Dividend Investment Basics

|

Description

Book Introduction

Stability and growth, two birds with one stone

If you want to catch them all, dividend investing is the answer!

Starting with US dividend stocks that even beginners can easily start with.

Domestic dividend stocks that maximize profits through buy and sell timing

A Dividend Investing Guide: Creating Your Own Reliable ATM

1,000% returns, billions of won in profits... Social media is overflowing with stories of people quitting their jobs after making a one-shot investment.

But for most ordinary people, their salary quickly disappears as living expenses, and marriage, childcare, and retirement planning, let alone owning a home, feel like a dream.

I want to invest in assets, but bank interest rates are extremely low and stocks and coins are still volatile.

Is there no answer to this?

To readers struggling with these concerns, the author suggests a reliable source of cash flow called 'dividend investing.'

Dividend investing doesn't offer the glamorous benefits of short-term asset growth like altcoins or leveraged products, but it also protects against the risk of losing everything if stock prices suddenly plummet.

Dividend investing is highly predictable and holds investors' hearts firmly.

With cash coming in regularly, is there any investment more lazy, accurate, and comfortable than this? You don't have to worry about the market's fluctuations, and the dividends that come in automatically give you peace of mind.

Dividend investing is simple and straightforward.

All you have to do is choose a quality company that will be your partner, receive the dividends it pays, and follow its growth trends to see if it continues.

In addition, in this book, the author introduces domestic dividend stock investment strategies and tax-saving methods based on U.S. dividend stocks.

Is your salary not enough? Do you want to create a second stream of cash? Do you want to build a solid, unwavering portfolio of your own? If so, now is the time to start investing in dividends!

If you want to catch them all, dividend investing is the answer!

Starting with US dividend stocks that even beginners can easily start with.

Domestic dividend stocks that maximize profits through buy and sell timing

A Dividend Investing Guide: Creating Your Own Reliable ATM

1,000% returns, billions of won in profits... Social media is overflowing with stories of people quitting their jobs after making a one-shot investment.

But for most ordinary people, their salary quickly disappears as living expenses, and marriage, childcare, and retirement planning, let alone owning a home, feel like a dream.

I want to invest in assets, but bank interest rates are extremely low and stocks and coins are still volatile.

Is there no answer to this?

To readers struggling with these concerns, the author suggests a reliable source of cash flow called 'dividend investing.'

Dividend investing doesn't offer the glamorous benefits of short-term asset growth like altcoins or leveraged products, but it also protects against the risk of losing everything if stock prices suddenly plummet.

Dividend investing is highly predictable and holds investors' hearts firmly.

With cash coming in regularly, is there any investment more lazy, accurate, and comfortable than this? You don't have to worry about the market's fluctuations, and the dividends that come in automatically give you peace of mind.

Dividend investing is simple and straightforward.

All you have to do is choose a quality company that will be your partner, receive the dividends it pays, and follow its growth trends to see if it continues.

In addition, in this book, the author introduces domestic dividend stock investment strategies and tax-saving methods based on U.S. dividend stocks.

Is your salary not enough? Do you want to create a second stream of cash? Do you want to build a solid, unwavering portfolio of your own? If so, now is the time to start investing in dividends!

- You can preview some of the book's contents.

Preview

index

If bank interest rates are a concern and aggressive investing is too much, dividend investing is the answer.

Chapter 1: Dividend Investing is the Answer for Busy Office Workers

01 Why Dividend Investment Among the Many Investments?

1-1 My journey of first starting dividend investing

1-2 Dividend Investment's Unique Differences

1-3 How Dividend Companies Return Profits to Shareholders

02 Pros and Cons of Dividend Investing

2-1 Advantages of Dividend Investing

2-2 Disadvantages of Dividend Investing

Chapter 2: If you want to kill two birds with one stone: stability and growth, dividend investing is the answer.

01 The First Principle of a Smart Dividend Stock: A Good Business Model

The 1-1 business model itself is a solid basis for dividend investing.

1-2 Dividend stocks won't collapse if their business model is solid.

1-3 How to Find a Good Business Model

02 Invest just 10 seconds in financial statements to see dividend investing at a glance.

2-1 Financial Statement Analysis Basics in Just 3 Points

2-2 In-depth analysis of financial statements through four perspectives

03 Selecting the best dividend stocks that others don't know about

3-1 Company Performance

3-2 odds

3-3 Dividend Growth

3-4 dividend payout ratio

04 Basic Dividend Investment Concepts That Are Too Good to Pass Up

4-1 Purchase and cancellation of preferred stock and treasury stock

4-2 Dividend Payment Procedure

Chapter 3: Peace of Mind: Dividend Investing in the US

01 US ETF Dividend Investment Perfect for Beginners

1-1 Advantages of US Dividend Stocks

1-2 Understanding the Features of US ETFs

1-3 Representative US Dividend ETFs

02 Investing in US Dividend Growth Stocks Individually

2-1 From US Dividend Royals to Dividend Blue Chips

2-2 Dividend investment products that require study before blindly investing

03 A site full of valuable information on US dividend stocks

3-1 Seeking Alpha

3-2 Investing.com

3-3 Yahoo Finance

3-4 pin beads

3-5 ETF Check

Chapter 4: Maximizing Profits with Domestic Dividend Investments by Targeting Timing

01 Target the low point to get both dividends and stock price increases.

Find Undervalued Dividend Stocks with a 1-1 PER

Find Undervalued Dividend Stocks with a Price-to-Dividend Yield of 1-2

Finding Undervalued Dividend Stocks Using 1-3 Moving Averages

Finding Undervalued Dividend Stocks with 1-4 Institutional and Foreign Investments

02 Revitalize your conservative dividend investing! Swing investing in dividend stocks is easier than you think.

2-1 Investing in Dividend Stocks by Utilizing KOSPI Index Volatility

2-2 Investing in dividend stocks by leveraging existing high-quality, high-dividend stocks.

03 A site full of valuable information on domestic dividend stocks

3-1 Naver Pay Securities

3-2 Eye Investment

April 1 million won, 2 million won, 3 million won dividend portfolio

April 1, 100,000 Won Dividend Portfolio

April 2, 200,000 won dividend portfolio

3 million won dividend portfolio for April-March

Chapter 5 High Dividends, Low Taxes

01 Types of Taxes to Know When Investing in Dividends

1-1 Dividend Income Tax

1-2 Comprehensive taxation of financial income

1-3 Comprehensive income tax

1-4 Health insurance premiums

02 The Three Tax-Saving Musketeers That Increase Hidden Returns

2-1 Pension Savings

2-2 IRP

2-3 ISA

03 If you're still unsure about dividend investing, experience the magic of compound interest.

3-1 How to become a small rich person through dividend investment

3-2 The absolute secret of dividend investing: compound interest

The earlier you start investing in dividends, the better.

Epilogue: Let's all become a little rich through dividend investing.

Chapter 1: Dividend Investing is the Answer for Busy Office Workers

01 Why Dividend Investment Among the Many Investments?

1-1 My journey of first starting dividend investing

1-2 Dividend Investment's Unique Differences

1-3 How Dividend Companies Return Profits to Shareholders

02 Pros and Cons of Dividend Investing

2-1 Advantages of Dividend Investing

2-2 Disadvantages of Dividend Investing

Chapter 2: If you want to kill two birds with one stone: stability and growth, dividend investing is the answer.

01 The First Principle of a Smart Dividend Stock: A Good Business Model

The 1-1 business model itself is a solid basis for dividend investing.

1-2 Dividend stocks won't collapse if their business model is solid.

1-3 How to Find a Good Business Model

02 Invest just 10 seconds in financial statements to see dividend investing at a glance.

2-1 Financial Statement Analysis Basics in Just 3 Points

2-2 In-depth analysis of financial statements through four perspectives

03 Selecting the best dividend stocks that others don't know about

3-1 Company Performance

3-2 odds

3-3 Dividend Growth

3-4 dividend payout ratio

04 Basic Dividend Investment Concepts That Are Too Good to Pass Up

4-1 Purchase and cancellation of preferred stock and treasury stock

4-2 Dividend Payment Procedure

Chapter 3: Peace of Mind: Dividend Investing in the US

01 US ETF Dividend Investment Perfect for Beginners

1-1 Advantages of US Dividend Stocks

1-2 Understanding the Features of US ETFs

1-3 Representative US Dividend ETFs

02 Investing in US Dividend Growth Stocks Individually

2-1 From US Dividend Royals to Dividend Blue Chips

2-2 Dividend investment products that require study before blindly investing

03 A site full of valuable information on US dividend stocks

3-1 Seeking Alpha

3-2 Investing.com

3-3 Yahoo Finance

3-4 pin beads

3-5 ETF Check

Chapter 4: Maximizing Profits with Domestic Dividend Investments by Targeting Timing

01 Target the low point to get both dividends and stock price increases.

Find Undervalued Dividend Stocks with a 1-1 PER

Find Undervalued Dividend Stocks with a Price-to-Dividend Yield of 1-2

Finding Undervalued Dividend Stocks Using 1-3 Moving Averages

Finding Undervalued Dividend Stocks with 1-4 Institutional and Foreign Investments

02 Revitalize your conservative dividend investing! Swing investing in dividend stocks is easier than you think.

2-1 Investing in Dividend Stocks by Utilizing KOSPI Index Volatility

2-2 Investing in dividend stocks by leveraging existing high-quality, high-dividend stocks.

03 A site full of valuable information on domestic dividend stocks

3-1 Naver Pay Securities

3-2 Eye Investment

April 1 million won, 2 million won, 3 million won dividend portfolio

April 1, 100,000 Won Dividend Portfolio

April 2, 200,000 won dividend portfolio

3 million won dividend portfolio for April-March

Chapter 5 High Dividends, Low Taxes

01 Types of Taxes to Know When Investing in Dividends

1-1 Dividend Income Tax

1-2 Comprehensive taxation of financial income

1-3 Comprehensive income tax

1-4 Health insurance premiums

02 The Three Tax-Saving Musketeers That Increase Hidden Returns

2-1 Pension Savings

2-2 IRP

2-3 ISA

03 If you're still unsure about dividend investing, experience the magic of compound interest.

3-1 How to become a small rich person through dividend investment

3-2 The absolute secret of dividend investing: compound interest

The earlier you start investing in dividends, the better.

Epilogue: Let's all become a little rich through dividend investing.

Detailed image

Publisher's Review

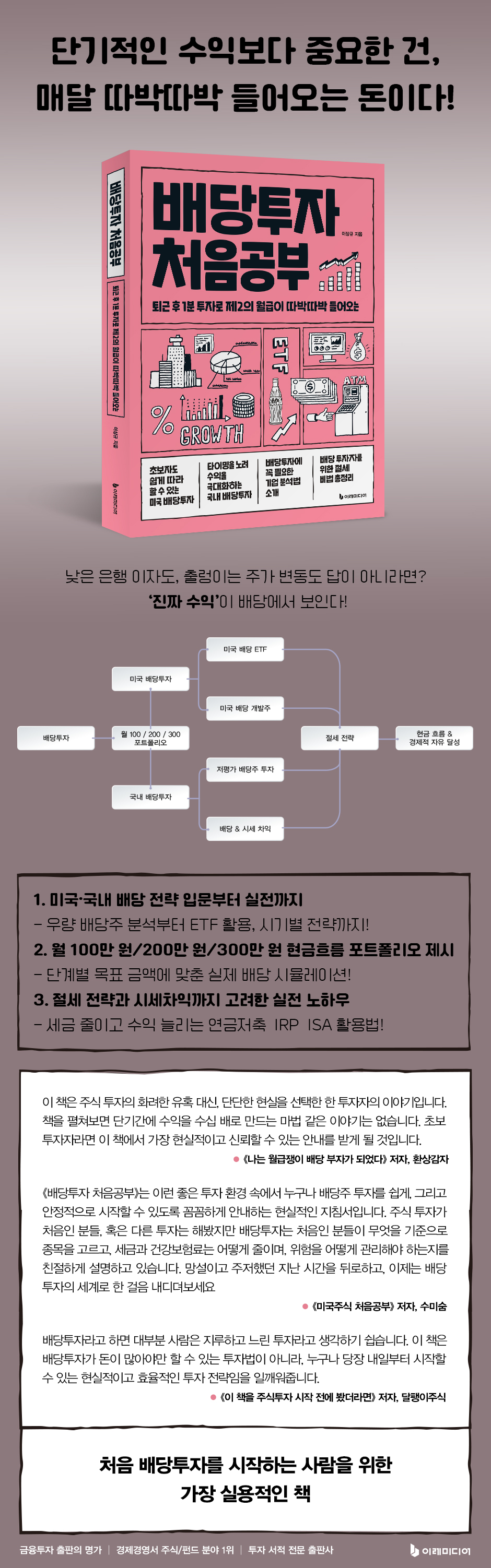

The King of Cash Flow, Built on Over 50 Years of Compound Interest

Investing in US dividend stocks

In the United States, there are many companies that have paid dividends to shareholders for over 50 years, even during global crises such as Black Monday in 1987, the dot-com bubble in 2000, the financial crisis in 2008, and the COVID-19 outbreak in 2020.

The United States is truly a 'ship power'.

The United States offers a wide range of dividend-paying companies, from high-dividend value stocks to growth stocks.

In addition to individual stocks, there are also various dividend ETFs such as SCHD, VYM, and NOBL, making them suitable for beginner investors.

American dividend investing is where you can enjoy the amazing compounding effect by reinvesting the dividends you have already received.

To fully enjoy all the benefits of dividend investing, you must first and foremost choose the right company.

"Dividend Investing: A Beginner's Guide" provides clear criteria for determining which of the numerous U.S. dividend-paying companies are truly blue-chip stocks.

Rather than being swayed by trendy high-dividend products, it also includes content on selecting dividend stocks that can be held for a long time by focusing on the company's essence and sustainability.

In addition, it covers not only individual stocks but also ETFs, providing practical assistance in creating a dividend portfolio that suits each individual's investment style.

Maximize your profits by timing

Investing in domestic dividend stocks

While many investors prefer U.S. stocks over domestic stocks due to the Korea discount phenomenon, surprisingly, there are quite a few investors who generate cash flow exceeding their monthly salary solely from domestic dividend investments.

Korea is also a market rich in high-dividend stocks, such as securities, banking, insurance, and preferred stocks.

Furthermore, regardless of political affiliation, the government is raising its voice to promote dividend investment in order to shift the structure of corporate profits to one in which they are shared more with shareholders.

With a relatively low tax burden and excellent access to information for Koreans, domestic dividend investing is ultimately the most realistic and advantageous investment strategy for Koreans.

The author goes further and introduces a method for identifying undervalued domestic dividend stocks using factors such as price-to-earnings ratio (PER), dividend yield, moving averages, institutional and foreign supply and demand, and KOSPI index volatility.

Beyond simply receiving dividends, this book presents a practical strategy that leverages low prices to both generate dividend income and capital gains, lowering the barriers to domestic dividend investing and making it more engaging.

This book is a unique guide that transforms dividend investing from a boring investment to a strategic means of generating profits.

Reduce taxes and increase dividends

This is the true essence of dividend investing!

One of the reasons many people hesitate to invest in dividends is the vague fear that the taxes will be too high.

However, if you properly manage your financial income and develop a few strategies, such as diversifying your IRP or pension savings accounts, you can sufficiently manage your tax burden.

In this book, the author presents simulations of various amounts based on earned income and dividend income to help investors predict their tax burden and develop strategies.

Additionally, we offer dividend portfolios of 1 million won, 2 million won, and 3 million won per month, intuitively designing them so that investors can see at a glance the actual cash flow they will receive and the taxes they will have to pay.

Ultimately, rather than avoiding dividend investments due to tax concerns, it is important to maximize investment returns with a strategy that takes taxes into account.

Dividend investing remains a powerful investment strategy, generating steady cash flow in an uncertain market environment.

For investors who want long-term, stable cash flow rather than short-term profits, dividend investing is the answer.

Let's dive into the world of dividend investing right now!

Investing in US dividend stocks

In the United States, there are many companies that have paid dividends to shareholders for over 50 years, even during global crises such as Black Monday in 1987, the dot-com bubble in 2000, the financial crisis in 2008, and the COVID-19 outbreak in 2020.

The United States is truly a 'ship power'.

The United States offers a wide range of dividend-paying companies, from high-dividend value stocks to growth stocks.

In addition to individual stocks, there are also various dividend ETFs such as SCHD, VYM, and NOBL, making them suitable for beginner investors.

American dividend investing is where you can enjoy the amazing compounding effect by reinvesting the dividends you have already received.

To fully enjoy all the benefits of dividend investing, you must first and foremost choose the right company.

"Dividend Investing: A Beginner's Guide" provides clear criteria for determining which of the numerous U.S. dividend-paying companies are truly blue-chip stocks.

Rather than being swayed by trendy high-dividend products, it also includes content on selecting dividend stocks that can be held for a long time by focusing on the company's essence and sustainability.

In addition, it covers not only individual stocks but also ETFs, providing practical assistance in creating a dividend portfolio that suits each individual's investment style.

Maximize your profits by timing

Investing in domestic dividend stocks

While many investors prefer U.S. stocks over domestic stocks due to the Korea discount phenomenon, surprisingly, there are quite a few investors who generate cash flow exceeding their monthly salary solely from domestic dividend investments.

Korea is also a market rich in high-dividend stocks, such as securities, banking, insurance, and preferred stocks.

Furthermore, regardless of political affiliation, the government is raising its voice to promote dividend investment in order to shift the structure of corporate profits to one in which they are shared more with shareholders.

With a relatively low tax burden and excellent access to information for Koreans, domestic dividend investing is ultimately the most realistic and advantageous investment strategy for Koreans.

The author goes further and introduces a method for identifying undervalued domestic dividend stocks using factors such as price-to-earnings ratio (PER), dividend yield, moving averages, institutional and foreign supply and demand, and KOSPI index volatility.

Beyond simply receiving dividends, this book presents a practical strategy that leverages low prices to both generate dividend income and capital gains, lowering the barriers to domestic dividend investing and making it more engaging.

This book is a unique guide that transforms dividend investing from a boring investment to a strategic means of generating profits.

Reduce taxes and increase dividends

This is the true essence of dividend investing!

One of the reasons many people hesitate to invest in dividends is the vague fear that the taxes will be too high.

However, if you properly manage your financial income and develop a few strategies, such as diversifying your IRP or pension savings accounts, you can sufficiently manage your tax burden.

In this book, the author presents simulations of various amounts based on earned income and dividend income to help investors predict their tax burden and develop strategies.

Additionally, we offer dividend portfolios of 1 million won, 2 million won, and 3 million won per month, intuitively designing them so that investors can see at a glance the actual cash flow they will receive and the taxes they will have to pay.

Ultimately, rather than avoiding dividend investments due to tax concerns, it is important to maximize investment returns with a strategy that takes taxes into account.

Dividend investing remains a powerful investment strategy, generating steady cash flow in an uncertain market environment.

For investors who want long-term, stable cash flow rather than short-term profits, dividend investing is the answer.

Let's dive into the world of dividend investing right now!

GOODS SPECIFICS

- Date of issue: July 25, 2025

- Page count, weight, size: 260 pages | 552g | 170*235*18mm

- ISBN13: 9791193394731

- ISBN10: 1193394732

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)