Ken Fisher's Contrarian Stock Investing

|

Description

Book Introduction

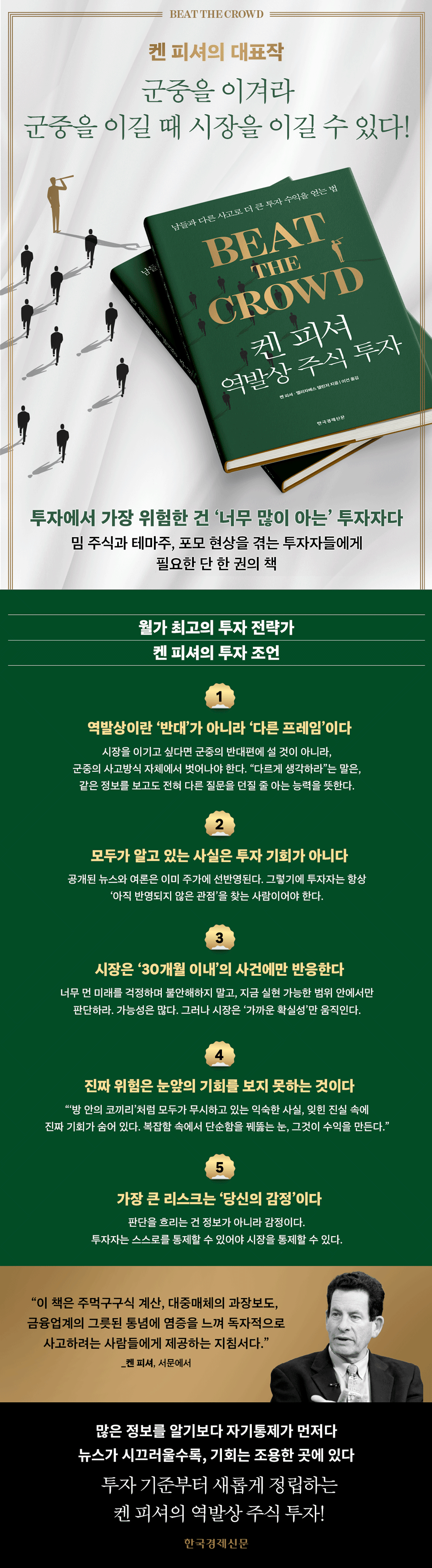

“Leap over the crowd”

Ken Fisher's Market-Beatin' Investment Principles

'Buy low, sell high.' This is the golden rule of stock investing that everyone knows, but in reality, most people buy high and sell low.

"Ken Fisher's Contrarian Stock Investing" is a book that teaches these people how to think independently without being swayed by crowd psychology.

Ken Fisher, Wall Street's top strategist, explains the true meaning of contrarianism to both those who misunderstand it and misexecute it, and those who unknowingly practice it.

This book is a kind of brain training guide from Ken Fisher for investors who are fed up with rule-of-thumb calculations, media hype, and financial industry conventions.

Readers can learn principles to protect their brains from the exaggerated reports of the mass media and stay one step ahead of the crowd.

On the one hand, you will be able to get a glimpse into the secrets of Ken Fisher, who has reduced mistakes and increased his winning percentage while managing assets for the past 40 years.

Ken Fisher's Market-Beatin' Investment Principles

'Buy low, sell high.' This is the golden rule of stock investing that everyone knows, but in reality, most people buy high and sell low.

"Ken Fisher's Contrarian Stock Investing" is a book that teaches these people how to think independently without being swayed by crowd psychology.

Ken Fisher, Wall Street's top strategist, explains the true meaning of contrarianism to both those who misunderstand it and misexecute it, and those who unknowingly practice it.

This book is a kind of brain training guide from Ken Fisher for investors who are fed up with rule-of-thumb calculations, media hype, and financial industry conventions.

Readers can learn principles to protect their brains from the exaggerated reports of the mass media and stay one step ahead of the crowd.

On the one hand, you will be able to get a glimpse into the secrets of Ken Fisher, who has reduced mistakes and increased his winning percentage while managing assets for the past 40 years.

- You can preview some of the book's contents.

Preview

index

introduction_

Chapter 1.

Brain Training Guidelines

Wall Street's definition of a contrarian investor is a contradiction | The grumpy fringe crowd | There are exceptions everywhere | Why most investors are wrong most of the time | The first rule of contrarian investing | The market sees through everything | The other way, not the other way | The right mindset | Restrain yourself

Chapter 2.

The story the bell curve tells

Wall Street's Obsession with Calendars | The Groupthink of Experts | How Contrarian Investors Use Expert Forecasts | Even Masters Make Mistakes | How to Beat Wall Street

Chapter 3.

Vampires and Doomsdayers

The media's perspective is flawed | The vampire right in front of your nose | Useless indicator analysis | Magical indicators | The impact of war | Don't be a cow, be a contrarian investor

Chapter 4.

An event that will not occur within 30 months

Are Baby Boomers a Bomb? | What about Social Security and Medicare? | What if the younger generation continues to wander? | National Debt | What if debt causes inflation to soar? | What if the US stops innovating? | Global Warming? | Income Inequality? | What if the Dollar loses its status as the world's reserve currency? | What the Markets Know

Chapter 5.

How to See the Elephant in the Room

How Elephants Get Power | Dumbo the Baby Elephant, Gross Profit Margin, and Other Flying Elephants | When Good News Disguises Itself as Bad News | The Yield Curve | When Elephants Attack | A History of Tragedy | When Textbooks Lie | What Elephants Can't Be

Chapter 6.

Chapters you'll hate

First, let go of your prejudices. Is my candidate the best? The magical elephant of gridlock. The bills sleeping in Congress. What's visible and what's not. A group worse than politicians. Government policies that made the next crisis worse.

Chapter 7.

Put away your textbooks

Don't throw away your textbooks, but know their limitations! | Rule number one: The PER has no predictive power. | The innovative CAPE ratio isn't a panacea either. | Are small-cap stocks advantageous? | A fantastic academic formula. | Theory and practice are different. | So how should we learn?

Chapter 8.

Throw this book away too!

Miley Cyrus, Justin Bieber, and Pop Star Economics | Why They Became Classics | Introduction to Philosophy and Economics | How to Learn from Legendary Investors | People Who Don't Remember History | A 21st Century Classic

Chapter 9.

Control Your Emotions and Biases: Behavioral Finance

The Birth of Behavioral Finance | Behavioral Finance on the Drift | The Merging of Academia, Capitalism, and Marketing | Behavioral Finance and Tactical Positioning | Recent Information Bias and Psychology | Tactical Advantages from Behavioral Finance | Stock Selection | When to Exit the Market | The Importance of Self-Control

Chapter 10.

Negative and short-sighted mass media

How to Use the News | What the Mass Media Always Misses | We Trust Technology

In closing the book

Translator's Note

main

Chapter 1.

Brain Training Guidelines

Wall Street's definition of a contrarian investor is a contradiction | The grumpy fringe crowd | There are exceptions everywhere | Why most investors are wrong most of the time | The first rule of contrarian investing | The market sees through everything | The other way, not the other way | The right mindset | Restrain yourself

Chapter 2.

The story the bell curve tells

Wall Street's Obsession with Calendars | The Groupthink of Experts | How Contrarian Investors Use Expert Forecasts | Even Masters Make Mistakes | How to Beat Wall Street

Chapter 3.

Vampires and Doomsdayers

The media's perspective is flawed | The vampire right in front of your nose | Useless indicator analysis | Magical indicators | The impact of war | Don't be a cow, be a contrarian investor

Chapter 4.

An event that will not occur within 30 months

Are Baby Boomers a Bomb? | What about Social Security and Medicare? | What if the younger generation continues to wander? | National Debt | What if debt causes inflation to soar? | What if the US stops innovating? | Global Warming? | Income Inequality? | What if the Dollar loses its status as the world's reserve currency? | What the Markets Know

Chapter 5.

How to See the Elephant in the Room

How Elephants Get Power | Dumbo the Baby Elephant, Gross Profit Margin, and Other Flying Elephants | When Good News Disguises Itself as Bad News | The Yield Curve | When Elephants Attack | A History of Tragedy | When Textbooks Lie | What Elephants Can't Be

Chapter 6.

Chapters you'll hate

First, let go of your prejudices. Is my candidate the best? The magical elephant of gridlock. The bills sleeping in Congress. What's visible and what's not. A group worse than politicians. Government policies that made the next crisis worse.

Chapter 7.

Put away your textbooks

Don't throw away your textbooks, but know their limitations! | Rule number one: The PER has no predictive power. | The innovative CAPE ratio isn't a panacea either. | Are small-cap stocks advantageous? | A fantastic academic formula. | Theory and practice are different. | So how should we learn?

Chapter 8.

Throw this book away too!

Miley Cyrus, Justin Bieber, and Pop Star Economics | Why They Became Classics | Introduction to Philosophy and Economics | How to Learn from Legendary Investors | People Who Don't Remember History | A 21st Century Classic

Chapter 9.

Control Your Emotions and Biases: Behavioral Finance

The Birth of Behavioral Finance | Behavioral Finance on the Drift | The Merging of Academia, Capitalism, and Marketing | Behavioral Finance and Tactical Positioning | Recent Information Bias and Psychology | Tactical Advantages from Behavioral Finance | Stock Selection | When to Exit the Market | The Importance of Self-Control

Chapter 10.

Negative and short-sighted mass media

How to Use the News | What the Mass Media Always Misses | We Trust Technology

In closing the book

Translator's Note

main

Detailed image

Into the book

Numerous academic studies have shown that the majority of investors have poor judgment and usually buy high and sell low.

They believe that if they go against the crowd, they will inevitably buy low and sell high.

The problem is that 'everyone else' also acts like a crowd, just like 'everyone else'.

Their opinions are equally cliche, and their analysis is no better than that of the mainstream crowd.

They just go against the judgment of the mainstream crowd, meddle in it, and mock it.

People who think this way and believe they are contrarian investors are no different from the mainstream crowd.

The results they achieve are also almost the same.

But there is some good news.

You can become a true contrarian investor! Once you understand why the crowd is losing its way, it's easy to think and act more rationally.

While perfection may be impossible, getting ahead of the crowd isn't all that difficult.

_p.17

Whatever the crowd's expectations, I guarantee the market will defy them.

But that doesn't mean the market goes against the crowd's expectations! Let's revisit the analog clock example from earlier.

If the mainstream crowd predicts that the clock hand will point to 1 o'clock, the fringe crowd predicts that it will point to 7 o'clock.

A true contrarian investor knows that markets are efficient, so he or she will most likely not think of the 11 o'clock to 3 o'clock range.

Because it is seen as too close to the predictions of the mainstream crowd.

In this way, contrarian investors can rule out four possibilities:

However, there are still eight possibilities left.

For example, if the mainstream crowd expects a 10 percent annual stock price increase, a true contrarian investor will most likely exclude a 5 to 15 percent increase.

However, the rate of increase can be very high, it can be flat, or it can be declining.

_p.32

Wall Street is foolishly obsessed with predicting annual returns.

However, the annual rate of return is not important.

Seriously! What matters is the market cycle, and the market cycle doesn't care about the calendar.

It is rare for a bull or bear market to follow a calendar.

Based on the S&P 500 index, no bull market since 1926 has started in January, and only one, from 1957 to 1961, ended in December.

If the market cycle ever aligns with the calendar, it will be the first of its kind.

But even if it fits like that, nothing fundamentally changes.

Yet Wall Street remains fixated on annual returns, with experts racing to announce their annual return forecasts.

Because it can attract people's attention through mass media (always a good thing for experts).

It's just one number, so it stands out and is easy to understand.

It is a specific index number.

It's easy to track and evaluate, and it seems like the experts are taking responsibility and speaking.

However, few professionals submit their transcripts later, and few people even want to see them.

_p.41~42

Experts do not intentionally present similar predictions.

However, they all use the same information and interpret it in similar ways.

No matter how you call them, they are ultimately part of the crowd and are reflected in market prices, so contrarian investors must avoid them.

Fundamental analysts are equally concerned with the Fed's policies, the economic dynamics, interest rates, and valuation politics.

, and make the same assumptions about good and bad news.

And since all of these have a mean reversion tendency, when predicting long-term performance, it is assumed that bull and bear markets alternate.

Technical analysts all use the same charts, patterns, and principles.

The rest of the crowd also regurgitates the same public information every day.

Dow theorists follow Dow theory.

Rover

Those who follow Shiller interpret the 10-year PER (Cyclically Adjusted PER, CAPE) created by Shiller in the same way.

As a result, everything agreed upon by the experts is reflected in the price.

Will the events they predicted affect stock prices? They've already been factored in! Will the risks discussed in reports and articles affect stock prices? They have! The likelihood of the market moving as experts predict is extremely slim.

Even if some events unfold as experts predict, the market's reaction will likely be different.

_p.45~46

The public has something else in common besides myopia.

The fact is that everyone is ruminating.

Sometimes I spend years ruminating on a topic.

Rumination is the act of regurgitating digested food and chewing it again.

Such foods have little nutritional value.

Rumination is not a very useful activity.

It's just a habitual behavior that cows do, like people chewing gum.

The same goes for news recaps.

Ruminating doesn't improve investment performance.

It doesn't improve your investment judgment either.

The news that the mass media exaggerates and ruminates on is not nutritious.

Because the market is very efficient.

The news that the mass media churns out is usually neither accurate nor has any impact on stock prices.

Because it has already been reflected in the stock price.

_p.112

The market only looks at events that will occur within the next 30 months, so the annoying and noisy ideological debates and social issues in academia do not affect the current market.

It may become an important issue 20, 30, or 40 years from now.

Or perhaps our lives will change in unimaginable ways, rendering the flat-rate estimates useless.

Perhaps social and climate-related issues may not be economic concerns.

But right now we don't know for sure, and neither does the market.

So there is no need to worry.

There is no need to fear unless something happens within 30 months.

The crowd also fears misfortunes that may come in the distant future.

And the mass media can't help but make noise all the time.

Tell them to talk as much as they want.

There is no need to worry even if the mass media exaggerates and reports all sorts of bad news.

Because if you're extremely excited, there's nothing more surprising.

If everyone in the room sees an elephant, there's no need to be surprised by the elephant.

If the market knew, it wouldn't be surprising.

_p.155

But there are also elephants that are not good.

Risk can be an elephant.

When an elephant charges, it is scarier than a bear.

A dangerous elephant is the opposite of a good elephant.

The good elephant is a blessing that everyone knew about but later forgot.

The dangerous elephant is a misfortune that everyone knew about but later forgot.

(…) As long as long-term risks continue to be discussed, this will be reflected in the market.

But the moment people forget, long-term risks can become real risks.

It means becoming a dangerous elephant.

Like the story of the boy who cried wolf.

When the boy cried out, "Wolf," people reacted.

But when the wolf actually appeared, people ignored the boy's cries.

The same goes for the market.

_p.180~181

Investing is a field where you learn more through practice than through reading.

It's like baseball, for example.

Yogi Berra never received any baseball training as a child.

I just enjoyed playing neighborhood baseball.

It's not a bad idea to go to business school and learn about investing.

However, you should learn the textbook theory, and it will only be useful for teaching purposes in school.

Because it is a theory that is out of touch with the real world.

We succeed in investing when we learn from our mistakes.

You must understand your own behavior and overcome your greatest enemies: emotions and prejudices.

We need to invest real money and learn in real time in the real world.

Theory sometimes fits reality, but more often than not it doesn't.

_p.238

Does your brain feel better now? Even if you do feel that way, try to avoid getting overly excited.

Because no matter how smart a person is, he cannot defeat his greatest enemy.

That enemy is none other than yourself.

That is, emotions and prejudices.

The field that specializes in this phenomenon is behavioral finance.

It's also my favorite field.

Behavioral finance can help us understand how emotions and biases lead us to make mistakes.

The purpose of studying behavioral finance is to control the emotions and biases that lead to incorrect investment decisions.

Behavioral finance becomes a weapon to suppress the speculative instinct inherent in our minds.

They believe that if they go against the crowd, they will inevitably buy low and sell high.

The problem is that 'everyone else' also acts like a crowd, just like 'everyone else'.

Their opinions are equally cliche, and their analysis is no better than that of the mainstream crowd.

They just go against the judgment of the mainstream crowd, meddle in it, and mock it.

People who think this way and believe they are contrarian investors are no different from the mainstream crowd.

The results they achieve are also almost the same.

But there is some good news.

You can become a true contrarian investor! Once you understand why the crowd is losing its way, it's easy to think and act more rationally.

While perfection may be impossible, getting ahead of the crowd isn't all that difficult.

_p.17

Whatever the crowd's expectations, I guarantee the market will defy them.

But that doesn't mean the market goes against the crowd's expectations! Let's revisit the analog clock example from earlier.

If the mainstream crowd predicts that the clock hand will point to 1 o'clock, the fringe crowd predicts that it will point to 7 o'clock.

A true contrarian investor knows that markets are efficient, so he or she will most likely not think of the 11 o'clock to 3 o'clock range.

Because it is seen as too close to the predictions of the mainstream crowd.

In this way, contrarian investors can rule out four possibilities:

However, there are still eight possibilities left.

For example, if the mainstream crowd expects a 10 percent annual stock price increase, a true contrarian investor will most likely exclude a 5 to 15 percent increase.

However, the rate of increase can be very high, it can be flat, or it can be declining.

_p.32

Wall Street is foolishly obsessed with predicting annual returns.

However, the annual rate of return is not important.

Seriously! What matters is the market cycle, and the market cycle doesn't care about the calendar.

It is rare for a bull or bear market to follow a calendar.

Based on the S&P 500 index, no bull market since 1926 has started in January, and only one, from 1957 to 1961, ended in December.

If the market cycle ever aligns with the calendar, it will be the first of its kind.

But even if it fits like that, nothing fundamentally changes.

Yet Wall Street remains fixated on annual returns, with experts racing to announce their annual return forecasts.

Because it can attract people's attention through mass media (always a good thing for experts).

It's just one number, so it stands out and is easy to understand.

It is a specific index number.

It's easy to track and evaluate, and it seems like the experts are taking responsibility and speaking.

However, few professionals submit their transcripts later, and few people even want to see them.

_p.41~42

Experts do not intentionally present similar predictions.

However, they all use the same information and interpret it in similar ways.

No matter how you call them, they are ultimately part of the crowd and are reflected in market prices, so contrarian investors must avoid them.

Fundamental analysts are equally concerned with the Fed's policies, the economic dynamics, interest rates, and valuation politics.

, and make the same assumptions about good and bad news.

And since all of these have a mean reversion tendency, when predicting long-term performance, it is assumed that bull and bear markets alternate.

Technical analysts all use the same charts, patterns, and principles.

The rest of the crowd also regurgitates the same public information every day.

Dow theorists follow Dow theory.

Rover

Those who follow Shiller interpret the 10-year PER (Cyclically Adjusted PER, CAPE) created by Shiller in the same way.

As a result, everything agreed upon by the experts is reflected in the price.

Will the events they predicted affect stock prices? They've already been factored in! Will the risks discussed in reports and articles affect stock prices? They have! The likelihood of the market moving as experts predict is extremely slim.

Even if some events unfold as experts predict, the market's reaction will likely be different.

_p.45~46

The public has something else in common besides myopia.

The fact is that everyone is ruminating.

Sometimes I spend years ruminating on a topic.

Rumination is the act of regurgitating digested food and chewing it again.

Such foods have little nutritional value.

Rumination is not a very useful activity.

It's just a habitual behavior that cows do, like people chewing gum.

The same goes for news recaps.

Ruminating doesn't improve investment performance.

It doesn't improve your investment judgment either.

The news that the mass media exaggerates and ruminates on is not nutritious.

Because the market is very efficient.

The news that the mass media churns out is usually neither accurate nor has any impact on stock prices.

Because it has already been reflected in the stock price.

_p.112

The market only looks at events that will occur within the next 30 months, so the annoying and noisy ideological debates and social issues in academia do not affect the current market.

It may become an important issue 20, 30, or 40 years from now.

Or perhaps our lives will change in unimaginable ways, rendering the flat-rate estimates useless.

Perhaps social and climate-related issues may not be economic concerns.

But right now we don't know for sure, and neither does the market.

So there is no need to worry.

There is no need to fear unless something happens within 30 months.

The crowd also fears misfortunes that may come in the distant future.

And the mass media can't help but make noise all the time.

Tell them to talk as much as they want.

There is no need to worry even if the mass media exaggerates and reports all sorts of bad news.

Because if you're extremely excited, there's nothing more surprising.

If everyone in the room sees an elephant, there's no need to be surprised by the elephant.

If the market knew, it wouldn't be surprising.

_p.155

But there are also elephants that are not good.

Risk can be an elephant.

When an elephant charges, it is scarier than a bear.

A dangerous elephant is the opposite of a good elephant.

The good elephant is a blessing that everyone knew about but later forgot.

The dangerous elephant is a misfortune that everyone knew about but later forgot.

(…) As long as long-term risks continue to be discussed, this will be reflected in the market.

But the moment people forget, long-term risks can become real risks.

It means becoming a dangerous elephant.

Like the story of the boy who cried wolf.

When the boy cried out, "Wolf," people reacted.

But when the wolf actually appeared, people ignored the boy's cries.

The same goes for the market.

_p.180~181

Investing is a field where you learn more through practice than through reading.

It's like baseball, for example.

Yogi Berra never received any baseball training as a child.

I just enjoyed playing neighborhood baseball.

It's not a bad idea to go to business school and learn about investing.

However, you should learn the textbook theory, and it will only be useful for teaching purposes in school.

Because it is a theory that is out of touch with the real world.

We succeed in investing when we learn from our mistakes.

You must understand your own behavior and overcome your greatest enemies: emotions and prejudices.

We need to invest real money and learn in real time in the real world.

Theory sometimes fits reality, but more often than not it doesn't.

_p.238

Does your brain feel better now? Even if you do feel that way, try to avoid getting overly excited.

Because no matter how smart a person is, he cannot defeat his greatest enemy.

That enemy is none other than yourself.

That is, emotions and prejudices.

The field that specializes in this phenomenon is behavioral finance.

It's also my favorite field.

Behavioral finance can help us understand how emotions and biases lead us to make mistakes.

The purpose of studying behavioral finance is to control the emotions and biases that lead to incorrect investment decisions.

Behavioral finance becomes a weapon to suppress the speculative instinct inherent in our minds.

---p.323

Publisher's Review

“Leap over the crowd”

Ken Fisher's Market-Beatin' Investment Principles

'Buy low, sell high.' This is the golden rule of stock investing that everyone knows, but in reality, most people buy high and sell low.

"Ken Fisher's Contrarian Stock Investing" is a book that teaches these people how to think independently without being swayed by crowd psychology.

Ken Fisher, Wall Street's top strategist, explains the true meaning of contrarianism to both those who misunderstand it and misexecute it, and those who unknowingly practice it.

It's easy to think that going against the crowd is contrarian.

The crowd's judgment is mostly wrong, so they believe that doing the opposite will lead to success.

However, this thinking is sometimes right, but often wrong.

Because stock prices don't always move against crowd expectations.

People who act in the opposite way also have the same way of thinking as the crowd.

In reality, the market is not a battle between the crowd and contrarian investors.

The market is made up of the mainstream crowd, the fringe crowd who act contrary to the mainstream crowd, and the true contrarian investors who think independently.

A true contrarian investor looks at both sides of the crowd and draws his own conclusions.

The key to contrarian investing lies in independent thinking.

We must not be swayed by exaggerated reports, see what others do not see, and avoid being swayed by rules of thumb or public opinion.

Successful investing doesn't require perfect judgment.

You succeed if you hit more times than you miss.

Contrarian investors can't always be right.

Even seasoned investors are wrong 30-40% of their judgments.

So how can we improve our odds of hitting the mark? Ken Fisher repeatedly emphasizes the importance of remembering that markets don't move in the direction the crowd expects, and urges us to ignore the noise and see the world from a different perspective than the crowd.

This book is a kind of brain training guide from Ken Fisher for investors who are fed up with rule-of-thumb calculations, media hype, and financial industry conventions.

Readers can learn principles to protect their brains from the exaggerated reports of the mass media and stay one step ahead of the crowd.

On the one hand, you will be able to get a glimpse into the secrets of Ken Fisher, who has reduced mistakes and increased his winning percentage while managing assets for the past 40 years.

In a different direction, not the opposite direction

Why do most people fail at investing?

It's not because of a lack of knowledge or intelligence.

Even smart people often make poor decisions.

Mostly for one reason.

It is being unintentionally led by market opinion.

People think of investing as a kind of discipline, skill, or science, but the techniques actually used are often nothing more than conventional wisdom.

Based on common sense, determine whether it is good or bad news and choose the right time to buy or sell.

So what is true contrarian investing?

When people believe something will happen in the market, contrarian investors believe something else will happen.

It is important to note that this is not an opposing case, but a different case.

The market reflects all information perceived by the crowd into today's stock price.

If everyone has witnessed the bad news, there is no need to be pessimistic.

This is because the moment everyone sees the bad news, it spreads through TV and the internet and is reflected in the stock price.

Contrarian investors know when to hold their breath and where not to go.

How do we know? Because we know that markets are generally efficient.

Markets are very inefficient in the short run, but in the long run, all public information is reflected in stock prices.

This is because investors trade using public information.

Understanding how markets reflect public information can help narrow the range of possibilities.

Ken Fisher points out that while you can't know what will happen, knowing what is unlikely to happen allows you to consider viable alternatives and improve your odds of winning.

To narrow the range of possibilities, contrarian investors also investigate alternatives that the mainstream and fringe crowds ignore.

Or look at the same alternative from a different angle.

This way, you can discover risks and opportunities that the crowd misses.

Is this something that will happen within 30 months?

Let's take a look at the economic news right now.

The story is about excessive debt, society being in disarray and going bankrupt.

Ken Fisher calls this obsession with long-term forecasts by the mass media "the vampire in front of your nose."

Because it scares you like a vampire is going to attack you at any moment.

But there is no need to listen to such exaggerated reports.

The market has already taken care of the short-term issues and doesn't care about the long-term issues at all.

Can you predict the future two years from now? The same goes for the market.

The distant future of the market is not known at this time.

Because there are so many changes to guess at.

The stock market knows this, which is why it doesn't look further than 30 months.

Anything beyond 30 months is purely a guess and is considered a possibility rather than a probability.

Probability has no effect on the stock market.

Yet the news continues to highlight slow, long-term trends that will ultimately lead us to ruin.

Excessive debt, China's rise as a global hegemon, and global warming are examples.

Experts endlessly exaggerate and report on the assumptions made by scholars as facts.

Furthermore, many experts warn that this ominous long-term trend could devastate the stock market in the near future.

But we can use a simple technique to disregard these meaningless claims about the distant future.

Simply ask, “Will this issue have a significant impact on the economy within 30 months?”

No matter how big or dire the risks warned by the mass media are, they won't have a significant impact on the stock market unless they happen within 30 months.

Even if that event finally happens in the distant future.

The stock market doesn't have that far-sighted a vision.

Beware the elephant in the room

A true contrarian investor doesn't look for the long term, but rather focuses on what others are missing.

Ken Fisher calls this "the elephant in the room."

It refers to something that is always there but cannot be seen.

If there's an elephant in the room, it's a big deal.

Anyone would be surprised if they saw the elephant in the room for the first time.

But as time goes by, you gradually get used to the elephant and forget about it.

Elephants are gray and hard to see.

You can't miss it even if you pass by.

But when the elephant starts moving, it is startling.

The same goes for the market.

When investors are fully aware of a technique or risk, surprises rarely occur.

The market is nothing special, it is just a long-term environment.

But the moment we forget the existence of the market, the market strikes us again with a powerful punch.

The elephant in the room is something we've all experienced, once feared or loved, and then forgotten.

What people have forgotten is the obvious facts, but they are not reflected in the price.

Since it was once a widely known fact, it should theoretically be reflected.

But now it is forgotten and invisible, so it is not reflected.

It is because human memory is poor that elephants gain strength.

Ken Fisher points to gross profit margin (sales minus cost of goods sold divided by sales) as one of the elephants, a formerly popular but now fading metric.

In the past, when detailed corporate performance data was not readily available, gross operating profit margin was a very popular indicator.

But these days, investors are in a state of information overload.

As data grows, we become so caught up in the details that we lose sight of the elephant in the room.

Control your emotions and prejudices

Could it be possible to achieve perfection by blocking out external noise and focusing on the elephant? There's something you shouldn't miss.

Your biggest enemy in investing is yourself, your emotions and biases.

Ken Fisher proposes behavioral finance as a solution to this.

Behavioral finance can help us understand how we make mistakes due to our emotions and biases, and can help us curb our inherent speculative instincts.

In Daniel Kahneman's famous experiment, people increased the amount they were willing to lose to ensure they had some chance of avoiding the loss.

It means that the pain you feel when you don't make money is greater than the joy you feel when you make money.

It is said that the pain people feel when they lose money is 2.5 times greater than the joy they feel when they win the same amount of money.

This very difference is the key factor that causes people to make mistakes.

When stock prices fall, people sell their stocks at a low price to avoid further losses.

Prospect theory explains why people rush to sell stocks when they are volatile, even though it would be more advantageous to hold them in the long run.

Recently, a new way of thinking has emerged that exploiting such irrational investors can yield excess returns.

When prices are distorted by crowd psychology, they try to take advantage of this to gain excess profits.

Ken Fisher points out that the focus of behavioral finance seems to have shifted from 'self-control' to 'acquiring excess returns.'

The original purpose of behavioral finance is to identify one's own cognitive errors and prevent them, not to exploit the mistakes of others.

He asserts that the latest techniques in behavioral finance do not actually improve investment skills.

He urges investors to make wise decisions, saying that self-control is far more useful than the latest trendy techniques.

Ken Fisher's Market-Beatin' Investment Principles

'Buy low, sell high.' This is the golden rule of stock investing that everyone knows, but in reality, most people buy high and sell low.

"Ken Fisher's Contrarian Stock Investing" is a book that teaches these people how to think independently without being swayed by crowd psychology.

Ken Fisher, Wall Street's top strategist, explains the true meaning of contrarianism to both those who misunderstand it and misexecute it, and those who unknowingly practice it.

It's easy to think that going against the crowd is contrarian.

The crowd's judgment is mostly wrong, so they believe that doing the opposite will lead to success.

However, this thinking is sometimes right, but often wrong.

Because stock prices don't always move against crowd expectations.

People who act in the opposite way also have the same way of thinking as the crowd.

In reality, the market is not a battle between the crowd and contrarian investors.

The market is made up of the mainstream crowd, the fringe crowd who act contrary to the mainstream crowd, and the true contrarian investors who think independently.

A true contrarian investor looks at both sides of the crowd and draws his own conclusions.

The key to contrarian investing lies in independent thinking.

We must not be swayed by exaggerated reports, see what others do not see, and avoid being swayed by rules of thumb or public opinion.

Successful investing doesn't require perfect judgment.

You succeed if you hit more times than you miss.

Contrarian investors can't always be right.

Even seasoned investors are wrong 30-40% of their judgments.

So how can we improve our odds of hitting the mark? Ken Fisher repeatedly emphasizes the importance of remembering that markets don't move in the direction the crowd expects, and urges us to ignore the noise and see the world from a different perspective than the crowd.

This book is a kind of brain training guide from Ken Fisher for investors who are fed up with rule-of-thumb calculations, media hype, and financial industry conventions.

Readers can learn principles to protect their brains from the exaggerated reports of the mass media and stay one step ahead of the crowd.

On the one hand, you will be able to get a glimpse into the secrets of Ken Fisher, who has reduced mistakes and increased his winning percentage while managing assets for the past 40 years.

In a different direction, not the opposite direction

Why do most people fail at investing?

It's not because of a lack of knowledge or intelligence.

Even smart people often make poor decisions.

Mostly for one reason.

It is being unintentionally led by market opinion.

People think of investing as a kind of discipline, skill, or science, but the techniques actually used are often nothing more than conventional wisdom.

Based on common sense, determine whether it is good or bad news and choose the right time to buy or sell.

So what is true contrarian investing?

When people believe something will happen in the market, contrarian investors believe something else will happen.

It is important to note that this is not an opposing case, but a different case.

The market reflects all information perceived by the crowd into today's stock price.

If everyone has witnessed the bad news, there is no need to be pessimistic.

This is because the moment everyone sees the bad news, it spreads through TV and the internet and is reflected in the stock price.

Contrarian investors know when to hold their breath and where not to go.

How do we know? Because we know that markets are generally efficient.

Markets are very inefficient in the short run, but in the long run, all public information is reflected in stock prices.

This is because investors trade using public information.

Understanding how markets reflect public information can help narrow the range of possibilities.

Ken Fisher points out that while you can't know what will happen, knowing what is unlikely to happen allows you to consider viable alternatives and improve your odds of winning.

To narrow the range of possibilities, contrarian investors also investigate alternatives that the mainstream and fringe crowds ignore.

Or look at the same alternative from a different angle.

This way, you can discover risks and opportunities that the crowd misses.

Is this something that will happen within 30 months?

Let's take a look at the economic news right now.

The story is about excessive debt, society being in disarray and going bankrupt.

Ken Fisher calls this obsession with long-term forecasts by the mass media "the vampire in front of your nose."

Because it scares you like a vampire is going to attack you at any moment.

But there is no need to listen to such exaggerated reports.

The market has already taken care of the short-term issues and doesn't care about the long-term issues at all.

Can you predict the future two years from now? The same goes for the market.

The distant future of the market is not known at this time.

Because there are so many changes to guess at.

The stock market knows this, which is why it doesn't look further than 30 months.

Anything beyond 30 months is purely a guess and is considered a possibility rather than a probability.

Probability has no effect on the stock market.

Yet the news continues to highlight slow, long-term trends that will ultimately lead us to ruin.

Excessive debt, China's rise as a global hegemon, and global warming are examples.

Experts endlessly exaggerate and report on the assumptions made by scholars as facts.

Furthermore, many experts warn that this ominous long-term trend could devastate the stock market in the near future.

But we can use a simple technique to disregard these meaningless claims about the distant future.

Simply ask, “Will this issue have a significant impact on the economy within 30 months?”

No matter how big or dire the risks warned by the mass media are, they won't have a significant impact on the stock market unless they happen within 30 months.

Even if that event finally happens in the distant future.

The stock market doesn't have that far-sighted a vision.

Beware the elephant in the room

A true contrarian investor doesn't look for the long term, but rather focuses on what others are missing.

Ken Fisher calls this "the elephant in the room."

It refers to something that is always there but cannot be seen.

If there's an elephant in the room, it's a big deal.

Anyone would be surprised if they saw the elephant in the room for the first time.

But as time goes by, you gradually get used to the elephant and forget about it.

Elephants are gray and hard to see.

You can't miss it even if you pass by.

But when the elephant starts moving, it is startling.

The same goes for the market.

When investors are fully aware of a technique or risk, surprises rarely occur.

The market is nothing special, it is just a long-term environment.

But the moment we forget the existence of the market, the market strikes us again with a powerful punch.

The elephant in the room is something we've all experienced, once feared or loved, and then forgotten.

What people have forgotten is the obvious facts, but they are not reflected in the price.

Since it was once a widely known fact, it should theoretically be reflected.

But now it is forgotten and invisible, so it is not reflected.

It is because human memory is poor that elephants gain strength.

Ken Fisher points to gross profit margin (sales minus cost of goods sold divided by sales) as one of the elephants, a formerly popular but now fading metric.

In the past, when detailed corporate performance data was not readily available, gross operating profit margin was a very popular indicator.

But these days, investors are in a state of information overload.

As data grows, we become so caught up in the details that we lose sight of the elephant in the room.

Control your emotions and prejudices

Could it be possible to achieve perfection by blocking out external noise and focusing on the elephant? There's something you shouldn't miss.

Your biggest enemy in investing is yourself, your emotions and biases.

Ken Fisher proposes behavioral finance as a solution to this.

Behavioral finance can help us understand how we make mistakes due to our emotions and biases, and can help us curb our inherent speculative instincts.

In Daniel Kahneman's famous experiment, people increased the amount they were willing to lose to ensure they had some chance of avoiding the loss.

It means that the pain you feel when you don't make money is greater than the joy you feel when you make money.

It is said that the pain people feel when they lose money is 2.5 times greater than the joy they feel when they win the same amount of money.

This very difference is the key factor that causes people to make mistakes.

When stock prices fall, people sell their stocks at a low price to avoid further losses.

Prospect theory explains why people rush to sell stocks when they are volatile, even though it would be more advantageous to hold them in the long run.

Recently, a new way of thinking has emerged that exploiting such irrational investors can yield excess returns.

When prices are distorted by crowd psychology, they try to take advantage of this to gain excess profits.

Ken Fisher points out that the focus of behavioral finance seems to have shifted from 'self-control' to 'acquiring excess returns.'

The original purpose of behavioral finance is to identify one's own cognitive errors and prevent them, not to exploit the mistakes of others.

He asserts that the latest techniques in behavioral finance do not actually improve investment skills.

He urges investors to make wise decisions, saying that self-control is far more useful than the latest trendy techniques.

GOODS SPECIFICS

- Date of issue: June 30, 2017

- Format: Hardcover book binding method guide

- Page count, weight, size: 408 pages | 696g | 148*218*24mm

- ISBN13: 9788947542272

- ISBN10: 894754227X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)