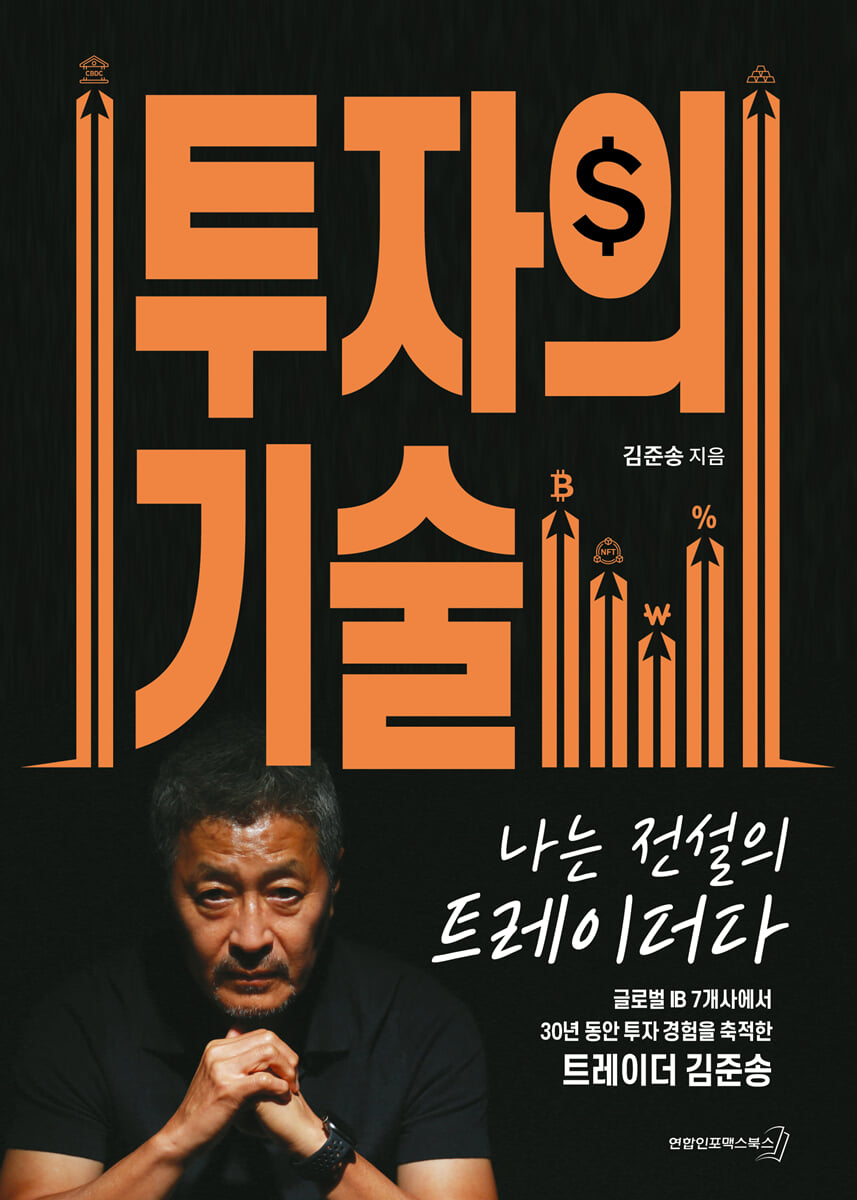

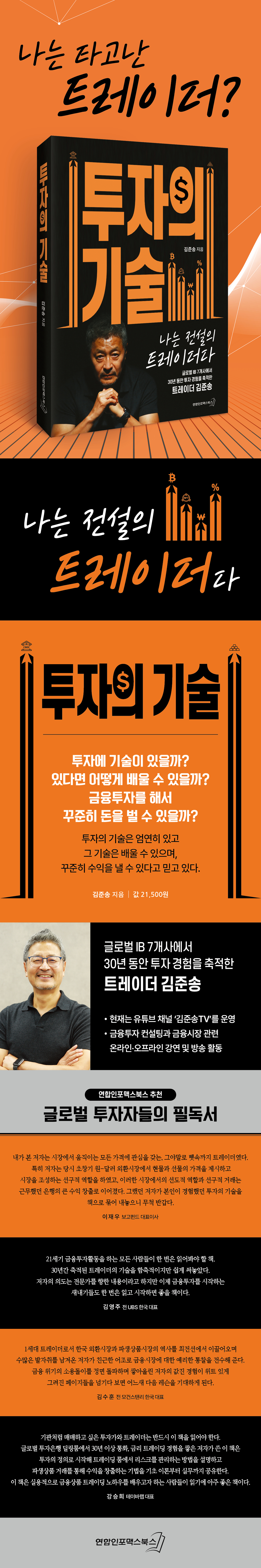

The Art of Investing

|

Description

Book Introduction

Investment techniques from legendary trader Kim Jun-song!

Is there a skill to investing? If so, how can you learn it? And once you learn it, can you consistently make money through financial investments? This book answers these questions.

To sum up, there is a definite skill to investing, and it can be learned, allowing you to consistently generate profits.

It will be of great help not only to students preparing to invest and individual investors currently investing, but also to fund managers, traders, sales, and support staff working at financial institutions.

Is there a skill to investing? If so, how can you learn it? And once you learn it, can you consistently make money through financial investments? This book answers these questions.

To sum up, there is a definite skill to investing, and it can be learned, allowing you to consistently generate profits.

It will be of great help not only to students preparing to invest and individual investors currently investing, but also to fund managers, traders, sales, and support staff working at financial institutions.

- You can preview some of the book's contents.

Preview

index

Recommendation

introduction

Chapter 1.

Nature of investment

01 Investing and Speculation - Are They the Same or Different?

02 Full-time Individual Investing - Is It Possible?

03 Beauty Contest - What Others Think Is More Important Than What I Think

04 Riding the Time Machine - Time Traveler or Scammer

05 Information Only I Know - Lose a lot of money or go to jail

06 Odds and Fees - Save your change

07 Economic Information - What if I can't read and interpret it?

08 Fear and Greed - It's All Psychological Warfare

Chapter 2.

Our Model - IB

01 Trading Like an IB - Can I Make Big Money?

02 IB's Role Division - You Don't Have to Do Everything Yourself

03 IB Risk - You must start by knowing the risks.

04 Setting Your IB Limits - How Much Do You Want to Earn?

05 Trader's Basics - Cut without thinking

06 IB's Business Model - Where do you earn money and how do you share it?

07 IB Bankruptcy - No One Is Safe

08 Lehman Brothers - Myths and Truths About Bankruptcy

09 Solo Trading - Do you want to do it all by yourself?

Chapter 3.

Understanding products and markets

01 The Concept of Gifts - Just Make a Promise

02 The price of a gift - not predicting the future

03 Financial Trading - Earn Unlimited Money

04 Theory Gift Practice - Quickly at a Glance

05 Gift price deviation - It can't be expensive, but it can be cheap.

06 Financial Transaction Case - Where there is regulation, there is opportunity

07 Swap - You can change anything

08 Yield Curve - Current Forecasts Come Together

Option 09 - What if you know the magnitude of the change, but not the direction?

10 Inflation, Interest Rates, and Exchange Rates - Still Starting with Theory

11 Future Forecasts - Current Prices Reflect Everything

12 Market Interpretation - What Others Think at the Time

Chapter 4.

Practical issues

01 Understanding Positions - What needs to change for the better?

02 Speculation and Hedging - Balancing Offense and Defense

03 Carry Trade - Just like that

04 Exchange Rates - Capital Flows Across Borders

05 How to trade - Easy, convenient and hassle-free

06 Global Investment - No Longer an Option

Chapter 5.

Investment performance

01 Timing of Investment - Starting from 2030

02 Trader Requirements - Anyone who doesn't hate it

03 Retirement Full-Time Investor - A New Turning Point

introduction

Chapter 1.

Nature of investment

01 Investing and Speculation - Are They the Same or Different?

02 Full-time Individual Investing - Is It Possible?

03 Beauty Contest - What Others Think Is More Important Than What I Think

04 Riding the Time Machine - Time Traveler or Scammer

05 Information Only I Know - Lose a lot of money or go to jail

06 Odds and Fees - Save your change

07 Economic Information - What if I can't read and interpret it?

08 Fear and Greed - It's All Psychological Warfare

Chapter 2.

Our Model - IB

01 Trading Like an IB - Can I Make Big Money?

02 IB's Role Division - You Don't Have to Do Everything Yourself

03 IB Risk - You must start by knowing the risks.

04 Setting Your IB Limits - How Much Do You Want to Earn?

05 Trader's Basics - Cut without thinking

06 IB's Business Model - Where do you earn money and how do you share it?

07 IB Bankruptcy - No One Is Safe

08 Lehman Brothers - Myths and Truths About Bankruptcy

09 Solo Trading - Do you want to do it all by yourself?

Chapter 3.

Understanding products and markets

01 The Concept of Gifts - Just Make a Promise

02 The price of a gift - not predicting the future

03 Financial Trading - Earn Unlimited Money

04 Theory Gift Practice - Quickly at a Glance

05 Gift price deviation - It can't be expensive, but it can be cheap.

06 Financial Transaction Case - Where there is regulation, there is opportunity

07 Swap - You can change anything

08 Yield Curve - Current Forecasts Come Together

Option 09 - What if you know the magnitude of the change, but not the direction?

10 Inflation, Interest Rates, and Exchange Rates - Still Starting with Theory

11 Future Forecasts - Current Prices Reflect Everything

12 Market Interpretation - What Others Think at the Time

Chapter 4.

Practical issues

01 Understanding Positions - What needs to change for the better?

02 Speculation and Hedging - Balancing Offense and Defense

03 Carry Trade - Just like that

04 Exchange Rates - Capital Flows Across Borders

05 How to trade - Easy, convenient and hassle-free

06 Global Investment - No Longer an Option

Chapter 5.

Investment performance

01 Timing of Investment - Starting from 2030

02 Trader Requirements - Anyone who doesn't hate it

03 Retirement Full-Time Investor - A New Turning Point

Detailed image

Into the book

The biggest vulnerability of domestic individual investors today is their inability to invest in a variety of products.

Product diversification for individual investors is a pressing issue, and it is also a crucial factor in determining their future investment performance.

--- p.29

Stop loss is literally a stop order that prevents further losses when the loss reaches a certain level.

It's a simple and obvious concept, but it's the most important principle a trader must follow.

This applies not only to IB traders but also to individual investors.

--- p.89

Yield curves not only differ across currencies, but also across commodities.

Representative examples include the government bond yield curve, interest rate swap yield curve, and cross swap yield curve. It will be easy to understand if you remember that each financial product has its own supply and demand, and that interest rates are determined for each product.

--- p.174

The most important factor affecting option prices is the volatility of the commodity's price.

Some goods have prices that fluctuate greatly, while others have prices that do not change much over time.

Naturally, options for products with high price volatility will be more valuable.

In other words, the price volatility of a product is an important factor in determining the price of its options.

--- p.181

The risk of cross position is basis risk.

Basically, the reason for trading two commodities in opposite directions is that the profit and loss of the two positions are expected to occur in opposite directions, that is, if one side loses, the other side gains, so that they somewhat offset each other.

However, in some cases, the two positions may move in the same direction rather than in opposite directions to form a hedge, resulting in simultaneous profits or losses in both positions.

--- p.216

Domestic individual investors, especially those seeking to make a living from investing, should diversify their trading beyond just trading domestic stocks. They should also consider trading U.S., European, and Asian stocks, foreign exchange, bonds, and raw materials, and even derivatives. This will significantly increase their long-term investment returns.

--- p.230

The days when one lifelong career could solve all of life's financial problems are long gone.

Even if you have the will to work hard, there are not enough good jobs.

Even if you leave a small amount of assets alone, it is unlikely that they will turn into a large sum of money later on.

My parents and older brother's generation don't show any mercy to me, perhaps because they too are having a hard time.

Although there are enormous opportunities for new cutting-edge businesses, in reality they are only available to a very select few.

Product diversification for individual investors is a pressing issue, and it is also a crucial factor in determining their future investment performance.

--- p.29

Stop loss is literally a stop order that prevents further losses when the loss reaches a certain level.

It's a simple and obvious concept, but it's the most important principle a trader must follow.

This applies not only to IB traders but also to individual investors.

--- p.89

Yield curves not only differ across currencies, but also across commodities.

Representative examples include the government bond yield curve, interest rate swap yield curve, and cross swap yield curve. It will be easy to understand if you remember that each financial product has its own supply and demand, and that interest rates are determined for each product.

--- p.174

The most important factor affecting option prices is the volatility of the commodity's price.

Some goods have prices that fluctuate greatly, while others have prices that do not change much over time.

Naturally, options for products with high price volatility will be more valuable.

In other words, the price volatility of a product is an important factor in determining the price of its options.

--- p.181

The risk of cross position is basis risk.

Basically, the reason for trading two commodities in opposite directions is that the profit and loss of the two positions are expected to occur in opposite directions, that is, if one side loses, the other side gains, so that they somewhat offset each other.

However, in some cases, the two positions may move in the same direction rather than in opposite directions to form a hedge, resulting in simultaneous profits or losses in both positions.

--- p.216

Domestic individual investors, especially those seeking to make a living from investing, should diversify their trading beyond just trading domestic stocks. They should also consider trading U.S., European, and Asian stocks, foreign exchange, bonds, and raw materials, and even derivatives. This will significantly increase their long-term investment returns.

--- p.230

The days when one lifelong career could solve all of life's financial problems are long gone.

Even if you have the will to work hard, there are not enough good jobs.

Even if you leave a small amount of assets alone, it is unlikely that they will turn into a large sum of money later on.

My parents and older brother's generation don't show any mercy to me, perhaps because they too are having a hard time.

Although there are enormous opportunities for new cutting-edge businesses, in reality they are only available to a very select few.

--- p.254

GOODS SPECIFICS

- Date of issue: November 7, 2025

- Page count, weight, size: 280 pages | 150*210*17mm

- ISBN13: 9791198896193

- ISBN10: 1198896191

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)