Mastering Monthly Dividend ETF Financial Statements

|

Description

Book Introduction

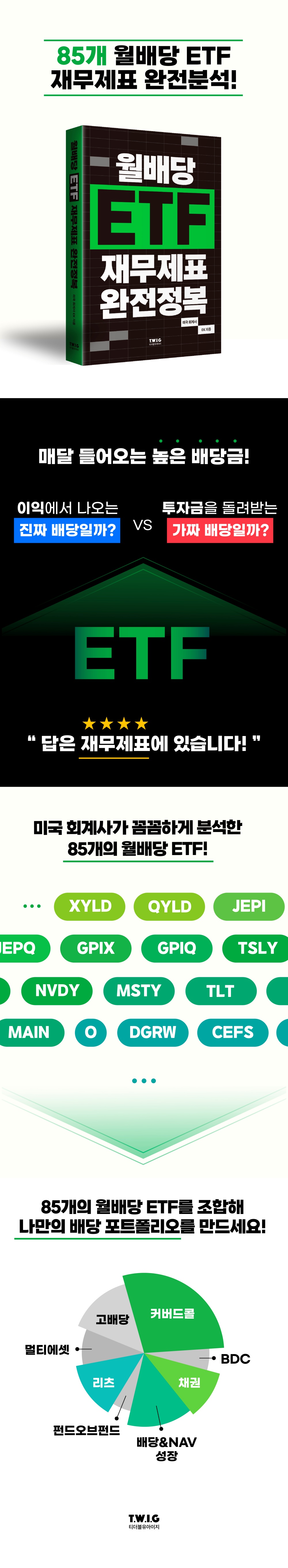

Monthly dividend ETFs are very popular.

But which of the numerous monthly dividend ETFs should you choose?

Some monthly dividend ETFs tempt investors with double-digit dividend yields.

However, it is important to carefully consider whether the source of high dividends is profits from excellent performance or return of capital.

What you need at this time is financial statements.

Financial statements provide a clear understanding of the profits and losses generated by an ETF and the amount of dividends distributed to investors.

This book introduces the management strategies of 85 monthly dividend ETFs listed on the U.S. market and analyzes their financial statements for the past 10 years.

By selecting ETFs that fit your investment style and goals and building a portfolio, anyone can create a second paycheck that's more substantial than their regular salary.

But which of the numerous monthly dividend ETFs should you choose?

Some monthly dividend ETFs tempt investors with double-digit dividend yields.

However, it is important to carefully consider whether the source of high dividends is profits from excellent performance or return of capital.

What you need at this time is financial statements.

Financial statements provide a clear understanding of the profits and losses generated by an ETF and the amount of dividends distributed to investors.

This book introduces the management strategies of 85 monthly dividend ETFs listed on the U.S. market and analyzes their financial statements for the past 10 years.

By selecting ETFs that fit your investment style and goals and building a portfolio, anyone can create a second paycheck that's more substantial than their regular salary.

- You can preview some of the book's contents.

Preview

index

prolog

PART 1. The First Step to ETF Investing

Basic concepts of ETFs

- Funds and ETFs

- Asset management company and total compensation

- Passive Management VS Active Management

- ETF AUM

- NAV and gap rate

- Closed-end funds

PART 2.

Covered call ETFs that pay monthly dividends

Basic Concepts of Covered Call ETFs

- Understanding options

- Covered call strategy

In-Depth Analysis of Major Covered Call ETFs

- Underlying Assets_ Major Indices

- Underlying Assets_ Individual Stocks & Coins

PART 3.

High-dividend ETFs that pay monthly dividends

Basic Concepts of High-Dividend ETFs

In-Depth Analysis of Major High-Dividend ETFs

- High-dividend stocks

- High-dividend stocks and bonds

- High-dividend stocks and covered call strategies

PART 4.

Bond ETFs that pay monthly dividends

Basic Concepts of Bond ETFs

- Understanding bonds

- The relationship between bond prices and interest rates

- Bond stability and credit rating

- Bond thermometer, duration

- Credit risk and interest rate risk

- Bond ETFs

In-Depth Analysis of Major Bond ETFs

- Investment grade bonds

- Speculative grade bonds

- Multi-sector

- Selling bonds and options

PART 5.

REITs that pay monthly dividends

Basic concept of REITs

In-Depth Analysis of Major REITs

- Ritz

- REIT ETF

PART 6.

BDC that pays monthly dividends

Basic concepts of BDC

In-depth analysis of major BDCs

PART 7.

MLPs that pay monthly dividends

Basic concepts of MLP

In-Depth Analysis of Major MLP ETFs

PART 8.

Multi-asset ETFs and fund-of-funds ETFs that pay monthly dividends

Basic Concepts of Multi-Asset ETFs

In-Depth Analysis of Major Multi-Asset ETFs

Fund of Funds ETF Basic Concepts

In-Depth Analysis of Major Fund-of-Fund ETFs

PART 9.

Dividend & NAV Growth ETFs that pay monthly dividends

Basic Concepts of Dividend & NAV Growth ETFs

In-Depth Analysis of Major Dividend & NAV Growth ETFs

PART 10.

Complete your portfolio

7 Traps Investors Can Fall Into

- The trap of focusing only on specific sectors and strategies

- The pitfalls of only using new ETFs

- The trap of only including ETFs with high dividend yields

- The trap of only composing ETFs with high interest rate sensitivity

- The trap of only investing in high-volatility ETFs

- The pitfall of only ETFs with small assets under management

- The trap of only investing in ETFs with high total fees

- Summary

Epilogue

PART 1. The First Step to ETF Investing

Basic concepts of ETFs

- Funds and ETFs

- Asset management company and total compensation

- Passive Management VS Active Management

- ETF AUM

- NAV and gap rate

- Closed-end funds

PART 2.

Covered call ETFs that pay monthly dividends

Basic Concepts of Covered Call ETFs

- Understanding options

- Covered call strategy

In-Depth Analysis of Major Covered Call ETFs

- Underlying Assets_ Major Indices

- Underlying Assets_ Individual Stocks & Coins

PART 3.

High-dividend ETFs that pay monthly dividends

Basic Concepts of High-Dividend ETFs

In-Depth Analysis of Major High-Dividend ETFs

- High-dividend stocks

- High-dividend stocks and bonds

- High-dividend stocks and covered call strategies

PART 4.

Bond ETFs that pay monthly dividends

Basic Concepts of Bond ETFs

- Understanding bonds

- The relationship between bond prices and interest rates

- Bond stability and credit rating

- Bond thermometer, duration

- Credit risk and interest rate risk

- Bond ETFs

In-Depth Analysis of Major Bond ETFs

- Investment grade bonds

- Speculative grade bonds

- Multi-sector

- Selling bonds and options

PART 5.

REITs that pay monthly dividends

Basic concept of REITs

In-Depth Analysis of Major REITs

- Ritz

- REIT ETF

PART 6.

BDC that pays monthly dividends

Basic concepts of BDC

In-depth analysis of major BDCs

PART 7.

MLPs that pay monthly dividends

Basic concepts of MLP

In-Depth Analysis of Major MLP ETFs

PART 8.

Multi-asset ETFs and fund-of-funds ETFs that pay monthly dividends

Basic Concepts of Multi-Asset ETFs

In-Depth Analysis of Major Multi-Asset ETFs

Fund of Funds ETF Basic Concepts

In-Depth Analysis of Major Fund-of-Fund ETFs

PART 9.

Dividend & NAV Growth ETFs that pay monthly dividends

Basic Concepts of Dividend & NAV Growth ETFs

In-Depth Analysis of Major Dividend & NAV Growth ETFs

PART 10.

Complete your portfolio

7 Traps Investors Can Fall Into

- The trap of focusing only on specific sectors and strategies

- The pitfalls of only using new ETFs

- The trap of only including ETFs with high dividend yields

- The trap of only composing ETFs with high interest rate sensitivity

- The trap of only investing in high-volatility ETFs

- The pitfall of only ETFs with small assets under management

- The trap of only investing in ETFs with high total fees

- Summary

Epilogue

Detailed image

Publisher's Review

Are you still investing in monthly dividend ETFs solely based on their high dividend yields? If you don't verify whether the dividends are "true dividends" derived from profits or "fake dividends" that return the principal, the stock price may fall by the amount of the dividends received, resulting in no real return.

This book, meticulously analyzed by an American accountant, will help you achieve both dividend income and stock price appreciation by selectively investing in dividend-paying ETFs!

This book, meticulously analyzed by an American accountant, will help you achieve both dividend income and stock price appreciation by selectively investing in dividend-paying ETFs!

GOODS SPECIFICS

- Date of issue: September 25, 2025

- Page count, weight, size: 424 pages | 152*225*24mm

- ISBN13: 9791191590357

- ISBN10: 1191590356

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)