The All-Round Investment of a Tech Farmer

|

Description

Book Introduction

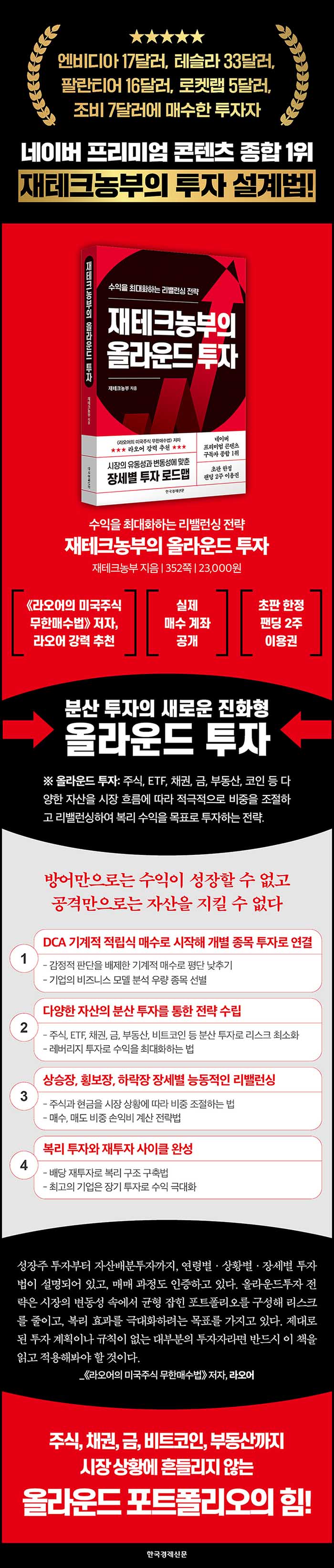

Nvidia $17, Tesla $33,

Buy Palantir at $16, Rocket Lab at $5, and Joby at $7!

How did he manage to buy big tech companies at such low prices?

The all-round investment method of the No. 1 Naver subscriber, Jae-tech Farmer!

From lump-sum buying to leveraged investing and rebalancing methods

An all-round investor prepares for all market conditions!

Before COVID-19, a 1% drop in the Nasdaq would have triggered fear, but now a 2% plunge is routine, and extreme volatility has even emerged, with a 12% surge in a single day.

Moreover, all these changes, including the synchronization of global assets linked to U.S. stocks, Korean stocks, and Bitcoin, are dispelling conventional investment wisdom.

Investment strategies that rely solely on specific countries or sectors are no longer viable, and a new approach that allows for flexible asset diversification in line with economic trends is urgently needed.

In this chaos, the solution suggested by Jaetech Farmer, who holds the number one spot in total Naver Premium subscribers, is "all-round investment."

Just as an all-rounder is a player who can take on multiple roles in sports, it is also a strategy in investment that flexibly responds to various assets.

The key is to flexibly allocate assets without distinguishing between rising and falling markets and maintain a compound interest structure.

If an interest rate cut is expected, the portfolio is actively rebalanced by increasing the bond weight, and if the outlook for the AI sector is good, the weight of the sector is increased.

At this time, in addition to stocks, gold, and bonds, real estate and Bitcoin are also included in the rebalancing strategy.

The goal of an all-round investment approach is to actively generate performance by using a variety of strategies without being limited by market conditions or asset types.

The author's message is that you can create more robust returns by protecting your assets in a bear market, identifying opportunities, and betting on growth industries during a rebound.

In these unpredictable times, an all-round investment strategy that prepares for all situations will guide you toward greater wealth creation.

Buy Palantir at $16, Rocket Lab at $5, and Joby at $7!

How did he manage to buy big tech companies at such low prices?

The all-round investment method of the No. 1 Naver subscriber, Jae-tech Farmer!

From lump-sum buying to leveraged investing and rebalancing methods

An all-round investor prepares for all market conditions!

Before COVID-19, a 1% drop in the Nasdaq would have triggered fear, but now a 2% plunge is routine, and extreme volatility has even emerged, with a 12% surge in a single day.

Moreover, all these changes, including the synchronization of global assets linked to U.S. stocks, Korean stocks, and Bitcoin, are dispelling conventional investment wisdom.

Investment strategies that rely solely on specific countries or sectors are no longer viable, and a new approach that allows for flexible asset diversification in line with economic trends is urgently needed.

In this chaos, the solution suggested by Jaetech Farmer, who holds the number one spot in total Naver Premium subscribers, is "all-round investment."

Just as an all-rounder is a player who can take on multiple roles in sports, it is also a strategy in investment that flexibly responds to various assets.

The key is to flexibly allocate assets without distinguishing between rising and falling markets and maintain a compound interest structure.

If an interest rate cut is expected, the portfolio is actively rebalanced by increasing the bond weight, and if the outlook for the AI sector is good, the weight of the sector is increased.

At this time, in addition to stocks, gold, and bonds, real estate and Bitcoin are also included in the rebalancing strategy.

The goal of an all-round investment approach is to actively generate performance by using a variety of strategies without being limited by market conditions or asset types.

The author's message is that you can create more robust returns by protecting your assets in a bear market, identifying opportunities, and betting on growth industries during a rebound.

In these unpredictable times, an all-round investment strategy that prepares for all situations will guide you toward greater wealth creation.

- You can preview some of the book's contents.

Preview

index

An All-Round Investment Strategy: Creating Opportunities in Crisis

Chapter 1: The Era of the All-Round Investor

The bear market changed my life.

Meet the All-Round Investment Method

DCA and All-Round Investment Method

DCA Next Step Strategy

Institutions' Choice to Outperform Market Averages

Practical Investment Advice

The Magic of Compound Interest: SCHD and Broadcom

Chapter 2: Economic Cycles and Buying Timing

Economic cycle, interest rates, and stock prices

Contrarian market forecasting method

How to Use Indicators to Timing Buys

Chapter 3: Volatility and Leverage Strategy

The Light and Dark Side of Leveraged Products

This is how I invest in leverage

Leveraged trading using indicators

Exchange Rate Risk Management Act

Reading Market Psychology to Turn Bad News into Opportunity

Chapter 4: Successful All-Round Investment Strategies

What matters is the return on total assets

Diversified investments to prepare for risk

Asset Allocation and Rebalancing Strategies

How to Identify the Bottom in a Bear Market

Four Investing Habits for Surviving a Bear Market

Why You Should Hold Safe Assets

Bonds and Gold: The All-Rounder's Shield and Weapon

What asset allocation strategy is right for me?

Chapter 5 Stocks to Buy, Stocks to Sell, and Stocks to Hold

Stocks to Watch When the Market Is Down

Let's keep an eye on these stocks

Small and Medium Stock Trading Method

Tracking stocks through institutional supply and demand flows

The best investment method proven by history

How to Use PER in Practice: When to Buy and When to Sell

Finding Stocks Using Warren Buffett's Buying Criteria

Create your own AI ETF

Leaders of the AI era

The stop loss criterion determines the rate of return.

A summary of the key investment criteria for a tech farmer.

Chapter 6: Real Estate is Also a Portfolio

Why You Could Buy a Seoul Apartment in 2022

Let's wait for the right time

Which properties should you pay attention to?

Real Estate Outlook Beyond 2025

Chapter 7: Trump and Bitcoin

Don't predict tariffs

Addressing Policy Risk in an Age of Uncertainty

Investment Stocks to Watch During Trump's Second Term

Reasons to Invest in Bitcoin

Chapter 1: The Era of the All-Round Investor

The bear market changed my life.

Meet the All-Round Investment Method

DCA and All-Round Investment Method

DCA Next Step Strategy

Institutions' Choice to Outperform Market Averages

Practical Investment Advice

The Magic of Compound Interest: SCHD and Broadcom

Chapter 2: Economic Cycles and Buying Timing

Economic cycle, interest rates, and stock prices

Contrarian market forecasting method

How to Use Indicators to Timing Buys

Chapter 3: Volatility and Leverage Strategy

The Light and Dark Side of Leveraged Products

This is how I invest in leverage

Leveraged trading using indicators

Exchange Rate Risk Management Act

Reading Market Psychology to Turn Bad News into Opportunity

Chapter 4: Successful All-Round Investment Strategies

What matters is the return on total assets

Diversified investments to prepare for risk

Asset Allocation and Rebalancing Strategies

How to Identify the Bottom in a Bear Market

Four Investing Habits for Surviving a Bear Market

Why You Should Hold Safe Assets

Bonds and Gold: The All-Rounder's Shield and Weapon

What asset allocation strategy is right for me?

Chapter 5 Stocks to Buy, Stocks to Sell, and Stocks to Hold

Stocks to Watch When the Market Is Down

Let's keep an eye on these stocks

Small and Medium Stock Trading Method

Tracking stocks through institutional supply and demand flows

The best investment method proven by history

How to Use PER in Practice: When to Buy and When to Sell

Finding Stocks Using Warren Buffett's Buying Criteria

Create your own AI ETF

Leaders of the AI era

The stop loss criterion determines the rate of return.

A summary of the key investment criteria for a tech farmer.

Chapter 6: Real Estate is Also a Portfolio

Why You Could Buy a Seoul Apartment in 2022

Let's wait for the right time

Which properties should you pay attention to?

Real Estate Outlook Beyond 2025

Chapter 7: Trump and Bitcoin

Don't predict tariffs

Addressing Policy Risk in an Age of Uncertainty

Investment Stocks to Watch During Trump's Second Term

Reasons to Invest in Bitcoin

Detailed image

Into the book

Investment is a mirror that accurately shows me what standards I use to view the world and what principles I use to make decisions and live by.

I remember when I first encountered the American stock market.

It seemed difficult and complicated, but as I gradually adapted, I realized that it was a market that operated more transparently than anywhere else and that moved with the company's values at the center.

At the time, the market was in turmoil due to COVID-19, with the Nasdaq plummeting over 12% during the day. Despite that, I bought big tech companies.

Because I believed that even if the market falls, the value of the company will not fall.

---From the "Preface"

All-round investing is not simply a diversification strategy.

Basically, we follow All Weather's stable asset allocation structure, but actively rebalance the portfolio according to market conditions.

In other words, rather than simply holding on, this is a strategy of preemptively increasing the weighting of sectors with a high potential for significant future rebounds and companies with high long-term growth potential.

There's also a reason why the all-round investment strategy shines in a rebound.

The S&P 500 is literally the market average.

Even if there is a rebound, it will only be an average recovery.

However, the all-rounder focuses on growth sectors that will lead the rebound.

Companies like Nvidia and Apple, which have been held by institutions for a long time and have generated returns several to tens of times higher than the index, are proof of this.

Because it is structured to strategically increase the weighting of such stocks, it shows much stronger performance than DCA in a rebound market.

---From "Chapter 1: The Era of All-Round Investors"

After Trump announced a reciprocal tariff waiver, the Nasdaq recorded an unprecedented rebound, jumping 12% in a single day.

And as of July 2025, with the Nasdaq and S&P 500 hitting record highs, the positive perception that "a decline is an opportunity to buy more" has spread widely.

A real bear market is one we don't want to remember, because it leaves global markets in silence for long periods of time.

If you invest in stocks, a bear market will definitely come at some point.

That doesn't mean you need to worry too much.

Because there is one truth that doesn't change no matter how the market flows.

The point is that the US market is trending upward in the long term and eventually breaks through its peak again.

---From "Chapter 2: Economic Cycle and Purchase Timing"

What matters is the return on your total assets.

The key to an all-round investment strategy is to maximize the return of the entire portfolio rather than the performance of individual stocks.

To achieve this, you need to diversify your assets across various sectors and rebalance appropriately according to market conditions.

For example, if the stock market is overheated, you should take some profits and increase your exposure to bonds or cash.

Conversely, if the stock market has fallen significantly, you should use this as an opportunity to purchase additional blue-chip stocks using your cash.

By adjusting your portfolio in this way to match the market rhythm, you can generate stable overall returns even if individual stocks underperform.

Additionally, you can reduce risk and expand opportunities by diversifying your investments globally, rather than focusing on specific sectors or regions.

---From "Chapter 4 Successful All-Round Investment Methods"

Many people suffered as the market fell sharply starting in March 2025.

It could be because you haven't allocated your assets through all-round investing, or because you're psychologically shaken by investing more than you can handle.

And there is another thing, it may have been because I was unable to ‘cut my losses’.

In a bear market, it is important to keep in mind how important it is to minimize losses, that is, to cut your losses.

This is because cutting losses is not simply a matter of timing a sell, but rather the starting point of risk management to protect investment assets and survive in the market.

There are many people who hold on without giving up, holding on with the hope that 'it will go up again someday.'

However, this approach can lead to catastrophic losses.

For example, if a stock you bought at $100 falls to $50, the loss is 50%, but it takes a whopping 100% return to recover to its original level.

---From "5 Stocks to Buy, Stocks to Sell, and Stocks to Hold On To"

The real secret of the stock market is that volatility itself is not risk.

The real risk lies in my emotions reacting to volatility.

Even with the same volatility, some investors panic, while others seize the opportunity.

This difference ultimately determines long-term returns.

Volatility never goes away.

Volatility is the nature of markets and will always be with us as long as stock markets exist.

So rather than trying to get rid of it, we need to learn how to coexist.

There is only one way to beat volatility.

It's about preparing in advance and acting consistently.

I remember when I first encountered the American stock market.

It seemed difficult and complicated, but as I gradually adapted, I realized that it was a market that operated more transparently than anywhere else and that moved with the company's values at the center.

At the time, the market was in turmoil due to COVID-19, with the Nasdaq plummeting over 12% during the day. Despite that, I bought big tech companies.

Because I believed that even if the market falls, the value of the company will not fall.

---From the "Preface"

All-round investing is not simply a diversification strategy.

Basically, we follow All Weather's stable asset allocation structure, but actively rebalance the portfolio according to market conditions.

In other words, rather than simply holding on, this is a strategy of preemptively increasing the weighting of sectors with a high potential for significant future rebounds and companies with high long-term growth potential.

There's also a reason why the all-round investment strategy shines in a rebound.

The S&P 500 is literally the market average.

Even if there is a rebound, it will only be an average recovery.

However, the all-rounder focuses on growth sectors that will lead the rebound.

Companies like Nvidia and Apple, which have been held by institutions for a long time and have generated returns several to tens of times higher than the index, are proof of this.

Because it is structured to strategically increase the weighting of such stocks, it shows much stronger performance than DCA in a rebound market.

---From "Chapter 1: The Era of All-Round Investors"

After Trump announced a reciprocal tariff waiver, the Nasdaq recorded an unprecedented rebound, jumping 12% in a single day.

And as of July 2025, with the Nasdaq and S&P 500 hitting record highs, the positive perception that "a decline is an opportunity to buy more" has spread widely.

A real bear market is one we don't want to remember, because it leaves global markets in silence for long periods of time.

If you invest in stocks, a bear market will definitely come at some point.

That doesn't mean you need to worry too much.

Because there is one truth that doesn't change no matter how the market flows.

The point is that the US market is trending upward in the long term and eventually breaks through its peak again.

---From "Chapter 2: Economic Cycle and Purchase Timing"

What matters is the return on your total assets.

The key to an all-round investment strategy is to maximize the return of the entire portfolio rather than the performance of individual stocks.

To achieve this, you need to diversify your assets across various sectors and rebalance appropriately according to market conditions.

For example, if the stock market is overheated, you should take some profits and increase your exposure to bonds or cash.

Conversely, if the stock market has fallen significantly, you should use this as an opportunity to purchase additional blue-chip stocks using your cash.

By adjusting your portfolio in this way to match the market rhythm, you can generate stable overall returns even if individual stocks underperform.

Additionally, you can reduce risk and expand opportunities by diversifying your investments globally, rather than focusing on specific sectors or regions.

---From "Chapter 4 Successful All-Round Investment Methods"

Many people suffered as the market fell sharply starting in March 2025.

It could be because you haven't allocated your assets through all-round investing, or because you're psychologically shaken by investing more than you can handle.

And there is another thing, it may have been because I was unable to ‘cut my losses’.

In a bear market, it is important to keep in mind how important it is to minimize losses, that is, to cut your losses.

This is because cutting losses is not simply a matter of timing a sell, but rather the starting point of risk management to protect investment assets and survive in the market.

There are many people who hold on without giving up, holding on with the hope that 'it will go up again someday.'

However, this approach can lead to catastrophic losses.

For example, if a stock you bought at $100 falls to $50, the loss is 50%, but it takes a whopping 100% return to recover to its original level.

---From "5 Stocks to Buy, Stocks to Sell, and Stocks to Hold On To"

The real secret of the stock market is that volatility itself is not risk.

The real risk lies in my emotions reacting to volatility.

Even with the same volatility, some investors panic, while others seize the opportunity.

This difference ultimately determines long-term returns.

Volatility never goes away.

Volatility is the nature of markets and will always be with us as long as stock markets exist.

So rather than trying to get rid of it, we need to learn how to coexist.

There is only one way to beat volatility.

It's about preparing in advance and acting consistently.

---From "Chapter 7: Trump and Bitcoin"

Publisher's Review

The direction of investment that I realized only after losing money

Invest with systems, not emotions.

The author is currently working with investors on numerous platforms, including Naver Premium Content, YouTube, and Pending.

By analyzing market trends and key stocks every week and sharing them through Telegram and YouTube, we have focused on establishing "criteria for judgment" rather than simply conveying information.

The author's investment journey began with failure.

The excitement of receiving his first paycheck was fleeting, and he felt lost as he watched the money disappear into various fixed expenses. He was an ordinary office worker in the past.

The first semiconductor stock I bought, lured by the talk of the town, fell immediately after purchase, and I ended up having to sell it at a loss.

If I had held out longer, I could have quadrupled my profits, but at the time, I didn't have the patience or standards to do so.

The bigger frustration came from YouTube VIP members who paid 4 million won to sign up.

I fell for the sweet temptation of "Anyone can become rich if they just follow me" and invested a large sum of money, but the results were disastrous.

So he studied again and found the answer in American stocks.

The judgment was that if the value of a company does not change even if the market falls, it should be invested.

I invested based on the company's core performance and value, and as a result, I bought Nvidia at $17, Tesla at $33, Palantir at $16, Rocket Lab at $5, and Joby at $7, and sold some companies at their peaks, achieving great results.

Through these failures and successes, he gained an important insight.

Investing is not about prediction, but about response, not about emotions, but about systems, and not about luck, but about principles.

The result was the ‘all-round investment method.’

Currently, he holds the number one spot in subscriber counts among all 3,300 Naver Premium content channels, and based on his own experiences of failure and success, he is spreading his "unwavering investment principles" to countless investors.

This book is the culmination of that journey, a realistic and proven investment manual that can help ordinary investors survive and succeed in the markets.

Defense alone cannot grow profits.

Attacks alone cannot protect assets.

In an Age of Volatility, Why All-Round Investing Matters

What does all-round investing mean when it comes to reacting rather than predicting? In other words, rather than trying to predict where the market will go, it's about creating a structure that allows you to respond to any situation.

The key is flexibility: increasing the proportion of stocks in a bull market, increasing the proportion of cash and safe assets in a bear market, and even taking an aggressive approach in a market of extreme fear.

To survive this uncertainty, you need a portfolio that can prepare for a variety of scenarios.

The all-round investment strategy flexibly adjusts the weighting of various assets, such as stocks, bonds, gold, cash, real estate, and cryptocurrencies, depending on the situation, thereby diversifying risk.

This strategy focuses on growth assets in a rising market, takes refuge in defensive assets in a falling market, and increases cash holdings during periods of high volatility to wait for opportunities.

The most important thing is mechanical rebalancing that is not swayed by emotions.

You can use volatility as a profit opportunity by adopting a contrarian strategy: buying more when the market is fearful and selling some when greed is at its peak.

To achieve this, we need to establish clear standards in advance and have principles for mechanically implementing them. This book contains these principles and strategies.

What's interesting is the new interpretation of welfare.

Compounding isn't simply about holding an investment for a long period of time; it's about steadily accumulating profits while avoiding major losses. For SCHD, with a 4.1% dividend yield, reinvesting dividends can yield a 468% return over 10 years. For stocks like Broadcom, which combine growth and dividends, the analysis suggests a 2,277% return over 10 years.

But the premise of all this is to create a 'structure that can endure'.

No matter how good a stock is, it is meaningless if it cannot withstand volatility.

To remain unshaken in such situations, you must have appropriate asset diversification, sufficient cash reserves, and a solid investment philosophy.

Ultimately, the secret to getting rich in a bear market is simple.

It means being courageous when others are fearful, cautious when others are greedy, and above all, sticking to your own principles to the end.

The All-Round Investment Method presents a concrete methodology for systematically implementing this philosophy.

The greater the volatility and the greater the uncertainty, the more it can shine.

From stock buying methods to leveraged investment

A concrete investment guide that applies directly to real-world situations.

The greatest strength of this book lies in its practicality, which can be applied starting tomorrow.

Beyond abstract investment philosophies and theoretical explanations, it provides practical guidelines that can be applied immediately in real life, including specific benchmarks, methods for splitting purchases, and clear ratios of -8% loss and +20% profit compared to the average unit price.

In particular, it is packed with practical information that investors must know, including specific compound interest calculation methods that expect a 468% return after 10 years through SCHD dividend reinvestment, methods of investing in leveraged products, and hidden cost structures.

Above all, this book does not require 'perfect timing'.

Instead of the impossible task of guessing market peaks and troughs, we present a system that can respond mechanically and unwaveringly in any situation.

From simple and clear asset allocation of 50% stocks and 50% cash in a bull market and 80% stocks and 20% cash in a bear market, to a step-by-step investment roadmap that even beginners can easily follow, it is designed so that anyone can apply it to their own situation.

Ultimately, after reading this book, you'll realize that investing, which seemed complex and difficult, is actually a systematic system that operates according to clear standards and principles.

And through that system, you will acquire true investment skills that will allow you to steadily increase your assets without being swayed by market noise.

Invest with systems, not emotions.

The author is currently working with investors on numerous platforms, including Naver Premium Content, YouTube, and Pending.

By analyzing market trends and key stocks every week and sharing them through Telegram and YouTube, we have focused on establishing "criteria for judgment" rather than simply conveying information.

The author's investment journey began with failure.

The excitement of receiving his first paycheck was fleeting, and he felt lost as he watched the money disappear into various fixed expenses. He was an ordinary office worker in the past.

The first semiconductor stock I bought, lured by the talk of the town, fell immediately after purchase, and I ended up having to sell it at a loss.

If I had held out longer, I could have quadrupled my profits, but at the time, I didn't have the patience or standards to do so.

The bigger frustration came from YouTube VIP members who paid 4 million won to sign up.

I fell for the sweet temptation of "Anyone can become rich if they just follow me" and invested a large sum of money, but the results were disastrous.

So he studied again and found the answer in American stocks.

The judgment was that if the value of a company does not change even if the market falls, it should be invested.

I invested based on the company's core performance and value, and as a result, I bought Nvidia at $17, Tesla at $33, Palantir at $16, Rocket Lab at $5, and Joby at $7, and sold some companies at their peaks, achieving great results.

Through these failures and successes, he gained an important insight.

Investing is not about prediction, but about response, not about emotions, but about systems, and not about luck, but about principles.

The result was the ‘all-round investment method.’

Currently, he holds the number one spot in subscriber counts among all 3,300 Naver Premium content channels, and based on his own experiences of failure and success, he is spreading his "unwavering investment principles" to countless investors.

This book is the culmination of that journey, a realistic and proven investment manual that can help ordinary investors survive and succeed in the markets.

Defense alone cannot grow profits.

Attacks alone cannot protect assets.

In an Age of Volatility, Why All-Round Investing Matters

What does all-round investing mean when it comes to reacting rather than predicting? In other words, rather than trying to predict where the market will go, it's about creating a structure that allows you to respond to any situation.

The key is flexibility: increasing the proportion of stocks in a bull market, increasing the proportion of cash and safe assets in a bear market, and even taking an aggressive approach in a market of extreme fear.

To survive this uncertainty, you need a portfolio that can prepare for a variety of scenarios.

The all-round investment strategy flexibly adjusts the weighting of various assets, such as stocks, bonds, gold, cash, real estate, and cryptocurrencies, depending on the situation, thereby diversifying risk.

This strategy focuses on growth assets in a rising market, takes refuge in defensive assets in a falling market, and increases cash holdings during periods of high volatility to wait for opportunities.

The most important thing is mechanical rebalancing that is not swayed by emotions.

You can use volatility as a profit opportunity by adopting a contrarian strategy: buying more when the market is fearful and selling some when greed is at its peak.

To achieve this, we need to establish clear standards in advance and have principles for mechanically implementing them. This book contains these principles and strategies.

What's interesting is the new interpretation of welfare.

Compounding isn't simply about holding an investment for a long period of time; it's about steadily accumulating profits while avoiding major losses. For SCHD, with a 4.1% dividend yield, reinvesting dividends can yield a 468% return over 10 years. For stocks like Broadcom, which combine growth and dividends, the analysis suggests a 2,277% return over 10 years.

But the premise of all this is to create a 'structure that can endure'.

No matter how good a stock is, it is meaningless if it cannot withstand volatility.

To remain unshaken in such situations, you must have appropriate asset diversification, sufficient cash reserves, and a solid investment philosophy.

Ultimately, the secret to getting rich in a bear market is simple.

It means being courageous when others are fearful, cautious when others are greedy, and above all, sticking to your own principles to the end.

The All-Round Investment Method presents a concrete methodology for systematically implementing this philosophy.

The greater the volatility and the greater the uncertainty, the more it can shine.

From stock buying methods to leveraged investment

A concrete investment guide that applies directly to real-world situations.

The greatest strength of this book lies in its practicality, which can be applied starting tomorrow.

Beyond abstract investment philosophies and theoretical explanations, it provides practical guidelines that can be applied immediately in real life, including specific benchmarks, methods for splitting purchases, and clear ratios of -8% loss and +20% profit compared to the average unit price.

In particular, it is packed with practical information that investors must know, including specific compound interest calculation methods that expect a 468% return after 10 years through SCHD dividend reinvestment, methods of investing in leveraged products, and hidden cost structures.

Above all, this book does not require 'perfect timing'.

Instead of the impossible task of guessing market peaks and troughs, we present a system that can respond mechanically and unwaveringly in any situation.

From simple and clear asset allocation of 50% stocks and 50% cash in a bull market and 80% stocks and 20% cash in a bear market, to a step-by-step investment roadmap that even beginners can easily follow, it is designed so that anyone can apply it to their own situation.

Ultimately, after reading this book, you'll realize that investing, which seemed complex and difficult, is actually a systematic system that operates according to clear standards and principles.

And through that system, you will acquire true investment skills that will allow you to steadily increase your assets without being swayed by market noise.

GOODS SPECIFICS

- Date of issue: July 30, 2025

- Page count, weight, size: 352 pages | 556g | 152*225*22mm

- ISBN13: 9788947501804

- ISBN10: 8947501808

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)