to avoid turning into a devil in the pursuit of money, it is important to 'be clear about the purpose of where you spend your money'.

Warren Buffett started small businesses and investments with the hope of becoming rich from a young age, but the reason was 'self-reliance'.

He said this:

“You can become self-sufficient through that (small business and investment).

You can do whatever you want in life.

And it's best to work for yourself.

I don't want to be told what to do by others.

“I thought it was important to do what you wanted to do every day.” Warren Buffett sometimes asked his students this question.

“You don’t want to work just for the money, do you?” “You don’t want to do something you hate, do you?” “You want to feel excited when you leave the house every morning, do you?” Warren Buffett’s outlook on life is revealed in these questions.

Warren Buffett devotes all his energy to 'making money', but he has little interest in using the money he earns for himself, and he does not make money his only goal.

--- p.20

A stockbroker's main job is to earn commissions by trading stocks, but Warren Buffett recommended GEICO stocks, which he was obsessed with at the time, to his clients, and advised them, "The best thing to do is to hold on to them for 20 years without selling them."

This is a huge contradiction.

Buffett said he felt like a pharmacist and confided his concerns:

“You get paid according to the amount of medicine you sell.

Depending on the medicine, there are some that pay more.

But would any patient want to go to a doctor whose fee is determined by the amount of medicine he sells?” Warren Buffett said of the way brokerage firms recommend stocks with high turnover, using terms like “marketability” and “liquidity.”

“Investors must understand that just because the owner of a gambling establishment likes it, it doesn’t mean it’s good for the customers.

“The less someone can make your wallet fat, the more confident they will be in trying to inject something into you.” Although it is a somewhat harsh criticism, it can be said that the words reflect the bitter experience of being a stockbroker at the time.

--- p.38

Warren Buffett put it bluntly about his investment principles:

“Stock investing is simple and clear.

We discover outstanding companies led by honest and capable management and purchase their stocks at a price lower than their intrinsic value.

And you can hold it forever,” said Benjamin Graham, Warren Buffett’s mentor.

“Investors should hold onto their investments for about a year without thinking about it.” He recommended holding onto them for as long a period as possible rather than trading them in the short term.

However, in this respect, Buffett inherited the values of another mentor, Philip Fisher, rather than Graham.

Philip Fisher said:

“Instead of making a fuss with the idea of buying low and selling high, it is actually much more profitable for many people to find a truly excellent company and continue to hold its stock no matter how extreme the market fluctuations are.” If you have decided to hold stocks for the long term, you should naturally not be obsessed with the daily fluctuations of stock prices.

Rather, Warren Buffett believed that no matter how much the stock price fluctuated today, one should take the attitude of "it doesn't matter."

--- p.52

Although the company was on the verge of bankruptcy, the stock price was much lower than the corporate value, so he thought, 'I should buy it anyway since it's cheap.'

Afterwards, Warren Buffett made various efforts to rebuild the company, including injecting capital several times, but in 1985, 20 years later, he finally folded the textile division, laid off 400 workers, and sold all of the machinery and equipment for $160,000.

And Berkshire Hathaway continued to grow by changing its business to an investment company, and Warren Buffett recalled it as follows:

“If I hadn’t heard the name Berkshire Hathaway back then, I would be richer by now.” After this bitter experience, Buffett abandoned the “bargain” and “cigarette butt” methods of investing in companies with extremely low stock prices relative to their assets, and began to value companies with excellent business performance and excellent management, even if their stock prices were high relative to their assets.

In particular, attention was paid to ‘outstanding business potential.’

Warren Buffett said this:

“Even a skilled rider can win if he rides a fine horse, but he cannot win if he rides a horse with a broken bone.” Even if you have an excellent manager, it is difficult to rebuild a company if the business is not going well.

The secret to reducing risk and making a successful investment is to check whether the business is 'good'.

--- p.66

I said that risk can be reduced by following a few principles, but that doesn't mean there haven't been failures in the past.

There have been several failures, including the acquisition of Berkshire Hathaway, and there have also been instances of missed purchase timing, such as not investing in Fannie Mae (the Federal Housing Mortgage Corporation) and Walmart.

However, Warren Buffett believes that it is impossible to avoid making mistakes in investment judgments, and he said the following:

“It is natural for humans to fail, so there is no need to fret and groan.

Because it doesn't mean anything anyway.

Tomorrow will come, so you have to be positive and think about what to do next.” Anyone can't help but feel discouraged when they fail.

But why did Buffett say we should think positively?

When Warren Buffett makes investments, he doesn't let other people's opinions influence him. He researches and thinks for himself, and only then makes a decision based on his own convictions.

He said this:

--- p.86

Rather than increasing risk by investing in difficult businesses, you should invest in simple businesses that you know and understand well.

But investing isn't a competition like baseball, where you don't need to churn out hits or aim for long hits to become the home run king.

When you stand at the plate, you just have to swing the bat when the ball you're aiming for comes your way.

Walter Schloss, a friend of Warren Buffett, dug up the necessary indicators in books and looked through annual reports, believing, "If I can buy a business worth $1 for 40 cents, something good might happen to me," and diversified his investments across more than 100 stocks.

Schloss faithfully repeated this method and succeeded in achieving excellent operating results.

Buffett praised Schloss, saying, “We should all emulate Walter’s management style.”

Elon Musk, who founded SpaceX and other companies with a huge amount of his own money to 'save the world', said that in order to avoid turning into a devil in the pursuit of money, it is important to 'be clear about the purpose of where you spend your money'.

Warren Buffett started small businesses and investments with the hope of becoming rich from a young age, but the reason was 'self-reliance'.

He said this:

“You can become self-sufficient through that (small business and investment).

You can do whatever you want in life.

And it's best to work for yourself.

I don't want to be told what to do by others.

“I thought it was important to do what you wanted to do every day.” Warren Buffett sometimes asked his students this question.

“You don’t want to work just for the money, do you?” “You don’t want to do something you hate, do you?” “You want to feel excited when you leave the house every morning, do you?” Warren Buffett’s outlook on life is revealed in these questions.

Warren Buffett devotes all his energy to 'making money', but he has little interest in using the money he earns for himself, and he does not make money his only goal.

--- p.20

A stockbroker's main job is to earn commissions by trading stocks, but Warren Buffett recommended GEICO stocks, which he was obsessed with at the time, to his clients, and advised them, "The best thing to do is to hold on to them for 20 years without selling them."

This is a huge contradiction.

Buffett said he felt like a pharmacist and confided his concerns:

“You get paid according to the amount of medicine you sell.

Depending on the medicine, there are some that pay more.

But would any patient want to go to a doctor whose fee is determined by the amount of medicine he sells?” Warren Buffett said of the way brokerage firms recommend stocks with high turnover, using terms like “marketability” and “liquidity.”

“Investors must understand that just because the owner of a gambling establishment likes it, it doesn’t mean it’s good for the customers.

“The less someone can make your wallet fat, the more confident they will be in trying to inject something into you.” Although it is a somewhat harsh criticism, it can be said that the words reflect the bitter experience of being a stockbroker at the time.

--- p.38

Warren Buffett put it bluntly about his investment principles:

“Stock investing is simple and clear.

We discover outstanding companies led by honest and capable management and purchase their stocks at a price lower than their intrinsic value.

And you can hold it forever,” said Benjamin Graham, Warren Buffett’s mentor.

“Investors should hold onto their investments for about a year without thinking about it.” He recommended holding onto them for as long a period as possible rather than trading them in the short term.

However, in this respect, Buffett inherited the values of another mentor, Philip Fisher, rather than Graham.

Philip Fisher said:

“Instead of making a fuss with the idea of buying low and selling high, it is actually much more profitable for many people to find a truly excellent company and continue to hold its stock no matter how extreme the market fluctuations are.” If you have decided to hold stocks for the long term, you should naturally not be obsessed with the daily fluctuations of stock prices.

Rather, Warren Buffett believed that no matter how much the stock price fluctuated today, one should take the attitude of "it doesn't matter."

--- p.52

Although the company was on the verge of bankruptcy, the stock price was much lower than the corporate value, so he thought, 'I should buy it anyway since it's cheap.'

Afterwards, Warren Buffett made various efforts to rebuild the company, including injecting capital several times, but in 1985, 20 years later, he finally folded the textile division, laid off 400 workers, and sold all of the machinery and equipment for $160,000.

And Berkshire Hathaway continued to grow by changing its business to an investment company, and Warren Buffett recalled it as follows:

“If I hadn’t heard the name Berkshire Hathaway back then, I would be richer by now.” After this bitter experience, Buffett abandoned the “bargain” and “cigarette butt” methods of investing in companies with extremely low stock prices relative to their assets, and began to value companies with excellent business performance and excellent management, even if their stock prices were high relative to their assets.

In particular, attention was paid to ‘outstanding business potential.’

Warren Buffett said this:

“Even a skilled rider can win if he rides a fine horse, but he cannot win if he rides a horse with a broken bone.” Even if you have an excellent manager, it is difficult to rebuild a company if the business is not going well.

The secret to reducing risk and making a successful investment is to check whether the business is 'good'.

--- p.66

I said that risk can be reduced by following a few principles, but that doesn't mean there haven't been failures in the past.

There have been several failures, including the acquisition of Berkshire Hathaway, and there have also been instances of missed purchase timing, such as not investing in Fannie Mae (the Federal Housing Mortgage Corporation) and Walmart.

However, Warren Buffett believes that it is impossible to avoid making mistakes in investment judgments, and he said the following:

“It is natural for humans to fail, so there is no need to fret and groan.

Because it doesn't mean anything anyway.

Tomorrow will come, so you have to be positive and think about what to do next.” Anyone can't help but feel discouraged when they fail.

But why did Buffett say we should think positively?

When Warren Buffett makes investments, he doesn't let other people's opinions influence him. He researches and thinks for himself, and only then makes a decision based on his own convictions.

He said this:

--- p.86

Rather than increasing risk by investing in difficult businesses, you should invest in simple businesses that you know and understand well.

But investing isn't a competition like baseball, where you don't need to churn out hits or aim for long hits to become the home run king.

When you stand at the plate, you just have to swing the bat when the ball you're aiming for comes your way.

Walter Schloss, a friend of Warren Buffett, dug up the necessary indicators in books and looked through annual reports, believing, "If I can buy a business worth $1 for 40 cents, something good might happen to me," and diversified his investments across more than 100 stocks.

Schloss faithfully repeated this method and succeeded in achieving excellent operating results.

Buffett praised Schloss, saying, “We should all emulate Walter’s management style.”

--- p.126

Publisher's Review

Don't be overly reliant on stock prices

The market is a quantity sum in the short term, but

In the long run, it's the sum of weights

It was his mentor, Benjamin Graham, who taught Warren Buffett the importance of a long-term perspective.

Graham taught Buffett that investing meant owning a piece of a business and that margins of safety were paramount.

And another important lesson is that 'the stock market is a quantity sum in the short term, but a weight sum in the long term.'

It became a famous saying because Buffett often used it to accurately describe the market.

These days, there is a tendency to place importance on market capitalization and evaluate companies with high market capitalization as good companies.

Of course, a high stock price means that the market values the company, but it's important to note that stock prices don't always accurately reflect the company's value.

When the IT bubble burst in 2000, Amazon, then a leading company, also suffered a harsh blow, with its stock price falling to less than a tenth of its original value in less than a year.

At the time, Amazon's shareholders and employees were also agitated, but founder Jeff Bezos quoted the saying, "In the short term, it's the sum of quantity, but in the long term, it's the sum of weight," and urged them not to be swayed by stock price fluctuations, but to focus on doing what they had to do and faithfully creating services.

As a result, Amazon was able to grow into a huge company.

“If you want to be successful, act like you already are.”

Mike Markkula, Apple's first angel investor

You have to make an effort to develop good habits.

If you act without regard to means and methods in the process of becoming successful and making money, or if you incur people's hatred, you will only become a 'funny rich person'.

Charlie Munger, Warren Buffett's partner, has been working hard since he was young with the single-minded goal of becoming rich. Even then, he always kept in mind that "the best way to avoid people's envy is to make yourself worthy of success."

Charlie Munger is said to have evaluated Warren Buffett like this.

“It is a great asset to grow up with the right values from birth.

This also makes financial sense.” Warren Buffett inherited the right values and morals from his parents and has tried to instill good habits in him since childhood.

Financially, he also had a goal of 'wanting to become rich', but he hated extravagance and did not have the sinister attitude of 'I will do anything for money'.

If you want to become a wealthy person admired by everyone, you must cultivate the right values and good habits.

Only then can you be 'respected' by others.

Even foolish people can run a good company.

A representative example of growth is Coca-Cola.

When studying Warren Buffett's investment strategy, the easiest case to understand is Coca-Cola.

Warren Buffett is a person who basically invests with the premise of long-term holding, and he first invested in Coca-Cola in 1988, so he has held it for over 36 years.

And it always ranks high among Berkshire Hathaway's holdings.

According to Warren Buffett, if someone who bought Coca-Cola at $40 when it went public in 1919 had reinvested all of the dividends, it would be worth $1.8 million by 1982.

Likewise, if you purchased it for 10 million won in 1977 and reinvested all dividends, it would be worth over 2 billion won in 2021, which is surprising.

This company is truly a model example of strong brand power and long-term growth.

Regarding this, Warren Buffett quoted Microsoft founder Bill Gates, saying, “Coca-Cola could be run by a ham sandwich man.”

A company isn't always perfect, and sometimes incompetent managers make big mistakes, but Coca-Cola's strength is that it can grow again.

'If you're going to buy stocks, buy stocks of good companies that even a fool can manage' is one of Warren Buffett's key principles.

The market is a quantity sum in the short term, but

In the long run, it's the sum of weights

It was his mentor, Benjamin Graham, who taught Warren Buffett the importance of a long-term perspective.

Graham taught Buffett that investing meant owning a piece of a business and that margins of safety were paramount.

And another important lesson is that 'the stock market is a quantity sum in the short term, but a weight sum in the long term.'

It became a famous saying because Buffett often used it to accurately describe the market.

These days, there is a tendency to place importance on market capitalization and evaluate companies with high market capitalization as good companies.

Of course, a high stock price means that the market values the company, but it's important to note that stock prices don't always accurately reflect the company's value.

When the IT bubble burst in 2000, Amazon, then a leading company, also suffered a harsh blow, with its stock price falling to less than a tenth of its original value in less than a year.

At the time, Amazon's shareholders and employees were also agitated, but founder Jeff Bezos quoted the saying, "In the short term, it's the sum of quantity, but in the long term, it's the sum of weight," and urged them not to be swayed by stock price fluctuations, but to focus on doing what they had to do and faithfully creating services.

As a result, Amazon was able to grow into a huge company.

“If you want to be successful, act like you already are.”

Mike Markkula, Apple's first angel investor

You have to make an effort to develop good habits.

If you act without regard to means and methods in the process of becoming successful and making money, or if you incur people's hatred, you will only become a 'funny rich person'.

Charlie Munger, Warren Buffett's partner, has been working hard since he was young with the single-minded goal of becoming rich. Even then, he always kept in mind that "the best way to avoid people's envy is to make yourself worthy of success."

Charlie Munger is said to have evaluated Warren Buffett like this.

“It is a great asset to grow up with the right values from birth.

This also makes financial sense.” Warren Buffett inherited the right values and morals from his parents and has tried to instill good habits in him since childhood.

Financially, he also had a goal of 'wanting to become rich', but he hated extravagance and did not have the sinister attitude of 'I will do anything for money'.

If you want to become a wealthy person admired by everyone, you must cultivate the right values and good habits.

Only then can you be 'respected' by others.

Even foolish people can run a good company.

A representative example of growth is Coca-Cola.

When studying Warren Buffett's investment strategy, the easiest case to understand is Coca-Cola.

Warren Buffett is a person who basically invests with the premise of long-term holding, and he first invested in Coca-Cola in 1988, so he has held it for over 36 years.

And it always ranks high among Berkshire Hathaway's holdings.

According to Warren Buffett, if someone who bought Coca-Cola at $40 when it went public in 1919 had reinvested all of the dividends, it would be worth $1.8 million by 1982.

Likewise, if you purchased it for 10 million won in 1977 and reinvested all dividends, it would be worth over 2 billion won in 2021, which is surprising.

This company is truly a model example of strong brand power and long-term growth.

Regarding this, Warren Buffett quoted Microsoft founder Bill Gates, saying, “Coca-Cola could be run by a ham sandwich man.”

A company isn't always perfect, and sometimes incompetent managers make big mistakes, but Coca-Cola's strength is that it can grow again.

'If you're going to buy stocks, buy stocks of good companies that even a fool can manage' is one of Warren Buffett's key principles.

GOODS SPECIFICS

- Date of issue: October 29, 2025

- Page count, weight, size: 232 pages | 436g | 153*225*14mm

- ISBN13: 9788965023579

- ISBN10: 8965023572

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)