Wealth Strategy Class

|

Description

Book Introduction

- A word from MD

-

Money is never stableIs money truly a tool for freedom? Financial expert and author Paul Podolsky argues that money actually traps us in a cycle of anxiety.

To achieve true wealth, you must first change the way you view money.

This book offers sharp insights into how to balance money, career, and life.

May 13, 2025. Economics and Management PD Oh Da-eun

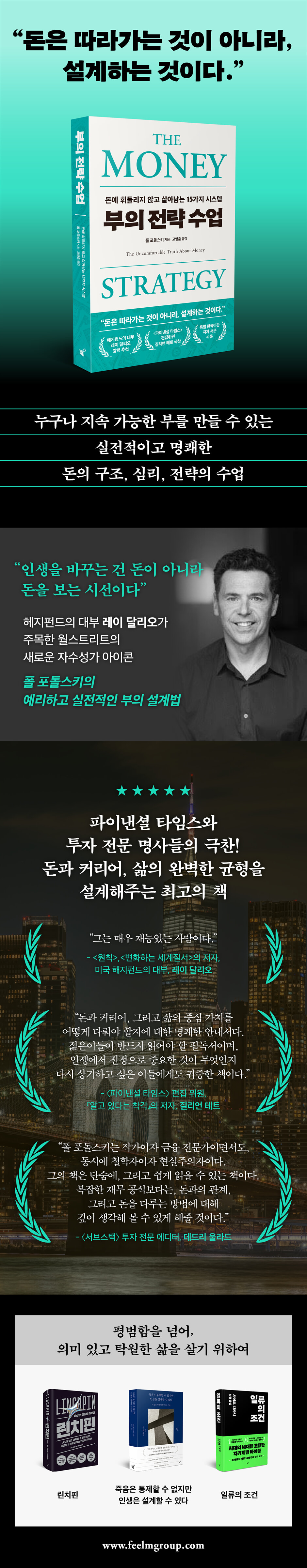

“Money isn’t something you follow, it’s something you design.”

Ray Dalio, the hedge fund tycoon, has taken notice.

Self-made icon Paul Podolski

Anyone can create sustainable wealth

A practical and clear lesson on the structure, psychology, and strategy of money.

"Strategy Lessons in Wealth" is a book filled with sharp and practical insights into the wealth of Paul Podolsky, a new self-made icon on Wall Street who has drawn the attention of hedge fund magnate Ray Dalio.

We all want wealth, but it is not easy to obtain.

The world, which changes rapidly every day, makes investment uncertain, and the constantly fluctuating values of assets make it difficult to predict the future.

And this anxiety actually increases as money increases.

Our desire to earn more is endless, and satisfaction becomes increasingly distant.

The problem now is not money itself, but our attitude toward money.

《Strategy Class for Wealth》 explores how to build sustainable wealth, not just get rich quick.

It shows how money rules our lives and how we can become masters of our money.

Beyond simply making money, it teaches you how to manage money and strategies for maintaining wealth.

This book goes beyond financial technology and fundamentally changes your perspective on money and life.

Through core principles and practical strategies for achieving financial freedom, readers can become masters of their money, not its controllers.

Do you want sustainable wealth? If so, it's time to change your perspective on money.

Ray Dalio, the hedge fund tycoon, has taken notice.

Self-made icon Paul Podolski

Anyone can create sustainable wealth

A practical and clear lesson on the structure, psychology, and strategy of money.

"Strategy Lessons in Wealth" is a book filled with sharp and practical insights into the wealth of Paul Podolsky, a new self-made icon on Wall Street who has drawn the attention of hedge fund magnate Ray Dalio.

We all want wealth, but it is not easy to obtain.

The world, which changes rapidly every day, makes investment uncertain, and the constantly fluctuating values of assets make it difficult to predict the future.

And this anxiety actually increases as money increases.

Our desire to earn more is endless, and satisfaction becomes increasingly distant.

The problem now is not money itself, but our attitude toward money.

《Strategy Class for Wealth》 explores how to build sustainable wealth, not just get rich quick.

It shows how money rules our lives and how we can become masters of our money.

Beyond simply making money, it teaches you how to manage money and strategies for maintaining wealth.

This book goes beyond financial technology and fundamentally changes your perspective on money and life.

Through core principles and practical strategies for achieving financial freedom, readers can become masters of their money, not its controllers.

Do you want sustainable wealth? If so, it's time to change your perspective on money.

- You can preview some of the book's contents.

Preview

index

Chapter 1.

The shackles of money

Chapter 2.

Constant confusion and change

Chapter 3.

earnings

Chapter 4.

price

Chapter 5.

Hierarchy

Chapter 6.

Surviving in an organization

Chapter 7.

Prepare for the risks that may arise in life.

Chapter 8.

fan

Chapter 9.

source of money

Chapter 10.

Types of assets

Chapter 11.

portfolio

Chapter 12.

Various investment philosophies

Chapter 13.

When to stop working

Chapter 14.

Snipers targeting you

Chapter 15.

slogan

The shackles of money

Chapter 2.

Constant confusion and change

Chapter 3.

earnings

Chapter 4.

price

Chapter 5.

Hierarchy

Chapter 6.

Surviving in an organization

Chapter 7.

Prepare for the risks that may arise in life.

Chapter 8.

fan

Chapter 9.

source of money

Chapter 10.

Types of assets

Chapter 11.

portfolio

Chapter 12.

Various investment philosophies

Chapter 13.

When to stop working

Chapter 14.

Snipers targeting you

Chapter 15.

slogan

Detailed image

Into the book

I was standing on a sidewalk in Brooklyn, holding my three-year-old son, Sasha, and watching a swarm of rats leisurely scurry back and forth between the entrance to our building and the trash heap, when it suddenly occurred to me, 'Paul, this isn't right.

I thought, 'Something needs to change quickly.'

I didn't want to raise my children among rats.

But I didn't have enough money to move house.

The long journey to where I am today began then, and this book systematically organizes lessons about money so that even readers like me who had no idea how money worked could easily understand them.

--- From "Chapter 1: The Shackles of Money"

At that moment, I realized that although I had been living my whole life with the idea that I would never have enough money, that didn't have to be the case.

You could choose, just like Rob did.

We moved to another bar while still drunk.

And as the night deepened and I was walking back to the hotel, I suddenly thought back to the past.

When was the first time I saw someone who was significantly wealthier than me? It was probably at school.

I started thinking of places that rich people often mention.

Vail, a luxury ski resort in Colorado, USA; Florence, full of Italian art and history; Opera, a symbol of upper-class culture; and Martha's Vineyard, famous as a vacation spot for the wealthy on the eastern coast of the United States.

The rich spent their time in places like this.

If Rob can go, can't I go too?

--- From "Chapter 3: Income"

Whichever path you choose, you need to have a clear understanding of how the system works.

You should choose a game that will naturally give you an advantage.

The hierarchical structure must be analyzed.

We exist within a hierarchy in some form.

Then you have to choose the class you want.

And you have to make sure that class will accept you.

--- From "Chapter 5: Hierarchy"

Once you have a job, save some money, and even build up an emergency fund, you will naturally start to think about debt.

I was like that too.

But the debt we're talking about here isn't something like credit card debt.

Credit card debt is really dangerous, and I want you to follow just one rule:

Never go into credit card debt.

I use a credit card, but it's just a convenience tool and I pay it off in full every month.

Credit card companies prey on the financially vulnerable.

Don't be the target.

--- From "Chapter 8: Debt"

Do you want to spend your life in such an uncertain and painful investment environment? I did, but maybe you can do it differently.

If so, follow the 'buy, hold, and rebalance regularly' strategy.

If I do that, I can be one step ahead of my father and grandfather.

--- From "Chapter 11: Portfolio"

You have to find your own balance between what lifestyle you choose and where you spend your money.

I have been unhappy because I was poor.

Even now, there are moments when I feel anxious about the numbers in my bank account disappearing or about getting sick when I get old.

So I always try to handle money calmly and carefully.

At the same time, it leaves plenty of room for wonder and delight.

And I try to find balance every day.

I thought, 'Something needs to change quickly.'

I didn't want to raise my children among rats.

But I didn't have enough money to move house.

The long journey to where I am today began then, and this book systematically organizes lessons about money so that even readers like me who had no idea how money worked could easily understand them.

--- From "Chapter 1: The Shackles of Money"

At that moment, I realized that although I had been living my whole life with the idea that I would never have enough money, that didn't have to be the case.

You could choose, just like Rob did.

We moved to another bar while still drunk.

And as the night deepened and I was walking back to the hotel, I suddenly thought back to the past.

When was the first time I saw someone who was significantly wealthier than me? It was probably at school.

I started thinking of places that rich people often mention.

Vail, a luxury ski resort in Colorado, USA; Florence, full of Italian art and history; Opera, a symbol of upper-class culture; and Martha's Vineyard, famous as a vacation spot for the wealthy on the eastern coast of the United States.

The rich spent their time in places like this.

If Rob can go, can't I go too?

--- From "Chapter 3: Income"

Whichever path you choose, you need to have a clear understanding of how the system works.

You should choose a game that will naturally give you an advantage.

The hierarchical structure must be analyzed.

We exist within a hierarchy in some form.

Then you have to choose the class you want.

And you have to make sure that class will accept you.

--- From "Chapter 5: Hierarchy"

Once you have a job, save some money, and even build up an emergency fund, you will naturally start to think about debt.

I was like that too.

But the debt we're talking about here isn't something like credit card debt.

Credit card debt is really dangerous, and I want you to follow just one rule:

Never go into credit card debt.

I use a credit card, but it's just a convenience tool and I pay it off in full every month.

Credit card companies prey on the financially vulnerable.

Don't be the target.

--- From "Chapter 8: Debt"

Do you want to spend your life in such an uncertain and painful investment environment? I did, but maybe you can do it differently.

If so, follow the 'buy, hold, and rebalance regularly' strategy.

If I do that, I can be one step ahead of my father and grandfather.

--- From "Chapter 11: Portfolio"

You have to find your own balance between what lifestyle you choose and where you spend your money.

I have been unhappy because I was poor.

Even now, there are moments when I feel anxious about the numbers in my bank account disappearing or about getting sick when I get old.

So I always try to handle money calmly and carefully.

At the same time, it leaves plenty of room for wonder and delight.

And I try to find balance every day.

--- From "Chapter 14: Snipers Aiming at You"

Publisher's Review

“Money, a tool of freedom? Or a shackle?”

Only those who understand the nature of money can accumulate wealth.

From birth to death, money is involved in every moment of our lives.

So the sooner we realize the true nature of money, the wiser we can build wealth.

The world is changing at an ever-faster pace, but the fundamental principles of how money works remain unchanged.

A proper understanding of money is the most effective weapon for navigating uncertain times.

Most of us spend our entire lives being driven by money.

In particular, I feel a sense of awe at the size and speed of the money.

But the moment you learn the truth about money, it is no longer a chain, but a tool for freedom.

Of course, the process will not be easy.

But the moment we face the painful reality we've been ignoring, we'll be able to break free from the shackles of money, look at money with a free attitude, and accumulate wealth.

“What does it mean to be good with money?”

The Reality of Money We've Been Ignoring

Being good with money isn't just about accumulating a lot of knowledge.

What really matters is 'how' you make money.

Making a lot of money alone is not enough to build sustainable wealth.

Surprisingly, the answer to this 'how' can be found not in books or lectures, but in our lives itself.

Like the author who found financial freedom after living in a rat-infested neighborhood.

Author Paul Podolski once lived aimlessly and in poverty, but the moment he understood the mechanics of money, his life began to change completely.

I was able to clearly define what kind of life I wanted to live, and I started to gradually build up my wealth.

Also, as he gained some freedom and purpose in life, he chose to become a writer as his second career, and his life began to become richer as a result.

Once I accepted the painful truth about money that I had been ignoring, the direction of my life was naturally determined.

And this book is a book that organizes the process of accumulating wealth.

“Money doesn’t provide security.”

The Secrets of Life Revealed by a Wall Street Strategist

Author Paul Podolsky included 15 stories about money in this book.

Particularly noteworthy among them are stories about people who are naturally good at handling money, such as Ray Dalio.

What they have in common is that they are not good at expressing their emotions, but they are good at analytical thinking.

But unfortunately, very few people are born with this temperament.

The author is the same.

So, he considered 'calmness' and 'strategic thinking' to be the most important virtues in learning how to handle money.

If you don't want to be swayed by money, you shouldn't be swayed by emotions.

To move steadily toward your goals, you must maintain "calmness" to control your emotions, and "strategic thinking" to calmly assess your starting point and achieve your goals one by one.

The author finally found stability in life by practicing these two things.

Although the author is now a successful writer and investment expert on Wall Street, he started out as a bicycle messenger.

Then one day, he was faced with the reality that he and his family were living in a rat-infested neighborhood, and he desperately needed more money.

But he was not impatient.

After calmly developing a strategy, he entered the financial industry by working as a banker, and later built a career in the hedge fund industry, becoming the founder of an asset management company.

That doesn't mean he's completely free from money.

However, he now views money as a tool rather than a goal in life.

Now that he has realized what money is in life, he just thinks about a better life and sees money as just a means to that end.

I hope that readers of this book will also understand the true nature of money and build wealth that will make their lives safe and happy.

Only those who understand the nature of money can accumulate wealth.

From birth to death, money is involved in every moment of our lives.

So the sooner we realize the true nature of money, the wiser we can build wealth.

The world is changing at an ever-faster pace, but the fundamental principles of how money works remain unchanged.

A proper understanding of money is the most effective weapon for navigating uncertain times.

Most of us spend our entire lives being driven by money.

In particular, I feel a sense of awe at the size and speed of the money.

But the moment you learn the truth about money, it is no longer a chain, but a tool for freedom.

Of course, the process will not be easy.

But the moment we face the painful reality we've been ignoring, we'll be able to break free from the shackles of money, look at money with a free attitude, and accumulate wealth.

“What does it mean to be good with money?”

The Reality of Money We've Been Ignoring

Being good with money isn't just about accumulating a lot of knowledge.

What really matters is 'how' you make money.

Making a lot of money alone is not enough to build sustainable wealth.

Surprisingly, the answer to this 'how' can be found not in books or lectures, but in our lives itself.

Like the author who found financial freedom after living in a rat-infested neighborhood.

Author Paul Podolski once lived aimlessly and in poverty, but the moment he understood the mechanics of money, his life began to change completely.

I was able to clearly define what kind of life I wanted to live, and I started to gradually build up my wealth.

Also, as he gained some freedom and purpose in life, he chose to become a writer as his second career, and his life began to become richer as a result.

Once I accepted the painful truth about money that I had been ignoring, the direction of my life was naturally determined.

And this book is a book that organizes the process of accumulating wealth.

“Money doesn’t provide security.”

The Secrets of Life Revealed by a Wall Street Strategist

Author Paul Podolsky included 15 stories about money in this book.

Particularly noteworthy among them are stories about people who are naturally good at handling money, such as Ray Dalio.

What they have in common is that they are not good at expressing their emotions, but they are good at analytical thinking.

But unfortunately, very few people are born with this temperament.

The author is the same.

So, he considered 'calmness' and 'strategic thinking' to be the most important virtues in learning how to handle money.

If you don't want to be swayed by money, you shouldn't be swayed by emotions.

To move steadily toward your goals, you must maintain "calmness" to control your emotions, and "strategic thinking" to calmly assess your starting point and achieve your goals one by one.

The author finally found stability in life by practicing these two things.

Although the author is now a successful writer and investment expert on Wall Street, he started out as a bicycle messenger.

Then one day, he was faced with the reality that he and his family were living in a rat-infested neighborhood, and he desperately needed more money.

But he was not impatient.

After calmly developing a strategy, he entered the financial industry by working as a banker, and later built a career in the hedge fund industry, becoming the founder of an asset management company.

That doesn't mean he's completely free from money.

However, he now views money as a tool rather than a goal in life.

Now that he has realized what money is in life, he just thinks about a better life and sees money as just a means to that end.

I hope that readers of this book will also understand the true nature of money and build wealth that will make their lives safe and happy.

GOODS SPECIFICS

- Date of issue: May 7, 2025

- Page count, weight, size: 320 pages | 140*210*25mm

- ISBN13: 9791193262474

- ISBN10: 119326247X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)