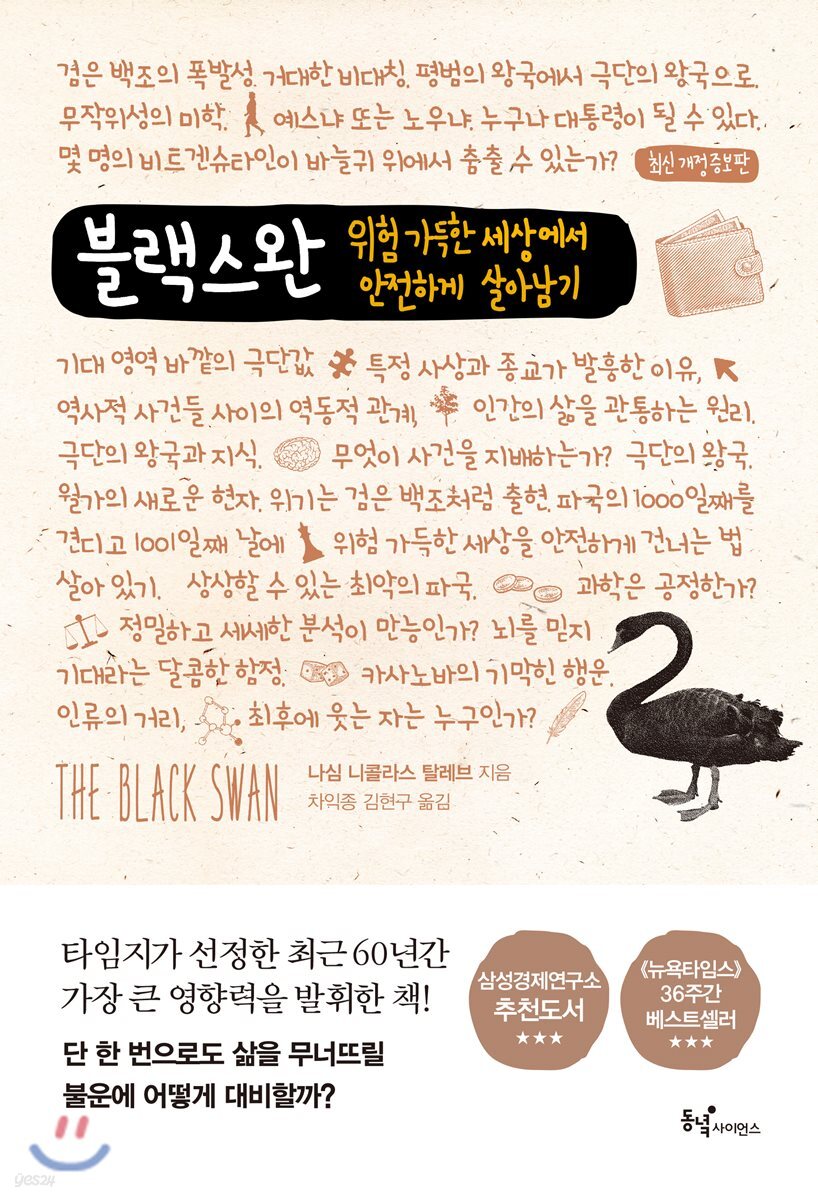

Black Swan

|

Description

Book Introduction

“There is more to say about the real world in this one book than in all the books in ten libraries combined.”

- Tom Peters, author of "Managing the Future"

Celebrating the 10th anniversary of Black Swan

The latest revised and expanded edition has been published!

『Black Swan』 is a bestseller that has been translated into 27 languages and sold over 2 million copies worldwide since its first publication in the United States in 2007.

Since its first publication in Korea in 2008, it has been reprinted more than 20 times and has been a favorite of many readers.

This 『Black Swan』 has been republished in a new edition to commemorate its 10th anniversary.

In the latest revised edition, 『Prepare for the Black Swan (2011)』 was added as a [Postscript] after 『Black Swan』.

By combining two books into one, we were able to deliver Nassim Nicholas Taleb's message more effectively to readers.

"Prepare for the Black Swan" can be said to be a kind of [postscript] written by Taleb three years after the publication of "The Black Swan."

In this review, Taleb conveys his second realization that the only solution to surviving in a world full of risks is to create a society that is 'resilient' to black swans.

Through [Parts 1 to 4], readers can understand what the 'Black Swan' phenomenon is and how many dangers we live surrounded by.

[In the review - A more profound philosophical and empirical reflection on resilience and vulnerability], we can learn specific guidelines on what we need to prepare to build a society resilient to Black Swans.

Taleb, who emerged as the "new sage of Wall Street" by predicting the 2008 financial crisis that rocked the global economy, still offers insightful wisdom in today's world, a world marked by uncertainty and randomness, and will serve as an essential guide for safely navigating risk.

- Tom Peters, author of "Managing the Future"

Celebrating the 10th anniversary of Black Swan

The latest revised and expanded edition has been published!

『Black Swan』 is a bestseller that has been translated into 27 languages and sold over 2 million copies worldwide since its first publication in the United States in 2007.

Since its first publication in Korea in 2008, it has been reprinted more than 20 times and has been a favorite of many readers.

This 『Black Swan』 has been republished in a new edition to commemorate its 10th anniversary.

In the latest revised edition, 『Prepare for the Black Swan (2011)』 was added as a [Postscript] after 『Black Swan』.

By combining two books into one, we were able to deliver Nassim Nicholas Taleb's message more effectively to readers.

"Prepare for the Black Swan" can be said to be a kind of [postscript] written by Taleb three years after the publication of "The Black Swan."

In this review, Taleb conveys his second realization that the only solution to surviving in a world full of risks is to create a society that is 'resilient' to black swans.

Through [Parts 1 to 4], readers can understand what the 'Black Swan' phenomenon is and how many dangers we live surrounded by.

[In the review - A more profound philosophical and empirical reflection on resilience and vulnerability], we can learn specific guidelines on what we need to prepare to build a society resilient to Black Swans.

Taleb, who emerged as the "new sage of Wall Street" by predicting the 2008 financial crisis that rocked the global economy, still offers insightful wisdom in today's world, a world marked by uncertainty and randomness, and will serve as an essential guide for safely navigating risk.

- You can preview some of the book's contents.

Preview

index

Translator's Note

Wall Street's Heretic Becomes Wall Street's New Sage

prolog

Lessons from Bird Feathers

Another ungrateful person

Life itself is a very unusual event

Plato and the Clueless

Avoid empty theories

starting point

Part 1: Umberto Eco's Anti-Study

Chapter 1: The Apprenticeship of an Empirical Skeptic

Anatomy of a Black Swan

History and the Triple Opacity

Together

After gaining 3.3kg

Chapter 2: Yevgenia's Black Swan

Chapter 3: Speculators and Prostitutes

Best (or worst) advice

Pay attention to variability in scale

Scalability and globalization

Journey to the Kingdom of Ordinary

Chapter 4: Alive on the First Day

Lessons from the Turkey

A Brief History of the Black Swan Problem

Chapter 5: The Fallacy of Confirmation Bias

negative empiricism

Chapter 6: Errors in Storytelling

About the reason I refuse to find the cause

What Hemispheric Disorder Tells Us

Memories of old things

Is precise and detailed analysis a panacea?

Intuition and the Black Swan

shortcut

Chapter 7: Living in the Waiting Room of Hope

Peer Review: The Cruel World

Tartary Desert

Chapter 8: The Incredible Luck of Giacomo Casanova: The Problem of Silent Evidence

People who drowned despite praying

Grave of Letters

Mouse Health Club

Seeing and Not Seeing

Shamelessness, or the power of Casanova

I am a black swan: anthropological bias

Chapter 9: The Ludic Error, or Nero's Uncertainty

Fat Tony

Lunch at Lake Como

Summary of Part 1

Part 2 We Can Never Predict

Chapter 10: The Scandal of Prediction

Guess the number of Empress Catherine the Great's lovers

The Return of the Black Swan

Information is a barrier to knowledge

The Tragedy of the Empty Shell Expert

If only there weren't unavoidable circumstances

Do not cross when the river is (average) 4 feet deep.

Chapter 11: How to Find a New "Butt"

How to find a new 'butt'

Can you predict that predictability is possible?

nth billiard ball

The creepiness of emerald

giant prediction machine

Chapter 12: The Kingdom of Perception: Is It a Dream?

Past of the past, future of the past

Chapter 13: Apelles the Painter, or What Can Be Done If You Cannot Foresee

Advice is always cheap

The concept of positive events

Part 3: The Gray Swan of the Kingdom of Extremes

Chapter 14: From the Kingdom of Ordinary to the Kingdom of Extremes, and Back Again

A kingdom of extremes, where no one is safe.

Stepping out of the kingdom of extremes

Chapter 15: The Normal Distribution Curve: The Great Intellectual Fraud

Gaussian and Mandelbrot mathematics

Ketlet's Average Monster

Thought experiment on the normal distribution curve

Chapter 16: The Aesthetics of Randomness

Poet of Randomness

The Platonic Character of the Triangle

The logic of fractal randomness

Beware of Forecast Experts

Where is the gray swan?

Chapter 17: Locke's Madness, or the Absurd Use of the Normal Distribution Curve

The Appearance of the Black Swan

Chapter 18: The Uncertainty of Counterfeiting

Revisiting the Ludic Error

How many Wittgensteins can dance on the eye of a needle?

Part 4 Conclusion

Chapter 19: Half Plus Half, or How to Avoid Confronting a Black Swan

When you don't feel sorry about missing the train

conclusion

Epilogue

Evgenia's White Swan

Acknowledgements

Glossary of Terms

About later strength and fragility,

More profound philosophical and empirical reflections

Chapter 1: Learning from Mother Nature: The Oldest and the Wiseest

About slow but long walks

Strength and fragility

A society resilient to errors

Chapter 2: Why I Do All This Walking, or How the System Fragments

A few other barbells

Chapter 3: Pearl Necklaces on Pigs' Necks

Common errors in understanding messages

Chapter 4: Asperger Syndrome and the Ontological Black Swan

Asperger's probability

The revival of blindness toward the future

Probability is bound to be subjective.

Chapter 5: (Perhaps) the most useful problem in the history of modern philosophy

Living in two dimensions

Explaining rare events through theory

Errors in single-event probability

Problems of causality and induction in complex domains

Chapter 6 Quadrant 4: Solutions to the Most Useful Problems

Rest in peace, David Friedman.

decision

Quadrant 4, Map

Chapter 7: What to Do About Quadrant 4

Avoiding the Wrong Map: The Concept of Personification

Chapter 8: Ten Principles for a Black Swan-Resilient Society

Chapter 9: Amor Fati: How to Become Unbreakable

[Part 1-4] Main

References

Wall Street's Heretic Becomes Wall Street's New Sage

prolog

Lessons from Bird Feathers

Another ungrateful person

Life itself is a very unusual event

Plato and the Clueless

Avoid empty theories

starting point

Part 1: Umberto Eco's Anti-Study

Chapter 1: The Apprenticeship of an Empirical Skeptic

Anatomy of a Black Swan

History and the Triple Opacity

Together

After gaining 3.3kg

Chapter 2: Yevgenia's Black Swan

Chapter 3: Speculators and Prostitutes

Best (or worst) advice

Pay attention to variability in scale

Scalability and globalization

Journey to the Kingdom of Ordinary

Chapter 4: Alive on the First Day

Lessons from the Turkey

A Brief History of the Black Swan Problem

Chapter 5: The Fallacy of Confirmation Bias

negative empiricism

Chapter 6: Errors in Storytelling

About the reason I refuse to find the cause

What Hemispheric Disorder Tells Us

Memories of old things

Is precise and detailed analysis a panacea?

Intuition and the Black Swan

shortcut

Chapter 7: Living in the Waiting Room of Hope

Peer Review: The Cruel World

Tartary Desert

Chapter 8: The Incredible Luck of Giacomo Casanova: The Problem of Silent Evidence

People who drowned despite praying

Grave of Letters

Mouse Health Club

Seeing and Not Seeing

Shamelessness, or the power of Casanova

I am a black swan: anthropological bias

Chapter 9: The Ludic Error, or Nero's Uncertainty

Fat Tony

Lunch at Lake Como

Summary of Part 1

Part 2 We Can Never Predict

Chapter 10: The Scandal of Prediction

Guess the number of Empress Catherine the Great's lovers

The Return of the Black Swan

Information is a barrier to knowledge

The Tragedy of the Empty Shell Expert

If only there weren't unavoidable circumstances

Do not cross when the river is (average) 4 feet deep.

Chapter 11: How to Find a New "Butt"

How to find a new 'butt'

Can you predict that predictability is possible?

nth billiard ball

The creepiness of emerald

giant prediction machine

Chapter 12: The Kingdom of Perception: Is It a Dream?

Past of the past, future of the past

Chapter 13: Apelles the Painter, or What Can Be Done If You Cannot Foresee

Advice is always cheap

The concept of positive events

Part 3: The Gray Swan of the Kingdom of Extremes

Chapter 14: From the Kingdom of Ordinary to the Kingdom of Extremes, and Back Again

A kingdom of extremes, where no one is safe.

Stepping out of the kingdom of extremes

Chapter 15: The Normal Distribution Curve: The Great Intellectual Fraud

Gaussian and Mandelbrot mathematics

Ketlet's Average Monster

Thought experiment on the normal distribution curve

Chapter 16: The Aesthetics of Randomness

Poet of Randomness

The Platonic Character of the Triangle

The logic of fractal randomness

Beware of Forecast Experts

Where is the gray swan?

Chapter 17: Locke's Madness, or the Absurd Use of the Normal Distribution Curve

The Appearance of the Black Swan

Chapter 18: The Uncertainty of Counterfeiting

Revisiting the Ludic Error

How many Wittgensteins can dance on the eye of a needle?

Part 4 Conclusion

Chapter 19: Half Plus Half, or How to Avoid Confronting a Black Swan

When you don't feel sorry about missing the train

conclusion

Epilogue

Evgenia's White Swan

Acknowledgements

Glossary of Terms

About later strength and fragility,

More profound philosophical and empirical reflections

Chapter 1: Learning from Mother Nature: The Oldest and the Wiseest

About slow but long walks

Strength and fragility

A society resilient to errors

Chapter 2: Why I Do All This Walking, or How the System Fragments

A few other barbells

Chapter 3: Pearl Necklaces on Pigs' Necks

Common errors in understanding messages

Chapter 4: Asperger Syndrome and the Ontological Black Swan

Asperger's probability

The revival of blindness toward the future

Probability is bound to be subjective.

Chapter 5: (Perhaps) the most useful problem in the history of modern philosophy

Living in two dimensions

Explaining rare events through theory

Errors in single-event probability

Problems of causality and induction in complex domains

Chapter 6 Quadrant 4: Solutions to the Most Useful Problems

Rest in peace, David Friedman.

decision

Quadrant 4, Map

Chapter 7: What to Do About Quadrant 4

Avoiding the Wrong Map: The Concept of Personification

Chapter 8: Ten Principles for a Black Swan-Resilient Society

Chapter 9: Amor Fati: How to Become Unbreakable

[Part 1-4] Main

References

Detailed image

Publisher's Review

As long as the danger is not over,

The Black Swan must continue to be talked about!

Ten years after the 2008 global financial crisis, are black swans no longer relevant to us? What will be the next black swan? Another black swan that Nassim Nicholas Taleb warns about is climate change.

You might think that climate change is so unremarkable that it feels more like a white swan than a black swan.

Indeed, when Taleb issued a statement in 2017 highlighting the uncertainty surrounding climate change and calling for a thorough response, one expert said climate change was a "white" swan and that there was no evidence that humans were changing it.

But Taleb said that climate change will cause unprecedented events.

In fact, in our country, fine dust and unprecedented heat waves have emerged as serious problems in the past few years.

Some scholars believe that natural disasters such as earthquakes are increasing due to climate change.

If we don't establish appropriate countermeasures from now on, we may be hit by a black swan.

“We only have one planet,” says Taleb, warning that the next black swan event may not give us a chance to recover.

Taleb said that our lives themselves are extraordinary events.

This means that we should not think that the Black Swan was just an economic crisis.

The danger that always lurks is a black swan.

And as long as we live with unpredictable risks, the black swan is an important concept that must continue to be talked about.

If you think climate change is a given and you're doing everything you can to address it, it might be time to take a closer look.

Are you not an old world person who would never dare to think of a black swan?

Just when we mistakenly believe we're accurately predicting the risks posed by climate change, another black swan will strike.

We don't know that we don't know!

To escape from danger

The first message of "Black Swan"

If you search for 'black swan' on the Internet, you will find many news articles citing this word when reporting on accidents or disasters that cause significant damage.

In particular, Taleb's Black Swan concept is sometimes brought up to explain our country's chronic problem of 'safety insensitivity'.

The Jecheon Sports Center fire that occurred in December last year is a representative example of damage caused by insensitivity to safety.

Because it was built with cheap Styrofoam, which was said to be easy to construct and cost less, the fire spread even faster, and many people were unable to evacuate because the emergency exit doors were covered with shelves.

The reason why these accidents with casualties are all the more regrettable is probably because we assume that the damage could have been reduced if only some level of preparation had been in place.

In the Black Swan Principle, Taleb emphasizes that ‘what we don’t know’ is important.

If they had known in advance that a fire would break out, they would not have blocked the emergency exits, and the number of casualties might have been reduced.

But we don't have the ability to predict what will happen right away.

The problem is that we make the problem worse by thinking we know when we don't.

According to Taleb, we delude ourselves into thinking we know everything and can predict it.

We repeat the mistake of focusing only on what we already know and failing to recognize what we don't know.

Moreover, according to Taleb, after an event occurs, we tend to anticipate the possibility of another unexpected event occurring in the same way that the one that surprised us occurred.

It means that you cannot see the possibility that the event could have happened in a different way.

To properly face and prepare for Black Swans, we must recognize the truth: “We don’t know what we don’t know.”

Perhaps the reason we can't shake off our insensitivity to safety even after experiencing such huge incidents is because of the arrogance of thinking, "I already know everything."

He realizes what we don't know and teaches us how to learn.

'Half plus half' is his added comment.

“I'm a strong skeptic half the time.

Another half of the time, we grasp certainty and cling to it doggedly.

(…) I hate black swans half the time.

Another half of the time I like black swans.

(…) I'm super conservative about my work half the time.

Another half of the time it's super aggressive.

This may seem no different from others, but it differs in that it is conservative in areas where others take risks, and aggressive in areas where others move cautiously.

I am less concerned about the well-known and high-profile risks, and more concerned about the hidden, worse risks.

I'm more worried about diabetes than terrorism.

(…) Instead of worrying about the unexpected happening, I lament the missed opportunity.” (pp. 460-461)

'Black Swan',

The hottest concept of the times!

The 'black swan' has long been considered an important new concept in the field of economics and management, along with the 'long tail' and the 'tipping point'.

Now, it is commonly used as a title or keyword in research papers in academic journals of business administration, economics, statistics, political science, psychology, and law.

Given this situation, not only foreign opinion leaders but also domestic opinion leaders still have great interest in “Black Swan.”

After the book was published, The Times described Taleb as “the most intense and passionate thinker in the world today,” and Daniel Kahneman, winner of the 2002 Nobel Prize in Economics, wrote in Foreign Policy, a leading American bimonthly journal specializing in foreign affairs, “Taleb has changed the way many people think about uncertainty, especially uncertainty in financial markets.

His book, The Black Swan, “has made us understand the meaning of unexpected events in a unique and bold way,” and suggested that his name be included in the list of the world’s intellectuals.

The "black swan," which made Taleb the new sage of Wall Street and an authority on the global financial crisis, refers to an extremely improbable event that has three characteristics.

First, they are unpredictable, second, they have a tremendous impact, and third, once they become reality, people belatedly try to explain them away, making it seem as if the 'black swan' was explainable and predictable.

Google's success and the 9/11 terrorist attacks are representative examples of black swans.

Taleb demonstrates the insight that black swans lurk in every area of our world, from the rise of religion to the lives of individuals.

Moreover, he warns that events that previously had minimal impact are now having major consequences, and that black swans are occurring more frequently today.

This is why Black Swan continues to be talked about even ten years after its publication.

Those who consider themselves 'elite'

Beware of the gentleman in the tie!

The 2008 global financial crisis was also the sudden appearance of a black swan.

Neither the financial experts who created countless derivative products with magical financial engineering nor the consumers who were guaranteed high returns by the financial experts could have predicted that the enormous amount of capital invested could become worthless in an instant.

Like a runaway colt, financial capital has penetrated into people's daily lives, as if the financial market will always boom (the first characteristic of a black swan).

However, because the financial crisis was impossible to predict (or not predicted), there was no safety net for it, and so the devastation it brought was as horrific as we are witnessing now (the second characteristic of the black swan).

And now that the global financial crisis has erupted, people are trying to explain it away and make it seem predictable and explainable (the third characteristic of the black swan).

Taleb shows how the normal distribution is a huge intellectual fraud, and how “so-called financial experts manipulate the numbers to commit fraud,” and he scoffs that their predictive abilities are “not much better than those of astrologers.”

Because they come up with a strategy that completely ignores the possibility of a black swan.

In 1987, Taleb was working at Credit Suisse First Boston, a Wall Street investment bank.

And on October 19th of the same year, I experienced 'Black Monday' with my whole body.

“Until the day before (Black Monday), the occurrence of the incident was beyond the realm of imagination.

If I had ever pointed out that possibility, I would have been treated like a lunatic.

It was definitely a black swan.

…I was convinced that I was completely incompetent at predicting starting prices.

“In fact, other people were just as incompetent, but they didn’t know it and they didn’t know that they were taking a huge risk.” (pp. 67-69)

Taleb criticizes so-called "experts" who delude themselves into thinking they can measure the unmeasurable (especially financial experts who use Gaussian mathematics, including the "normal distribution," to manage risk) and who diligently avoid the possibility of "extremely exceptional events," or black swans.

“The real reason (bankers) appear conservative is because their loans rarely, if ever, go out of business.

So (…) even after observing and observing for over a century, there's no way to measure the profitability of their lending operations! Yet, in the summer of 1982, America's major banks lost nearly all the profits they had ever earned (cumulatively)—virtually all the profits recorded in American financial history.

“This is an ‘extremely exceptional event’ in which Central and South American countries that borrowed from these banks simultaneously defaulted on their debts.” (p. 96)

“Ten years later, another comedy was repeated.

The collapse of the real estate market in the early 1990s again put the "risk-management-savvy" big banks in a financial crisis, many of them on the verge of bankruptcy.

Over $500 billion in taxpayer funds were bailed out by savings and loan banks that no longer exist.

The Federal Reserve protected them with taxpayer money.

So-called 'conservative' banks take advantage of the profits when they are made.

But when a crisis hits, our taxpayers pay the price.

(…) I have no intention of arguing with the term risk management.

I'm just asking you to please stop calling yourself a conservative investor.

Also, don't pretend to be superior to other businesses that are less vulnerable to black swans.

Another recent incident was the bankruptcy of a financial investment firm called Long-Term Capital Management in 1988.

At the time, the company was using a risk management technique developed by two Nobel Prize winners in economics who were considered geniuses.

However, this technique was based on the nonsensical mathematics of the normal distribution curve.

Somehow they convinced themselves that this was some great science.” (pp. 96-97)

Nassim Nicholas Taleb,

From "Wall Street's Heretic" to "Wall Street's Sage"

Who is Nassim Taleb, who cleverly presents the Black Swan idea, a remarkably well-structured model applicable to all fields, through thought experiments, epistemology, history, economics, management, statistics, fractals, mathematics, psychology, and even his own anecdotes?

In Black Swan, Taleb presents a witty, provocative, and fresh style that reflects the diverse experiences he has lived, and the range of areas from which he draws is surprisingly wide.

Michael Schreiz, author of Serious Play, called Taleb, author of The Black Swan, “a brilliant scientist and writer,” and placed him in the same category as Richard Dawkins and Stephen Jay Gould.

Nassim Taleb is as problematic and fascinating a figure as the books he writes.

Taleb is the kind of person who, whenever people at cocktail parties ask him what he does, is tempted to say, "I'm a skeptical empiricist, a lazy reader, and someone who delves deeply into an idea," but who ultimately simply says, "I'm a limousine driver."

When he was on a transatlantic flight and a woman spoke to him in broken French while he was reading Bourdieu, he feigned pride by telling her that he was a "limousine driver" and that he only drove "top-of-the-line" cars, thus warding off the interruption of his reading.

Taleb, a witty figure, is a Lebanese-born "empirical skeptic" who, based on his childhood experiences, "went from Wall Street investment professional to the world of philosophy."

When he was fifteen, his grandfather, then Lebanese interior minister, was imprisoned for his involvement in student unrest.

An excited police officer, hit by a rock thrown by a student, opened fire on the protesters, and it was his grandfather who gave the order to suppress the riot.

Having spent his teenage years in Lebanon, he heard adults around him say that “the war will be over in just a few days,” despite the 17-year-old Lebanese civil war, and realized that people “don’t realize that the unexpected is happening every day, even though it is completely unexpected.”

This may have been the beginning of the 'black swan' idea.

Taleb specialized in derivatives among financial products, and his reason for doing so is also 'heretical'.

“In the field of derivatives, advanced mathematics is required, and adopting the wrong mathematical model can lead to the worst disaster.”

He received his PhD in this field.

Later, while working as an investment expert on Wall Street, Taleb began to develop the idea of a "black swan" by identifying the "Black Monday" of 1987 and the Lebanon War as the same phenomenon.

“It has become clear that almost everyone has some kind of mental blindness when it comes to recognizing the role of these events.”

Having figured this out, Taleb decided to stay in the financial world, where the six-letter words were rampant, and instead do intense, exciting work that required minimal time.

He avoided associating with “successful people who wear designer clothes but don’t read a single book,” and used his sabbatical year to supplement his lack of knowledge in science and philosophy.

It is the embodiment of the idea of the 'black swan'.

And the book that was published was “Black Swan.”

After publication, Taleb was criticized by both academics and financial circles, and was treated as a "Wall Street heretic."

However, when Wall Street faced a global financial crisis due to the sudden appearance of the black swan that this book warned about, Taleb came to be called 'the new sage of Wall Street.'

Taleb and The Black Swan were another black swan.

Praise pours in for Black Swan and Nassim Nicholas Taleb

* Taleb changed the way many people think about uncertainty, especially uncertainty in financial markets.

His book, The Black Swan, offers a unique and bold way to understand the meaning of unexpected events.

- Daniel Kahneman, author of Thinking, Fast and Slow, and Nobel Prize winner in economics

* This one book contains more information about the real world than all the books in ten libraries.

- Tom Peters, author of Managing the Future

* A book that changed our thinking.

- [Times]

* The author not only explained why the financial crisis occurred, but also witnessed that the financial crisis was coming.

- [New York Times]

* Taleb is real.

It accurately pointed out that it was not our greed and corruption, but our intellectual hubris that brought the global financial system to its knees.

- John Gray, author of Homo Rapiens

* The risk modeling expert now called a prophet! - [The Economist]

* Taleb is a truly important philosopher who changes our perspective on the world. - [GQ]

* This is very appropriate advice in these volatile times.

- Malcolm Gladwell, author of Outliers

* The world's most famous thinker.

- [Sunday Times]

* A masterpiece! - Chris Anderson, author of The Long Tail

* Can't take my eyes off it.

It's easy to get sucked in.

- [Financial Times]

* 'Black Swan' is the most attractive theory in this uncertain era.

- [Observer]

* This is a beautiful book with a reflective and powerful argument.

Like Calvino's fable, it criticizes the fatalistic error of humans who reduce the complexity of the real world to black-and-white logic.

- Emmanuel Derman, author of Quant: A Retrospective on Physics and Finance

* It is a fun read, full of knowledgeable advice and important messages.

- [Business Week]

* This is a vivid and bold research piece that delves into what is still unknown.

- [Philadelphia Inquirer]

* This is a thorough meditation on modern society.

- [Daily Telegraph]

* A thought-provoking, intellectual book! - [Wall Street Journal]

* It's different.

Great.

- [Los Angeles Times]

A book that offers insight into our thoughts and attitudes toward the uncertainty of the world! - [Dong-A Ilbo]

* It is a sharp criticism of the arrogant reality that assumes that black swans do not exist.

- [Maeil Business Newspaper]

The Black Swan must continue to be talked about!

Ten years after the 2008 global financial crisis, are black swans no longer relevant to us? What will be the next black swan? Another black swan that Nassim Nicholas Taleb warns about is climate change.

You might think that climate change is so unremarkable that it feels more like a white swan than a black swan.

Indeed, when Taleb issued a statement in 2017 highlighting the uncertainty surrounding climate change and calling for a thorough response, one expert said climate change was a "white" swan and that there was no evidence that humans were changing it.

But Taleb said that climate change will cause unprecedented events.

In fact, in our country, fine dust and unprecedented heat waves have emerged as serious problems in the past few years.

Some scholars believe that natural disasters such as earthquakes are increasing due to climate change.

If we don't establish appropriate countermeasures from now on, we may be hit by a black swan.

“We only have one planet,” says Taleb, warning that the next black swan event may not give us a chance to recover.

Taleb said that our lives themselves are extraordinary events.

This means that we should not think that the Black Swan was just an economic crisis.

The danger that always lurks is a black swan.

And as long as we live with unpredictable risks, the black swan is an important concept that must continue to be talked about.

If you think climate change is a given and you're doing everything you can to address it, it might be time to take a closer look.

Are you not an old world person who would never dare to think of a black swan?

Just when we mistakenly believe we're accurately predicting the risks posed by climate change, another black swan will strike.

We don't know that we don't know!

To escape from danger

The first message of "Black Swan"

If you search for 'black swan' on the Internet, you will find many news articles citing this word when reporting on accidents or disasters that cause significant damage.

In particular, Taleb's Black Swan concept is sometimes brought up to explain our country's chronic problem of 'safety insensitivity'.

The Jecheon Sports Center fire that occurred in December last year is a representative example of damage caused by insensitivity to safety.

Because it was built with cheap Styrofoam, which was said to be easy to construct and cost less, the fire spread even faster, and many people were unable to evacuate because the emergency exit doors were covered with shelves.

The reason why these accidents with casualties are all the more regrettable is probably because we assume that the damage could have been reduced if only some level of preparation had been in place.

In the Black Swan Principle, Taleb emphasizes that ‘what we don’t know’ is important.

If they had known in advance that a fire would break out, they would not have blocked the emergency exits, and the number of casualties might have been reduced.

But we don't have the ability to predict what will happen right away.

The problem is that we make the problem worse by thinking we know when we don't.

According to Taleb, we delude ourselves into thinking we know everything and can predict it.

We repeat the mistake of focusing only on what we already know and failing to recognize what we don't know.

Moreover, according to Taleb, after an event occurs, we tend to anticipate the possibility of another unexpected event occurring in the same way that the one that surprised us occurred.

It means that you cannot see the possibility that the event could have happened in a different way.

To properly face and prepare for Black Swans, we must recognize the truth: “We don’t know what we don’t know.”

Perhaps the reason we can't shake off our insensitivity to safety even after experiencing such huge incidents is because of the arrogance of thinking, "I already know everything."

He realizes what we don't know and teaches us how to learn.

'Half plus half' is his added comment.

“I'm a strong skeptic half the time.

Another half of the time, we grasp certainty and cling to it doggedly.

(…) I hate black swans half the time.

Another half of the time I like black swans.

(…) I'm super conservative about my work half the time.

Another half of the time it's super aggressive.

This may seem no different from others, but it differs in that it is conservative in areas where others take risks, and aggressive in areas where others move cautiously.

I am less concerned about the well-known and high-profile risks, and more concerned about the hidden, worse risks.

I'm more worried about diabetes than terrorism.

(…) Instead of worrying about the unexpected happening, I lament the missed opportunity.” (pp. 460-461)

'Black Swan',

The hottest concept of the times!

The 'black swan' has long been considered an important new concept in the field of economics and management, along with the 'long tail' and the 'tipping point'.

Now, it is commonly used as a title or keyword in research papers in academic journals of business administration, economics, statistics, political science, psychology, and law.

Given this situation, not only foreign opinion leaders but also domestic opinion leaders still have great interest in “Black Swan.”

After the book was published, The Times described Taleb as “the most intense and passionate thinker in the world today,” and Daniel Kahneman, winner of the 2002 Nobel Prize in Economics, wrote in Foreign Policy, a leading American bimonthly journal specializing in foreign affairs, “Taleb has changed the way many people think about uncertainty, especially uncertainty in financial markets.

His book, The Black Swan, “has made us understand the meaning of unexpected events in a unique and bold way,” and suggested that his name be included in the list of the world’s intellectuals.

The "black swan," which made Taleb the new sage of Wall Street and an authority on the global financial crisis, refers to an extremely improbable event that has three characteristics.

First, they are unpredictable, second, they have a tremendous impact, and third, once they become reality, people belatedly try to explain them away, making it seem as if the 'black swan' was explainable and predictable.

Google's success and the 9/11 terrorist attacks are representative examples of black swans.

Taleb demonstrates the insight that black swans lurk in every area of our world, from the rise of religion to the lives of individuals.

Moreover, he warns that events that previously had minimal impact are now having major consequences, and that black swans are occurring more frequently today.

This is why Black Swan continues to be talked about even ten years after its publication.

Those who consider themselves 'elite'

Beware of the gentleman in the tie!

The 2008 global financial crisis was also the sudden appearance of a black swan.

Neither the financial experts who created countless derivative products with magical financial engineering nor the consumers who were guaranteed high returns by the financial experts could have predicted that the enormous amount of capital invested could become worthless in an instant.

Like a runaway colt, financial capital has penetrated into people's daily lives, as if the financial market will always boom (the first characteristic of a black swan).

However, because the financial crisis was impossible to predict (or not predicted), there was no safety net for it, and so the devastation it brought was as horrific as we are witnessing now (the second characteristic of the black swan).

And now that the global financial crisis has erupted, people are trying to explain it away and make it seem predictable and explainable (the third characteristic of the black swan).

Taleb shows how the normal distribution is a huge intellectual fraud, and how “so-called financial experts manipulate the numbers to commit fraud,” and he scoffs that their predictive abilities are “not much better than those of astrologers.”

Because they come up with a strategy that completely ignores the possibility of a black swan.

In 1987, Taleb was working at Credit Suisse First Boston, a Wall Street investment bank.

And on October 19th of the same year, I experienced 'Black Monday' with my whole body.

“Until the day before (Black Monday), the occurrence of the incident was beyond the realm of imagination.

If I had ever pointed out that possibility, I would have been treated like a lunatic.

It was definitely a black swan.

…I was convinced that I was completely incompetent at predicting starting prices.

“In fact, other people were just as incompetent, but they didn’t know it and they didn’t know that they were taking a huge risk.” (pp. 67-69)

Taleb criticizes so-called "experts" who delude themselves into thinking they can measure the unmeasurable (especially financial experts who use Gaussian mathematics, including the "normal distribution," to manage risk) and who diligently avoid the possibility of "extremely exceptional events," or black swans.

“The real reason (bankers) appear conservative is because their loans rarely, if ever, go out of business.

So (…) even after observing and observing for over a century, there's no way to measure the profitability of their lending operations! Yet, in the summer of 1982, America's major banks lost nearly all the profits they had ever earned (cumulatively)—virtually all the profits recorded in American financial history.

“This is an ‘extremely exceptional event’ in which Central and South American countries that borrowed from these banks simultaneously defaulted on their debts.” (p. 96)

“Ten years later, another comedy was repeated.

The collapse of the real estate market in the early 1990s again put the "risk-management-savvy" big banks in a financial crisis, many of them on the verge of bankruptcy.

Over $500 billion in taxpayer funds were bailed out by savings and loan banks that no longer exist.

The Federal Reserve protected them with taxpayer money.

So-called 'conservative' banks take advantage of the profits when they are made.

But when a crisis hits, our taxpayers pay the price.

(…) I have no intention of arguing with the term risk management.

I'm just asking you to please stop calling yourself a conservative investor.

Also, don't pretend to be superior to other businesses that are less vulnerable to black swans.

Another recent incident was the bankruptcy of a financial investment firm called Long-Term Capital Management in 1988.

At the time, the company was using a risk management technique developed by two Nobel Prize winners in economics who were considered geniuses.

However, this technique was based on the nonsensical mathematics of the normal distribution curve.

Somehow they convinced themselves that this was some great science.” (pp. 96-97)

Nassim Nicholas Taleb,

From "Wall Street's Heretic" to "Wall Street's Sage"

Who is Nassim Taleb, who cleverly presents the Black Swan idea, a remarkably well-structured model applicable to all fields, through thought experiments, epistemology, history, economics, management, statistics, fractals, mathematics, psychology, and even his own anecdotes?

In Black Swan, Taleb presents a witty, provocative, and fresh style that reflects the diverse experiences he has lived, and the range of areas from which he draws is surprisingly wide.

Michael Schreiz, author of Serious Play, called Taleb, author of The Black Swan, “a brilliant scientist and writer,” and placed him in the same category as Richard Dawkins and Stephen Jay Gould.

Nassim Taleb is as problematic and fascinating a figure as the books he writes.

Taleb is the kind of person who, whenever people at cocktail parties ask him what he does, is tempted to say, "I'm a skeptical empiricist, a lazy reader, and someone who delves deeply into an idea," but who ultimately simply says, "I'm a limousine driver."

When he was on a transatlantic flight and a woman spoke to him in broken French while he was reading Bourdieu, he feigned pride by telling her that he was a "limousine driver" and that he only drove "top-of-the-line" cars, thus warding off the interruption of his reading.

Taleb, a witty figure, is a Lebanese-born "empirical skeptic" who, based on his childhood experiences, "went from Wall Street investment professional to the world of philosophy."

When he was fifteen, his grandfather, then Lebanese interior minister, was imprisoned for his involvement in student unrest.

An excited police officer, hit by a rock thrown by a student, opened fire on the protesters, and it was his grandfather who gave the order to suppress the riot.

Having spent his teenage years in Lebanon, he heard adults around him say that “the war will be over in just a few days,” despite the 17-year-old Lebanese civil war, and realized that people “don’t realize that the unexpected is happening every day, even though it is completely unexpected.”

This may have been the beginning of the 'black swan' idea.

Taleb specialized in derivatives among financial products, and his reason for doing so is also 'heretical'.

“In the field of derivatives, advanced mathematics is required, and adopting the wrong mathematical model can lead to the worst disaster.”

He received his PhD in this field.

Later, while working as an investment expert on Wall Street, Taleb began to develop the idea of a "black swan" by identifying the "Black Monday" of 1987 and the Lebanon War as the same phenomenon.

“It has become clear that almost everyone has some kind of mental blindness when it comes to recognizing the role of these events.”

Having figured this out, Taleb decided to stay in the financial world, where the six-letter words were rampant, and instead do intense, exciting work that required minimal time.

He avoided associating with “successful people who wear designer clothes but don’t read a single book,” and used his sabbatical year to supplement his lack of knowledge in science and philosophy.

It is the embodiment of the idea of the 'black swan'.

And the book that was published was “Black Swan.”

After publication, Taleb was criticized by both academics and financial circles, and was treated as a "Wall Street heretic."

However, when Wall Street faced a global financial crisis due to the sudden appearance of the black swan that this book warned about, Taleb came to be called 'the new sage of Wall Street.'

Taleb and The Black Swan were another black swan.

Praise pours in for Black Swan and Nassim Nicholas Taleb

* Taleb changed the way many people think about uncertainty, especially uncertainty in financial markets.

His book, The Black Swan, offers a unique and bold way to understand the meaning of unexpected events.

- Daniel Kahneman, author of Thinking, Fast and Slow, and Nobel Prize winner in economics

* This one book contains more information about the real world than all the books in ten libraries.

- Tom Peters, author of Managing the Future

* A book that changed our thinking.

- [Times]

* The author not only explained why the financial crisis occurred, but also witnessed that the financial crisis was coming.

- [New York Times]

* Taleb is real.

It accurately pointed out that it was not our greed and corruption, but our intellectual hubris that brought the global financial system to its knees.

- John Gray, author of Homo Rapiens

* The risk modeling expert now called a prophet! - [The Economist]

* Taleb is a truly important philosopher who changes our perspective on the world. - [GQ]

* This is very appropriate advice in these volatile times.

- Malcolm Gladwell, author of Outliers

* The world's most famous thinker.

- [Sunday Times]

* A masterpiece! - Chris Anderson, author of The Long Tail

* Can't take my eyes off it.

It's easy to get sucked in.

- [Financial Times]

* 'Black Swan' is the most attractive theory in this uncertain era.

- [Observer]

* This is a beautiful book with a reflective and powerful argument.

Like Calvino's fable, it criticizes the fatalistic error of humans who reduce the complexity of the real world to black-and-white logic.

- Emmanuel Derman, author of Quant: A Retrospective on Physics and Finance

* It is a fun read, full of knowledgeable advice and important messages.

- [Business Week]

* This is a vivid and bold research piece that delves into what is still unknown.

- [Philadelphia Inquirer]

* This is a thorough meditation on modern society.

- [Daily Telegraph]

* A thought-provoking, intellectual book! - [Wall Street Journal]

* It's different.

Great.

- [Los Angeles Times]

A book that offers insight into our thoughts and attitudes toward the uncertainty of the world! - [Dong-A Ilbo]

* It is a sharp criticism of the arrogant reality that assumes that black swans do not exist.

- [Maeil Business Newspaper]

GOODS SPECIFICS

- Date of issue: April 30, 2018

- Page count, weight, size: 647 pages | 927g | 152*225*31mm

- ISBN13: 9788990247674

- ISBN10: 8990247675

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)